Solana DeFi Revival: Checking Q3 Progress and Q4 Outlook of the Ecosystem Projects

Original author: FA 2, co-founder of SolanaFM

Translation: Odaily

Solana's DeFi universe is being efficiently built in the third quarter, filled with creativity and experimental spirit. From experienced developers to enthusiastic community members, everyone is rolling up their sleeves to lay a solid foundation for financial innovation skyscrapers in their sights.

This is not just a simple stacking of bricks and stones, but a meticulously designed architecture. Developers and community contributors collaborate to ensure the unique value added to the entire structure. The result of their labor is an ecosystem that is constantly growing and evolving in an exciting and unpredictable manner.

Here are some highlights:

TVL growth: The TVL in Solana DeFi has grown by 21%, from $268 million to $327 million.

Number of daily active wallets (DAW): The number of daily active wallets fluctuates between 230,000 and 350,000.

Trading volume: Even excluding important participants like Zeta Markets and Phoenix, the trading volume fluctuates between $15 million and $162 million.

In addition to these numbers, there are some noteworthy events that have catalyzed the Solana ecosystem:

MakerDAO wants to use Solana's Virtual Machine (SVM).

Maple Finance returns to Solana.

EUROe stablecoin is launched on Solana.

CNBC rates Solana higher than BCH and LTC.

Let's see what the team has built in Q3 and what we can expect in the fourth quarter.

Derivatives and Synthetic Assets

There is a lot of activity in the derivatives and synthetic assets space. Here are the details:

Zeta Markets

Q3 Review:

New V2 upgrade: Enhanced system architecture for improved performance.

New user interface: Simplified and user-friendly trading experience.

Portfolio page: Real-time tracking of assets and trades in one dashboard.

USDC-based perpetual trading: Introducing new USDC-based trading options.

On-chain order book: Nasdaq-like speed on-chain.

Q4 Outlook:

Faster transactions: The team plans to accelerate transaction execution time.

New incentive measures: Introducing rewards and incentive measures to attract and retain users.

