Demystifying Ethereum's largest Gas consumer in the meme craze

This article comes from Bankless, the original author: Jack Inabinet, compiled by Odaily translator Katie Koo.

The ability to create assets permissionlessly has been one of the most compelling use cases for smart contract platforms since the ICO boom of 2017. Recently, permission-free creation of assets has been revived on Ethereum as the meme coin craze spreads.

While blue chips like bitcoin and ethereum plummet from their respective bear market highs, money is flowing into meme coins like PEPE. Since April 26, PEPE has risen 1,500%, peaked on May 5, and has since retreated, dropping 50% from its highs.

image description

Source: Dune Analytics

secondary title

Uniswap

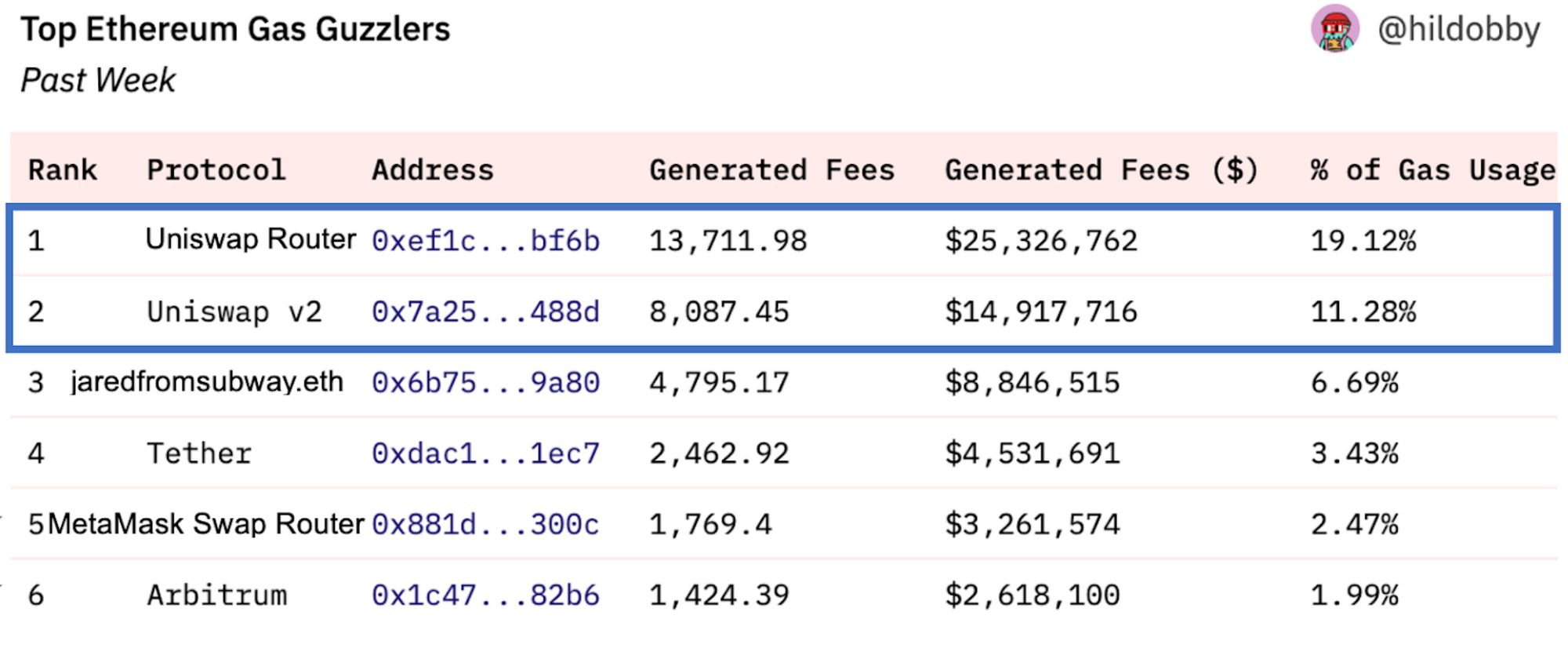

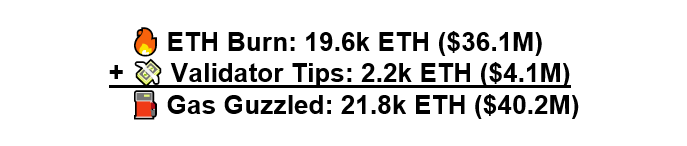

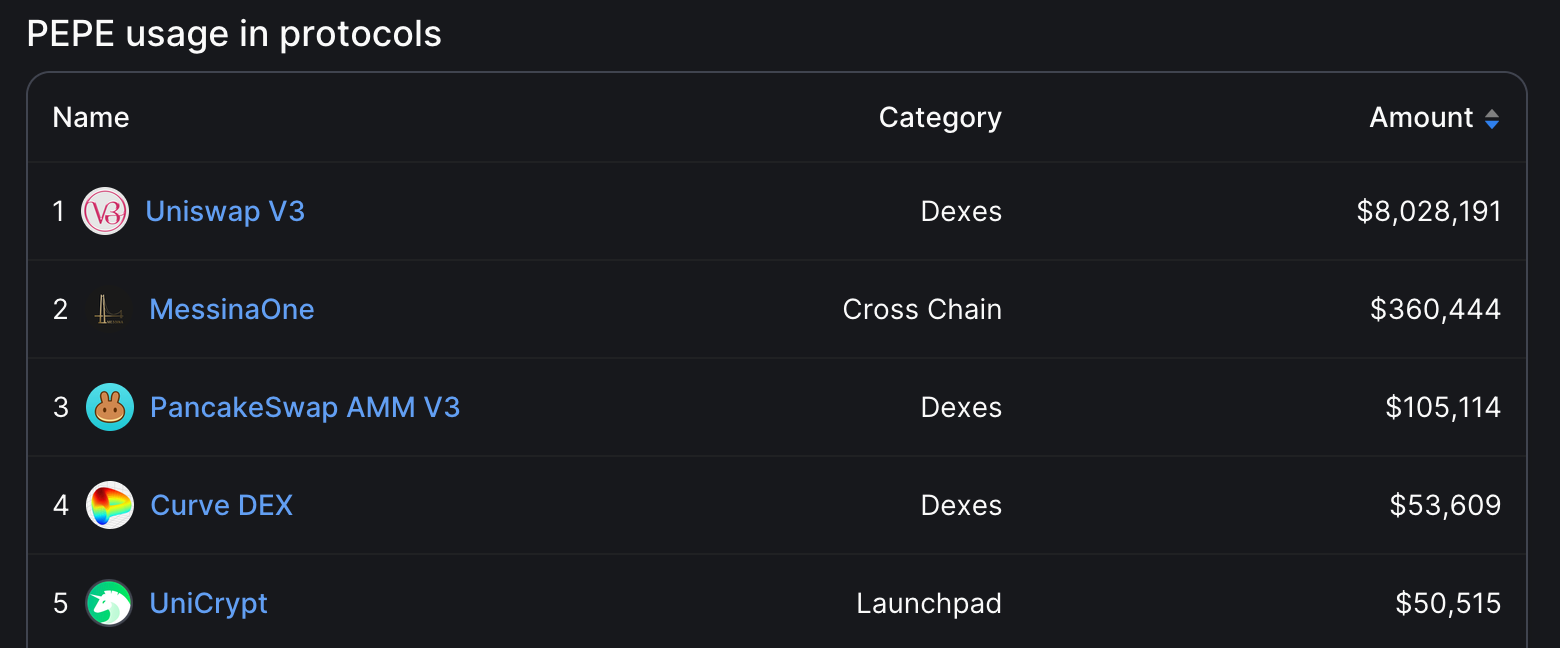

