SignalPlus Daily Information (20230417)

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

US retail sales data came out better than feared. Retail sales fell 1.0% mom, a bigger-than-consensus 0.5% drop, mainly dragged down by gasoline and auto sales, however, the decline in the control group was more modest at 0.3% mom, with overall nominal spending still showing consumer Be resilient. Although retail sales fell in March, after strong growth in January and a smaller-than-expected decline in February, investment banks still estimate that retail spending in the first quarter will have a quarter-on-quarter growth of nearly 7%.

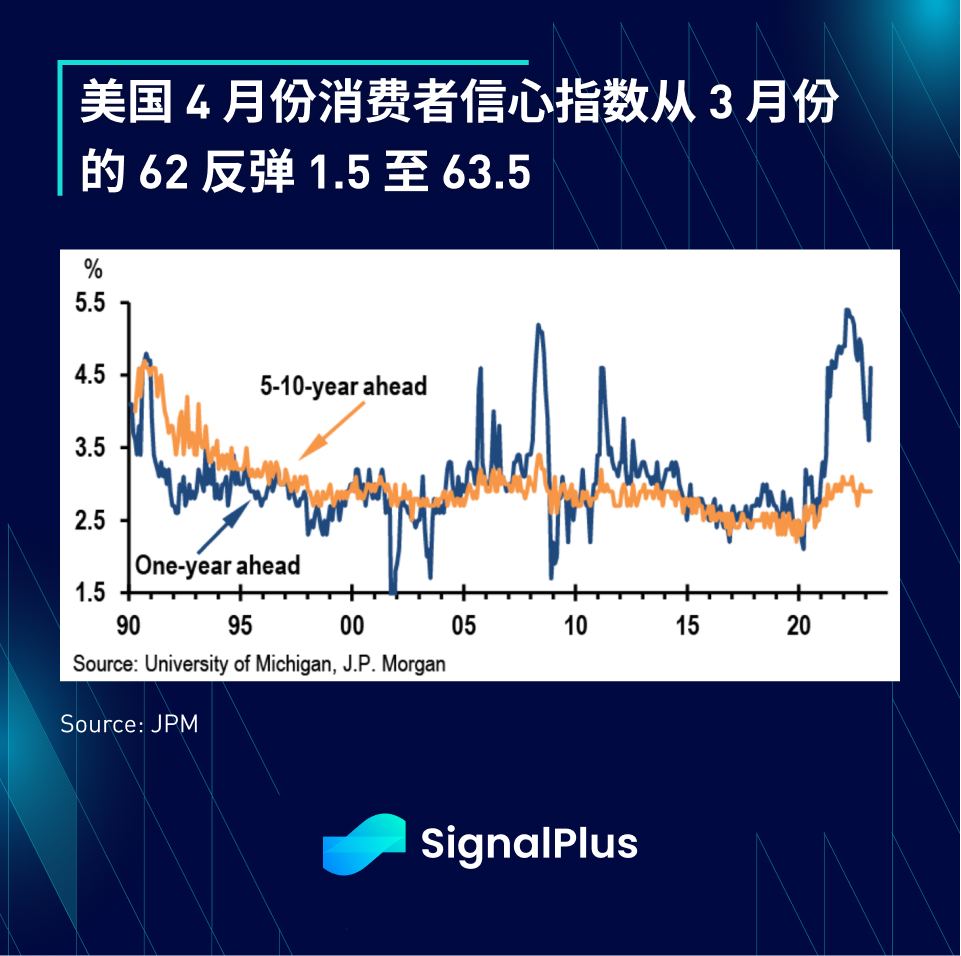

US Consumer Confidence Index rebounded 1.5 to 63.5 in April from 62 in March, with both current conditions and expectations indicators improving; however, 1-year inflation expectations unexpectedly jumped to 4.6% from 3.6% in the previous month, at 11 It was the highest level since the previous month's peak of 4.9%.

March CPI data released last Wednesday showed core inflation held steady, but the softer housing CPI was encouraging, while food prices were flat in March, the weakest level since mid-2020, while a larger-than-expected decline in energy prices also helped headline CPI The annual growth rate fell back to 5%.

The Federal Reserve's H.8 report showed that the balance sheet remained stable for the fourth consecutive week, with emergency liquidity provided to the banking system through the discount window and BTFP falling to $139.5 billion in the week ended April 12 from $149 billion in the previous week; In addition, aggregated data from 4 large banks (JPM/Citi/Wells Fargo/PNC) shows continued improvement in AOCI (minus accumulated losses) and SLR/CET 1 ratios; in addition, money market funds have only inflows of $30.3 billion, It appears that the worst of the deposit flight is over.

