Falling below $28,000, has BTC bottomed?

Original |

Author | Qin Xiaofeng

According to the OKX Ouyi market, at 11:00 p.m. Beijing time on the 17th, BTC fell below the $28,000 mark, setting a new low since June 20 this year. In the past 48 hours, the price of BTC has continued to decline from 29,330 USDT, with the lowest falling to 27,676 USDT, and the maximum drop of 5.6%. As of press time, BTC was temporarily at 27,900 USDT, a 24-hour drop of 3.8%.

Affected by the decline of BTC, the overall performance of the encryption market was poor, with a decline of more than 3% in the past 24 hours; among them, ETH fell as low as 1718 USDT, with a 24-hour decline of 4.4%; among the top 50 tokens by market value, the top three decliners They are SHIB (-11.7%), BSV (-7.4%) and BCH (-5.5%).

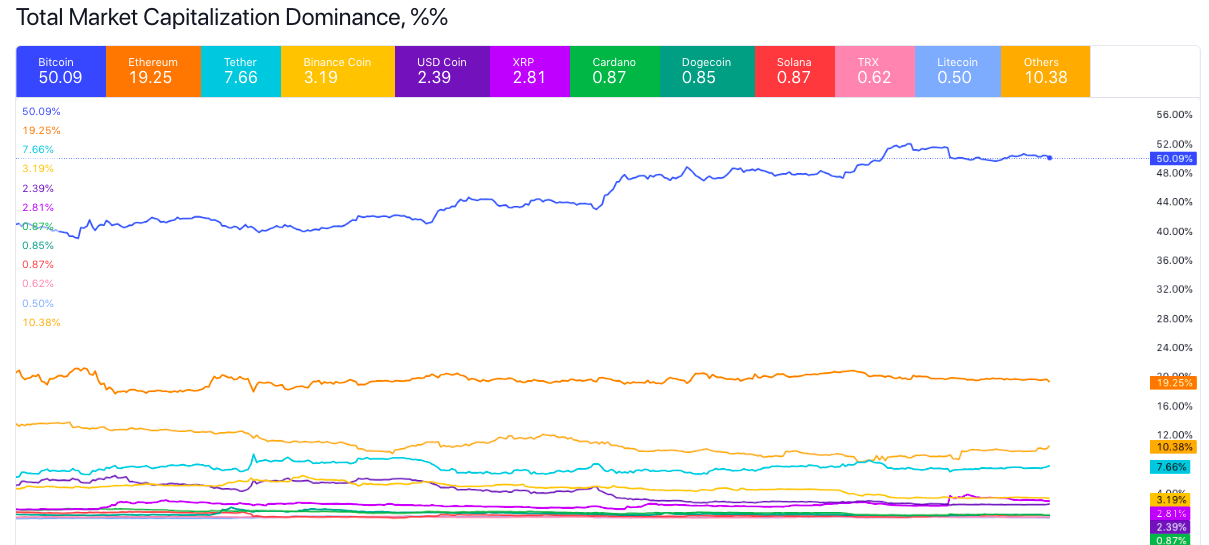

Tradingview dataIt shows that the current total market capitalization of encryption has dropped to 1,153.3 billion US dollars, a drop of 3.3% in 24 hours; from the perspective of market capitalization, BTC’s market capitalization still remains above 50%, tentatively reported at 50.09%, compared to this year’s high (52.03% ) fell by 1.94%; ETH’s market value accounted for 19.25%, returning to the level around June 20. Todays Panic and Greed Index is 50 (yesterdays 50), and the rating remains Neutral.

In terms of derivatives trading,Coinglass dataIt shows that in the past 4 hours, the liquidation of the entire network has reached 102 million US dollars, of which 43 million US dollars have been liquidated in Bitcoin, and 35 million US dollars have been liquidated in Ethereum; A total of 59,289 people became liquidation victims. The largest liquidation order occurred on OKX-ETH-USD-SWAP, worth 6 million US dollars.

