Mint Ventures: Concerns with MakerDao, not just RWA exposure

Original author: Alex Xu, Partner at Mint Ventures

This issue of Clips focuses on the recent hot topics of the RWA giant and the DeFi blue-chip project MakerDao. The author attempts to analyze the internal and external factors behind the rise of MKR, and evaluates its advantages, challenges, and long-term risks from the perspective of Maker's business.

The following content represents the author's perspectives at the time of publication and may contain factual errors and biases. It is intended for discussion purposes only, and feedback from other investment research professionals is welcome.

1. MKR Price Rebound: A Result of Multiple Factors Resonating

In recent times, the secondary market prices of older DeFi projects have shown clear signs of recovery, with Compound and MakerDao experiencing the most significant increases. While Compound's surge is partly related to its founder Robert Leshner's second venture in the RWA field, this event has limited impact on Compound's fundamental strength, making its rise less analytically significant.

The rise of MKR, on the other hand, is driven by a combination of internal and external factors. It involves a logic of fundamental business reversal as well as the gradual fermentation of the long-term vision of the Endgame plan.

Specifically, the forces behind the recent increase in MKR include:

1. Decrease in protocol monthly expenses, where monthly spending has dropped from previously reaching 5 to 6 million US dollars to around 2 million in June.

Token transfer payment statistics for Maker, image source: https://makerburn.com/#/expenses/accounting

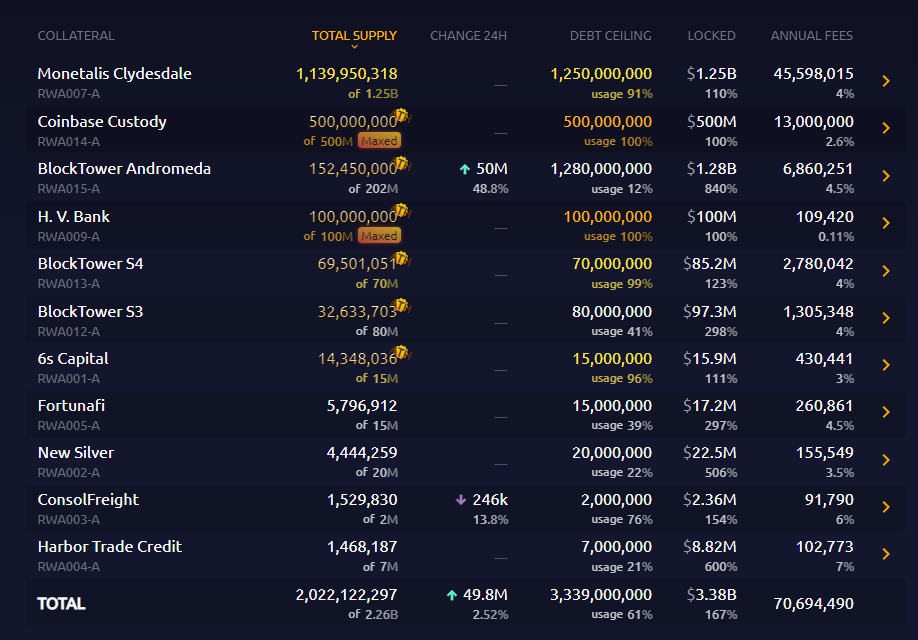

2. Converting collateral from interest-free stablecoins to national debt or stablecoin financial management has significantly increased the expected financial income, which is reflected in the decrease in PE. According to makerburn's statistics, MakerDao's projected annual income from RWA alone is nearly $71 million.

Maker's RWA asset list, image source: https://makerburn.com/#/rundown

3. Founder Rune selling other tokens such as LDO on the secondary market and continuously repurchasing MKR for several months has given the market confidence.

4. By governance, the threshold for repurchasing the surplus pool funds from 250 million USD to 50 million USD has been reduced. Currently, the available funds in the surplus pool are 70.25 million USD, with around 20 million in repurchasing funds. However, according to Maker's current repurchasing mechanism, it has changed from buyback and burn to "buyback and market-making". Therefore, the actual amount of repurchased MKR is 2000/2, and the remaining 10 million DAI will be used to provide liquidity with MKR on Uniswap v2 as LP form, serving as treasury assets.

