Gryphsis Cryptocurrency Weekly Report: Coexistence of Compliance and Anonymity, Vitalik's Public Research on the Use of Zero-Knowledge Proofs in Privacy Pools

Dear readers, welcome to the weekly cryptocurrency digest from Gryphsis Academy. We bring you key market trends, in-depth insights into emerging protocols, and the latest industry news, all designed to enhance your expertise in cryptocurrencies and Web3. Follow us on Twitter and Medium for more in-depth research and insights.

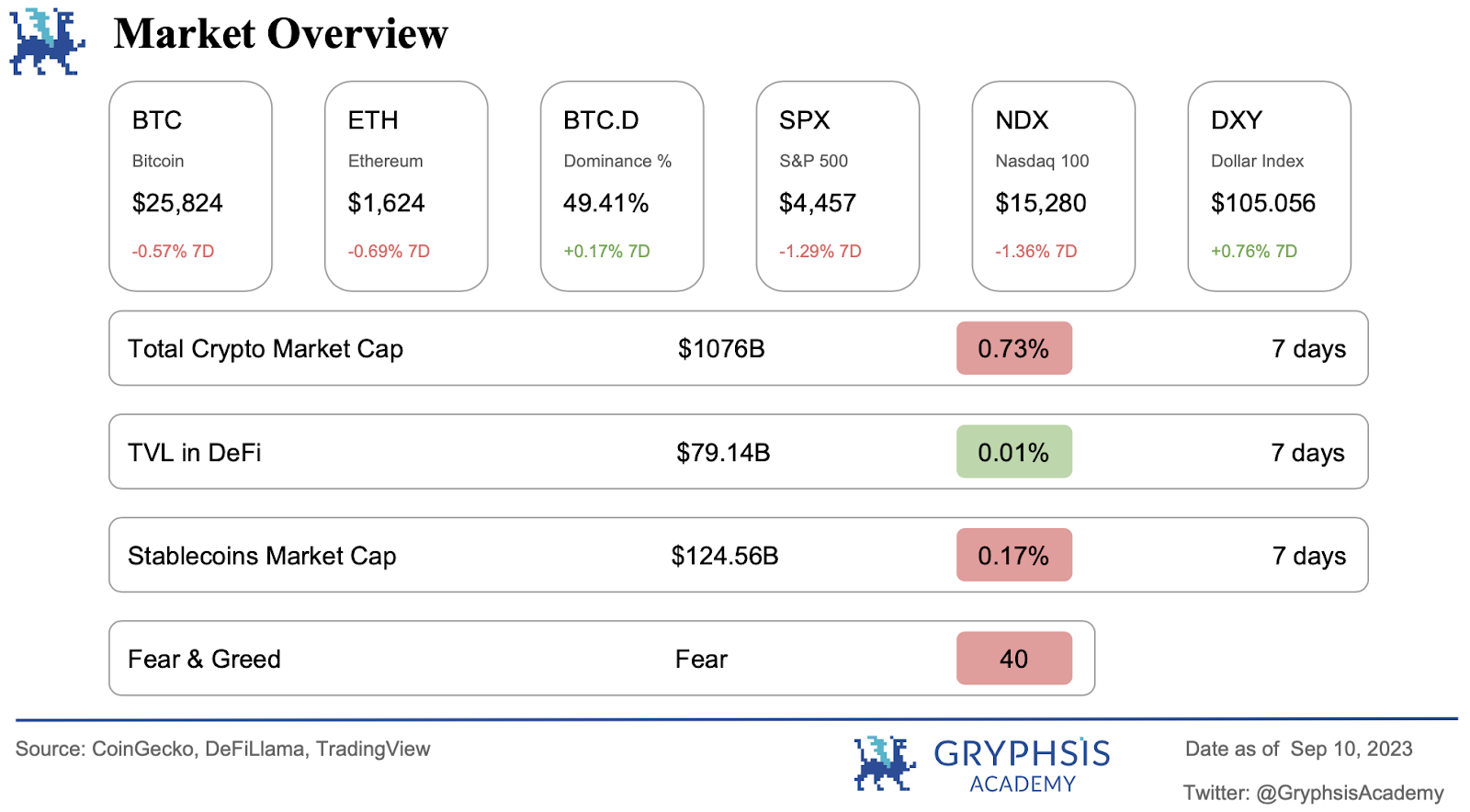

Market and Industry Snapshot:

