Bixin Ventures: Will Pendle open up a new paradigm for yield trading?

investment logic

secondary title

The Complete Yield Strategy Toolkit

In the traditional financial market, the daily trading volume of interest rate derivatives is as high as trillions, and market participants can use this financial product to speculate or hedge interest rate fluctuations. As decentralized finance (DeFi) continues to mature, the opportunities for these types of gains will gradually increase. Whether providing liquidity for trades on GMX/Gains Network or participating in liquidity staking like Lido, yield-seeking investors have many options. But how do users trade yield in today's market? For example, what if I believe that the yield currently offered by GLP is undervalued and is expected to rise in the next few days? What if I believe that the current Stargate yield does not accurately reflect stablecoin trading volume and may fall rapidly? What if I just want to maintain a market neutral position and earn extra income?Vu Gaba Vineb provides a succinct overview of ETH and LSD yield changes as opportunities for short-term yield speculation such as the Ethereum Shapella upgrade emerge.various possibilities

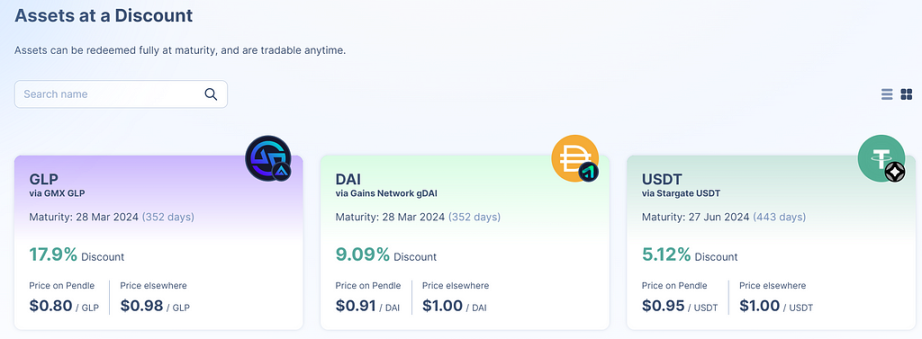

— — Whether you think it will go up, down or sideways, Pendle has a corresponding strategy for you to profit.EquilibriaPendle provides users with a complete set of tools to enjoy fixed income through discounted asset purchases, speculate on income through YT (more on this below), or participate in their capital pools and earn additional income through exchange fees and rewards. picture

We are excited that Pendle is opening up a new paradigm for yield traders as they can now manage the risk of their holdings in response to market volatility.

secondary title

Founded in 2021, Pendle Finance is a decentralized finance (DeFi) protocol, where users can purchase assets at discounted prices, participate in various income strategies, or earn income by providing liquidity for the fund pool. Currently, Pendle has been deployed on Ethereum and Arbitrum. TVL has grown from $7.8 million in December 2022 to $60.5 million today, an increase of nearly 775% in just five months.

secondary title

SY, PT and YT

Pendle is a yield trading protocol. We can mark the yield of interest-bearing assets (such as GLP, stETH, aUSDC, etc.) as YT and PT, where holding YT will earn yield, and PT represents the principal. Users will be able to purchase PT at a discounted price as the revenue portion of YT is stripped. For example, buying PT-GLP is equivalent to getting GLP at a discounted price, and 1 PT-GLP can be exchanged for 1 GLP at maturity. How is the PT-GLP discount determined? Fundamentally, the discount rate is determined by the market demand for PT-GLP. If there is a large demand for PT-GLP, the discount will naturally decrease, otherwise the demand will be small.

What is SY? It is a token standard, and SY implements a standardized API for interest-earning assets in the form of Wrap in smart contracts.

