Negative premium returns to the same level as last year, is GBTC making a comeback?

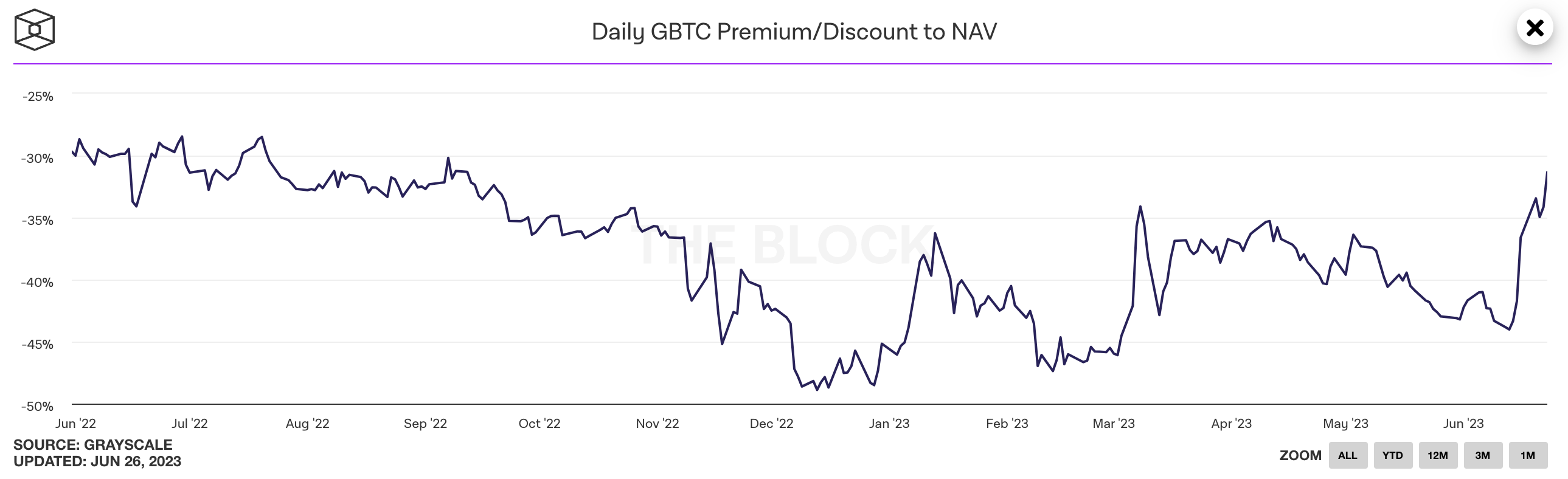

The discount of grayscale GBTC has continued to narrow. Recently, its negative premium rate officially entered 30%, and has narrowed to 29.79%, the lowest level in a year. Its premium rate has recovered to the level of July 2022.

To put it more directly, how much return can GBTC bring to new investors this year?

Take February of this year as an example, GBTC once reached a low point of $10.3, with a negative premium of about 47% at that time. Using today's price as an example, the current GBTC price is $18.6. In less than 5 months, GBTC has already generated an 80% return in USD terms, and also achieved a high return of 32% in coin terms.

It is precious to be able to outperform BTC in such a bear market.

Trading surge, price surge, GBTC fully recovers

Previously, GBTC once faced a selling crisis. Since October 22, the negative premium level has continued to rise, quickly rising from over 30% to over 40%. In December 22 and February 23, GBTC faced a "half-price" high discount for a long period of time, and the negative premium rate continued to hover around 50%.

From the graph, we can see that since mid-June, it has been continuously rising for nearly half a month.

From the graph, we can see that since mid-June, it has been continuously rising for nearly half a month.

