LD Capital: Lybra V2的产品拓展与机制更新

Original author: Yuuki, LD Capital

Introduction

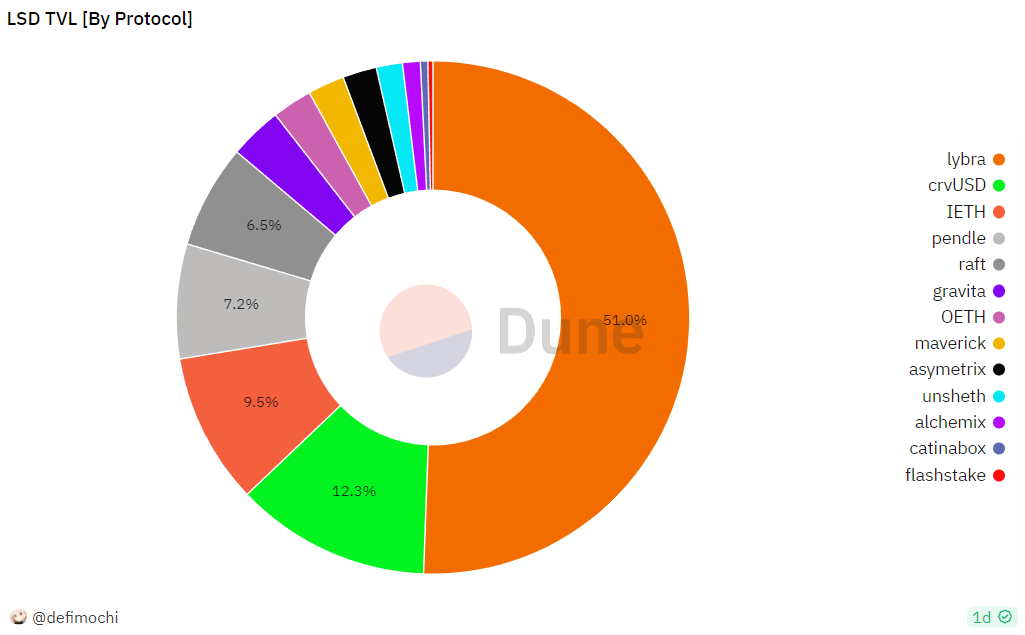

Lybra Finance currently has a TVL (Total Value Locked) of 3.28 billion, surpassing the total of mainstream LSDFi protocols such as crvUSD, Pendle, Raft, and Gravita, making it the largest LSDFi protocol. Currently, during the upgrade of Lybra V2, this article mainly analyzes the existing problems resolved by Lybra V2 and the protocol expansions made.

Lybra holds over 50% market share in the LSDFi space

Source: Dune@defimochi, LD Capital

Lybra V2 is currently audited by Cod 4 rena and Consensys; Halborn's final audit is about to be completed; confirmed to be launched at the end of August. The main feature updates include the introduction of peUSD to support non-rebase LST, the launch of Abitrum, the introduction of LBR War to control token emissions through governance (similar to Curve War), and the introduction of early unlock fines and dLP fines to introduce LBR burn and eUSD price stabilization fund, etc.

Lybra V2 vs. V1 feature comparison

Source: Lybra, LD Capital

In Lybra V1, the protocol has attracted market attention with its innovative mechanism design for interest-bearing stablecoins, accumulating a large amount of TVL, but it has also exposed the following four issues:

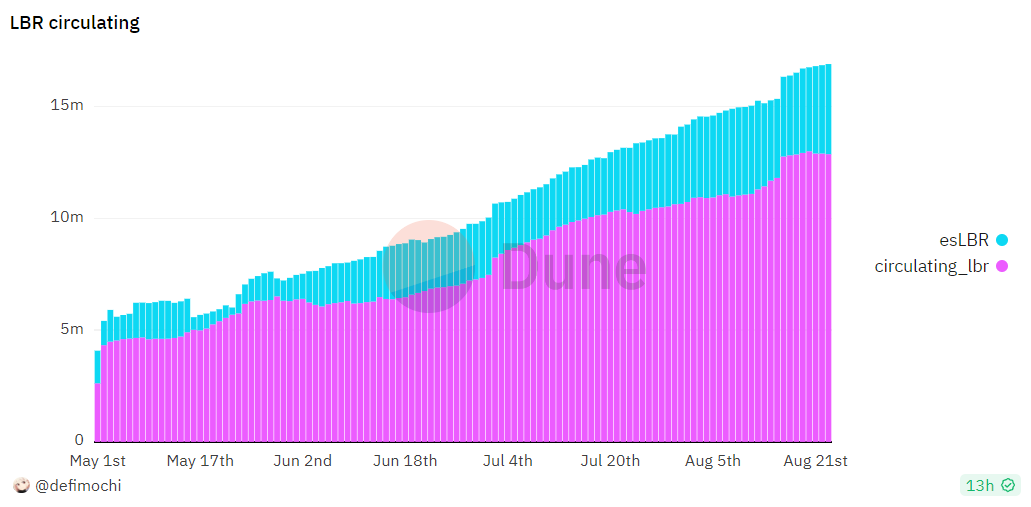

1. Imbalanced risk and return for eUSD minting: In Lybra V1, 1.5% of the interest generated from the collateral provided by the minters is taken as protocol income, while the remaining portion is converted into eUSD and distributed to eUSD holders to achieve the functionality of an interest-bearing stablecoin. This results in a loss of 1.5% interest income for eUSD minters and exposes them to contract risks. To incentivize minting behavior, esLBR subsidies are required, leading to severe inflation of LBR circulation. From early May to now (August 23rd), LBR circulation has increased from 4.33m to 12.87m, a 297% inflation, and LBR+esLBR has increased from 5.42m to 16.9m, a 312% inflation.

LBR Severe inflation

Source: Dune@defimochi, LD Capital

2. Holding eUSD can earn interest, making the minters more willing to hold the currency (giving up holding the currency means giving up all collateral income). The market's willingness to buy is strong (compared to interest-free stablecoins like USDT, holding eUSD can earn an annual interest rate of 7% - 10%), and the continuous purchase of eUSD by the protocol for interest distribution makes eUSD have a long-term premium;

eUSD has a long-term premium.

Source: Coingecko, LD Captial

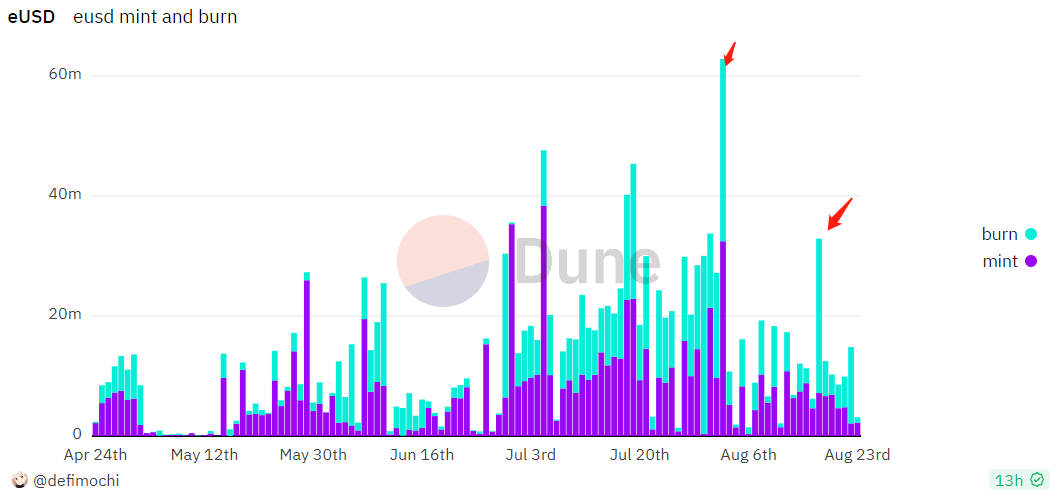

3. stETH collateral interest is converted into eUSD and distributed to eUSD holders, making coin issuers often choose the highest leverage rate for maximum benefit, resulting in a very low collateral ratio (CR) that is prone to liquidation; On August 2nd and August 17th, there were large drops in ETH's daily value, resulting in significant liquidation of eUSD, which not only caused losses to coin issuers but also increased the protocol's bad debt risk.

eUSD with high leverage ratio is prone to liquidation.

Source: Dune@defimochi, LD Capital

4, eUSD converts it into eUSD by charging interest on the underlying collateral and distributes it to eUSD holders. This interest mechanism makes Lybra unable to support rETH, WBETH, and other non-rebase LST, limiting the expansion of protocol collateral.

