Super detailed study guide: How to use the tool website DefiLlama?

Original author:

Original author:waynezhang.eth

What did you first use DefiLlama for?

For the first time, I was assigned by the leader to inquire about the potential DeFi task of Avalanche ecology. Now he is a Big Aggragator, I will re-introduce its function & usage of these data & interesting data to you through this Thread.

What you will gain from reading this article:

-Learn more about the full functionality of DefiLlama

-Understand DeFi data & indicators: LTV, Delta neutral strategy, New Listed Projects

-Indicators & methods to find DeFi Alpha

- How to use the corresponding indicators and derivative indicators

- Check out DefiLlama's novelty data

secondary title

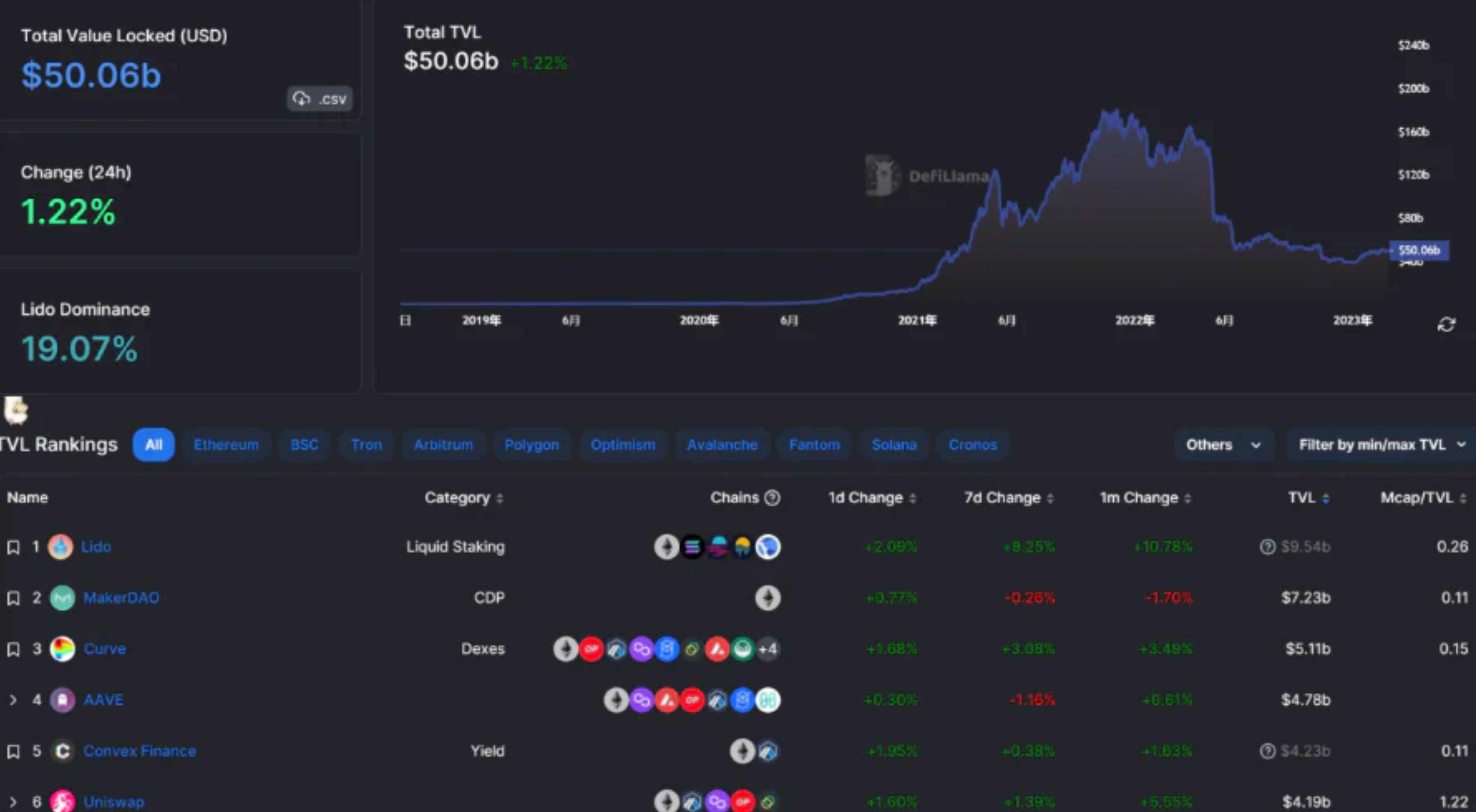

1.1 DeFi-Overview

- TVL of the entire DeFi ecosystem

- Ranked according to TVL protocol

- Can be ranked according to the public chain

secondary title

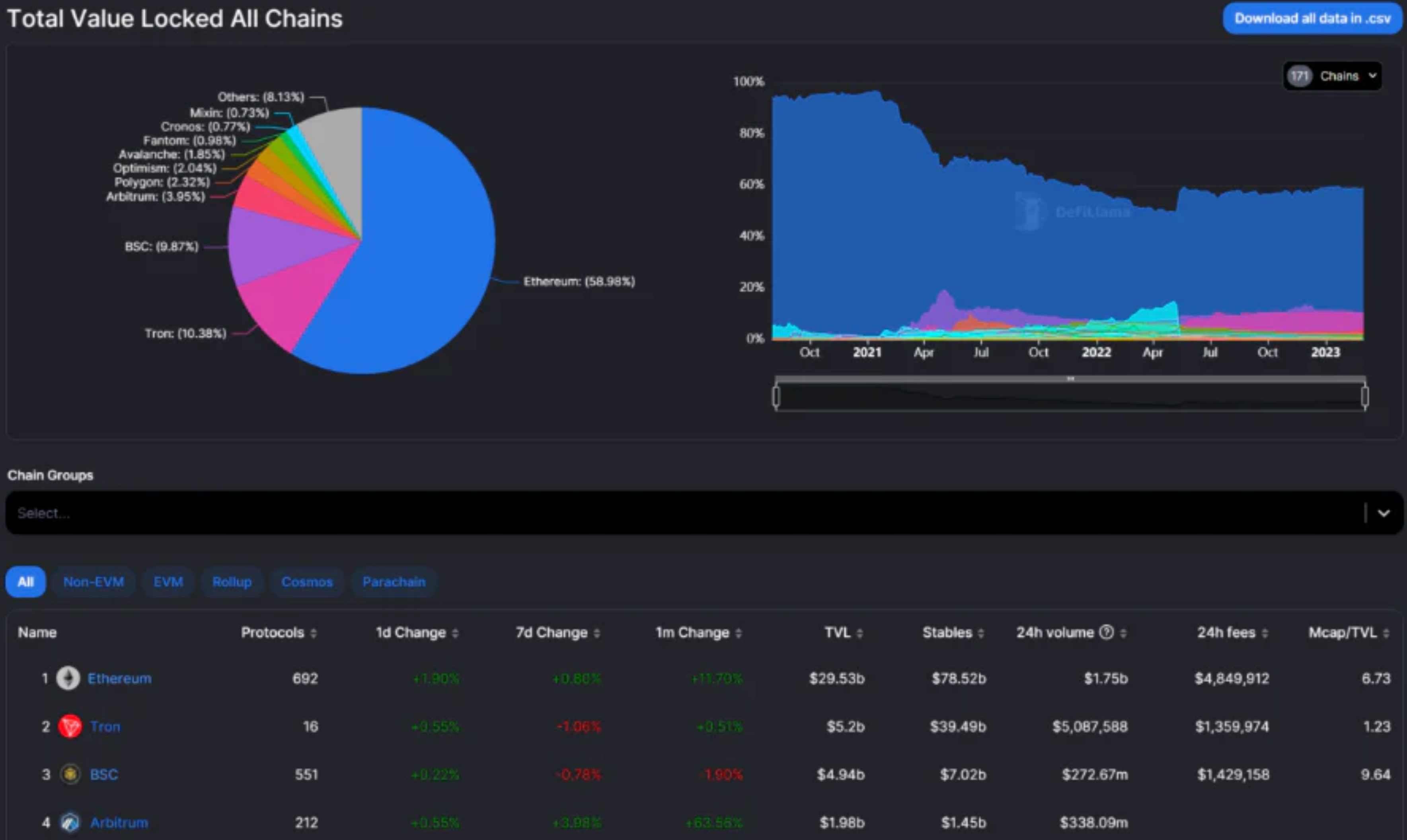

1.2 DeFi-chains

-Each public chain is ranked by TVL/number of protocols/variation/number of stable coins