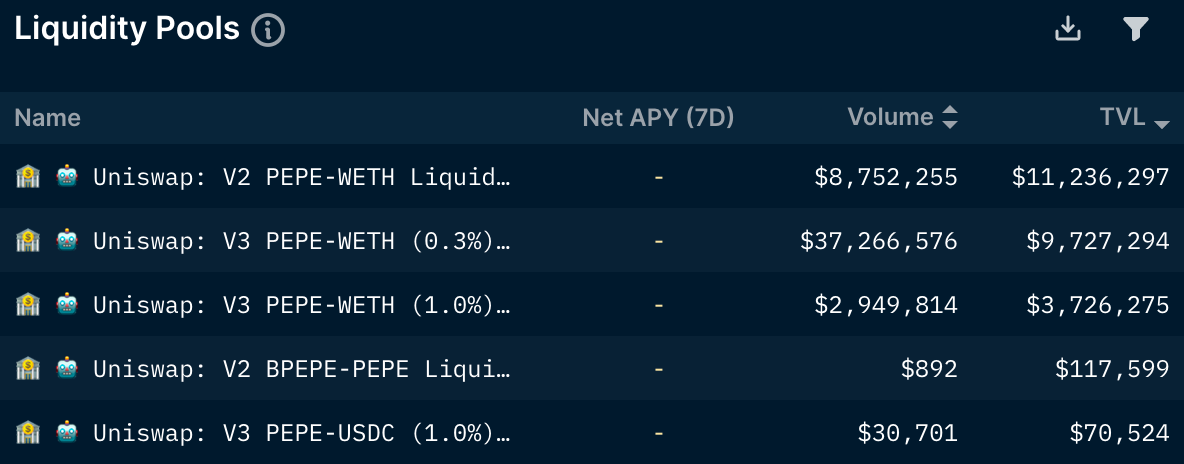

Although Uniswap involves multiple contracts, only two of them were selected. Uniswap’s router aggregates the transactions of the entire protocol to improve the efficiency of order execution. Its all-round liquidity contract (V2) has consumed a total of 30% of the Gas on Ethereum in the past week. Increased speculation on long-tail tokens means increased DEX trading volume.

Why Uniswap?

image description

Source: DeFi Llama

image description

secondary title

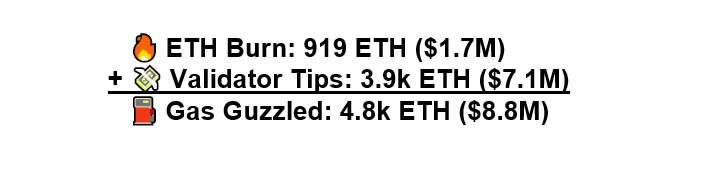

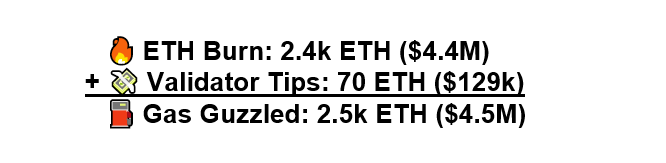

jaredfromsubway.eth

"Public Enemy" jaredfromsubway.eth has been a hot topic at MEV lately. Founded in late February, jaredfromsubway.eth outperformed the MEV competition by far outperforming other MEV bots, achieving a $6.3 million profit in less than three months from a “sandwich attack.”

A sandwich attack is a "poisonous" form of MEV that runs a user's order flow ahead of time, thereby maliciously executing prices. They earn a lot of money in low liquidity pools, a common feature of meme coins, as attackers can easily drive up prices with relatively small amounts of initial capital.

On April 17, over 60% of blocks contained transactions from jaredfromsubway.eth. This led to an initial spike in fees that have remained high ever since. These sandwich attacks are "atomic," meaning that the entire transaction occurs in one block, and the attacker does not risk the transaction.

However, it's important to note that sandwich attacks are still not completely risk-free. MEV robots must hold certain assets to launch an attack, creating risks between blocks. For this reason, many sandwich attack bots only hold ETH and stablecoins, choosing to avoid exposure to Memecoin prices.

