SignalPlus Daily Information (20230404)

Dear friends, welcome to SignalPlus Daily Information. SignalPlus Information updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Information. SignalPlus Information updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

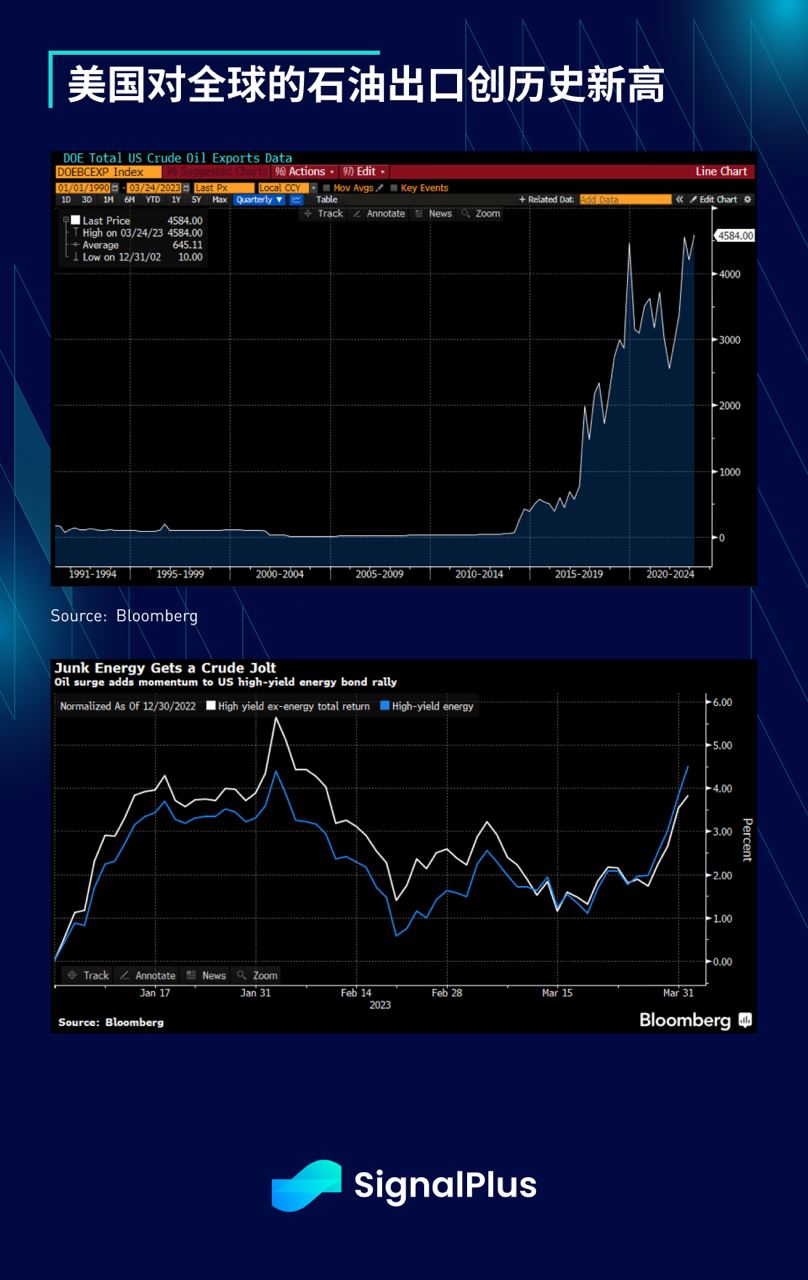

- OPEC+ unexpectedly announced that it will cut production by 1.16 million barrels per day from May 2023. Oil prices jumped more than 6% on Monday. The fundamentals of crude oil have gradually weakened in the past few months, especially the growth rate of crude oil inventories in 2023 is faster than expected A slower-than-expected reopening of China and record U.S. oil exports to the world have traders already heavily shorting crude futures, so a bigger-than-expected price increase shouldn't be too surprising.

