SignalPlus Volatility Column (20231031): Front-end IV falls back, and bulk prices continue to rise

Yesterday (30 Oct), as the U.S. government lowered its borrowing forecast for the fourth quarter, U.S. long-term yields fell. Among them, the 10-year Treasury bond fell below 4.9% and is now at 4.824%; the two-year bond yield rose first and then fell, now closing at around 5.02%. The three major U.S. stock indexes all rose by more than 1%, and the SP/Nasdaq/Dow closed up 1.16%/1.16%/1.58% respectively, setting their best single-day performance in the past six months.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

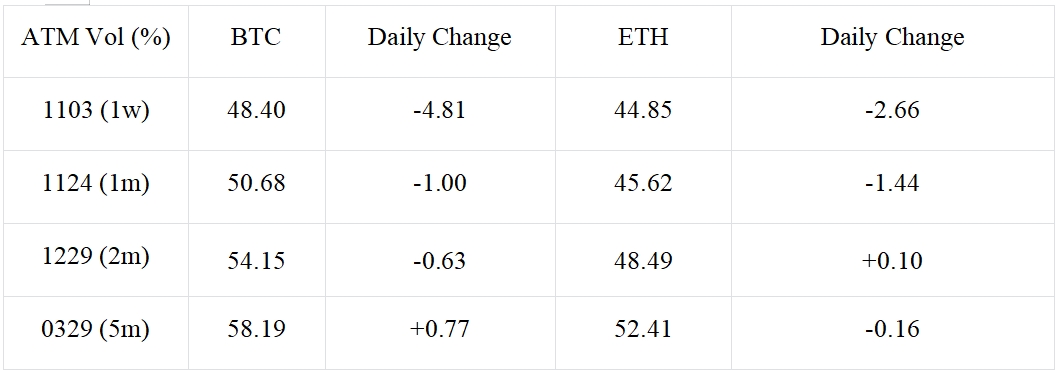

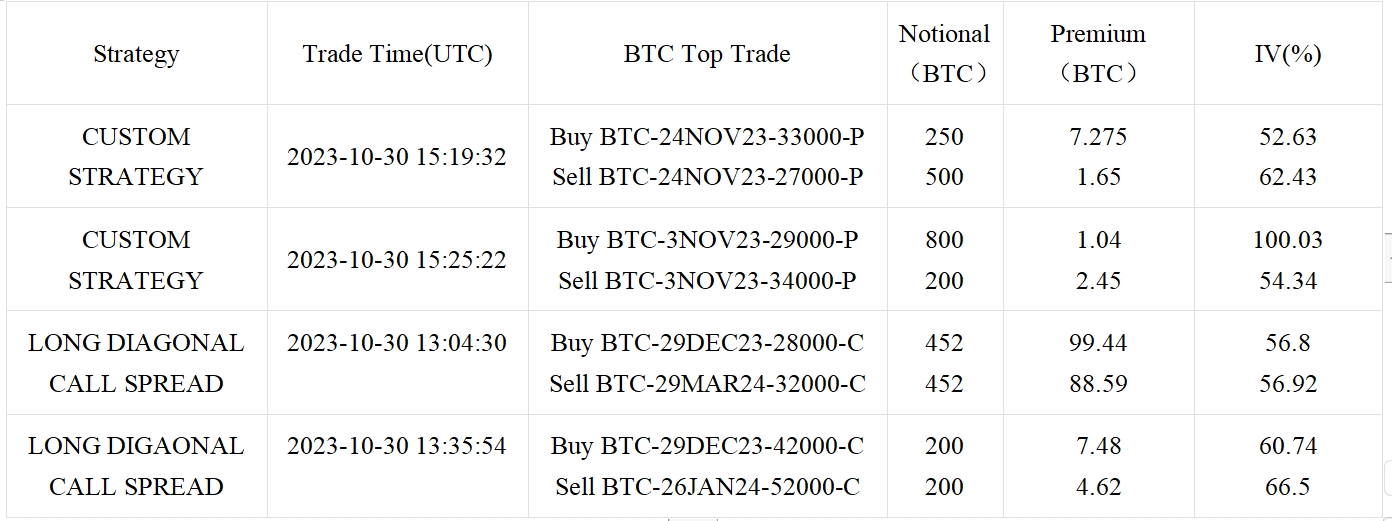

In terms of digital currencies, affected by the continued sluggish actual volatility environment, the recent IV has fallen sharply after climbing to near the high point again yesterday. However, at the same time, the bulk market still maintains optimistic expectations for BTC to rise again in the future, on 24 Nov A large number of Call Spread positions were opened, and at the same time, there were many buy-short-sell Yangtze River Delta call spread strategies in several periods after the end of the year; on ETH, we observed that 24 Nov 1650/1700 C was sold and closed in large numbers (OI respectively (reduce 6.76 K/8.76 K ETH) to take profits. At the same time, the call options near 1900-2000 got the opportunity to roll the position and continue to be bullish.

On the other hand, the largest OI change of BTC is 3 No v2 3 29000-P (+ 1.65 K), which mainly comes from large-scale customized transactions. Traders gain high Premium by selling 34000-P in ATM, and at the same time buy 4 Multiples of the 29000-P were protected.

Source: Deribit (as of 31 Oct 16:00 UTC+8)

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com