SignalPlus Macro Review (20230523)

Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

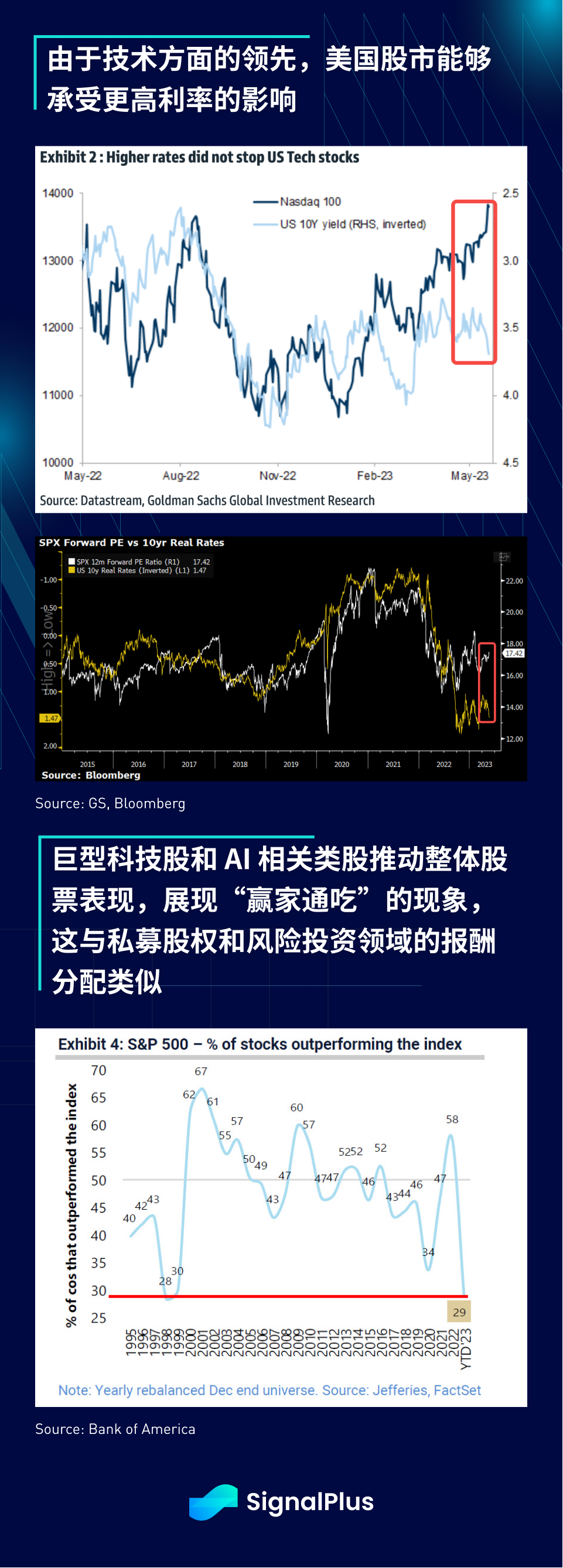

The market was particularly quiet yesterday, with many hot stocks trading at 1/3 of last week's daily volume. Tech stocks and AI-related stocks continued to lead the way, with Tesla up 5% and Alphabeta also up +2.4%, while the real estate sector also staged a nice rebound, with growing views of U.S. The real estate market has bottomed out.

The daily debt ceiling soap opera didn't have much substance, but the news was chaotic and hilarious:

McCarthy @ 1pm: "We don't have a deal"

McCarthy @ 2pm: "We can make a deal tonight"

McHenry (Chief Republican Negotiator): Saw a "lack of urgency" in the White House and didn't sense a "consensus" between Biden and McCarthy

As investors await political developments, it is understandable that market volumes are so subdued. Below we try to summarize the discussion and status of the most recent meeting (source - White House reporter via social media):

The White House proposed a 2-year spending cap, with spending in 2024 capped at 2023 levels (+0%), followed by a +1% increase in 2025.

