A major crash tested three AI assistants: "Hexagon Player," "Riddler," and "Android Mind"

- 核心观点:交易所AI助手可辅助加密交易决策。

- 关键要素:

- GetAgent提供差异化巨鲸洞察。

- 小安助手侧重历史数据复述。

- TradeGPT倾向模糊双向策略。

- 市场影响:降低信息门槛,提升决策效率。

- 时效性标注:中期影响

As the crypto industry continues to mature and its infrastructure improves, the technical narrative is evolving towards a more fundamental and segmented level, with new applications, protocols, and tokens emerging in an endless stream. At the same time, the crypto market remains the most volatile, with altcoins still experiencing single-day surges of 1,000% and declines of 90%. This explosive growth, coupled with its proximity to capital, also presents significant challenges for users:

- Information barriers: The underlying technology and project mechanisms are becoming increasingly complex, and the threshold for non-professional users to understand is getting higher and higher.

- Information overload: Market information is growing explosively, and it is difficult to distinguish the true from the false, and the quality is uneven. It is difficult for users to quickly capture the mainstream narrative and draw holistic and objective judgments from it.

- Differentiated needs: Users with different experience levels have significantly different needs. New users need systematic guidance to quickly get started and even help them make decisions, while experienced users require professional tools that can improve information processing and decision-making efficiency .

Recently, major exchanges have launched AI products embedded in their platforms, aiming to provide users with one-stop information acquisition and decision-making assistance services.

Can these AI assistants provide authentic, reliable information and deliver valuable insights to users ? Or are they still early-stage, pilot products? How do they perform in real-world scenarios? To address this question, we selected three established AI assistants—Binance's Xiaoan Assistant, Bitget's GetAgent, and Bybit's TradeGPT—and conducted an in-depth evaluation of their usability, centered around the October 11th crypto market crash.

New trading solutions in the era of information overload

Have you ever woken up in the morning to find Bitcoin plummeting $10,000, altcoins decimated, and a bewildered altcoins decimated? In the past, users typically consulted market analysis and outlooks from media outlets like Odaily or influencers on platform X. AI assistants have changed this dynamic, freeing users from fixed sources and enabling faster answers. However, there's a key difference: media articles are sourced from multiple sources and manually reviewed by multiple parties, ensuring a high level of quality, accuracy, and depth. Whether exchange crypto assistants can achieve the same standards of quality and accuracy remains questionable .

