SignalPlus Daily Information (20230405)

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

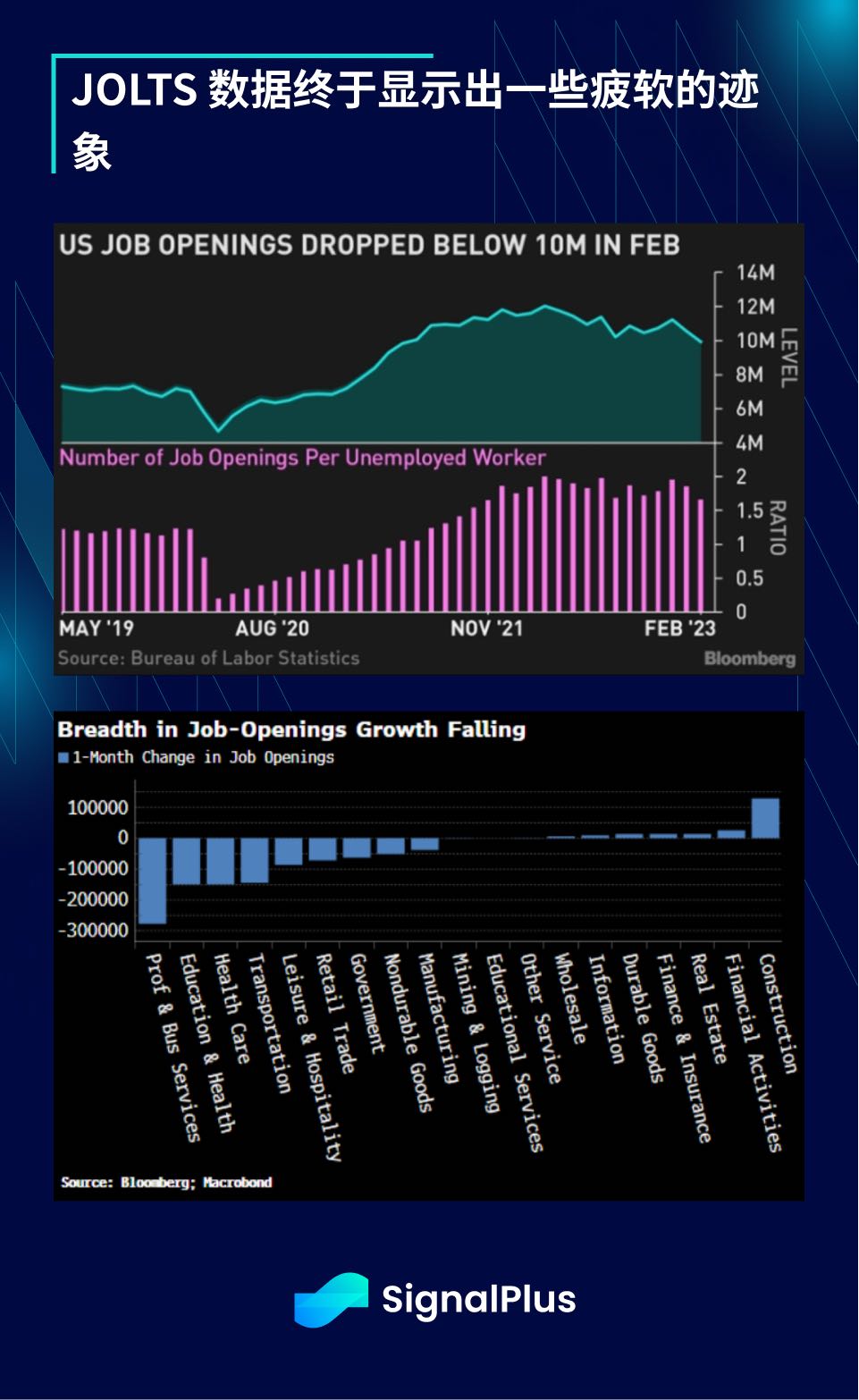

The JOLTS data finally showed some signs of weakness, with job vacancies falling by 632,000 to 9.931 million in February, the lowest since May 2021; the job openings-to-unemployed ratio was 1.7, and the job vacancy rate fell from 6.4% in January 6%, also lower than the high of 7.4% in March last year; the number of hiring fell to 6.163 million from the previous 6.327 million, and the pace of hiring slipped to 4%, the lowest since December 2020; the weakness in job vacancies was seen in all Among the industries, the construction industry was the only one showing growth.

