Explore how TinyTrader can help emerging derivatives platforms build a mature Web3 product system and achieve profitable growth

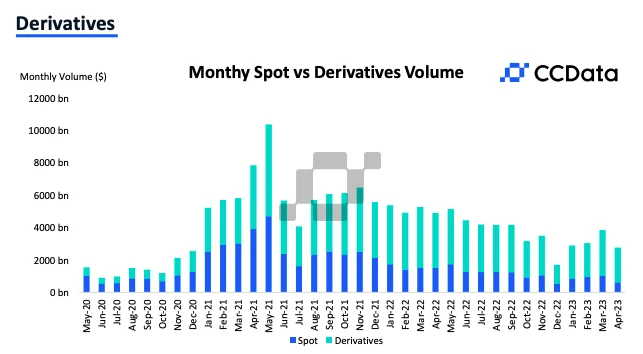

With the development of the Web3 financial industry, the trading volume of emerging derivatives is soaring from less than 50% in the early days. Although the spot market continues to show strong growth, the growth rate is relatively slower than that of the derivatives market. Today, the trading volume of the Web3 derivatives market is completely dominant. As of the end of May, the trading volume of the derivatives market (about 2 trillion US dollars) accounted for more than 78%.

image description

Comparison chart of encrypted asset spot and derivatives monthly trading volume (source: CCDatafirst level title)

The siphon of top derivatives platforms is serious, and the development of emerging platforms is struggling

image description

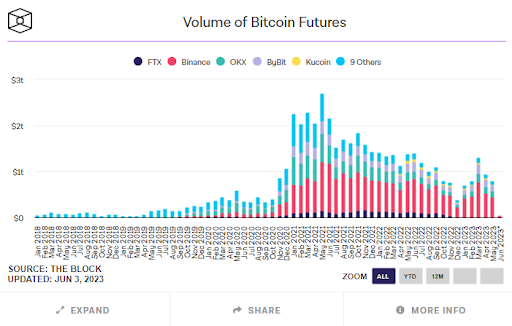

Bitcoin futures trading volume, source (https://www.theblock.co/data/crypto-markets/futures)

image description

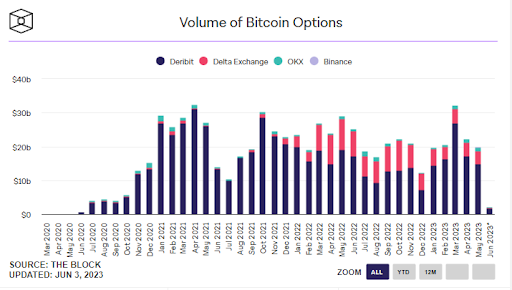

Bitcoin options trading volume, source (https://www.theblock.co/data/crypto-markets/options)

According to data from a research report by Jump Crypto last year, the trading volume of the encrypted option sector only accounted for a small part (less than 2%) of the spot trading volume, while in the US stock market, this proportion was 3500%, which means that the encrypted The option track is expected to continue to explode in the next few years.

Through the observation of the market, it is not difficult to find that the top platform of the derivatives track occupies the main trading share of the market, and its continuous profitability has further promoted its siphoning of new trading users. Although the encrypted derivatives track is a potential sector and a new market opportunity, under the continuous influence of leading platforms, the development of emerging derivatives platforms is usually difficult.

We have seen that the crux of most emerging platforms lies in their limited technical level and market awareness, further manifested in the lack of product innovation and market operation strategies, and it is difficult to form differentiated competition with top platforms, which directly leads to their Difficulties in acquiring customers and achieving profitability, coupled with the impact of external markets and policies (compliance, etc.), eventually fell into a vicious circle.

first level title

So, how can white label service providers help emerging platforms achieve growth and profitability?

secondary title

Derivatives contract platform just needs a new layout, how can newcomers break through?