- Can be classified according to EVM, Non-EVM, Rollup, Cosmos, Parachain

secondary title

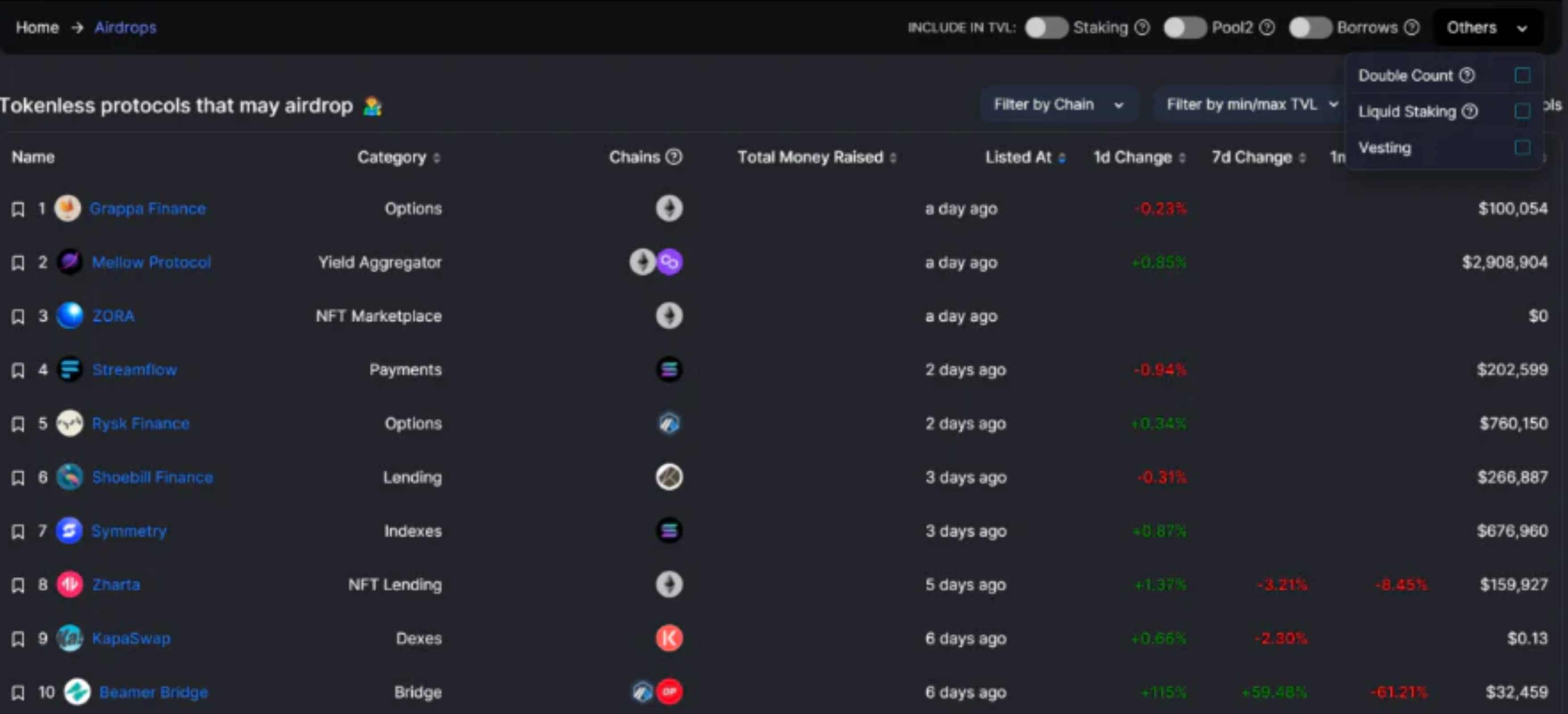

1.3 DeFi- Airdrops (the airdrop here means that no currency is issued)

-Sort DeFi protocols by fundraising time

secondary title

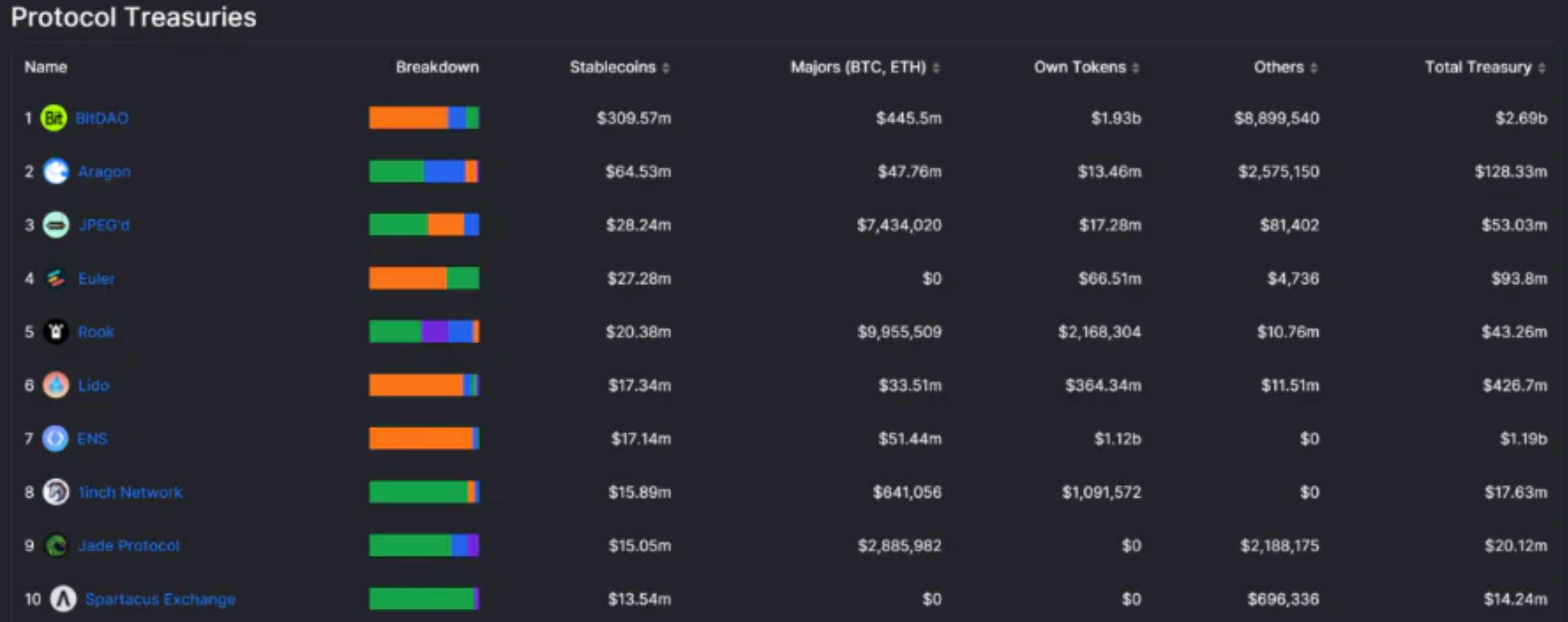

1.4 DeFi-Treasuries

- Sort according to the total amount of treasury, etc., and the proportion of various tokens in the treasury

Money in the protocol = rapid development of the protocol? uncertain

But the protocol has a large number of its own tokens = small market circulation or DAO may become the biggest seller of tokens

secondary title

1.5 DeFi-Oracles

-Use TVS (Total Value Secured) for sorting

-Agreement status of each oracle service

secondary title

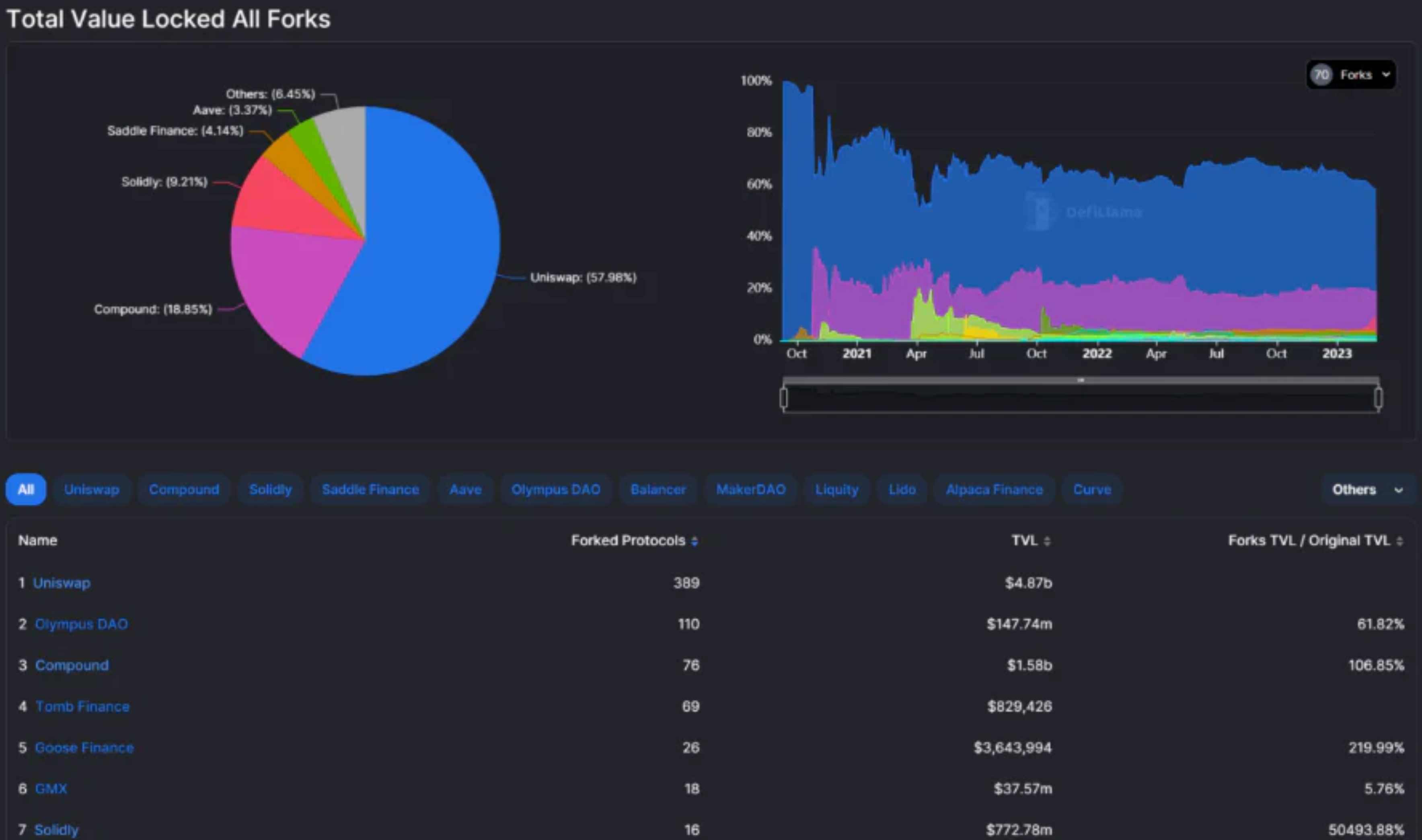

1.6 DeFi-Forks

- See which protocols are copied the most

secondary title

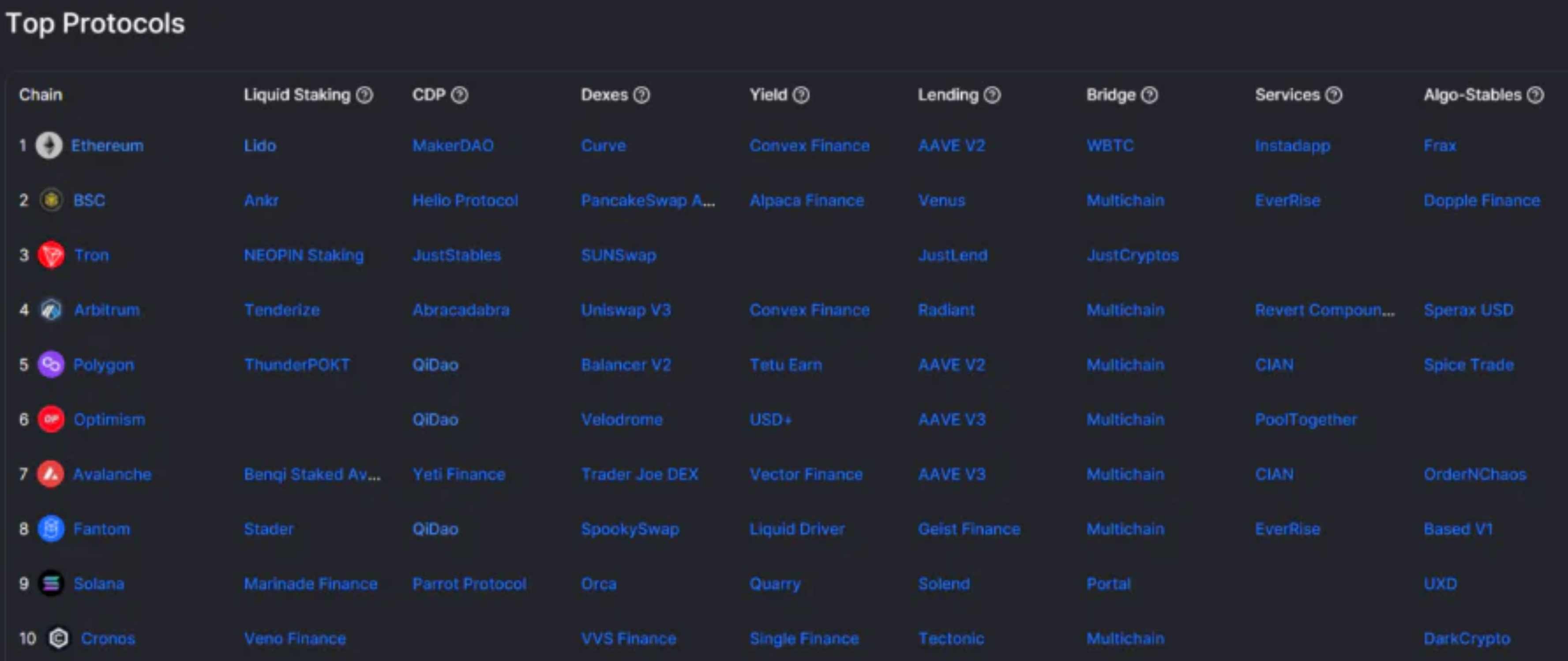

1.7 DeFi-Top Protocols

- Check out the leading brothers in each DeFi segment of each public chain

-Scope includes: Liquid Staking, CDP, DEX, Lending, Yield, Bridge, Services, Algo-Stables

The leaders in the big public chain ecology are multi-chaining, and the leaders in the small/new ecology are also looking for larger markets through multi-chains.

secondary title

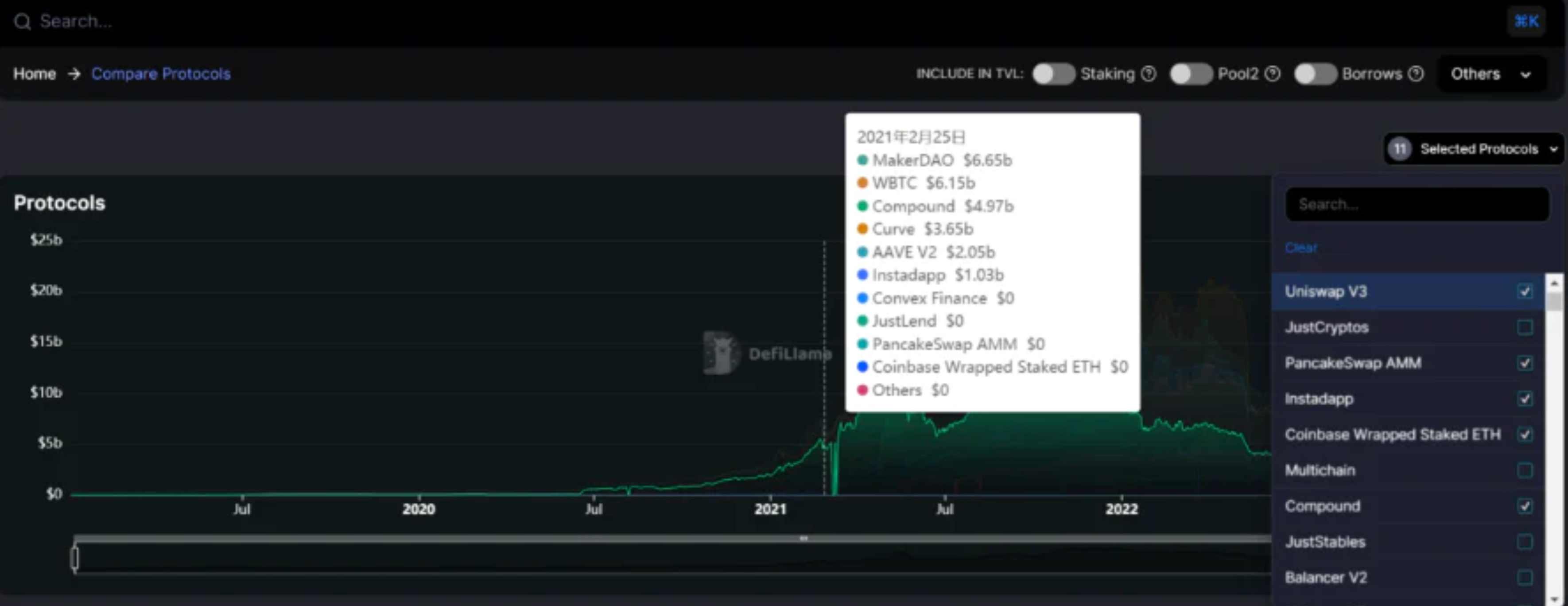

1.8 DeFi-Comparison

-Support multiple protocols to be selected for TVL comparison based on the time axis