- Rising oil prices will make the Fed's job trickier, as economic surveys and data show signs of a persistent pullback in inflation and a softening labor market, which could once again complicate the inflation outlook in the coming months, especially This is when the SPR (Strategic Petroleum Reserve) in the US probably hasn't been replenished yet, so it won't act as a buffer this time around. St. Louis Fed's Bullard said OPEC's decision to cut production was a "surprise" and that a surprise rise in oil prices could make the Fed's job of fighting inflation more challenging.

- The ISM manufacturing index in the US fell 1.4 to 46.3 in March, below expectations, the lowest level since May 2020 and has been in contraction since November 2022. Among them, the employment index fell for the third consecutive month, from 49.1 to 46.9, the new orders index fell from 47 to 44.3, and the payment price index also fell from 51.3 to 49.2; the stock market did not fluctuate much after the release of the data. The problem is that the market chooses to focus on the positive news of softening inflation items.

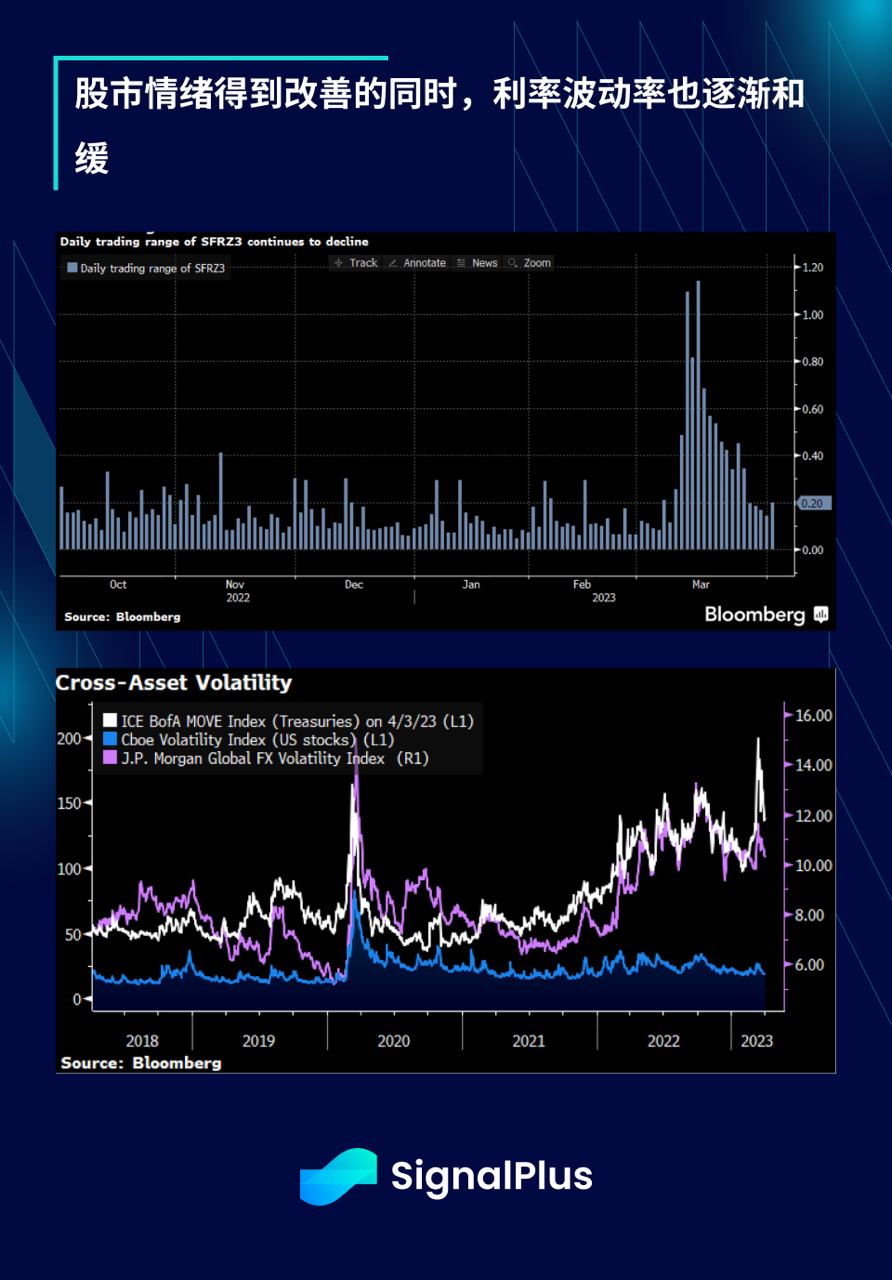

- While stock market sentiment has improved, interest rate volatility has gradually moderated. December SOFR futures saw their lowest intraday volatility since early March, while the overall MOVE index also retreated sharply from its March high. Market forecasts are back to about a 65% chance of a rate hike in May, and expectations for cumulative rate cuts by the end of 2023 are about 60 basis points, down from 85 basis points a few weeks ago.

- The CPI is the last major event that can be expected before the full start of the earnings season, and the next focus will be on U.S. corporate stocks. We'll learn more about how corporate management's operating outlook has changed following the 1Q banking turmoil and the Fed's sharp drop in the forward discount rate, expecting the next move in stocks to be driven by corporate earnings performance rather than macro data outcomes .