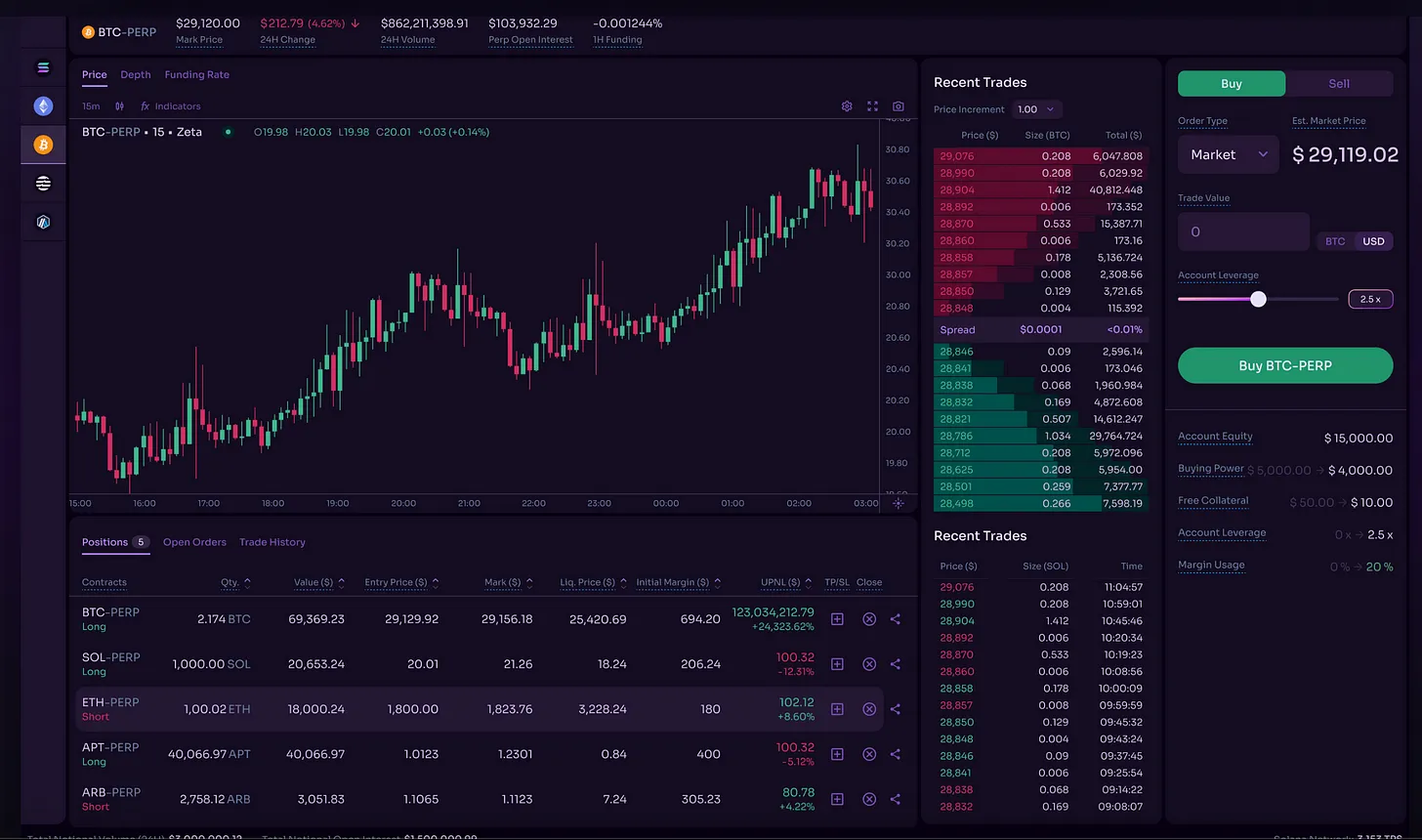

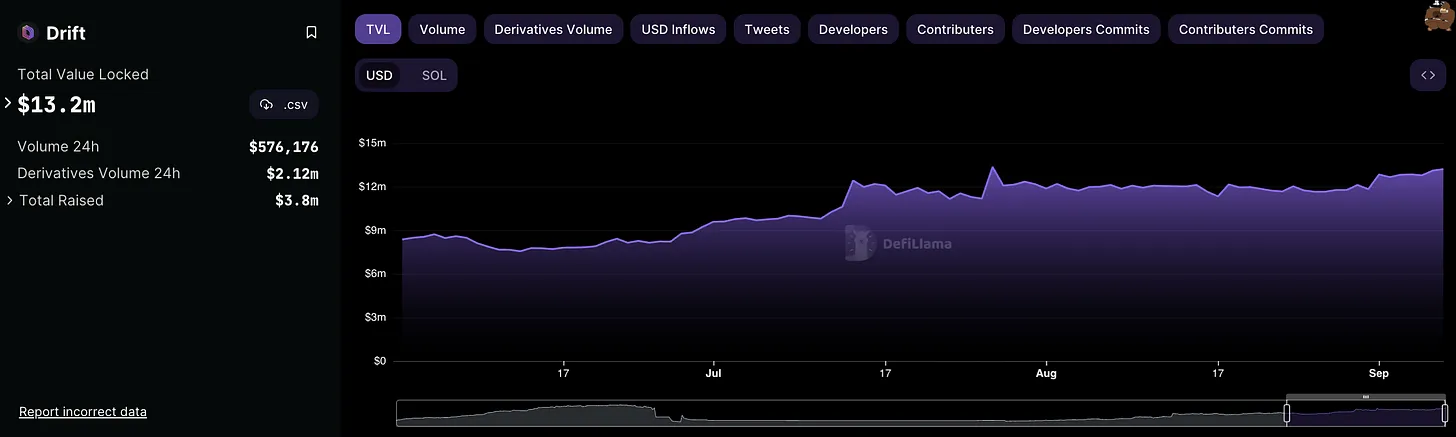

Drift

Q3 Review:

Weekly active users: Reached a historical high of 1800 on August 21st.

