SignalPlus Daily Information (20230418)

Dear friends, welcome to SignalPlus Daily Information. SignalPlus Information updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

The U.S. New York Fed manufacturing index surged 35.4 points to 10.8 in April, well above expectations and the highest level since July, with strong performance across all items, with new orders climbing to 25.1 from -21.7 in the previous month and prices paid up from 41.9 It fell to 33.0 and the employment index rose to -8 from -10.1 in the previous month.

The U.S. NAHB housing market index rose 1 to 45 in April, the fourth straight month of gains and the highest level since September, as the percentage of builders cutting prices fell from nearly 40 in the fourth quarter as housing supply remained tight. % down to just 30%. Dietz, NAHB's chief economist, said lending conditions are indeed tight, but "there's no clear evidence that stress in the regional banking system is worsening the lending environment for builders and land developers.

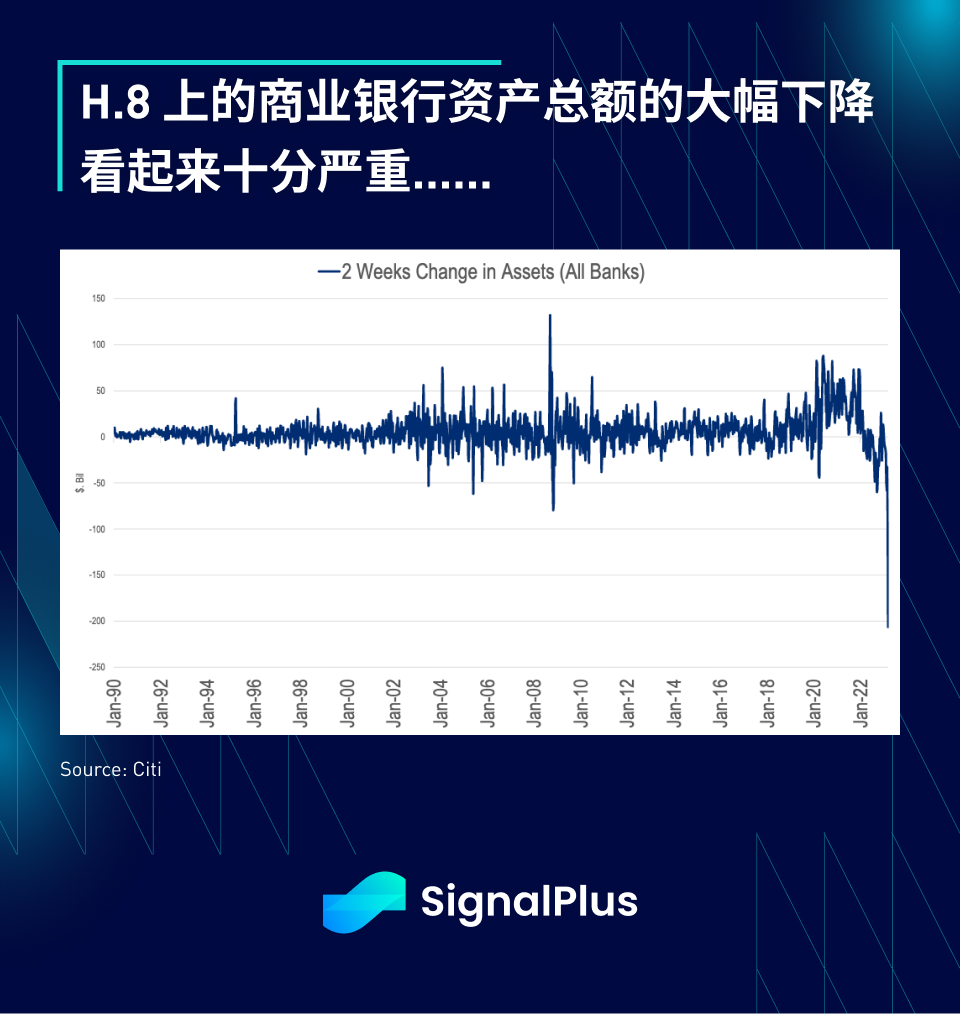

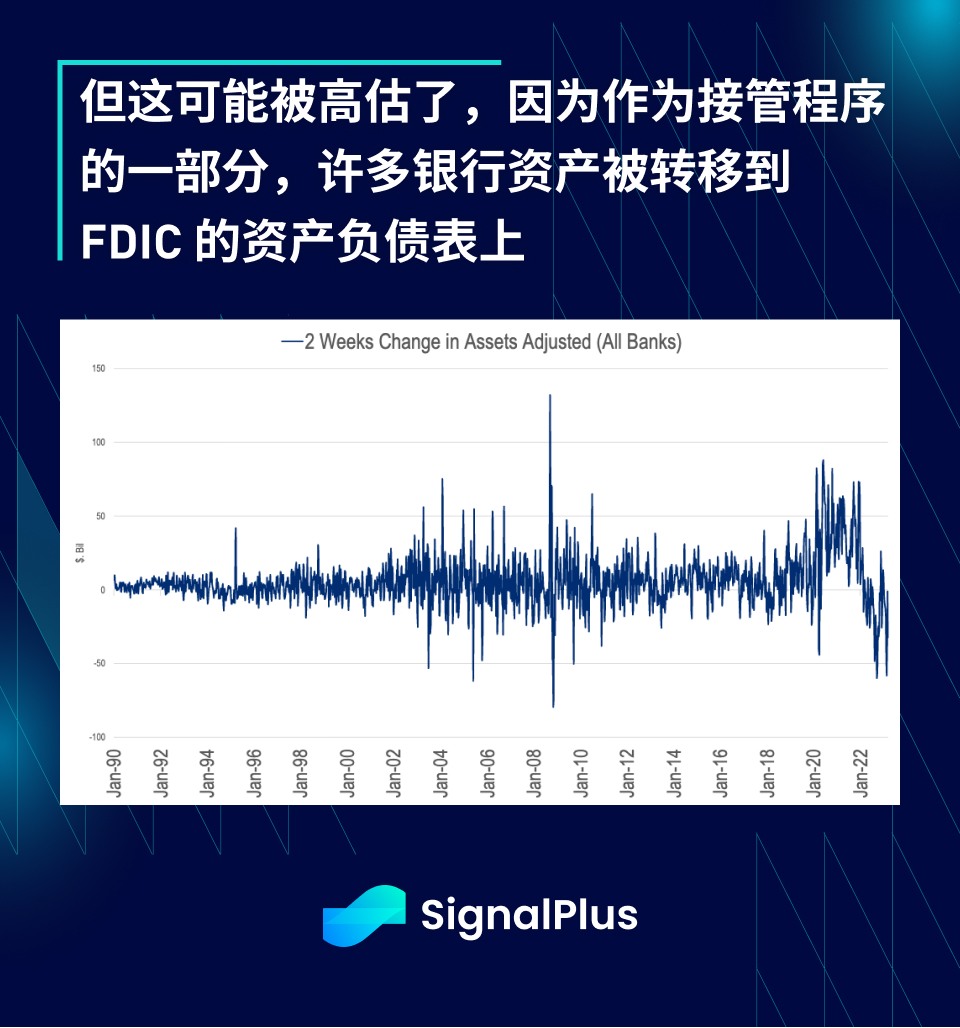

Lending conditions for US companies have been tightening, although the sharp decline in commercial bank assets in H.8 is exaggerated. The two-week change in total bank assets, a measure of bank credit, fell by $200 billion, faster than during the global financial crisis. The balance sheets of commercial banks have been transferred to the custody of the FDIC. If the factor of the FDIC is excluded, although the total assets of the banks are still reduced, it is not as serious as the indicators show.