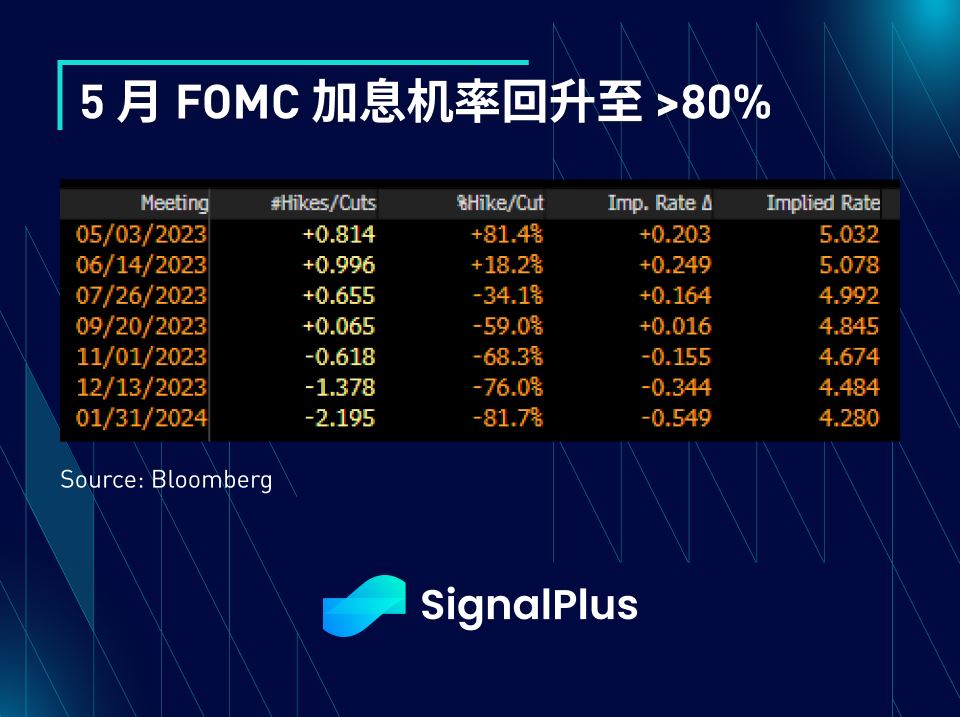

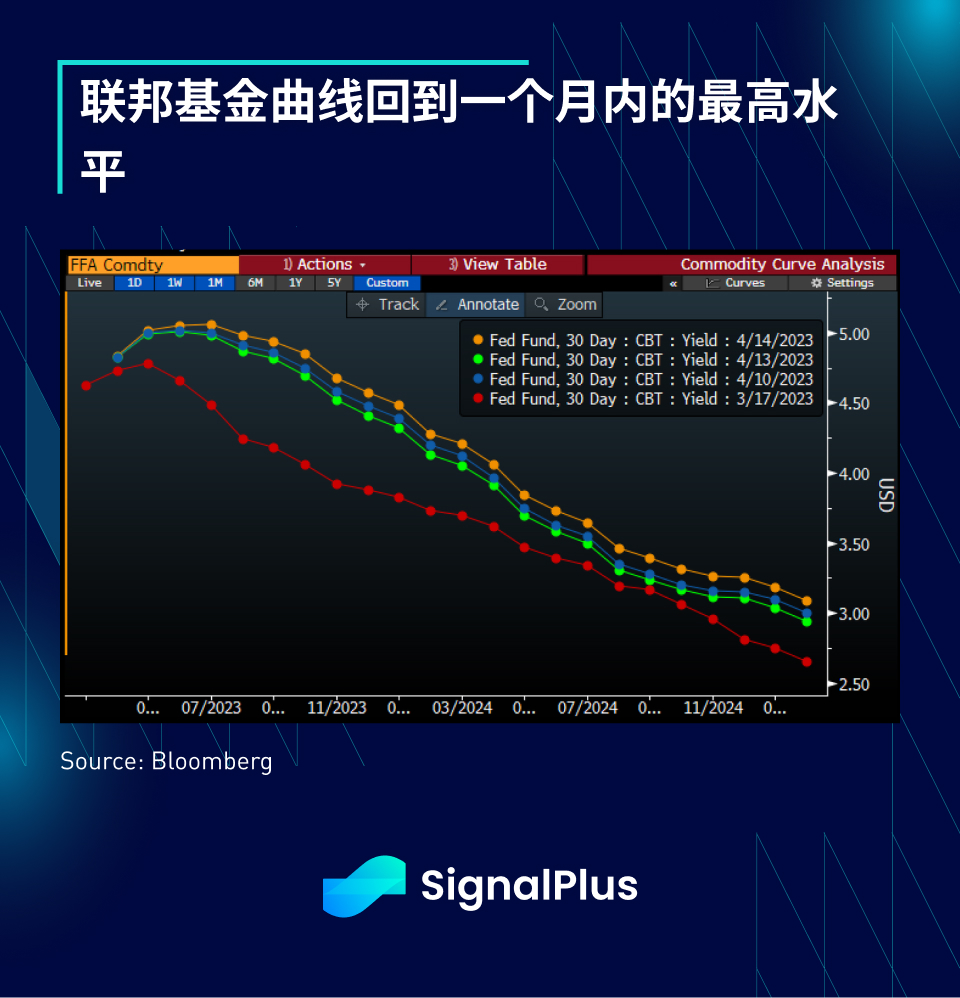

Fed rate expectations climbed back to their highest level in a month on the back of economic data results and strong stock market sentiment, with the probability of a rate hike in May rising to over 80% and market expectations for cumulative rate cuts by the end of the year less than 50 basis points. It has fallen sharply from more than 80 basis points in early March. Although the banking industry is still in turmoil and the market is worried about the coming recession, the actual economic situation shows that inflation is still above the Fed's target, employment and wage growth are still tight, the overall economic growth is still above the trend level, and the risk of the banking industry The likelihood of further contagion is also decreasing. Perhaps the current mood is best summed up on the recent cover of The Economist magazine, where the US economy continues to climb the wall of worry and the stock market continues to rise against market consensus.

Cross-asset volatility continued to retreat in April, with interest rate and FX volatility falling back to Q4 2022 levels, while equities are also returning to 3-year lows. Softer headline inflation (albeit still above target), slower wage growth, a fading banking crisis, and the fact that the Federal Reserve has yet to respond aggressively to the current expectations of rate cuts implicitly appear to conspire to create an ideal scenario for a soft landing, keeping asset prices Automatically strengthened in April.

