Gryphsis Cryptocurrency Weekly: Security Issues at Stars Arena, Battle with Security Breach

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Follow ourTwitterandMediumGet deeper research and insights.

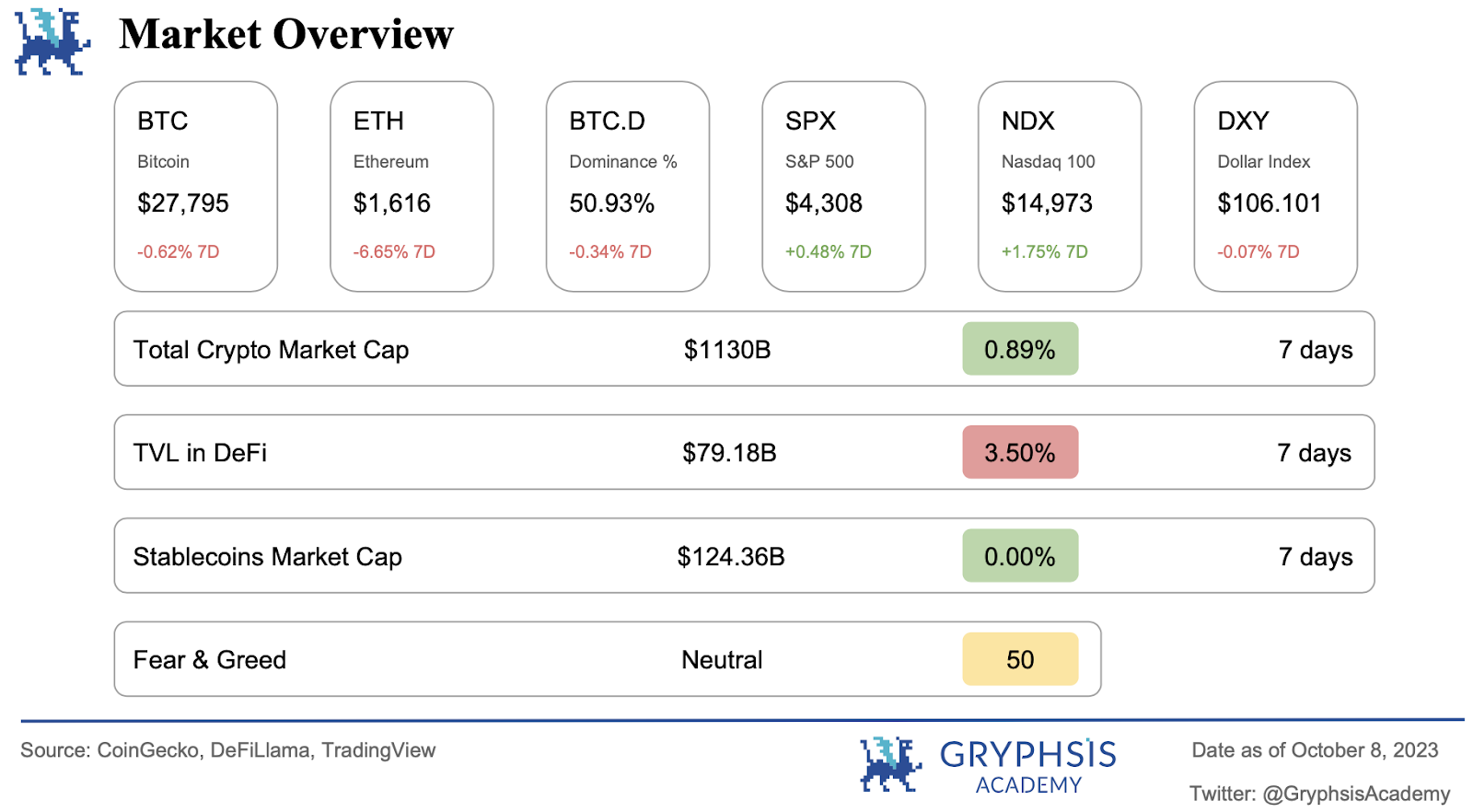

Market and Industry Snapshot:

