SignalPlus Volatility Column (20231103): Market retreats, IV plummets

Yesterday (2 Nov), after the market gave a dovish interpretation of the FOMC meeting, the 10-year U.S. bond continued to decline, hitting a new low in nearly three weeks, closing at 4.66%. The two-year U.S. bond fell below 5% for several days, closing at 4.99%. . The Bank of England also announced the suspension of interest rate hikes for the second consecutive time at its meeting. Global bond market yields fell and stock markets were boosted. European stock markets rose for the fourth consecutive day. The three major U.S. stock indexes also opened higher. Dow/NASDAQ Dak/SP closed up 1.7%/1.78%/1.89% respectively.

Source: SignalPlus, Economic Calendar

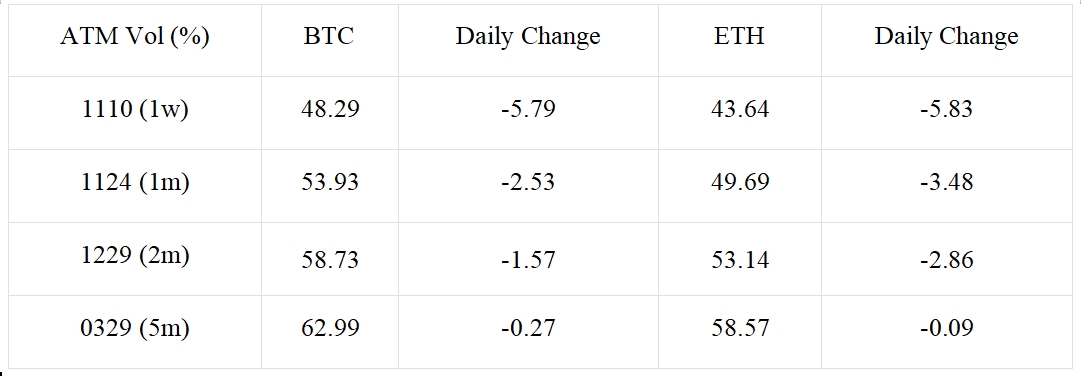

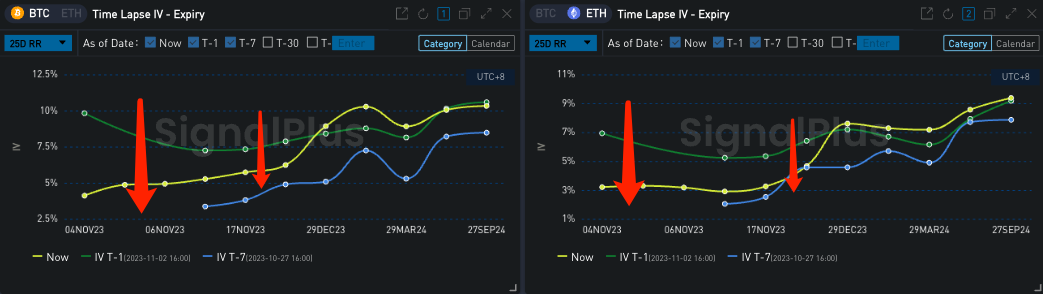

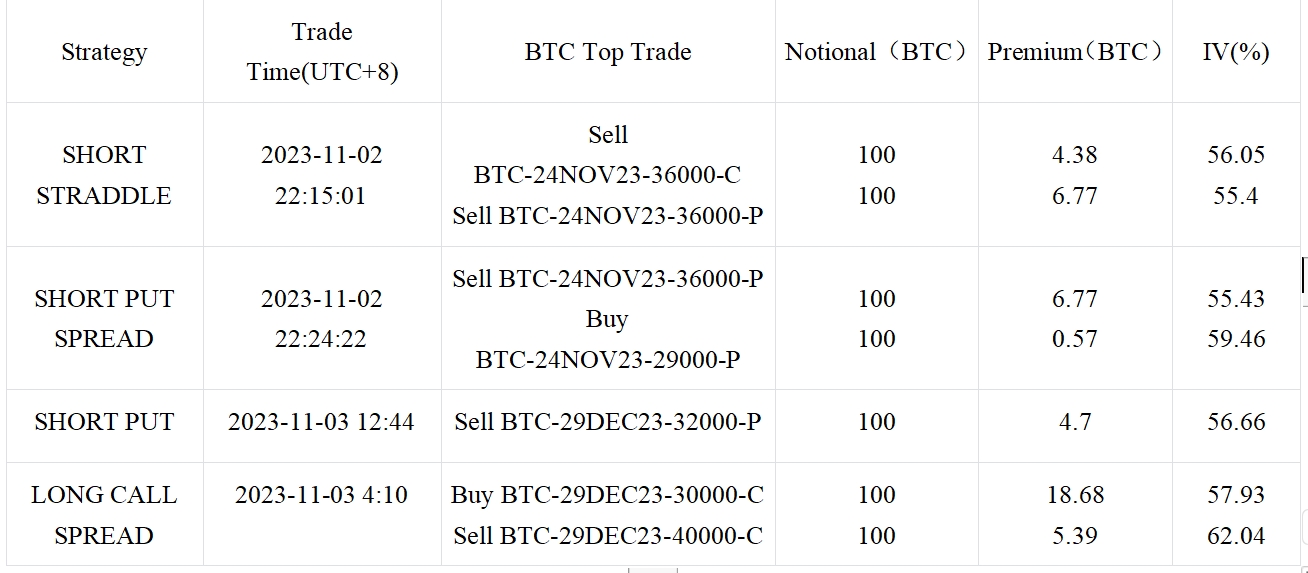

Although the reduction in risk-free interest rates has driven global stock markets higher, digital currencies have shown a more negative trend, with prices falling sharply. BTC fell to around 34,500 again, giving up almost all of yesterdays gains. At the same time, this wave of price decline has also brought a lot of cold water to the options market, resulting in a sharp decline in the recent implied volatility, which has dropped back to around 50% Vol. The curve has gone from flat to steep, and large-scale transactions have also emerged. The bearish volatility strategy represented by Short 24 Nov Straddle; judging from the slope of the IV surface, Skew has also seen a significant decline in price recently. Currently, the front-end 25 dRR of BTC/ETH is around 5% /3%. Large transactions were lackluster, with only a few strategic transactions of 100 btc size. The overall market trading volume decreased compared with the previous day and the main transactions were concentrated on retail/small transactions.

Source: Binance & TradingView

Source: Deribit (as of 3 NOV 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com