Neon EVM starts public offering, can the compatibility layer boost the Solana ecosystem?

Recently, CoinList announced that it will start the sale of Neon EVM token NEON, a Solana EVM compatible solution, at 17:00 UTC, June 8th (1:00 June 9th, Beijing time). The total sales volume is 50,000,000 NEON. 5% of the total circulating supply at a price of $0.1. Registration for this community sale is now open until June 5 at 12:00 UTC.

secondary title

Neon EVM intends to combine the advantages of Ethereum and Solana

In November 2021, Solana TVL will reach an all-time high of over $10 billion.

As FTX collapsed, so did Solana, and funds were evacuated. Since the collapse of FTX, TVL has experienced a long period of continuous decline. Currently, TVL has fallen to about $266 million, which is only about 2% of ATH.

With Solana detached from the influence of FTX, how to revive this EVM heterogeneous chain has become a concern of the Solana community and Solana developers. Whether EVM can be introduced into Solana has also become a concern of the Solana community.

Neon is one of the solutions to this problem. In 2021, Neon labs will be established. The project is committed to deploying an EVM compatibility layer on Solana to take advantage of Solana's low fees and introduce a mature EVM developer ecosystem and mature dApps.

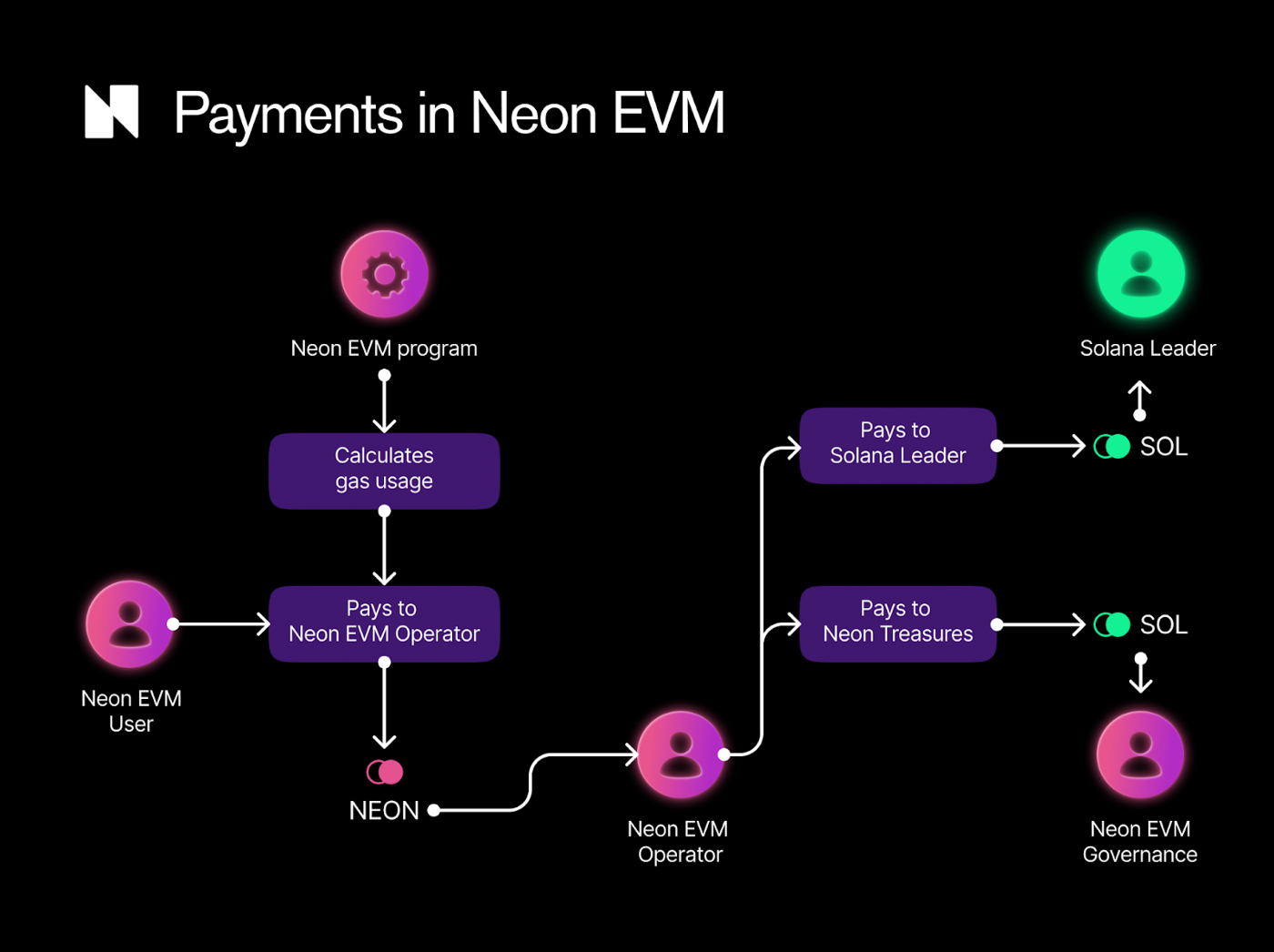

Neon allows anyone to run Ethereum smart contracts on Solana and deploy dApps without reconfiguring the smart contracts. The project designed a Neon EVM with an incentive mechanism to run dApps on the EVM and package them into Solana transactions, which would be executed and completed on Solana instead of users.

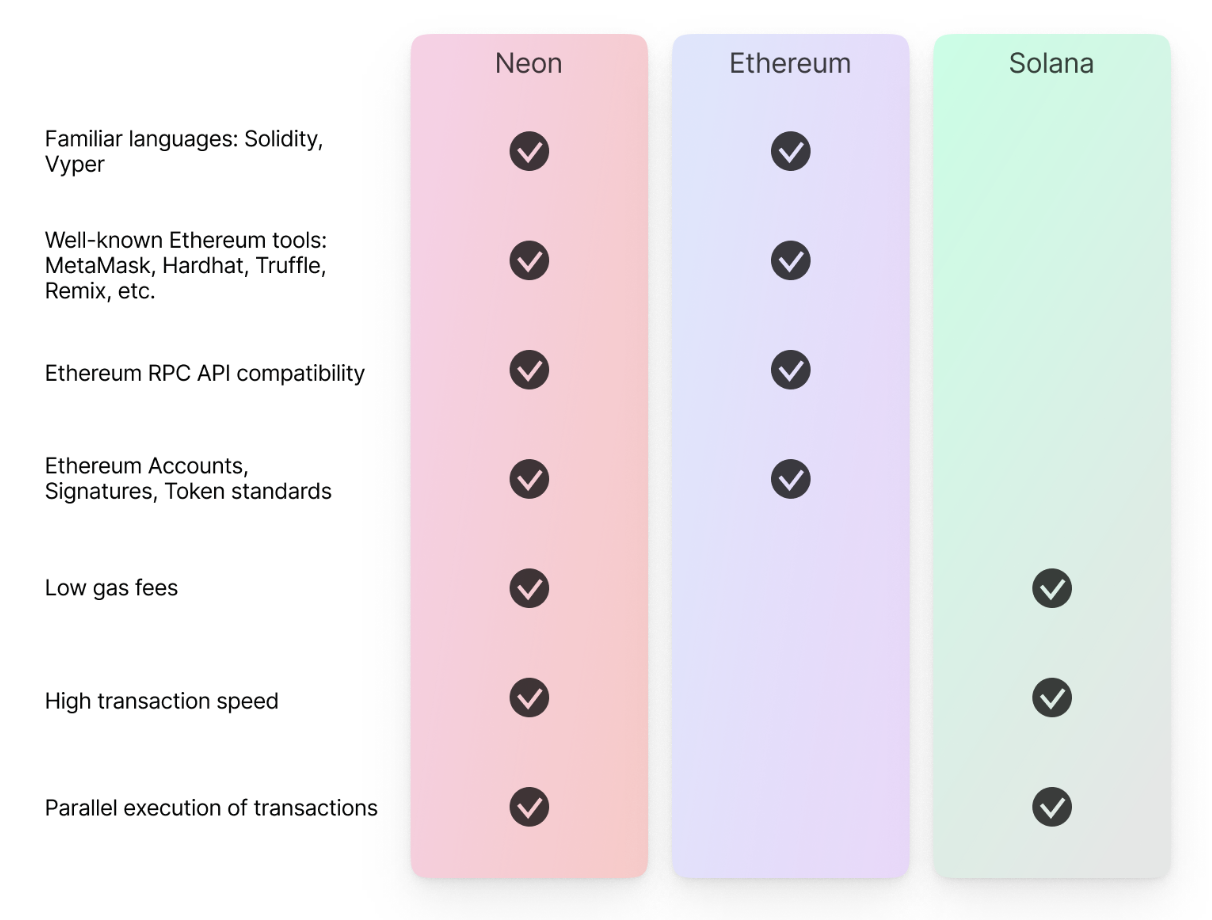

The Neon team believes that Neon can retain the advantages of both Ethereum and Solana.