Maker's system surplus data, image source: https://makerburn.com/#/system-surplus

In addition, since last year, Maker's founder Rune Christensen proposed the Maker transformation plan "Endgame" which has a grand vision in its narrative, which has made many investors begin to believe in and buy MKR after its performance and coin price rebounded.

The ultimate goal of MakerDao's "Endgame" is to achieve its vision of a "world fair and stable coin" by optimizing governance structure and funding sub-projects.

In addition, the narrative of RWA seems to be quite popular in the market recently, although there are not many projects that have launched tokens related to this business, the discussion has clearly increased in intensity and has gained the favor of many investment institutions.

In summary, the recent rise of MKR is the result of a combination of internal and external factors. Among them, internal factors play a major role. As for the narrative push of RWA, I am inclined to believe that it is the result of MakerDao's practice and positive results in the RWA business that have driven the development of the narrative in the crypto market, rather than the other way around. The causality here has been inverted.

2. The Essence of MakerDao's Business

So, how should we evaluate the long-term impact of these factors on MakerDao? Can these positive factors propel Maker to a higher level and achieve its grand vision of creating a "world fair and stable coin"?

I find it difficult. This needs to begin with an understanding of the essence of MakerDao's business.

The core business of MakerDao has never changed and is fundamentally similar to projects like USDT, USDC, BUSD, and so on. It involves promoting its own stablecoin and generating "seigniorage revenue" from the issuance and operation of the stablecoin.

The so-called seigniorage can be broadly understood as the income obtained by the currency issuer through the issuance of money. Different stablecoin projects have different ways of obtaining seigniorage revenue. For example, in another decentralized stablecoin project, Liquity, users are charged a fee of 0.5% when minting its stablecoin, Lusd. As for Tether users, they are required to pay a fee of 0.1% or $1000 when depositing or withdrawing US dollars.

In addition, Tether actively invests the US dollars deposited by users in high-liquidity government bonds, reverse repurchase agreements, or money market funds to earn financial income from its asset side.

One of Dai's previous main sources of income was the stability fees users paid when obtaining Dai through collateral. Later, a similar approach to Tether's was adopted, where the collateral for its PSM module, such as USDC, was replaced with income-generating assets such as government bonds or deposited in Coinbase's USDC savings account.

However, the core of stablecoin business lies in the expansion of demand for stablecoins. Stablecoins can only obtain sufficient collateral assets and generate financial income by maintaining a high issuance scale.

In addition, the main difference between Dai and USDT and USDC lies in its decentralized positioning. "Dai has stronger resistance to censorship and smaller regulatory exposure compared to USDT and USDC". This is the most important differentiating value of Dai, and replacing a large amount of Dai's collateral with RWA assets that can be seized by centralized forces essentially dissolves the differences between Dai and USDC and USDT.

Of course, Dai is still the largest decentralized stablecoin with a market value of 4.3 billion, which is significantly ahead of Frax (nominal market value of 1 billion) and LUSD (market value of 290 million).

3. Sources of Dai's Competitive Advantage

In addition to actively trying to align itself with RWA assets on the asset side, over the past few years, Maker's overall operation of Dai has been lackluster, but it still firmly maintains its competitive advantage as the leading decentralized stablecoin. This is due to two factors:

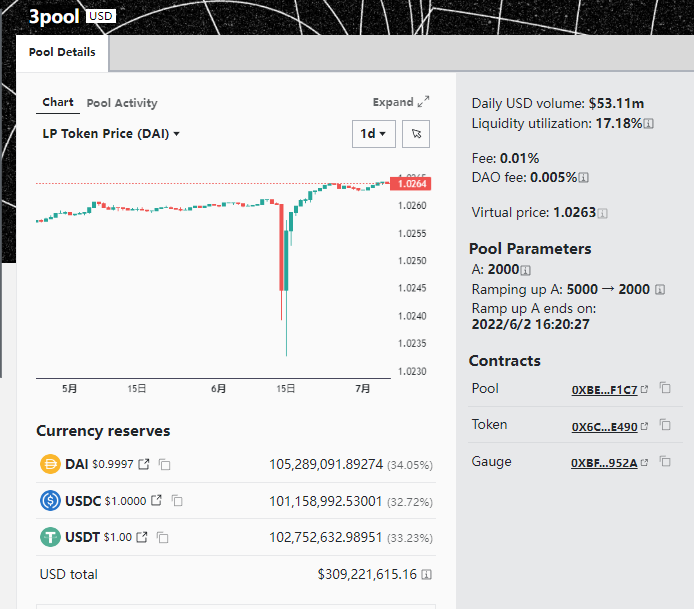

1. Authenticity and brand as the "first decentralized stablecoin": This has allowed Dai to be integrated and adopted by many top DeFi and CEX platforms earlier, greatly reducing its liquidity and business PR costs. For example, in the case of Curve, Dai is one of the currencies in Curve's oldest stablecoin liquidity basepool, 3pool. Curve defaults to Dai as the base stablecoin, which means that Maker, as the issuer of Dai, does not need to spend a dime on Dai's liquidity on Curve. Moreover, Dai also enjoys indirect subsidies provided by other liquidity bribe providers (when these projects purchase their own tokens and pair them with 3pool liquidity).

Curve's 3 pool stablecoin pool, source: https://curve.fi/#/ethereum/pools/3pool/deposit

2. Network effect of stablecoins: People always tend to use the stablecoin with the largest network scale, the most users and scenarios, and the one they are most familiar with. In the decentralized stablecoin subcategory, Dai's network scale still leads other competitors.

However, Dai's main competitors are not Frax and Lusd (they are also in a difficult situation). When users and project parties choose which stablecoin to use and cooperate with, they often compare it with USDT\USDC. Compared to them, Dai is at a clear network disadvantage.

4. The Real Challenge for MakerDao

Although MakerDao has many short-term positive factors, I still hold a pessimistic attitude towards its future development. After discussing that Maker's core business is stablecoin issuance and operation, as well as the competitive advantages currently possessed by Dai, let's face the real problems they are facing.

Problem 1: Dai's continuous reduction in scale, long-term stagnation in application scenarios

Data source: https://www.coingecko.com/en/coins/dai

The market capitalization of Dai has dropped by nearly 56% from its previous high, with no signs of recovery. Meanwhile, USDT has reached a new high in market capitalization even in bearish market conditions.

Data source: https://www.coingecko.com/en/coins/tether

The previous wave of growth for Dai came from the DeFi summer mining frenzy, but where can its next wave of growth come from? It seems difficult to find a strong use case for Dai within sight.

Maker has not been without thinking and planning on how to expand the use cases for Dai to be more widely accepted. According to Endgame's design, the first approach is to introduce renewable energy projects as underlying assets for Dai, making Dai a "green currency" (Clean money). In the scenario envisaged by Endgame, this would give Dai a brand element that is accepted by the mainstream, and also make it more politically costly for real-world administrative powers to attempt to seize or confiscate clean energy projects funded by Dai. In my opinion, it is overly naive to think that increasing the "greenness" of the collateral would increase the acceptance of Dai. People may support environmental protection in their thoughts or slogans, but when it comes to actual actions, they will still choose the more widely accepted USDT or USDC. It is already extremely difficult to promote decentralized stablecoins in the decentralized world of Web 3, so how can we expect residents of the real world to use Dai just because of "environmental protection"?

The second measure, also the focus of Endgame, is incubated by Maker and developed by the community around the subDAO of Dai. On the one hand, the subDAO undertakes the governance and coordination work that is currently concentrated on the MakerDao main line, transforming centralized governance into decentralized governance for different sections and projects. On the other hand, the subDAO can establish independent commercial projects to explore new sources of income and provide new use cases for Dai through these projects. However, this is also the second important challenge faced by Maker.

Question 2: How can the subDAO project succeed in both supporting MKR and Dai and achieving entrepreneurial success?