It is worth noting that the discount of trust products under Grayscale Fund has improved in the past two months. There are currently only 7 discounts among the 14 products, which is one discount product (BAT) less than in June, and the previous positive premium products Premium rates have also surged in the past two months. Among them, the BTC discount rose from 44.02% (June 15) to 23.9% (August 15), hitting a high since April 2022. The rest of Grayscale’s mainstream trust discounts are as follows: ETH (-37.46%), ETC (-56.01%), LTC (-39.2%), BCH (-24.6%), ZEC (-2.1%), LPT (-36.7%) %); the seven products with positive premiums are FIL (455%), SOL (303.1%), LINK (127.7%), XLM (87.01%), MANA (48.9%), ZEN (26.09%) and BAT (8.3%) ).

Crypto-related listed companies were also affected by the downward trend, and stock prices generally fell back today. Among them, the US compliant encryption platform Coinbase (NASDAQ: COIN) shares fell 2.9% to $76.80 temporarily; MicroStrategy (NASDAQ: MSTR ), the listed company with the largest bitcoin holdings, fell 5.2% to $353.9 today.

Regarding the recent decline in crypto prices, there are several possible reasons:

First, the spot trading market is shrinking, and existing users are fighting in the derivatives market, which affects the short-term market direction.According to data from The Block, the seven-day average spot trading volume of crypto exchanges dropped to US$11.2 billion, less than 30% of March (US$46.26 billion). At the same time, the positions in the derivatives market have increased significantly. For example, the positions of Bitcoin contracts on Bybit reached a 16-month high in the last two days, and CME Bitcoin futures hit the highest monthly trading volume this year in July.

Especially in recent times, Bitcoin volatility has been at historically low levels. Kaiko data shows that the 90-day volatility of Bitcoin has dropped to 35%, and the 30-day volatility is close to a five-year low; the current volatility of Bitcoin is still lower than the SP 500 Index, technology stocks, gold, etc. The longer volatility remains low, the more fragile the system will become, the more leverage is used, and the market will undergo major changes in the short term. Judging by todays results, the bears appear to have won this time around.

UTXO Management analyst Dylan LeClair said: The current market is just an endgame in which derivatives traders are fighting each other. Most of the spot bearish traders have already sold out, while the spot bullish traders may have fully deployed their funds, or Still waiting on the sidelines for approval of Bitcoin spot ETF.”

Second, there is insufficient funds in the market, and the new currency is sucking money online.As spot trading shrinks and Bitcoin volatility weakens, another direction of the market game revolves around new coins. In the past two days, Sei (SEI) and CyberConnect (CYBER) have been launched on major platforms, attracting attention. Taking SEI as an example, its 24-hour trading volume on South Koreas Upbit exceeded US$400 million, accounting for a quarter of the platforms total trading volume that day and nearly four times the trading volume of the BTC/KRW trading pair (US$120 million). The funds in the market are limited, and the blood-sucking of the new currency further reduces the liquidity of the market, and the market has declined.

Third, investors may shift their assets from high-risk Bitcoin to U.S. Treasuries.The decline coincided with a surge in U.S. bond yields, with U.S. 10-year Treasury yields climbing to 4.31% on Aug. 17, the highest level since October 2022, suggesting investors are turning to safer assets, while Not inclined to choose cryptocurrencies such as Bitcoin.

(U.S. 10-year Treasury bond yield and BTC price chart)

Regarding the market outlook, crypto data analysis companySantimentTweeted that the encryption market may be about to rebound. The ratio of losing trades to winning trades recently hit a five-month high, historically a sign of a bottom, according to Santiment data. Historically, a high ratio of losing trades to winning trades has increased the probability of a rally more than any profit-taking.

From a larger cycle perspective, Bitcoin is still bullish. At the data level, BTC reserves in exchanges have decreased, and the number of long-term BTC holders has hit a record high in the near future; at the news level, applications for Bitcoin spot ETFs from many companies are expected to be approved next year; at the macro level, the Federal Reserve has entered the late stage of raising interest rates, and next year It is expected to stop raising interest rates and start a new round of bull market.