The advantages from Ethereum are: you can use the Solidity or Vyper language that developers are more familiar with; you can use MetaMask, Hardhat, Remix and other infrastructure; the compatibility of Ethereum RPC API; support for Ethereum accounts, signatures, token standards, etc. wait.

The advantages from Solana lie in high concurrent execution capability; gas fee as low as 0.000015 SOL for each transfer; up to 5000 tps and so on.

In order to realize these functions, Neon consists of three parts: Neon EVM, Neon Proxy, and Neon DAO.

secondary title

NEON Token Economics

The Neon compatibility layer uses the project's native token NEON as a gas token. Its operation process is that users use NEON to pay transaction fees to the agent operation, and then the agent operation uses SOL to pay the fee to the Solana validator Neon treasury. Therefore, a part of user gas will enter Neon’s treasury, which is also Neon’s future source of income.

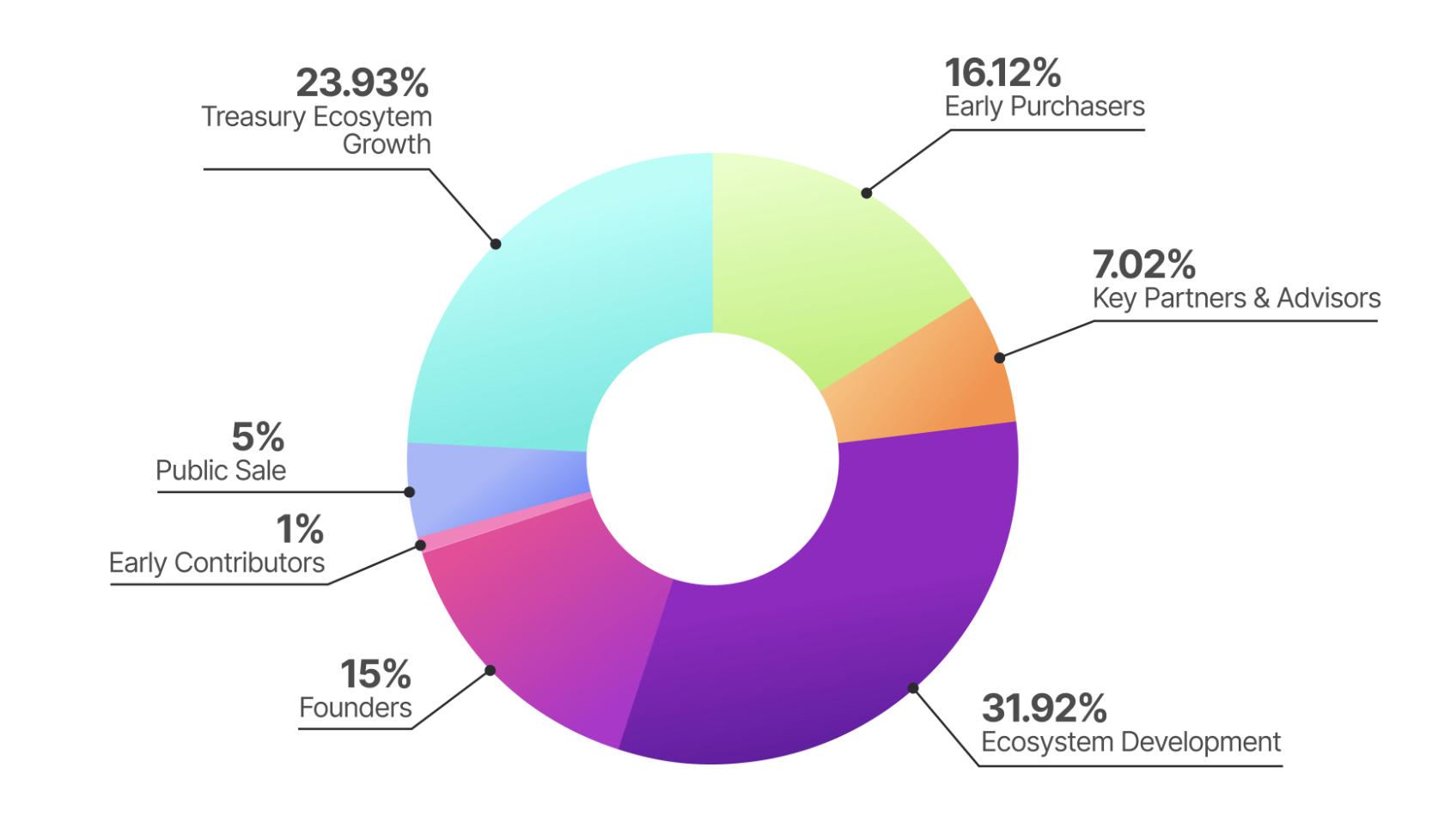

Neon EVM announced token economics shows that the total number of NEON tokens is 1 billion. The total sales volume of this public offering is 50,000,000 pieces, accounting for 5% of the total, and the price of each piece is 0.1 US dollars.