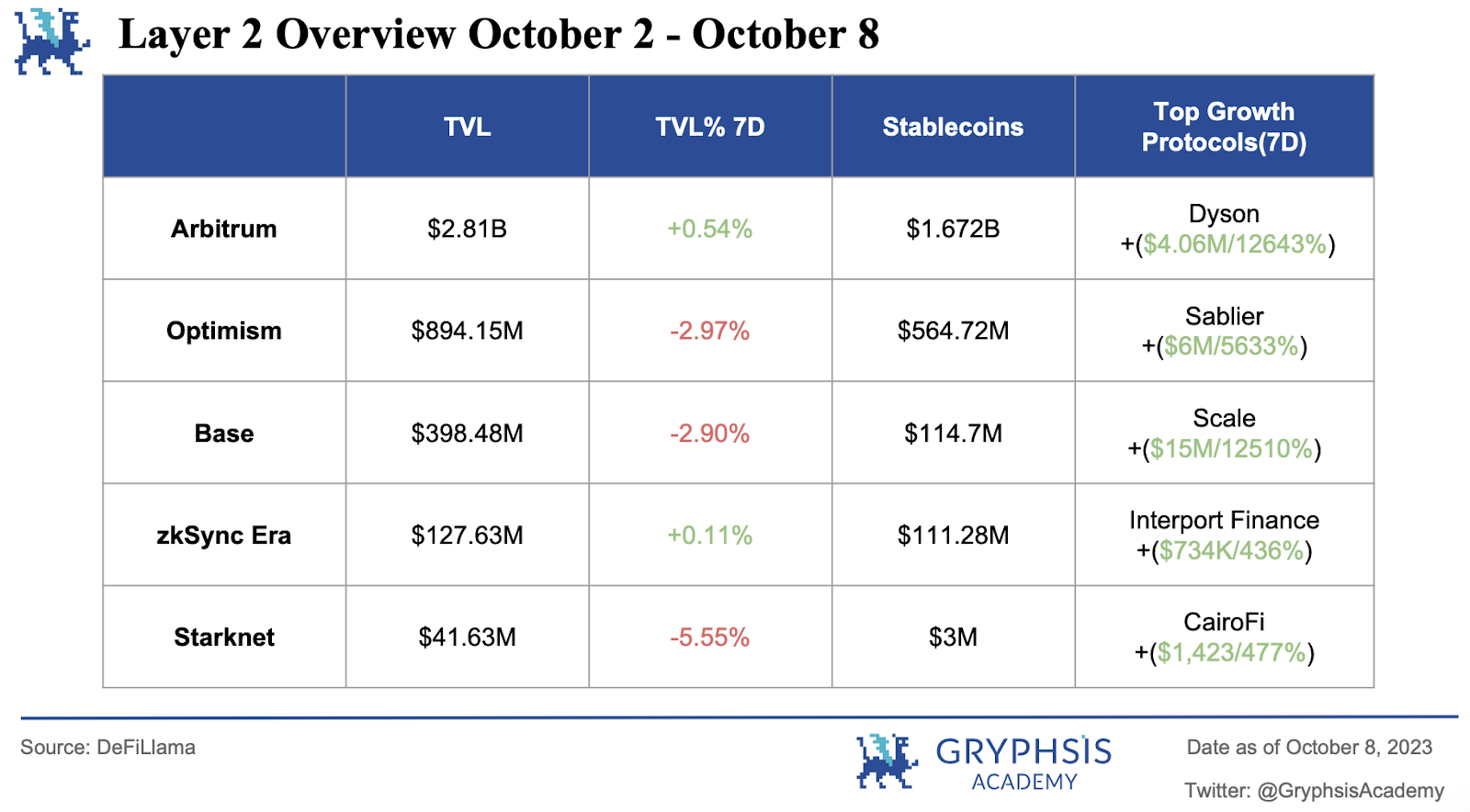

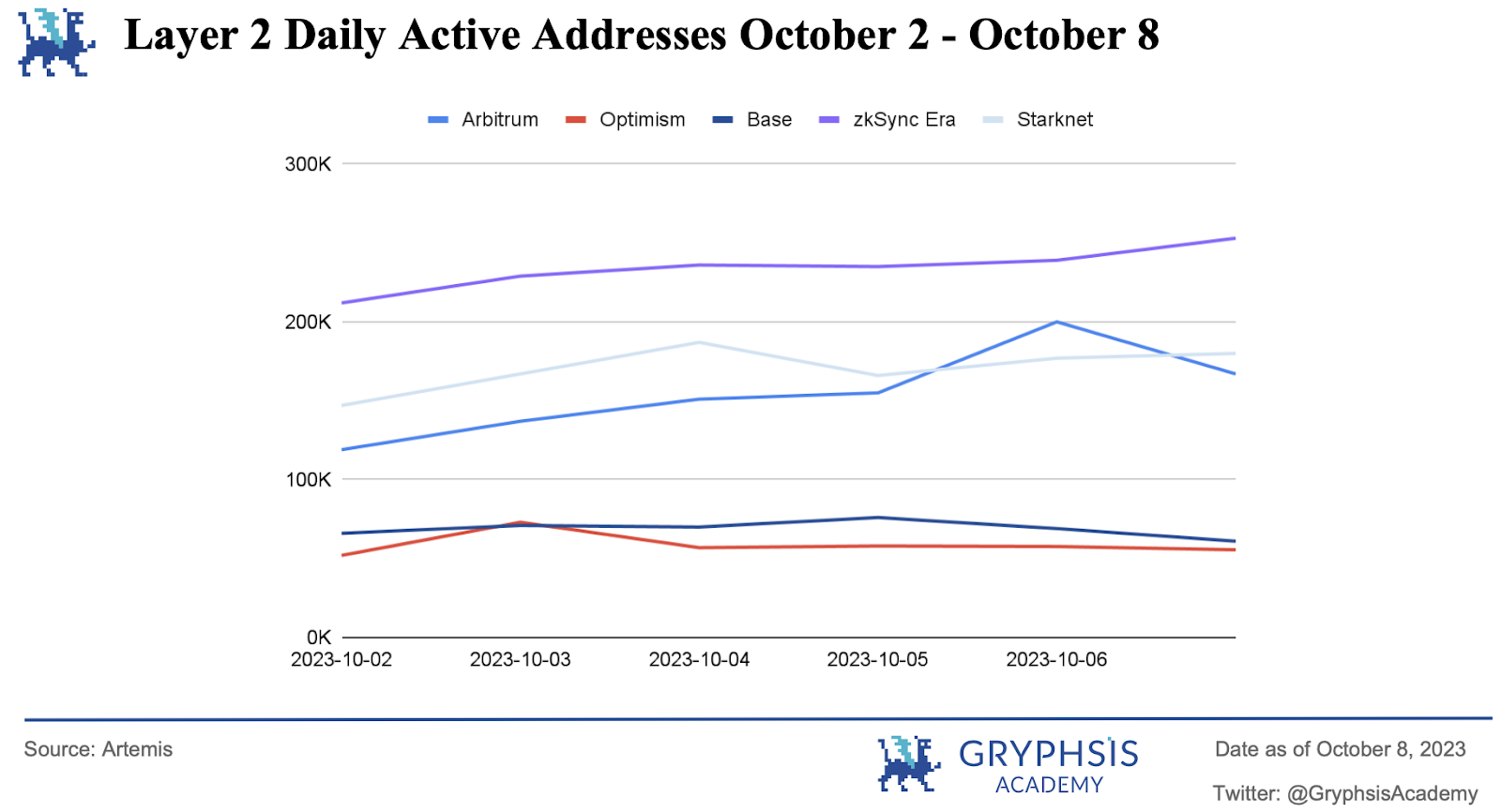

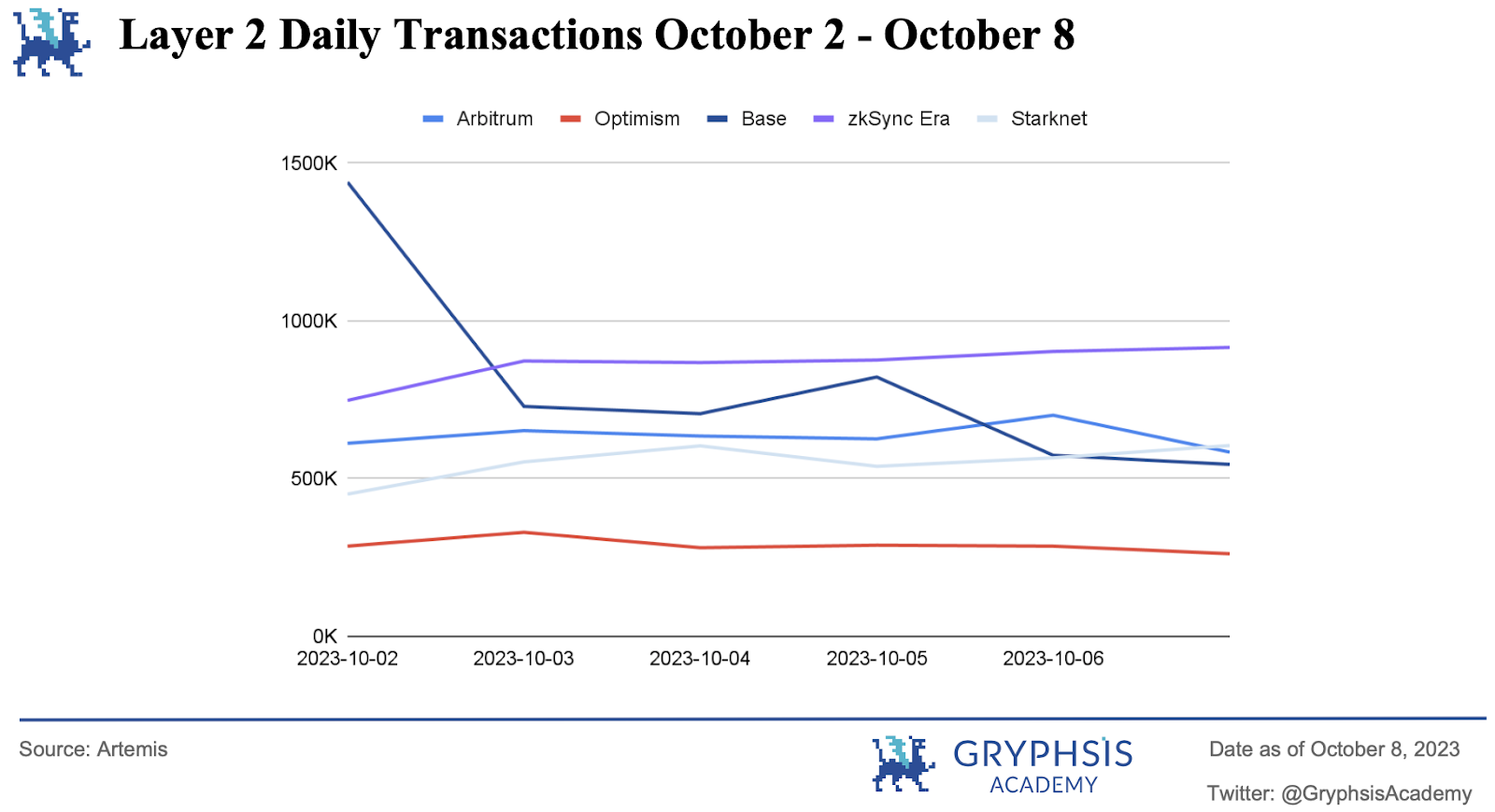

Layer 2 Overview:

The total value locked (TVL) of most Layer 2 solutions has declined over the past week. Momentum seems to be waning in Base and Starket, with TVL falling for two weeks in a row. In comparison, protocols such as Dyson, Sablier, Scale, Interport Finance, and Cairo have all seen significant growth in their TVL.