secondary title

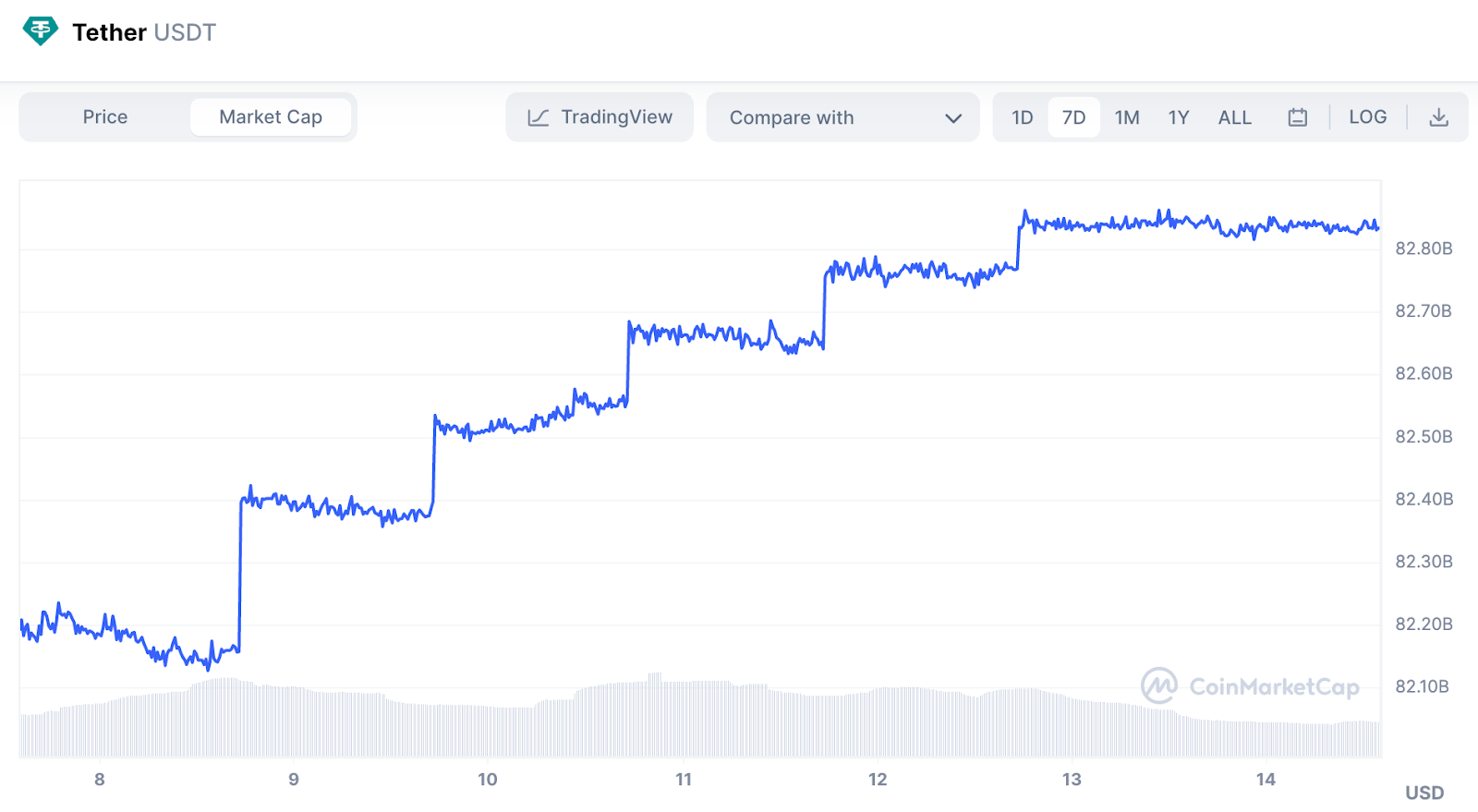

Tether

image description

Source: CoinMarketCap

image description

Source: Nansen

secondary title

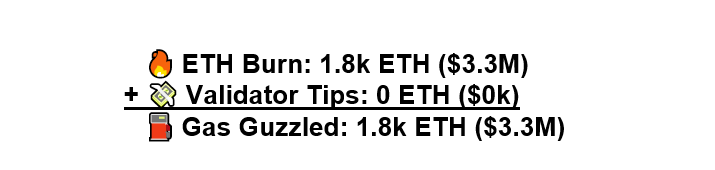

MetaMask

Web3 Wallet has been working hard to improve the user experience. The ETH Gas consumed by the MetaMask Swap router is a testament to the progress made in this area.

