New opportunities in Cosmos: USDC enters the Cosmos ecosystem through CCTP,

Original - Odaily

Author - Loopy

Today, native USDC officially entered the Cosmos ecosystem, and Circle officially announced that CCTP has been connected to the Noble chain. Noble chain is a chain within the Cosmos ecosystem. The main purpose of this chain is to introduce stable coins into the Cosmos ecosystem.

Currently, after the CCTP deployment is completed, the Circle Cross-chain Transfer Protocol (CCTP) was launched on Noble’s testnet on November 3 and is expected to be launched on the mainnet on November 28.

This development was completed by the Circle, Noble and dYdX teams, and its purpose is to facilitate the transfer of USDC to the dYdX chain between different networks. Although the main purpose is dYdX, thanks to the convenient IBC cross-chain, this will undoubtedly benefit the entire Cosmos ecosystem. This feature will bring USDC to Cosmos in a simple, convenient and secure way.

Nathan Cha, head of marketing at dYdX, said a key tenet of DeFi is improving accessibility for all users. dYdX is very happy to see this kind of cooperation.

For Cosmos users, how is the introduction of CCTP different from other cross-chain bridges and other stable coins? This starts with CCTP’s unique “casting-burning” mechanism.

Unique destroy-cast mechanism

CCTP, Cross-Chain Transfer Protocol, is an official permissionless cross-chain bridge launched by Circle.

The difference between CCTP and common bridges is that this bridge does not adopt the common lock-cast model, but adopts the destroy-cast model.

In the more mainstream lock-and-mint mechanism, the bridge protocol establishes a liquidity pool on two chains, and realizes the transfer of tokens between different chains by locking tokens on the original chain side and casting tokens on the target chain side. flow.

Since the authority of the USDC contract is controlled by Circle, third-party bridges cannot mint native USDC. CCTP can destroy native USDC on the original chain and mint an equal amount of native USDC on the target chain.

After the user cross-chain, CCTP will destroy USDC on the original chain. Circle will then collect evidence, including observing and proving the USDC destruction transaction on the original chain. The original chain application needs to request a signature certificate from Circle before it can be destroyed, and it must also obtain a signature certificate before it can be destroyed on the target chain. Authorizes the minting of a specified amount of USDC. After minting is completed, the visitor will send the USDC to the recipients wallet address.

In this process, there is no capital pool, and of course there is no accumulation of hundreds of millions of funds. This process optimizes capital efficiency and liquidity experience. More importantly for users, the USDC received on different chains is all native USDC, which is directly guaranteed by Circle in US dollars. There is no need to worry about the USDC of the target chain and the native USDC of the original chain detaching.

In terms of applications, the main use cases given by Circle include transactions, lending, payments, NFTs and games, such as cross-chain Swap, cross-chain deposits, cross-chain NFT purchases, etc.

Is cross-chain safer without a fund pool?

In the traditional lock-and-cast cross-chain model, the disadvantages are very obvious. In order to maintain the 1:1 price anchoring of the two currencies in the pool, LP providers are required to make markets, and the large number of locked tokens in the pool also become an excellent target for hackers.

Odaily once took inventoryThe ten largest cross-chain bridge attacks in history. In March 2022, Ronin Network’s cross-chain bridge was attacked, with total losses reaching $624 million. This is also the largest cross-chain bridge theft in history. Chainalysis research found that cross-chain bridge attacks have caused more than $2 billion in financial losses in 2022 alone.

In addition, the lock-and-cast model naturally divides the two ends of the bridge into the original chain and the target chain. The tokens on both sides are the native assets and the bridge assets respectively. A large number of minted tokens are merged with the native assets. Are not the same. If there is a security problem on the bridge, the assets cast in the target chain will face the risk of de-anchoring.