It might be useful to compare the same track like LSD.

secondary title

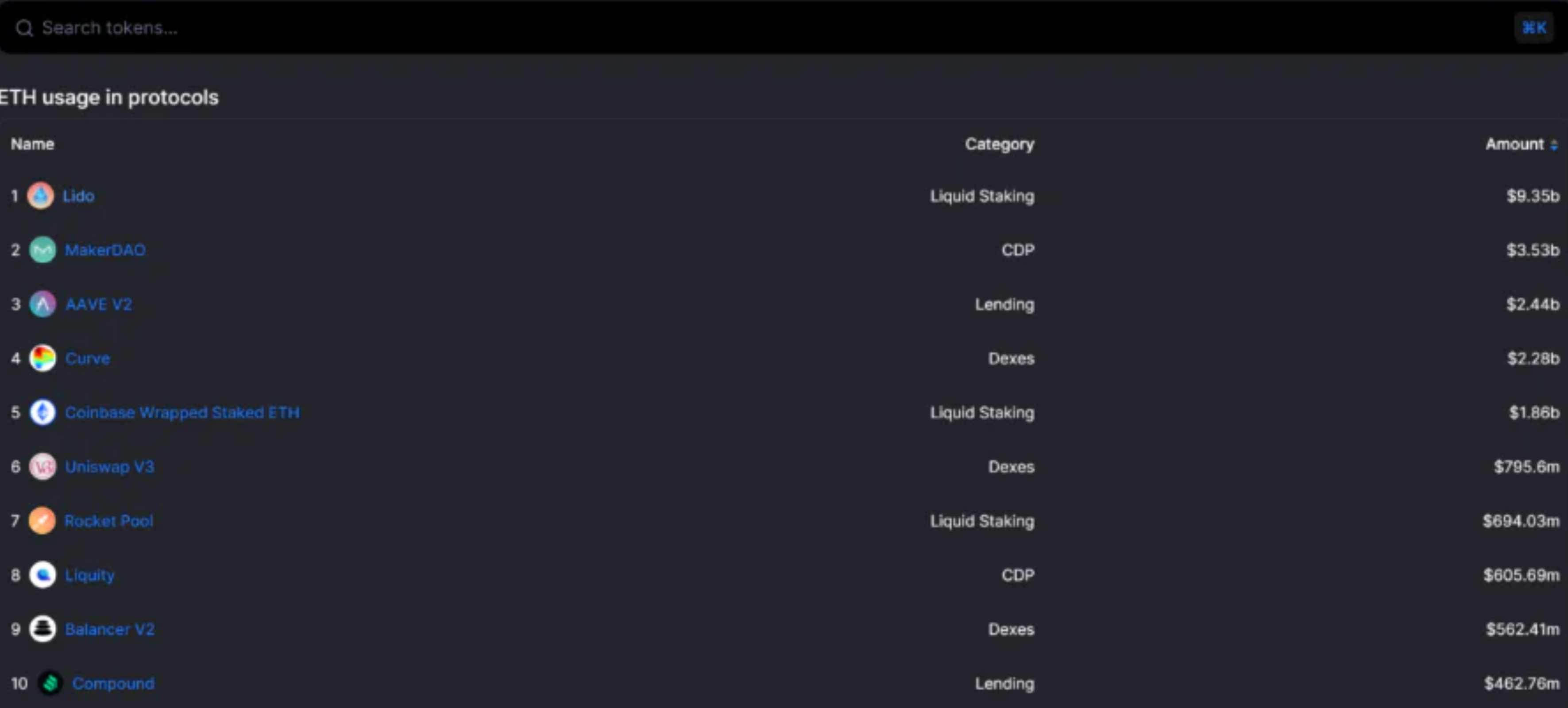

1.9 DeFi-Token Usage

- You can query the usage of tokens in DeFi

This data should be the data on the chain, and it is not complete, it will only show the projects included by DeFillama