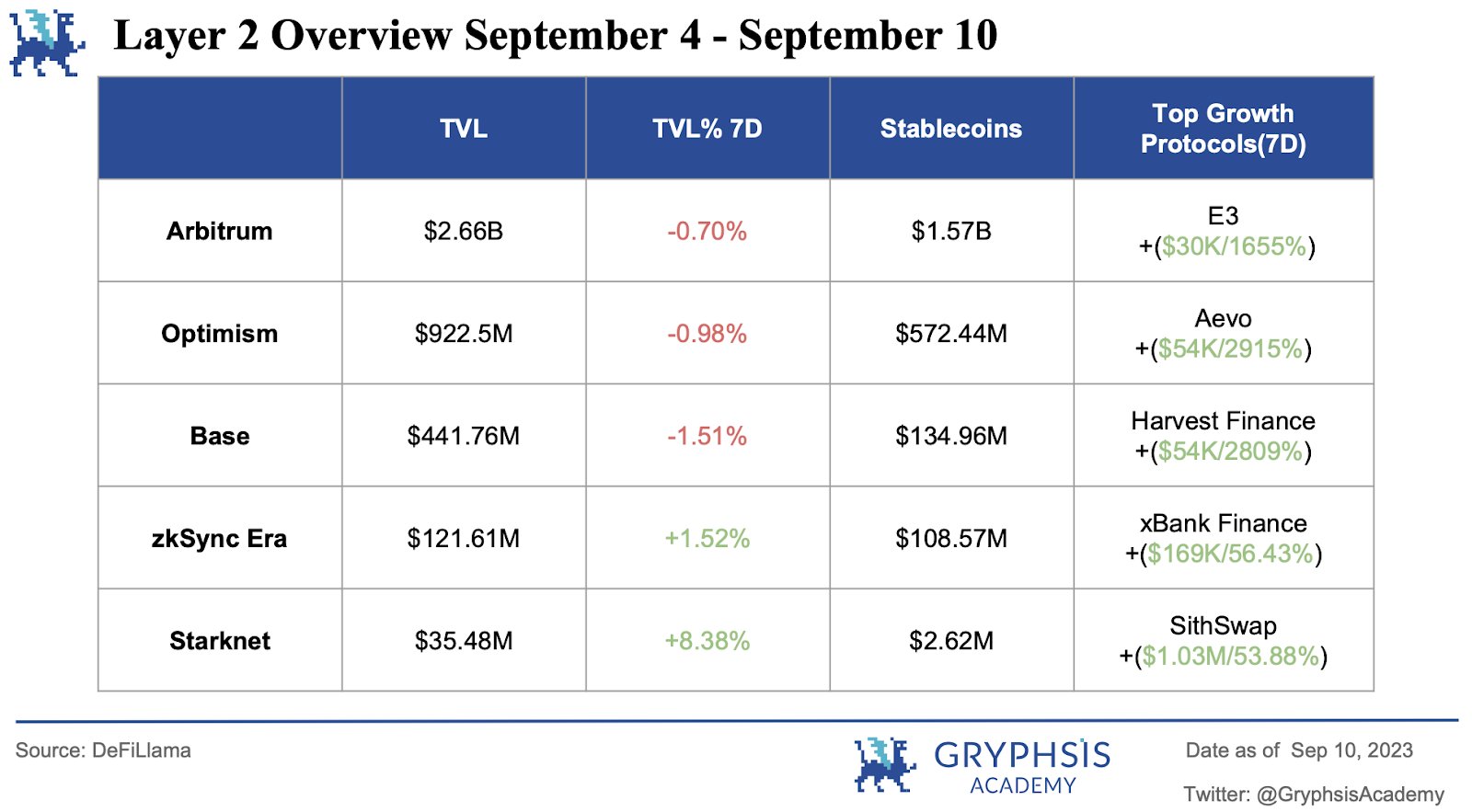

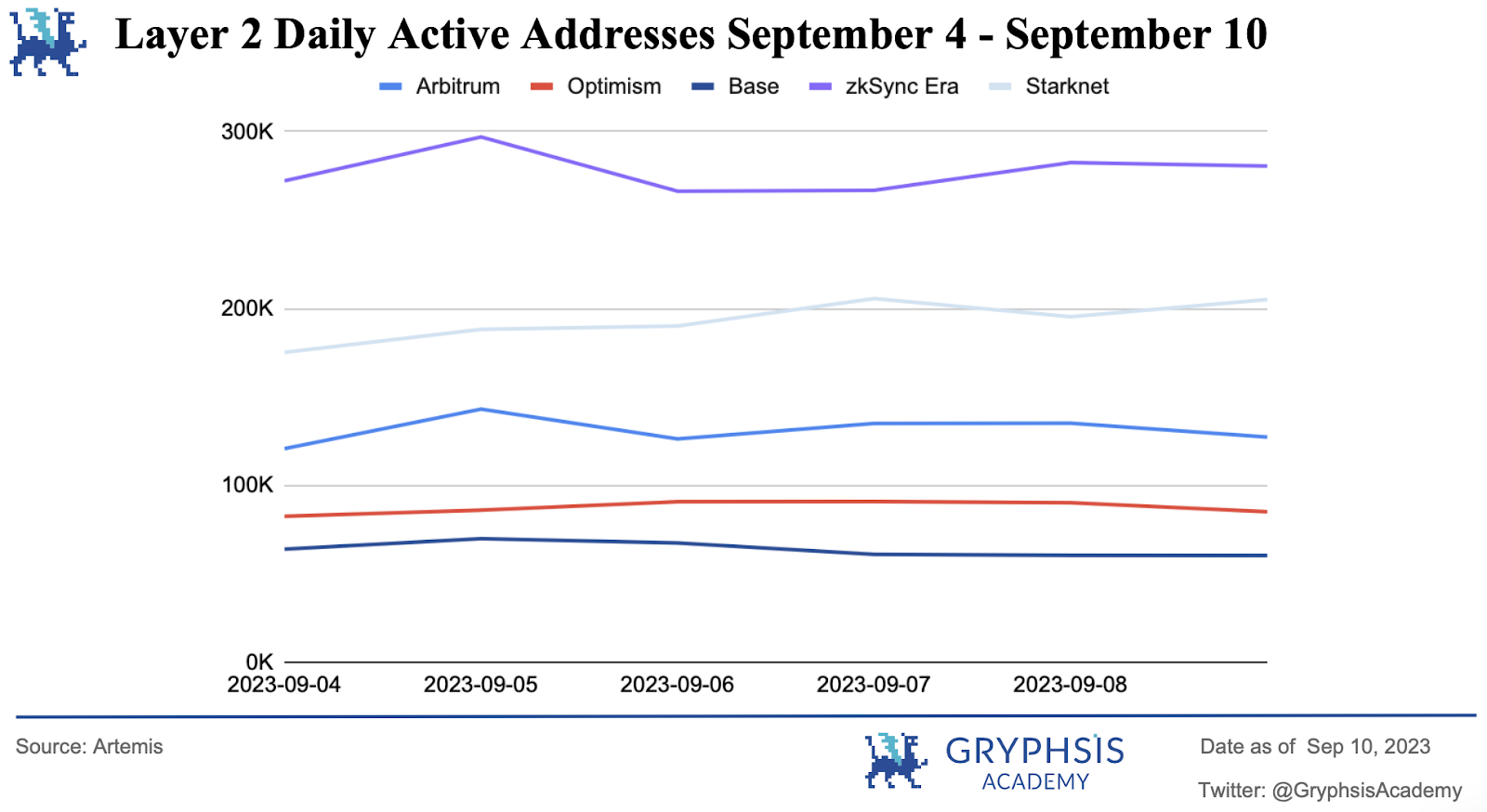

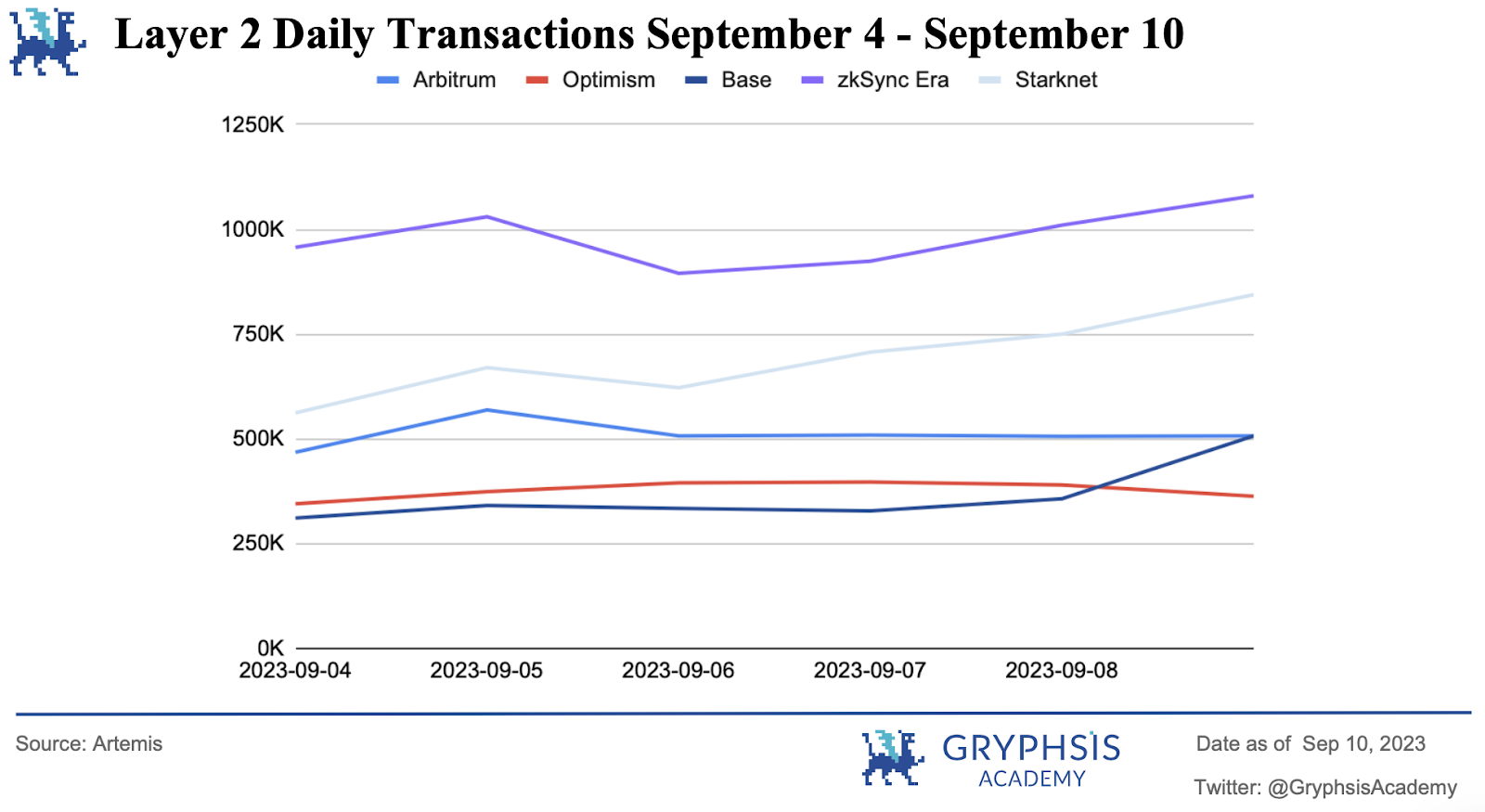

Layer 2 Overview:

In the field of Layer 2 this week, most platforms have shown a continued decline in Total Value Locked (TVL), with the underlying chains also experiencing negative performance for the first time since their launch. Remarkably, StarkNet has shown stable performance and is the only Layer 2 platform reported to have positive growth in this survey. Specific Layer 2 protocols, namely E3, Aevo, Harvest Finance, xBank Finance, and SithSwap, have performed exceptionally well, with significant growth in TVL.