TVL growth: TVL increased by 50%, now reaching $13.2 million.

New features:

Leverage Swap: Provides users with more trading options.

Drift Liquidity Provider (DLP): Added over $7 million in liquidity to the platform.

Q4 Outlook:

MetaMask Integration: To enable easier user onboarding and interaction.

Collaboration with Circuit Vaults: Introducing additional liquidity.

These developments signify that Drift will further enhance usability and user base in the fourth quarter.

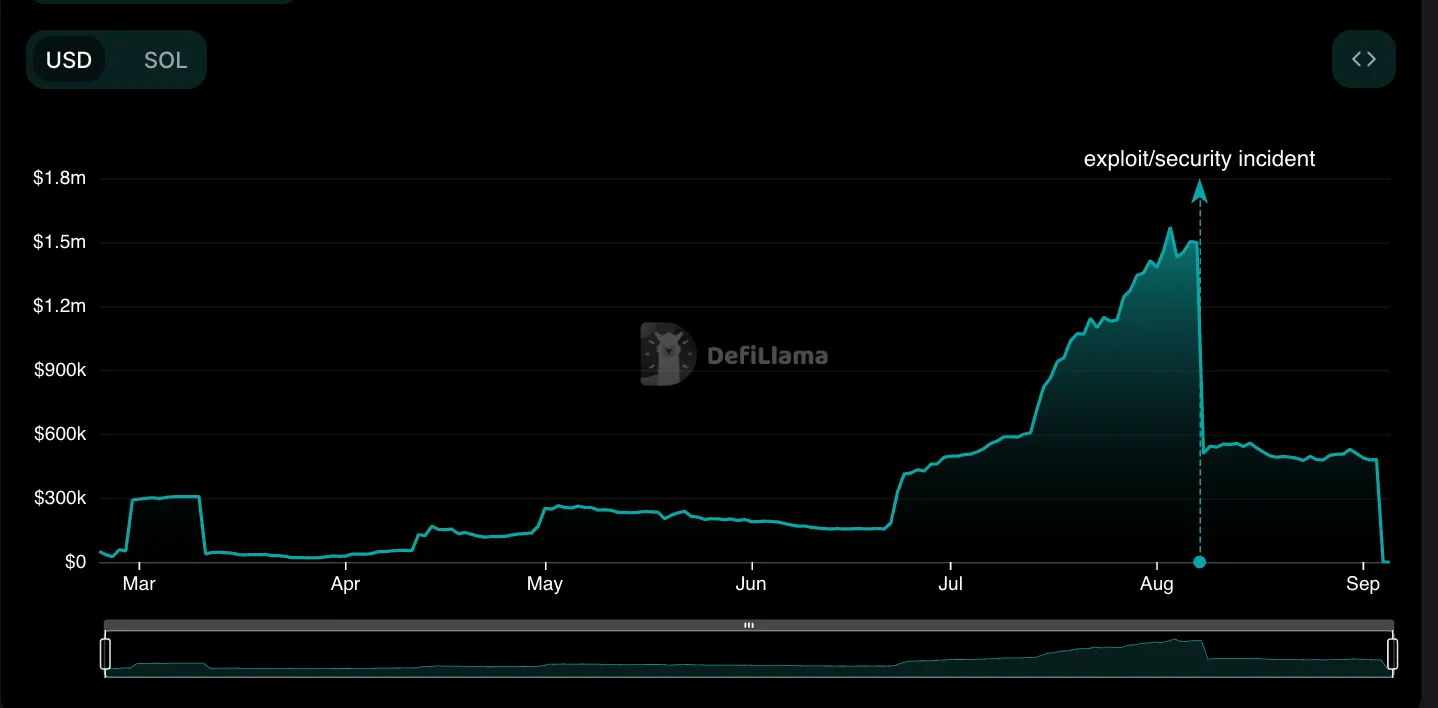

Cypher

Q3 Review:

TVL Growth: TVL increased by 10 times in less than three months.

