SignalPlus Volatility Column (20230925): The market is waiting for guidance from macro news

U.S. stocks closed slightly lower on Friday, with the SPX 500 recording its largest weekly decline since March, while U.S. bond yields climbed across the board again today to near their recent peaks after experiencing a correction and decline last Friday. Looking ahead to this week, the U.S. GDP annual rate will be released on Thursday; Federal Reserve Chairman Powell will deliver a speech on Friday, and the U.S. core personal consumption expenditures index will be released in the evening, which may provide further guidance on the markets trading direction.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

Since the FOMC meeting last week raised expectations for economic growth and interest rate prospects, market risk appetite has continued to weaken. Against this background, the price of BTC has continued to be under pressure and fell. It once touched the 26,000 support level at the weekend, and then rebounded slightly back above it. Whole plate.

Source: Deribit (as of 25 Sep 16:00 UTC+8)

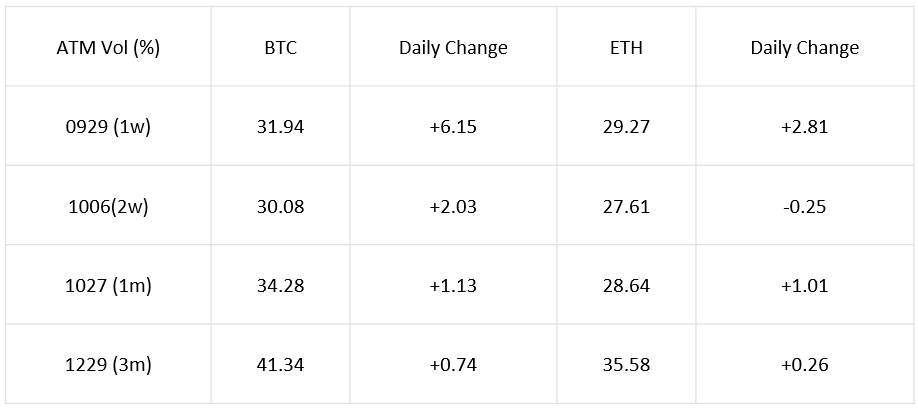

In terms of options, the market will usher in September quarter-end settlement this week, and the release of a large amount of margin during the period may cause changes in the IV surface. In addition, the release of data such as the US PCE and the Michigan Consumer Survey this week is also the focus of the market. If these data further strengthen concerns about rising inflation in the United States, risk appetite is likely to continue to be weakened, and BTC will be under downward pressure. Affected by this, the short-term IV rebounded sharply from the bottom of the weekend, and the front end of the curve changed from steep to flat. But unlike previous Mondays, the overall level of IV after the increase is still not high. ETH ATM IV within a month is basically still below 30% Vol, and BTC 2 W will only remain at the 30.08% level.

Source: SignalPlus

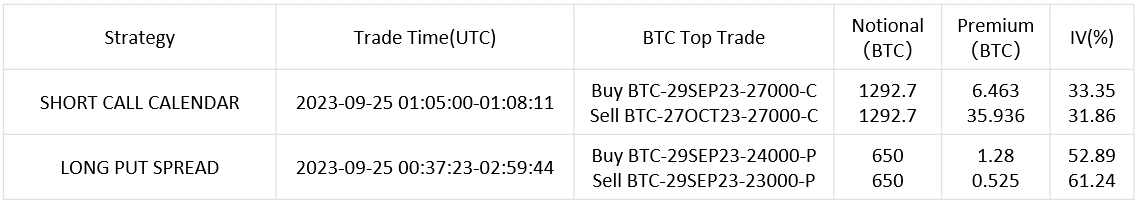

In terms of trading, the past 24H 29 SEP vs 27 OCT SHORT 27000-CALL CALENDAR (1292.7 BTC per leg) has become the focus of the market. At a time when risk assets are under pressure, a high premium is harvested by selling Octobers call, while buying this Fridays 27000-call provides protection from the uncertainty that may arise from events such as data releases/talks this week.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends .

SignalPlus Official Website:https://www.signalplus.com