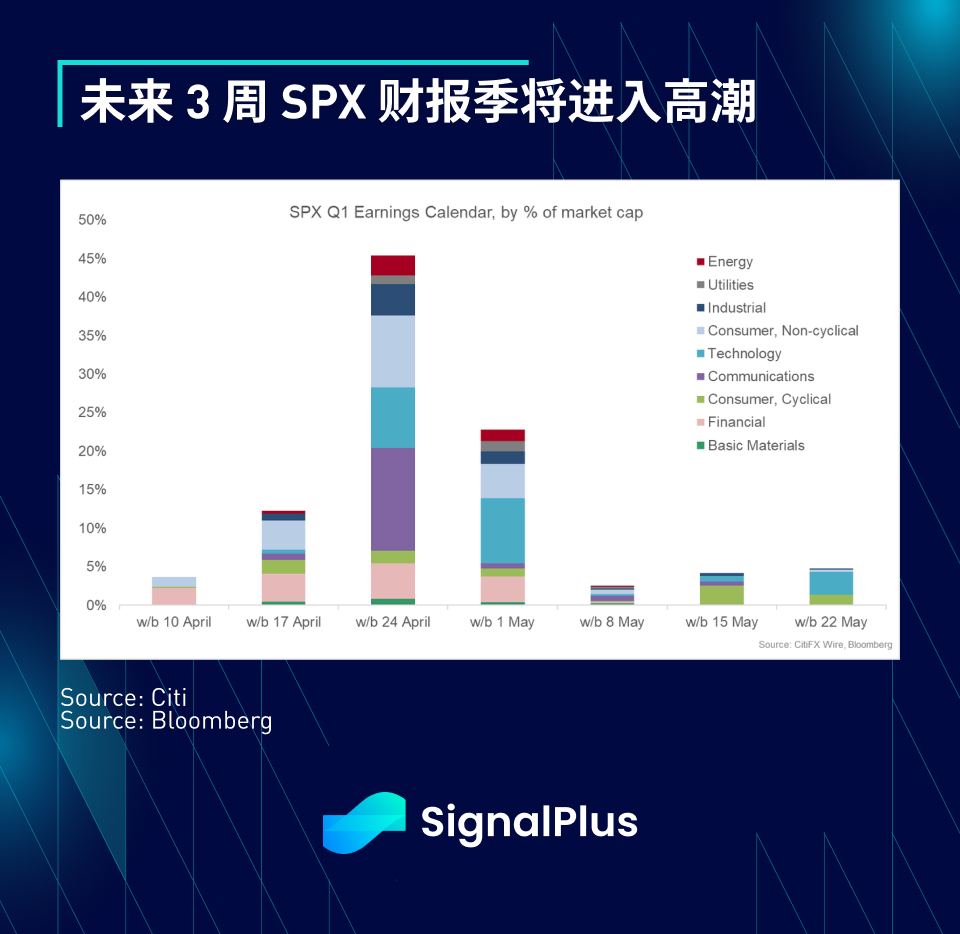

In the next 3 weeks, the US stock earnings season will enter its climax. JPMorgan Chase and Citigroup have already announced the results of their earnings first. As the net interest income was higher than expected, both of them showed good results. Despite the economic slowdown, the investment bank expects S&P 500 EPS to be flat or slightly higher in 2023, at about $225, although share buybacks are expected to slow.

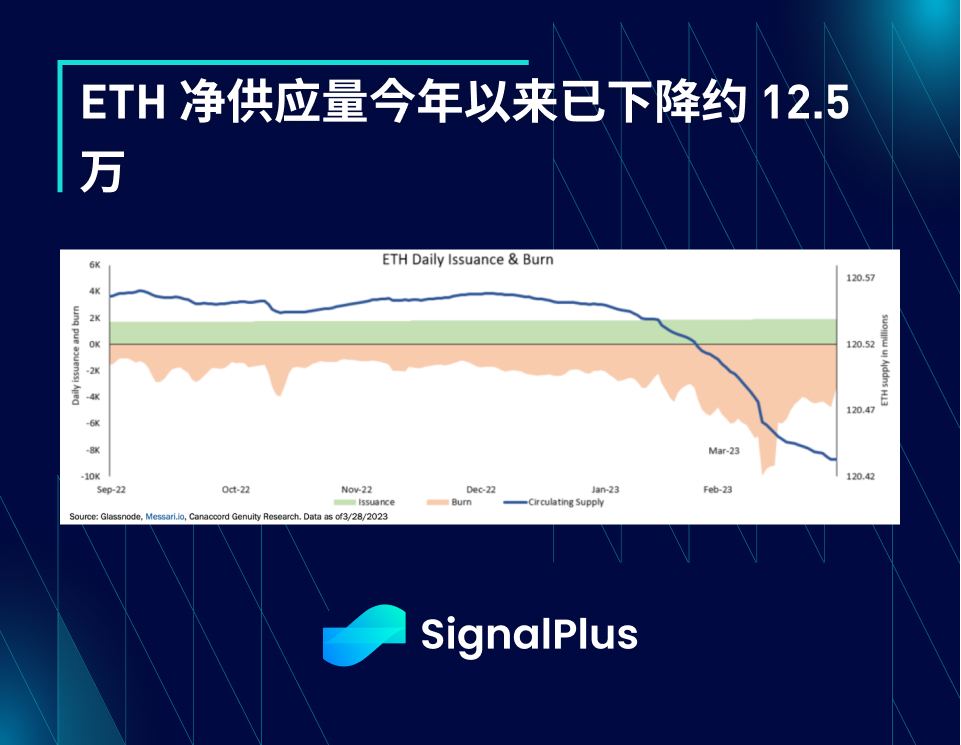

The cryptocurrency market continues to rise, gaining about 10% in the past week, and TVL activity is picking up. Ethereum completed its long-awaited Shapella upgrade on April 12, with about 185,000 withdrawn and about 304,000 ETH distributed in the ensuing 48 hours, however, ETH did not fall on fears of increased supply , but rose by 10% after Shapella, and a large number of futures short positions were liquidated (about 250 million US dollars) as the spot ETH price broke through 2,000 US dollars, reaching the highest level since May last year.