The essence of business is to earn profits. Although profit may not be the only purpose, it must be one of the most important factors to maintain sustainable business. Therefore, for the derivatives platform, the most important thing is how to continuously obtain benefits through its own products.

From the perspective of the nature of trading, traders in all trading modes mainly obtain income through continuous strategic trading from the constant changes in the exchange rates of different encrypted assets. Therefore, from the perspective of trading, traders' continuous trading will be the platform Bring benefits. From the perspective of the Web3 derivatives platform, whether it is futures (mainly perpetual contracts, but also CFDs) or option models, the main profit model of the trading platform includes several parts:

transaction fee income(Maker Rate, Taker Rate, option exercise fee, liquidation rate, etc.).

Usually, the value of encrypted assets in contract exchanges is determined by the supply and demand relationship between the order maker and the buyer. Therefore, only when the transaction volume of the order book is huge and the market depth is sufficient, can we guarantee to provide the lowest spread in the market to bring a better trading experience. Therefore, in this process, it is usually necessary to introduce the role of a "market maker" as the counterparty of the trader, and the platform collects various handling fees during their transaction process. For some platforms with considerable transaction volume, the handling fee is also a very considerable income.

Provide market maker services, Earn liquidity income through market making (Market Making, Liuqudity income)

Of course, whether it is the first category, the second category or both, the most important premise is that there is a continuous transaction flow, that is, having sticky transaction users, which is the basis for achieving profitability.

From the perspective of customer acquisition, the platform itself not only needs to formulate good and reasonable operation, marketing, and publicity strategies, but also ensure that it has multiple advantages in terms of ease of use, security, good reputation, and endorsement (compliance) with gold content. In terms of competitiveness and characteristics. The former brings incremental users to the platform through publicity, while the latter helps these users to continuously convert into sticky users. Therefore, to establish a trading platform with potential profitability and growth expectations, multiple aspects must be considered.

1. Several elements of the core trading system of the derivatives platform

The core trading system of the derivatives trading platform is its foundation, and it is also the main embodiment of the product power of the platform. In order to meet the considerations of platform transactions, user management, basic operation, transaction security, etc., to meet market competition, a mature core transaction system needs to contain 6 basic elements:

Trading software, risk management systems, liquidity and bridging systems, customer and agent management systems, marketing promotion management systems, and network and security solutions.

(1 )trading software: The trading software is the main window for C-end users and the main front-end interface for executing transactions. It includes PC-side, web-version, and APP-side trading interfaces. In the design of the functional interface, it needs to be easy to operate, simple to use, and comprehensive in function, so as to further enhance the user's transaction experience and build a foundation for transaction stickiness.

(2 )Risk Management System: The risk control system can set the hedging strategy of the merged platform by itself to control potential transaction risks. The risk control system is the moat for platform transactions to resist risks. Especially in some extreme market conditions, a good risk control system can reduce the risk losses faced by platform users and platforms. It is also the key to bringing stable profits to the platform.

(3 )Liquidity and Bridging Systems: After connecting with the liquidity provider (LP), the supplier can quote for the buyer and the seller, and provide the best price matching transaction ECN for both parties. Liquidity is the foundation of the trading platform. A good liquidity strategy can reduce the spread and ensure that traders enjoy a better trading experience. Relatively speaking, emerging trading platforms generally have a gap with top platforms in terms of liquidity.

(4 )Customer and agent management system: User data and agent network system are the main tools for the platform to manage user data and agent data. A system with a mature mechanism can promote more efficient operation of the platform, and has more advantages in formulating operation and marketing strategies.

(5 )Marketing promotion management system: The marketing promotion management system is a tool to improve user account opening, order placement and activity. It needs to include a series of operational strategy templates including bonuses, red envelopes, etc., to facilitate operations.

(6 )netNetwork and Security Solutions: Any cloud software needs network and security protection, so that the data on the platform can be backed up to the server in real time, and security patches are implemented in real time to deal with the risk of hackers and ensure the security of platform data.