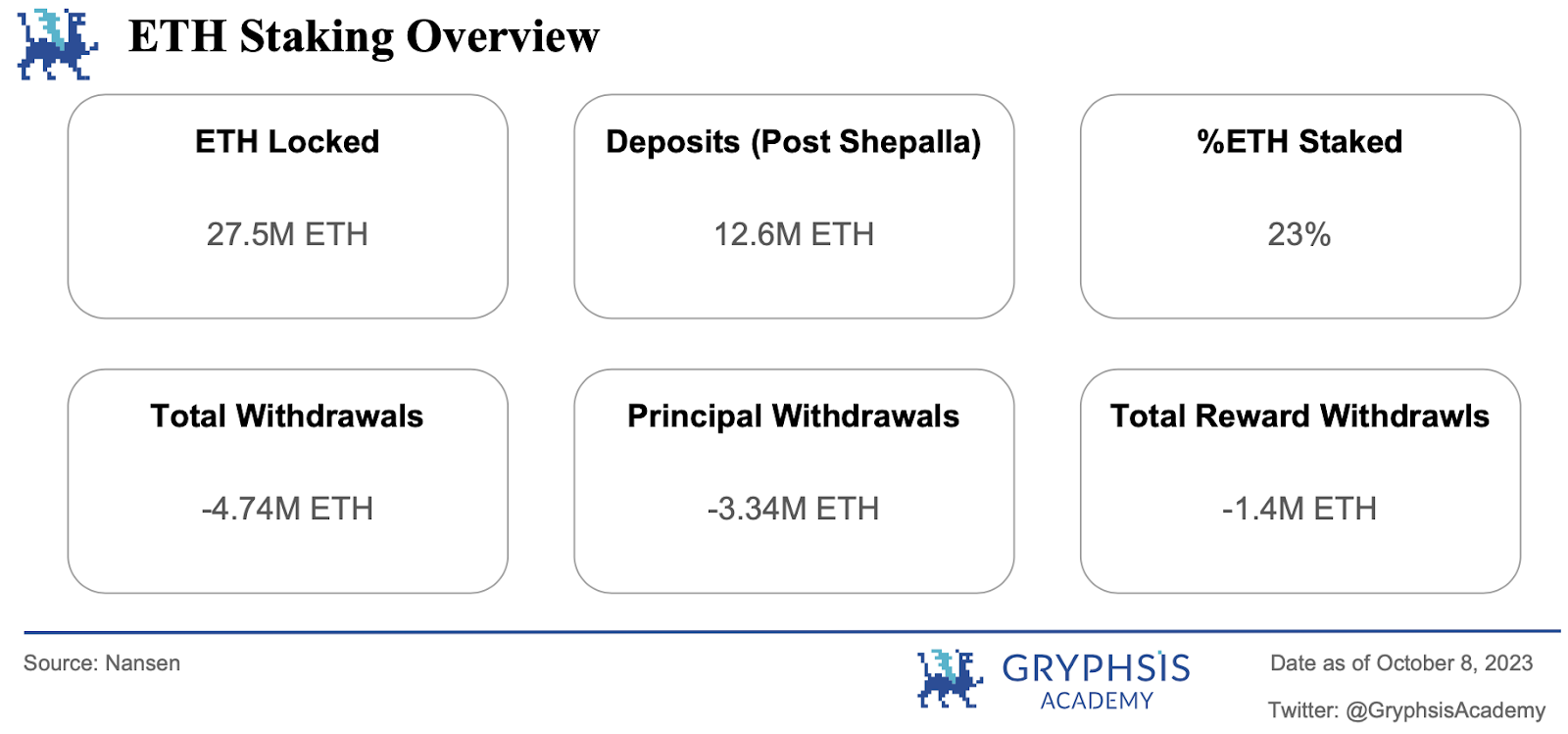

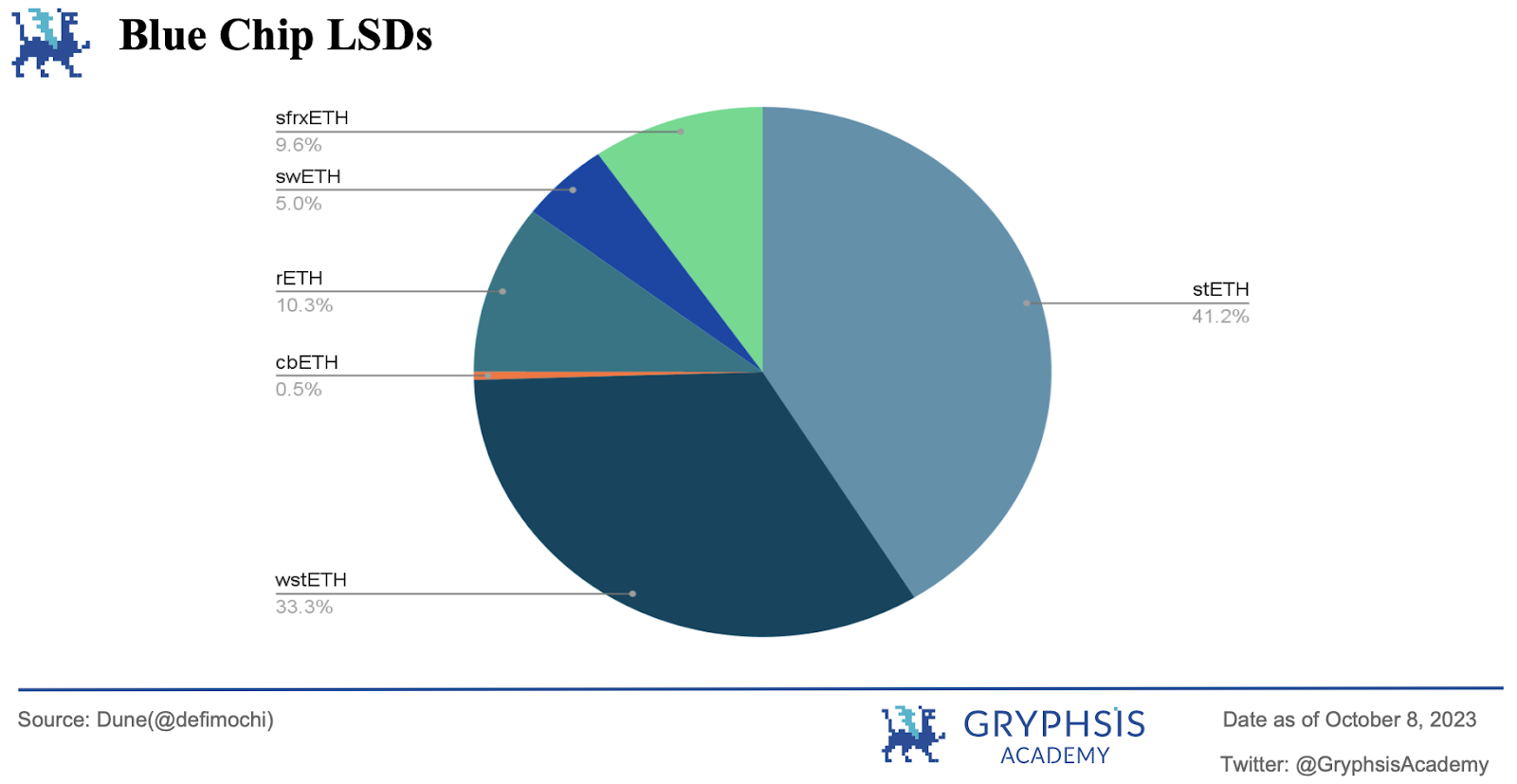

LSD Sector Overview:

The LSD space remains stable and the number of Ethereum pledges continues to grow. In terms of market share, both Rocket Pool and Frax showed modest gains this week.

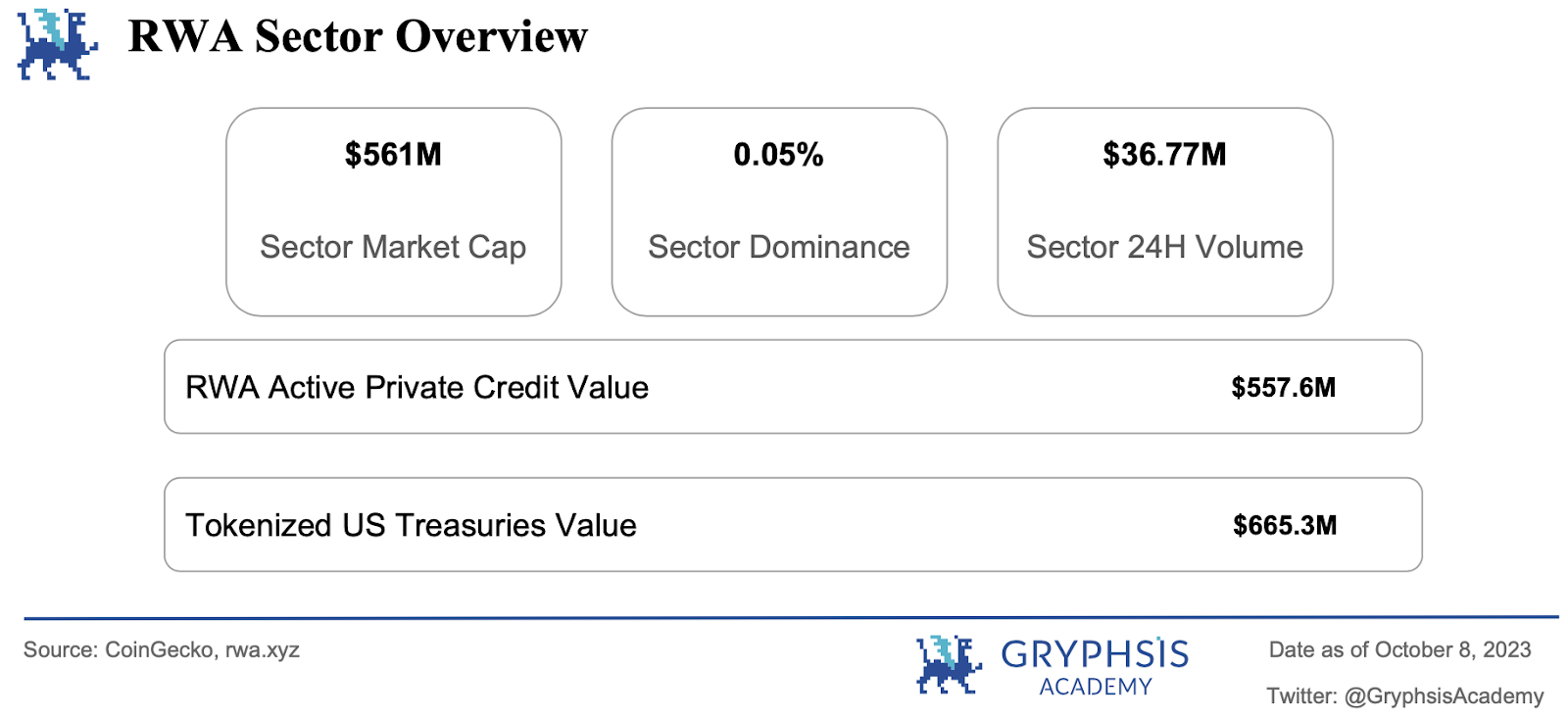

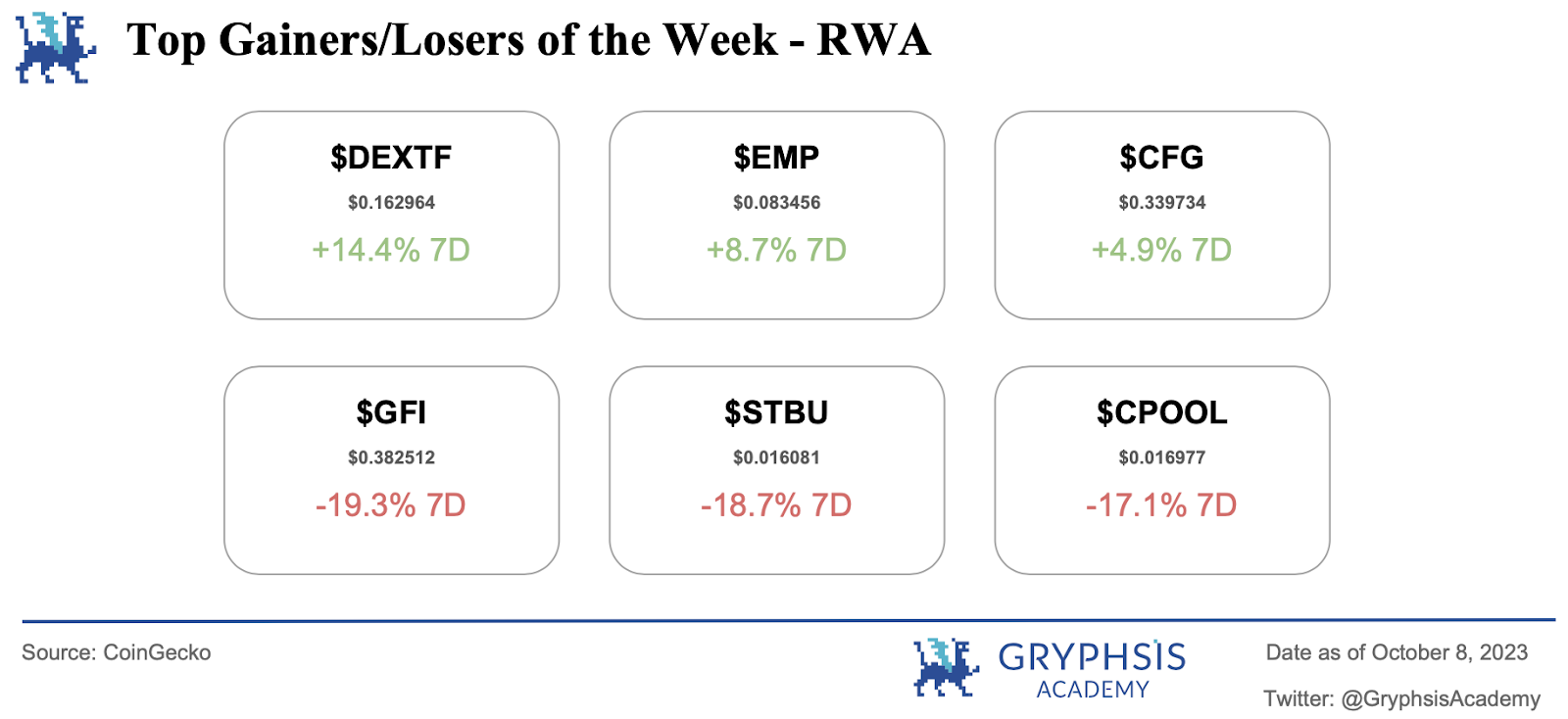

RWA Sector Overview:

The RWA situation remains stable. Active loan amounts and tokenized Treasuries remained unchanged from last week’s data. This week’s leaders are tokens $DEXTF, $EMP, and $CFG, while $GFI, $STBU, and $CPOOL have declined.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

Star Arena Exploit

Weekly Agreement Recommendations:

Radpie

Weekly VC Investment Focus

Blackbird ($ 24 M)

phaver ($ 7 M)

Twitter Alpha:

@TheDeFISaint weekly L2 roundup

@thedefiedge lesson from past cycle

@DeFiMinty’s twitter growth tip

@wacy_time 1 on psychology

Macro Overview

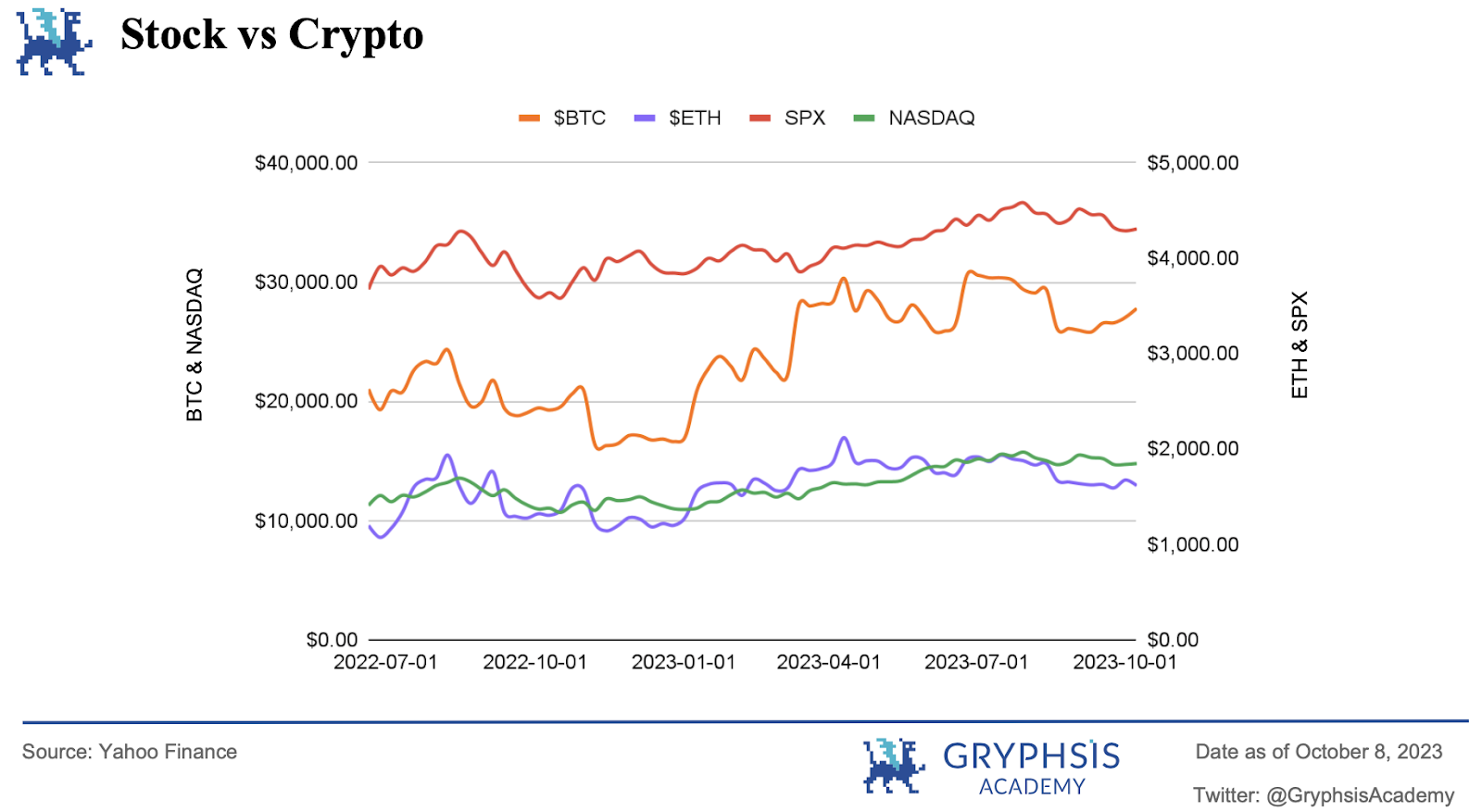

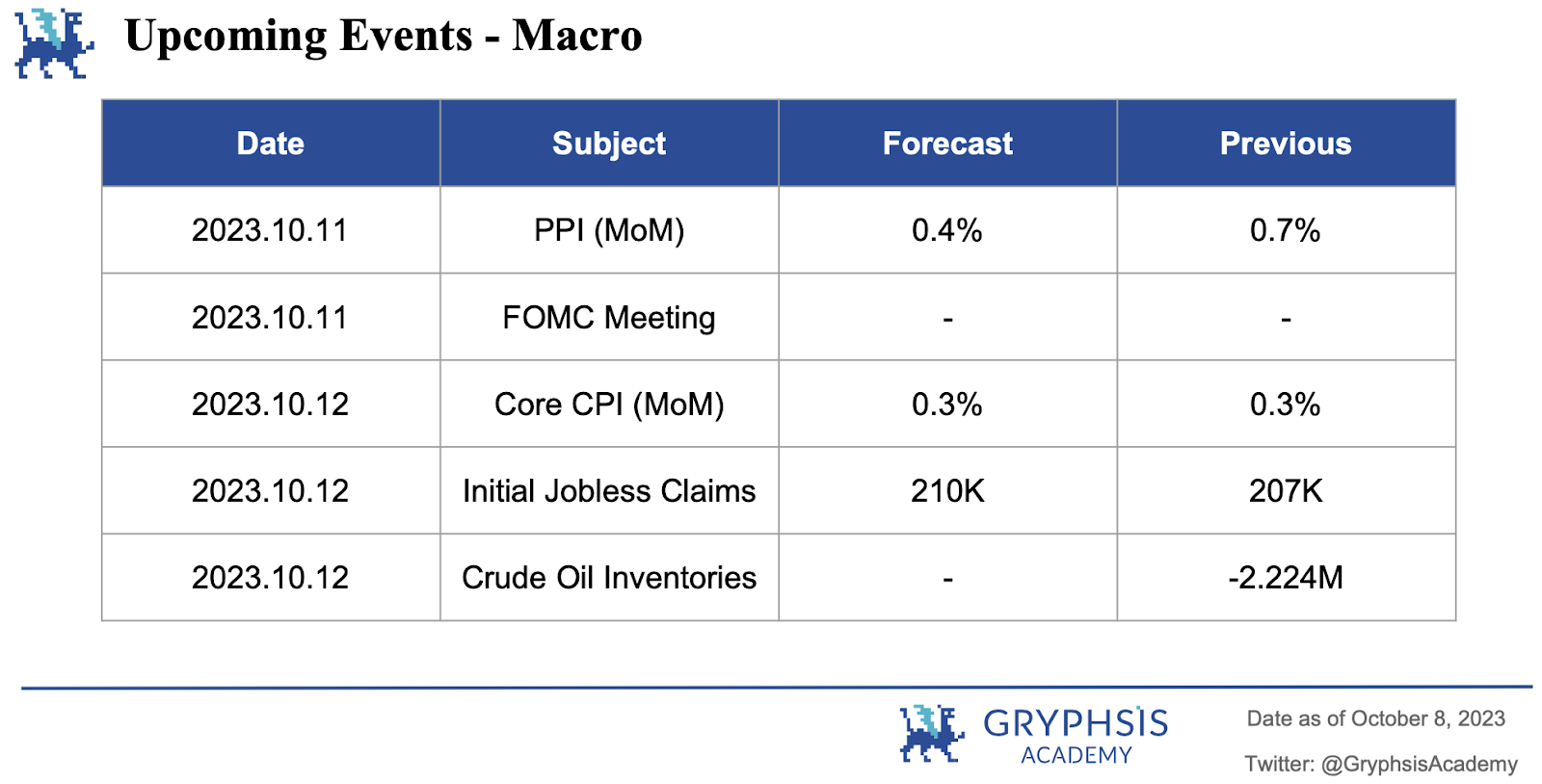

Bitcoin, SPX, and NAQ have all seen modest price gains over the past week. However, Ethereum lags slightly behind, with a seven-day price drop of more than 6%. Looking ahead, readers should monitor releases on the FOMC, PPI, CPI, crude oil inventories and initial jobless claims.

Big news this week

Security Issues at Stars Arena: The Fight Against Security Breach

Stars Arena, a Web3 social media application based on Avalanche, recently suffered a major security attack, highlighting the challenges facing emerging platforms in the encryption field. On October 6, the platform suffered a critical exploit that resulted in the theft of nearly $3 million in AVAX tokens. The stolen funds were subsequently traced to the Fixed Float cryptocurrency exchange, raising concerns about the security measures in place.

https://twitter.com/el3 3 th 4 xor/status/1710617850807832910? s= 61&t=x-elXoazvNjP-jMagbvbbQ

The Stars Arena team responded quickly to the breach, announcing that they had mobilized resources to address the financial damage caused by the breach. They further emphasized their commitment to platform security, bringing in a professional white hat development team to conduct a thorough review. The aim is to ensure that such vulnerabilities can be addressed and prevented in the future. The team also stated that they intend to reopen smart contracts, but only after conducting a comprehensive security audit to safeguard user assets and trust.

However, this is not the only security challenge the platform has faced in a short period of time. Just a day before the major leak, on October 5, Stars Arena had to address another bug. This early security incident resulted in attackers quietly transferring $2,000 worth of AVAX from the platform. This spate of security incidents has not only drawn attention but also led to criticism from the cryptocurrency community, questioning the platform’s security protocols and readiness.

https://twitter.com/starsarenacom/status/1709934535570608172?s=61&t=x-elXoazvNjP-jMagbvbbQ