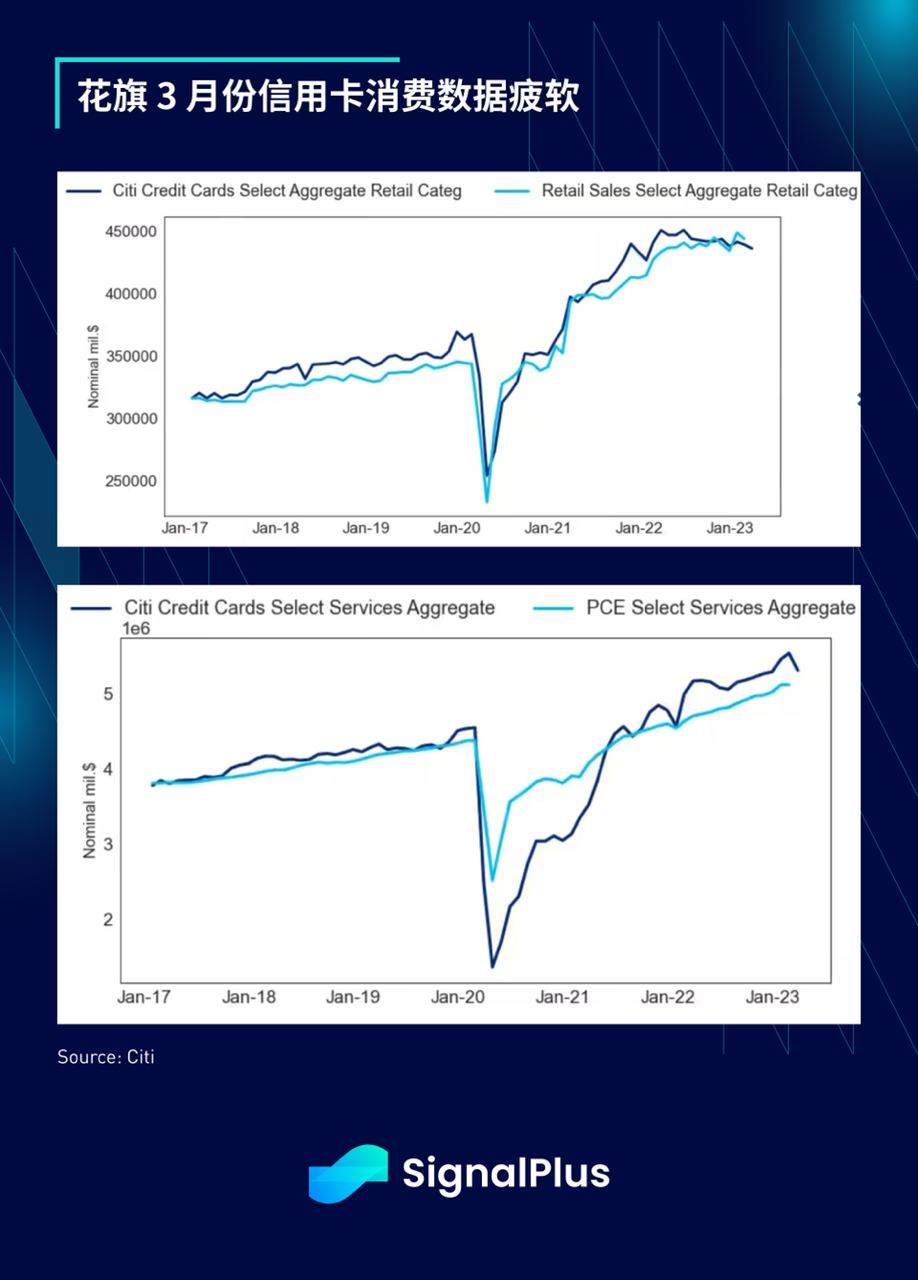

- Citi's March credit card consumption data is weak, and the preliminary estimate is that consumer spending will drop by about 0.7% month-on-month, indicating that overall consumption is gradually slowing down from 2022 levels. drag.

