The Past and Present of LSD: Evolutionary Path, Track Overview, and Interest Rate Returns

Original author: SAURABH

Compilation of the original text: Deep Tide TechFlow

Human beings have been exploring the concept of truth for a long time. We divide them into different types to help our minds harmonize—absolute truth, objective truth, personal truth, and so on. Truth can take many forms, if you will. In the financial world, the sequence of transactions determines the ultimate truth, and blockchain facilitates the establishment of these truths.

The genius of Satoshi Nakamoto was to find a way to allow computers distributed in different geographical locations to independently achieve the same sequence of transactions. The “independence” aspect is important because relying on other nodes means that the system is based on trust, not unlike what already happens in traditional finance. Using blocks as building blocks enables nodes to arrive at the correct order. At their core, blockchain networks are often differentiated based on who has the authority to propose new blocks.

Base

In Bitcoin, a new block is proposed through Proof of Work (PoW). Make sure block proposers have done enough work to show that they have consumed resources such as electricity or mining equipment. This makes spamming the network a loss-making activity.

Multiple block producers (miners in this case) compete to produce a block, but only one is accepted. This means that work done by others is wasted. Changing Bitcoins consensus model is now difficult given Bitcoins age and incentives for network participants. But the new network can take another approach.

Proof-of-Stake (PoS) systems avoid competition among block producers by electing block producers. These networks do not require miners to compete for mining power by setting up complex machines and consuming electricity. Instead, block producers are selected based on the amount of network native tokens staked by participants.

The earliest version of staking was similar to a time deposit. Tokens are locked for a specific period of time. Lock-up periods can be as low as a week. Banks often offer higher returns on term deposits than regular savings accounts to encourage individuals to lock up capital for longer periods of time. Banks use these funds for commercial activities, such as lending, and the pledged assets generate (and vote for) new blocks and protect old blocks.

The larger the number of tokens staked, the more difficult it is to change the consensus mechanism of the blockchain, because stakers holding tokens have an incentive to maintain the status quo. In most staking networks, participants are rewarded with a small percentage of tokens for securing the network. This measure becomes the benchmark for their earnings.

opportunity

With the emergence of PoS networks such as Solana, the entire industry has been perfected to help users with staking. This is done for two reasons:

As shown in the table above, validators typically require sophisticated computers costing thousands of dollars. The average user may not have these devices, or may not want to bother managing them.

It helps to liquidate idle crypto assets. Exchanges like Coinbase and Binance allow users to stake from their products and receive a small portion of the difference between the rewards provided by the network and passed through the exchange to the user who staked.

One way to measure the size of the staking market is to add up the market cap of all PoS-based chains. This figure is approximately $318 billion. 72% of them are Ethereum. The “staking ratio” mentioned below measures what percentage of the network’s native tokens are staked.

Ethereum has one of the lowest staking ratios in the network. But by dollar value, its an absolute juggernaut.

The reason Ethereum has attracted so much capital in terms of staking is because the network offers more sustainable yields. Why do you say that? Of all the proof-of-stake networks, Ethereum is the only one that offsets the daily issuance by burning a portion of the fees. The fees burned on Ethereum are proportional to the usage of the network.

Any amount offered as a staking reward is balanced by tokens burned as part of the fee model as long as people use the network. This is why the yield generated by Ethereum validators is more sustainable than other proof-of-stake networks. Let me explain with numbers.

According to data from Ultrasound.money, Ethereum will issue approximately 775,000 ETH to stakers this year. At the same time, Ethereum will burn approximately 791,000 ETH as transaction fees. This means that even after staking rewards are issued, the supply of Ethereum is still shrinking (by approximately 16,000 ETH).

Think of the burning of Ethereum alongside the stock buyback. When founders of public companies sell shares, it can make investors uneasy. But when companies consistently repurchase shares from the public market, it is generally considered a sign of health. Stocks go up and everyone feels slightly happier. Typically, in a low-interest rate environment, cash-rich companies confident in their prospects choose to buy back stock rather than use it to buy other instruments, such as Treasuries.