secondary title

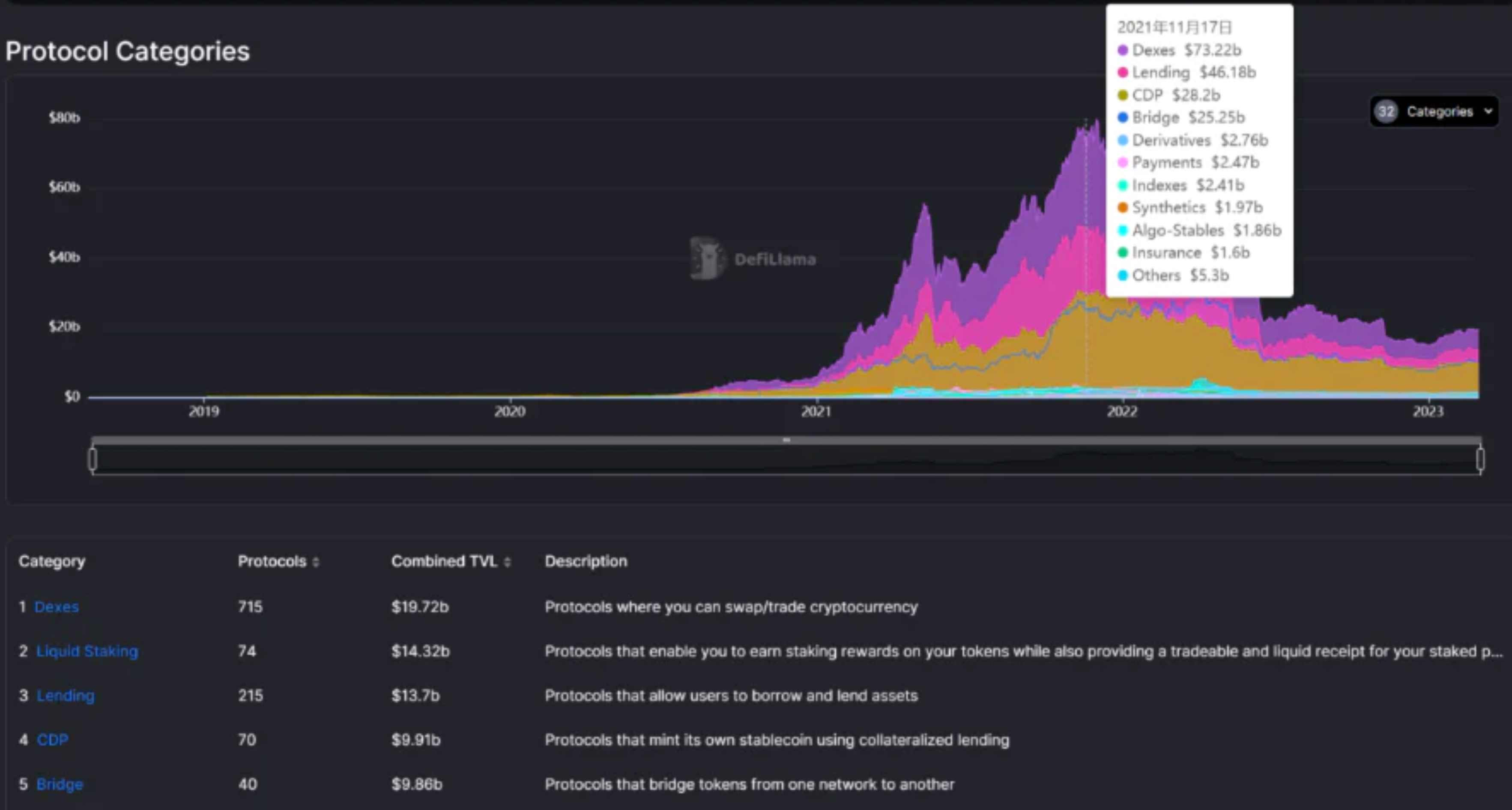

1.10 DeFi- Categorie

- Number of DeFi projects in each category, TVL

secondary title

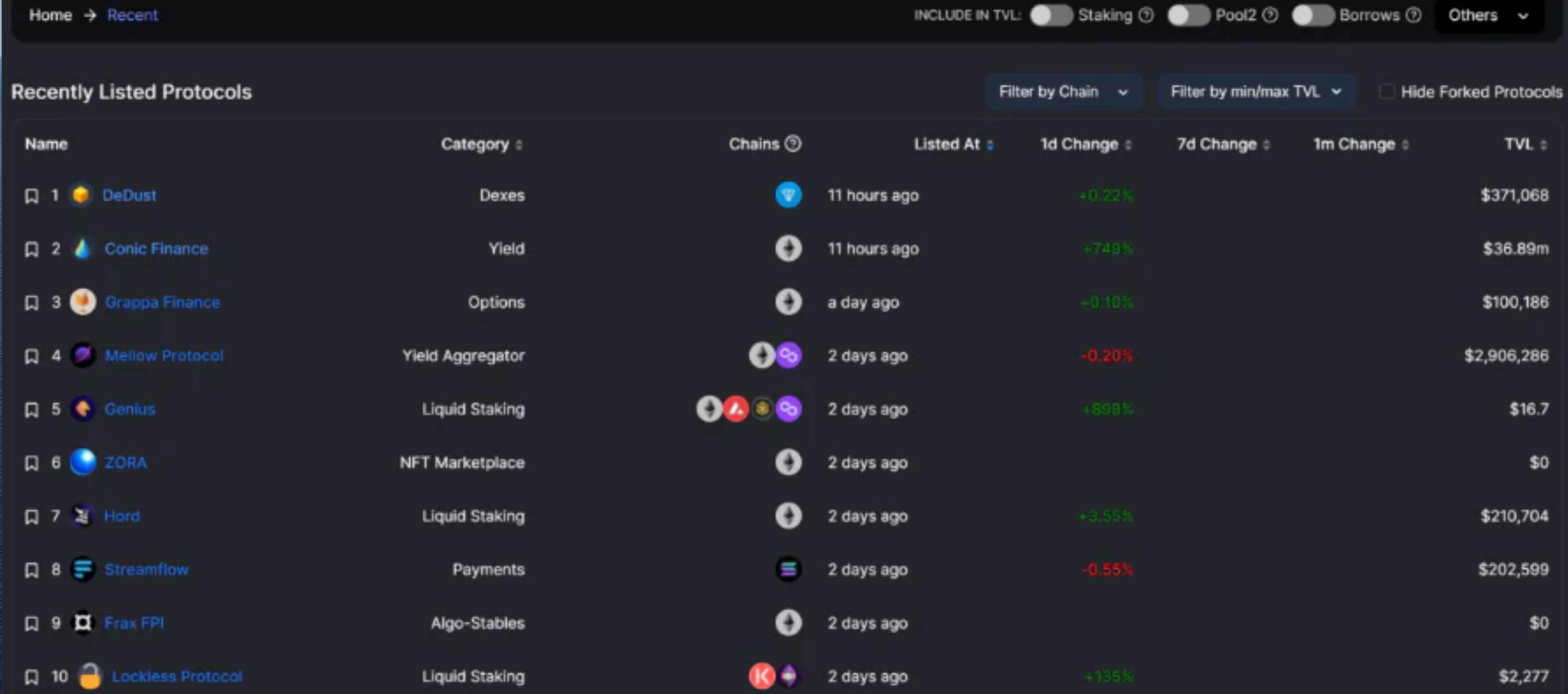

1.11 DeFi- Recent

-Recently indexed items

secondary title

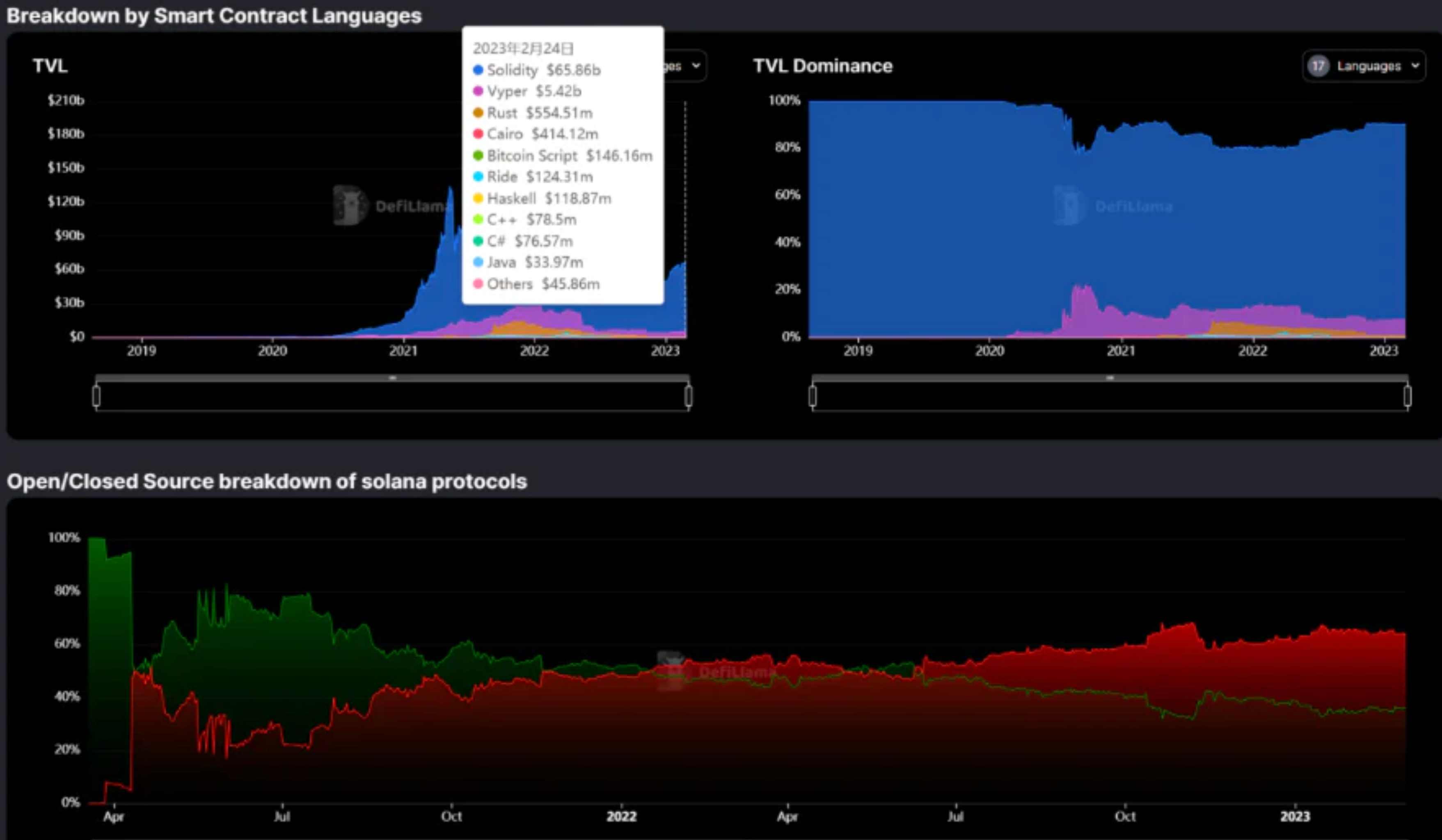

1.12 DeFi - Lauguage

-Proportion of different programming languages

-Language comparison according to TVL

-Solana ecological open source/non-open source agreement ratio

If you want to know more details, you can check @ElectricCapital'ssecondary title

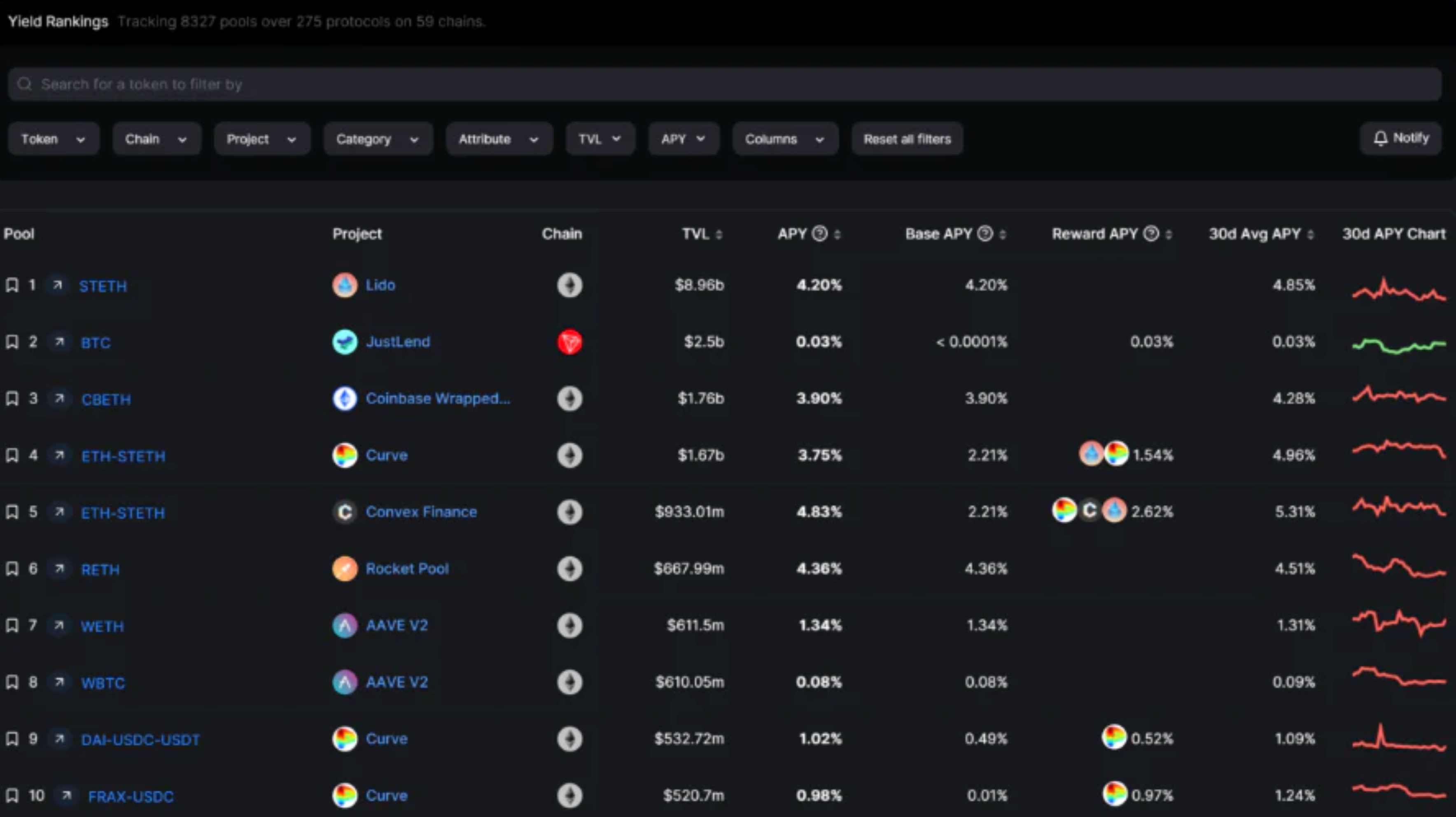

2.1 Yields - Pools

- Flow pool order according to TVL rank

- Included 5327 pools in 275 protocols on 59 chains

secondary title

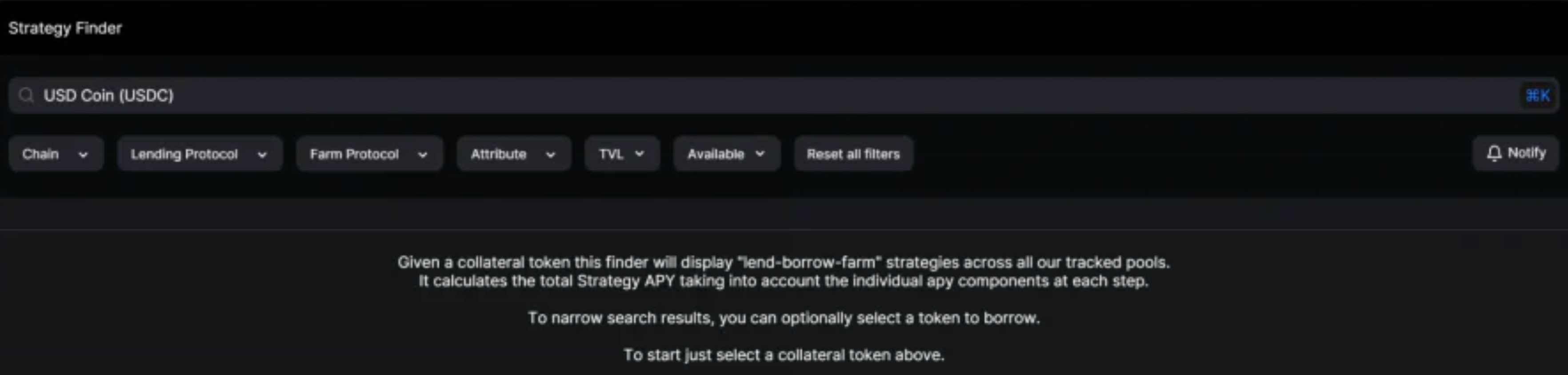

2.2 Yields-Delta Neutral

-Select the mortgage token, and then automatically select the strategy

-The strategy income is to calculate the total income of each strategy component

secondary title

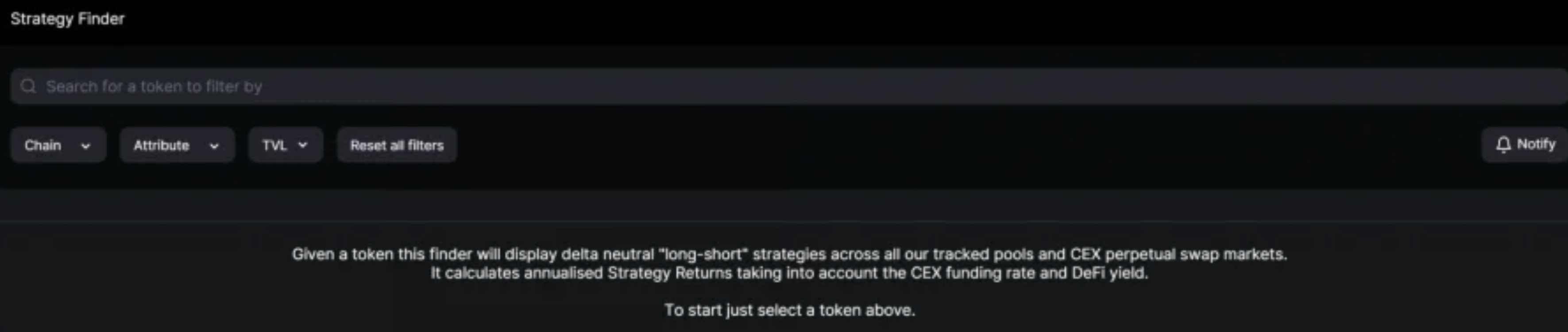

2.3 Long-short Strats

-Given a token, will show a delta-neutral "long-short" strategy across all tracked pools and CEX perpetual swap markets.