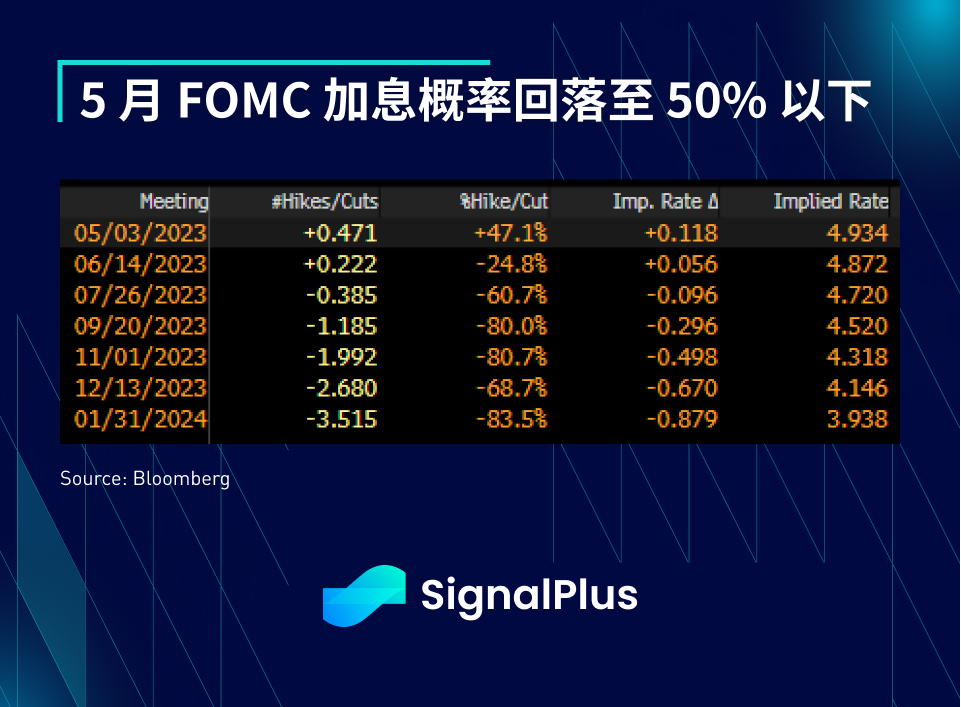

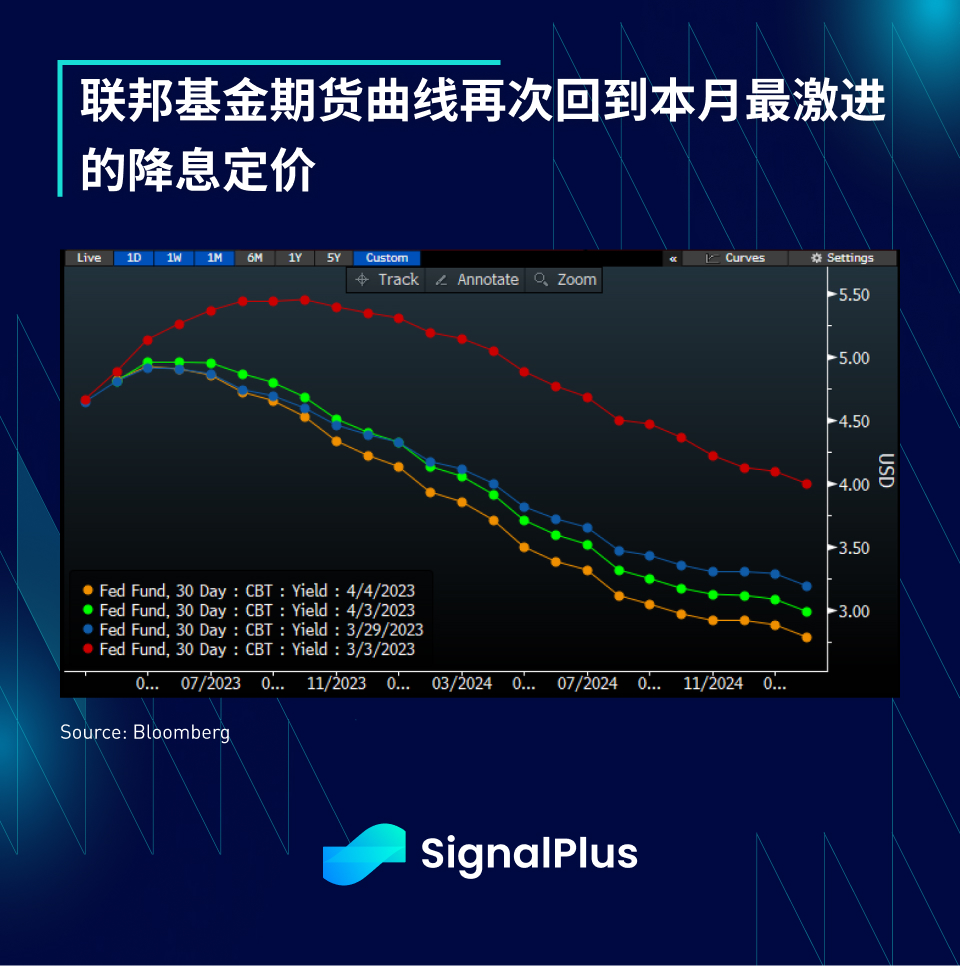

U.S. bond yields fell across the board. As the market predicted that the probability of FOMC raising interest rates in May fell below 50%, the 2-year yield fell 12.5 basis points to 3.84%, and the 2/10-year yield curve steepened 7 basis points In addition, the federal funds futures curve has once again priced in a cumulative rate cut of close to 80 basis points before the end of the year, with the entire forward curve falling to its lowest level this month.