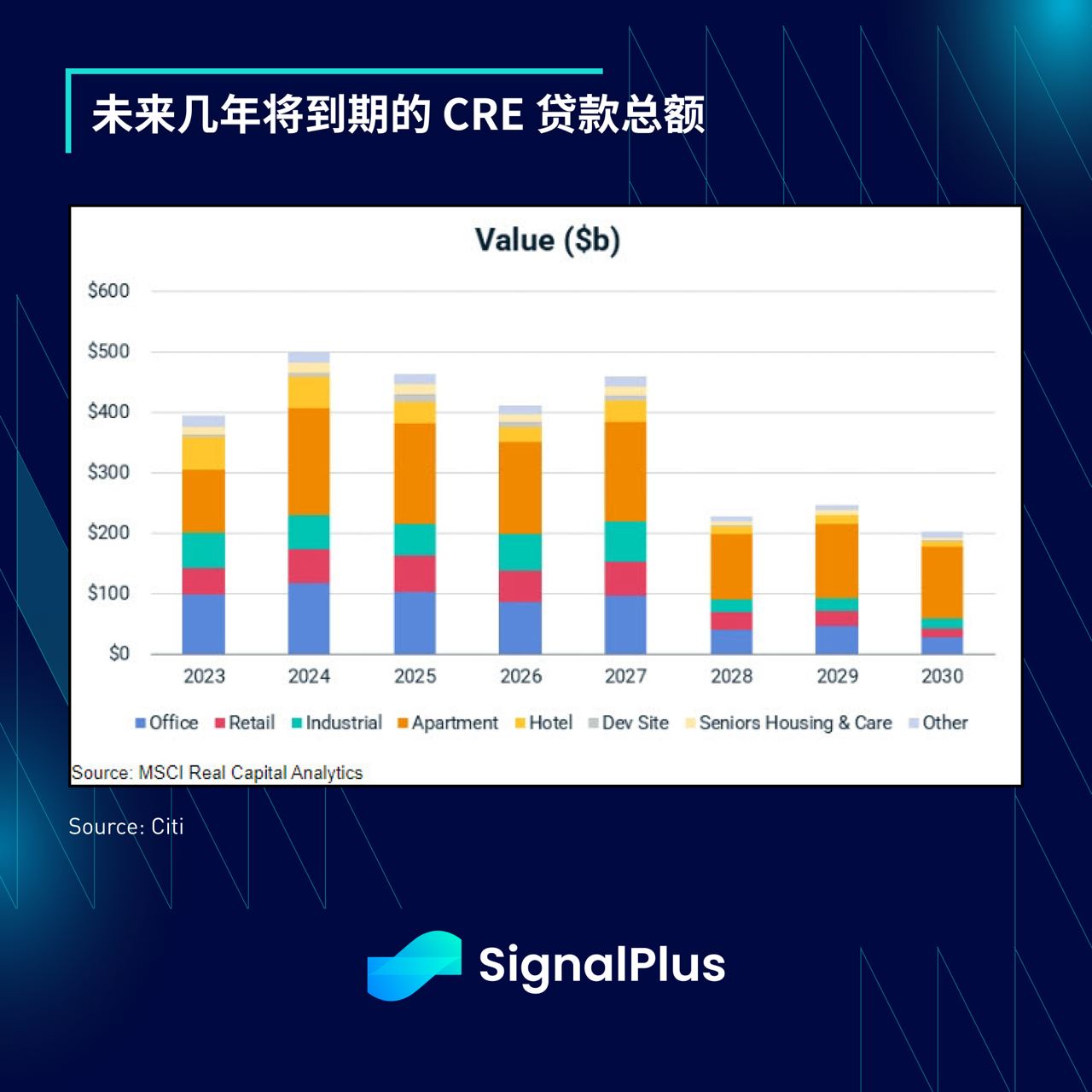

- Commercial real estate woes were back in the news as Blackstone's $70 billion high-net-worth real estate trust faced a massive $4.5 billion redemption request in March, following a $3.9 billion redemption request in February, forcing The company restricted customer withdrawals for 5 months in a row; the $20 trillion CRE market has about $5.5 trillion in debt financing, about half of which comes from commercial banks, and about $900 billion of that debt will be sold in 2023 and 2024 Years to maturity, the interest