-The annualized strategy return will be calculated taking into account the CEX funding rate and the DeFi rate of return.

secondary title

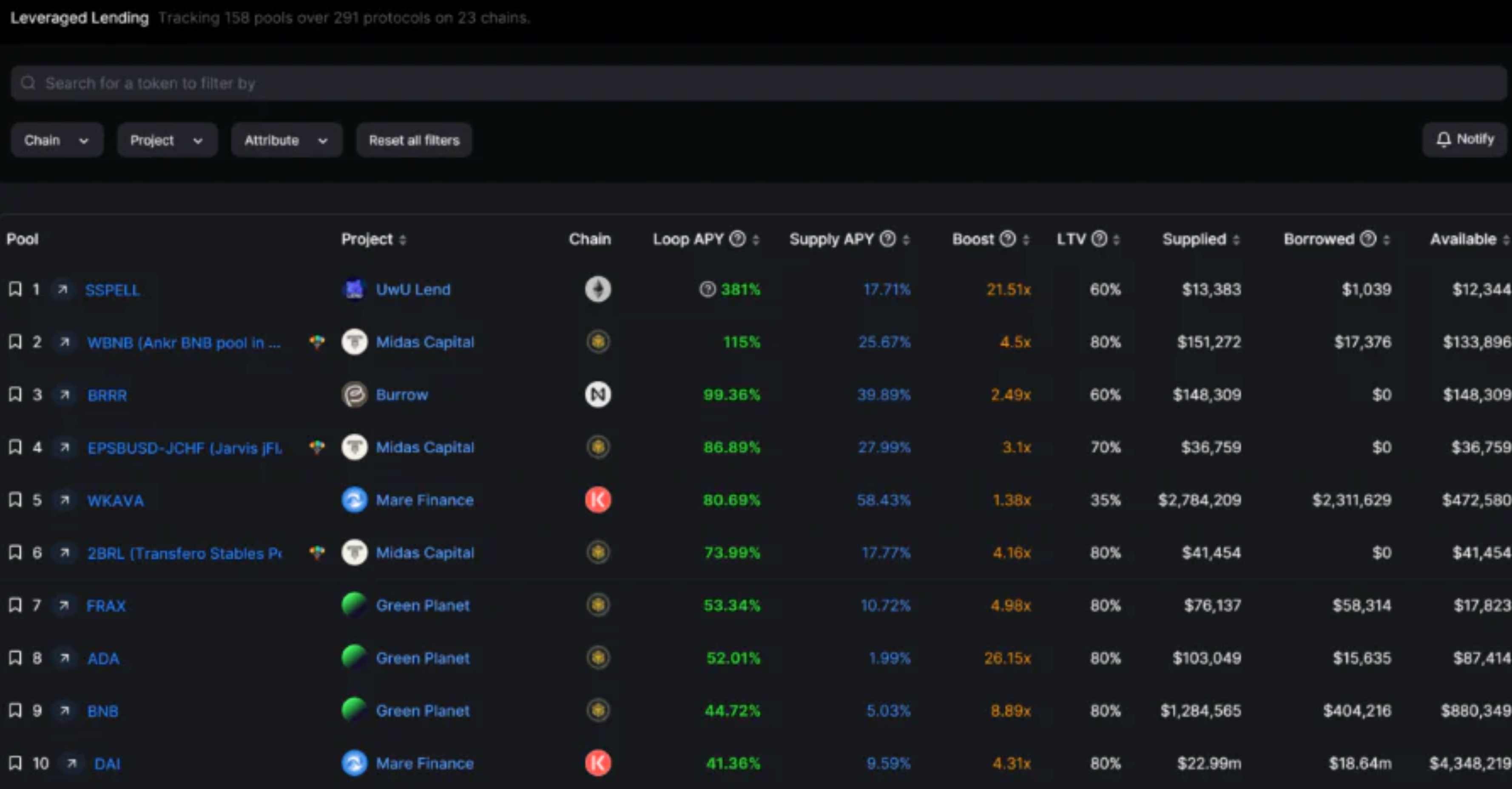

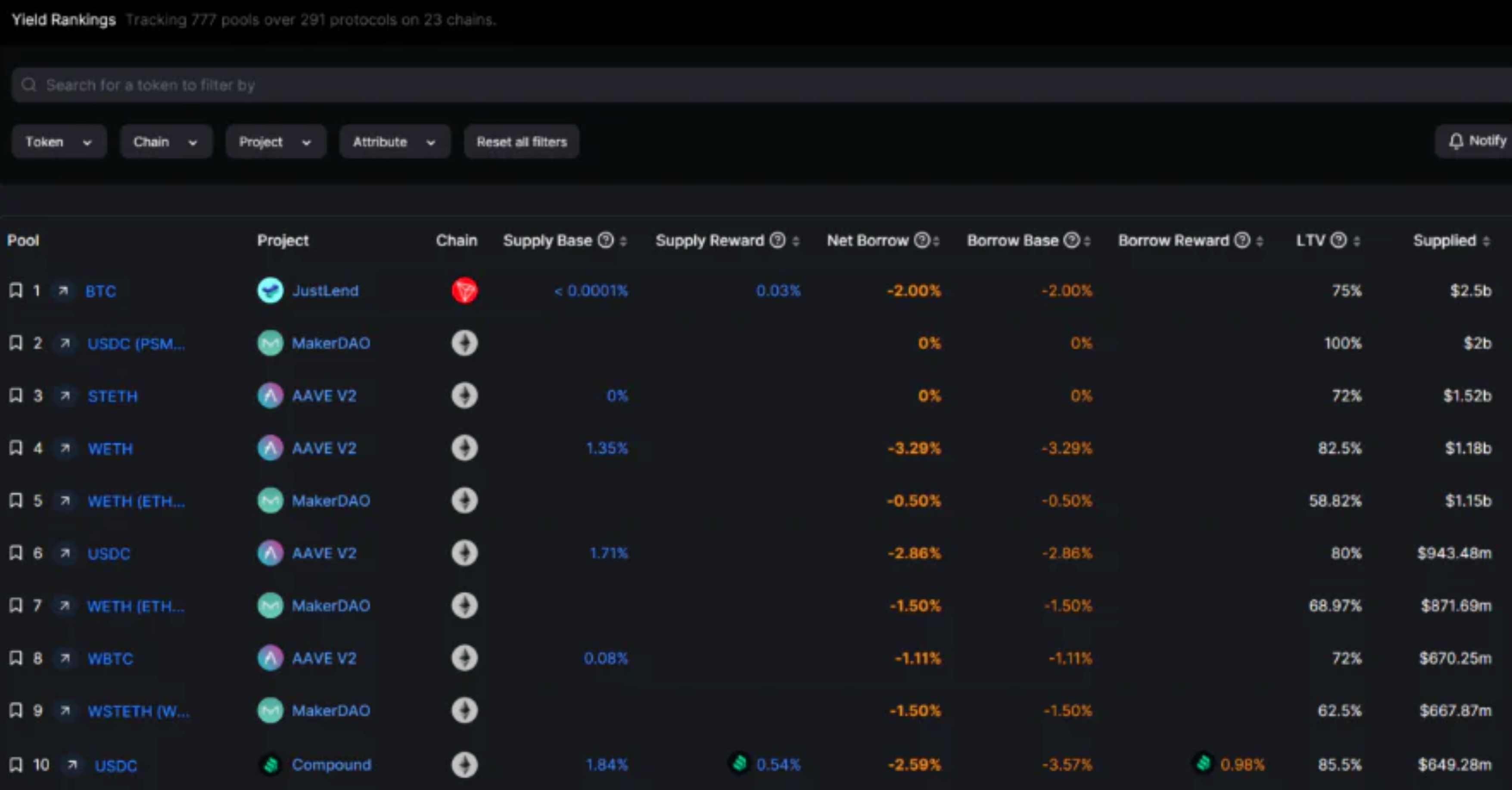

2.4 Yields-Leveraged Lending

-Look for Loop Apy, Supply Apy and LTV of different leveraged lending projects, current lending situation and other data

- Included 158 pools in 291 protocols on 23 chains

secondary title

2.5 Yields - Borrow

-Ranking according to the income of loan projects, LTV, supply and usage, etc.

secondary title

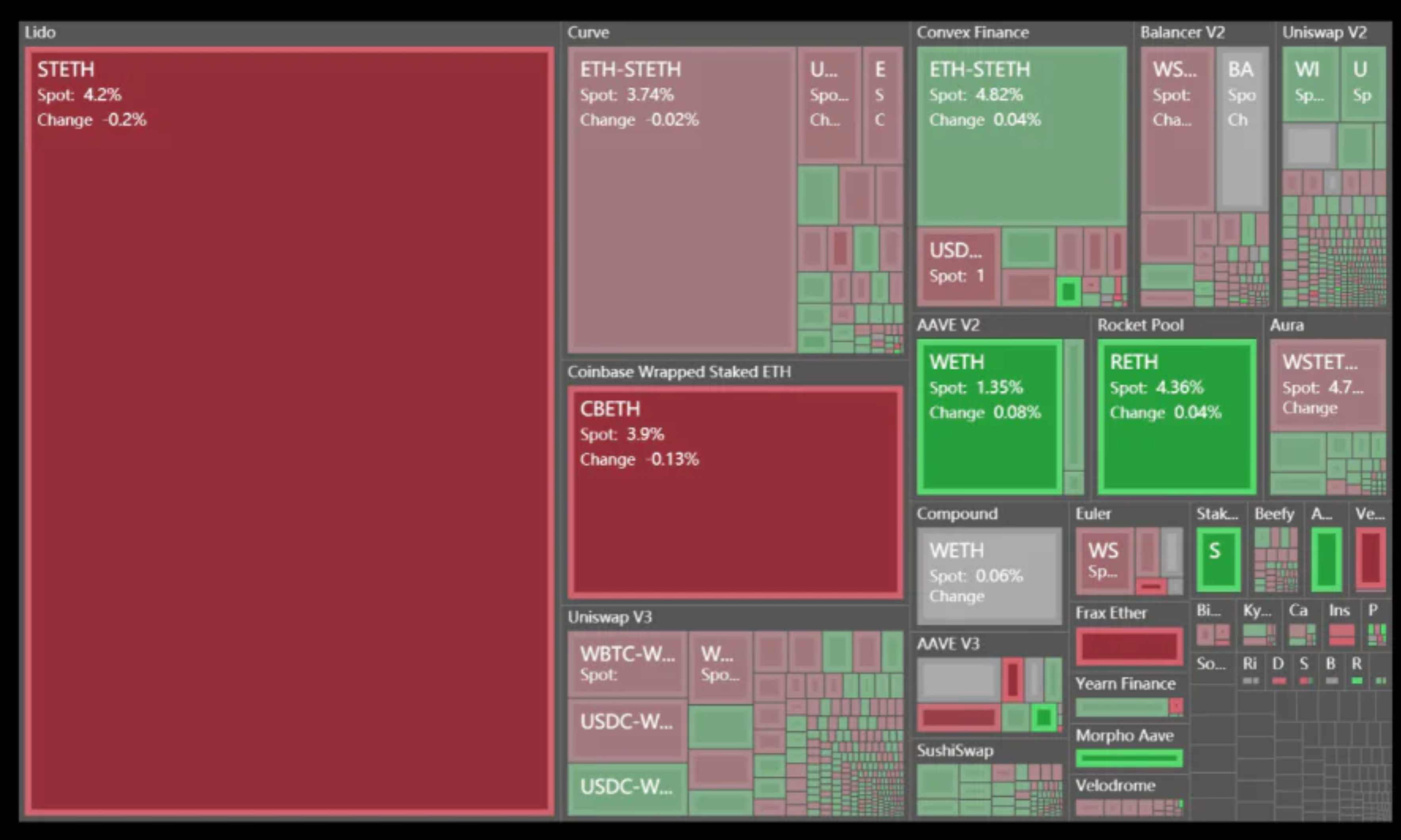

2.6 Yields -Overview

-Search for the median APY and distribution of a single currency

- You can check which APY a certain currency has in that pool of that project

-Visual comparison of APY data

secondary title

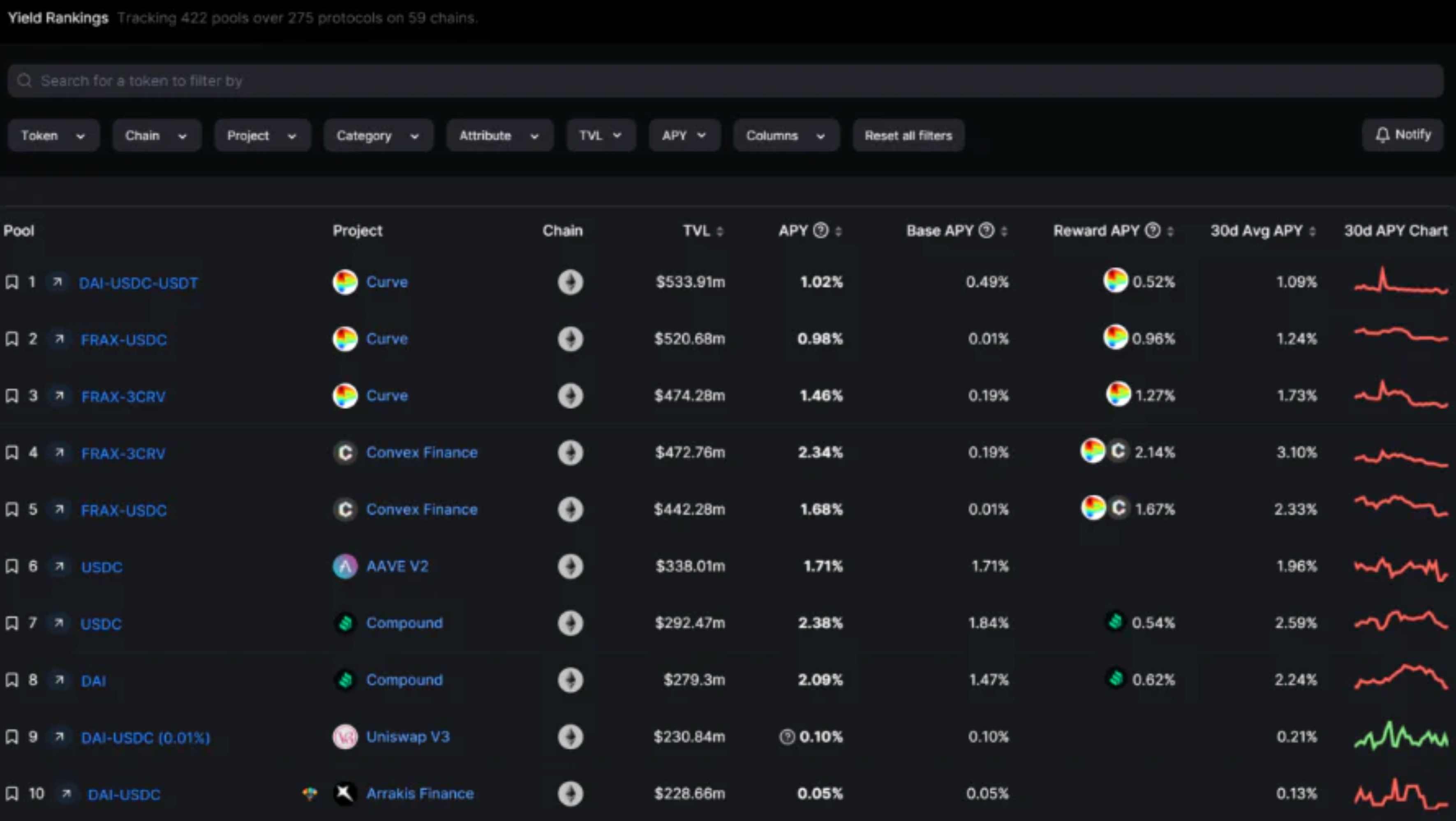

2.7 Yield - Stablecoins Pool

- Included 422 pools of 275 protocols on 59 chains

- Check the TVL and APY of each stablecoin pool (Base APY, Reward APY, 30d Average APY)

