Intent-centered design in blockchain systems

Original article written by Adam Arreola @NGC Ventures

Chinese Translation: Tudd Cai Henry Zhang @NGC Ventures

introduce

At this stage, conducting transactions using blockchain solutions is too complex for the average user. Users may know what their goal is, but complex steps hinder their ability to achieve their intent.Recently, a concept called “intention-centered design”(Intent-centric design) solutions have attracted the attention of the community. Intentions allow users to describe their desired outcome rather than listing every step needed to achieve that goal. For example, if a user wanted to receive a certain amount of Ethereum (ETH) and was willing to pay a certain amount of Bitcoin (BTC) to receive it, an intent-centric solution would make this possible without having to Users specify the specific steps for cross-chain transactions.

This article will explore emerging intent-centric designs and how they will simplify blockchain interactions. It will also explore in detail the lifecycle of intents, current implementations of related designs, and future applications of this technology. In addition to assessing the risks and challenges posed by intent-centric systems, this article will evaluate the value flows and provide a comprehensive examination of this innovation that is rapidly changing the blockchain landscape.

Users need a concise blockchain interaction process

The complexity of blockchain transactions creates an uneven playing field where only the savviest users can hope to profit. Experienced participants such as market makers, high-frequency trading companies and MEV searchers use advanced resources, systems and algorithms to compete to maximize profits.

Intent-centered design helps level the playing field and streamlines how users transact on-chain while improving capital efficiency throughout the system. For experienced participants, given their existing capabilities, becomingProcessor(Solver) is not a major change because they already have the capabilities. Intent-centric systems provide better UI, optimizedGas cost、Slippageprocessing and better composability.

Users only need to describe the effect they want to achieve, and they can easily achieve their goals. Users dont need to know or understand the underlying processes required to achieve their goals; they just need to know what the end effect they want is. This makes on-chain transactions more acceptable to ordinary participants. Providing users with an improved and easier-to-use operating interface can increase user demand for blockchain systems, thereby increasing overall liquidity and making the blockchain ecosystem more robust.

Digging deeper, the intent-centric system eliminates common user frustrations when dealing with gas fees and slippage. For example, in traditional blockchain transactions, users must pay gas fees, which may be an unfamiliar experience for novice users who are used to the abstraction of these fees in traditional financial systems.Account abstraction(passERC-4337 Introduced) allows users to use any ERC-20 token to pay gas fees, or sponsor and pay gas fees for its users through a licensing agreement, making the payment of gas fees more flexible. This not only simplifies the interaction process but also increases control over transactions. An intent-centric system can optimize the gas fee required for each transaction to achieve the users desired effect without making the user painfully estimate the required gas. Likewise, users are often affected when estimating slippage. Intent-centric systems can abstract and optimize slippage settings and trade timing to minimize the price impact on users.

Intent life cycle

While the intention is to simplify the user’s trading experience, the technology behind it is complex. There are several different teams working on building intent systems, but a typical intent-centric transaction flow looks like this:

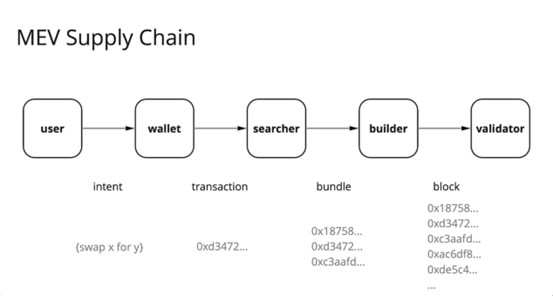

Image from Flashbots’ article “MEV supply chain: A peek into the future of the industry》

1. Off-chain submission:Users use wallets to submit intents.

2. Enter the memory pool (Mempool) or send to the block builder (Block builder):Transactions can be entered optionallymemory poolOr send directly to the block builder to speed up execution. The choice between using an alternate memory pool, a standard memory pool, or bypassing the memory pool entirely depends on the specific requirements of your intent. For example, high-value exchanges, especially those following the ERC-4337 standard, are often designed to bypass the public mempool entirely. This is to alleviate thefront-running(Front-running) andsandwich attack(Sandwich attacks) and other harmful MEV-related risks. Instead, these transactions are sent directly from the Bundler (which usually acts as a block builder), ensuring a faster and more secure transaction process.