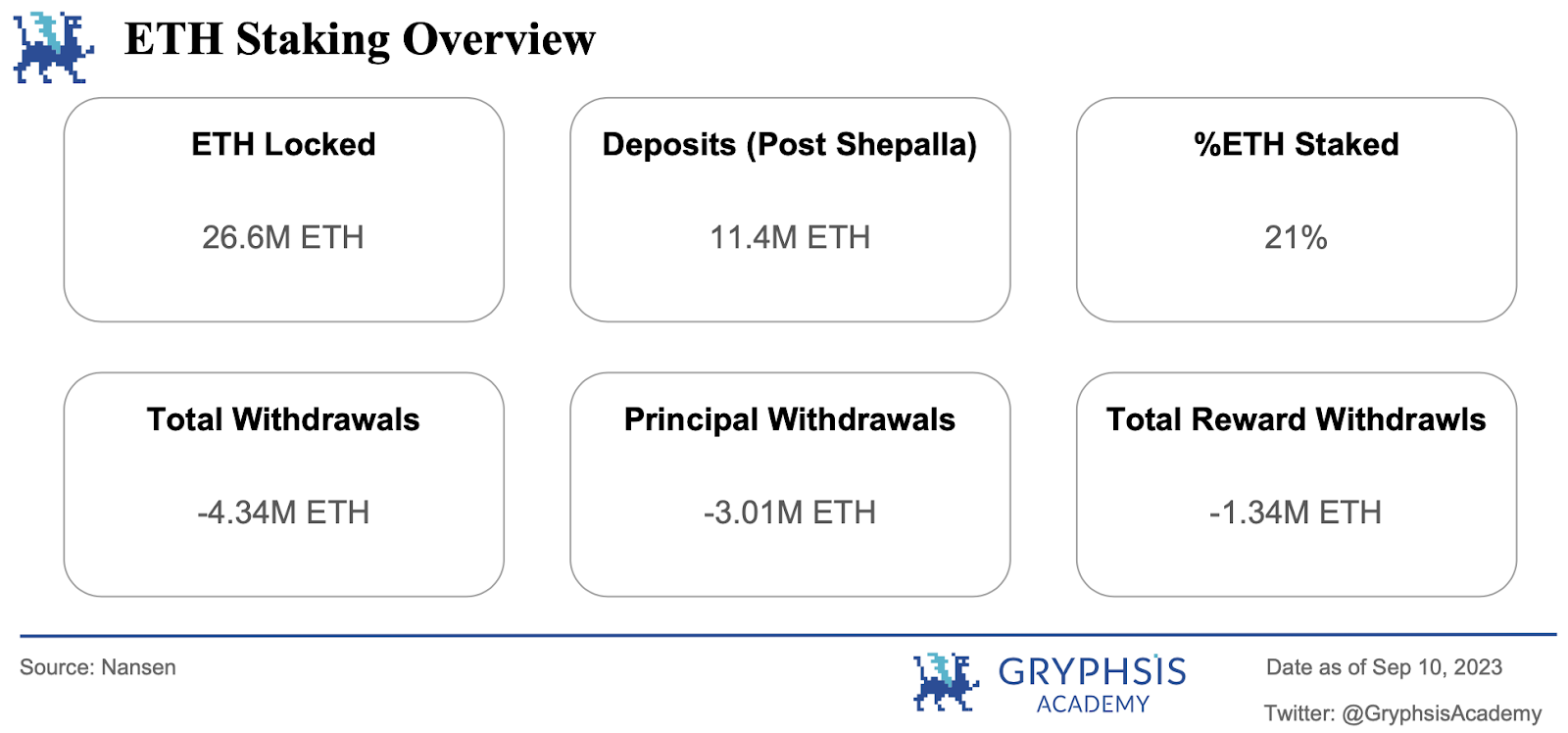

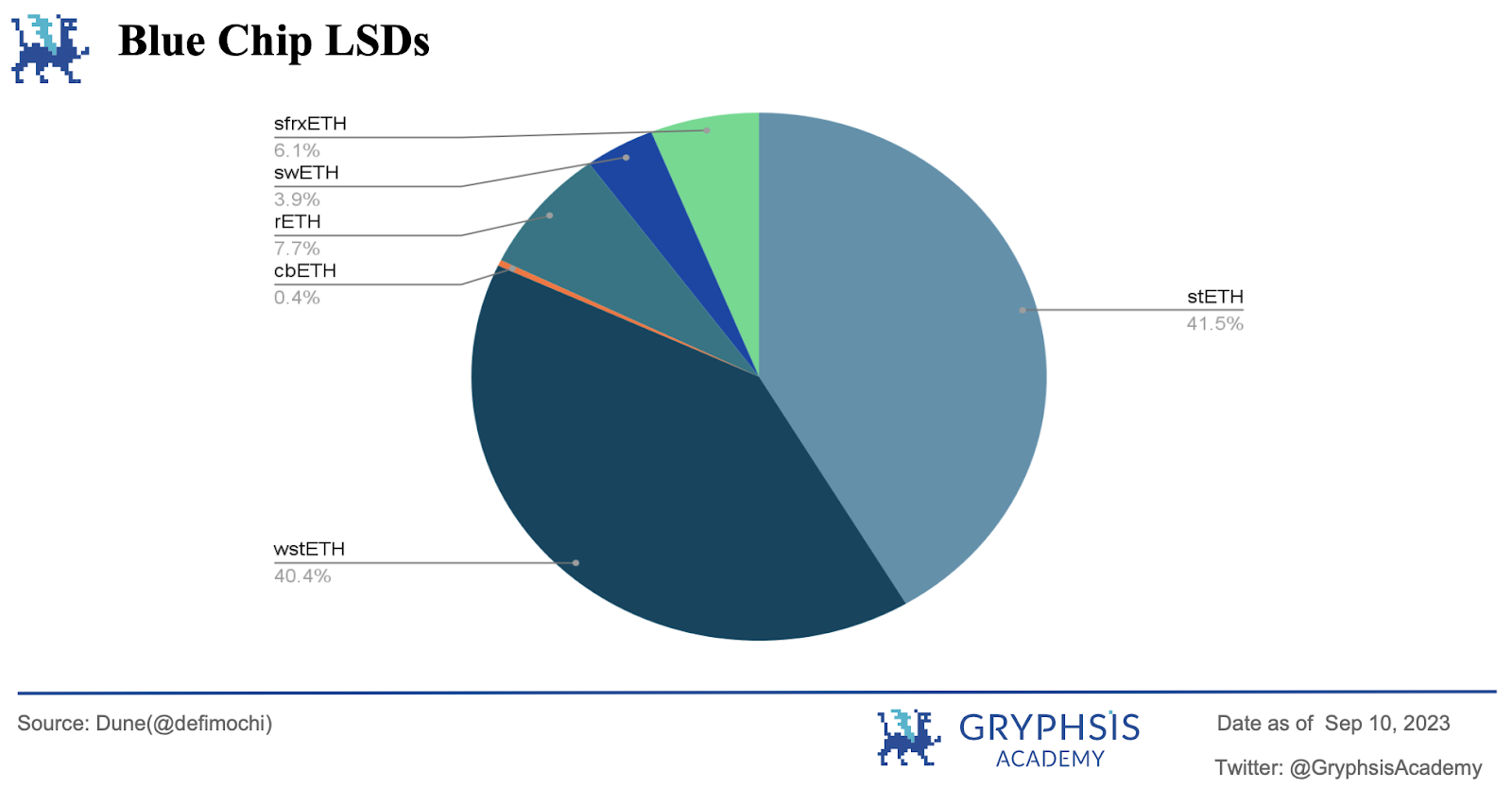

LSD Sector Overview:

In the Liquid Staking Derivatives (LSD) sector, although the growth rate has slowed down compared to previous months, the amount of ETH locked in the sector continues to grow. In terms of market share in the LSD sector, Lido continues to maintain its dominant position, while Rocket shows a noticeable upward trend.