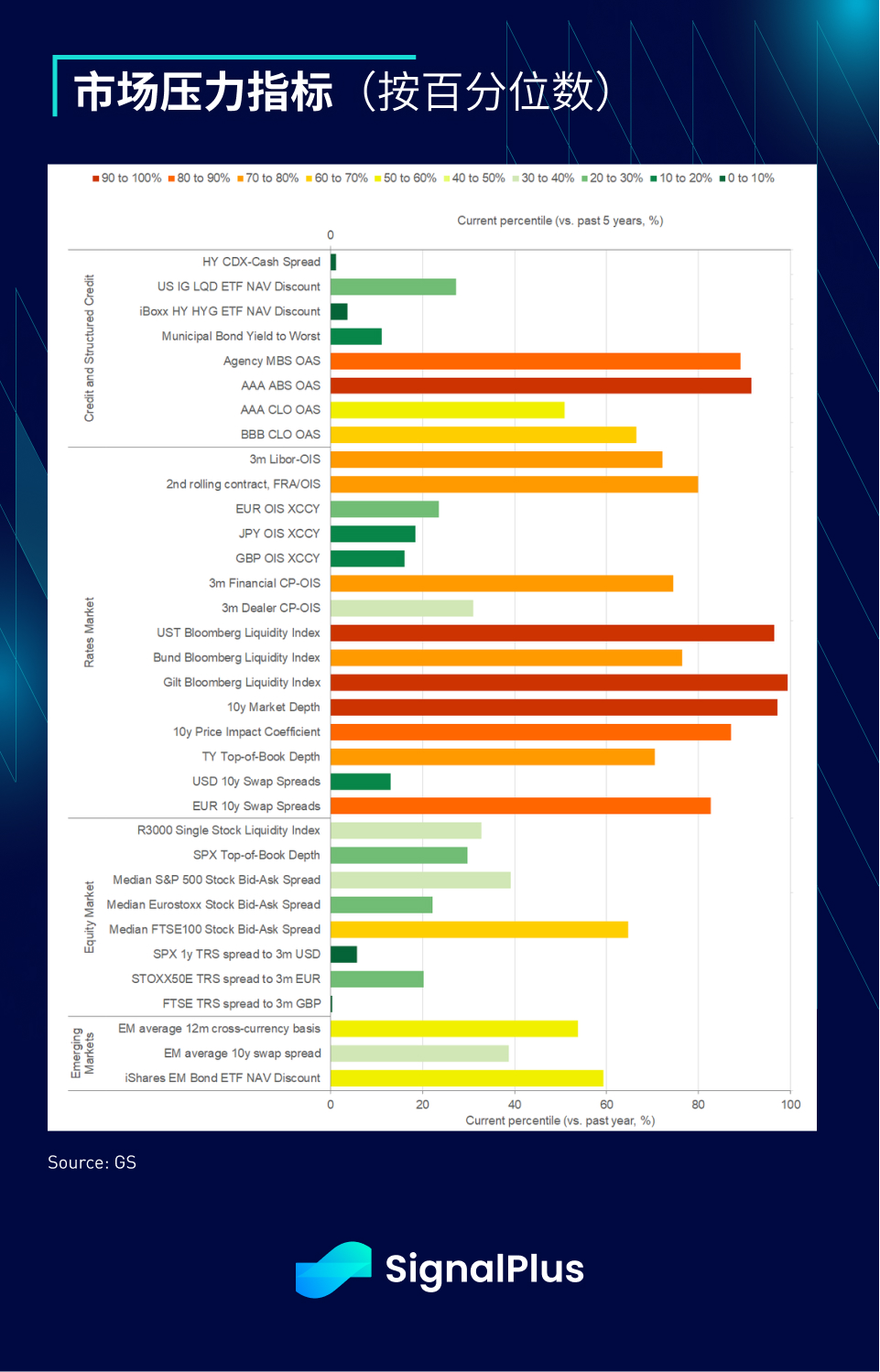

Weak US economic data (JOLTS missed expectations, Atlanta Fed GDP cut, US factory orders, etc.) led to a cooling of risk sentiment in the market, interest rates fell, the yen rose, CDS spreads widened, gold prices broke through the 2k mark, the S&P 500 index It slipped 0.6 percent, driven by losses in economically sensitive sectors. Equities are still doing well relative to other asset classes, as corporate earnings are expected to hold up (at least for now) and investor positions seem to have tilted bearish based on investor sentiment indicators. Additionally, April has been the best month for the S&P 500 based on historical data going back to 2001, a fact that will no doubt be of interest to short-term investors and traders in the current environment.