3. MEV searchers look for opportunities:If the transaction enters the mempool,MEV searcherSee the data in the memory pool and find the best path to achieve your intent and profit opportunities. MEV searchers can choose to process transactions themselves, or sell the information they find to a processor. In most cases, MEV searchers not only identify opportunities but also act as processors themselves.

4. Processors compete for best transaction execution and bundling of intent:Processors act as market makers as they compete to provide users with the best trade execution. Users naturally seek the cheapest and fastest solution to achieve their intentions, and processors who can provide that solution earn fees. Processors aggregate multiple intents into bundles so that they can be executed in a single transaction, and then forward these bundles to block builders to accommodate them in upcoming blocks.

5. Block construction and verification:block builderSelect Bundles and package them into chunks. These blocks are then sent to validators to include them in the blockchain. This stage represents the final assembly and verification of intentions, ensuring they are correctly executed and recorded on the blockchain.

Existing intent-related projects

Early forms of intent-centered design can already be seen in existing applications and blockchains. Among the well-known projects are:

Cow protocol + Cow swap

Cow protocolis a permissionless transaction protocol that utilizesbulk auction(Batch auctions) to discover prices. found byCoincidence of Needs(Coincidence of wants) opportunities (the situation where two users each have what the other wants) and aggregate all available on-chain liquidity sources to maximize liquidity. Unlike traditional transaction protocols, Cow Protocol’s processors compete to provide users with the best solution for their intentions.

Cow swapIt is the front-end interface of the Cow protocol developed by the same team. It is a decentralized exchange (DEX) that uses an intent-centric approach to help users find the lowest trading prices from all DEXs and aggregators. Additionally, Cow swap’s intent-centric design protects users from front-running and other harmful MEVs. New features of Cow swapCow HooksAllowing developers and advanced traders to write custom operations (such as trades, cross-chains, staking, deposits, etc.) that can be performed before or after a transaction, all within a single transaction, fully reflecting the intent.

Soul wallet

Soul wallet(one of NGC Ventures’ portfolio companies) is an upcoming user-friendly smart contract wallet that leveragesAccount abstraction(Account abstraction) to improve the flexibility of gas fee payment and sponsorship. It can also be achievedsocial recovery(Social recovery) function, which is a secure mechanism for recovering encrypted wallets without using a mnemonic phrase. Most (e.g., three out of five) other wallets owned by the user or their trusted friends and family members (called guardians) can sign a recovery agreement to help the user regain access to it. In addition to social recovery, Soul wallet also offers two-factor verification, allowing users to designate another wallet to approve transactions. Additionally, Soul wallet abstracts the underlying blockchain mechanisms to provide a seamless experience when using Ethereum and its various Layer-2 solutions. Soul walletsOne-Click secure swap leverages account abstraction to allow users to trade without worrying about security risks and manual token approvals.

UniswapX

Uniswapnew productsUniswapXIt solves some of the most pressing challenges in DeFi through its intent-centric architecture.

One of UniswapX’s goals is to solve the problem of decentralized liquidity. By aggregating various liquidity sources, such as Uniswap V2 and V3 pools of various asset pairs, UniswapX will satisfy each users intent to find assets and provide users with the best asset prices. This is provided by a third partyfiller(Filler), they leverage liquidity from these different pools or their own private liquidity to enable transactions.

UniswapX also brings a gas-free transaction process to users by letting fillers bear the gas fee of the exchange and include it in the transaction price. This eliminates the need for users to pay for failed transactions or hold native network tokens to pay gas fees, further simplifying the Uniswap user experience.