For users who want to avoid volatility, PT tokens can be purchased at a discounted price at the moment and held to maturity. For example, if PT-GLP is trading at a 22.5% discount, it means that if you buy 1 PT-GLP today, the trader essentially locks in a 22.5% gain and gets a fixed return. If the trader also believes that the future yield will be less than 22.5%, this gives you the opportunity to sell PT-GLP at a profit or at a higher yield than just holding GLP. On the other hand, users who wish to speculate on future yields can purchase YT tokens to increase their exposure to yields. In this case, you may think that the 22.5% yield is undervalued, then you can buy 1 YT-GLP today and sell it when the yield rises above 22.5%, or earn extra yield before expiration. In short, buying PT is equivalent to short-selling yield, while buying YT is equivalent to long-selling yield.

secondary title

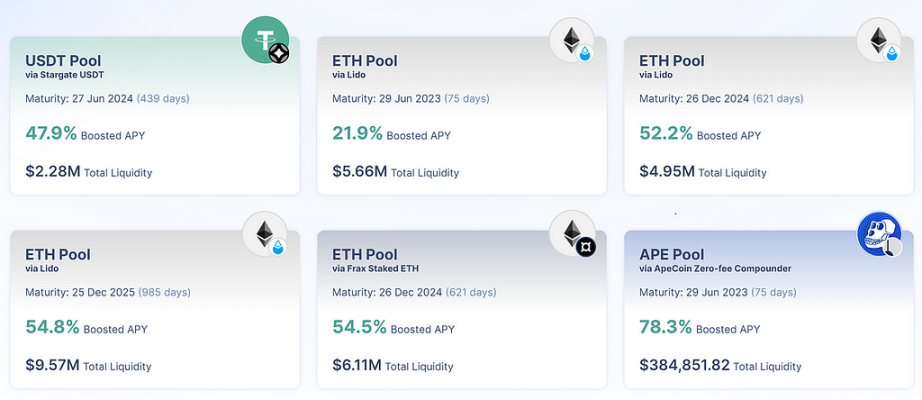

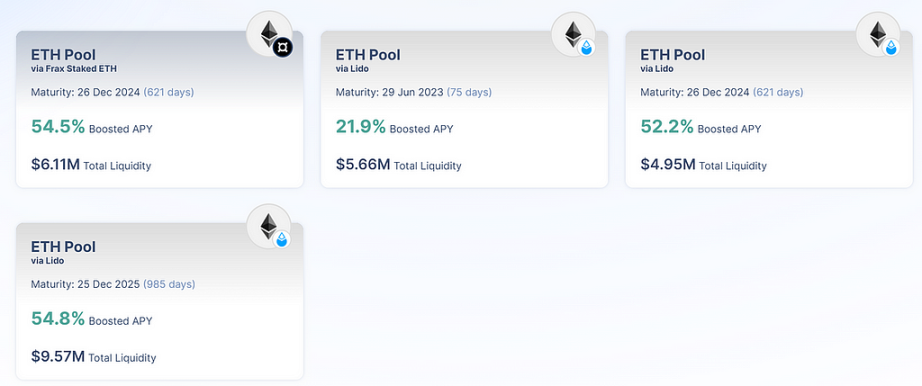

For users looking for a more passive strategy, liquidity pools on Pendle are the easy way to go. The annualized rate of return (APY) of the pool consists of four sources of income: (a) fixed rate of return from holding PT to maturity; (b) underlying token protocol rewards from income assets (such as GLP); © from SY , PT and YT transaction fees; (d) Pendle rewards; get additional income from vePendle by staking Pendle. As you can see, these benefits are very attractive, and due to the high correlation between pool assets, coupled with Pendle's unique Automated Market Maker (AMM) design, users face almost no impermanent losses. We should see an increase in interest-earning assets over time.

secondary title

Unique AMM Design

In Pendle v2, the main innovation is the AMM trading platform designed and built for yield trading. Since the assets in the pool are highly correlated, this will reduce the impermanent loss (IL) caused by volatility. What's more, if the asset stays in the pool until maturity, then the impermanent loss will be 0. Because at maturity, the PT in the pool will be equal to the underlying asset. In conclusion, users will be able to trade between SY, PT and YT with little to no impermanent loss.