Security Vulnerabilities: The platform was impacted by security vulnerabilities, becoming a focus for improvement.

Q4 Outlook:

Issue Resolution: Working diligently to address security issues and restore user trust.

IDO: Planning to launch the $CYPH token as part of the recovery and expansion strategy.

Upcoming IDOs and ongoing security improvements aim to restore confidence and lay the foundation for future growth.

Liquidity Staking Token (LST)

In the third quarter, there were some key innovations that can further expand the use cases of LST.

Marinade

Q3 Review:

User Growth: Marinade has a user base of over 74,000.

TVL: TVL has reached $146 million.

New Product Launch: Marinade Native launched in July and attracted 1.78 million SOL tokens staked within a month.

Q4 Outlook:

Upcoming Incentives: Marinade plans to launch new incentives in the fourth quarter, but specific details have yet to be disclosed.

Marinade achieved significant growth in the third quarter, with an expanding user base and successful product launches. The platform is keeping the details of its fourth-quarter plans confidential, but new incentives are on the horizon.

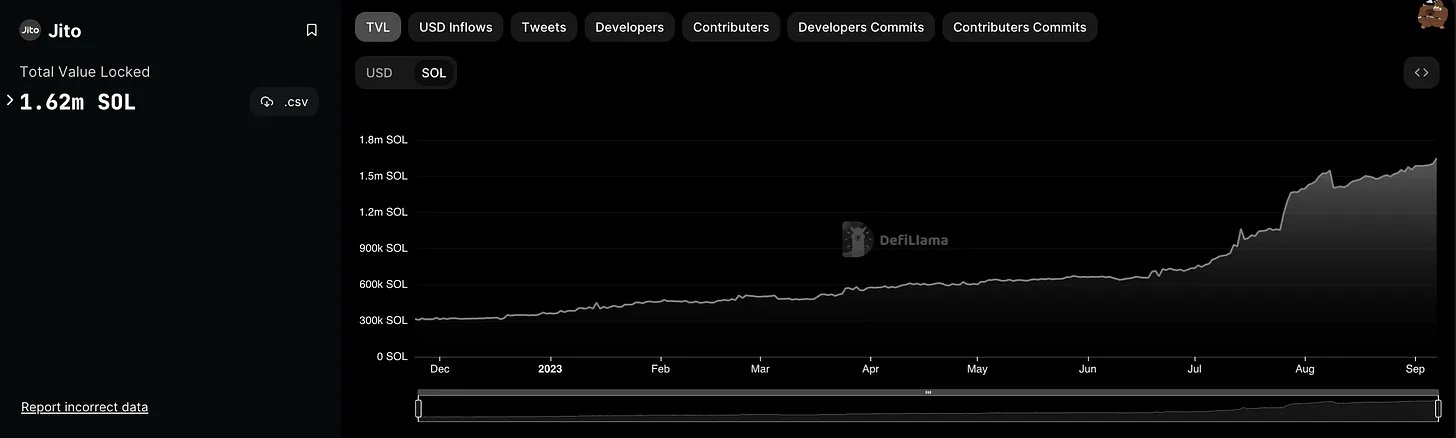

JitoSOL

Q3 Review:

TVL Growth: TVL increased by 100%, rising from 740,000 SOL to 1.62 million SOL in Q3.

Recommendation Plan: Launched a new recommendation plan to increase user engagement and adoption.

Q4 Outlook:

Potential Developments: The platform is exploring the possibility of launching new tokens and expanding its referral rewards system.

JitoSOL made significant progress in the third quarter, particularly in TVL growth and user engagement through its new referral plan. It is ready for potential innovations in the fourth quarter, keeping the community excited.

