SignalPlus Macro Review (20230524)

Dear friends, welcome to the SignalPlus macro research report. SignalPlus macro research reports update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to the SignalPlus macro research report. SignalPlus macro research reports update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

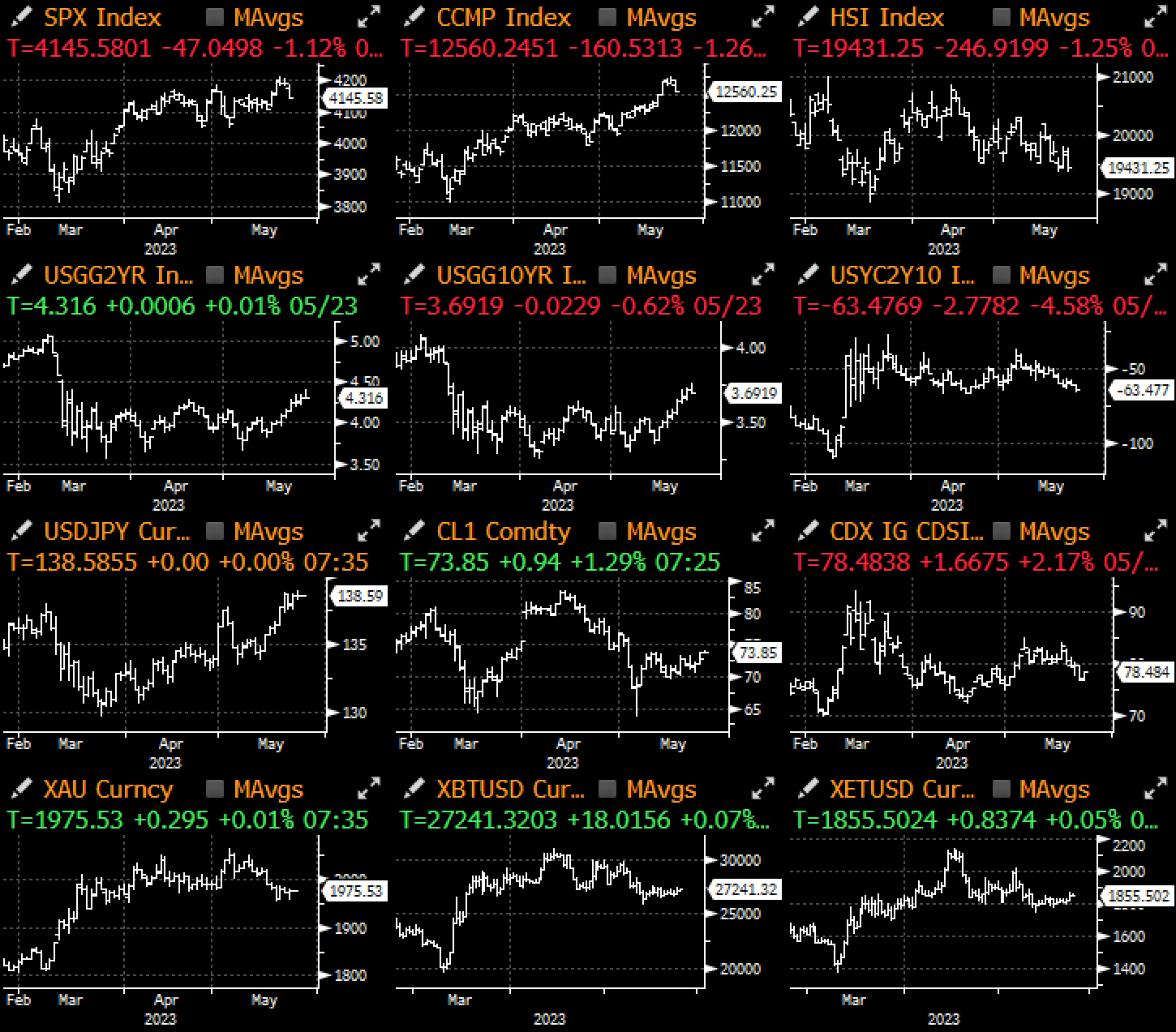

The U.S. stock market finally saw a more pronounced pullback, with the market down 1% to 1.5% yesterday amid ongoing debt ceiling fatigue and overcrowded long positions. Instead of repeating the latest details on the debt ceiling, some of the more interesting news yesterday included Speaker McCarthy allegedly telling Republicans in closed-door House Republican meetings that "I need your continued support on the debt ceiling ... we are close to A deal is still far away," and leaders of both parties in the House of Representatives have told lawmakers that they may continue to meet through Memorial Day weekend, and may even extend into the recess. Additionally, a press release in the afternoon stated that the Treasury Department had "asked federal agencies if they could delay incoming payments," suggesting they had at least begun to consider priority measures.

The interest rate gap between the treasury bills after May 30 and June 1 began to show a significant gap, and the signs of dislocation in the treasury bond market are still relatively obvious