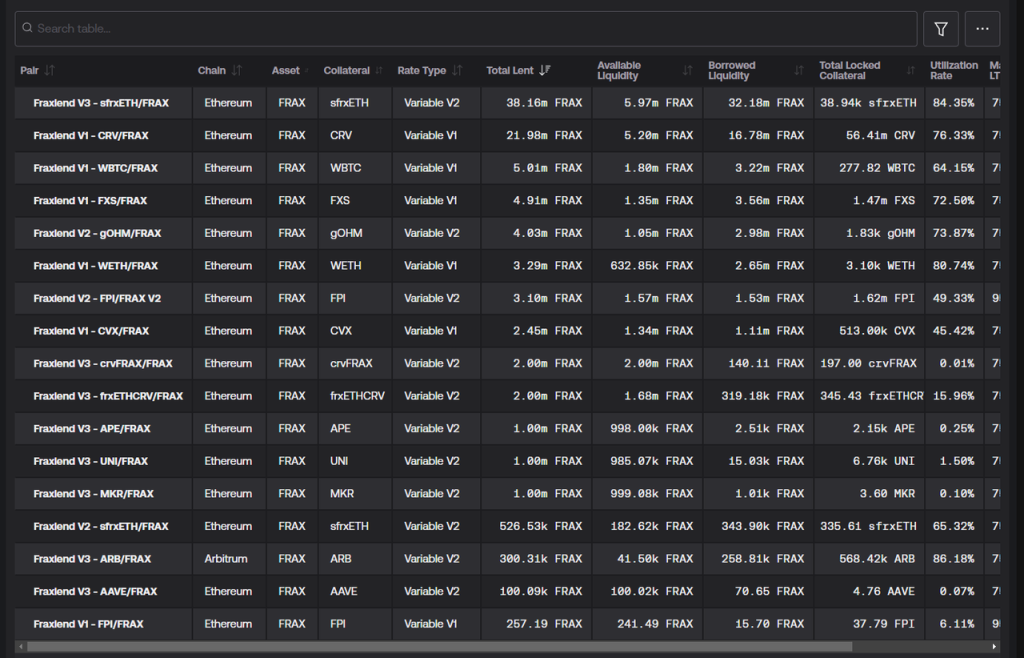

In the future, Maker will incubate numerous subDAOs. The subDAO's own new tokens will be used to incentivize Dai liquidity mining, thereby enhancing the usability of Dai. At the same time, MakerDao will provide low-interest or 0-interest Dai loans to subDAO commercial projects to help them complete their early stages. In addition to low-interest financial support, the subDAO also inherits MakerDao's brand reputation and community, which is important during the initial launch of DeFi. Compared to relying on introducing environmentally friendly projects to increase Dai adoption, the subDAO solution sounds more feasible and has been proven successful in the DeFi field. For example, Frax has developed its own Fraxlend to support lending and borrowing with various collaterals, providing usage scenarios for Frax.

Fraxlend asset lending list, image credit: https://facts.frax.finance/fraxlend

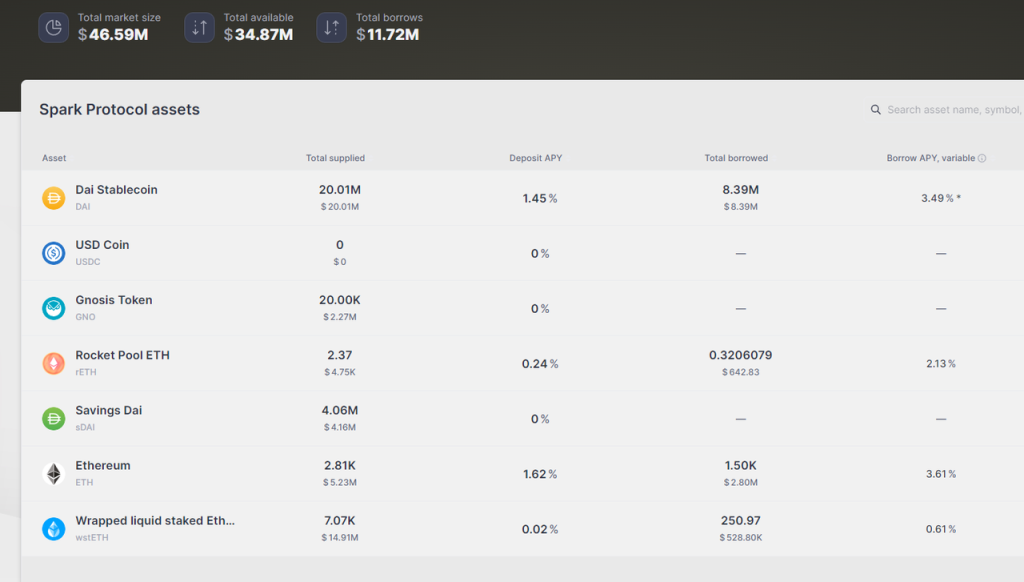

However, the problem is that in the DeFi field, where the "low-hanging fruit" has already been picked by entrepreneurs, it is not easy to develop a subDAO project that adapts to market demand. What's more important is that these subDAOs also need to shoulder the responsibility of delivering value to Dai and MKR while developing the project, as they need to distribute additional project tokens to Dai, ETHD (a repackaged version of LST token planned in Endgame, used as collateral for Dai), and MKR as incentives. With such a "tribute mission," it is difficult to fulfill the task of meeting user needs and defeating competitors. Among them, Spark, a lending product incubated and launched by MakerDao, has an actual TVL of only over 20 million Dai, excluding the 20 million Dai directly minted and provided by MakerDao.