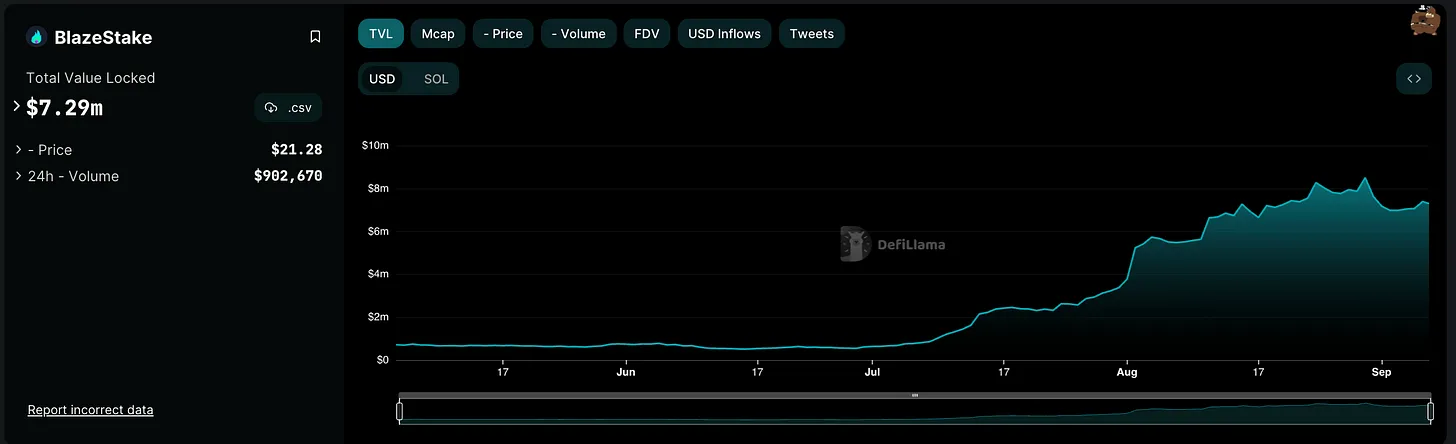

SolBlaze

Q3 Review:

Token Launch: SolBlaze has successfully launched a new native token, $BLZE.

Market Cap: The initial fully diluted market cap (FDMC) is $2.8 million.

TVL Growth: TVL has increased significantly by 10x, rising from $631,000 to $7.29 million.

Airdrop: Introduced a unique SolBlaze scoring metric for airdropping $BLZE tokens to users based on various factors, including staking and referrals.

Q4 Outlook:

Upcoming Features: The platform plans to introduce new features, including the BLZE scale for transparent and fair reward distribution and a bribery mechanism to incentivize staking.

SolBlaze made a splash with the launch of $BLZE tokens and the rapid growth of TVL in Q3. As we enter Q4, the focus will be on enhancing platform utility and user incentives through the introduction of new features.

Sanctum

Q3 Review:

Reserve Pool: Sanctum has established reserves exceeding 200,000 SOL.

Partnerships: Engaging in discussions regarding the usage of LST with the NFT market.

Q4 Outlook:

Upcoming Features: Sanctum has not released specific details but has indicated that new features are in the works.

Sanctum has made some progress in the third quarter, especially in accumulating a large reserve pool and initiating partner relationship negotiations. The details of its plans for the fourth quarter have not been disclosed yet.

Lending

The lending sector has been a driving force behind Solana's TVL growth. The TVL in this area has been steadily rising due to new incentives introduced by the token system and the two largest lending protocols on Solana. As we delve into the metrics, innovations, and upcoming features, it is evident that this sub-industry is laying the foundation for further growth of Solana's DeFi ecosystem.