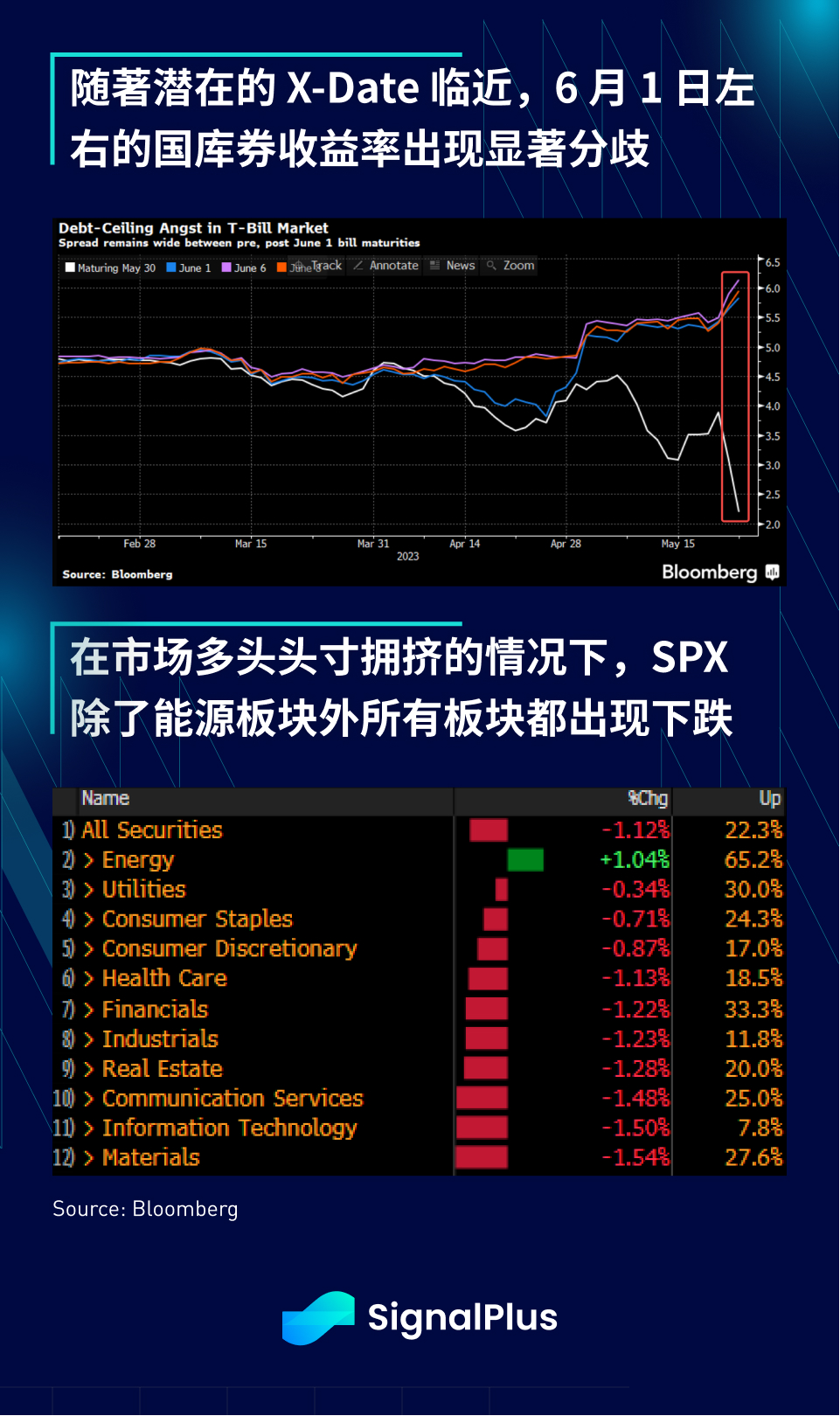

In terms of market positioning, while there are some charts showing "record net shorts" in U.S. stock and bond futures, we believe the information is incomplete because they do not include managers' hedged cash delta positions, which Wall Street investment banks more comprehensively Research shows that a more accurate picture of current stock positioning should be in favor of longs, especially after last week's stock market broke out to the upside when the market added a large number of long positions.

A typical stock futures chart would show "record" net short positions by leveraged hedge funds, as shown below, but a closer look reveals that individual stock shorts are also near record lows, suggesting that a large amount of short futures positions may be coming from portfolios hedging strategy.

This is in line with hedge fund servicer data showing gross exposures are at multi-year highs (positioning in equities) and net exposures are much lower (possibly due to directional hedging via futures).