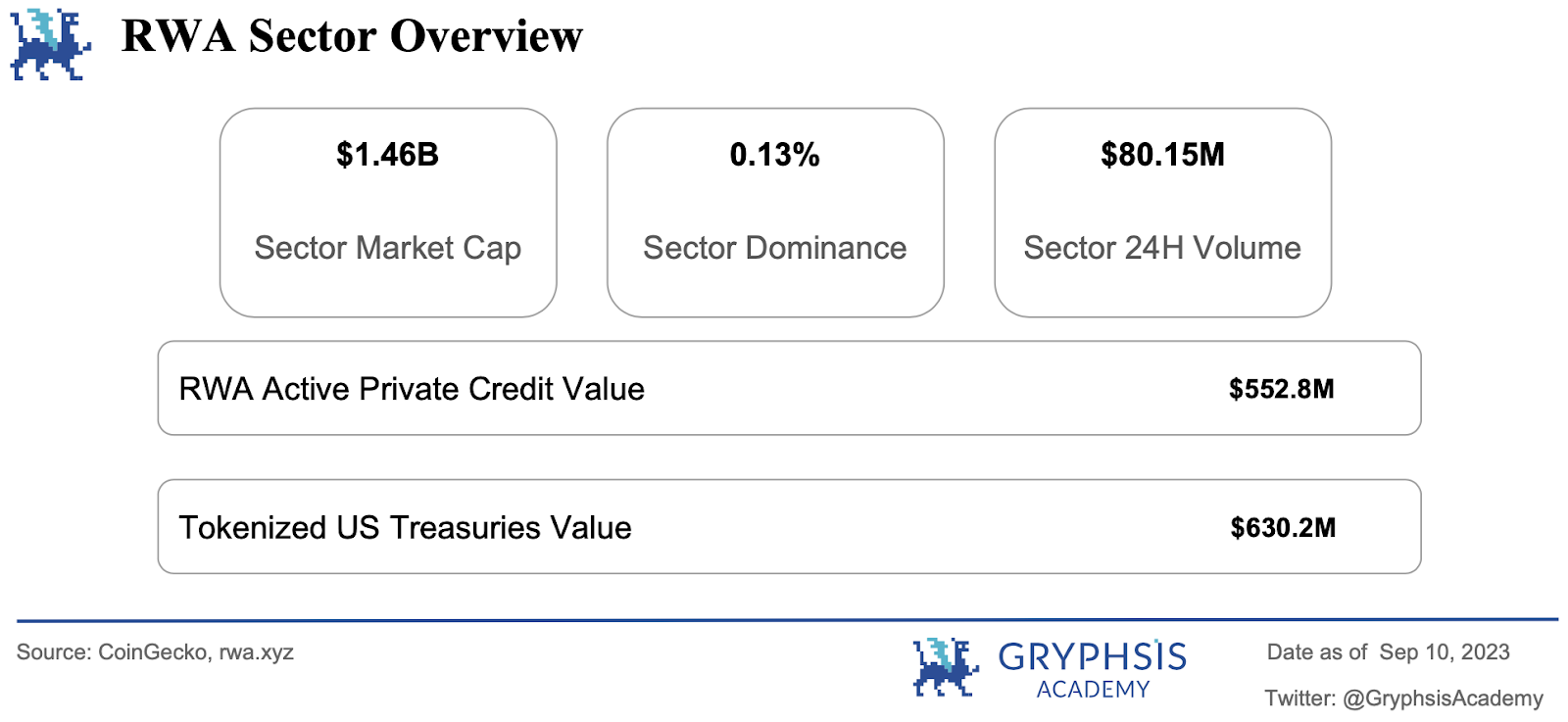

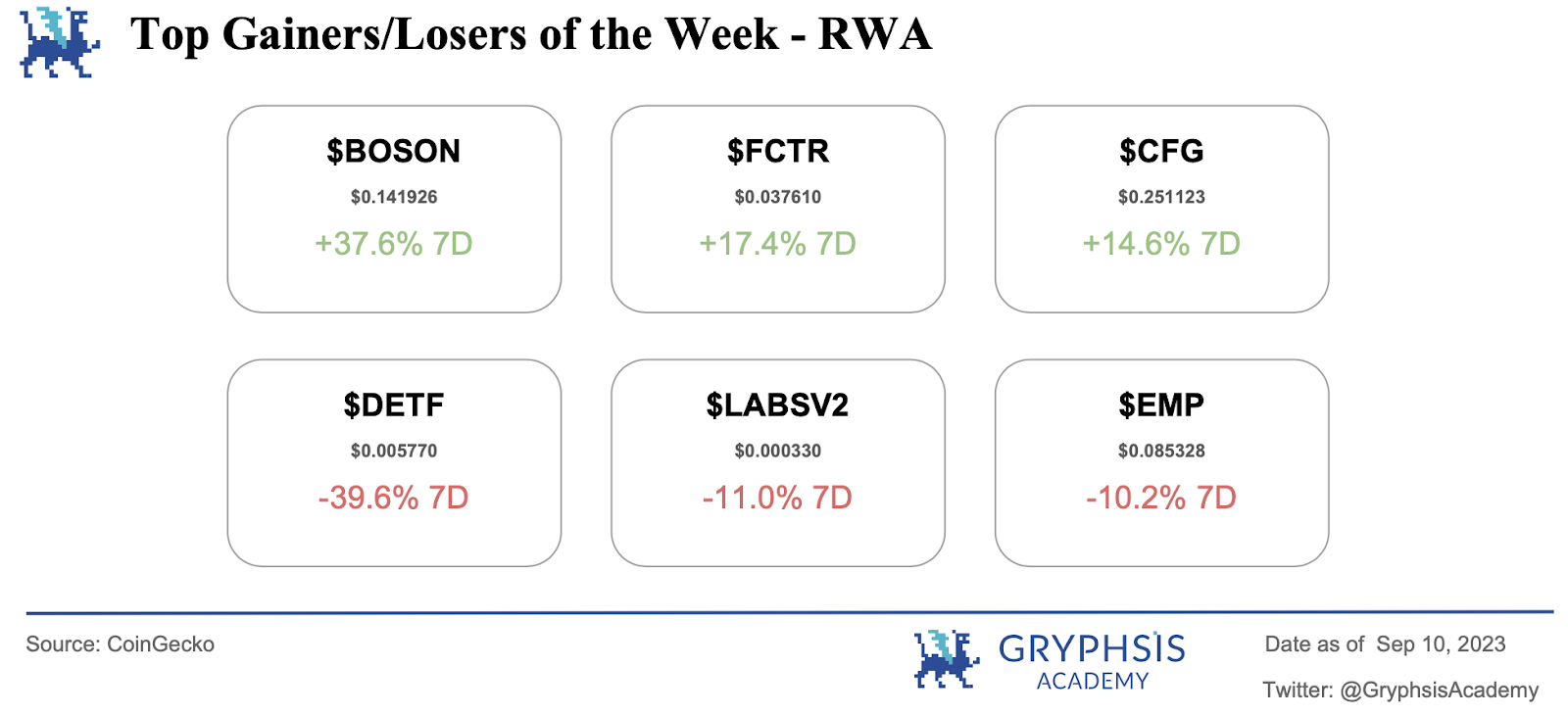

RWA Sector Overview:

In the past week, the Real World Assets (RWA) sector has remained relatively stable, with little change in various indicators compared to the previous week. Significant gains in this period include $BOSON, $FCTR, and $CFG, while the biggest declines include $DETF, $LABS V2, and $EMP.

Main Topics

Main Topics

Macro Overview:

US Stock V.S. Crypto

Major Events This Week:

Vitalik on Privacy

Weekly Protocol Recommendations:

Tipcoin

Weekly VC Investment Focus:

Story Protocol ($ 4.6 M)

Brine Fi ($ 3.5 M)

Twitter Alpha:

@CryptoGirNova on the best wallet and best DEX.