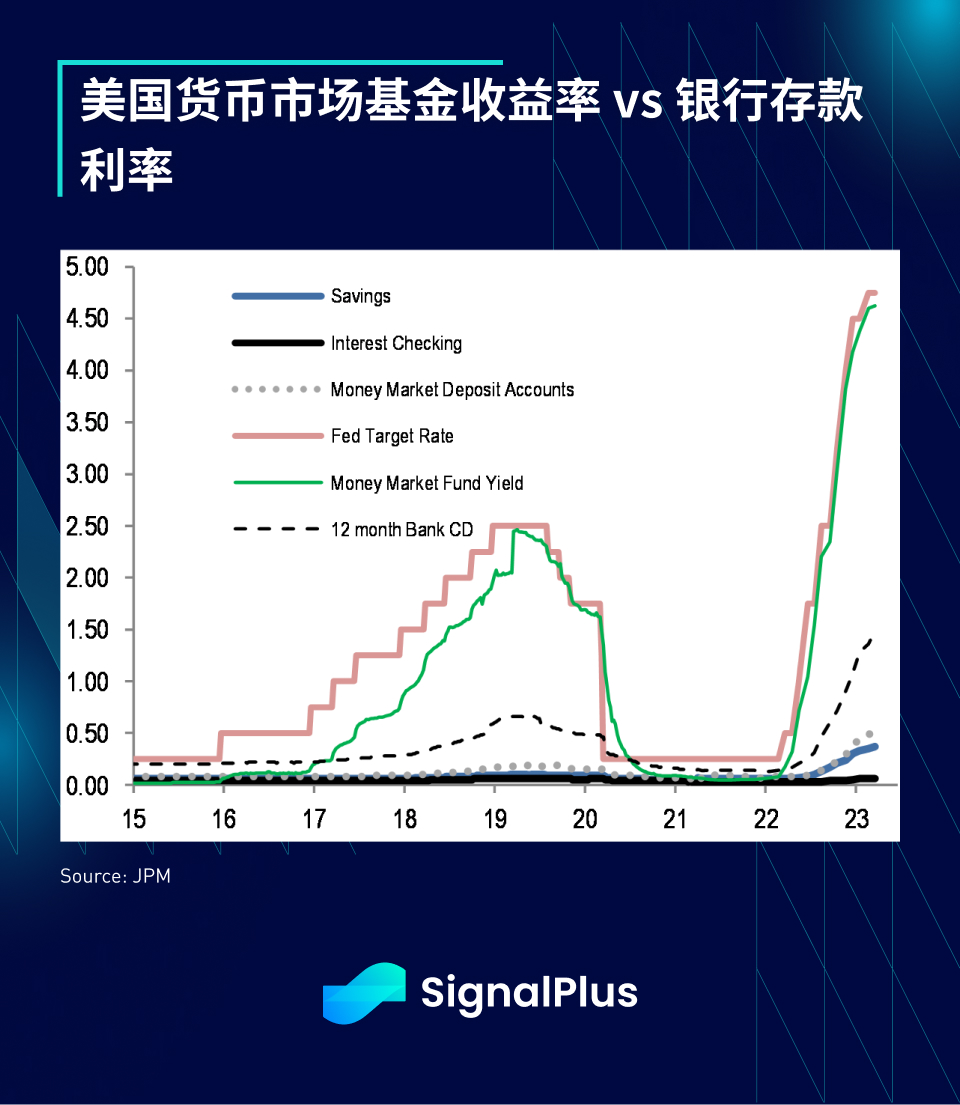

Since the banking industry failed to raise deposit rates as soon as possible, deposits continued to flow to money market funds, and there was still a large gap between bank deposit rates and money market rates. BTFP plan (at a cost of OIS+ 10 bp) to fund the deposit gap, apparently thinking it would be a relatively small hit to their NIM (net profit margin).

