LD track week observation (05/15~05/21)

Summary

Stablecoins:first level title

LSD:Summary

ETH L2:Stablecoins:

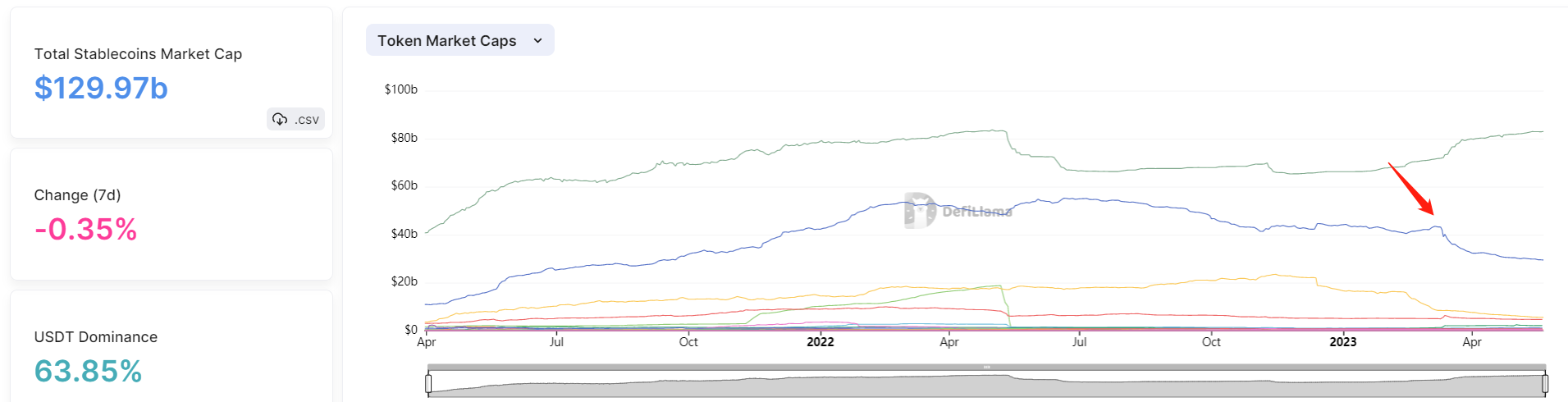

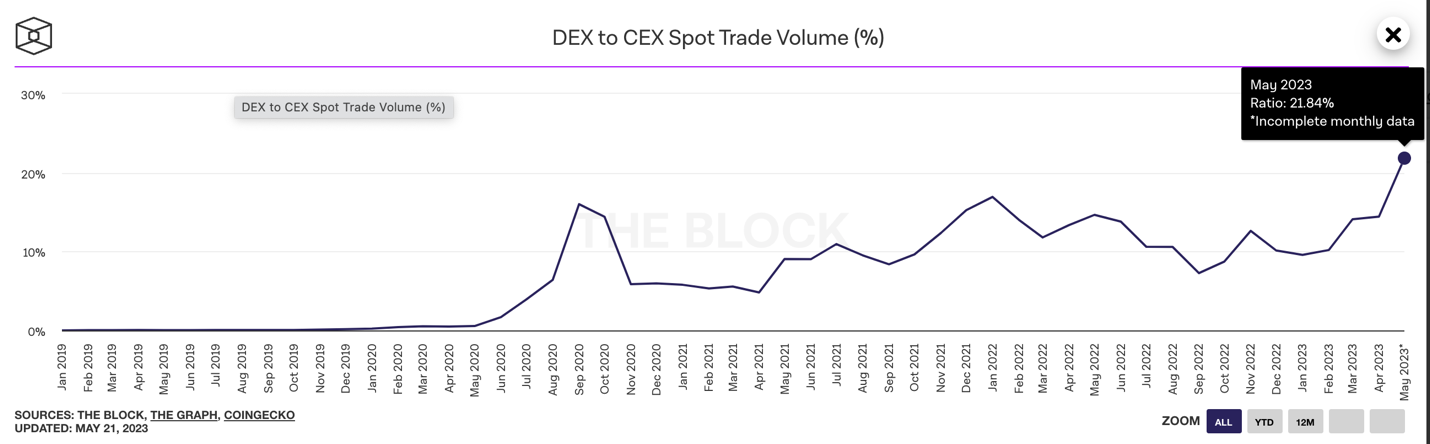

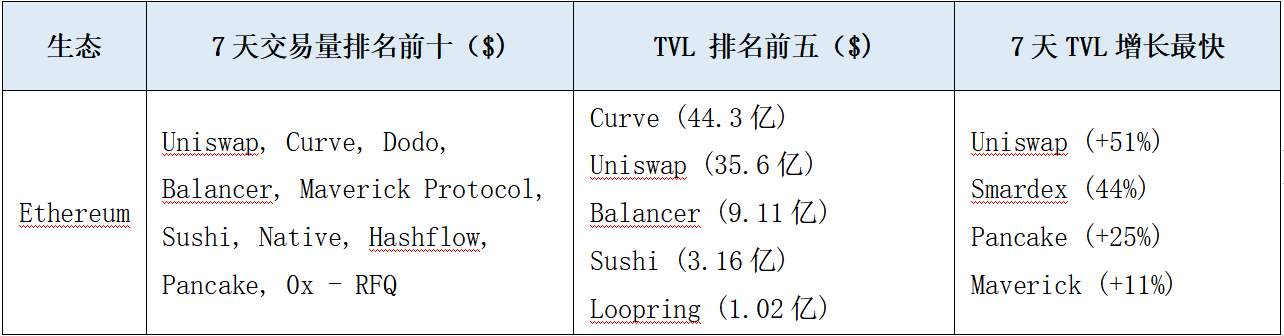

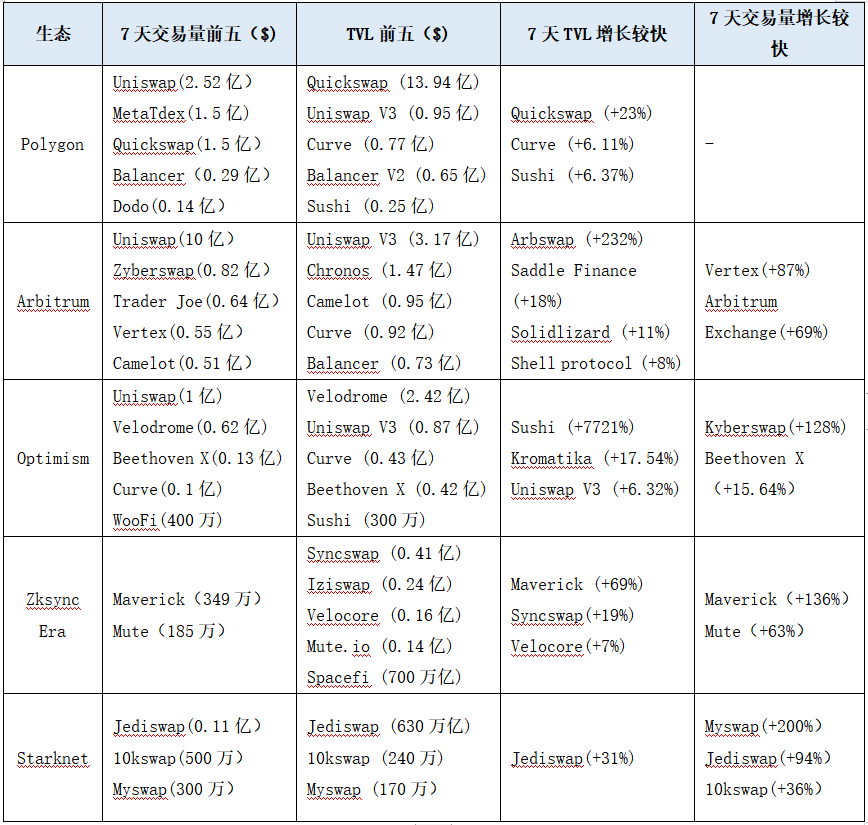

DEX:The total market value of the stablecoin sector continues to shrink, from US$137.5 billion at the beginning of 2023 to US$129.9 billion. Within the sector, the market value of USDC has been on a downward trend, falling below $30 billion and falling back to the level in September 2021. The market share of USDT continues to grow, with a market share as high as 63.85%. The crvUSD stablecoin is launched, the popularity is average, and the collateral is less than 10 million US dollars.

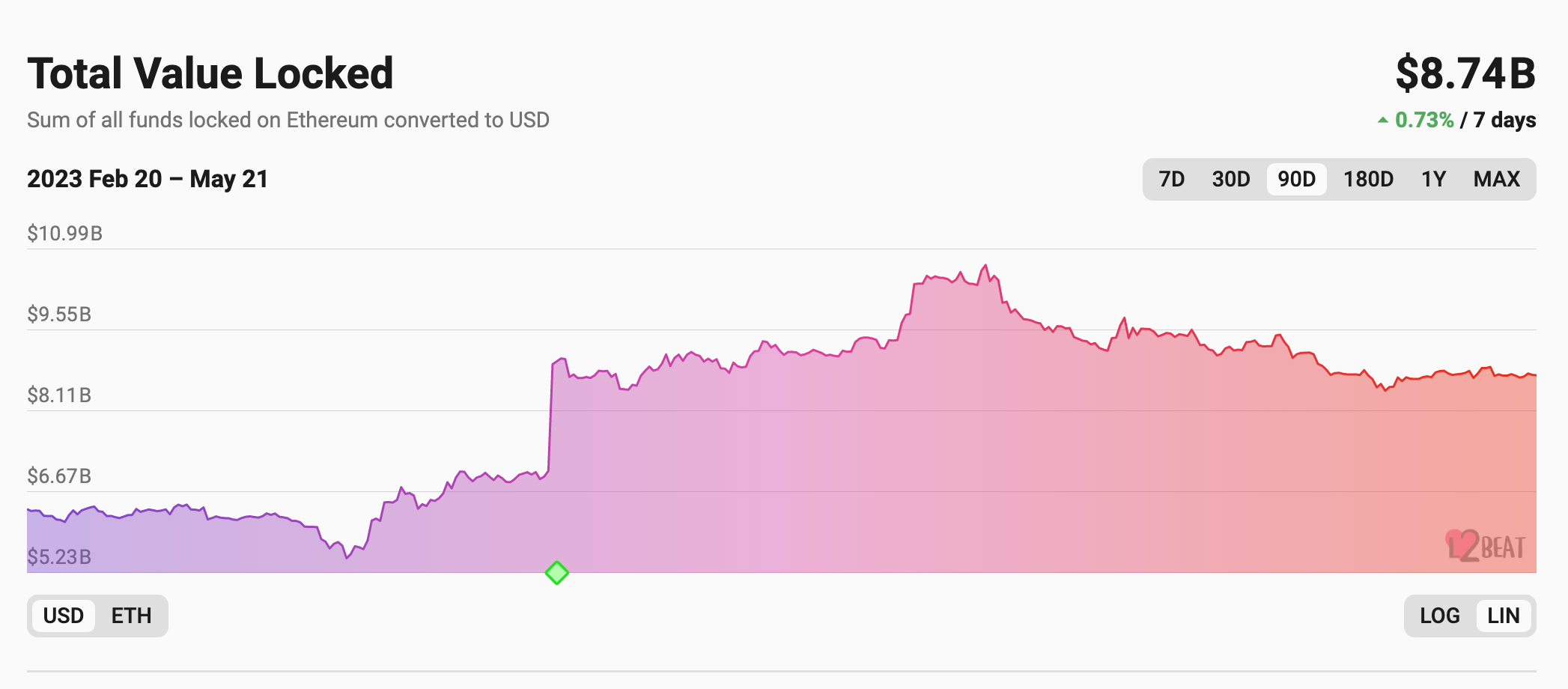

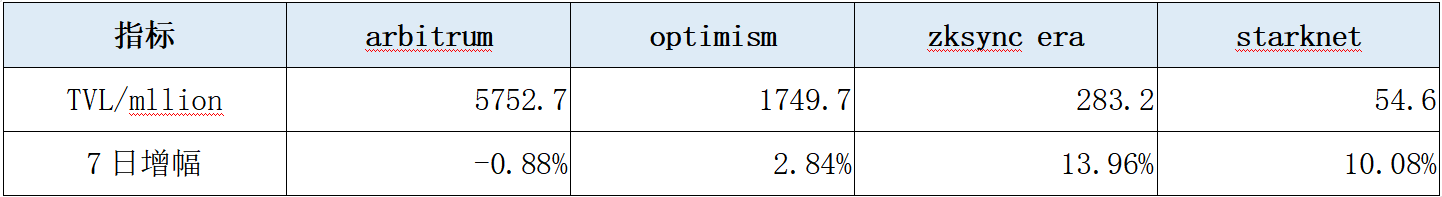

This week, the amount of ETH pledged in the beacon chain increased by 0.51% month-on-month, approaching the next growth range (when the number of verifiers reaches 589,824, the upper limit of ETH pledge growth will rise from 1800 verifiers per day to 2025 per day), and the current ETH pledge rate has reached 17.29% .The overall TVL of layer 2 has not changed significantly in the past week, and the total locked amount is 8.74 billion US dollars. Within the sector, Arbitrum TVL fell slightly, but still holds a 65.7% market share of layer 2 TVL. However, from the perspective of the number of bridged ETH, the number of the four major L2s is already very close. Among them, starknet has the highest bridged ETH, reaching 6647 ETH, and funds are gradually entering ZK series L2.

RWAs:Derivatives DEX:

Since May, the overall trading volume of derivatives DEX has continued to decline. Daily volumes for major protocols are down more than 50% from their April daily levels, and open interest is down about 20%. Due to the decline in transaction volume, protocol revenue decreased, protocol yield decreased, and TVL experienced a slight decrease of 5%.