Ethereum burning is similar to the act of buying back shares. It withdraws Ethereum from the market. And the more people use Ethereum, the more Ethereum is recovered from the market. Since EIP 1559 went live about two years ago, Ethereum has buyback over $10 billion worth of ETH. However, there is one difference between stock buybacks and proof-of-stake networks burning tokens as part of the fee model: Public companies do not issue new shares every quarter.

The assumption is that buybacks will take the stock back from the market. In the case of Ethereum, newly issued tokens (as staking rewards) balance the burned tokens (as fees). This balance between issuance and burning may be why Ethereum didn’t immediately rise after the merger earlier this year.

We did simple estimates to compare this with other networks. In the chart below, Staking Market Cap refers to the value of assets flowing into the network. The difference between issuance and burning (via fees) gives the net issuance. ETH is the only network we can verify that has had a slightly negative rate over a year. This explains why so many startups are building around it.

Panoramic view of staking track

While investing in Ethereum (ETH) is doing well economically, it has some fundamental problems that make it difficult for retail users to participate. First, you need to own 32 ETH to become a validator. At current prices, this equates to about $60,000, the cost of a masters degree in finance from the London School of Economics, or the cost of purchasing a Bored Ape NFT.

If you want to stake, thats a pretty hefty price to pay. Another challenge is that, until recently, staking on Ethereum was a one-way street. After committing to become a validator, you have no certainty when you will get your funds back. This means that if you need to use your ETH urgently, you will not be able to do so.

The chart below from Glassnode shows that new ETH is being staked at a faster pace after the Shanghai upgrade.

Soon, Liquid Staking Derivatives (LSDs) emerged to solve these problems. First, it allows retail participants to invest without losing access to their staked assets. Users can withdraw their earnings at any time. Second, people can participate in staking even with a small amount of ETH. But how is this possible? The model relies on the following:

Providing staking investors with a token receipt-like confirmation that they have invested ETH in the deposit contract.

Create an ETH pool and make deposits in batches of 32 ETH so that investors can stake with lower ETH denominations.

Imagine raising money for a trip while you were in college. LSDs provide a similar mechanism for cryptocurrency enthusiasts looking to stake. There are three emerging LSD models on the market.

In the rebase model, users will receive tokens equal to the amount of ETH they have locked through the protocol. For example, if you lock two ETH through Lido, you will receive two stETH. The amount of stETH will increase daily as you earn rewards from staking. Although this model is simple, the ever-changing volume poses a challenge for composability between DeFi protocols. Depending on your jurisdiction, each acquisition of new tokens may be a taxable event.

For tokens with rewards like cbETH issued by Coinbase and rETH issued by Rocket Pool, the value of the token is adjusted, not the quantity.

Frax employs a two-token model where ETH and accumulated rewards are split in two. They are called frxETH and sfrxETH, where frxETH maintains a 1:1 peg to ETH, while sfrxETH is a vault designed to accumulate staking returns to Frax ETH validators. The frxETH to sfrxETH exchange rate will increase over time as more rewards are added to the vault. This is similar to Compound’s c-tokens, which continuously accumulate interest rewards.

Of course, liquid mortgage investment service providers do not provide this option to retail users out of good intentions. There is a profit motive involved. Liquidity staking ventures receive a fixed fee from the yield provided by the network. So, if ETH offers 5% staking yield over a year, Lido will earn 50 bps from stakers.

By this calculation, Lido receives nearly $1 million in fees per day from its stakers. 10% of the fees will be allocated to node operators and DAO. It has little competition from its tokenized peers. While we don’t have access to data for other major derivatives such as Rocket Pool or Coinbase ETH, we can roughly estimate the fees they generate.

For example, Coinbase staked 2.3 million ETH and charged a 25% fee on staking proceeds. Assuming a staking yield of 4.3% and an ETH price of $1,800, Coinbases revenue is about $45 million from ETH alone. Data from SEC disclosures shows that Coinbase generates nearly $70 million per quarter from staking of all assets it supports.