@TheDeFinvestor ‘s watch out on big selling pressing next week

@punk 6529 experiences surviving two crypto bear markets

@CryptoMichNL insights on Altcoins's start trending upwards

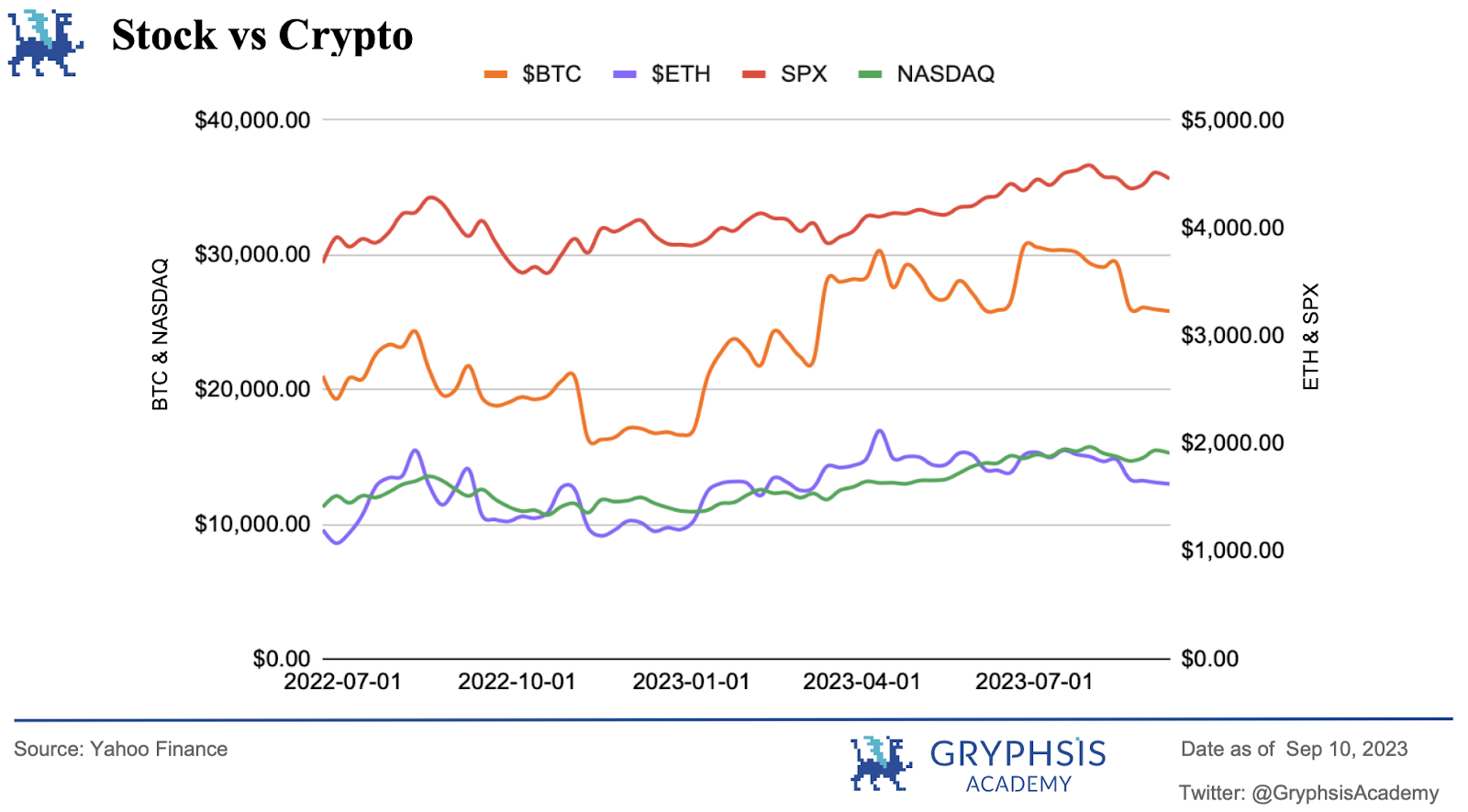

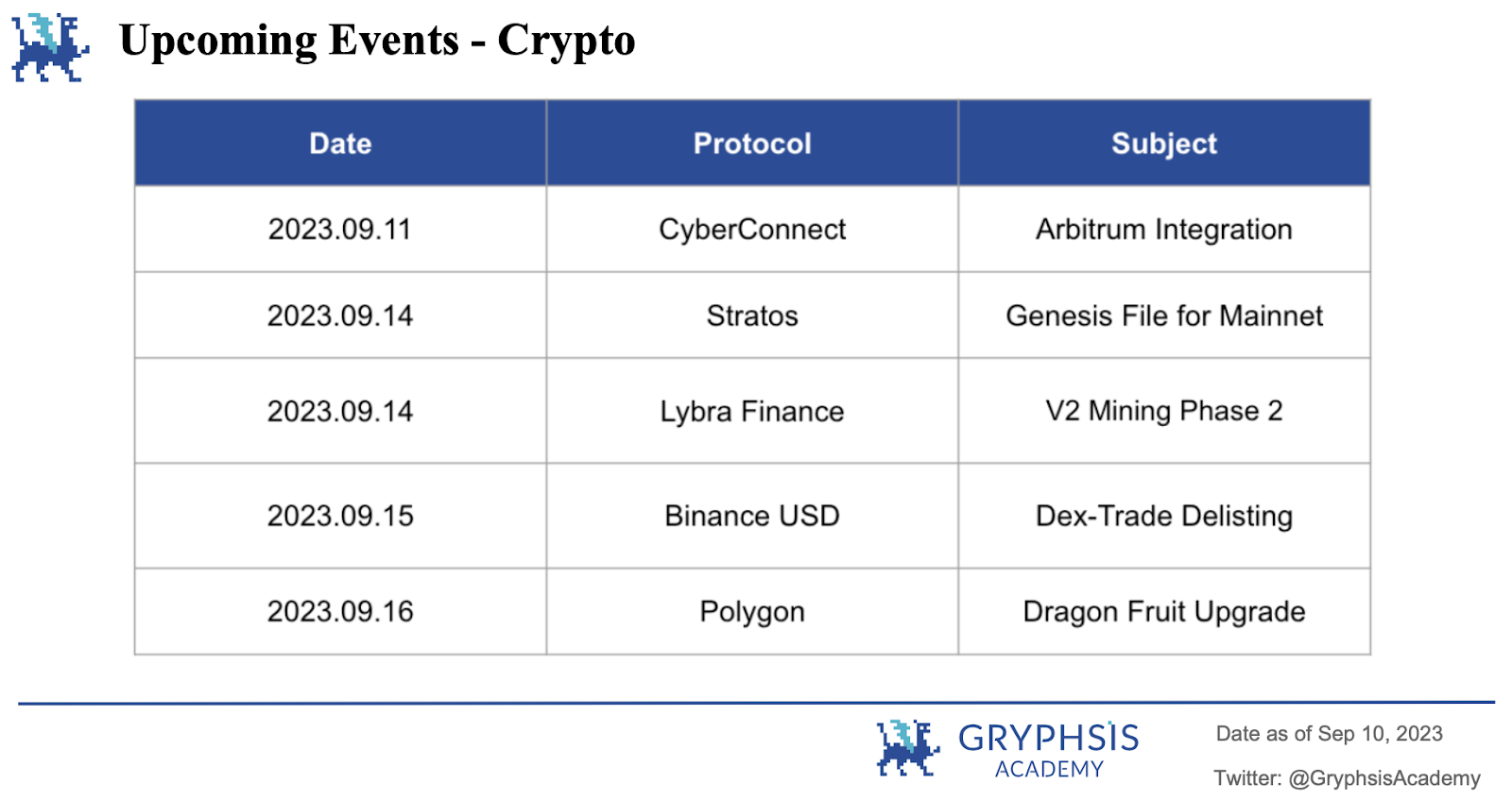

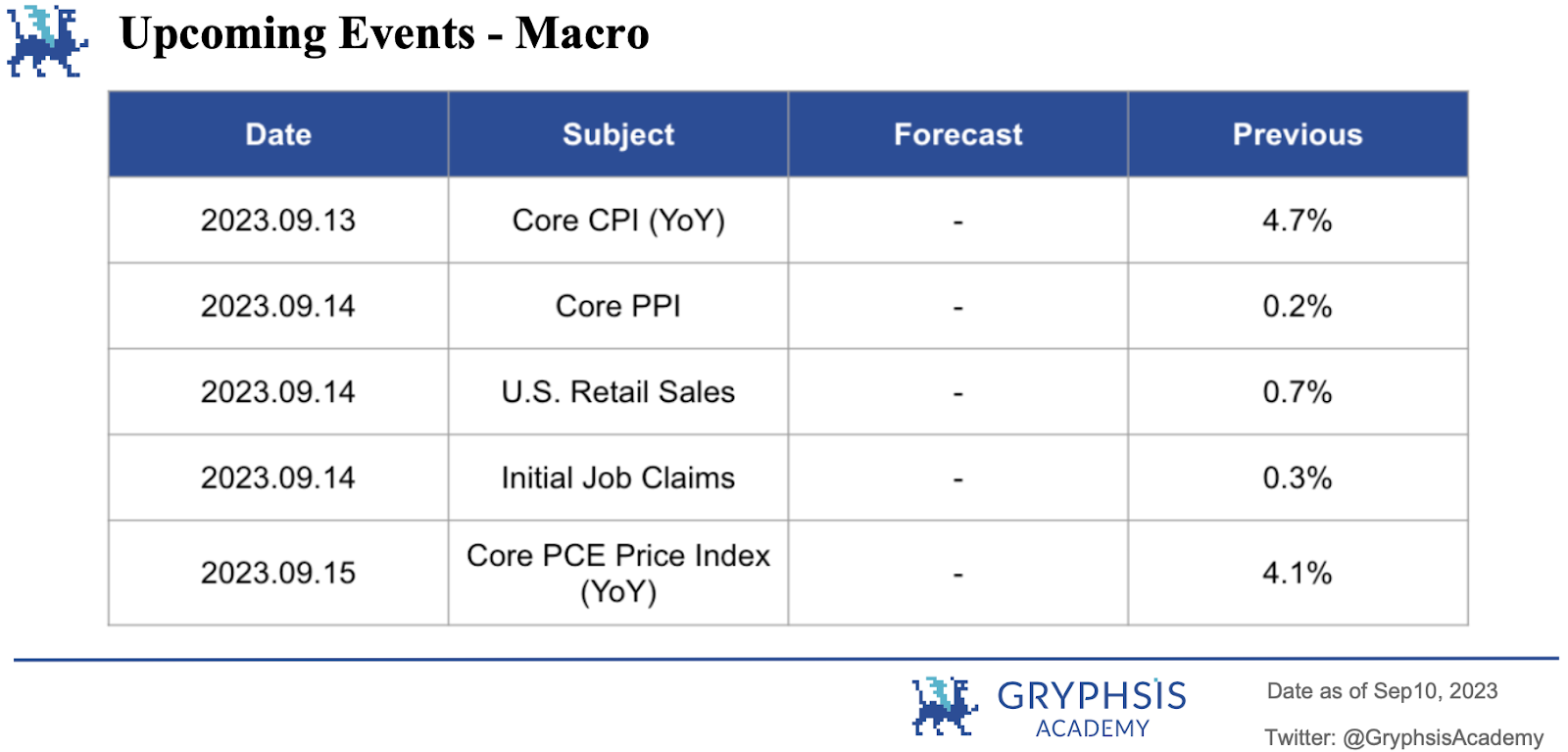

Macro Overview

In the past week, both the stock market and the cryptocurrency market have remained stable without significant price fluctuations or major news developments. Key upcoming events to watch include the Consumer Price Index (CPI), US retail sales, Core Personal Consumption Expenditures (PCE) Price Index, and initial jobless claims.

Major Events of the Week

Compliance and Anonymity Coexist: Vitalik's Public Research on Privacy Pool under Zero-Knowledge Proof

Co-founder of Ethereum, Vitalik Buterin, co-wrote a research paper discussing Privacy Pool, a new privacy-enhancing protocol based on smart contracts. The protocol can create a separation balance between honesty and dishonesty. It aims to demonstrate regulatory compliance by excluding illicit deposits through zero-knowledge proofs. Co-author Ameen Soleimani plans to engage with US regulatory agencies for the purpose of national security and anti-money laundering.

"Privacy Pools is an open-source project that attempts to address the most significant flaw of Tornado Cash: Tornado Cash users cannot prove their lack of involvement with illegal funds—unless they publicly disclose their entire transaction history—which only a few people do...

The paper discusses the limitations of the existing privacy-enhancing protocol Tornado Cash, which has recently faced legal challenges due to its use by malicious actors. The authors propose an extension to the Tornado Cash method that would allow users to prove their membership and exclusionary proof of fund origin on-chain using zero-knowledge proofs.

"The core idea of this proposal is to allow users to issue a zero-knowledge proof to demonstrate the (un)relatedness of their funds to (il)legitimate sources, without revealing their entire transaction graph. This is accomplished by proving membership in a custom association of centralized members that satisfy certain attributes required by regulations or social consensus."

Users have an incentive to prove their non-relatability and provide various use cases for proving fund legitimacy with zero-knowledge proofs. Research indicates that the scale of zero-knowledge proof solutions will significantly increase as global regulations evolve and privacy issues escalate, with Ethereum being at the forefront of adoption.

https://x.com/twobitidiot/status/1699437876474220952?s=46&t=VBOerRjJ 8 K 6 aSJJ__Bjgnw

>Our viewpoint

Balancing privacy and compliance can be challenging. On one hand, individuals and businesses value their financial privacy and seek secure and confidential transactions. On the other hand, regulatory agencies require financial institutions to implement robust anti-money laundering (AML) measures, which often involve collecting customer information and monitoring transactions to detect suspicious activities. This agreement focuses on the long-standing debate on compliance and privacy issues.

