SignalPlus Volatility Column (20230921): The market fluctuates downwards, focusing on BTC/ETH volatility arbitrage strategies

The Federal Reserves September meeting kept interest rates unchanged at a range of 5.25% to 5.50% as expected, staged a hawkish pause. What is worth paying attention to is:

First, while one more interest rate hike is expected this year, the forecast for an interest rate cut in 2024 has been reduced from 100 bp to 50 bp. As Powell mentioned in the follow-up question and answer session, “The Fed will maintain restrictive interest rates until it is confident Let inflation fall to 2%.

Second, the Federal Reserve significantly raised the expected economic growth rate of the United States this year (from 1% to 2.1%), and accordingly changed the statement on the pace of economic activity expansion in the Summary (SEP) from the previous"moderate"Changed to solid. After this meeting, the core conflict in the market is no longer whether there will be another interest rate increase in 2023, but when interest rates will break the Higher for Longer model and shift from interest rate increases to interest rate cuts.

Source: SignalPlus, Economic Calendar

In terms of digital currency, BTC ended its volatile upward trend for several consecutive days, and suffered a short-term decline together with US stock risk assets during yesterdays FOMC question and answer session, with a decline of about 2%. Although the price rebounded quickly after that and recovered most of the losses, the price trend of BTC during the day was still in a slow downward channel, with todays delivery closing at 27003 (-0.41%).

Source: Binance & TradingView

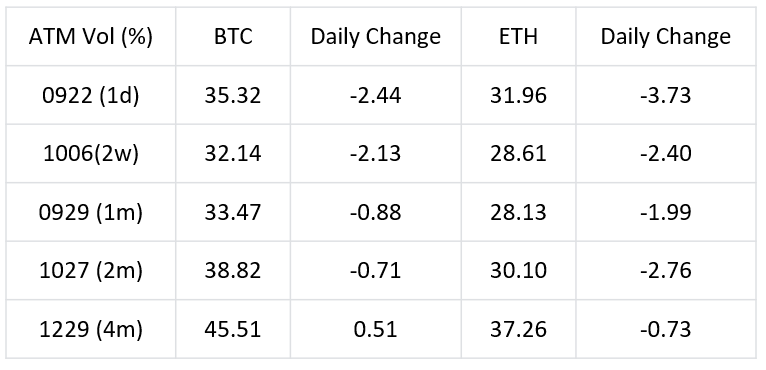

After the FOMC, the front-end IV fell significantly, and the BTC/ETH ATM IV dropped to 33.47% (-0.88%)/28.13% (-1.99%) respectively at the end of September. From the mid- to long-term perspective, ETH IV has declined, while BTC has increased slightly. This change has exacerbated the IV gap between BTC and ETH. At the end of October/December when liquidity was better, the ATM IV gap between the two Both have exceeded 8% Vol, which may provide entry opportunities for cross-variety volatility arbitrage strategies.

Source: Deribit (as of 21 Sep 16:00 UTC+8)

Source: SignalPlus, front-end IV falls quickly after FOMC

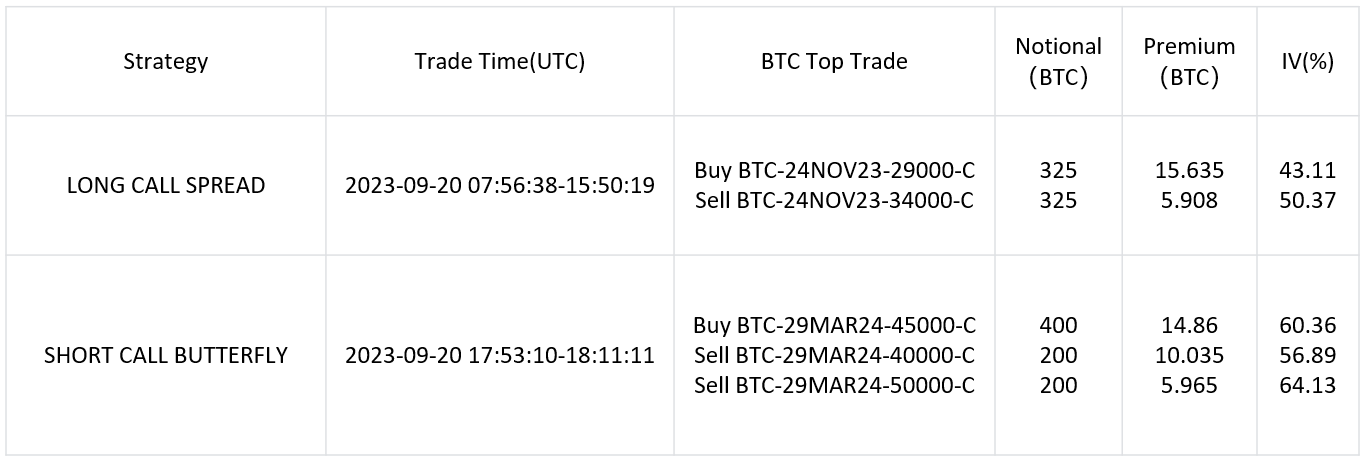

In terms of trading, the distribution of trading volume in the market over the past 24 hours has gradually shifted towards the medium to long term, and investors have begun to pay more attention to long-term investment strategies. Among them, forward buying Call Spread from the end of October has become the focus of attention, with the cumulative transaction volume reaching 1,700 BTC/16,800 ETH.

Source: Laevitas

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com