Basically high APY is subsidized by the Reward Apy of project tokens

secondary title

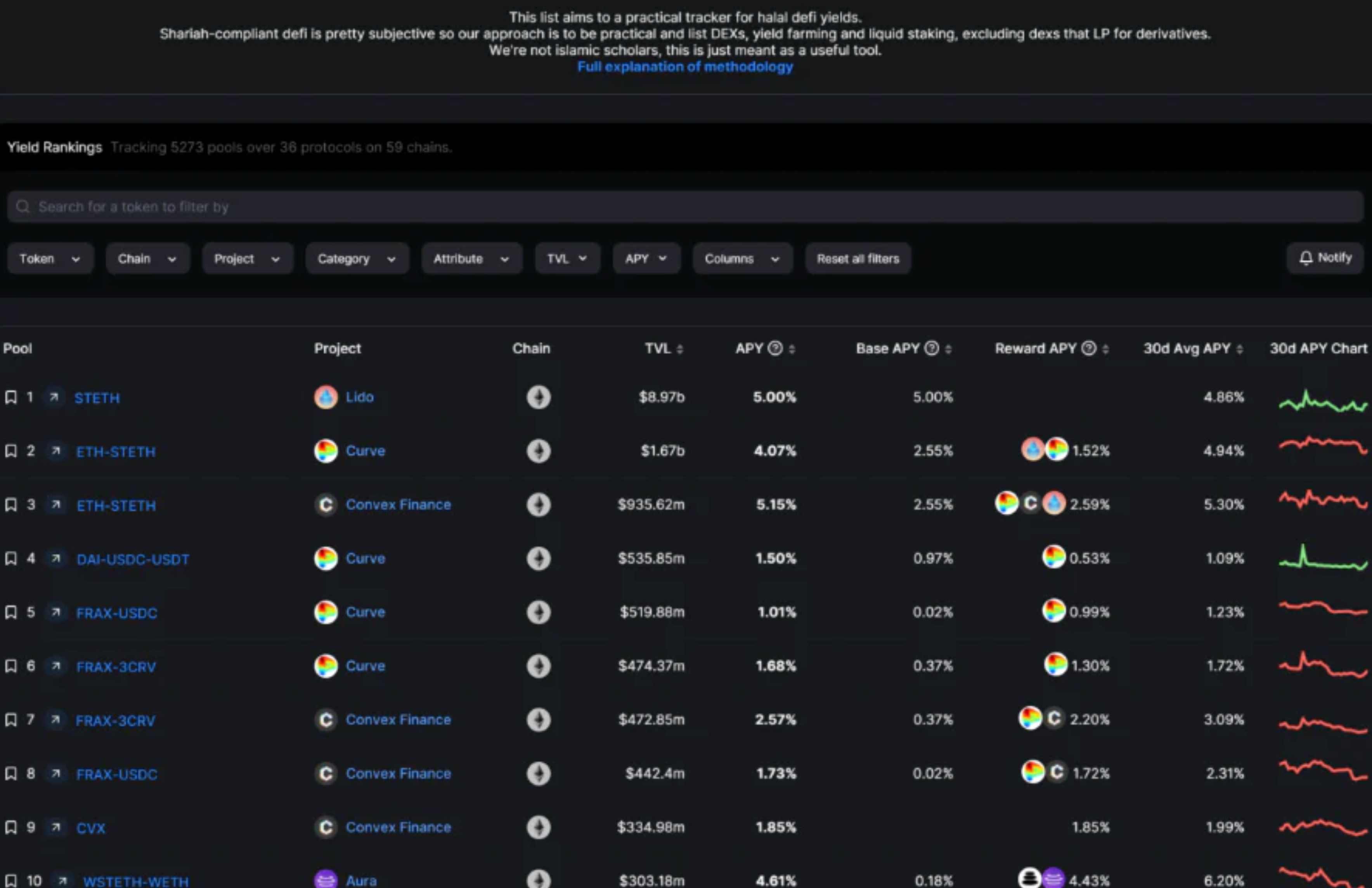

2.8 Yields-Halal

- 5273 pools tracking 36 protocols on 59 chains

- Simple exchange DEX, yield farming, liquid staking, bridging LPs

- How to understand Halal (Halal), I personally think it is a simple and safe pool

secondary title

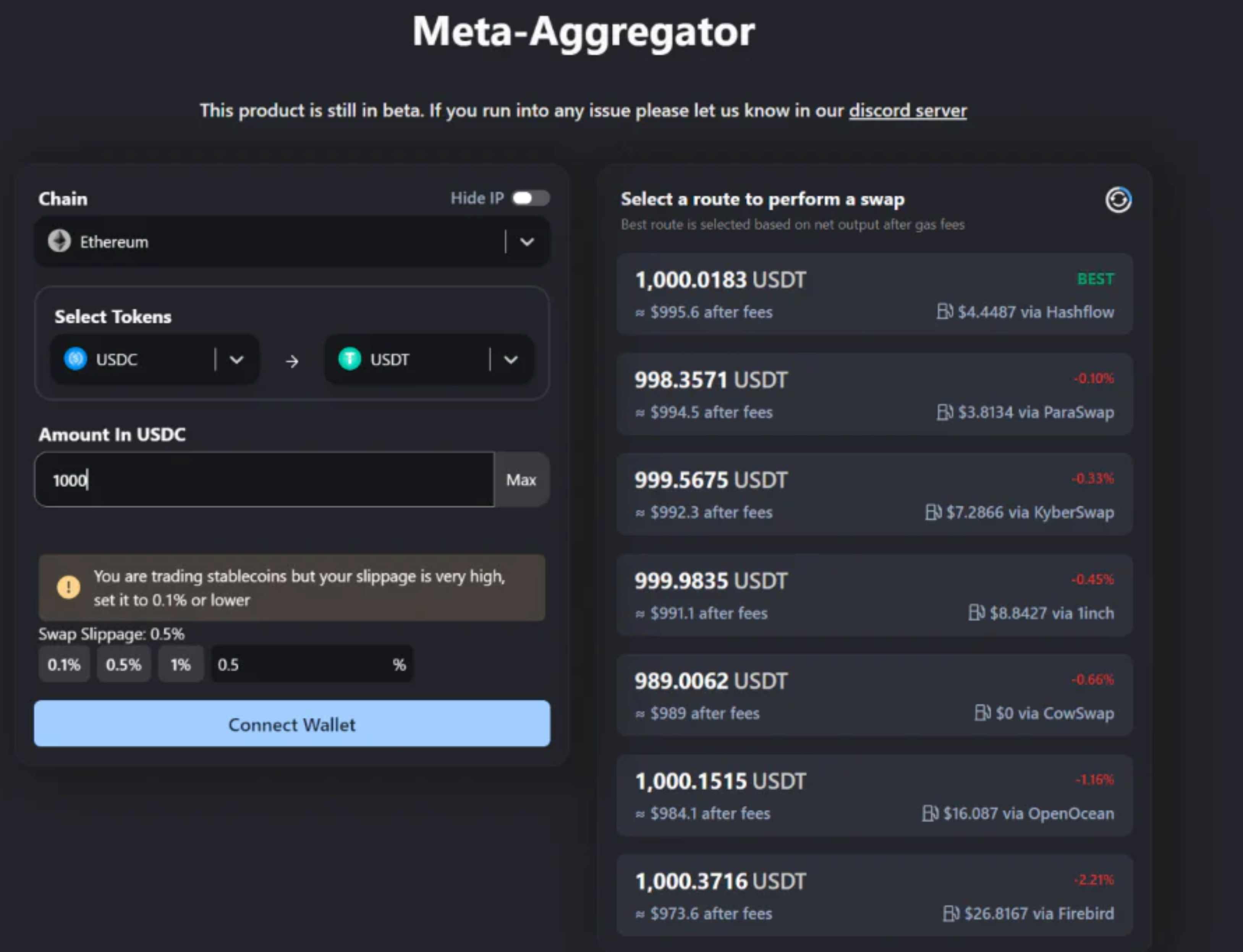

3. DefiLlama Swap-Meta-Aggregator

- By aggregating multiple aggregators, it provides the best transaction path query and can trade directly

- will calculate the transaction result and various fees and costs

- Slippage can be customized

secondary title

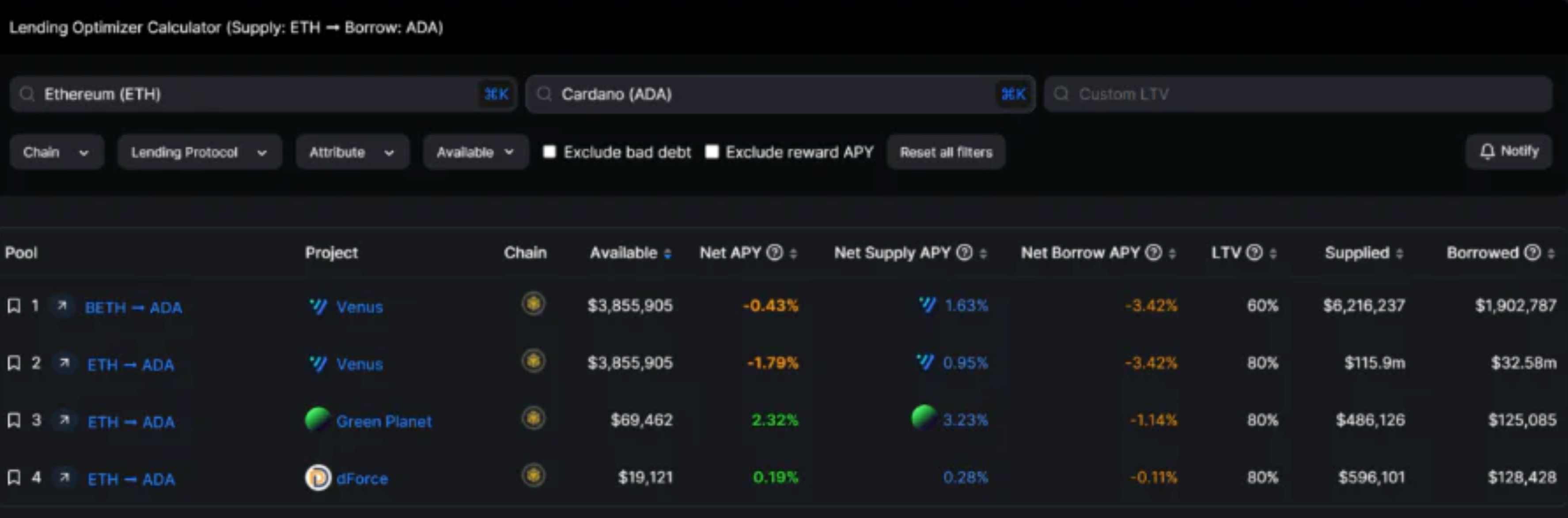

4.Borrow Aggragator

- Given a token for staking and a token for lending, the calculator will look at all lending protocols

