LD Capital Macro Weekly Report[2023/05/22]

In the first half of last week, the market was more uncertain about debt negotiations. In the second half of the week, as McCarthy repeatedly confirmed that the two parties are expected to reach an agreement over the weekend, market concerns cooled down, risk appetite rose sharply, equity assets first fell and then rose, gold and The digital currency rises first and then falls.

In the first half of last week, the market was more uncertain about debt negotiations. In the second half of the week, as McCarthy repeatedly confirmed that the two parties are expected to reach an agreement over the weekend, market concerns cooled down, risk appetite rose sharply, equity assets first fell and then rose, gold and The digital currency rises first and then falls.

Price action in the stock market, especially the big tech sector, last week showed signs of panic buying by investors who fear they will miss out on the next bull run.

The three major U.S. stock indexes closed up across the board, with the Nasdaq up more than 3%, the S&P 500 up 1.65%, and the Dow Jones up 0.38%. In terms of sectors, the technology sector rose by 4.19%, communications rose by 3.06%, technology stocks continued to lead the stock market, utilities fell by 4.36%, and real estate fell by 2.40%.

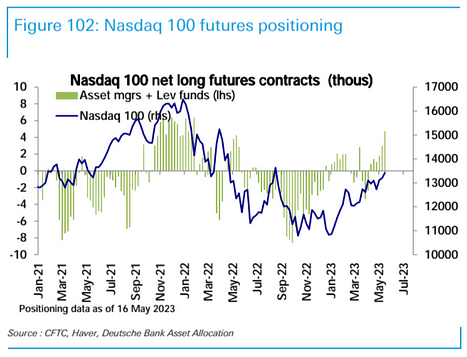

Nasda q100 futures net longs (of asset managers and leveraged funds) rose sharply last week to the highest level since May 2022, while S&P 500 net longs were flat, while Russell 2000 remained net short:

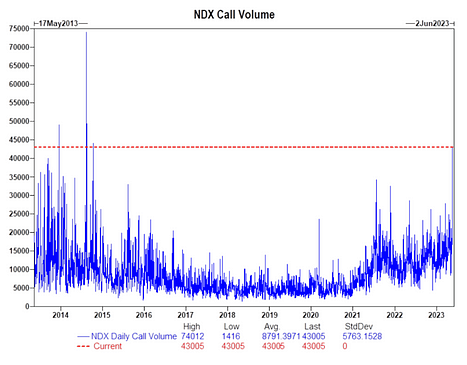

Call option volume on the Nasdaq hit its highest level since 2014 (nearly 10 years) on Friday. The growing AI craze in the market continues to trigger trending trading needs and “animal spirit” type behaviors in relevant market segments.

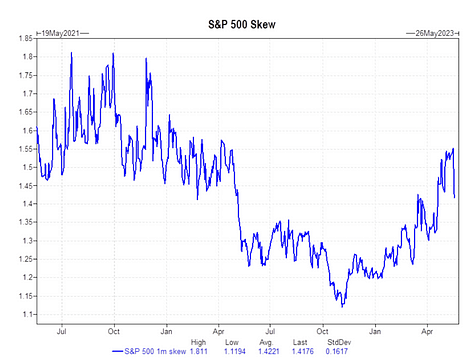

The S&P's skew fell sharply late last week, which could mean the market is less worried about future declines:

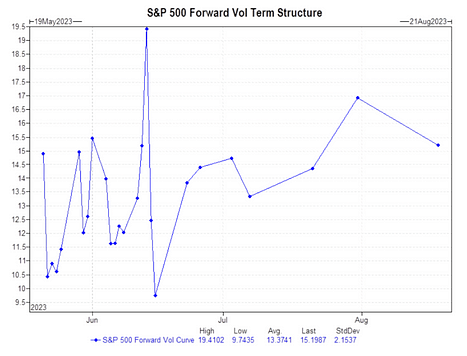

The options market shows that the debt ceiling is still not risk-priced, and the June FOMC (June 14, 2023) is now the next "big thing":

In terms of interest rates, the entire national bond yield curve moved up this week, and formed a situation of short-term decline and long-term rise: the yield of 2-year government bonds rebounded from less than 4% to close to 4.3%, and the yield of 10-year government bonds rose from 3.44% to 3.68%; one-month Treasury yields fell from 5.7% to 5.5%.

China's A-share Shanghai Composite Index rose slightly by 0.4%, the German stock index rose nearly 2% to set a record high, and the Japanese stock market rose 4.4% to set a new high since 1990.

The U.S. dollar index DXY also rose 0.48% to 103.20; oil rebounded slightly, up 254%, to close at $71.82/barrel last week; gold fell 1.5% to $1979/oz.

The digital currency market fluctuated widely last week. BTC fell slightly by 0.58% throughout the week, and ETH rose slightly by 0.21%.

Total Cryptocurrency Market Cap fell from $1.126 trillion to $1.119 trillion, down 0.6% in 7 days;

Total Cryptocurrency Market Capitalization (Excluding Bitcoin) fell from $604.3 billion to $600.1 billion, down 0.69% in seven days.

Among the crypto tokens with a market value of more than 100 million US dollars, the concept of AI has once again resonated globally. The decentralized graphics rendering network RNDR rose by 37%, ranking first, followed by MASK + 18%, AGIX + 14%, and SNX + 13%; TON-8% , SUI-6% , SOL-6% with larger declines:

Total Stablecoins Market Cap shrank 0.41% to $129.47b, starting the year at $137.56b.

A review of major macro events last week:

1. A number of Fed officials gave speeches, releasing hawkish signals and once raising interest rate hike expectations.

2. However, Powell made a final decision on Friday, suggesting that interest rate hikes can be suspended, and market expectations fell accordingly.

3. Negotiations on the debt ceiling crisis have twists and turns. Speakers of the House of Representatives McCarthy and Biden said they would not default on the contract, but a good deal was reached over the weekend, but the talks collapsed, dashing hopes of a breakthrough before the market opened on Monday to appease the market, and negotiations dragged into this week. In the United States, Biden and McCarthy will continue to meet and negotiate later on Monday.

4. Sunday’s G7 communiqué stated that they would support Ukraine and called on China to urge Russia to immediately stop its military aggression. At the same time, it pointed out that China acting in accordance with international rules will be in the global interest, and G7 is not seeking to harm China or hinder its economy. A policy of development that does not seek "decoupling nor turning inwards". In addition, U.S. President Joe Biden said over the weekend that the G7 should now open a hotline with China and expect relations with China to improve "soon" after a dispute over an alleged spy balloon derailed relations between the two countries earlier this year. The Chinese side expressed strong dissatisfaction with the communiqué, and the Chinese embassy in the UK urged the G7 to abandon the Cold War mentality and stop interfering in the internal affairs of other countries.