The research paper on Privacy Pools has attracted attention from experts, generating optimism and interest in testing its implementation. It presents benefits such as enhanced privacy, trust and verification, and potential detection of malicious actors. However, there are still some factors to consider:

Complex Implementation: Proving that there is no association with fraudulent deposits may be more complicated than initially suggested and requires a comprehensive assessment of scalability and technical challenges.

Compliance with Regulatory Frameworks: While privacy pools enhance privacy and risk management, they inherently do not comply with existing regulatory frameworks. Specific attention should be given to anti-money laundering regulations and Know Your Customer (KYC) rules.

Parallel Solutions Required: Privacy pools should be implemented alongside other solutions as tools to enhance privacy. They cannot fully address all regulatory and compliance requirements, thus requiring additional measures.

Uncertain Impact on Legal Cases: The effectiveness of detecting malicious actors remains speculative.

As we continue to monitor the progress of privacy pool implementations, it is evident that protocols utilizing zero-knowledge proof solutions are gaining momentum. With the continuous evolution of global regulations and growing user demand for privacy protection, the expansion of zero-knowledge proof solutions is expected to experience substantial growth. This trend emphasizes the importance of finding innovative approaches to balance privacy and compliance in a dynamic financial environment.

Weekly Protocol Recommendation

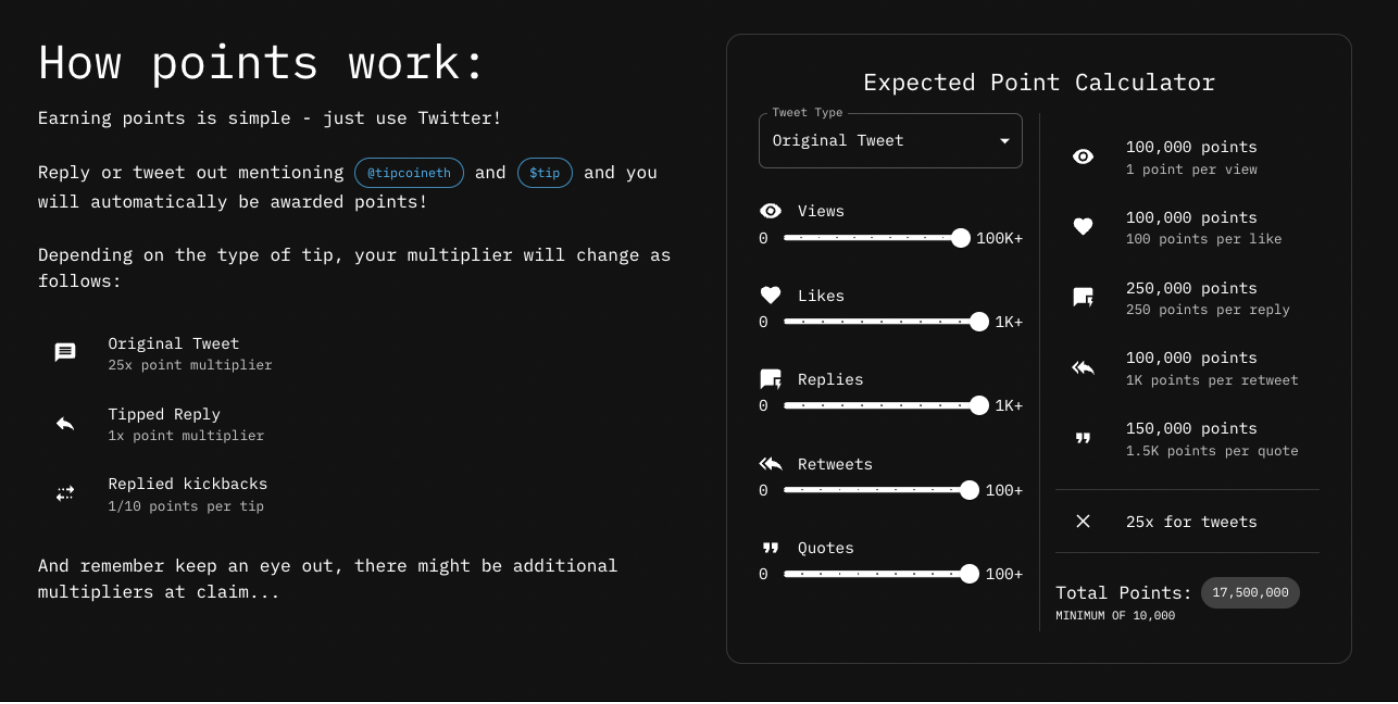

Welcome to our weekly protocol recommendation. This week, we have selected TIPCOIN, a protocol that rewards users on X (formally known as Twitter) for their participation and interactions.

Tipcoin has generated significant attention on Twitter, with users mentioning @tipcoineth and $tip in their original tweets or replies. The project launched on September 1 and has gained notable traction within the crypto community in just one week. The concept is simple: users earn points by tweeting or replying and mentioning @tipcoineth and $tip, with deleted tweets and replies resulting in the loss of all accumulated points. These earned points can be redeemed for $tip tokens in the following epochs.

The image below provides detailed information on the expected point calculator. The exact quantity of points awarded and tokens depends on the nature of the tip and multiples applied. The maximum point allocation for original tweets is set at 17,500,000 points, while the maximum point allocation for tip replies is 25,000 points.

https://twitter.com/tipcoineth/status/1697585638286008352?s=20

The $tip token obtained through the exchange of points is calculated as a percentage of the token quota within the era based on the use of points and account status. Each era will have new challenges and adjustments to ensure the community has a brand new tipping experience. The points earned in each era are unique. Users can only redeem $tip before the era ends, and any unredeemed points will be destroyed.

According to @1stswap, the technical lead of Tipcoin, there have been no counterfeit projects so far. This can be attributed to the complexity of Tipcoin's construction and measures to identify and mark bots.

https://twitter.com/1stswap/status/1699973707316564305?s=20

Tipcoin announced that the $tip token will be released on September 13th, including the final token economic model, liquidity, and contract details.

https://twitter.com/tipcoineth/status/1700694823861113272?s=20

Our Insight

Since its launch on September 1st, Tipcoin has quickly gained popularity on Twitter. The initial posts by Tipcoin asking for retweets to accumulate tipping points have received significant responses. In just one week, it has attracted a massive user base of 190.8K users (which may include some bots), gaining...

190.8 K retweets and 10.2 million views. By the end of the first epoch, $tip was mentioned millions of times on Twitter. Despite the inactive ERC contract and unclear token economy model, they managed to attract over 100,000 users within a week and educate the audience about their product, which is truly a remarkable marketing achievement.

https://twitter.com/tipcoineth/status/1697580061703245987?s=20

Tipcoin cleverly maximized the potential of social communication, igniting people's curiosity and motivation to explore and adopt the project. By incorporating a simple mechanism of mentioning in tweets, Tipcoin quickly expanded its influence and built trust through information shared by trusted contacts. This strategy enhanced brand awareness and attracted individuals to discover and adopt the product. Additionally, Tipcoin played a crucial role in helping numerous creators expand their influence.

https://twitter.com/danigg_eth/status/1698771600663789832?s=20

Many projects traditionally focus solely on the technical aspects they develop. However, exceptional founders have discovered that incorporating eye-catching elements with viral effects can effectively increase product visibility. This exaggerated advertising technique may serve as inspiration for other Web3 projects, leading to a new trend of airdrops to reach a wider audience. Despite suspicions of scams, the concept itself has shown significant success. A project with high popularity and a large user base is more likely to have a smooth launch on exchanges.

Despite Tipcoin's impressive recent performance, the unknown value of its $tips token might lead to a certain rebound if the initial value is lower than the expectations of users focused on airdrops. Its reliance on simple mechanical operations like posting on Twitter limits its long-term attractiveness. In contrast, Mask Network strives to create a social ecosystem with advanced features and has not hindered people's fleeting interest in the SocialFi project. Once the initial excitement and airdrop expectations fade, the sustainability of Tipcoin remains uncertain.

