All the short-term benefits of ETFs have failed. When will the window period of the next SEC decision come?

Original - Odaily

Author - Loopy Lu

This round of rising prices stems from expectations for the adoption of the Bitcoin spot ETF; but this week, the excitement in the crypto market began to gradually recede.

On November 18, Beijing time, the last Bitcoin spot ETF that may be approved by the SEC has been temporarily settled.

The SEC said it was delaying a decision on Franklin Templeton’s Bitcoin spot ETF, extending the original 45-day deadline to next year. Bloomberg ETF analyst James Seyffert analyzed that the delay was expected.

With the SEC’s recent intensive postponement of ETF applications, when will the “window period” for the next ETF resolution arrive?Odaily has statistics on the decision-making time points of each ETF, as follows:

Data shows that the recent window period of resolutions has ended, and it may be difficult to receive the benefits of ETF approval again this year. The key time point for the next round of ETF resolutions will begin as early as January 1 next year.

However, it should be noted thatThe deadline is only the final date for the SEC to make a decision.The SEC can grant, deny, or extend an application any day before the deadline.

ETF bullish shift to ETH?

In the past period of time, despite continuous good news for Bitcoin, it has never exceeded the $40,000 mark. In the past two days, Bitcoin has fluctuated widely in the range of US$35,000 to US$37,000. Although the decline was not significant, market sentiment has cooled significantly.

At the same time as the Bitcoin spot ETF flashed out, we also saw another potential direction of the market: ETH spot ETF.

On November 16, Beijing time, BlackRock submitted an S-1 application for its spot Ethereum ETF to the SEC, designating Coinbase as the custodian of the underlying ETH; on November 18, Fidelity submitted an application for the spot Ethereum ETF. 19 b-4 filing, becoming the seventh applicant for a spot Ethereum ETF. In addition, other asset managers such as Grayscale, Ark Invest, ProShares and Valkyrie have also submitted spot Ethereum ETF applications.