UniswapX’s intent-centric design also helps protect against harmful MEVs. For example, UniswapX reduces user losses by returning the surplus generated by orders to users in the form of price optimization. Additionally, UniswapX is designed by usingPermit 2 andReactor Contract to protect users from front-running and sandwich attacks by arbitrageurs, align transactions with user expectations and adjust transactions that do not meet user expectations. UniswapX uses time-dependent executionDutch auction order(Dutch auction orders),encourageCompetition among fillers minimizes the occurrence of harmful MEV.

Going forward, UniswapX plans to launch additional features consistent with its intent-driven philosophy. Upcoming pairsUniswap V4Support for is a noteworthy development, but even more groundbreaking is the introduction of gas-less cross-chain transactions. Users will be able to specify which assets they receive on their target chain, thus avoiding the high fees and delays associated with cross-chain transactions.

Upcoming Intent Protocol

Anoma

Anoma(another NGC Ventures portfolio company) isHeliaxunder developmentMultifunctionIntent solution that will allow transactions with additional conditions. The protocol seeks to find the best match between various blockchains for a user’s intentions, ensuring transactions are completed according to user-specified conditions. This is throughDecentralized counterparty discovery mechanism(decentralized counterparty discovery mechanism), this mechanism eliminates the protocol’s dependence on centralized third-party institutions, thereby strengthening the consistency between the protocol and the decentralized spirit of the blockchain.

Through a distributed approach, Anoma lets processors compete with each other to achieve user intentions. Decentralized counterparties explore direct and trustless interactions between parties, while distributed solutions leverage the collective computing resources of processors to efficiently fulfill user intent.

In addition, Anoma’s multi-chain atomic settlement capability optimizes digital asset transactions across multiple blockchains by compressing the process into a single transaction. This feature eliminates the hassle of manually conducting a series of transactions, improving the efficiency and overall user experience of cross-chain transactions.

SUAVE powered by Flashbots

SUAVE(Value Expression Single Unified Auction) is produced byFlashbots(another NGC Ventures portfolio company) developed a product that decouples the roles of mempools and block builders from existing blockchains and provides a highly specialized and decentralized plug-and-play alternative plan. SUAVE aims to promoteBlock buildingDecentralization to reduce the possibility of censorship and abuse of power by block builders within the blockchain ecosystem. As of the week of August 25, 2023, the top five block builders on Ethereum haveAbout 90% of the blocks are built,andApproximately 48% of constructed blocks comply with OFAC requirements. This leads to the risk of users being subject to centralized censorship, which goes against the original intention of the decentralized and censorship-resistant system established by Ethereum.

SUAVE is developingMEVM, a professional version of the EVM that enables developers to create MEV applications as smart contracts in a flexible and expressive programming environment. MEVM consists of three main components:Universal Preference Environment (UPE), which is a chain and mempool designed to express and aggregate preferences (intent) across different chains; the Best Execution Market (OEM), where processors compete to provide the best execution for user-submitted intentions, and block construction The decentralized network of cryptographers incorporates the intentions of crypto users into blocks. This architecture makes it easier to build new MEV applications, promotes competition in solving intent, and decentralizes the MEV supply chain.

SUAVESroute map(Divided into three stages:Centauri、AndromedaandHelios) describe their plans to reshape the MEV landscape through intent-centered design. During the Centauri phase, SUAVE introduced a privacy-aware order flow auction that allows users to recycle the MEV generated by their transactions. During the Andromeda phase, SUAVE’s mainnet launch will enable users to express intentions in SUAVE’s execution market and adoptSGX mechanism(SGX-based) to improve the efficiency and privacy of auctions and block generation. The Helios phase will further decentralize the building network and lay the foundation for cross-domain MEV solutions. This intent-centric approach aligns with SUAVE’s mission to build a neutral home for users, searchers, builders, and validators of different blockchains.

Essential

Essential isdevelopingIntent-based infrastructure is a suite of three products: For intent expressionDomain Specific Language (DSL),New intent-centric account abstraction for Ethereum and EVMERC standards, andModular intent layer。

As it stands, intentions lack a standardized language for communicating across blockchain systems. This can lead to cross-chain intentions being misinterpreted, leading to undesirable outcomes such as incorrect token exchanges. Essential wants to solve this problem by generating a domain-specific language (DSL) for intents so that users can effectively communicate intents between different systems and have them interpreted by processors.