Gryphsis Research Spotlight

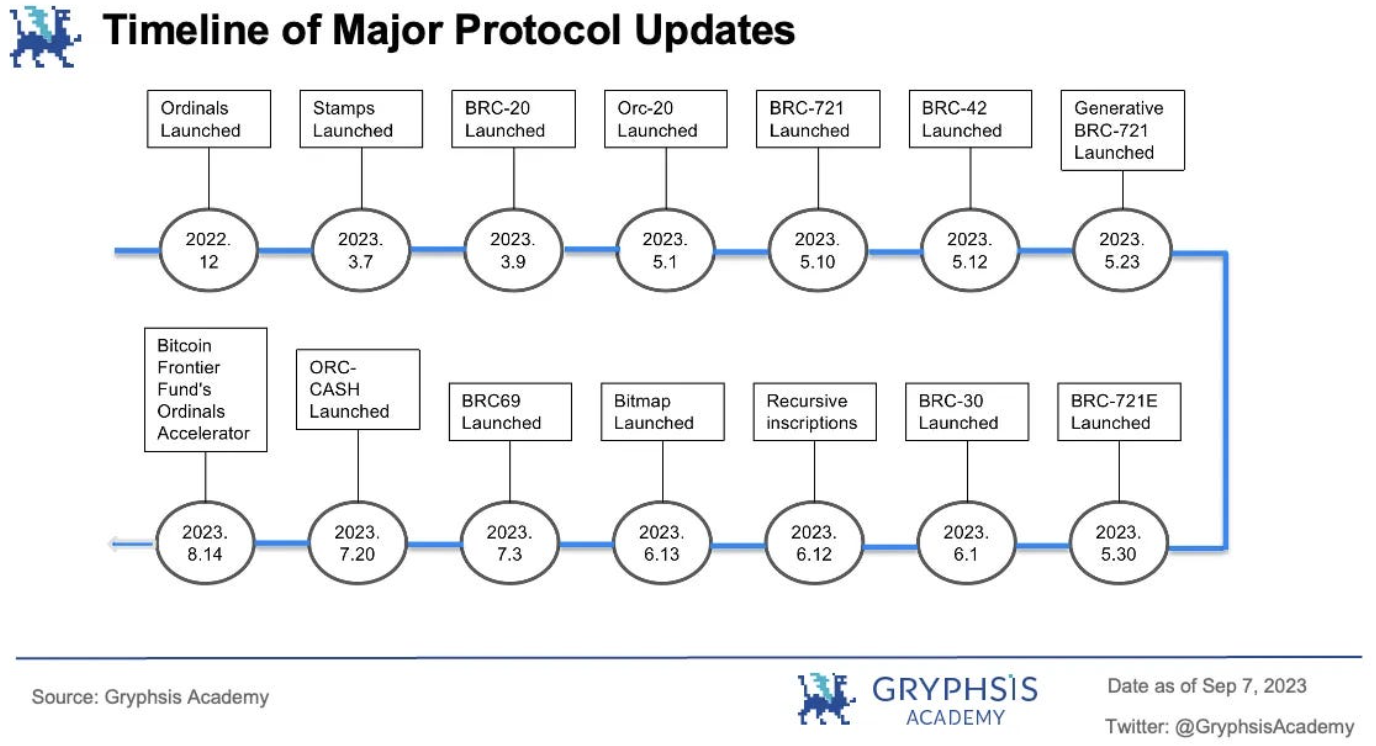

Welcome to this week's Gryphsis Research Spotlight, where we will share with you the latest research findings from our team. Our dedicated research team is constantly exploring the cutting-edge trends, developments, and breakthroughs in the cryptocurrency field. This week, we are thrilled to share with you our research on the Bitcoin ecosystem - "Recursive Inscriptions: The Cornerstone of BTC Lego and Complex Logical Products." Our aim is to deepen your understanding of the ever-evolving crypto world and spark your curiosity.

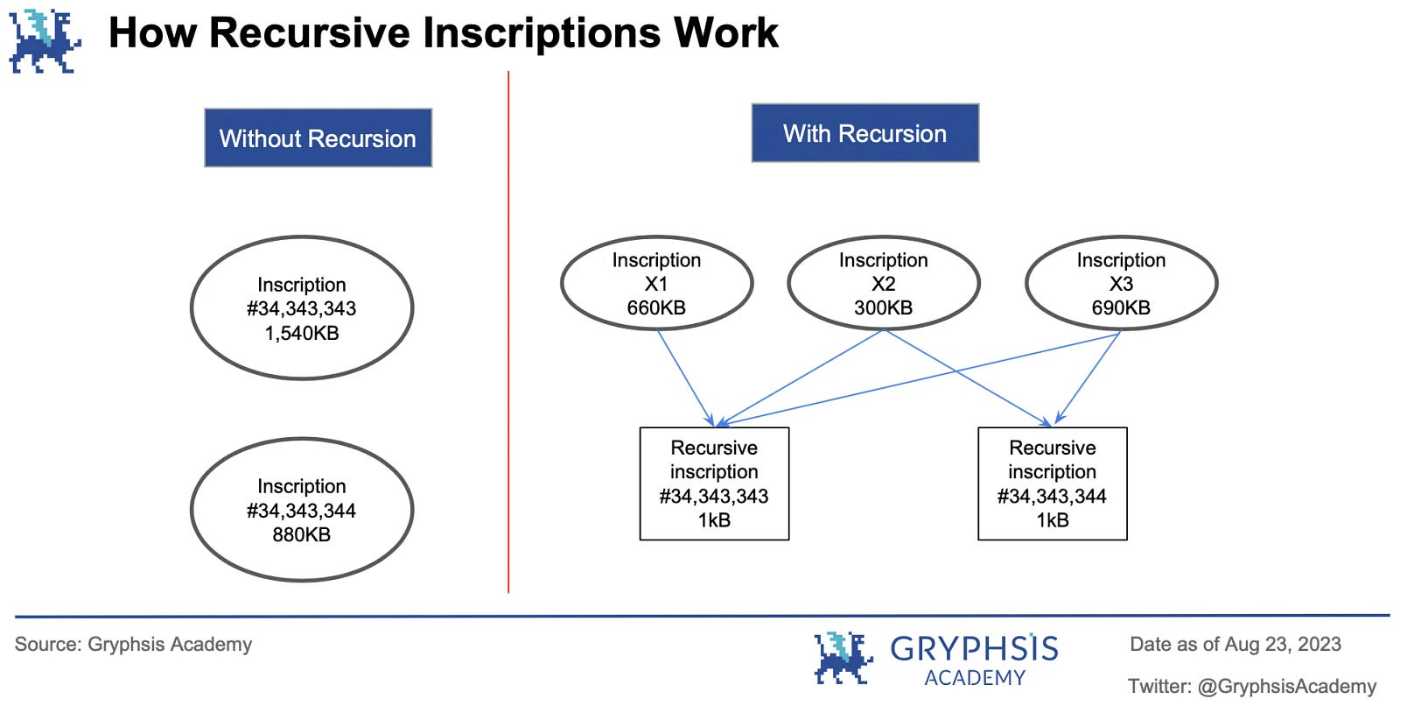

The recently introduced recursive inscriptions in the Ordinals protocol significantly expand its composability, becoming the standard for parsing and composing PFP (Profile Picture) collection inscriptions. This update improves interoperability, reduces costs, and overcomes the size limit of 4 MB, enabling creative applications such as inscription deconstruction, Bitcoin music, on-chain games, generative art, and decentralized websites. However, challenges still exist, including the need for fast parsing to accommodate the demand for recursive and referenced inscriptions. Despite these challenges, recursive inscriptions pave the way for feasible applications in generative art, Bitcoin on-chain games, and efficient storage, potentially leading to breakthroughs in these fields.

Basics and Technology: Ordinals Protocol

The Ordinals protocol, introduced by Casey Rodarmor, allows for the creation of unique digital artifacts by adding arbitrary content to the smallest unit of Bitcoin - satoshi. The protocol leverages the Unspent Transaction Output (UTXO) model, where balances are stored in UTXOs that contain Bitcoin amounts and ownership information. Satoshis are numbered based on their mining order, with metadata embedded in transaction witness data using Segregated Witness (SegWit) and Pay to Taproot (P2TR) upgrade. Taproot enables private storage of different transaction conditions and reduces costs. The Ordinals protocol utilizes the expanded content size limit of SegWit to store plaintext content in witness data, allowing for up to 4 MB of metadata storage. Engraving plaintext involves creating a commitment transaction that outputs to a Taproot script, followed by a transaction that reveals the plaintext content to the network. The plaintext is bound to a UTXO and associated with the first satoshi of the input UTXO. These tagged satoshis can be transferred, bought, sold, lost, and recovered.

Principles and Implementation of Bitcoin Recursive Engravings

Recursive engravings are built on the Ordinals protocol, enabling interacting and overcoming limitations of isolated and unrelated engravings on Bitcoin. By using the "/-/content/:inscription_id" syntax, engravings can request the content of other engravings, reducing capacity and lowering fees. Recursive engravings serve as a standard for engraving resolution, similar to using code to find images, and make it possible to create composable entities without the need to upload or download actual images. These engravings offer compactness, surpassing the 4 MB block limit, while enhancing interoperability, programmability, and scalability within Bitcoin. The future prospects of recursive engravings are promising, providing developers and users with ample opportunities to create and leverage them. However, integrating engravings into collection platforms and addressing indexing issues remains a challenge, which will impact their development speed and wider adoption.