MetaMask Swap is an in-wallet exchange that aggregates data from decentralized exchange aggregators, market makers and DEXs to ensure better pricing and network fees, less token approval process and slippage protection (A very useful tool for preventing sandwich attacks).

image description

Source: MetaMask Wallet

secondary title

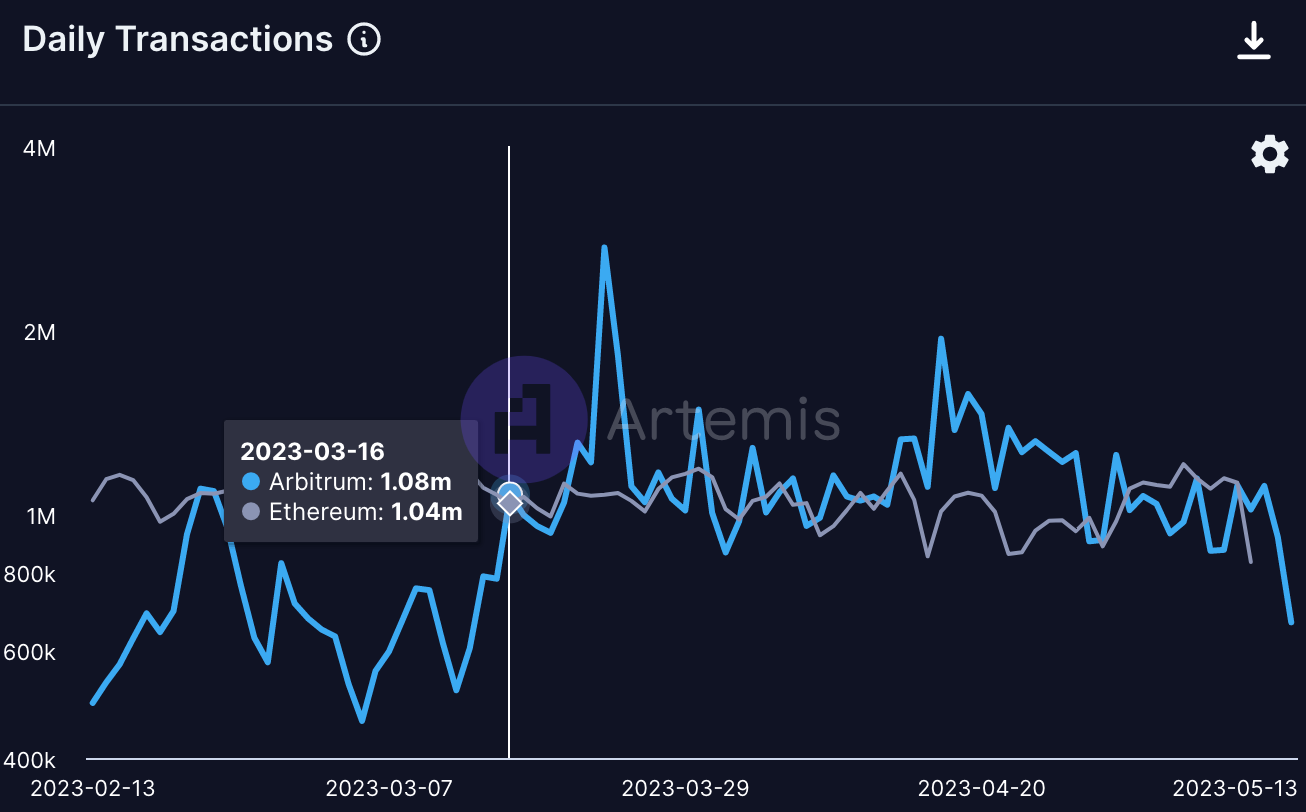

Arbitrum

image description

Source: Artemis

Since then, Arbitrum’s daily transaction volume has hovered close to the 1 million mark, and the meme coin fire has undoubtedly helped push the otherwise unbalanced transaction volume to L2. On the day that PEPE really started to go viral (April 29), the chain saw an increase of 342,000 transactions (38%).

Summarize

Summarize

With certain tokens achieving multi-billion dollar market caps seemingly overnight, it’s easy to overlook the wider impact of this frenzy on the Ethereum market. Whether we will see a resurgence of mania is unclear, but what is clear is that even in a falling price environment, meme coins, a non-mainstream currency in cryptocurrency, can dominate the gas consumption leaderboard and increase Demand for block space.