Despite these setbacks, the Stars Arena team remains resilient. They proactively respond to concerns, eliminating the “organized FUD” (fear, uncertainty, doubt) that arises after a security breach. The team’s determination to correct the problem and move forward was evident. These events are a reminder of the challenges new platforms face in the rapidly evolving crypto space and underscore the importance of strong security measures in ensuring user trust and platform credibility.

Our Take

The recent security breach of Stars Arena in the area of encryption has raised critical questions about security vulnerabilities and the need for strong protective measures. The incidents highlight teething problems with emerging platforms, where security protocols can be inadvertently compromised in the rush to market. These security vulnerabilities remind us that rigorous testing, continuous monitoring and comprehensive security audits are crucial. Furthermore, tracing the stolen funds to the Fixed Float cryptocurrency exchange also puts the exchange’s security and asset tracking under scrutiny, underscoring the need for exchanges to strengthen their defenses and vigilance.

Trust and reliability are the cornerstones of platform development, especially in the crypto space, where credibility is hard-won and fragile. Stars Arena’s continuous security lapses not only put its reputation at risk, but also cast a shadow over the broader Avalanche ecosystem and the DeFi/Web3 space.

Faced with such challenges, the crypto community’s resilience is tested. The rapid spread of “organized FUD” in the wake of security breaches demonstrates that platforms need to be good at managing not only technical issues but also public perception. In this context, continuous and transparent communication becomes a vital tool. As the industry matures, these incidents underscore the need for standardized security protocols, the importance of user education, and the potential benefits of cooperative defense strategies. Ultimately, as the crypto space evolves, user trust and rigorous security measures will determine its trajectory for success.

Weekly Agreement Recommendations

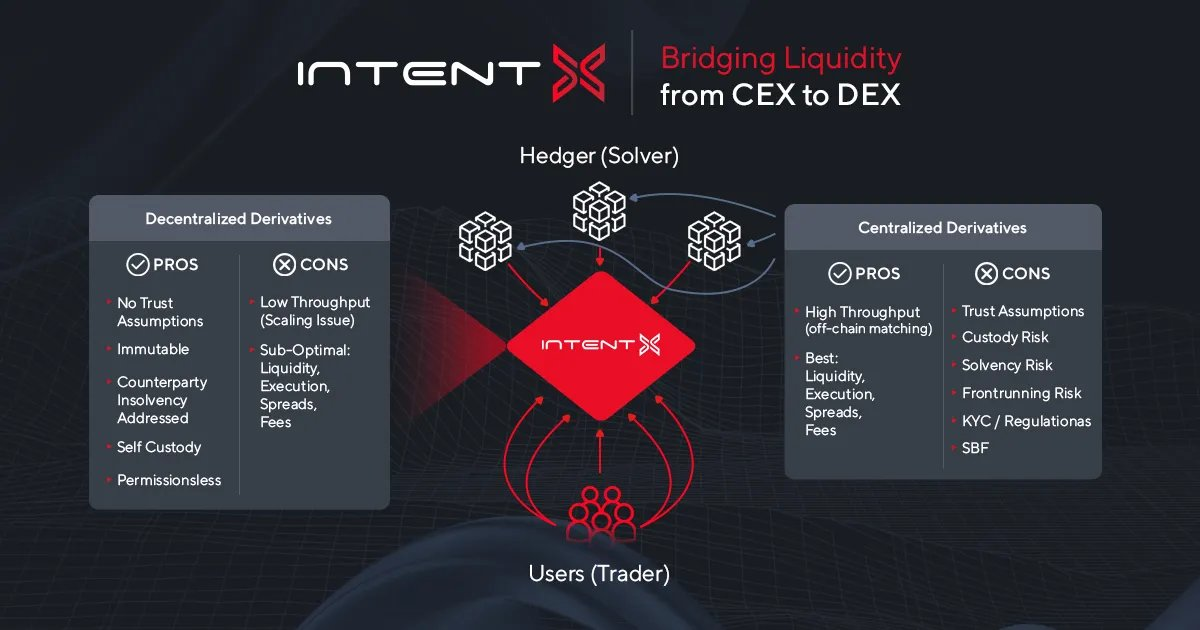

IntentX is an innovative decentralized trading platform designed to bridge the liquidity gap prevalent in the crypto derivatives market. Based on a unique RFQ (Request for Quote) or intent-based architecture, IntentX facilitates seamless interaction between traders and solution providers (market makers). By effectively “bridging” the liquidity of centralized exchanges (CEX) onto the chain, IntentX provides traders with the benefits of deep liquidity, optimal price execution, and trustless, permissionless trading while ensuring security sex and isolation. This combination makes IntentX a game changer in the on-chain derivatives space.