Innovative Applications of Bitcoin Recursive Inscriptions

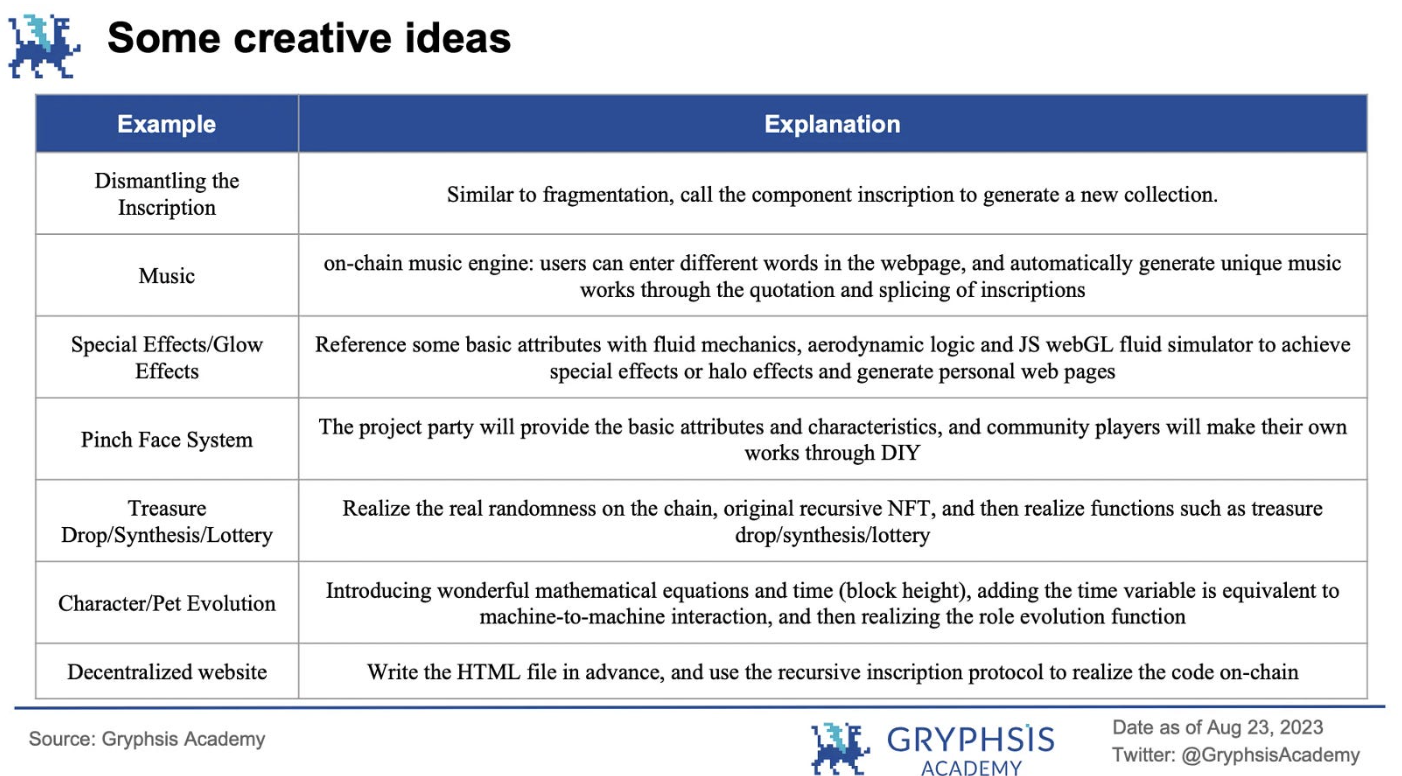

By using recursive inscriptions, the following creative ideas can be achieved:

We also introduced some applications of Bitcoin recursive inscription.

- On-chain Generated Art: 1 Mask - This is a generative art project entirely based on the BTC blockchain, with the theme centered around masks.

- Geek Project: Orbinals - A geek project with no Twitter or any other official website. All content of this project is built on the uncommon Sats.

- BRC 69 Project: Orditroops - A recursive NFT based on BRC 69, reflecting the content of the BRC 69 protocol. It enhances composability features while reducing storage space for images without sacrificing high definition quality.

- 3D NFT Project: OCM (On-Chain Monkeys) - OCM is the first 3D NFT project utilizing recursive inscription standard.

- On-Chain Music Engine: Descent Into Darkness Music Engine - This music engine serves as a supplementary product to the MUD RPG game "Descent Into Darkness," allowing music generation through inputting keywords.

- Single-player On-Chain Games: Snake Game, Match Game, MUD Game

- Multiplayer On-Chain Game: BTC PixelWar - This is a fully deployed multiplayer game on the BTC blockchain, claiming to be the first comprehensive on-chain multiplayer game on the BTC network.

Recursive inscription in Bitcoin presents challenges for off-chain rendering parsers as the recursive level and referenced inscriptions increase. These challenges are constrained by the limitations of the BTC network, but technical solutions can indirectly address them. Despite these challenges, recursive inscription enables generative art, on-chain displays, and efficient storage. Developers are actively exploring creative approaches using recursive inscription, such as games and generative art, resulting in new projects and broader applications in these fields, as well as potential breakthrough applications.

Weekly VC Investment Focus

Welcome to our weekly investment focus, where we reveal the most exciting developments in the crypto space.

Significant venture capital updates. Each week, we will focus on the agreements that receive the most funding.Story Protocol

Story Protocol is developing an Open IP (Intellectual Property) infrastructure that allows online collaboration and payment for any number of contributors. It recently announced the successful completion of a funding round, raising over $54 million. The round was led by a16z crypto, with participation from notable investors such as Endeavor and Samsung Ventures.

Story Protocol is an innovative initiative that brings IP into the internet era. The protocol introduces two key components that create a composable "IP LEGO" system:

1. Transparent, on-chain IP repository.

2. A powerful set of modules for extending the on-chain IP. It provides an open IP repository and a set of modules that seamlessly interact with IP assets.

By leveraging blockchain technology, Story Protocol offers a standardized and decentralized infrastructure for tracking the origin and ownership of creative works. It enables collaboration, licensing, and revenue generation from derivative works, empowering creators and nurturing a thriving ecosystem of applications built on the protocol. With Story Protocol, IP becomes more flexible, AI-generated content receives proper attribution and compensation, and a bridge is established between the worlds of code and law. It represents a transformative approach to IP in the digital age, opening new possibilities for creativity and value capture.

https://twitter.com/storyprotocol/status/1699411637244158037?s=61&t= X 2 TznuFxcz 4 plEA 4 MlH 0 gA

Brine Fi

Brine Fi, a decentralized order book trading platform, has completed its Series A funding led by Pantera Capital, reaching a valuation of 100 million dollars, raising a total of 16.5 million dollars. Other participants in this round of financing include Elevation Capital, StarkWare, Spartan Group, Goodwater Capital, Upsparks Ventures, and Protofund Ventures. The platform aims to provide enhanced privacy protection using zero-knowledge technology.

Brine Fi's order book platform was launched two weeks ago, allowing users to execute orders directly with other traders while retaining ownership of their assets. According to DeFiLlama, the platform's total locked value has reached 575, 000 dollars, with daily trading volume ranging from 1 to 3 million dollars. To address manipulation in trading and provide privacy of transaction positions, Brine Fi utilizes zero-knowledge proofs powered by StarkWare. The platform also offers gas-free transactions, with transaction fees set at 0.05%.

https://twitter.com/brinefinance/status/1700039990653100257?s=61&t= X 2 TznuFxcz 4 plEA 4 MlH 0 gA

Protocol Event

Ottochain Launches Testnet Powered by Cosmos SDK and Octopus

Avalanche Ecosystem Gets an Upgrade with Arkefi: AllianceBlock-Powered Art, Cars, and Exclusive Collectible Investment Platform

Concave Finance Settles with DAO Raiders with $ 2 Million USD — DL News

Introducing Copy Trading for Novices on WEEX Exchange: Seamlessly Replicate Expert Strategies

HashKey Signs MOU for Crypto Exchange Insurance

DYdX to Launch Decentralized Order Books Exchange on Cosmos

Gaming-Focused Blockchain Oasys Enters Partnership/a> with GroundX, Supports Klip Wallet SDK for Use with KakaoTalk

MetaMask Users Can Now Sell, Transfer, and Withdraw Crypto Directly to PayPal

WEMIX Introduces UNAGI, a New Omnichain Initiative That Transcends Blockchain Boundaries | Chainwire

Industry Updates

CFTC Charges Three DeFi Protocols with Violating AML Rules, Operating Without Licenses

Ethereum’s Proto-Danksharding to Make Rollups 1 0x Cheaper

Chicago Fed Economic Model Sees U.S. Interest Rates High Enough to Tame Inflation WhileAvoiding Recession

Top 10 Crypto Hacks of 2023 Ranked as Stake.com Is Fifth

Tokenization News Roundup: The ‘Next Trillion’

Change to US accounting rules will be a boon to companies holding crypto in 2025

Gold ETF launch holds lessons for Bitcoin investors

How Bitcoin Miners in Texas Are Making Millions Without Mining at All

Twitter Alpha

Many AAlpha, but navigating through thousands of Twitter threads can be difficult. Every week, we spend several hours doing research, curating insightful threads, and planning a curated list for you. Let's dive in!

https://twitter.com/CryptoGirlNova/status/1700223850179395720?s=20

https://twitter.com/punk6529/status/1700182302993617109?s=20

https://twitter.com/CryptoMichNL/status/1700443089872056493?s=20

https://twitter.com/TheDeFinvestor/status/1700461501977354386

Next Week Events

News Source:

https://dailyhodl.com/2023/09/08/ethereum-creator-vita

The above is all the content for this week. Thank you for reading this week's newsletter. We hope you benefit from our insights and observations.

You can follow us on Twitter and Medium for real-time updates. See you in the next issue!

This newsletter is for informational purposes only. It should not be construed as investment advice. Before making any investment decisions, you should do your own research and consult with independent financial, tax, or legal advisors. And past performance of any asset does not guarantee future results.