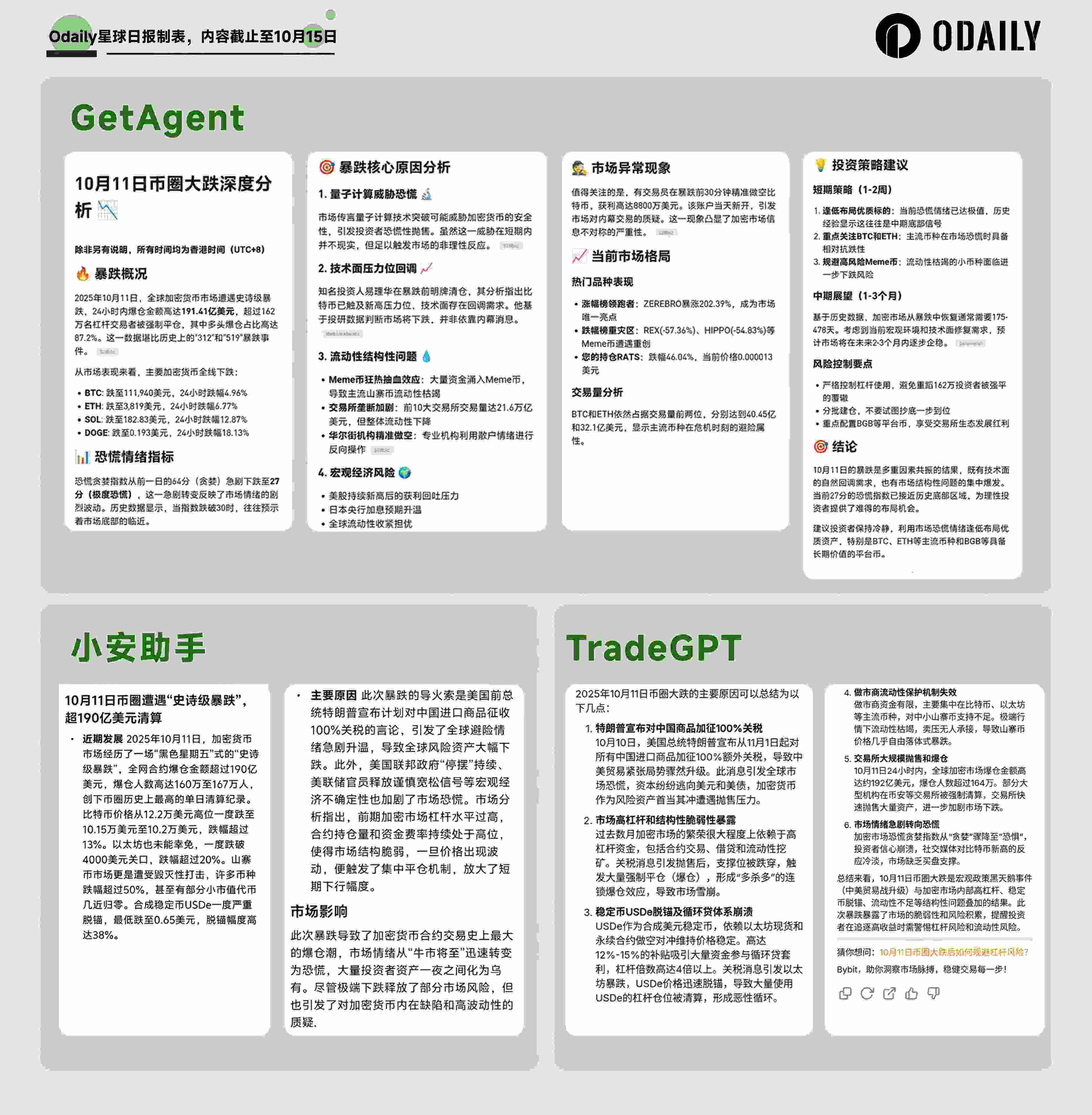

To this end, we first asked the three AIs a relatively rough question, "What caused the sharp drop in the cryptocurrency market on October 11?" for testing. Their answers are shown in the figure below.