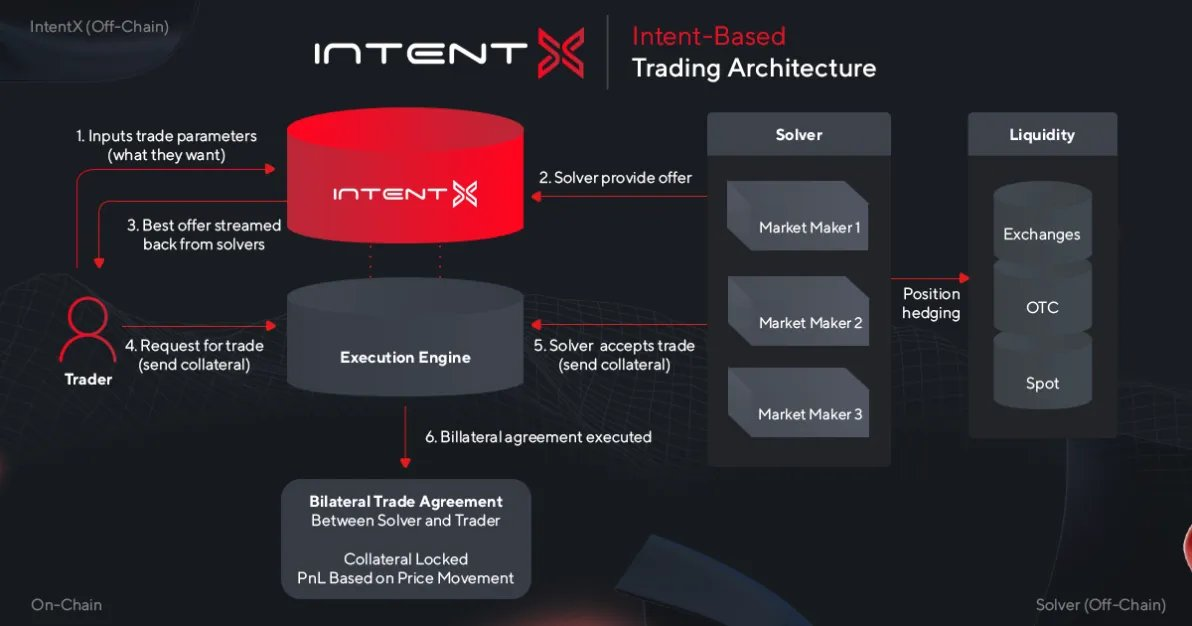

IntentXs architecture operates in a unique way. Traders specify the trades they want and solution providers (market makers) provide real-time conditions for the trades. Once the trader is satisfied, they send a “trade request” to the solution provider, locking up their collateral. The solution provider then accepts the request, deposits their collateral, and forms a bilateral agreement. Solution providers can hedge their position exposure through a variety of sources, including CEX, other DEXs, or even spot positions. This innovative approach changes the dynamics of on-chain derivatives, providing deep liquidity, capital efficiency, and rapid deployment across chains without liquidity challenges.

IntentX is architected explicitly around an RFQ (Request for Quotation) or intent-based model. Heres a step-by-step breakdown of how it works:

1. Trade Initiation: A trader approaches IntentX and specifies the details of their desired trade, for example, holding a long position of 1 BTC with 10x leverage.

2. The role of the solution provider: The solution provider as a market maker immediately provides conditions for transactions. These conditions include price, slippage, fees, funding rates, collateral requirements, and more. This interaction is real-time and automated.

3. Trade Review: The trader receives a pre-agreed set of conditions, called an “offer.” This quote simplifies the RFQ process, eliminating the need for traders to manually evaluate quotes. IntentX automates this step, ensuring traders get the best offer possible. This makes IntentX not just a traditional RFQ exchange, but an “Automated Quotation Market” exchange (AMFQ).

4. Trade Execution: Once the trader agrees to the conditions, they send a “trade request” to the solution provider and lock in the required collateral. In response, the solution provider accepts the request and deposits an equal amount of collateral into the contract.

5. Bilateral Agreement: This process creates a bilateral agreement between the solution provider and the trader. This is a symmetrical contract in which one party is obligated to pay profits or losses to the other party based on the price movement of the position.

6. Hedging by the Solution Provider: After the agreement, the Solution Provider hedges its position exposure. They can do this through a variety of sources, whether its a CEX, another DEX, an OTC desk, or their spot holdings. Additionally, solution providers can hedge their positions with other contracted traders.

7. Liquidity bridging: A prominent feature of IntentX is its ability to bridge the liquidity of CEXs onto the chain. Solution providers act as a “liquidity aggregation” layer, sourcing liquidity from the most efficient platform, whether it’s a CEX or another DEX.

8. Security and isolation: All transactions on IntentX are permissionless, secure and isolated, ensuring there is no risk of escrow or bankruptcy.

our insights

IntentX presents itself as a novel solution in the decentralized exchange space, aiming to bridge the existing liquidity gap in the crypto derivatives market. Currently, the crypto derivatives market has a monthly trading volume of approximately $3 trillion, with a staggering 99% of trading occurring on centralized exchanges (CEXs). Although CEXs dominate in terms of trading volume, they have inherent challenges such as trust issues, pre-emptive behavior, centralization, and regulatory restrictions. On the other hand, while blockchain technology offers trustless and permissionless transactions, current on-chain derivatives technology lags behind CEXs in terms of liquidity, fees, speed, and user experience. Through its unique RFQ/intent-based architecture, IntentX seeks to ensure transactions are permissionless, secure, and isolated by effectively “bridging” CEX liquidity onto the chain through a solution.

IntentX’s primary value proposition lies in its ability to provide deep liquidity by effectively bridging the gap between centralized and decentralized exchanges. By leveraging the solution mechanism, IntentX can source liquidity from the most efficient platforms, ensuring optimal price execution and minimal slippage. This approach is not only capital efficient, but also allows for rapid deployment across multiple chains without the need to build liquidity pools. Additionally, the protocol does not rely on oracles for asset pricing, thus protecting it from potential oracle manipulation vulnerabilities. The risks associated with derivatives contracts are perfectly contained in bilateral agreements, ensuring a trustless system in which one partys profits correspond to the others losses.