Stable currency track

source:defillama,LD Capital

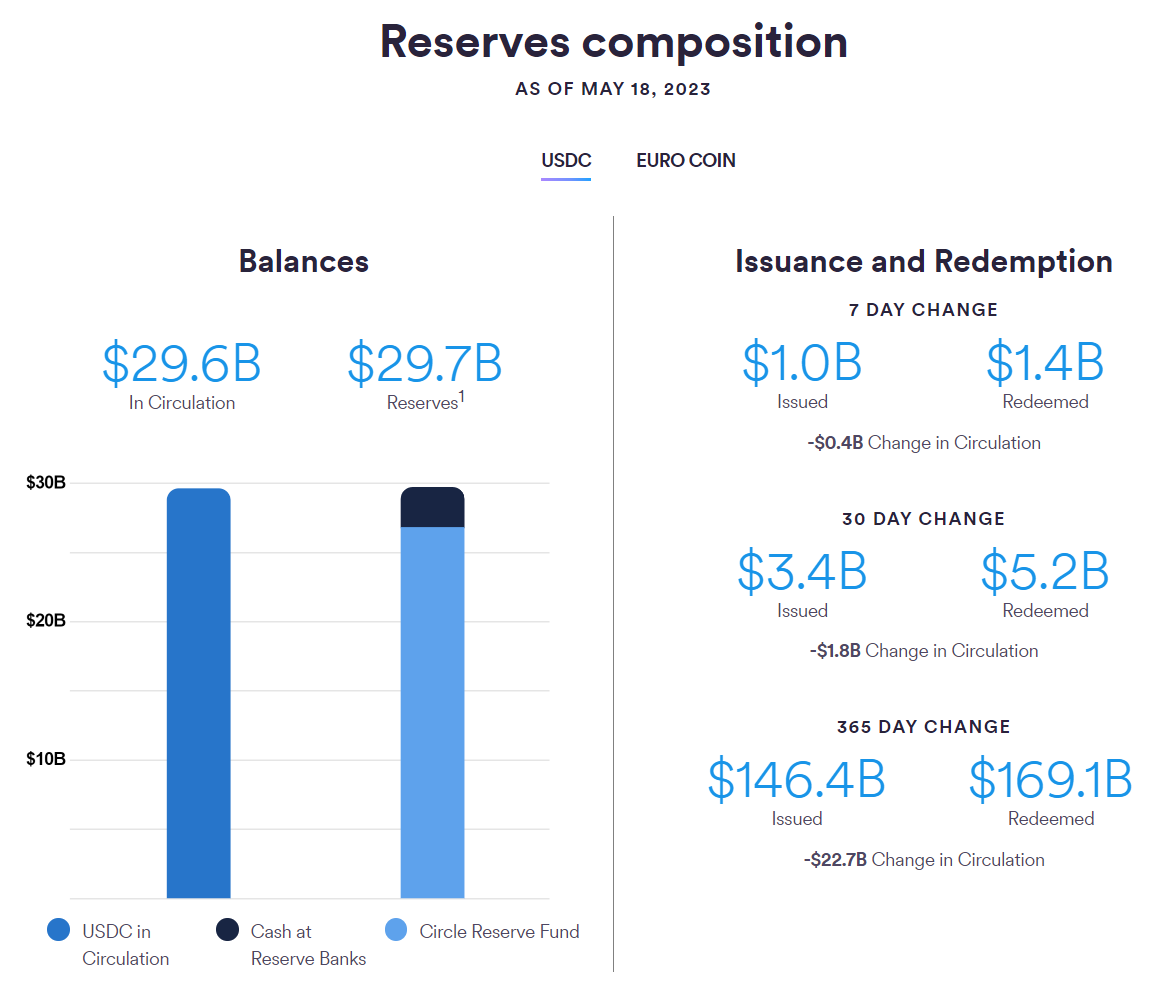

According to data from Circle’s official website, as of May 18, the total circulation of USDC was 29.6 billion U.S. dollars, and the total capital reserves were 29.7 billion U.S. dollars. The market value has fallen back to the level in September 2021. In the past week, USDC issuance was $1 billion, redemptions reached $1.4 billion, and circulation decreased by $400 million.

source:Circle official website,LD Capital

Circle official website

source:duneanalytics,LD Capital

source:

source:

LSD

Spark official website

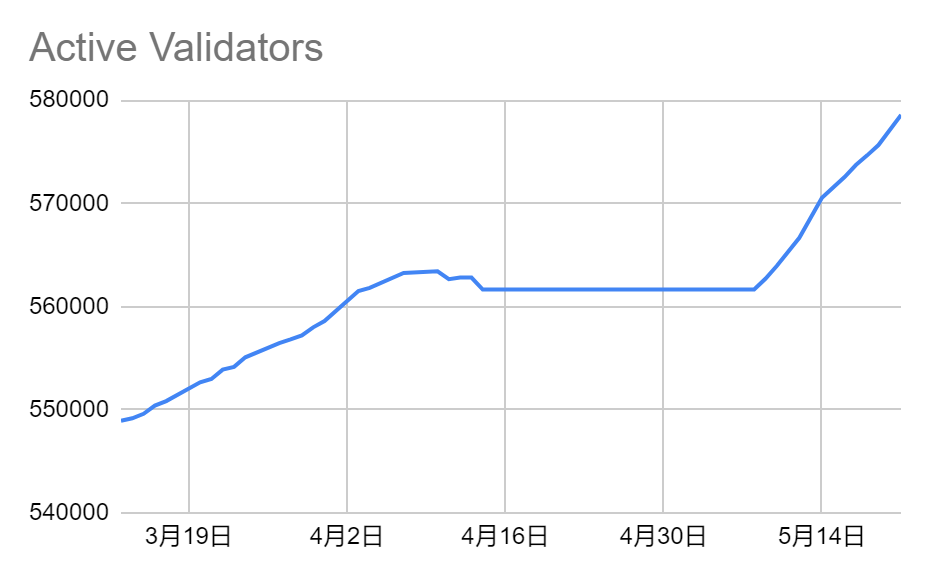

This week, the amount of ETH pledged in the beacon chain increased by 0.51% month-on-month, approaching the next growth range, and the current ETH pledged rate reached 17.29%*. This week, the amount of ETH pledged reached 18,514,148, a month-on-month increase of 0.51%; the number of verifiers reached 578,573. When it reaches 589,824, the upper limit of ETH pledge growth will rise from 1,800 verifiers per day to 2,025 verifiers per day, entering the next growth Interval, this situation is 7 days at the fastest, and it is expected to happen in 9 days.

Source: LD Capital

Figure: The number of beacon chain validators continues to grow

*The statistical caliber is ETH Locked/ETH Supply; the numerator includes ETH pledged in the beacon chain, ETH deposited in the beacon chain but not yet activated for verification, and ETH rewarded by the beacon chain.

Source: LD Capital

Figure: ETH pledge rate of return fell from last week

image description

Source: LD Capital

The Lido community discusses staking dividends, and there are uncertainties in the implementation of proposals. Discuss the model of using 20% -50% of the protocol income (governance adjustment parameters) for direct distribution or repurchase of $LDO distribution to pledgers of $LDO; currently Lido's annual income is about 30 million, assuming operating expenses of 15 million, and the remaining 15 million Ten thousand is used for dividends. Currently, MC is 1.866 billion, corresponding to 124 times PE. At present, the proposal is still in the discussion stage and has not yet entered the voting stage. Due to regulatory issues, multi-party interest reconciliation, and community differences on the introduction of DCF valuation for the current stage of dividends, there are great uncertainties in the implementation of the proposal.