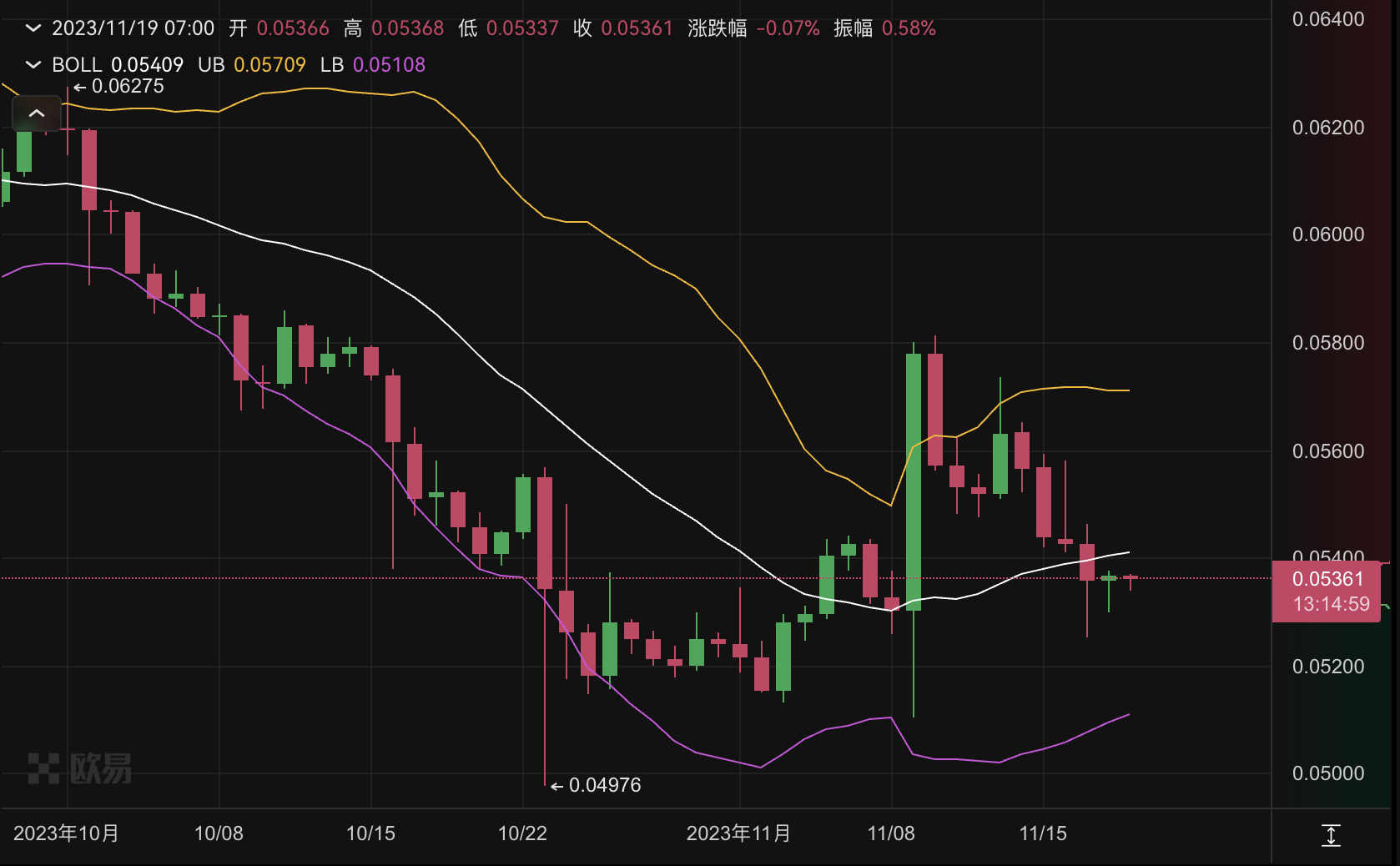

Affected by the news, Ouiyi OKX market shows that the ETF/BTC exchange rate has stopped its downward trend in recent days after a long and lasting decline.

As traditional financial giants submit applications for ETH ETFs one after another, will the positive speculation about ETFs be expected to shift from BTC to ETH?

Can ETFs usher in a new bull market?

The entire crypto market is eagerly awaiting the adoption of ETFs. But as a kind of good news, how much change can the adoption of ETF bring to the crypto market? No one can give a definite answer until the good news is implemented and runs smoothly for a period of time.

At present, the market is still divided on the actual role of this good news.

JPMorgan has observed that similar ETFs in Canada and Europe have seen minimal investor interest since their launch. In the middle of this month, JPMorgan released a report showing that analysts are skeptical about the positive effects of ETFs. Rather than bringing new capital into the crypto market, they argue, the ETF will move existing Bitcoin capital into a newly approved spot Bitcoin ETF.

Additionally, analysts have also questioned whether the SEC’s losses in the Grayscale and Ripple cases will lead to a loosening of the SEC’s regulatory stance. “U.S. crypto industry regulations are still in place, and we do not believe U.S. lawmakers will change their stance because of the two legal cases mentioned above, especially with the memory of the FTX fraud still fresh.”

Analysts believe the recent surge is overdone compared to Bitcoin’s fundamentals. Analysts believe that Bitcoin prices have risen by 30% in the past month, with expectations of the approval of a spot Bitcoin ETF being the main driver of this increase. However, this factor is not enough to support a price increase of this magnitude.

Is the calf dead, or is the market coming?

MVRVIndicators show that the current MVRV is as high as 1.7 to 1.8. Generally speaking, this indicator can reflect whether the current market sentiment is overheated.

Since the beginning of this year, the MVRV indicator has continued to rise and has now reached a recent high, returning to the level from January to April 2022. The Blokck data shows that the current discount rate of Grayscale GBTC is 14.78%, reaching the lowest level since the end of December 2021, and continues to narrow, which also means that traditional market investors recognize the expectations of spot ETFs.

At present, we cannot tell whether this round of rising prices is the beginning of a new bull market or the end of the Little Indian Spring.

No matter what the market direction is, the 2024 halving event will eventually arrive as scheduled. Bitcoin is expected to experience its next halving in April 2024. Analysts at JPMorgan believe that the recent Bitcoin rally may encounter setbacks due to unstable fundamentals, and that the halving event and its impact are already well reflected in the current Bitcoin price.

At around $36,000, Bitcoin’s price is currently only about 48% below its all-time high of nearly $69,000 reached in November 2021. At current prices, the potential rate of return between Bitcoin and ATH is no longer high (measured from a crypto market perspective).

With ETFs and the halving approaching, where will the market go? Will the market end up with a calf that exceeds the expectations of optimists?

Analysts at JPMorgan say current risks to cryptocurrencies remain greater than the recent strong gains. Although the crypto community’s expectations for Bitcoin spot ETFs are still optimistic, he believes that the approval of spot Bitcoin ETFs may lead to a “buy gossip, sell news” type of decline.。

Odaily reminds investors that the crypto market is volatile and please manage risks carefully.