According to the project team, Essential’sNew ERC StandardandERC-4337The difference is that it will assign processors the task of constructing valid transactions to satisfy the users intent. As of August 25, 2023, the team has not shared further details about the upcoming ERC standard mechanism. This new solution willEVM compatible blockchainBringing the benefits of intent-centric design beyond Ethereum with EVM and creating a smoother experience for the broader blockchain ecosystem.

Finally, Essential aims to go one step further by making modular intent layers. Intents will be grouped into individual batches, and the modular intent layer will process each new chunk as a solution to the batch of intents. Essential’s modular intent layer will facilitate transparent order flow aggregation by directing all order flow through a unified network of processors, ensuring they have access to as much information as possible to process transactions. Furthermore, by encouraging competition among processors to provide users with the best implementation of intents, a modular intent layer will be able to resist harmful MEV in transaction-centric design systems. The modularity of this layer will enable the protocol to be integrated into various ecosystems, creating paths for efficient cross-chain intent execution.

Potential future intended applications

there are manyNovel intent applicationsIt is under development and will be available to users in the future;

● conditional intention(Conditional intents) will enable actions to be performed based on specific conditions, such as the outcome of certain governance decisions or the price reached.

● continuous intention(Continuous intents) will allow operations to be executed repeatedly through a single intent expression, enabling tasks such as cost leveling or market making.

Intention-centered design can also be combined with other unique technologies such as artificial intelligence. For example, viaAccount abstractionLeveraging intent-centered design and combining it with artificial intelligence, users can enjoy personalized and automated investment strategies. Allowing each user to have a tailored blockchain experience makes on-chain operations easier while opening the door to new innovative applications and services. Additionally, AI can be used to augment the capabilities of processors, helping them optimize trade execution and adapt to market conditions more effectively.

Another interesting potential application of intents is withreal world assets(RWA) combined with:

Intents can be used to connect traditional finance and DeFi if users want to convert traditional financial assets into tokenized blockchain assets.

Intent can be used in lending protocols where users indicate their intention to use RWA as collateral for DeFi loans. Protocols can tokenize assets for users and use them as collateral without requiring users to specify every transaction required to achieve their goals.

In the case where a user wants to earn real estate tokenization income, intent can help the user generate RWA income. The protocol can invest in properties on behalf of users and earn income from rental income or property appreciation.

Additionally, intent-centered design has the potential to be applied beyond the blockchain realm, revolutionizing many aspects of daily life. For example:

Intent-centric solutions can aggregate ride-sharing apps like Uber and Lyft to let users express their travel intentions and let the system find the best ride options for users across multiple platforms.

When booking a flight, intent-based systems can analyze user preferences such as travel dates, preferred airlines and budget constraints to find the best flight option for the user to book.

With intent-centered design, users can find the best deals across many online stores, enhancing their online shopping experience.

Unlike traditional aggregators like Expedia, which can only compile options, intent-centric systems consider and interpret users potential needs. While aggregators offer a fixed set of choices based on predefined criteria, intent-centric systems actively cater to each users unique preferences, dynamically adjusting to deliver more personalized solutions.

Risks and Challenges

While intentions optimize the user experience flow, they also create a set of risks and challenges. First, Intent relies on outsourcing decision-making to third parties—processors and block builders. This means that users must place a certain level of trust in these parties and the systems that connect them. Users need to be wary of processors and block builders abusing their ability to charge high fees for the execution of intents, or to prioritize the execution of intents that offer the highest rewards. This can lead to users paying too much to execute their intent, making the system inefficient. Likewise, if a small group of people controls the execution of most intentions, the system runs the risk of a small number of people deciding terms, setting prices, or reviewing transactions. This could lead to reduced competition, higher user costs, and less overall decentralization. To prevent these factors from inhibiting innovation and ruining the user experience, crypto users must demand system designs that resist centralization and help build trustworthy and neutral ecosystems through transparency and cryptoeconomic incentives that incentivize good behavior by intermediaries.