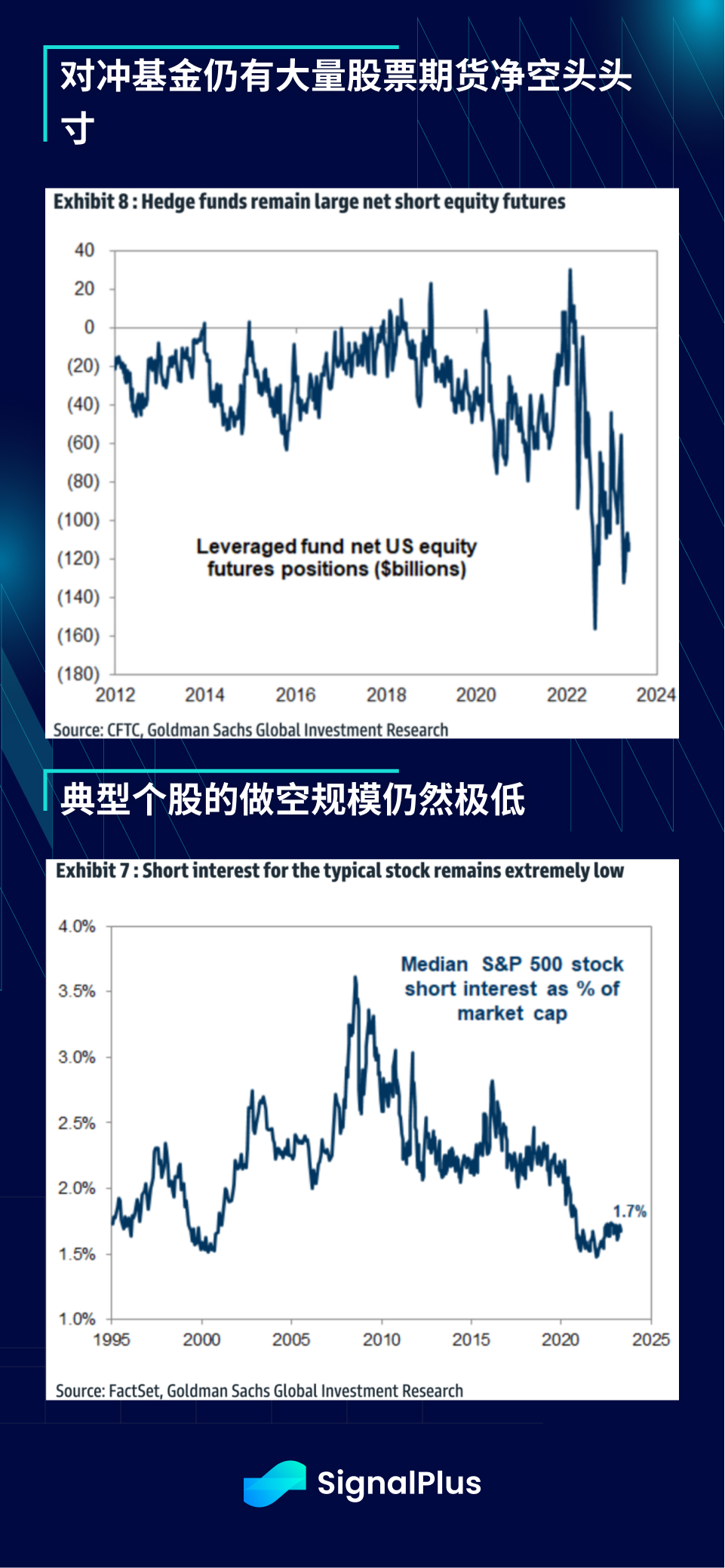

In fact, further research by Citi shows that the SPX added $21 billion in new long positions last week, one of the largest in 5 years, with net positions now at the 93rd percentile and an estimated long-to-short ratio of more than 9 1 . The Nasdaq and Nikkei indexes are in a similar situation. Just when the balance sheets and liquidity channels of the four major central banks are about to flip again, the investment community has started FOMO buying stocks again, and the hot stocks in both indexes have a large number of long positions.

In terms of cryptocurrencies, the Hong Kong SFC released the long-awaited guidance on virtual asset trading platform operators after a long period of consultation with industry partners. Effective together with the VASP system.

The conclusion of the consultation is 380 pages long (weekend intern program?), and the highlights are summarized as follows:

1. The virtual asset trading platform can provide spot trading services for retail investors

2. Tokens that can be listed must meet the following requirements:

Platforms must conduct proper due diligence on it before going public.

Security tokens (with actual asset ownership) are not allowed.

Non-Security/Utility Tokens need to have at least one year of track record before listing.

Eligible tokens must have a certain market cap size and must be included in at least 2 accredited and independent cryptocurrency indices run by reputable index providers.

Possible initial coin candidates: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Polkadot, Solana, Avalanche, Cardano, Chainlink, Polygon