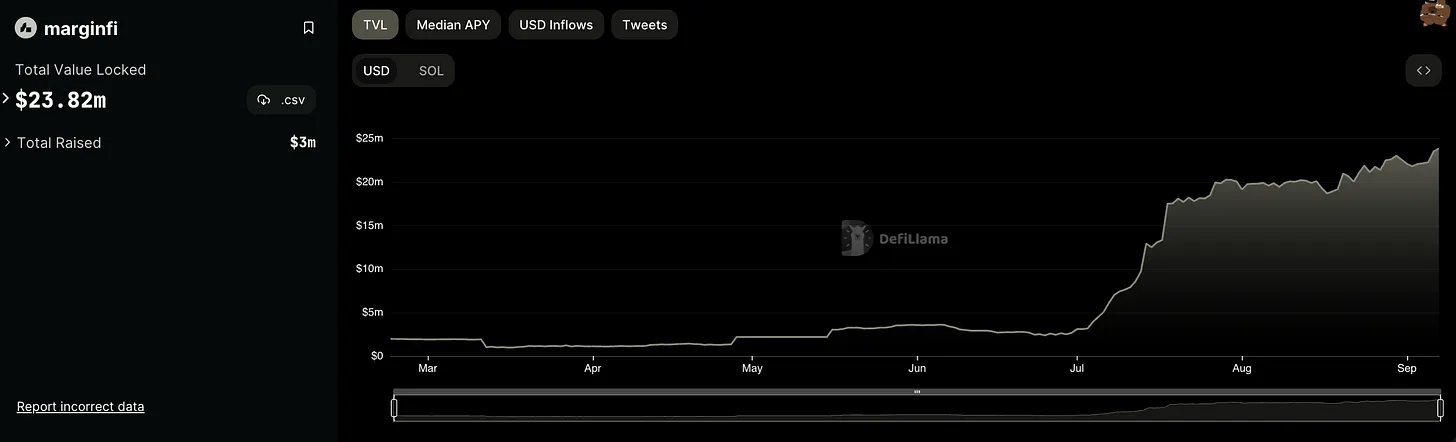

MarginFi

Q3 Review:

Surge in TVL: MarginFi's TVL has grown 10-fold, from $2 million in July to the current $23.82 million.

Market Background: Only 3% of the $10 billion worth of staked assets on Solana are in LST.

Q4 Outlook:

Upcoming Features: The team plans to launch a stable swap platform and their own stablecoin $mUSD in the fourth quarter.

Reward System: It is currently unclear whether the introduced token system will translate into native token or stablecoin rewards for the community.

MarginFi has achieved great success in the third quarter, characterized by rapid growth in TVL and integration with the Solana staking environment. In the fourth quarter, the platform aims to further diversify its product offering and may introduce unique reward systems.

Solend

Q3 Review:

TVL Growth: Solend's TVL increased by 50%, climbing from $30.37 million to $54.23 million.

User Engagement: New features such as margin and point systems were introduced. The margin function provides a transaction view, while the point system rewards users for activities such as deposits and transactions.

Q4 Outlook:

Future Development: The fourth quarter plan includes more support for liquidity staking tokens (LST) and the introduction of RWA assets pool.

Solend made significant progress in the third quarter, both in terms of TVL and user engagement features. The fourth quarter aims to consolidate this momentum through support for new asset types and further financial tools, expanding the platform's utility and coverage.