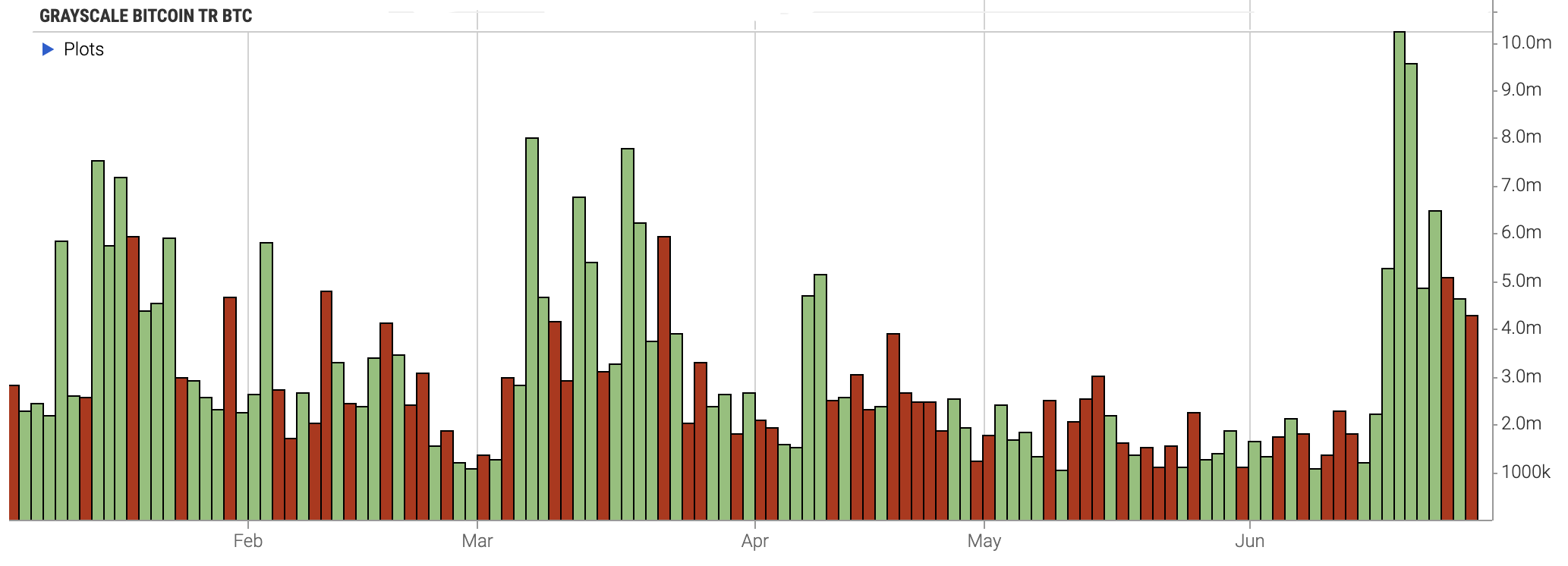

With the narrowing of the negative premium, GBTC's trading activity has gradually become more active. Data from Nasdaq shows that since mid-June, GBTC's trading volume has continued to increase, and on June 20th, it reached the highest trading volume of the year, with a daily trading volume of $10.2 million.

The Nasdaq data shows that the trading volume of GBTC in June reached 69.2 million US dollars, while in May, this number was only 38.7 million US dollars, a month-on-month increase of 79%.

Accompanying the recovery of GBTC is the increase in Grayscale's revenue, which may revive this "flagship" institution in the coin circle that has faced many crises and rumors in the past year.

For a long time, Grayscale's high fees have been criticized by investors, with a management fee of 2% for GBTC and 2.5% for ETHE. Based on estimated holdings, Grayscale is expected to have earned approximately $44.13 million in revenue from its flagship products GBTC and ETHE this month. This is also the best income performance since the market downturn in May 2022.

Various signs indicate that the recovery of GBTC data reflects the growing positive sentiment in the market.

What has happened to GBTC, which has gone from being disliked by everyone to a overall recovery?