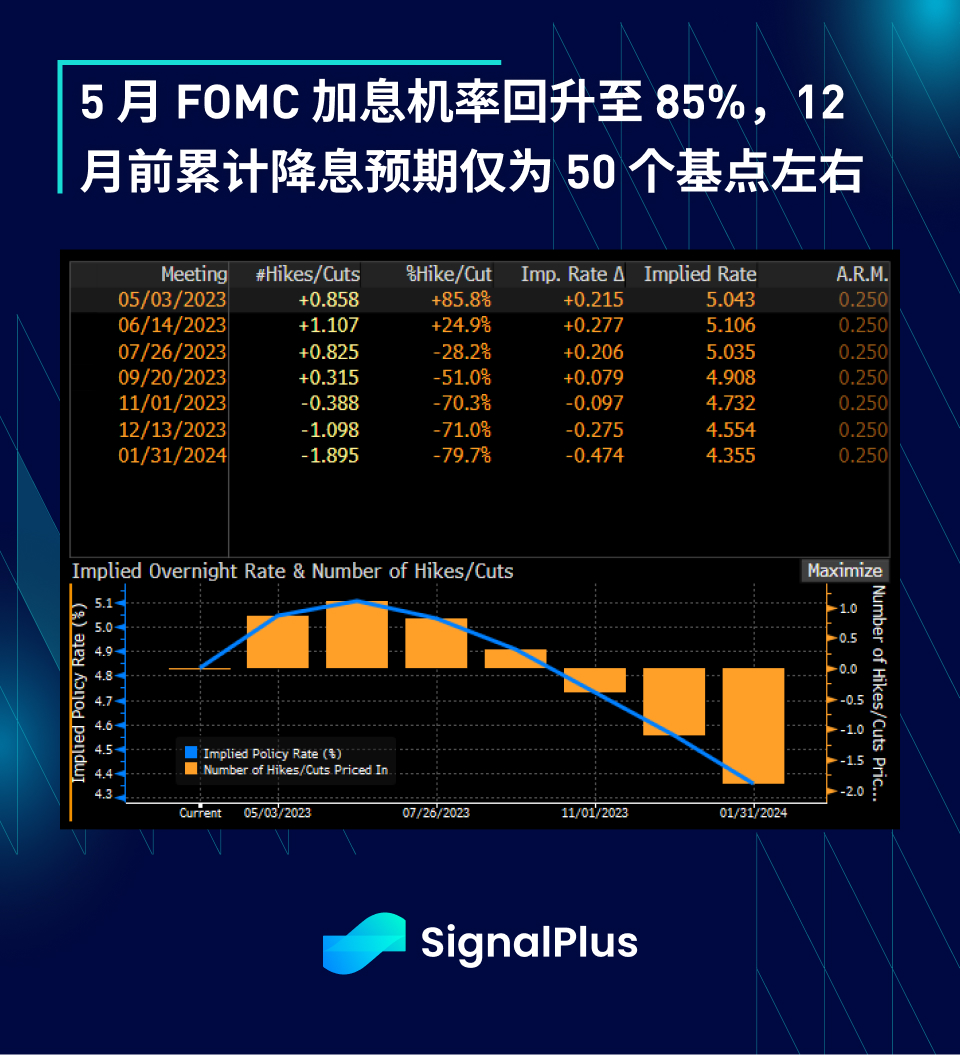

Continuing the trend after the retail sales data, the U.S. Treasury bond interest rate continued to rise, consumption remained strong, the housing market showed early signs of stabilization, the New York Fed’s new orders index jumped sharply, and the bank’s profit performance was quite positive. The same economic reality is that economic data has not been "weak enough" to suggest that a recession is imminent, and that the pullback in inflation can only be sustained at a level that remains above the Fed's target. The latest market pricing shows that the probability of raising interest rates in May has risen to 85% (<50% in the previous month), the cumulative interest rate cut is expected to be about 50 basis points before the end of the year (the highest is about 100 basis points), and the terminal interest rate is stable at 5.07 %, during the SVB crisis, the terminal interest rate was expected to be as low as 4.75%.