Lybra Finance in LSDFi stands out, but its sustainability is questionable. The TVL of the Lybra protocol has risen by 225% in 7 days, and the price has risen by 565% in 7 days. At the current stage, it should be observed that the main reason for the current increase in the TVL of the protocol is the price-TVL spiral brought about by the attributes of the mining currency, and the protocol itself is formed due to the imbalance of risk and return. The long-term growth limitation has not improved, and at the same time, the single currency pledge of the agreement is less than the emission of the agreement, and the circulation is in a state of inflation.

first level title

Ethereum L2

image description

Source: LD Capital

source:duneanalytics,LD Capital

image description

In the past week, the numbers of arbitrum, optimism, starknet, and zksync Total Value Bridged are close. Among them, starknet has the highest bridge of 6647 ETH, arbitrum has dropped significantly from last week, and zksync has rebounded.

first level title

Layer 2 week event recap

secondary title

1. The Bedrock upgrade of the Optimism mainnet will be carried out at 00:00 on June 7

Bedrock is a major upgrade of the optimism system. According to official documents, the Bedrock upgrade will bring the following 5 improvements.

(1) Reduce costs

Bedrock will reduce data costs through an optimized data compression strategy, which is expected to significantly reduce costs, but the official did not give a specific range. At the same time, Bedrock removed the gas cost associated with EVM execution when submitting data to L1, which can reduce the cost by an additional 10%.

(2) Shorten the deposit confirmation time

Confirmation times for deposits on earlier versions of the protocol could take up to 10 minutes, and Bedrock expects to be able to reduce this time to less than 3 minutes by better handling L1 reorgs.

(3) Improved proof modularity

(4) Improve node performance

Upgrade the "one transaction per block" model in the original version to multiple transactions (several transactions in a single rollup "block"), significantly improving node software performance.

secondary title

secondary title

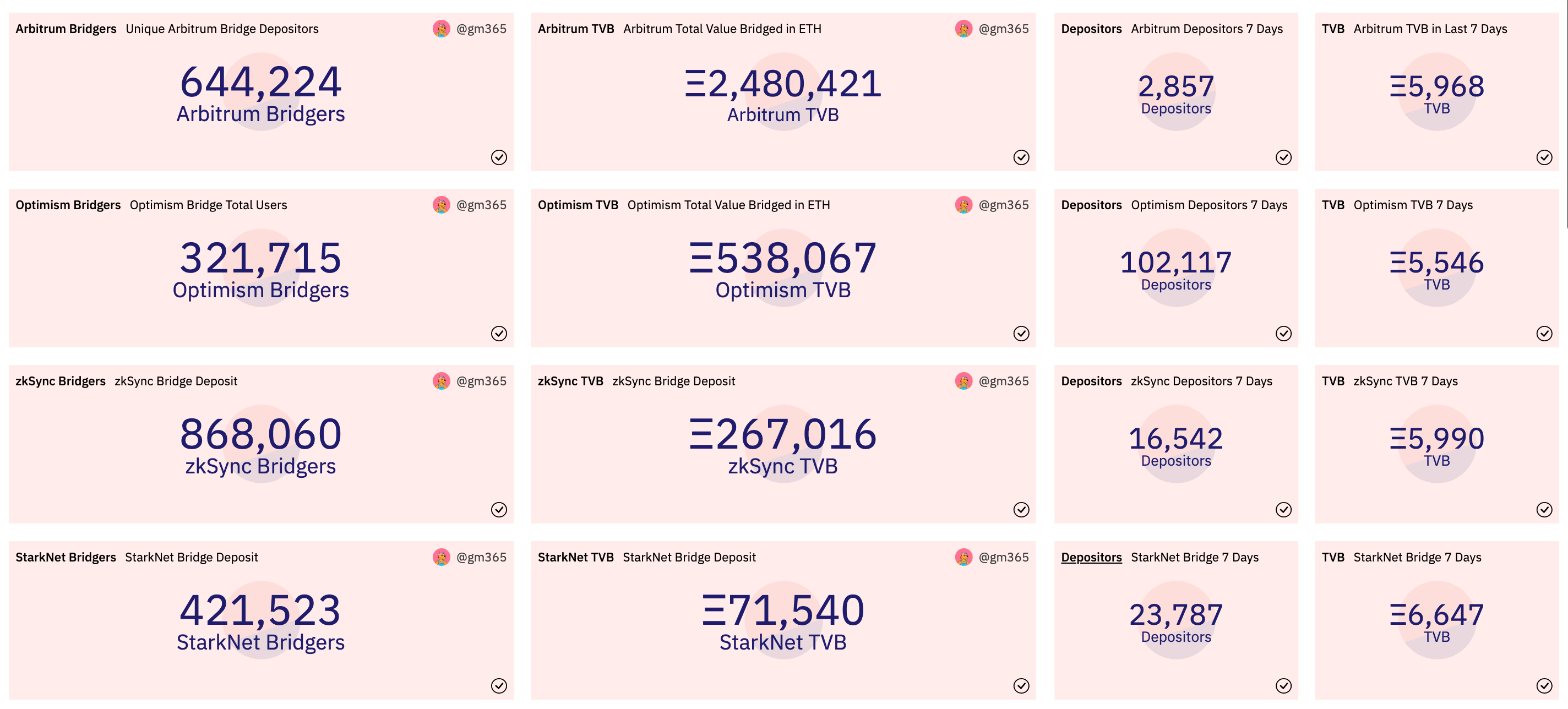

2. As the first anniversary of OP is about to be launched, the circulation of OP will increase on May 31. Optimism tweeted that in the two weeks before that, there may be a large number of on-chain transfers in preparation for distribution

According to the official table, the number of ops that will be unlocked in the coming year from May 2023 is 913 million, accounting for 21.26% of the total circulation and 2.7 times the current circulation. Note that the tokens of early core contributors and investors will be unlocked for the first time. According to token unlock data, early core contributors and investors will unlock 81.6 million and 73.01 million ops on May 31, 2023, accounting for 45.8% of the current circulating supply may form a huge selling pressure.

secondary title

3. Radiant Capital passed the ARB allocation proposal on May 18

The proposal “RFP-18: Strategic Application of the Radiant DAO Treasury for ARB Allocation” passed with 89% approval, and the 3,348,026 ARB tokens awarded to the Radiant DAO Treasury by the Arbitrum Foundation will be distributed as follows:

30% of ARB (1,004,408 tokens) will be allocated to all dLP lockers on Arbitrum in the next 52 weeks;

30% of ARB ( 1,004,408 tokens) will be used as a strategic reserve for future use.