Therefore, building a derivatives platform is an extremely cumbersome and complicated development work, which further reflects the importance of white label service providers, and in recent years, many emerging trading platforms have used white label service providers to build platforms.

Initially, some early white-label service providers generally took more than two months to build the above-mentioned trading system. With the development of the white-label exchange field, the technology of this sector is also being innovated. At present, new white label service providers such as TinyTrader can basically complete the construction and launch of the contract trading core system within 7 days.

2. Potential organizers of the derivatives contract platform

From the perspective of the encryption industry, it is difficult for a single spot trading service to meet the needs of traders. With market competition, the overall profit expectations of spot platforms are declining. Therefore, for spot platforms that initially have customer resources and trading volume, through It will be a very urgent need to build derivatives and contract products to broaden income channels.

In addition to the Web3 industry, it will also be a rigid demand for the traditional financial field to deploy to the derivatives sector. At present, traditional financial asset trading service providers such as financial trading platforms (stocks, private equity, foreign exchange) and traditional financial derivatives platforms are declining in revenue after MT 4 and MT 5 encounter regulatory issues. In order to further expand its business scenarios and increase revenue, it is also a new choice to make an appropriate layout in the Web3 field. In addition, industrial companies, game companies, and traditional Internet companies with strong financial strength and operational capabilities are also expected to turn to this field or explore new business models. They are also potential user groups for building contract platforms .

We have seen that the derivatives contract platform is becoming a new rigid demand for layout, which will also form a new market rigid demand for the white label service field.

3. Explore TinyTrader, how to help emerging derivatives platforms achieve quick profits?

The emerging derivatives platform itself has further broadened the trading options for traders, but from the current point of view, most platforms are still dominated by encrypted assets, and there is still a lack of extensive support for asset types. Regardless of whether the traditional financial platform is moving towards the Web3 field, or the emerging derivatives platform is moving closer to the traditional financial field, compliance is an issue that cannot be ignored.

At present, white label service providers are expected to further break the bottleneck, and are expected to help demanders broaden their income channels, and achieve rapid growth and profitability from subsequent and continuous ecological support. Let us take TinyTrader, which has demonstrated strong competitiveness, as an example.