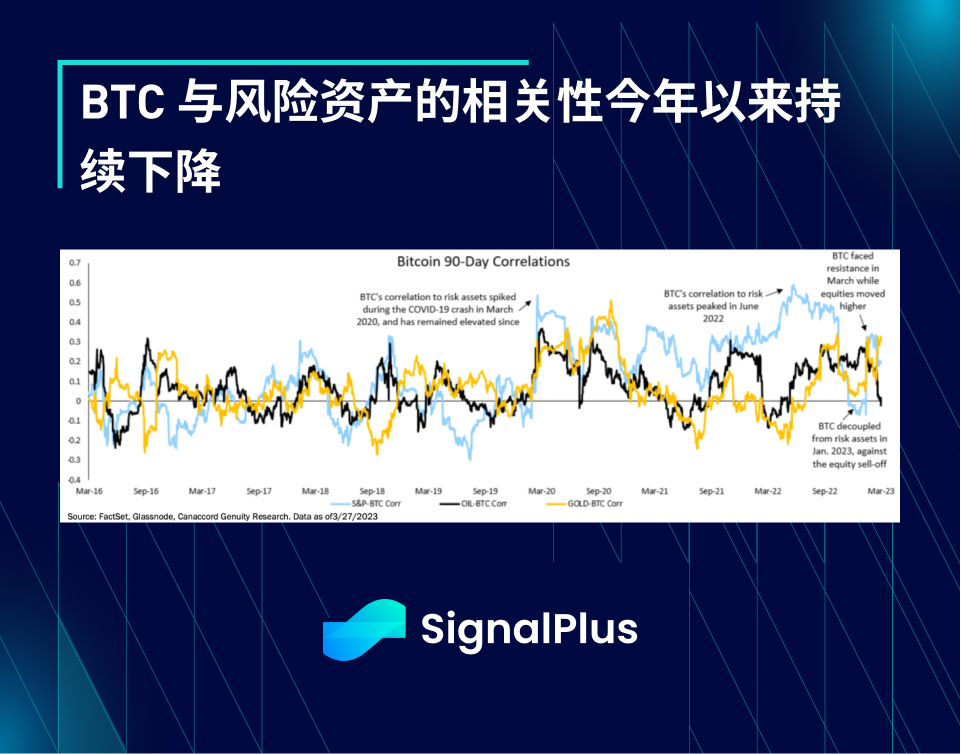

Similar to U.S. stocks, cryptocurrencies are up about 70 percent this year, beating expectations despite intense regulatory pressure and U.S. overnight interest rates currently as high as 5 percent. Additionally, while BTC prices hit 12-month highs, rolling correlations with risky assets have been declining since the start of the year, and BTC dominance has rebounded to about 45% due to recent concerns over stablecoins.

Crypto options volatility rebounded slightly after the Ethereum upgrade, but overall volatility remained relatively subdued despite the sharp rise in spot prices. ETH volatility skew has also returned to normal levels as sell-off concerns ease.

The U.S. Congress has drafted a framework bill covering stablecoin regulation ahead of a hearing on April 19. While we are not legal experts and the following is not legal advice, some key highlights include:

- The Federal Reserve will be responsible for regulating stablecoin issuers such as Circle and Tether, while deposit issuers covered by insurance will be regulated by the corresponding federal banking regulators.

- The details of the process for obtaining the license are unclear, but appear to be at the discretion of the relevant U.S. regulators.

- A 2-year moratorium on the issuance of stablecoins that are not backed by tangible assets.

- Offering stablecoins in the US without a license and transferring unlicensed stablecoins to US entities will be punished with up to 5 years in prison, which will apply to global issuers.

- Do not allow "Endogenously collateralized stablecoins" and unlicensed foreign-issued stablecoins to operate in the United States.

- Foreign currency stablecoins can be licensed but must be backed by USD assets.

- On the other hand, licensed stablecoin issuers (such as USDC) may have the opportunity to use Fed accounts directly.

- An official study on CBDC has been carried out, which mentions many details and standards.

https://docs.house.gov/meetings/BA/BA 21/20230419/115753/BILLS-118 pih-Toproviderequirementsforpaymentstablecoinissuersresearchonadigitaldollarandforotherpurposes.pdf

Finally, the sub-forum held by SignalPlus at the HK Web3 Festival last week was very successful, thank you very much for your support! We will share more content summaries on the official Twitter and TG groups in the future. We welcome your attention and look forward to seeing you again in the next event!

https://twitter.com/i/web/status/1646438075575447552

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/