rate for the rollover will be much higher than when financing was originally financed in the ZIRP era.

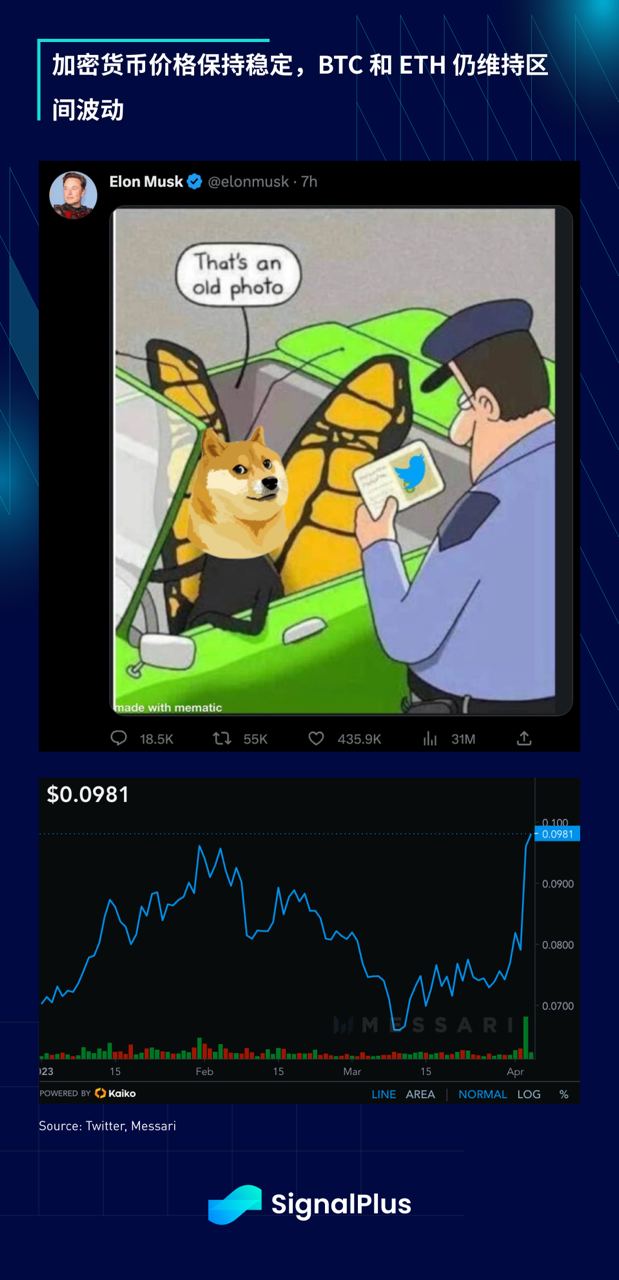

-Cryptocurrency prices remain steady, BTC and ETH remain range-bound, and perhaps the most interesting piece of news is that Elon Musk changed the Twitter logo from bluebird to Dogecoin, as the creative entrepreneur continues to demonstrate his commitment to the generation Dogecoin has a soft spot for coins, and the price of Dogecoin has soared by 20%.

SignalPlus Official Links

Website: https://www.signalplus.com/