Over the past year, Lido Finance is one of the few divisions that has amassed significant value from operating income. As I write this, $279 million has flowed into Lidos DAO treasury. The agreement brought it $5.4 million in revenue in the past 30 days alone, compared with $1.7 million for Aave and $0.4 million for Compound. Comparing the fees of other liquid collateralized investment derivatives programs with Lido shows its dominance in the LSD market.

As the staking market grows, new entrants may erode Lidos profit margins, and stakers may look elsewhere for lower fees. But for now, all I know is that Lido is one of the few crypto projects that can profit from idle assets at scale. About $15 billion in ETH is staked on Lido. As long as ETH can generate income and funds dont flow out, liquidity-backed investment companies will be in good shape.

Also, unlike Uniswap or Aave, Lido is less exposed to market volatility. Lido takes advantage of peoples laziness.

risk-free rate

The risk-free rate is the rate of interest earned on investments with no risk of default. Thats why its called risk-free. Typically, bonds issued by governments that are financially and politically stable are considered risk-free. Wait, why are we talking about the risk-free rate?

In the world of investing, a good or bad investment is judged based on the cost of capital. A basic question every investor asks before investing is whether the expected return is greater than the cost of capital.

If yes, then its investable; otherwise, its not. The cost of capital includes the cost of equity and the cost of debt.

The cost of debt is pretty straightforward, its the interest rate you pay. The cost of equity depends on three factors: the risk-free rate, the riskiness of the investment relative to the risk-free asset, and the risk premium.

Without a defined risk-free rate, it is difficult to determine the cost of capital on which to judge the basis of any investment.

Take the London Interbank Offered Rate (LIBOR) as an example. It is the interest rate benchmark that sets everything from floating rate bonds to priced derivatives contracts. The interest rate earned by Ethereum validators is probably the closest standard by which other interest rates should be determined in other DeFi.

There is a problem with the current DeFi interest calculation. For example, the annualized rate of return (APR) for lending ETH on Compound is about 2%, while the validator rate according to the Ethereum Foundation is 4.3%. In an ideal world, the lending rate for ETH should be slightly higher than the validator yield because:

The application is more risky than the protocol itself. Smart contract risk is mispriced in lending markets.

If alternatives to liquidity staking provide both liquidity and competitive yields, investors have little incentive to lend funds to smart contracts. And thats exactly whats happening right now.

As mentioned earlier, Ethereum has one of the lowest staking ratios. When the withdrawal function is enabled, the amount of assets entering the stake will continue to increase. As assets increase, the rate of return per validator will decrease, as more assets will be chasing finite returns. The amount of ETH issued will not increase proportionally to the number of tokens staked.

The profit motive drives everything around us. If validators notice the opportunity cost, they will move their staked assets elsewhere. For example, if the interest rate for lending ETH or providing liquidity on Uniswap is significantly higher than the validator yield, they will have no incentive to run a validator node. In this case, finding alternative revenue sources for validators is crucial to maintaining the security of Ethereum.

Restaking is becoming an alternative avenue for validators to increase their yield.

EigenLayer is one of the leading middleware supporting rehypothecation. Let’s explain it in detail. When you use a blockchain like Bitcoin or Ethereum, you pay for block space so that your transactions can be stored in a block permanently. This fee may vary across different networks. Consider trading on Bitcoin, Ethereum, Solana, and Polygon and observe the differences in these fees.

Why is this so? EigenLayer’s white paper explains this in an elegant way – blockspace is the product of decentralized trust provided by the nodes or validators beneath it. The greater the value of this decentralized trust, the higher the price of block space.