Republicans propose a 10-year spending cap, based on 2022 levels, with +1% annual growth for the next decade.

Inflation adjustment is also under debate.

The White House proposed closing the carried interest loophole (a tax break for private equity and hedge fund managers).

The Republicans rejected it because it would technically violate their "no tax hikes" pledge.

All parties agree to recover and repurpose unspent Covid funds.

Other debates include welfare programs, the climate agenda and drug benefits, among others.

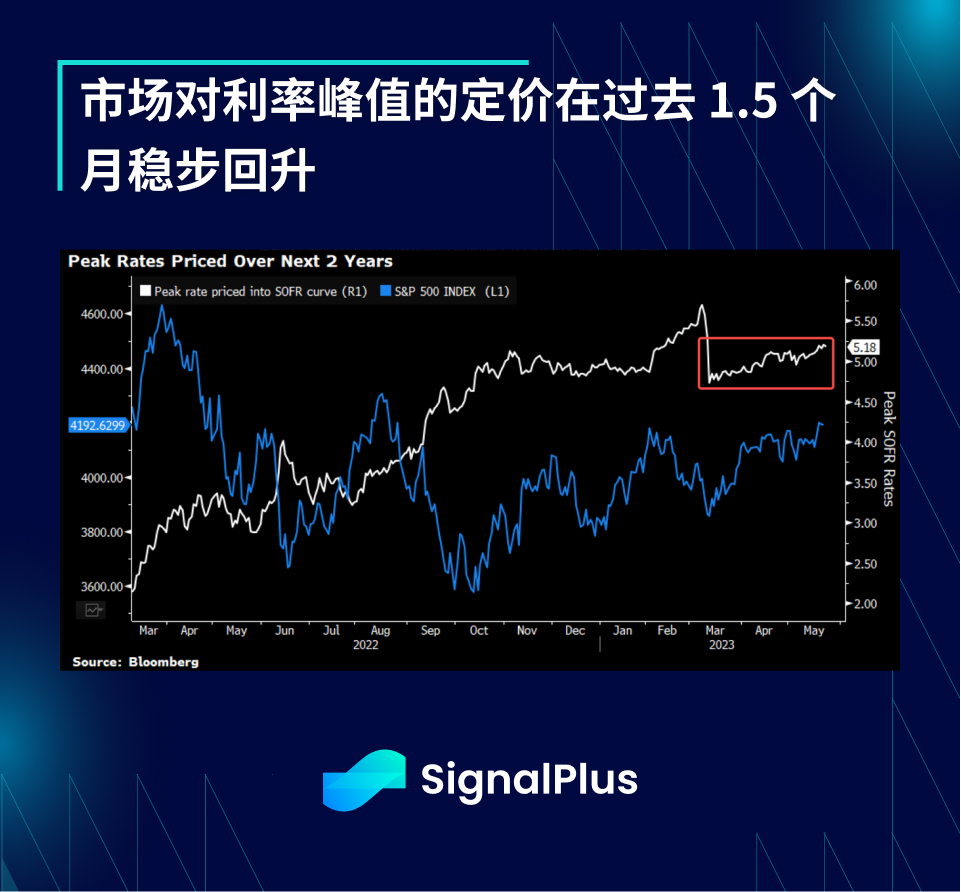

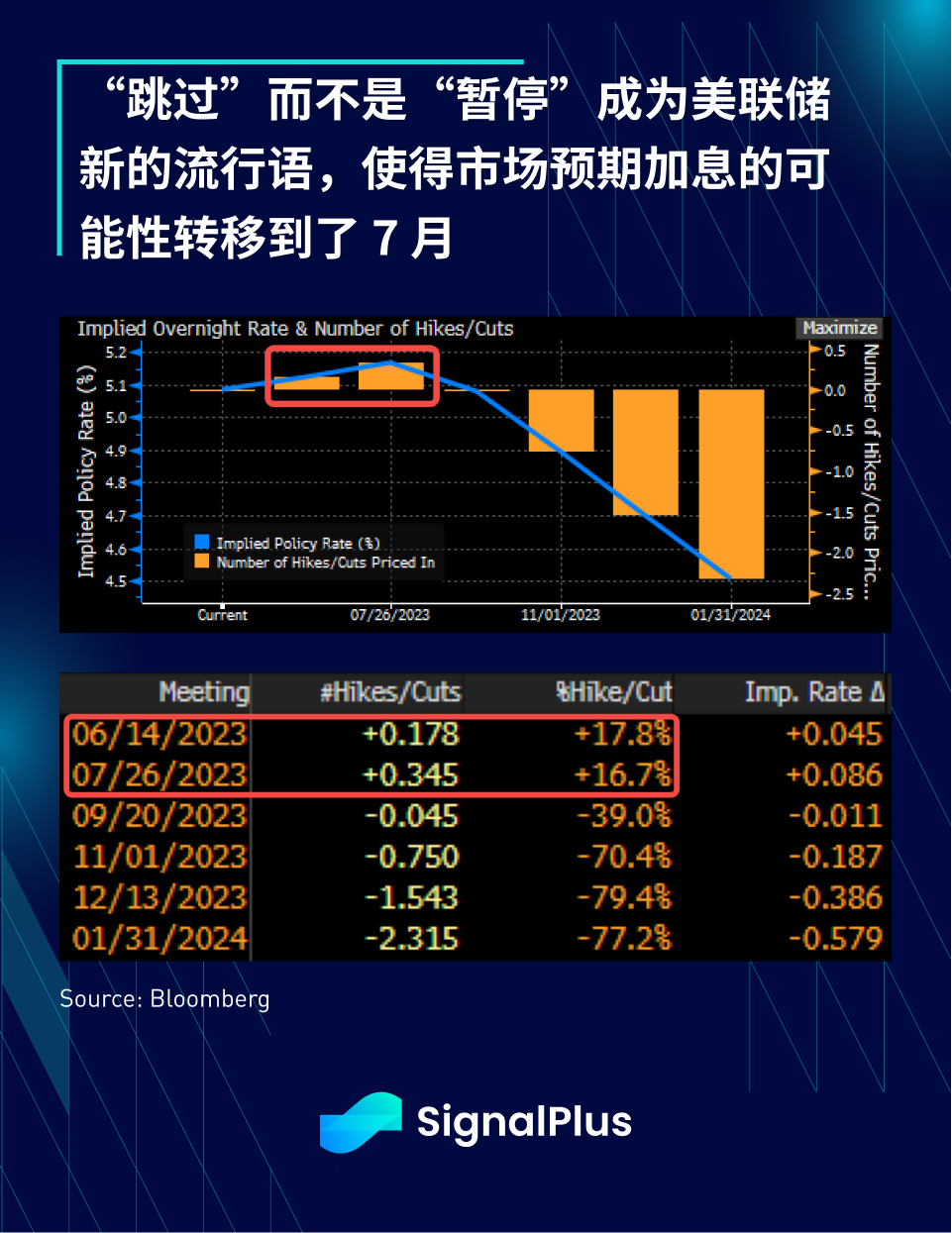

While the debt crisis has been unfolding, U.S. bond yields have been sneaking back up, and the implied terminal interest rate has reached a new high since the regional banking crisis in March. In fact, some Fed speakers recently introduced in their talks With the neologism "skip" serving as a middle ground between "pause rate hikes" and "continue raising rates," savvy bond market investors were quick to pick up on the change in tone and start putting the rate hikes into perspective. Possibility shifted from June to July.

On the cryptocurrency front, realized and implied volatility continues to decline, with trading activity, stablecoin inflows, correlations with TradFi assets, and overall mainstream interest all down. A quick “sentiment check” by comparing AI vs. Bitcoin’s new searches reveals an undeniable divergence in sentiment starting in January this year, which also corresponds to the subsequent narrowing of price ranges and volatility Decline. In the absence of further regulatory action, we will be watching closely to see if developments in the debt crisis bring a new narrative to our space and reignite some deal energy in the coming months.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/