secondary title

DEX

4. The Starknet Foundation announced the Starknet Early Adopter grant (EAG) selection results

first level title

secondary title

Ethereum

Source: LD Capital

ETH L2/sidechain

Source: LD Capital

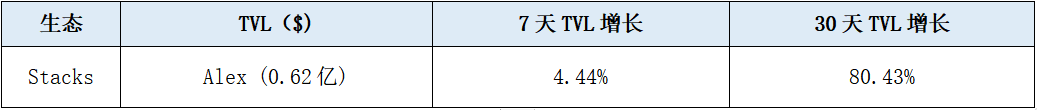

BTC L2/sidechain

Source: LD Capital

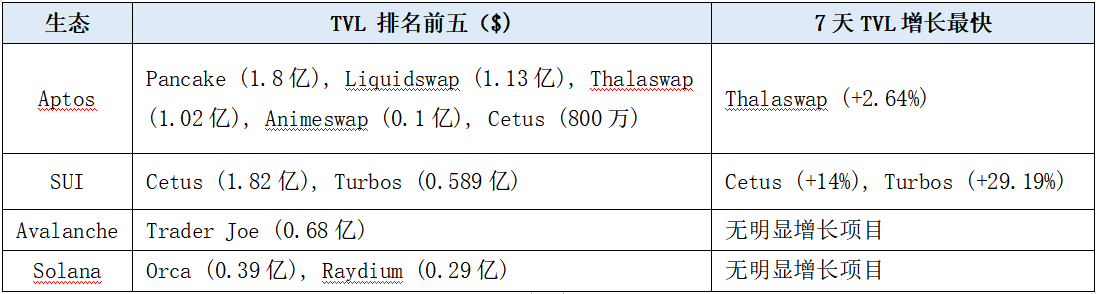

Alt L1

Source: LD Capital

image description

Project week review

Derivatives DEX

Maverick, an AMM for customized liquidity strategies, has captured TVL of USD 20 million and USD 2.6 million on Ethereum and Zksync Era respectively. The 24-hour trading volume ranks among the top five on Ethereum, and the Mcap/TVL value is low, which also reflects The custom liquidity AMM adopted by Maverick is more capital efficient.