In the “pGALA incident” in November 2022, there were no problems with the GALA token deployed on the Ethereum mainnet. However, there were security issues with the pNetwork cross-chain bridge. The pGALA issued and minted by it in BNB Chain was issued in huge quantities. One pGALA of BNB Chain no longer has the corresponding one Ethereum GALA as support, and pGALA immediately returned to zero.

For asset issuers, the problem of liquidity fragmentation on each chain also affects the use of assets. (CCTP documents show that this is what Circle cares about most - unifying the liquidity of the entire ecosystem.)

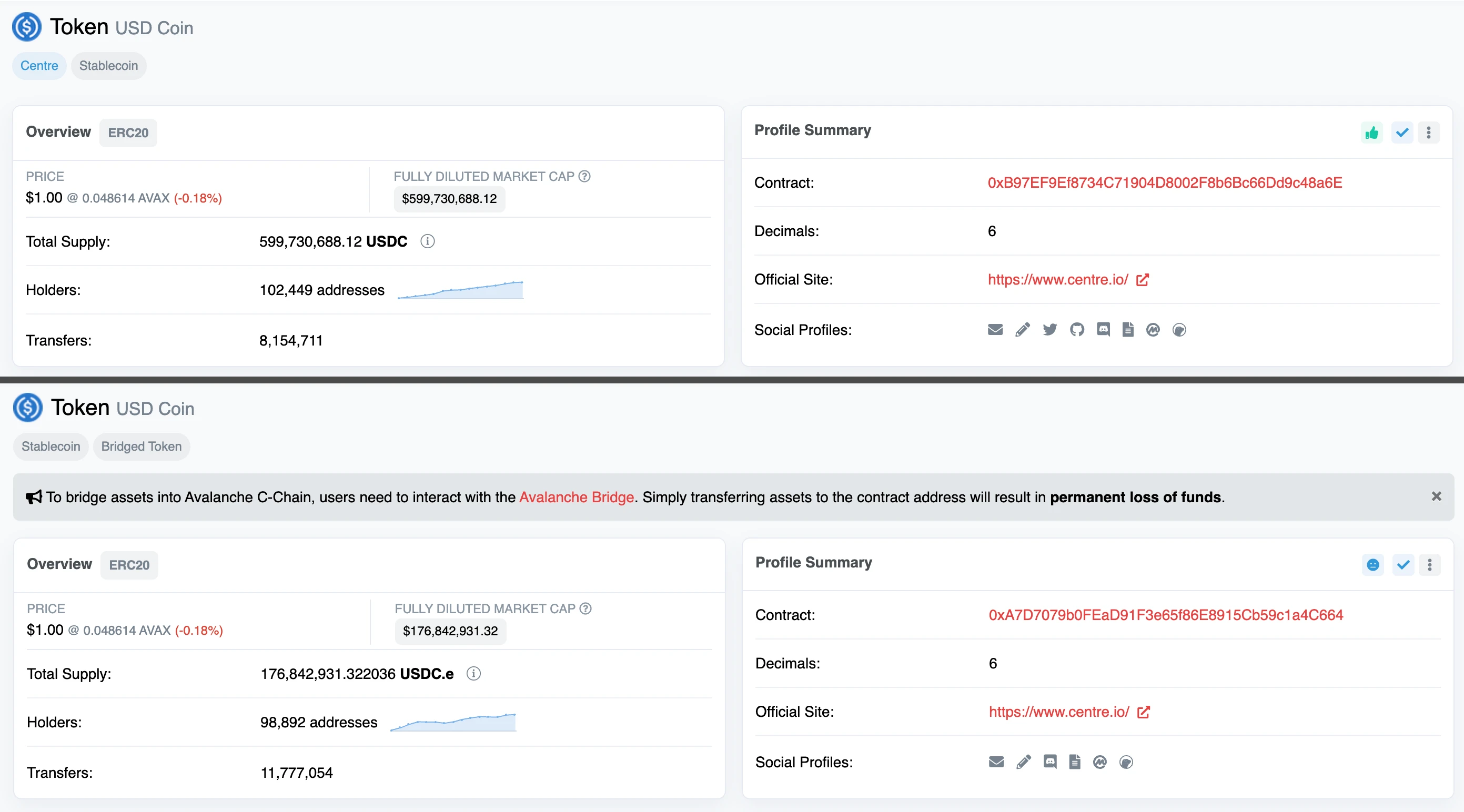

Taking Avalanche as an example, there are currently two mainstream USDC tokens on this network. 599 million native USDC issued by Circle, with the contract ending number “8a6E”. 176 million USDC.e issued and minted by the Avalanche official bridge, with the contract ending number C664.

(The cross-chain asset USDC.e is not supported by legal currency, but is supported by the USDC of the Ethereum chain through the bridge)

For users, there is no difference between the two USDC usage experiences. Both are worth US$1 and can be used on major DEXs. But what’s interesting is that if a user holds both USDC at the same time, both coins will appear in the wallet at the same time. In Avalanches DeFi world, the large number of trading pairs based on two different USDCs is even more confusing. Users will always inadvertently conduct inefficient transactions of exchanging one USDC for another USDC.

Having two types of USDC on the same chain is a more intuitive way to experience liquidity fragmentation. And this separation is even more obvious when placed in a broader multi-chain ecosystem.

In order to use USDC on multiple chains, a large amount of non-native USDC is issued by the bridge. And what is the native USDC doing at this time? After being locked in the capital pool as an LP. This lock-in model will undoubtedly sacrifice a lot of capital efficiency.

Generally speaking, in order to provide sufficient liquidity, mainstream bridges always need to lock a large number of tokens at both ends of the bridge. Although these tokens can support daily transactions, staying in the LP pool for a long time has reduced the number of tokens that can be circulated in the market. We can roughly think that in order to support the cross-chain flow of some tokens, a considerable part of the funds need to be deposited in the pool and cannot be effectively utilized.