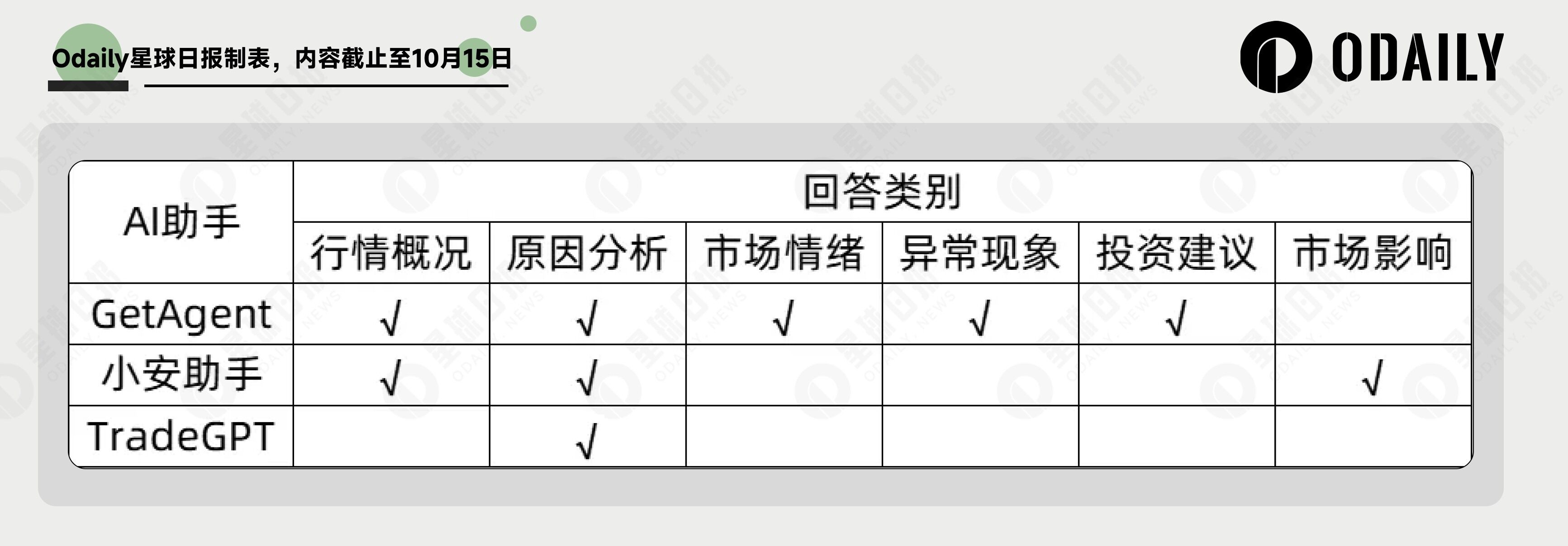

We sorted them out by category, and the types of answers given by each AI are as follows

As can be seen from the category, the three show huge differences in their underlying design. GetAgent is "recall-oriented" and its answers are the most comprehensive. It independently provides a large number of answers that far exceed user requirements, which is most convenient for users who want to obtain all information at once; TradeGPT is completely "precision-oriented" and tends to conduct in-depth research on specific issues; Xiaoan Assistant is somewhere in between the two.

Information depth and differentiated insights

GetAgent identified a key factor that other AIs failed to mention : "A certain insider whale precisely shorted BTC 30 minutes before the crash, making a profit of $88 million." This whale's precise, suspected core insider trading makes it the most noteworthy target in the market outlook. This is crucial information for users, demonstrating GetAgent's whale tracking and differentiated insight capabilities.

Furthermore, we asked Xiaoan Assistant and TradeGPT the question provided by GetAgent, "Were there any abnormal market phenomena on that day?" Xiaoan Assistant mentioned the insider whale in his answer, while TradeGPT did not mention it. Only when we asked the clear question "Was there any suspected insider operation" did it point out the existence of the whale.

In summary, there are very obvious differences in the information provided by various AIs:

GetAgent aims to be a one-stop assistant, completing the entire closed loop from what, why to how , allowing users to choose the corresponding information and solutions according to their needs; TradeGPT is the most focused, only answering the core part of the user's questions and never extending them secondary . It requires users to have the ability to accurately judge key issues, and Xiaoan Assistant is somewhere in between the two.

From “What” to “How to Trade”: Alpha Insights Review

After clarifying what happened, users are more concerned about how to operate in the future market. GetAgent's comprehensive first version of the answer has provided short-term and medium-term operation guidelines:

Short-term strategy (1-2 weeks): Invest in high-quality assets on dips: Current panic has reached its peak, and historical experience shows this often signals a mid-term bottom. Focus on BTC and ETH: Mainstream cryptocurrencies are relatively resilient during market panics. Avoid high-risk meme coins: Smaller cryptocurrencies facing depleted liquidity face further declines. Medium-term outlook (1-3 months): Based on historical data, crypto markets typically take 175-478 days to recover from a sharp decline. Considering the current macroeconomic environment and the need for technical correction, we expect the market to gradually stabilize over the next 2-3 months.