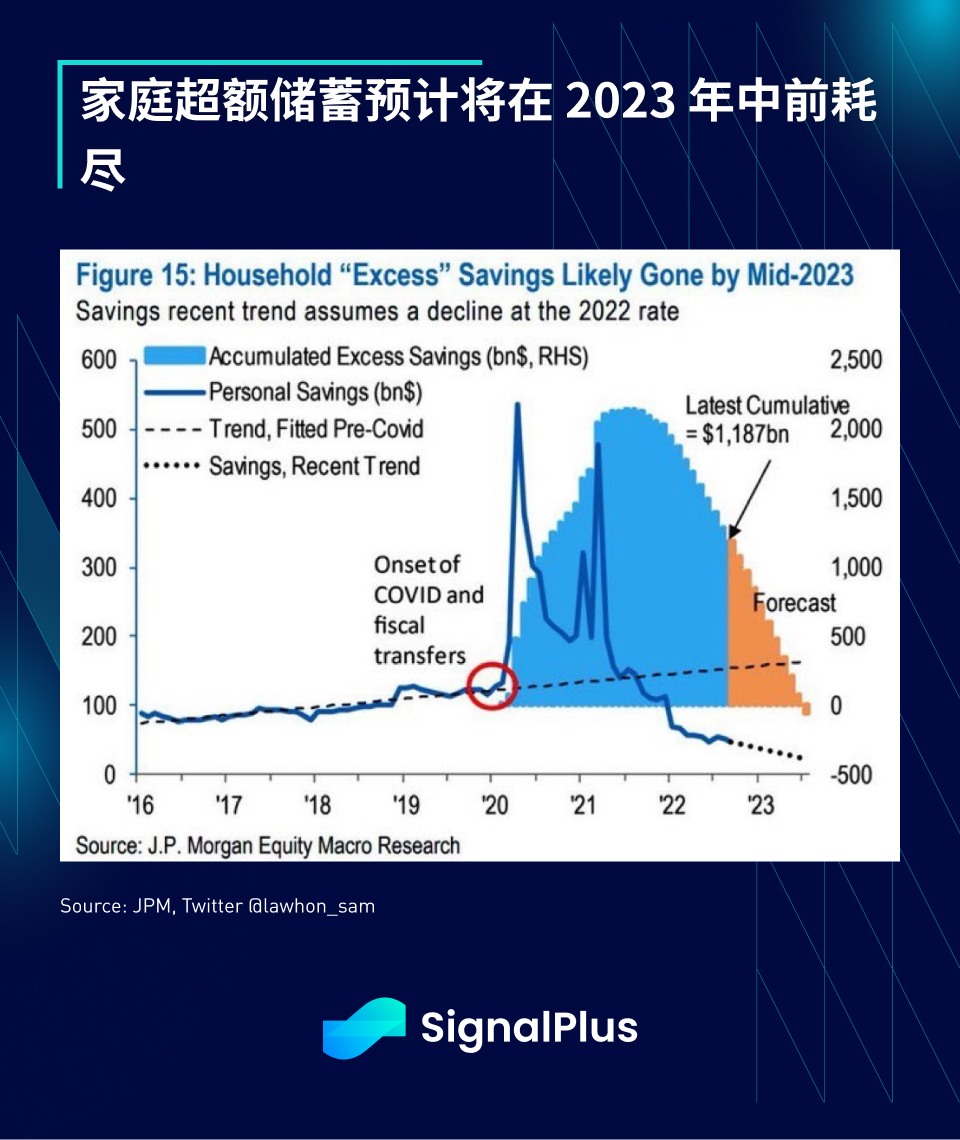

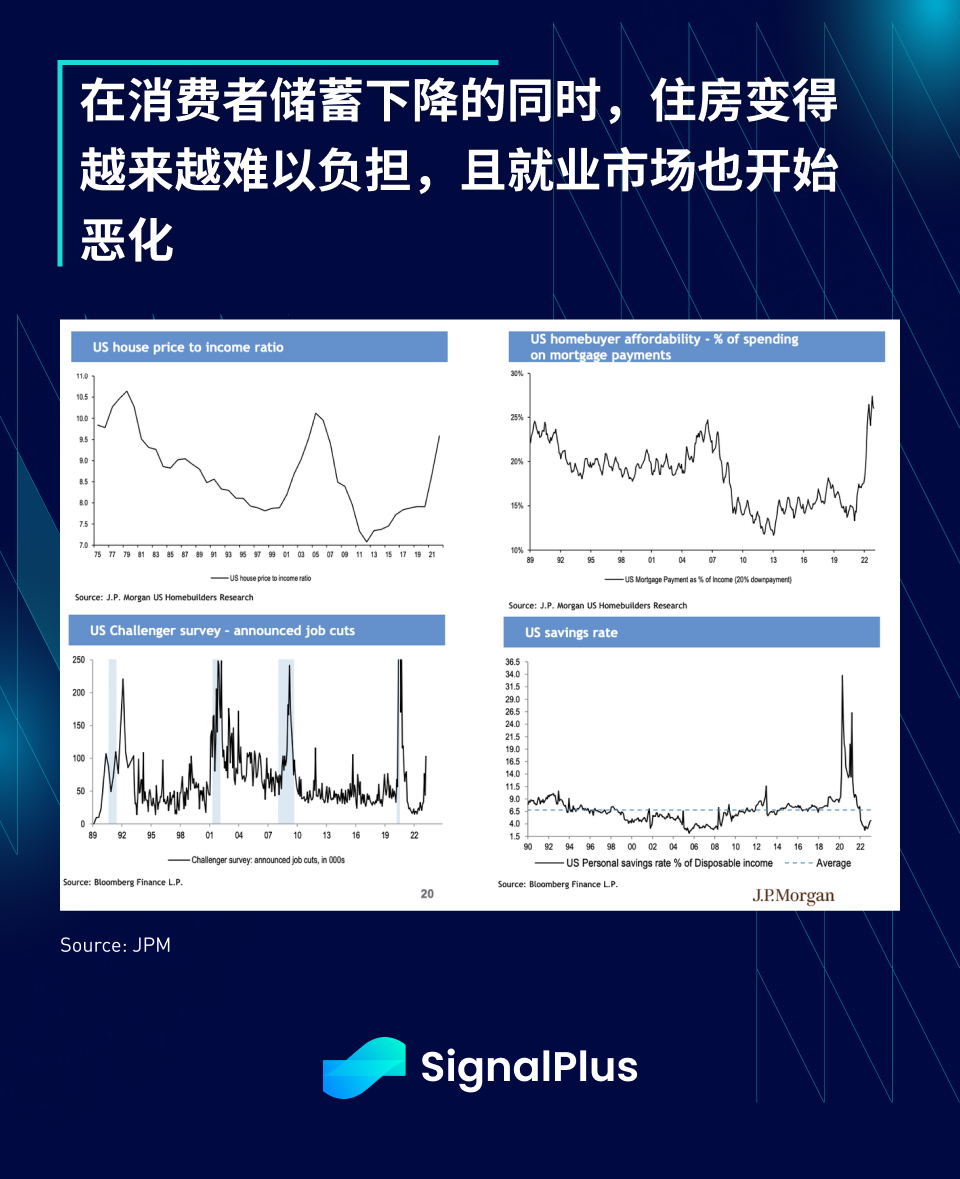

The U.S. consumer situation is finally showing signs of deterioration. The total credit card balance of American consumers has broken through a record high and has been rising since the epidemic. JPMorgan Chase predicts that household excess savings will be exhausted by mid-2023, and the total savings rate is currently at its lowest level since 2007. Household affordability is also hovering near historic lows at a time when layoffs are finally starting to pick up.