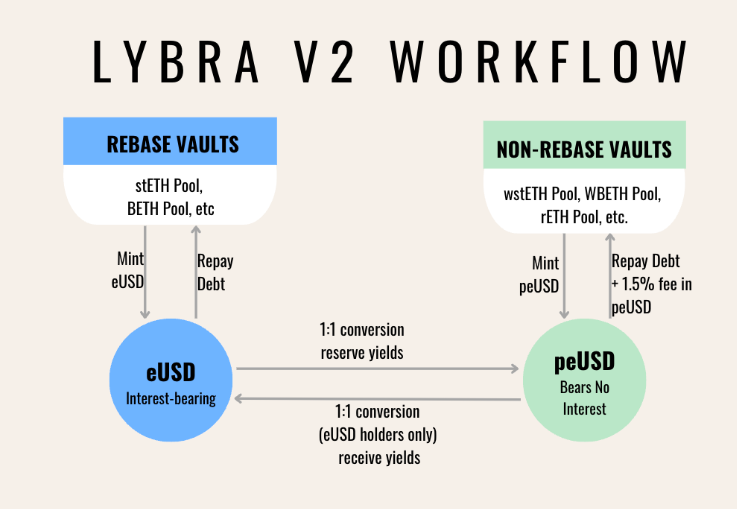

Adjustments made for Lybra V2

1, The high subsidies, high leverage, and limited use cases for stablecoins in the protocol are primarily caused by the interest mechanism of eUSD. The introduction of peUSD in Lybra V2 partially solves the aforementioned issues. peUSD is not an interest-bearing stablecoin. Its product form is similar to other CDP collateralized stablecoins. Specifically, it solves the problem of the inability to expand non-rebase LST in the collateral side and the difficulty of integrating eUSD with other DeFi applications. It also eliminates the high leverage tendency and premium of eUSD. peUSD is designed to support multi-chain integration according to the OFT standard, and the product functionality is improved with the introduction of flash loans.

At the beginning of the launch, peUSD's collateral supports rETH, WBETH, and eUSD, with a requirement that the collateral ratio of LST be greater than 130%, and the ratio of eUSD to peUSD is 1:1. By combining eUSD and peUSD, eUSD holders can retain eUSD interest while releasing liquidity. However, this may lead to circular loan arbitrage, and it is expected that the market will balance the premium of eUSD with the discount of peUSD. In general, peUSD expands the protocol's development in another dimension, but it will also face competition from other relatively homogeneous products such as crvUSD and Raft. Reducing the liquidity cost of peUSD is another challenge for the V2 version of the protocol.

peUSD Casting Process Diagram

Source: Lybra, LD Capital

2. Introducing penalty unlock and dLP penalty to burn LBR and maintain eUSD price stability. In Lybra V2, esLBR unlocks LBR tokens that can be traded on the secondary market after 90 days, but users can choose to pay 25%-95% of the total unlock amount as a penalty to speed up the unlock process. This penalty allows the market to purchase LBR or eUSD at a 50% discount. The penalty design for dLP is similar to the above. In V2, issuers are required to hold LBR/ETH LP worth more than 5% of the minting position value to be eligible for esLBR rewards. If the total value of LP held by the issuer does not meet the requirements, the reward portion will also be available as a penalty for the market to purchase LBR or eUSD at a 50% discount.

The two penalty auctions mentioned above allow the protocol to generate some LBR and eUSD revenue. The LBR revenue will be burned to reduce the LBR supply, while the eUSD portion will serve as a strategic reserve to maintain the secondary market price anchor for eUSD.

The design of dLP can bind the LBR/ETH LP with the eUSD minter, reducing the need for participants to maintain the protocol's proper operation, which may also help to lower the LP incentives and thus reduce the inflation rate of LBR; the downside is that it increases the entry barrier for minters.

3. The new eUSD premium suppression mechanism in V2 consists of two parts: first, when the cumulative platform fees exceed 1000 eUSD and the eUSD/USDC price is above 1.005, the excess eUSD will be exchanged for USDC and sent to the protocol's reward pool (the profits of eUSD holders will be distributed in the form of USDC); when the eUSD/USDC price is not higher than 1.005, the excess eUSD will be exchanged for peUSD and sent to the protocol's reward pool. In summary, the interest distribution for eUSD holders will be changed to USDC and peUSD, thereby reducing potential buying pressure from the protocol's interest distribution in the secondary market. (Currently, the required eUSD for interest distribution to eUSD holders is obtained through the exchange of protocol revenue and collateral income. However, in the long run, protocol revenue is not sufficient to pay for eUSD holders' interest, and the protocol needs to purchase eUSD from the secondary market for distribution. In V2, the interest distribution for eUSD holders will be changed to USDC and peUSD, which will increase short-term selling pressure on eUSD from the protocol and decrease long-term buying pressure on eUSD from the protocol.)