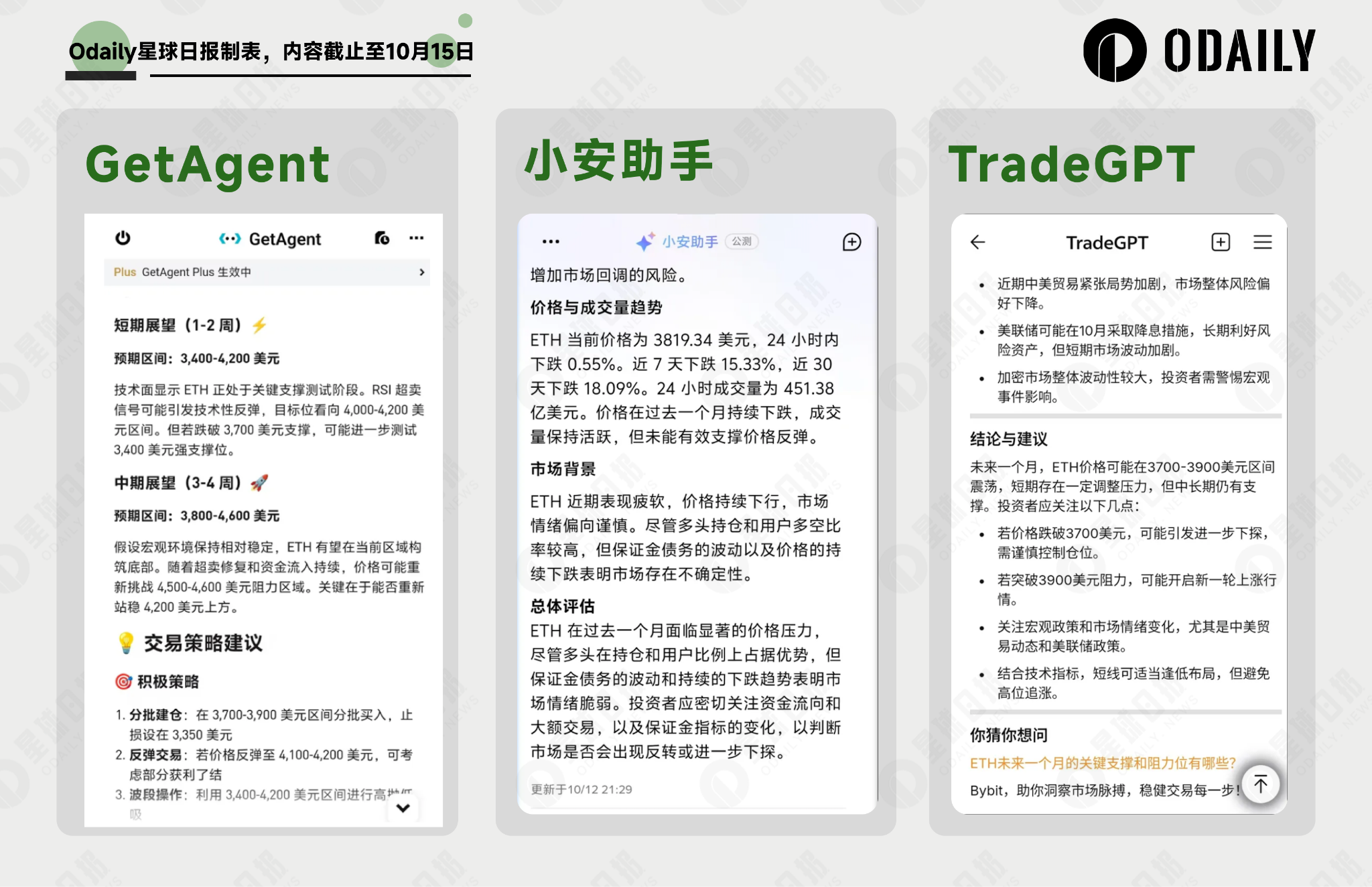

Similarly, when we asked Xiaoan Assistant and TradeGPT about "analyzing short-term and medium-term operation strategies," we got the following answers:

Xiaoan Assistant: Current market sentiment is in a state of fear, with extremely poor market breadth and declines in most currencies. Regarding institutional funds, the Bitcoin ETF saw a small outflow on October 10th after several consecutive days of large inflows, while the Ethereum ETF saw significant net outflows. This suggests the market may face downward pressure in the short term, and the cautious attitude of institutional funds warrants attention. Investors should fully consider current market sentiment and institutional fund flows when formulating medium- and short-term strategies, and be vigilant to the risk of a potential market correction.