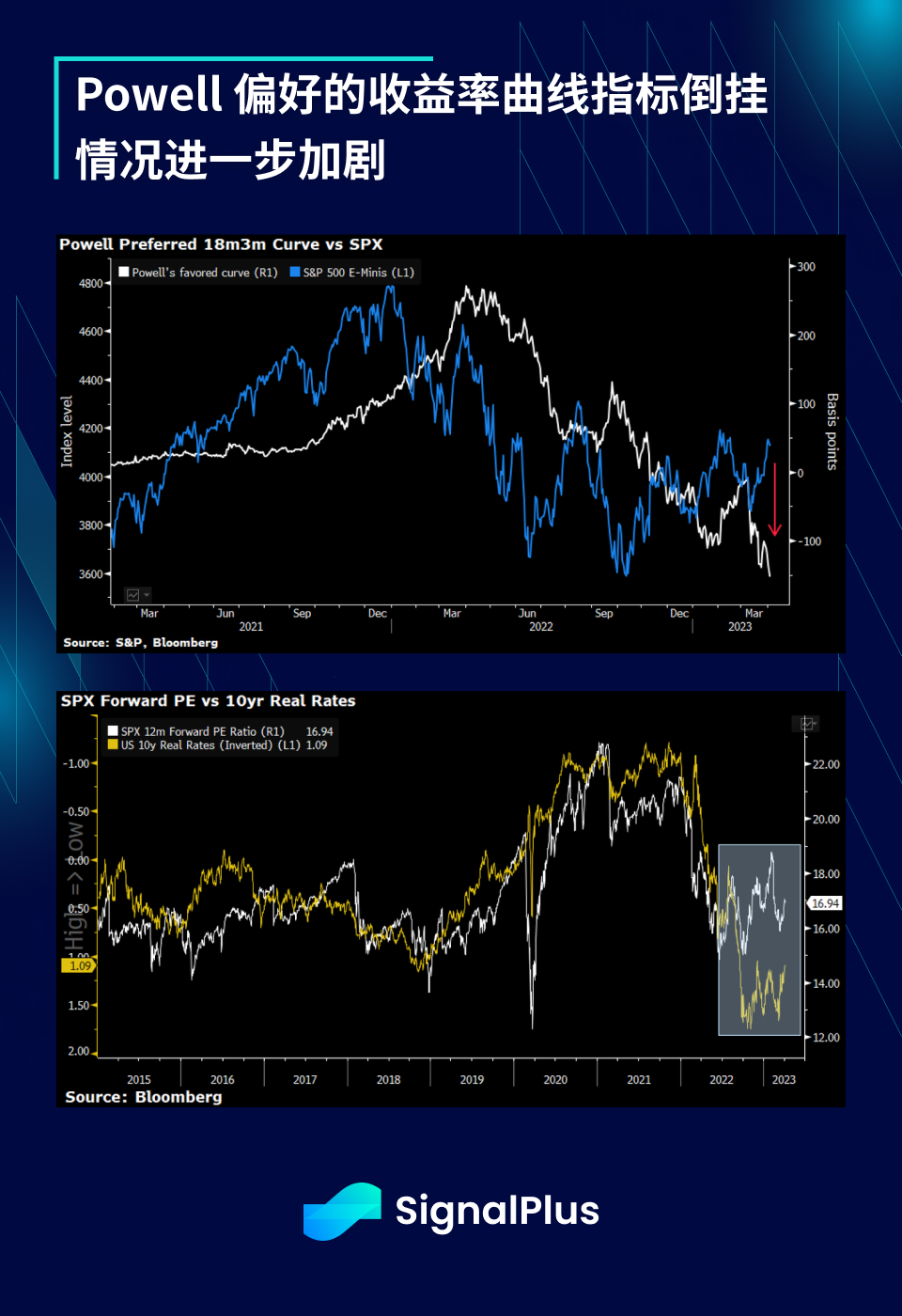

The inversion of Powell's preferred yield curve measure has intensified further, signaling fears of a worsening economic slowdown. Equity markets, on the other hand, continue to outperform and diverge from the yield curve and overall interest rate levels, a possibility we have been reminded of since January and could remain elevated until corporate earnings actually decline. Earnings season kicks off in full force in about 3 weeks, and this will be the next critical period where stock prices will recalibrate based on actual first quarter results.