secondary title

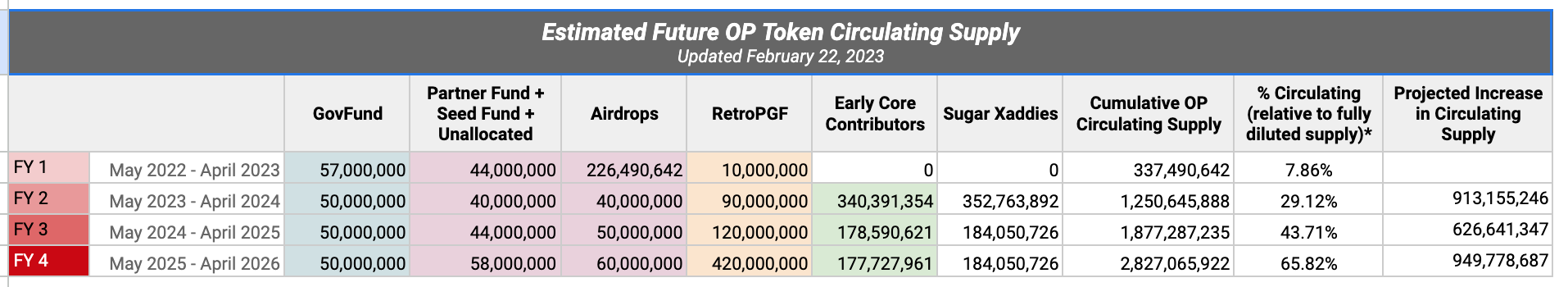

Derivatives DEX

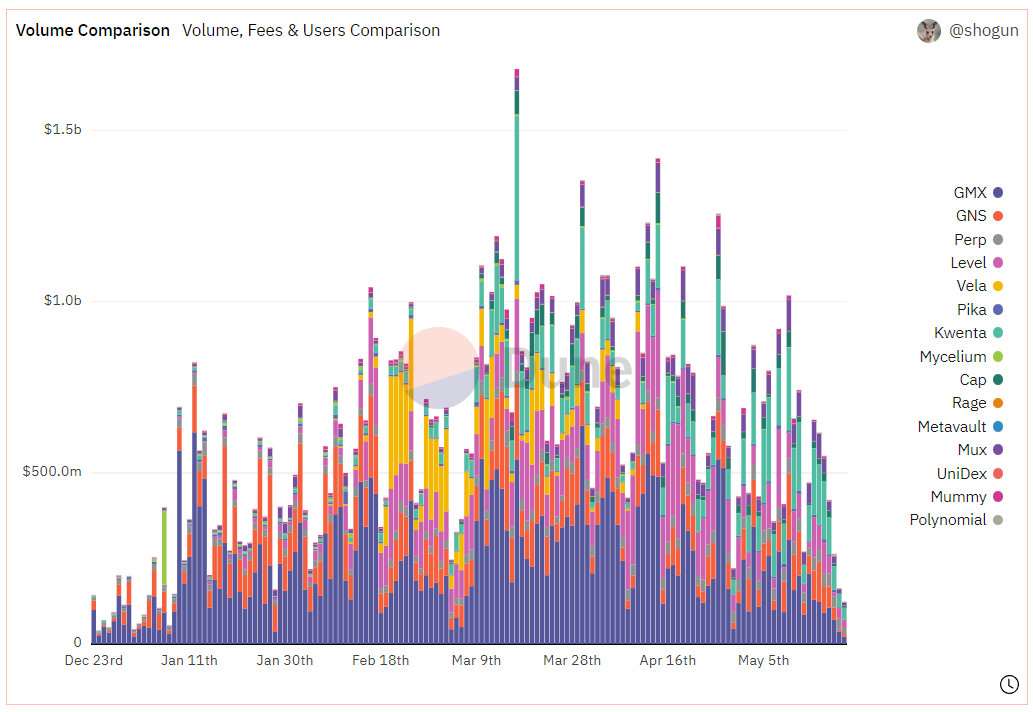

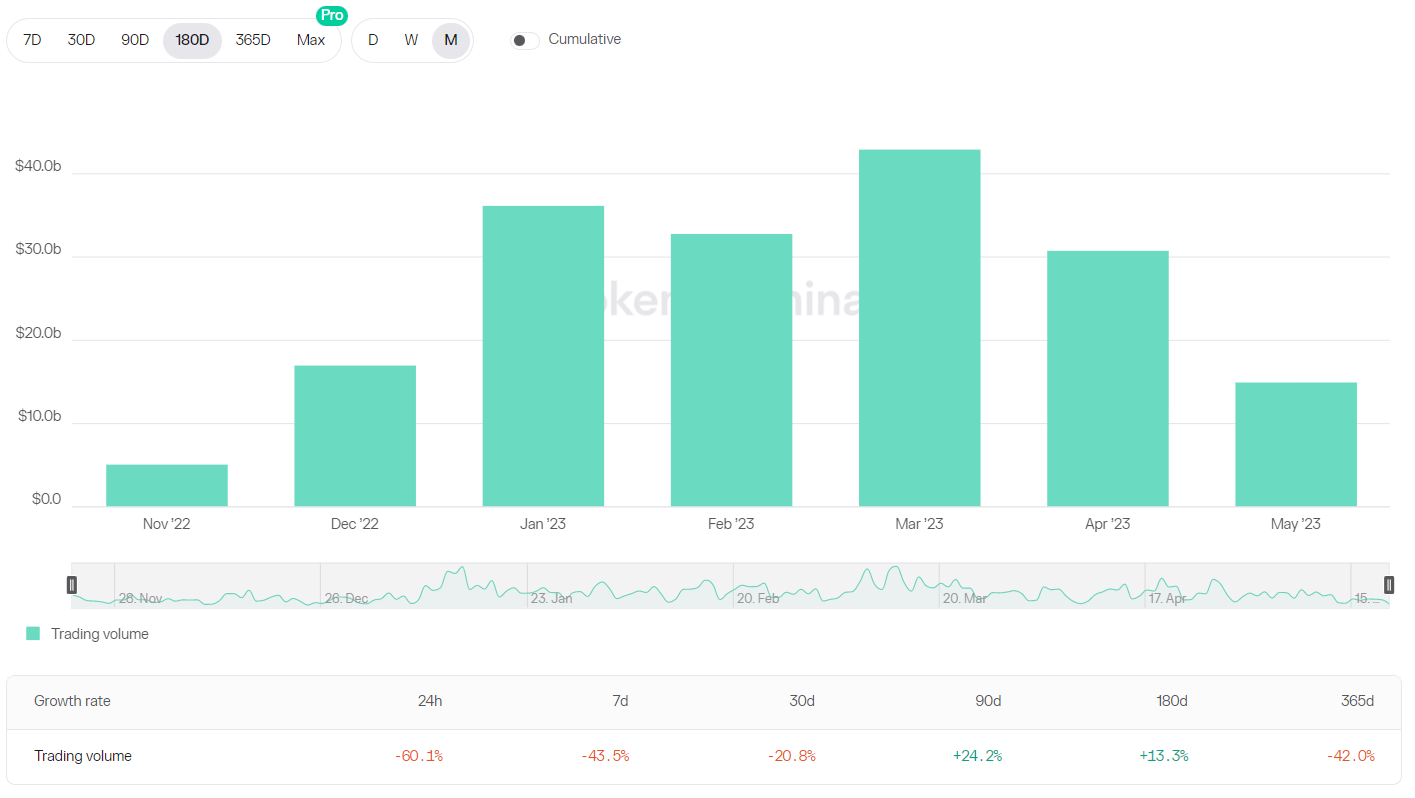

Since May, the trading volume of Derivatives DEX has continued to shrink. Daily volumes for major protocols are down more than 50% from their April daily levels, and open interest is down about 20%. Due to the decline in transaction volume, protocol revenue decreased, protocol yield decreased, and TVL experienced a slight decrease of 5%.

Since May, the trading volume of Derivatives DEX has continued to shrink. Daily volumes for major protocols are down more than 50% from their April daily levels, and open interest is down about 20%. Due to the decline in transaction volume, protocol revenue decreased, protocol yield decreased, and TVL experienced a slight decrease of 5%.