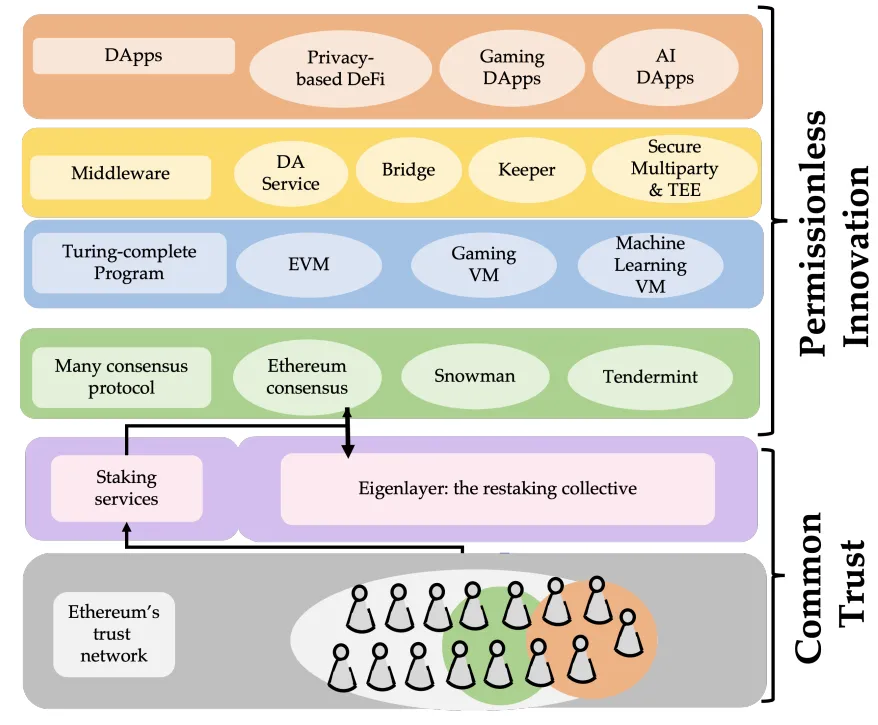

The re-staking mechanism allows us to go deeper into the decentralized stack and create a market for decentralized trust. EigenLayer allows Ethereum’s validators to repurpose their trust and enable new blockchains to benefit from the same trust.

It applies the security of one network to other applications, such as roll-ups, cross-chain bridges, or oracles.

important question

This all sounds great, but you might be wondering who is using all this stuff. We can analyze it from the perspective of supply and demand. On the supply side, there are three sources.

Native ETH stakers (staking their ETH themselves),

LST re-stakers (staking their LST like stETH or cbETH), and

ETH liquidity providers (who stake LP tokens containing ETH as one of the assets), they can also choose to validate other chains.

On the demand side, there are often emerging applications or new chains looking to bootstrap security. You might want to build a network of oracles that parse on-chain data and pass it on to DeFi applications.

A few years ago, when Ethereum and several other layer-1 networks were developing, we werent sure if there would be a single chain to rule them all. By 2023, we will see multiple tiers operating simultaneously. The idea of specific application chains seems likely.

But the question is: Should all these upcoming chains be building security from scratch?

We don’t want to jump to conclusions and say no. Lets look at how Web 2 has evolved to get a perspective. In the early days of the internet, like todays Web 3 startups, founders had to find solutions to problems like payments, authentication, and logistics. A few years later, companies like Stripe, Twilio, Jumio, etc. emerged to address these challenges. Part of the reason eBay bought Paypal in the early 2000s was to solve their payment problems.

Do you see a pattern? Applications on the Internet scale when they outsource things that are not their core competencies.

By 2006, AWS had significantly reduced hardware costs. A major Harvard Business Review paper in 2018 claimed that AWS changed the landscape of venture capital as we know it, due to its impact on the cost of experimentation. Suddenly, you can offer unlimited streaming (Netflix), storage (Dropbox), or social (Facebook) without worrying about buying your own servers.

Restaking is to blockchain networks what AWS is to servers. You can outsource one of the most expensive aspects of cybersecurity. The resources saved by doing this can be better used to focus on the application you are building.

Lets go back to the previous question. Should each chain build its own security? the answer is negative. Because not every chain is trying to become a global settlement network like Ethereum, Bitcoin, or SWIFT. Absolute security does not exist in public blockchains. Blocks are probabilistic (its not uncommon to roll back a block or two), security is a scope. While youre focusing on building your app, you should probably focus on your users.

Getting your security to a point where it can compete with chains with huge network effects is slow and painful. And if you are an application-specific chain, your users dont care about security, as long as it is enough for the application you provide.

The staking landscape continues to evolve. If the approval of an ETF triggers a surge in institutional interest in digital assets, it will be one of the few sectors that will grow exponentially.