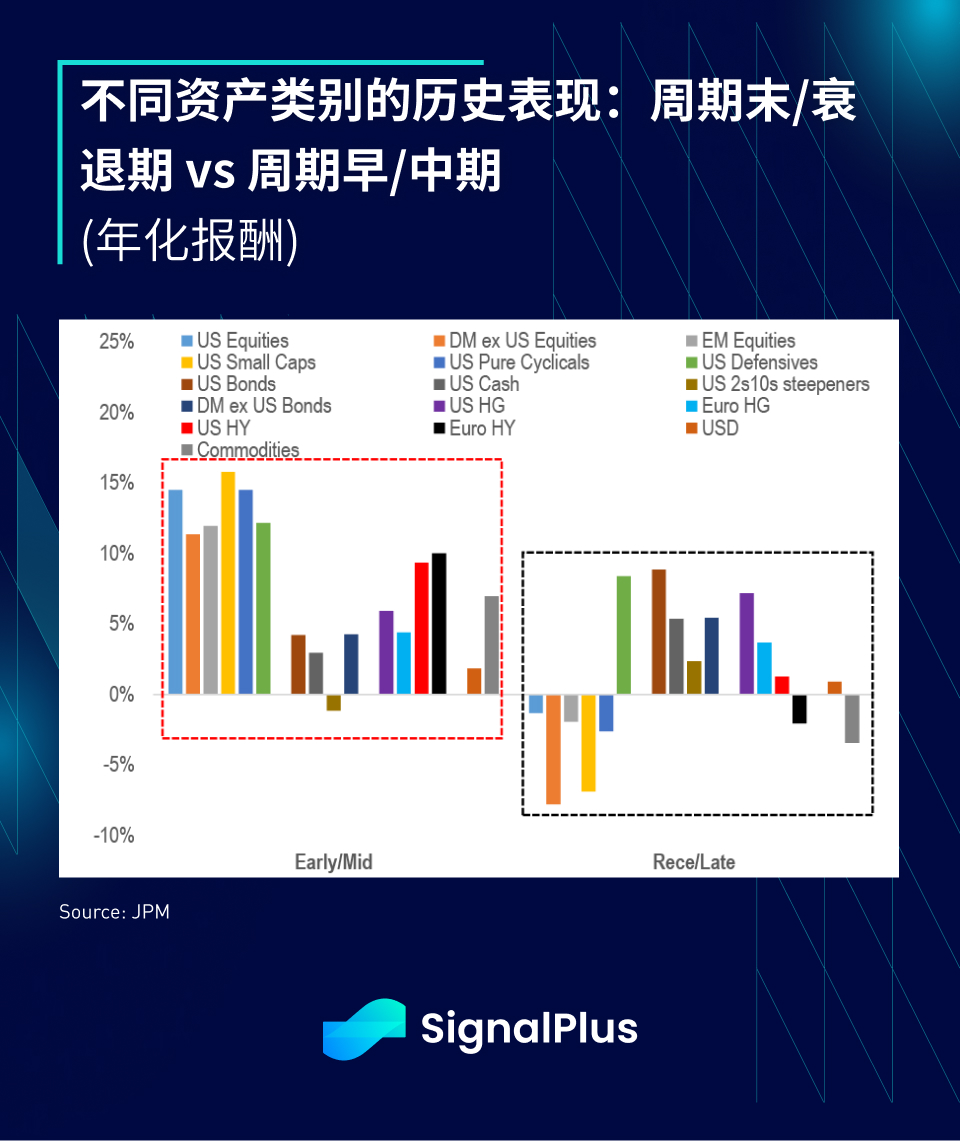

The historical performance of different asset classes shows that defensive stocks seem to be better held than large-cap stocks during late cycle and recession. Historically, stocks other than defensive stocks may return below average. The yield curve will also tend to steepen, which is what we have seen over the past month.

Please note that the Morning News will be suspended for a short period of time starting tomorrow and we will resume next Thursday 13th April. The SignalPlus team will participate in the Web3 Festival held by Wanxiang Blockchain Labs and HashKey Group at the Hong Kong Convention and Exhibition Center next week. We have prepared a series of exciting and rich keynote speeches and roundtable forum sessions on the afternoon of April 12th. Welcome to the Web3 Festival in Hong Kong! Friends come and participate in person, we really look forward to meeting you!

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/