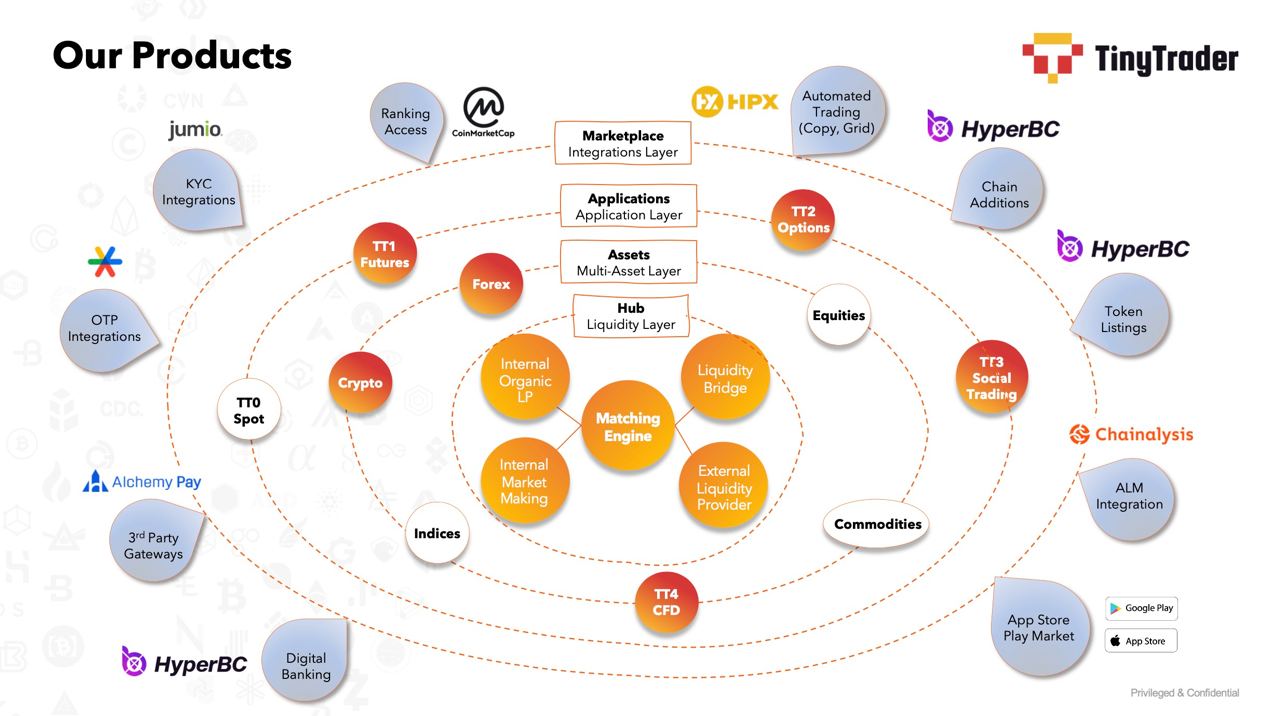

As the most competitive white label service provider at present, TinyTrader itself can not only provide spot, contract system (perpetual contract and CFD), liquidity aggregation system, fiat currency engine system (integration of Web3 assets and foreign exchange trading system), TooThe first white label service provider to support options trading system, can help more demanders to deploy in the option field in the early stage of development.

TinyTrader also provides customers with TTMarketplace of other third-party services, such as payment, KYC, OTC, compliance, etc., so as to build a more complete application ecosystem, and the service can span the two major markets of traditional finance and Web3, especially On the basis of the overall support of third-party ecological applications and compliance, it helps demanders to further expand richer application scenarios.

For each type of product line, TinyTrader will provide two types of services: "development mode" and "full stack mode". In the development mode, TinyTrader will only provide a development kit, and customers can use this to build the system by themselves. This mode is more suitable for customers with certain independent development capabilities, and is more customized and efficient. In the full-stack mode, TinyTrader will provide a complete "one-stop" service, take care of all system development work, and launch the core trading system within 7 days at the earliest.

In addition, TinyTrader can help customers make markets and provide risk control support. At the same time, it can accept the payment form of revenue sharing (subsequent platform operation profit sharing, no one-time payment is required), which creates a mature product system for emerging derivatives platforms and achieves rapid growth. And profitability provides the basis.

Zo Liang, CEO of Tiny Trader, also revealed recently that Tiny Trader has received a new round of financing totaling US$30 million, with the aim of further improving its technical level and product strength. He said that Tiny Trader, as a white label service provider capable of integrating Web2 and Web3 fields, is accelerating the exploration of customers in the Web2 field to the direction of Web3 through technology upgrades and product innovations. At the same time, it will explore and make breakthroughs in the field of AI technology to enrich and innovate its AI intelligent quantitative strategy pool and help customers better serve traders. In addition, Tiny Trader will also further upgrade the risk control system through financing to enhance the security moat.

From the perspective of actual operation, based on the TinyTrader framework, it is possible to build a trading system with high user stickiness and continuous user growth.

Personalized service and innovative exchange system continue to generate user stickiness

TinyTrader can build an exchange system with personalized services and innovations for users, such as the TT 1/TT 2 derivatives contract trading product series independently developed by TinyTrader, which itself has ST social copy trading and GT grid quantification Strategies are not only designed to be friendly to traders, but also help traders quickly learn and copy experienced operations in the community by learning the operations of expert traders, and gain profits quickly and efficiently. At the same time, the system's built-in trading strategy and grid trading function keep quantitative trading offline, allowing thousands of "most powerful brains" to serve users, allowing users to continue to generate stickiness in transactions.