In stark contrast to the present, GBTC has been surrounded by various crises and negative rumors in the past year.

At the end of 2022, a rumor about GBTC instantly triggered the market. Despite earning a considerable income through its advantageous market position, the crisis of Grayscale's parent company dragged Grayscale down. Market rumors suggest that the cryptocurrency trading and lending institution Genesis may have solvency problems. To fill the gap, Genesis's parent company DCG may choose to dissolve Grayscale, which issues GBTC and ETHE.

In January of this year, one wave subsided, and another wave rose. Cameron Winklevoss, co-founder of Gemini, issued an open letter on behalf of platform users to the founder of Digital Currency Group (DCG), with strong words demanding the repayment of $900 million owed. Cameron also disclosed in the open letter that DCG owes Genesis approximately $1.68 billion in total. The escalating crisis of DCG has aroused high attention from the cryptocurrency community.

With the intensification of the Genesis crisis, Gemini continues to sell off GBTC collateral in the off-market. This has also led to a continuous expansion of the GBTC discount. At one point, the scale of the sell-off accounted for 5% of the total circulating supply of GBTC.

Previously, DCG leveraged GBTC, which was one of the main reasons for its financial crisis. According to Odaily's statistics, starting from the first quarter of 2021, DCG spent a total of $1.305 billion to purchase 54,823,667 shares of GBTC, with an average unit price of $23.8. As the market turned bearish, DCG continued to increase its position in the bear market and even "leveraged" trading. With the continuous decline of GBTC and the worsening market environment, its financial crisis gradually emerged.

The previous market pessimism about GBTC is now replaced with a strong bullish sentiment.

Despite the extremely positive future prospects that the market has shown for GBTC, there is still a significant gap from its historical high point.

In June 2017 and September 2017, GBTC once reached a premium of over 100%. According to Coinglass data, its premium rate has reached a historical high of 132%.

During the bull market in 2021, GBTC premium rate has turned negative. However, the negative premium is not severe, and it has long been maintained at around 10% or 20%. Currently, the premium level of GBTC is much lower than it used to be. As market sentiment gradually shifts to "bullish", is there hope for GBTC to regain its former glory and even return to positive premium? On June 16th, the rise of GBTC in this round began.

On that day, BlackRock, one of the world's largest asset management firms, submitted a filing for a physical Bitcoin ETF to the U.S. SEC through its subsidiary iShares. This once again brings the narrative of the "mainstream" entering the crypto market.

According to the filing, the assets are mainly composed of Bitcoin held by the trustee representing the trust, and the "trustee" achieves custody through the cryptocurrency trading platform Coinbase. With the news of the mainstream ETF spreading, GBTC once again returns to the center of some investors' attention.

In the long history of GBTC, the company has made several attempts to convert GBTC to an ETF, in order to provide a better exit channel for GBTC investors. It first submitted this application in October 2021. Unfortunately, this idea has never been realized. With BlackRock entering the BTC ETF market, there is increasing speculation about the possibility of such products being approved.

If the BTC physical ETF is finally launched, it will be a historic moment for cryptocurrency. Once the physical ETF is launched, GBTC is expected to successfully convert to an ETF, and its premium will no longer exist. This not only implies huge arbitrage opportunities but also the possibility of GBTC returning to its throne.

Fierce competition for BTC ETF, can Grayscale reclaim the throne?

The comprehensive recovery of data and the strong expectation for ETFs make GBTC look like it is constantly improving. However, in the long run, whether its market position can return to its heyday still faces numerous challenges, and investors should not hold overly high expectations for it.