Image source: https://app.sparkprotocol.io/markets/

5. Other concerns about MakerDao

In addition to the two challenges mentioned above, MakerDao also faces other concerns.

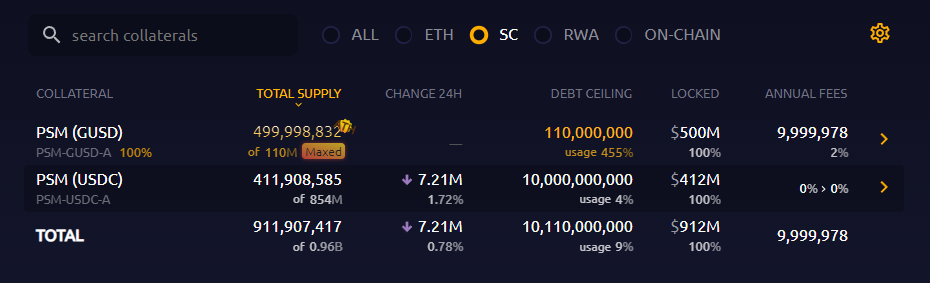

Firstly, there is not much stablecoin left in MakerDao's account to continue purchasing RWA, making it difficult to increase positions in US bonds.

According to Makerburn's statistics, there are currently about 912 million US dollars (USDC+GUSD) in stablecoins held within the PSM. Among them, 500 million US dollars of GUSD are already enjoying an annualized subsidy of 2% from Gemini, although it is much lower than the interest rates of other RWAs. However, due to various complex factors (such as the fact that the GUSD held by Makerdao PSM accounts for 89% of the total circulation, selling it forcibly and converting it into US dollars would result in significant price losses), there will not be much change in this portion of the funds in the short term.

Image source: https://makerburn.com/#/rundown

Therefore, Maker has only approximately 412 million USDC left in the PSM to continue purchasing yield-bearing assets with flexible cash. At worst, we can swap 500 million USDC from Coinbase, which has an annualized interest rate of 2.6%, into US Treasury bonds. So, all in all, Maker can only allocate around 9 billion USDC to purchasing US Treasury bonds. In reality, the amount of funds that Maker can use to buy US Treasury bonds in order to meet redemptions from PSM will not be too large. Otherwise, if users redeem a large amount of USDC with Dai, Maker will need to sell its bond assets to honor those redemptions, which would expose Maker to trading friction and bond price fluctuations, potentially resulting in losses. Furthermore, if the market capitalization of Dai continues to decrease, Maker's pool of investable assets will be further forced to shrink.