- Calculate the cost of each borrow taking into account incentives, supply APR and borrow APR,

secondary title

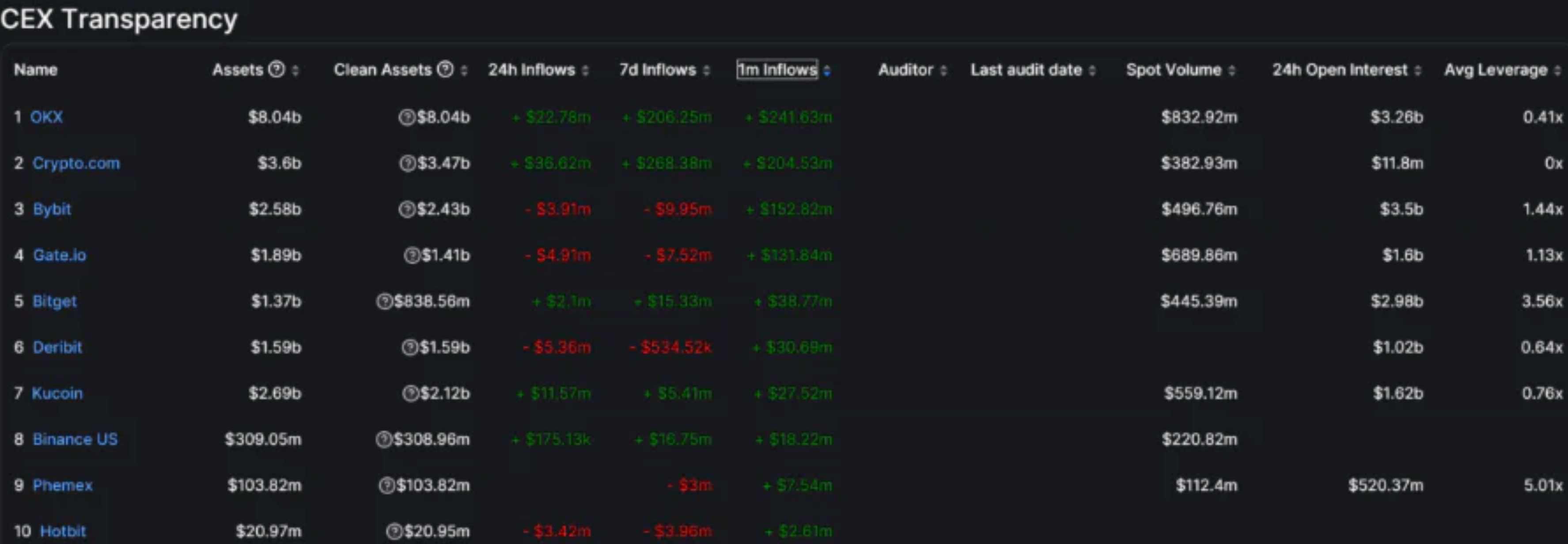

5.CEX Transparency

- List of inflow, outflow, net assets and other data of centralized exchange assets

Currently OKX has a net inflow ($241.63 M) in January, while Binane has a net outflow in January, with an outflow of $2.07 B so far

From the current point of view, TOP 5 net outflows have not all flowed into TOP 10 net inflows into CEX, and now there may be 1.5 B+ assets placed on the chain

secondary title

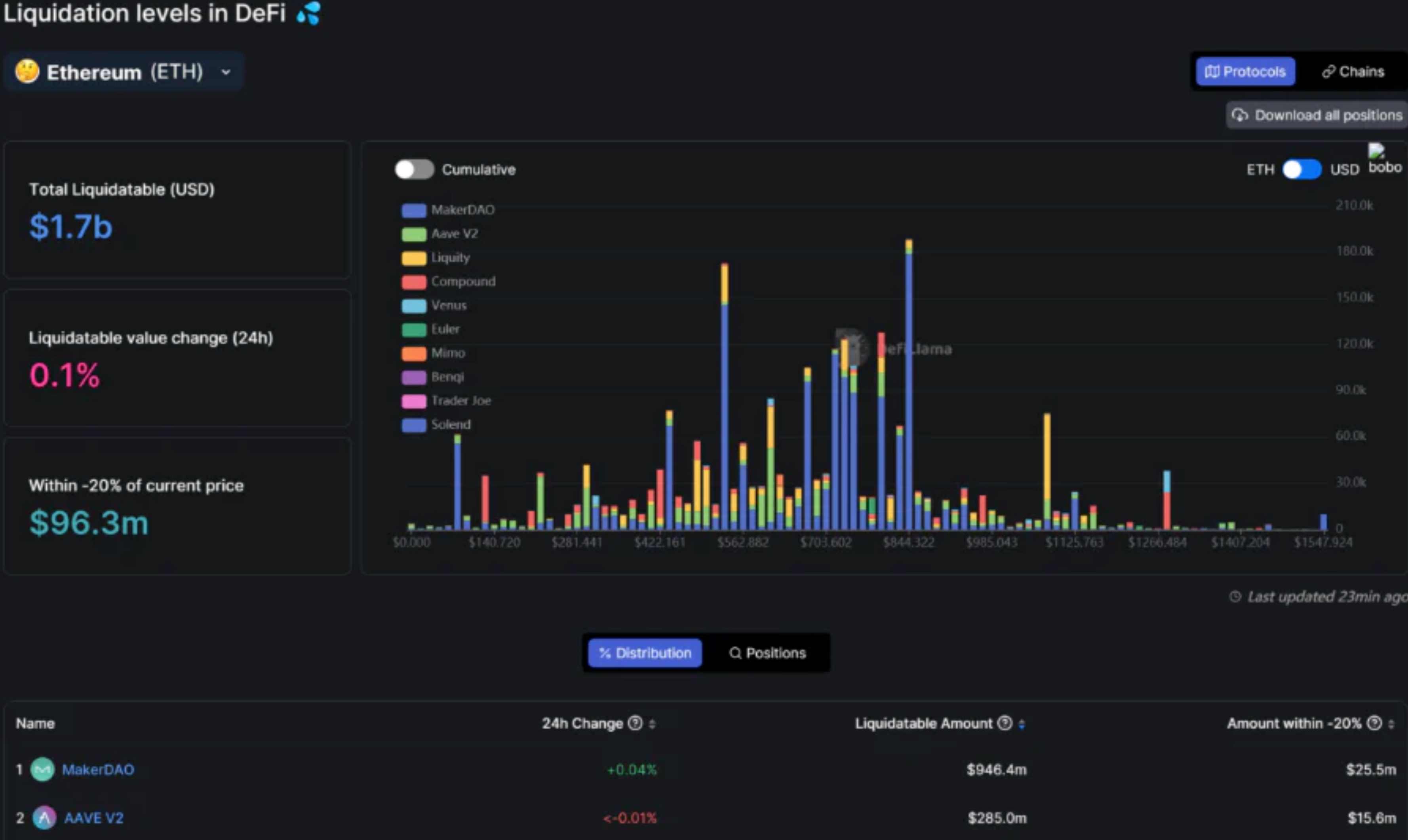

6. Liquidation

- View the liquidation totals of each agreement on each chain

- A 20% drop in liquidation totals

- View liquidations for the 100 largest positions

secondary title

7. Volumes - Overview/Chains/Options

-Dexs trading volume daily/weekly/monthly ranking

-Trading volume ranking by chain, as well as change volume, TVL, market share, cumulative trading volume

- Option volume ranking, change volume, TVL, market share, cumulative volume (data flawed)

secondary title

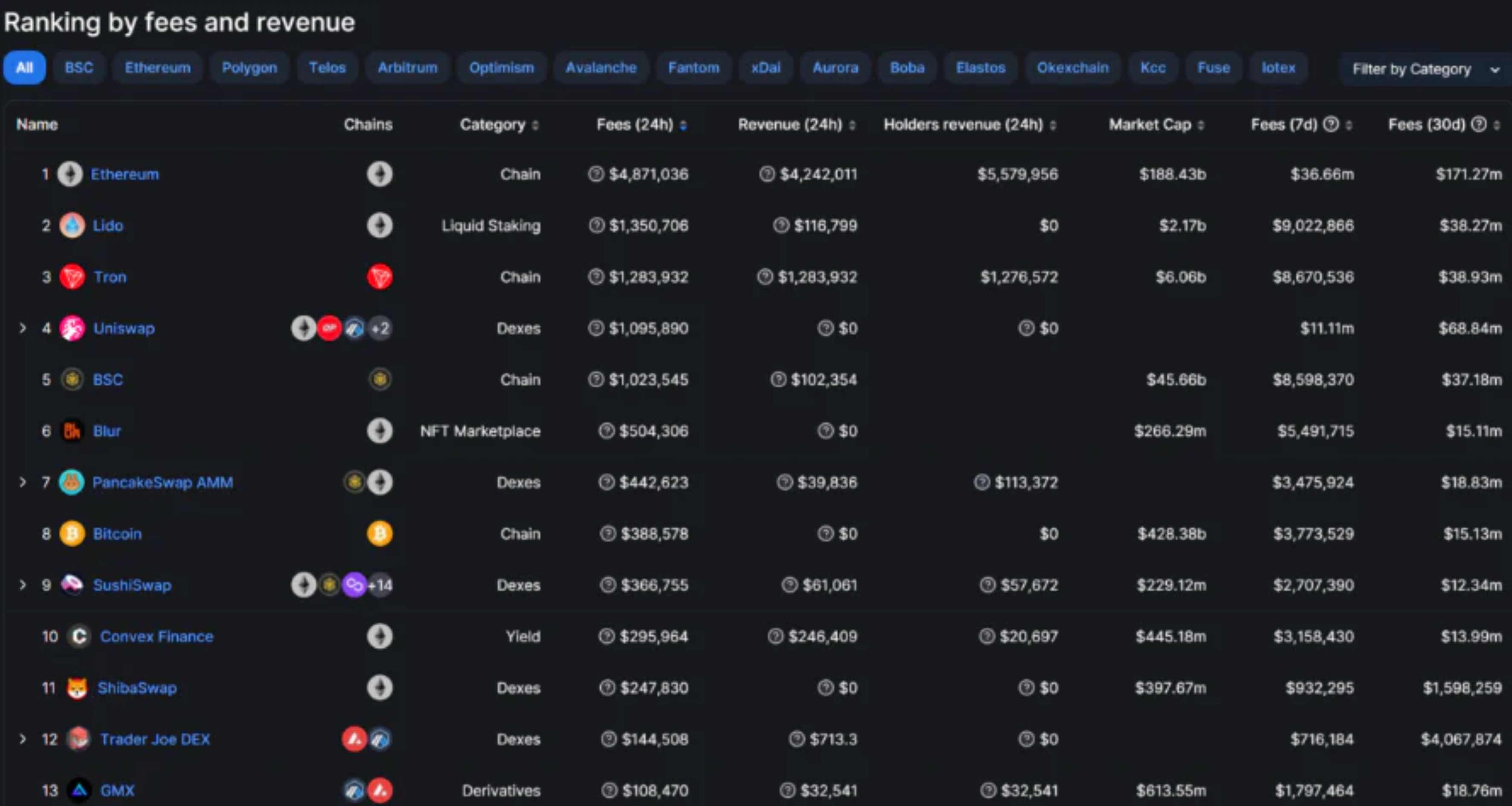

8. Fee & Revenue

- List of projects ranked by income and expenses

The top 50 income ranking categories are: Chain/Rollup (selling block space), DEX (handling fee), liquidity pledge (reward fee), options/futures/loan transaction, NFT market/loan, CDP, Synthetics, Oracle