Figure: Fund pool mode Derivatives DEX daily trading volume change chart

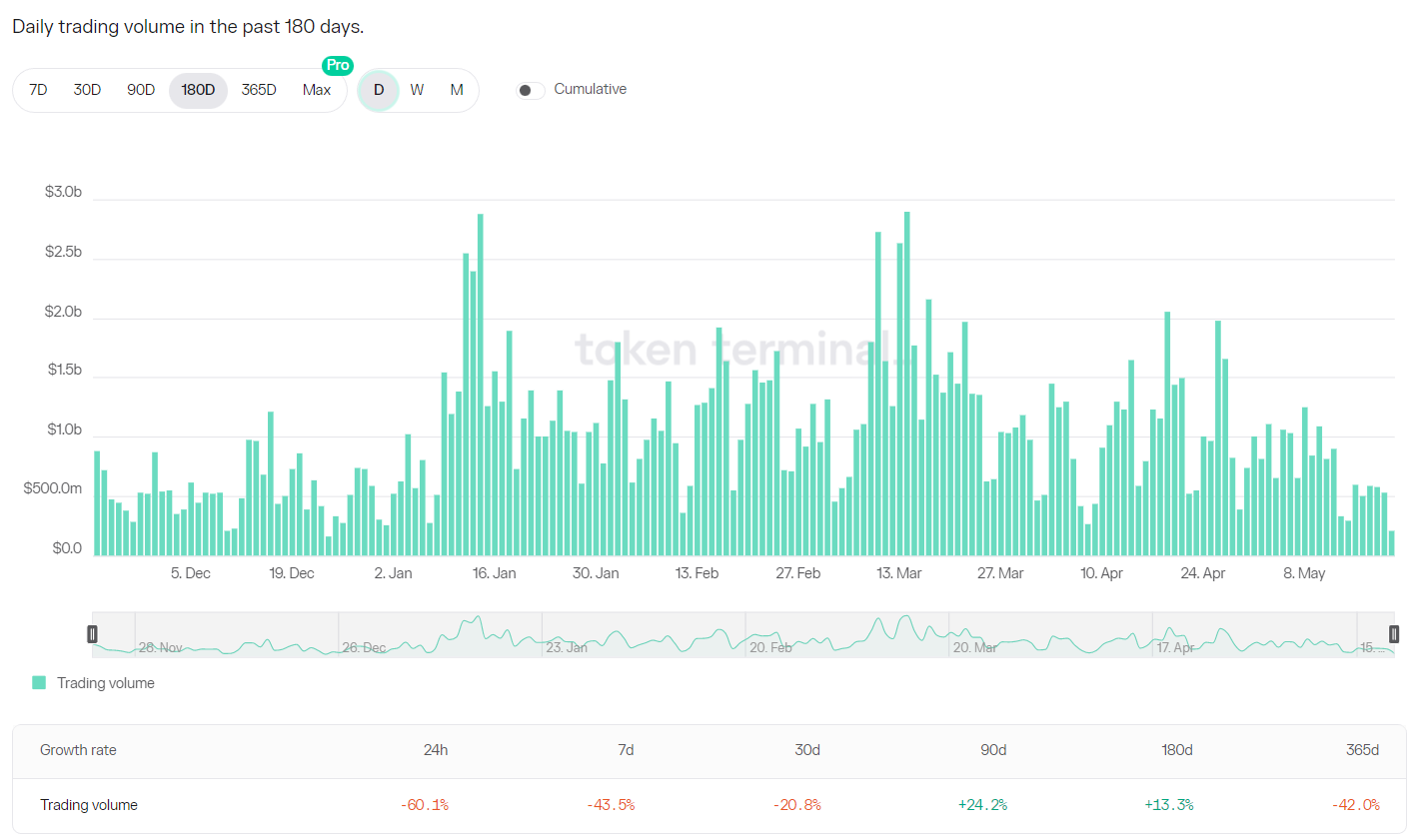

Figure: Change chart of DYDX daily trading volume in order book mode

Figure: Change chart of DYDX daily trading volume in order book mode

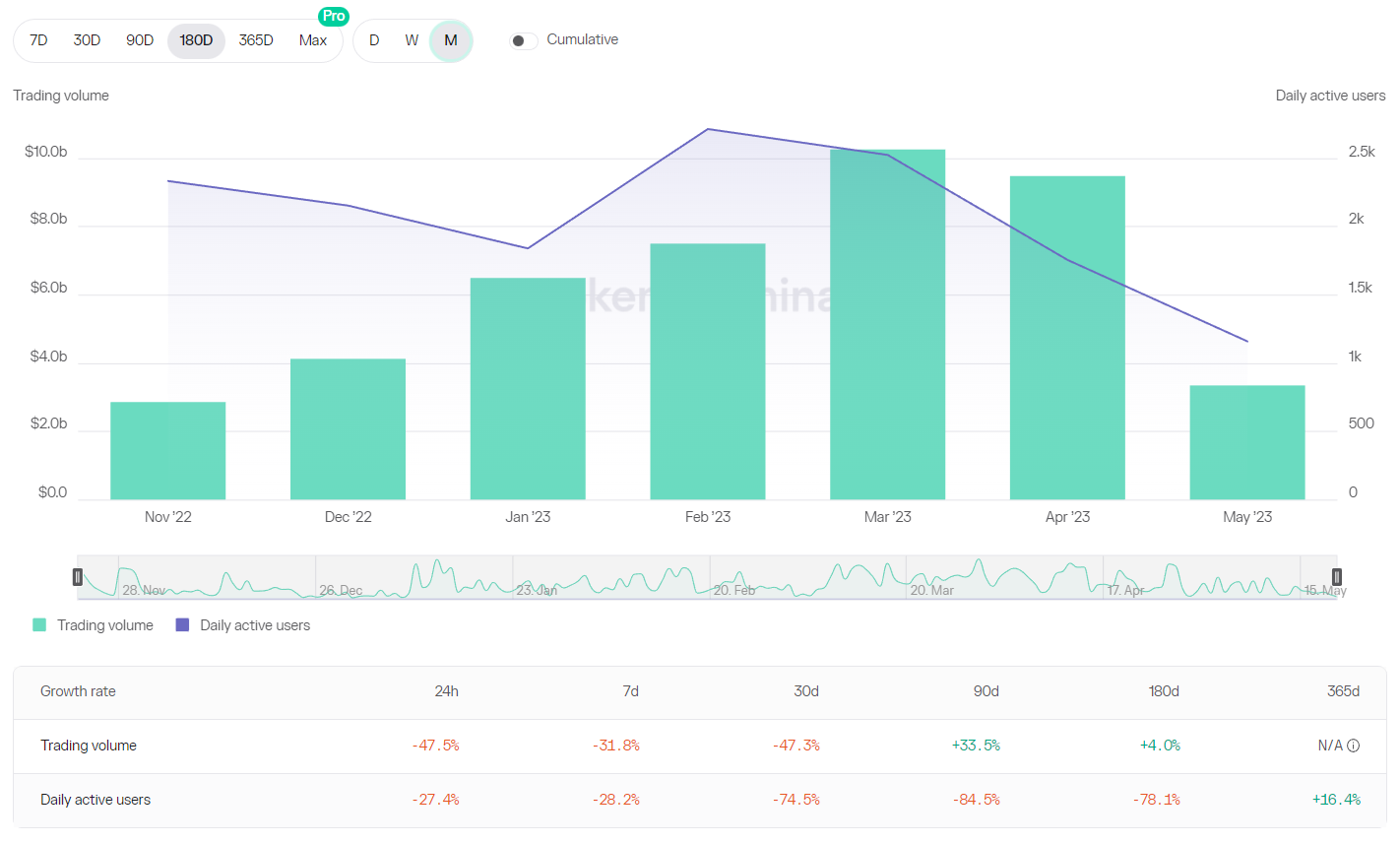

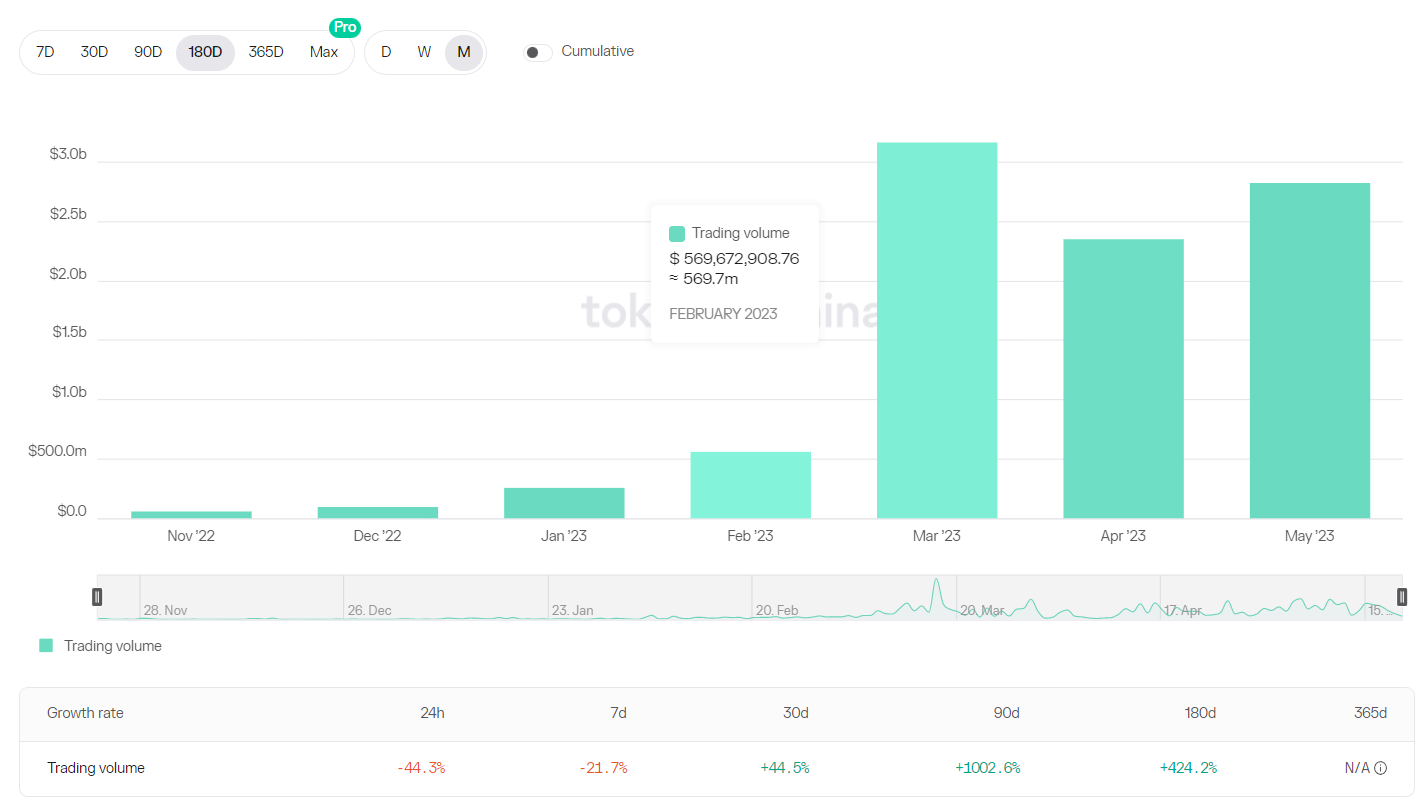

The trading volume and active number of leading protocols GMX and DYDX were lower than those in March and April. GMX reached its user peak in February, with more than 2,500 daily active users; it reached its transaction volume peak in March, exceeding $10 billion. After a slight decline in April and a significant decline in May, the transaction volume level is comparable to December 2022, and the number of daily active users has dropped to 1,200.