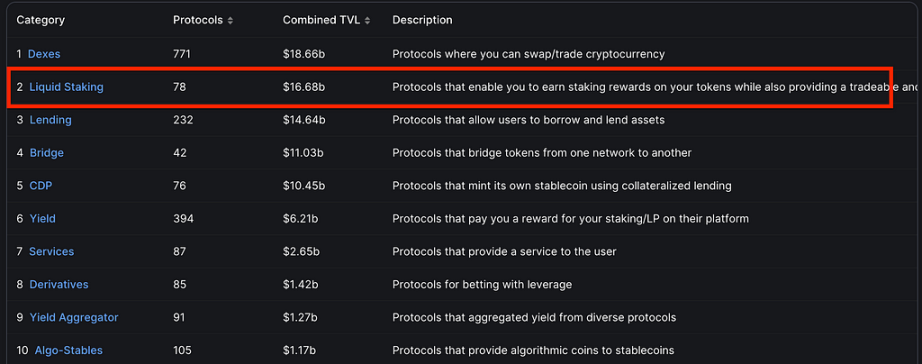

With the emergence of various interest-bearing assets, whether generated through lending platforms (such as Aave, Compound, etc.) or through staking on the LSD platform, Pendle has a huge market to expand.

vePENDLE

secondary title

Pendle draws on the models of veCurve and Solidly. Existing token holders can pledge $Pendle to obtain $vePendle, thereby reducing the circulating supply of $Pendle in the market. One of the main attractions of $vePendle is to earn a portion of the protocol revenue. Today, there are two protocol revenue streams in Pendle V2:

a) YT fee: Pendle takes 3% of all revenue generated by YT

b) Swap fee: Pendle takes 0.1% of the transaction value, which decreases as the expiration time shortens and vice versa. 20% of the above fees go to liquidity providers and the rest will be distributed to $vePendle holders. In addition, PT benefits that have expired will also be distributed pro rata

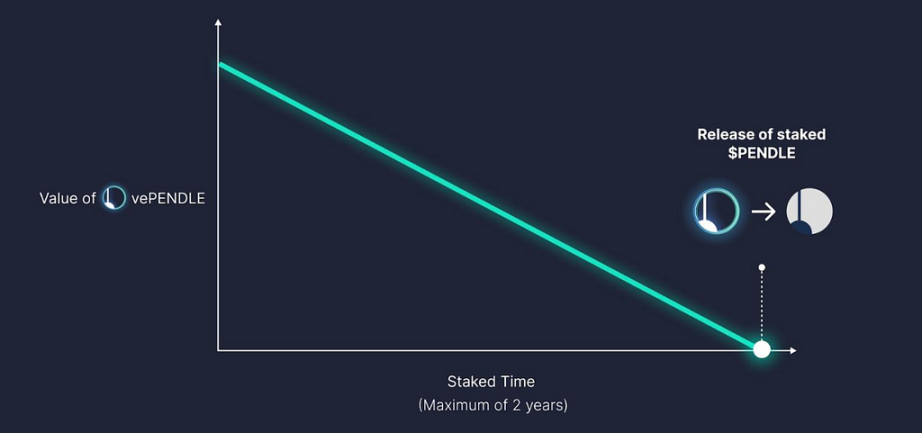

d) $vePendle will decrease linearly within 2 years, after which $Pendle will be released. Therefore, users wishing to maintain their voting weight / $vePendle token value will need to extend their stake duration or stake amount

Drivers of recent growth

secondary title

LSDs will explode

After the Shapella upgrade, users will be able to withdraw Ethereum. In this way, liquid mortgage derivatives will be able to better maintain their anchor prices, making them better collateral for borrowing, which will increase the utilization rate of DeFi protocols. As of April 6, 2023, Defillama data shows that the TVL of the LSD industry has grown to $16.6 billion, ranking second among all DeFi sub-sectors.Discount assets。

secondary title

Gaps in fixed income products in the market

Fixed income products are commonplace in traditional finance, but less common in the cryptocurrency space. Yield volatility has always been one of the themes of cryptocurrencies. For example, the yield of stETH usually fluctuates between 4-5% in the last 30 days, peaking at 7.1%, and even reaching 10.2% in November 2022.

first level title

in conclusion

in conclusion

In conclusion, we believe that Pendle now provides users with a variety of tools to manage various earning strategies. The market for fixed income and interest rate derivatives in traditional finance is huge, and we believe Pendle will be able to attract the attention and favor of more institutional capital over time.

Pendle uses a standardized form to tokenize interest-bearing assets, which makes it easier to integrate other interest-bearing assets in the future, and unlocks more composability for other DeFi protocols, allowing them to integrate Pendle or build more on top of Pendle. More and richer applications.