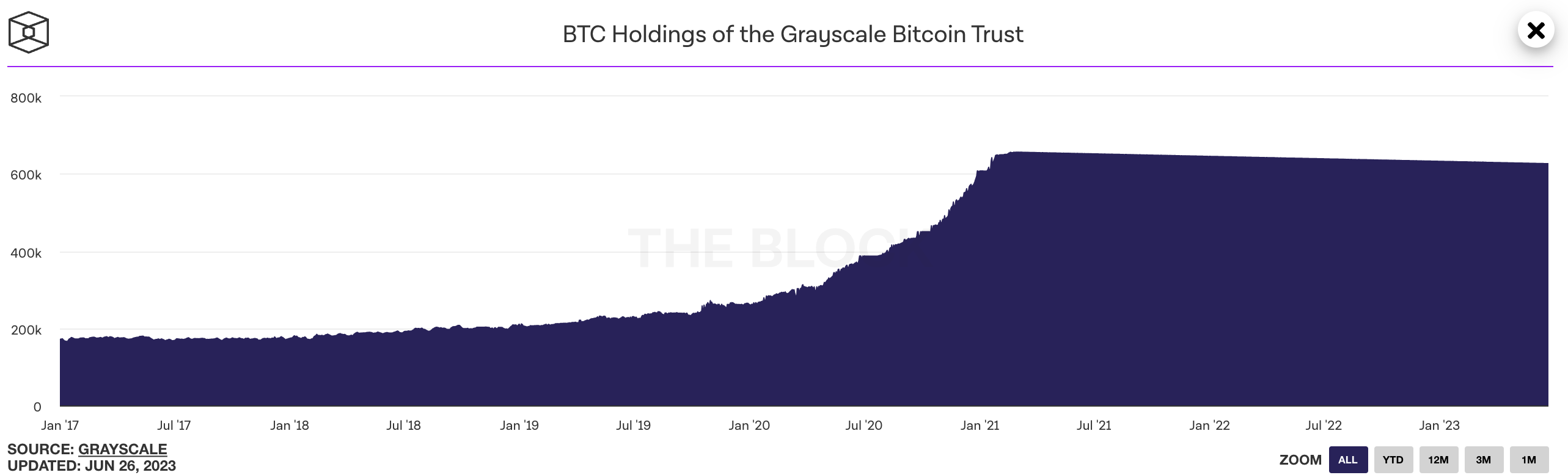

For a long time, Grayscale has been the largest single buyer in the crypto market.

At the beginning of 2021, Grayscale's holdings of BTC reached a historical peak, surpassing 650,000 BTC.

Looking at its chart, it is even more shocking. Before reaching its peak, the number of coins it held was like a steep mountain, constantly climbing. Due to its unique mechanism, Grayscale can only buy and cannot sell, exerting immeasurable influence on the Bitcoin spot market.

The consistently large-scale buying also earned it the nickname "bull market engine" and Bitcoin pixiu.

And in the new bull market, Grayscale's market position may be impacted.

Before this, due to numerous regulatory reasons or compliance requirements, Grayscale's GBTC was once considered the best choice for institutional investors. However, if spot ETFs are launched, GBTC will face many competitors.

Recently, Wall Street giants have concentrated on applying for ETFs and entering the cryptocurrency market. In addition to BlackRock, there are also institutions such as Fidelity, Invesco, WisdomTree, and others.

Once the ETF is approved, the impact on GBTC will be significant regardless of whether GBTC can successfully convert. If GBTC cannot convert, the approval of other BTC ETFs will attract GBTC investors to turn to other ETFs. If GBTC successfully converts, other competitors will also force Grayscale to reduce its high management fees. Most importantly, if GBTC converts to an ETF, the fund will face strong outflow pressure and its massive assets under management may dramatically decline.

The sentiment of "the bull has returned" is gradually showing, and regardless of whether Grayscale's market position can return to the past, its massive scale is still worth the market's attention. Even now, Grayscale still holds 625,900 BTC, worth about $19 billion, accounting for 3.2% of Bitcoin's circulating supply.

And as the market continues to improve, Grayscale's role as a "barometer" in the market is no longer as prominent as before. There is a gradual increase in alternative products to Grayscale in the market, and Grayscale is no longer the only choice in the market.