Figure: Changes in monthly transaction volume and daily active users of GMX

Figure: Changes in monthly transaction volume and daily active users of GMX

The monthly trading volume of DYDX shows a similar change as GMX. Monthly trading volume topped $40 billion in March and has since started to decline, with $30 billion in April and $1.5 billion so far in May, a notable drop. In terms of active users, the number of users holding margin on the platform in epoch 21 was 4,300, and the number dropped to 2,900 in epoch 22, indicating that many users withdrew their margin and left the trading market.

The decline in trading volume has led to a simultaneous decline in revenue, which has also led to a significant decline in the rate of return of the capital pool model DEX. The GMX staking yield has dropped from the previous 6% yield to 3%, and the GMX staking rate has also dropped from the previous high of 80% to 77%. The rate of return of GLP has dropped from the previous range of 20% -25% to the range of 10% -15%, and the amount of GLP funds has declined slowly, from the peak US$695 million to the current US$665 million. Gains Network's gDAI pool yield also dropped to the 3% -5% range.

RWAs

It should be noted that although the overall transaction volume is declining, Kwenta has seen an increase in transaction volume, and its transaction volume in May has exceeded the transaction volume in April. This is mainly due to its trading incentive program, starting from May 3, Kwenta provides its trading users with protocol tokens and OP tokens as incentives. When the overall market sentiment is not high and trading users are declining, Kwenta's trading incentives have attracted more users and seized more market share.

first level title

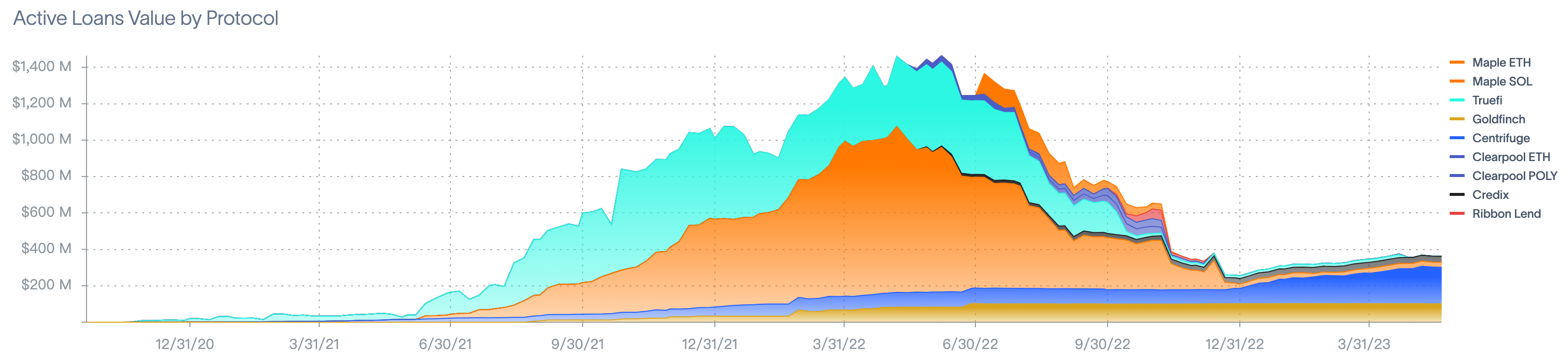

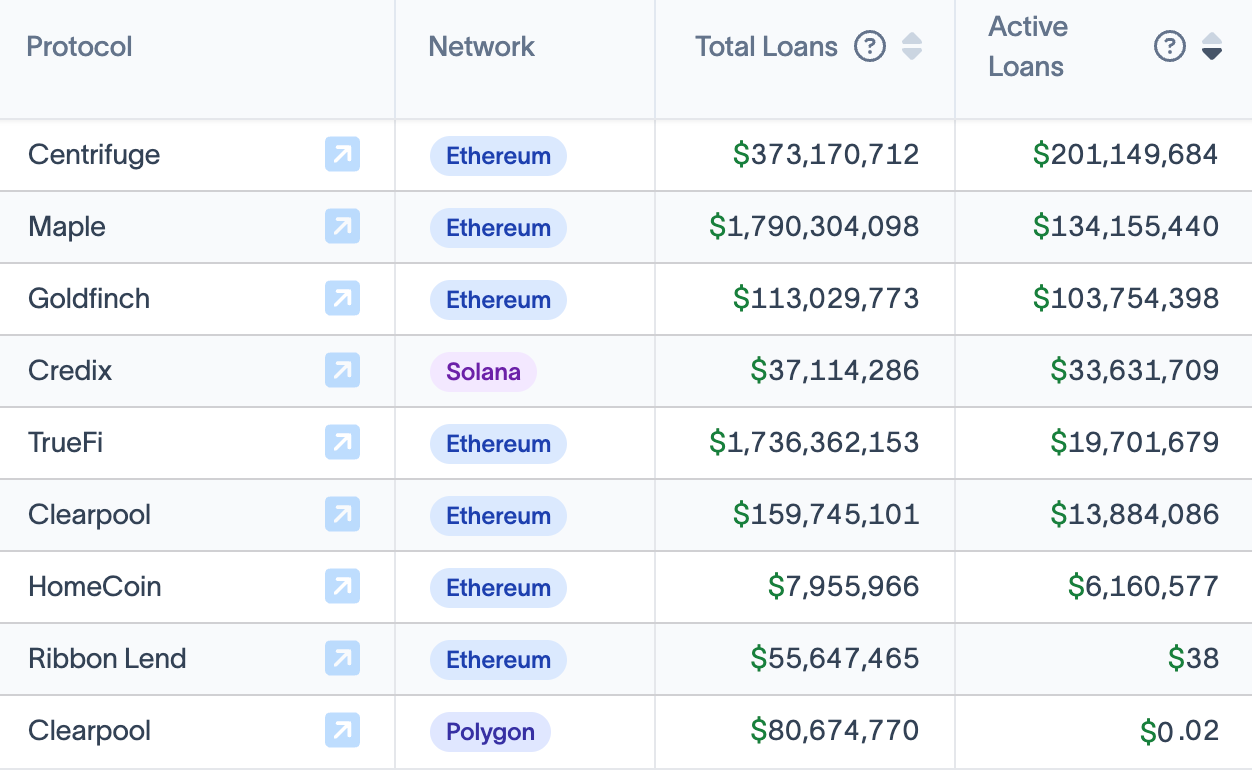

RWAs will have a peak cumulative borrowing volume of 1.4 billion in May 2022. Data for the RWAs sector has not changed much since the beginning of May, with current active loan volume at $512 million.

Figure: Protocol active loan volume

Source: rwa.xyz, LD Research

The 5 most active protocols are Maple Finance, Centrifuge, Clearpool, Goldfinch, Truefi. Except for Clearpool, there was no significant growth in other protocol data this week.

Figure: Active loan data of each agreement

image descriptionPortofinoSource: rwa.xyz, LD ResearchFasanaraAccording to defillama data, Clearpool TVL bottomed out in February 2023 at around 2.7 M. On April 21, the Clearpool TVL was 7.96 M, and as of May 21, the TVL was 17.46 M, with a monthly growth rate of 119.3% and a weekly growth rate of 12.7%.AlphanonceHigh growth in the past few months is mainly due to the agreement attracting 3 new borrowers

(Available April 26). In addition, the agreement also introduced a credit risk premium parameter in April.

Source: Defillama, LD Research