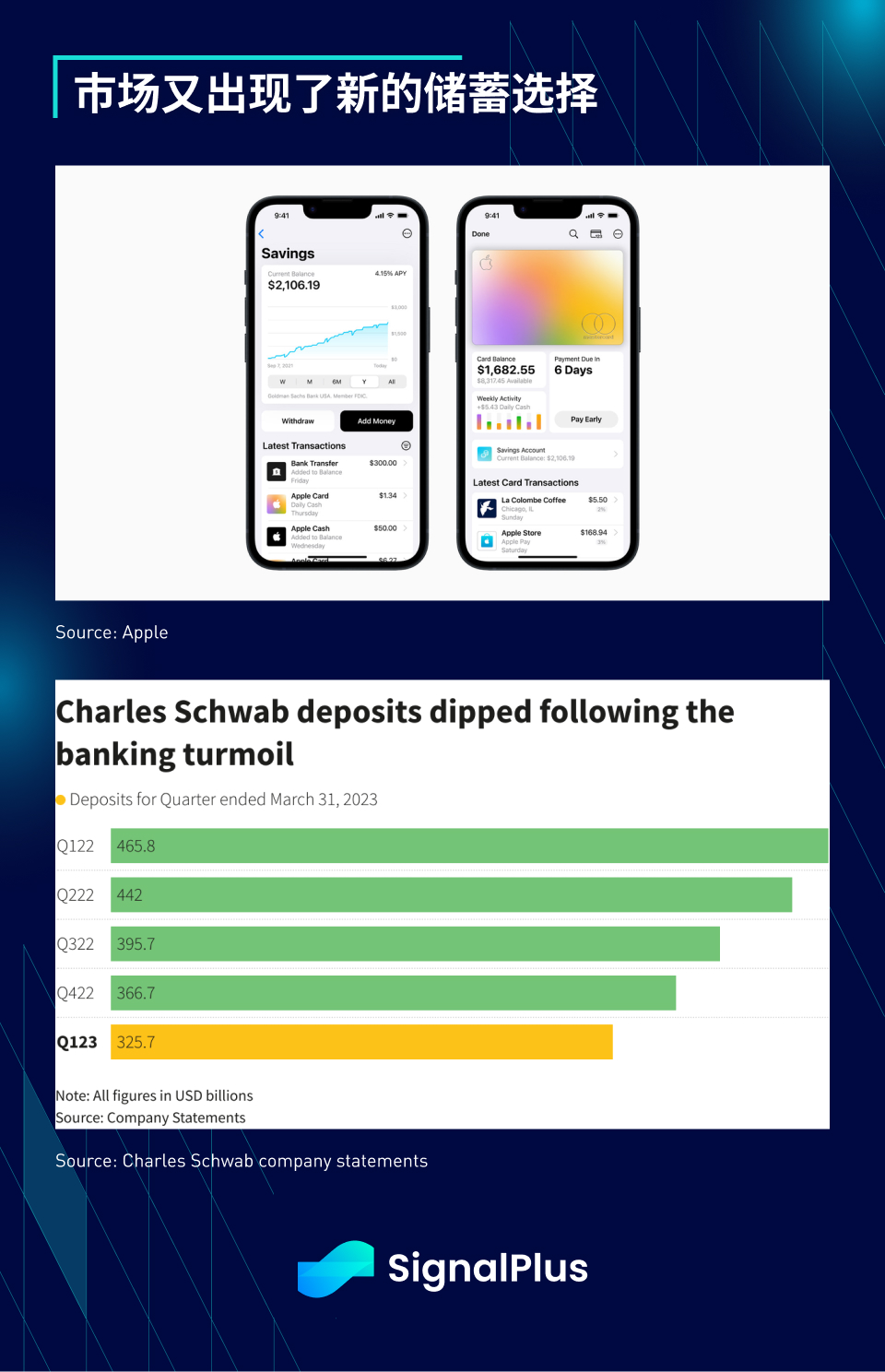

New savings options have appeared in the market, and Apple has also joined the competition to snatch deposits, launching a high-interest savings account with an annualized return of up to 4.15%. Save $250,000, on par with other savings institutions. The race for deposits comes as regional banks report massive first-quarter deposit exoduses, with Charles Schwab's deposits down 11% in the first quarter and 30% year-over-year, State Street's deposits down 5% in the first quarter, and M&T Bank fell by 3% over the same period, and the total deposit outflow of these three banks in the first quarter was as high as US$60 billion.