Efficiently manage customer and agency channels

TinyTrader's user management system can not only provide an unlimited hierarchical management system to achieve geometric fission explosive growth. It can also achieve a high degree of freedom in commission distribution, applicable to various commission policies (handling fees, net profit sharing, etc.), and realize automatic settlement. At the same time, it has built-in drainage tools to promote transactions, such as built-in bonus airdrops and other small tools to stimulate customers' interest in transactions, increase transaction fun, and promote transaction activity.

Automated Marketing and Growth

In terms of marketing and customer acquisition, TinyTrader can help customers automatically generate marketing funnel models, improve the customer conversion rate of contract exchanges, reduce labor costs, and increase return on investment. And through the automated notification system, the life cycle of customers is extended, and customers are allowed to participate in transactions more subtly.

TinyTrader can also conduct A/B tests for marketing content and images according to different customer segments, and all marketing materials can be flexibly adjusted according to new target markets and market demands. At the same time, the trading signals of social trading platforms that comply with compliance standards are pre-integrated, allowing the trading platform itself to conduct precise marketing for different types of users.

It is understood that using TinyTrader's new automated marketing tool, customers are 25% to 30% higher than the market average in terms of email open rate, user life cycle, initial deposit account value, potential customer conversion, etc. % , and the click-through rate is 100% higher than the market average.

first level title

TinyTrader is backed by the blue ocean market

1. The white label service market is developing towards a new paradigm

With the iteration of technology, the white label service provider market is also ushering in innovation.

At this stage, the main white label service providers in the market usually only focus on the development of trading systems, and it is difficult to support ecological development, especially difficult to support the compliance of "cross-border" Web2 and Web3 fields that hinder different needs. It is difficult for white label service providers in the Web2 and Web3 fields to provide "cross-border" services for different needs.

From the perspective of the white label platform itself, most of them only support the development and deployment of futures contracts (perpetual contracts with a high basic market share), CFDs with a very low market share, and option contracts that are still in the early stages of development. Support is lacking. In addition, the development cycle of most white label service providers is more than 2 months, and they only support one-time payment and lack the awareness of in-depth cooperation. Therefore, at present, many derivatives platforms that come from white label solutions have serious product homogeneity with leading platforms, and it is relatively difficult to achieve profitability and acquire customers.

As an emerging white label service provider, TinyTrader is currently the first to provide a complete set of white label solutions from front-end to back-end, from perpetual contracts to option contracts, from liquidity services to compliance support, and product services not only improve marketing, user The absolute efficiency of growth also spans two major potential markets, such as traditional finance and Web3, and breaks the customer acquisition limitations of platforms in different trading fields. It is more representative of a forward-looking trend.

2. The blue ocean market potential that TinyTrader relies on

After hundreds of years of development, the traditional financial field has formed a very large volume, while the total market value of encrypted assets is only 1.15 trillion US dollars. The comparison between the encrypted derivatives sector and the traditional financial derivatives field is also very different. The Web3 field based on encrypted assets is in the very early stage of development, which also means that backed by the Web2 field, the current Web3 market still has huge opportunities and dividends.

As a breaker capable of breaking the barrier between Web2 and Web3, TinyTrader is helping the traditional financial market to achieve financial upgrades, and deploying to a wider range of asset forms to improve the efficiency of financial transactions and reduce the entry threshold for investors to access Web3 assets. Helping the Web3 world bring huge market increments. In the longer term, TinyTrader, as a trend, is promoting the in-depth innovation of the white label service provider market and has blue ocean development potential.

TinyTrader launched the "Secrets of Success on Web3 Derivatives Trading Platform", aiming to help more users, contact TinyTrader's success team info@tinytrader.com, and receive a free industry trading manual worth $600.