TradeGPT: 1. Control your position and reduce leverage: The current market is volatile, so it is recommended to reduce leverage to avoid the risk of liquidation caused by high leverage. Bybit supports multiple risk limits to properly control the size of your position and prevent forced liquidation. 2. Pay attention to key support and resistance levels. Technically, pay attention to key support levels such as Bitcoin's $100,000 and Ethereum's $3,000. If the price stabilizes, consider buying low; if it falls below, be cautious and wait and see or short. 3. Avoid chasing rising prices and selling falling prices.

The main feature of GetAgent is that it strictly adheres to the "universal rules-corresponding strategies" to provide users with operation suggestions. The trading expectations are positive, and plans under different time periods are provided to help readers with different trading styles to clarify the operation direction at the corresponding time. It has the characteristics of being unambiguous and having very clear opinions .

Xiaoan Assistant's answers are more of a repetition of information . It details historical data such as ETF flows and market breadth, but this historical information is often associated with a "downturn," inevitable as long as a significant decline occurs, and is often not a reliable benchmark for the market.

TradeGPT responded with a vague two-way answer , offering a strategy of going long when prices rise and shorting when prices fall. This is a "safe answer" that is standard but lacks value.

Second test: What is the future of ETH?

To further explore the answer styles of the three AIs, we asked them to "predict the trend of ETH in the next month". The responses of the three AIs are shown in the figure below.

GetAgent once again provided clear trading points, but the judgment basis changed from universal rules to technical analysis, and also changed to a two-way solution. The difference was that GetAgent provided clearer trading guidance, including detailed plans such as batch bottom-picking ranges and clear profit-taking ranges; Xiaoan Assistant once again repeated a large amount of historical data, but without specific operational guidance; and TradeGPT once again provided a long-short two-way solution of "resistance level-support level".

The above questions were asked before the rebound on October 12, when the price of ETH was approximately $3,820. As of the time of writing, ETH had reached a high of $4,280 before falling back and fluctuating between $4,000 and $4,200, with a positive return of approximately 10%, verifying the reliability of the GetAgent strategy.

What should I do?