There will be no whitelist of acceptable indices and tokens, and the committee will consider them with reference to the IOSCO Financial Benchmark Principles.

Whether a token is a security token does not require a separate legal opinion, and it is expected that the platform will make the best judgment on the application.

3. Retail investors are not allowed to trade stablecoins until HKMA further provides clearer information on Hong Kong's stablecoin regulation.

5. 4. Since the CSRC believes that virtual asset trading platforms should be purely order-matching agents, lending activities are not allowed.

Derivatives transactions are not permitted.6. The platform must use its own hosting service. Due to the current lack of a virtual asset custody regulatory system,。

No third-party hosting services allowed

7. All private keys and seed phrases must be securely stored in Hong Kong with proper security certification.。

8. 98% of customer virtual assets need to be kept in cold storage

This can go down to 50% with proper insurance coverage.

Reserves may include demand deposits, short-term time deposits, Hong Kong bank guarantees, and certain virtual assets.

Although the local cryptocurrency industry may not get everything it wants, it is undoubtedly positive news to see the authorities clarify the relevant rules with detailed plans and protection measures; we also look forward to seeing other Hong Kong regulators continue to improve and clarify Relevant rules, and look forward to Hong Kong continuing to play a leadership role in the regulation of virtual assets, setting an example for the rest of the world.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/