Its NEON token distribution model is as follows:

Early buyers: 16.12%. 1-year lock-up period with linear release over subsequent 1-year periods.

Key partners and consultants: 7.02%. Minimum 1-year lock-up and 1-year linear release.

Ecosystem development: 31.92%. Minimum 1-year lock-up, followed by 1-year linear release.

Founders: 15.00%. 1 year lock, then 1 year linear release.

Early contributors: 1%. Minimum 1-year lock-in, followed by 1-year linear licensing.

Public Sale: 5%. All unlocked on July 17, 2023.

Ecosystem Growth (Treasury): 23.94%. Determined by the governance proposal.

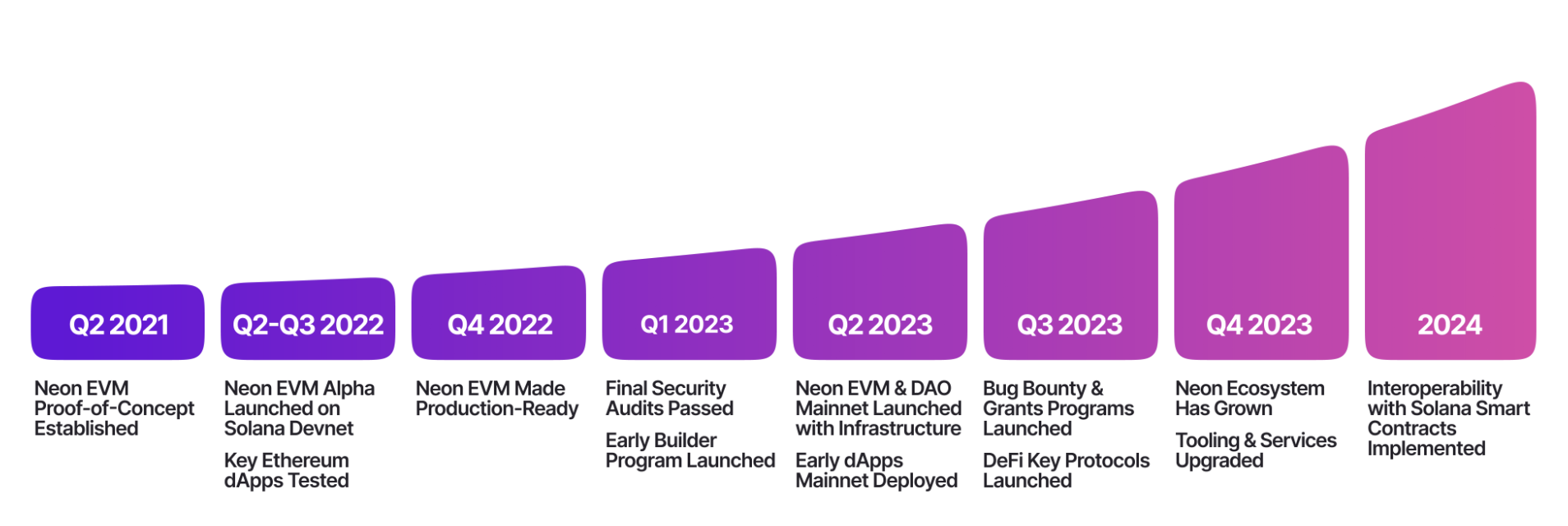

The Neon EVM roadmap shows that the current project has progressed to the main network stage, and the main network and some early dApps will be deployed this quarter. In the next quarter, key DeFi protocols will be deployed and funding programs will be launched to promote the development of dApps within the ecosystem.

As the most developed ecosystem in the encryption ecosystem, Ethereum provides many tools for dApp developers and users in terms of tools and infrastructure. With Neon EVM, dApp developers can easily enter Solana, which may be crucial for the Solana community at a time when Solana is shrinking.