Furthermore, IntentX has the potential to go beyond just providing liquidity. The platform’s unique architecture makes it a game-changer in the on-chain derivatives space. By combining the best features of CEXs (liquidity) and DEXs (security), IntentX paves the way for new use cases and applications in the DeFi ecosystem. The platform’s vision is clear: to facilitate the migration of derivatives trading from centralized platforms to on-chain solutions. While this shift may not be immediate, with IntentX’s strategic intent and innovative solutions, the evolution of on-chain derivatives trading is not only foreseeable, but inevitable.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Blackbird

Blackbird, a new venture located at the intersection of blockchain technology and the culinary world, has successfully raised $24 million in a Series A funding round led by prominent venture capital firm Andreessen Horowitz (a16z). Led by restaurant innovation luminary Ben Leventhal, known for his contributions to Resy and Eater, the platform aims to revolutionize the dining experience using Web3 technology. Blackbirds unique offer allows restaurants and customers to connect directly, offering rewards ranging from free drinks to exclusive memberships. With this significant investment, Blackbird is poised to redefine the value dynamics in the restaurant industry, emphasizing enhanced engagement and rewards for diners.

https://x.com/blackbird_xyz/status/1709562317615063465?s=20

Phaver

Phaver is a prominent player in the Web3 social ecosystem, having successfully raised $7 million in seed funding. The round saw contributions from prominent investors including Polygon Ventures, Nomad Capital, dao 5, Symbolic Capital and Foresight Ventures. Launching in May 2022, Phavers platform bridges the gap between Web2 and Web3, enabling users to connect using familiar Web2 logins while gradually introducing them to Web3 capabilities. The platform supports decentralized social graphs like Aave Company’s Lens Protocol and showcases on-chain assets like NFTs. Phavers application has been downloaded more than 250,000 times, making it one of the most active applications in the Web3 space. The company’s vision revolves around user ownership of the Web3 space, allowing users to use their data across various platforms and build credibility through decentralized IDs and an on-chain social layer.

https://x.com/phaverapp/status/1709922051576807490?s=20

protocol event

Stars Arena drained of $ 2.9 million in AVAX tokens, funds in user wallets are safe

Sui Foundation reallocates 117 million SUI from external market makers to support growth initiatives

Manifold Finance rolls out an MEV auction protocol, names Frax founder and 0x Maki as advisors

StarkWare delays first token unlocks to April 2024

OP Labs' 'fault proof' system goes live as an alpha on testnet

Orbiter Finance allays rug pull accusations, says Discord blocked its account

ZeroSync implements first Stark-based ZK client for Bitcoin

Frax Finance V3 doc released

Industry updates

Yuga Labs cuts employees, focuses on metaverse extension amid restructuring

FriendTech developers rake in nearly $ 20 million since August launch

Galxe hit by DNS attack on front-end website

Ostium Labs raises $ 3.5 million to bring DEX perpetual swaps to oil and gold

Solana's latest update brings native support for private blockchain transactions

MoonPay adds the ability to swap cryptocurrencies in its consumer app

Former FTX executive once found millions of dollars of airdrops that the exchange didn't know about

Ledger cuts 12% of staff due to macroeconomic headwinds

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/TheDeFISaint/status/1710742013635703089?s=20

https://x.com/wacy_time1/status/1710613871529001459?s=20

https://x.com/thedefiedge/status/1710839956464377902?s=20

https://x.com/DeFiMinty/status/1710331397771043288?s=20

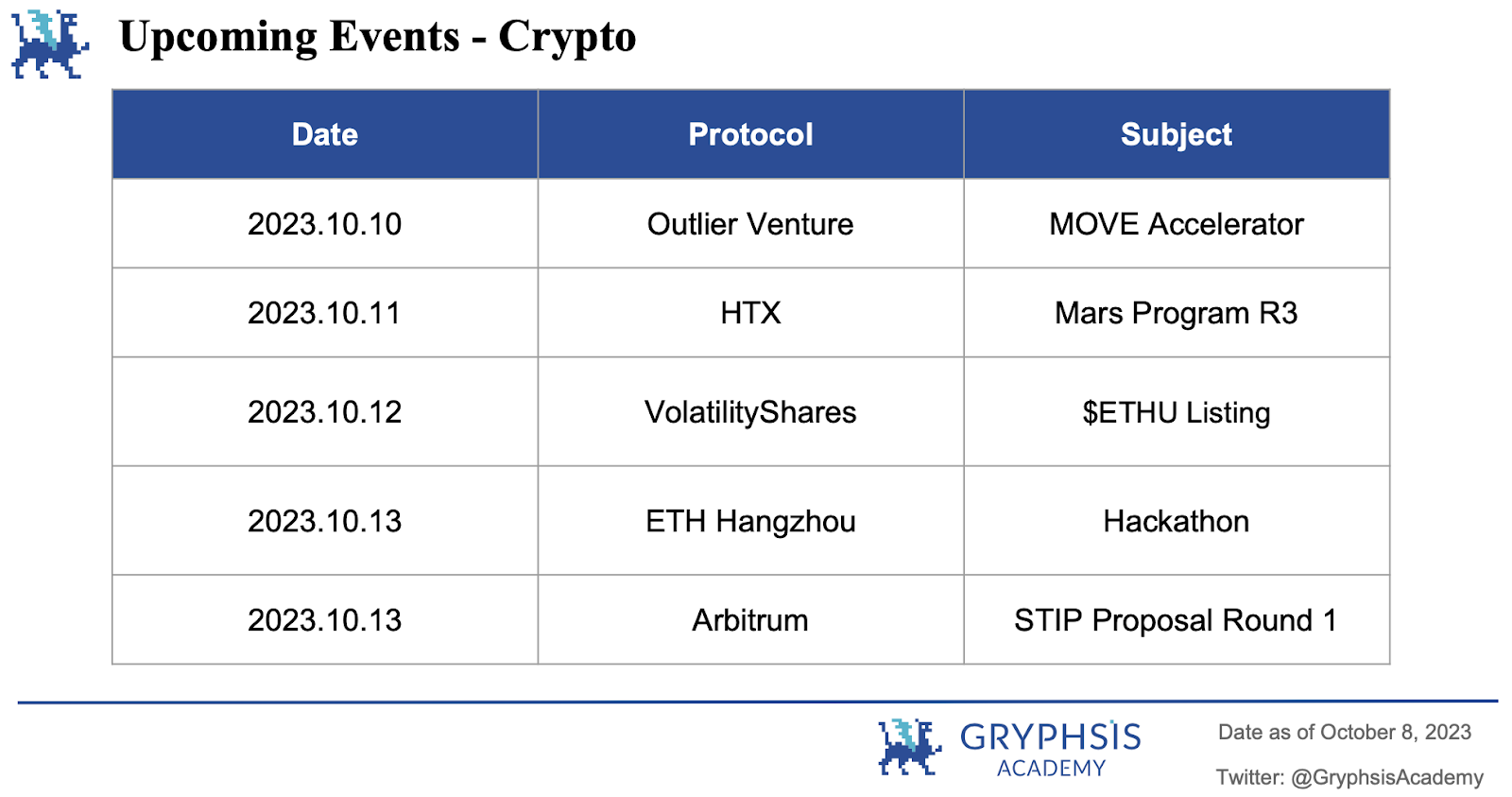

next week events

News sources/references:

https://www.coindesk.com/tech/2023/10/05/blackbird-crypto-restaurant-app-raises-24m-in-funding-led-by-a16z/

https://blockchain.news/news/a16z-leads-blackbird-24 m-series-a-funding-to-elevate-dining-experiences-through-web3

https://cointelegraph.com/press-releases/phaver-raises-7m-seed-funding-to-grow-its-web3-social-ecosystem

https://www.theblock.co/post/254946/web3-social-platform-phaver-raises-7-million-in-seed-funding

https://cointelegraph.com/news/stars-arena-secures-funds-to-plug-exploit

https://cointelegraph.com/news/friend.tech-copycat-starsarena-patches-exploit-after-some-funds-drained

https://cointelegraph.com/news/friend-tech-clone-stars-arena-drives-surge-avalanche-avax-token

https://cointelegraph.com/news/stars-arena-dispels-fud-patches-vulnerability

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.