secondary title

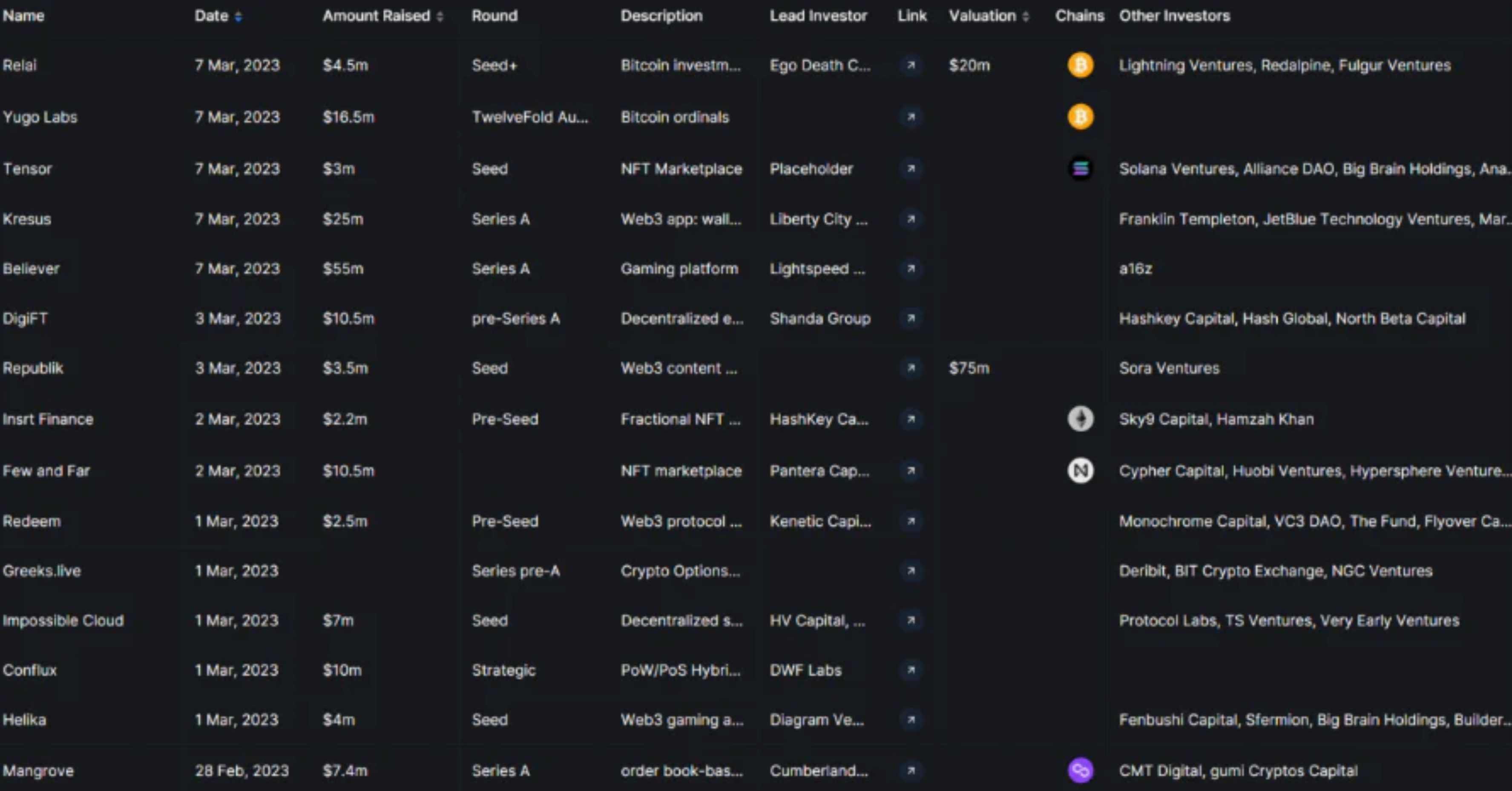

9.1 Raised-Overview

- Financing time sorted by time

secondary title

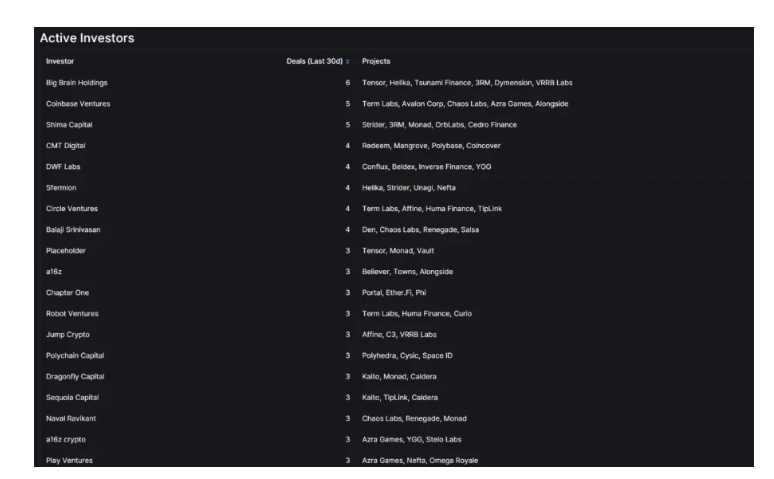

9.2 Raises - Active investors

-Sorted by the number of shots taken within 30 days

- Investment project status

10. Stables-Overview

-The peg situation, deployment situation, and changes of each stablecoin

There are 6 above 1 B, and the status of USDT and USDC is temporarily unshakable

There are currently 97 stablecoins included in DefiLlama alone

secondary title

11. Stable-chains

-Sort by the size of stablecoins on the public chain

secondary title

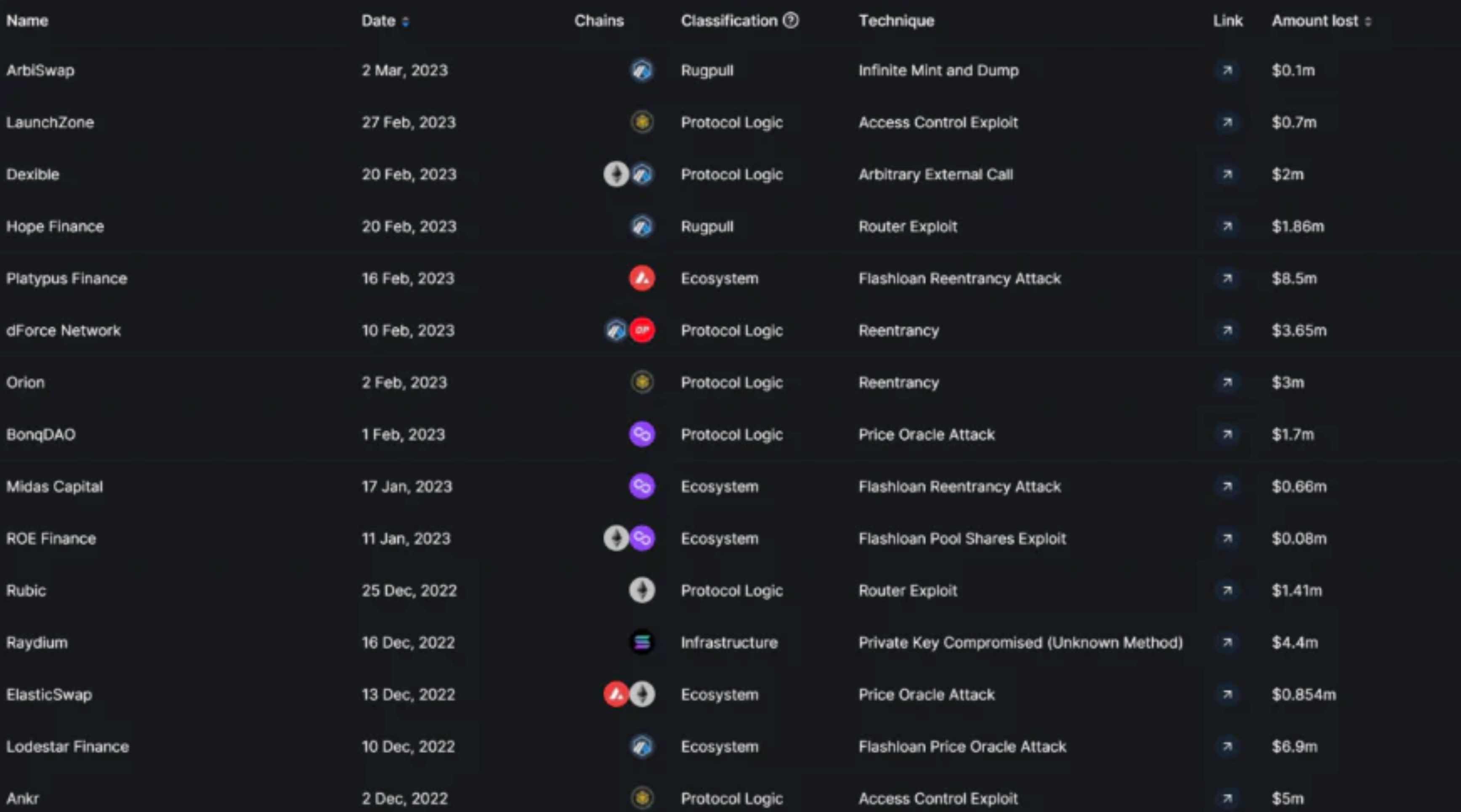

12. Hacks

-Include the time, reason, scale, and incident report status of each hacker attack incident

secondary title

13. ETH Liquid Staking

- Number of pledged projects, LSD status, APR, etc.

Lido is in the decisive leadership position, but unshETH has been established for 7 days +, and 86.05 ETH has been deposited

Hord's APR can reach 35.11%, the amount is scary

Some interesting gadgets provided by DefiLlama:

-roundup - A summary of various information and news organized by DefiLlama

-Trending Contracts: Query the contract interaction for a certain period of time in the past (the default is 60 minutes, I tried for 1 minute, but it couldn't be refreshed)

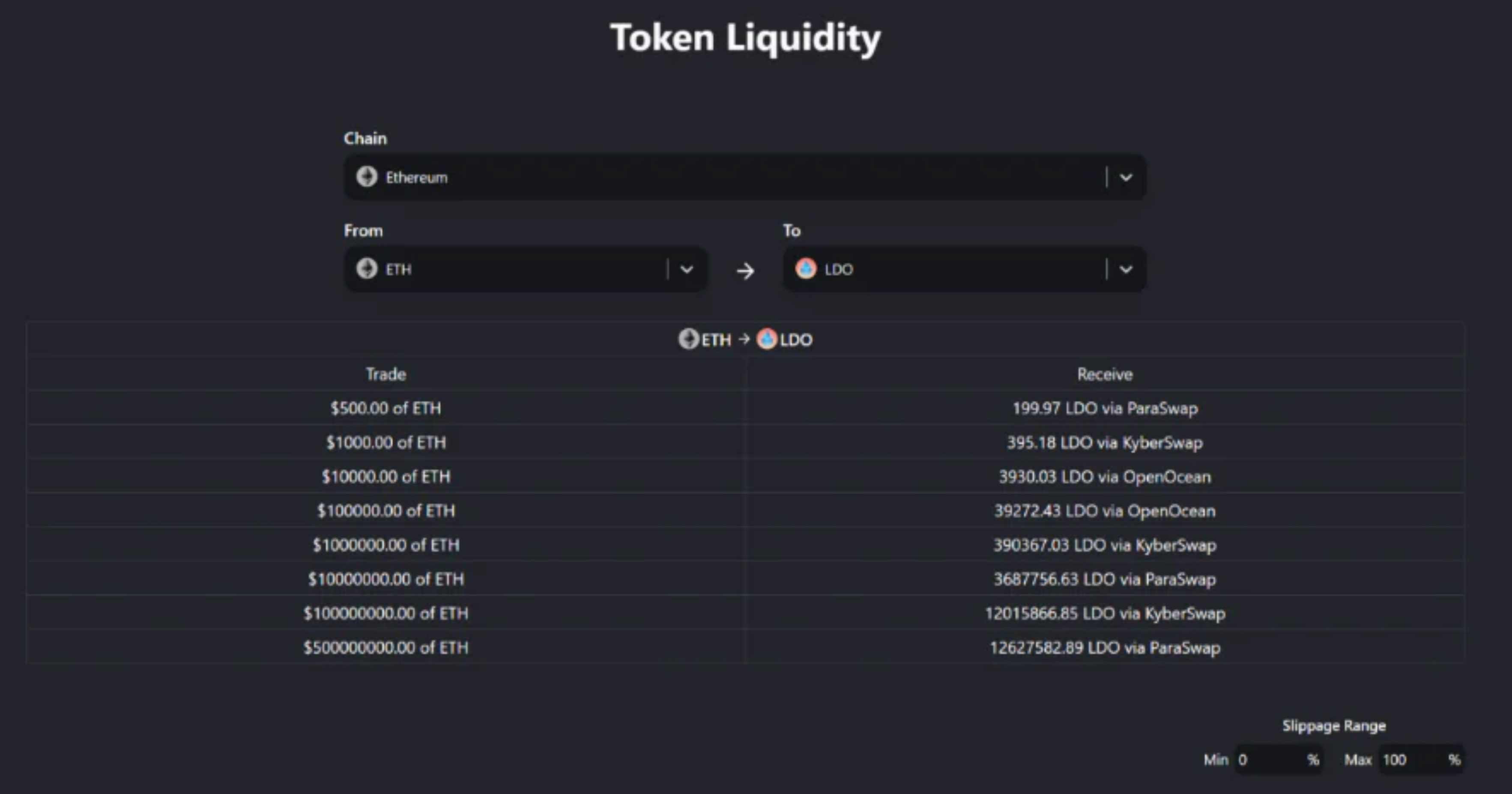

-Token Liquidity: Query the liquidity depth between tokens

In addition to DefiLlama, there are some great websites worth recommending:

Dune.xyz: You can build your own or view the on-chain charts made by the big guys

Coingecko: In addition to currency prices and new coins, there are also currency pairs on decentralized and centralized exchanges, futures trading volume, etc. Gecko Terminal can even track Tugouchi

TwitterCcan: generally used to see the social media activity and influence of the project

Google: Everything!

In fact, the sexiest thing is the original data. The sense of accomplishment is the strongest when you sort out the data or tables slowly, and the data tool is just a guide to guide your thinking.

Blockchain browser: Every blockchain has it. Don’t just think that it is a place where you can only check transactions. You can look at the contract and see what new mint NFT/tokens are available. For reasons of space, see below The second time can be highlighted.