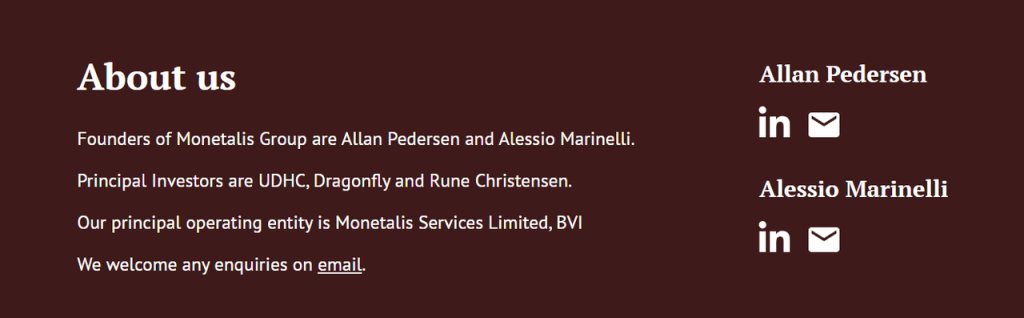

The next question is whether MakerDAO's cost control can continue to be maintained, and the author remains skeptical. Based on Endgame's current plan, although it attempts to decentralize the governance process and power of DAO from the "Maker center" to various subDAOs, it sets up complex roles, organizations, and arbitration departments within the governance units of subDAOs. The entire collaboration process is the most complicated among all projects I have known – it is truly a "governance maze." Interested readers can visit Endgame's V 3 complete overview for a mind-boggling reading experience. In addition, the introduction of RWA business results in the intersection between DeFi and offline traditional financial entities, as well as the generation of a large number of high-paying outsourcing jobs. Coupled with the current serious problem of centralized governance (the Endgame plan passed a vote in October 2022, with 70% of the approval votes coming from voting groups related to Maker founder Rune), the issue of interest distribution in MakerDAO is already the elephant in the room. For example, the largest RWA investment management treasury of Maker, which is responsible for managing $1.25 billion of Maker funds, is overseen by a small organization called Monetalis Clydesdale. This company charges nearly $1.9 million per year for its services, allocating the funds to government bond assets and negotiating with other traditional financial institutions. Maker was its only client at the time, and Maker's founder, Rune Christensen, is a major shareholder of that company.

Rune is monetalis' main investor, image source: https://monetalis.io/

Similar examples include Maker paying its risk management service provider, Block Analitica, nearly $5 million/year (Dai+MKR) in service fees. What's even more absurd is that Block Analitica not only provides the risk management services but also evaluates them. This dual role of both player and referee makes Maker's risk control services a lucrative monopoly business. The remaining question is how Block Analitica and the interest group that monopolizes the MKR governance rights will share the substantial profits obtained from Maker's treasury. With the implementation of Endgame's grand plan that even a 16z would shake their heads at, the future diversion of treasury funds is likely to intensify. However, with the decentralization and devolution of organizations, the means of emptying the treasury and splitting the accounts for interest groups may become even more concealed and circuitous.

Source: coindesk

In addition, the stability fee of Dai has recently been raised from 1%+ to over 3%, which further reduces the demand for borrowing behavior through MakerDao, which is not conducive to maintaining the scale of Dai.

Finally, from Endgame to large purchases of national debt and RWA, to the founder's high-profile secondary market buyback, and to the initiation of a vote to significantly reduce the threshold for withdrawing repurchase funds from the treasury, a series of combinations have given MKR a significant short-term boost in market value, but also leaving behind many hidden risks:

1. Insufficient retention of treasury surplus reserves, reducing the ability to cope with bad debt risks.

2. Aggressively increasing exposure to RWA increases the risk of assets being seized by centralized institutions, further magnifying the vulnerability of Dai.

3. The large and complex, continuously modified Endgame plan has caused severe community division. In the Endgame Phase One roadmap released by Rune Christensen in May, there are also "AI governance," the release of "new brand" stablecoin and governance tokens (while retaining the original Dai and MKR), and MakerDao launching its own chain, among other "ideas."

6. Endgame is not the end

In the comments section of the Endgame roadmap forum post by Rune Christensen in May (The 5 phases of Endgame), apart from the usual praise and questions from other governance participants, two users' comments stood out:

"The valuable money and energy we once had have been wasted on supporting useless people and garbage, instead of being invested in creating value for MKR and expanding the scale of Dai. All funds and research should be used to figure out how to make Dai and MKR run autonomously! Get rid of bloated personnel, get rid of cumbersome governance, this is the right way."

"Why do we think a globally pre-planned 'endgame plan' is better than solving current problems and gradually improving? This plan, except for the blockchain part, is always very specific about 'what we do', but there is very little related to 'why we do it'."

No one replied to them.

For Web 3 projects based on blockchain, we should make good use of transparency and low trust cost efficiency, instead of building new high walls and brewing new fog, seeking rent behind the walls and in the fog.

Endgame is not the ultimate goal that DeFi should have, it is just the wall and fog of MakerDao.

7. References and Acknowledgements

During the writing process of this article, the author discussed the topic of Maker with researcher @DigiFTTech, and thanks to him for providing a lot of important information. The research on Maker's RWA by @ryanciz233 will also be published soon.

MakerDAO Becoming 'a Company Run by Politics'?

Endgame-related article collection

A 16 Z Doesn’t Support Plan to Break Up DeFi Giant MakerDAO

MakerDao collateral data: https://makerburn.com/

MakerDao expense statistics: https://expenses.makerdao.network/

Dai related data: https://daistats.com/#/