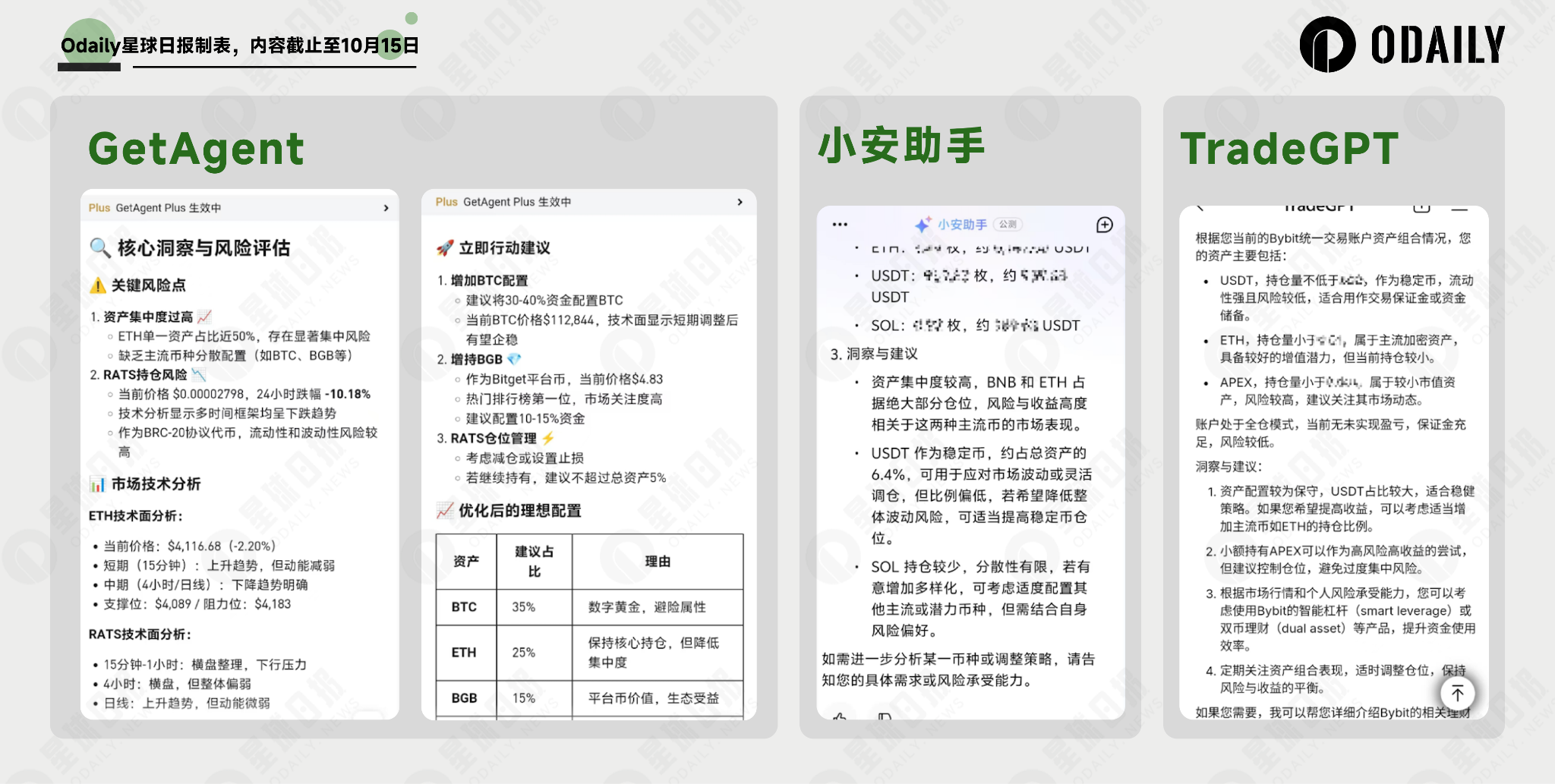

Trading strategies vary not only from an objective perspective, such as the length of trading cycles and stop-loss/take-profit strategies, but also from a subjective perspective. Everyone has their own risk preferences and position allocation needs. If AI assistants could provide recommendations based on individual account situations, in addition to price strategies, this would further demonstrate the usability and reliability of AI assistants. To address this, we asked the AI, "Analyze my current asset portfolio and provide insights and recommendations."

GetAgent analyzes issues such as unbalanced account configurations and which tokens are weak and no longer recommended for holding, and provides clear and executable operational instructions. It also provides configuration reasons at the end, providing users with clear long-term rebalancing goals.

Xiaoan Assistant's responses remained more observational. It also identified the issue of asset concentration, but the suggestions it offered were relatively general. While correct, they lacked specific guidance, leaving users to determine what was "appropriate" and which "potential currencies" to invest in, effectively failing to lower the threshold for decision-making.

TradeGPT still displays a "Tai Chi" style in terms of transactions. "ETH has potential" and "If you want to make money, you have to exchange USDT for ETH" are all correct nonsense. At present, users naturally know that ETH still has long-term appreciation potential, but users would rather know whether they can still buy it and how much they should buy, rather than giving "me" something that will definitely be right in the long run but they never know when it will be realized.

in conclusion

We can conclude that the exchanges’ built-in AI assistants are quite capable of processing information and providing Alpha insights.

For beginners, these tools can quickly integrate multiple sources of information on complex events and provide structured analysis, significantly lowering the barrier to information acquisition and understanding. For experienced traders, AI assistants can help them quickly identify unusual whale movements and provide valuable trading solutions, further improving their efficiency and alpha.

Whether you are a novice who wants to quickly keep up with the market pace or an experienced trader looking for efficient tools, these increasingly mature AI assistants are worth a try. They have become powerful tools to assist trading decisions.