Users interacting with intent-centric systems also run the risk of their intentions being misinterpreted, such as by performing the wrong actions and producing unintended consequences. Builders should be careful to develop standardized forms of communication that have intent at the core (e.g.EssentialareconstructedUniversaldomain specific language) to avoid this risk.

Finally, with the emergence of intent-centric systems, new security threats may emerge. Examples include accidental granting of unauthorized account access, data breaches that compromise user privacy, and information breaches that allow other traders to front-run or manipulate the market. In such circumstances, it is unrealistic to expect the processor to behave fairly and impartially. Just as todays MEV searchers exploit the system for profit, processors in intent-centric systems will have incentives to cheat if it is profitable. Therefore, it is the responsibility of the architects of these systems to build a framework that thwarts malicious behavior while promoting outcomes that are most beneficial to users.

The changing flow of value in intent-centric systems

In an intent-centric architecture, the interests of MEV searchers, processors, block builders, and validators are aligned with the fulfillment of user intent. For now, the value of intent-centric blockchain systems flows primarily to MEV searchers, processors, and block builders as they work together to communicate and execute the best possible outcomes for users, and from the process Profit.

Clearly, MEV searchers and processors accrue value. They are the first to see intent and are the individuals who find the most value in individual fragmented intents or in groupings of potential intents that they can process in batches. Processors effectively act as market makers as they compete to deliver the best deals to their users. Users want the cheapest and fastest way to achieve their intentions. Implementing intentions in the best possible way is not only a service, but also a lucrative opportunity for these individuals, helping to motivate them to deliver the best possible results. Alignment of interests between users, MEV searchers and processors helps the system run efficiently and transparently, promoting a competitive environment that benefits all participants.

A large portion of the value also flows to the block builders. Block builders are responsible for constructing and determining the formation of blocks, playing a key role in realizing each users intentions. Because searchers, processors, and users rely on block builders to fulfill intent, the block builder role becomes especially valuable to all participants as the system becomes more complex.

However, as competition among searchers, processors, and builders continues to increase, value is expected to be redistributed to validators, stakers, and users, reflecting the evolving nature of the MEV ecosystem.

Validators and stakers will benefit greatly from the intense competition among searchers, processors, and builders. As more processors, searchers, and builders join the MEV space, individual profit margins will decline. As transparency of on-chain intent-centric architecture increases and parties combine algorithms copied from each other, gas fees may eventually eat away at much of the profits processors hope to make. It is worth noting that the value does not disappear, but is redistributed to validators and stakers. This change is critical to the long-term stability of the network. A fully compensated validator increases the networks security budget, and higher staking rewards incentivize further staking, improving the overall security of the network.

Furthermore, as the system becomes more efficient and competitive, users (the initiators of transactions) will also benefit. Reduced processor profits and gas fees enable users to execute their intentions at lower costs. Additionally, increased competition among processors to provide the best execution paths results in better prices and faster transactions for users.

Conclusion

The intention-based paradigm shift is not just a technological advancement, but also a shift in value preferences. Project parties should focus development efforts on achieving user intentions rather than complex operations. Intent-centric systems provide the path to a composable blockchain landscape that values user needs, efficiency, and transparency. Not only that, enhanced user experience can also accelerate the adoption of crypto applications, making complex blockchain technology more relevant to users’ daily usage habits. Research on intent gives us a glimpse of the future: aligned interests among users, MEV searchers, processors, and block builders could streamline blockchain interactions and drive growth throughout the crypto ecosystem. By prioritizing the fulfillment of user intent, developers are paving the way for a more equitable and user-centric blockchain landscape, where the flow of value is tied to the fulfillment of human intent. The rise of intent-centered design marks a transformative moment and the beginning of a new era for blockchain, transforming a complex technological maze into a user-oriented frontier.