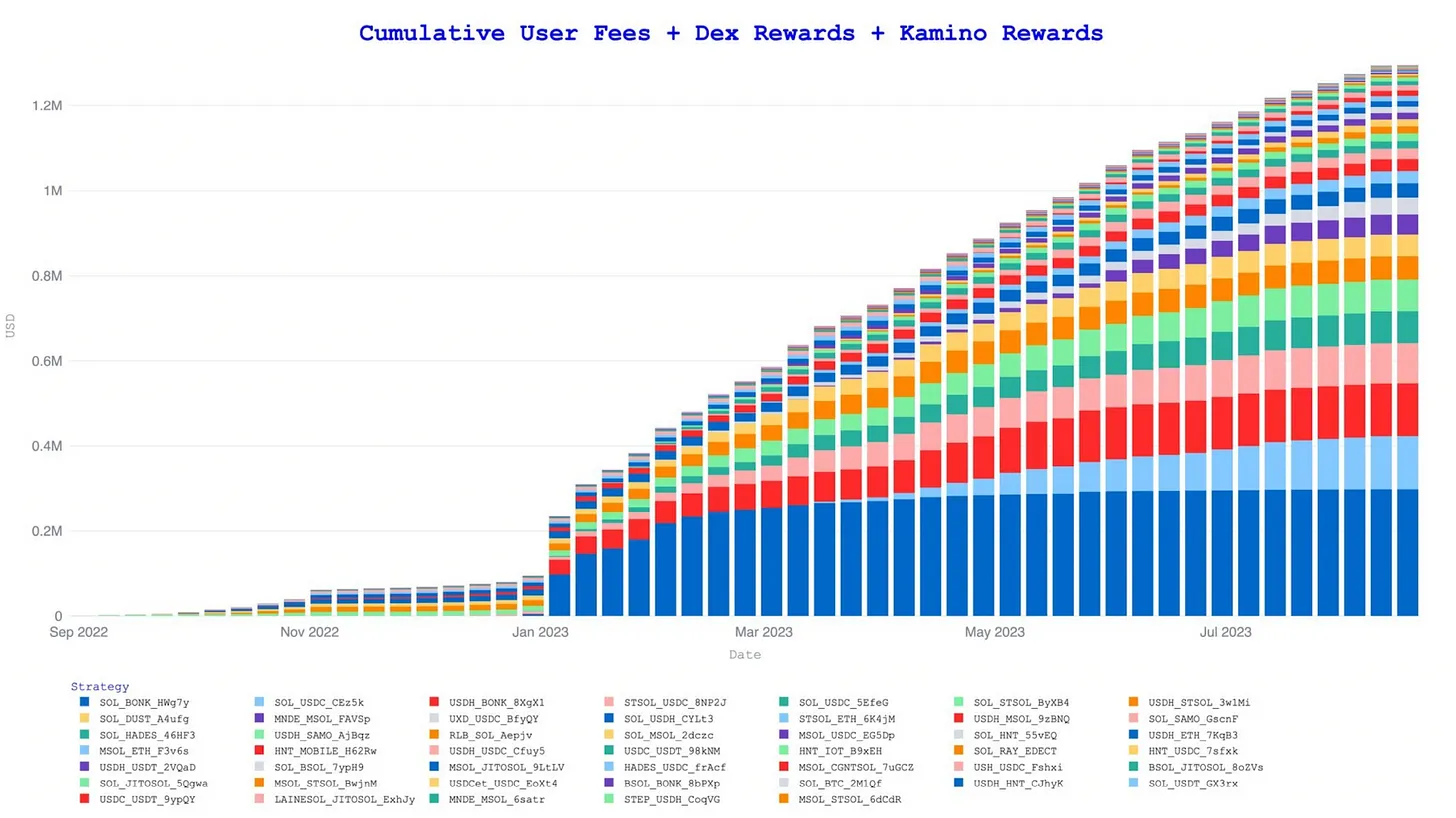

Kamino Finance

Q3 Review:

Trading Volume: Kamino Finance facilitated over $1 billion in trading volume.

Revenue: The protocol generated $1.25 million in fees for its depositors.

User Tools: New features include a creator vault for user-generated market strategies and comprehensive analytics for tracking performance metrics.

Q4 Outlook:

Next Version: Kamino 2.0 is planned for launch in the fourth quarter, promising additional functionality to further expand its utility within the Solana DeFi ecosystem.

Kamino Finance made significant progress in the third quarter, especially in terms of trading volume and user-generated tools. The Q4 version of Kamino 2.0 is expected to continue this trajectory, adding more features and capabilities.

Lifinity

Q3 Review:

$220,000 in protocol revenue generated over the past 3 months.

90% of which is either directly distributed to token holders or used to buy back LFNTY tokens.

Added pools for JitoSOL, bSOL, HNY, FIDA.

Q4 Outlook:

Lifinity V2: The team has developed a delta-neutral market maker and will launch it in the coming weeks.

Conclusion

In conclusion, the fourth quarter of the Solana DeFi ecosystem is expected to experience significant growth, much like evolving from the foundational stage of a skyscraper to equipping it with advanced features.

With the introduction of a series of incentive measures, plans to attract liquidity from all aspects, and improvements in user experience, the DeFi prospects for Solana in the fourth quarter are expected to be optimistic.