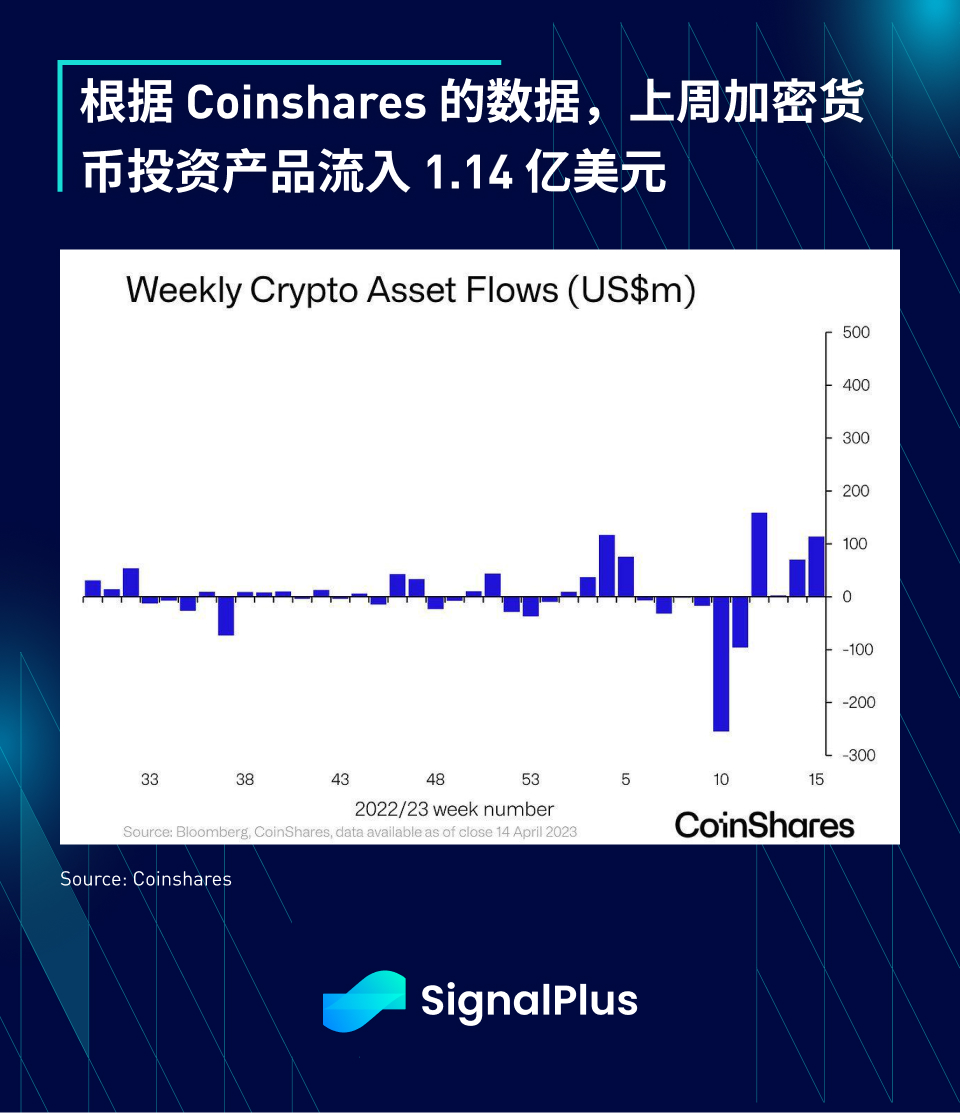

According to data from Coinshares, the inflow of cryptocurrency investment products last week was 114 million US dollars, and the total inflow in 4 weeks was 345 million US dollars. 50% of . Although the Ethereum Shapella upgrade was successfully completed, BTC still dominates the current market investment interest due to the store-of-value narrative, accounting for about 90% of recent capital inflows.

As Coinbase enabled the function of redeeming pledged ETH on its platform, the selling pressure of ETH began to gradually increase. Binance will start to enable ETH withdrawals on Wednesday. Whether it will bring further pressure to the spot price in the short term is worth watching closely.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/