This undoubtedly reduces token liquidity and capital efficiency to some extent. CCTP will have a certain impact on many parties in the encryption world, the first of which is cross-chain bridges. Stablecoins are currencies with high transaction volume in all major cross-chain bridges. CCTP may have a strong impact on the market share of cross-chain bridges.

In addition to existing interoperability protocols, LPs may not welcome the arrival of CCTP. The lock-up model of traditional cross-chain bridges requires a large number of LPs to provide funds. On major cross-chain bridges, cross-chain LP market making for stablecoins has always been a low-risk way to earn profits.

Cosmos’ Stablecoin Dilemma

The deployment of CCTP in Noble is a major event worth recording for both Cosmos and Circle. But the interesting thing is that dYdX is another partner actively promoting the deployment of the protocol.

The seemingly unrelated dYdX will actually benefit greatly from the native deployment of USDC. In June 2022, dYdX announced that it would move to the Cosmos ecosystem and implement the migration in the upcoming dYdX V4 version. This is also the first time that a well-known Ethereum-native DeFi application has chosen to escape.

However, after entering the Cosmos ecosystem, the differences between the Cosmos ecosystem and the EVM ecosystem caused dYdX to face a dilemma similar to that of most applications in the ecosystem - a lack of stablecoins.

Odaily checked several mainstream large-scale CEX and found that most of them do not support stablecoin deposits and withdrawals on the Cosmos network. As an on-chain contract exchange, dYdX’s demand for stablecoins is undoubtedly huge. The abundant stablecoin liquidity between the Cosmos ecosystem and the EVM ecosystem will undoubtedly be of great help to dYdX.

Before the collapse of Terra, the demand for stablecoins within the Cosmos ecosystem previously relied heavily on the algorithmic stablecoin UST on the Terra chain. After UST returned to zero, the Cosmos ecosystem suffered a big blow. Since then, Cosmos’ native stablecoin has been vacant.

Although Cosmos has Axelar cross-chain USDC, cross-chain USDT, USDC, etc. through the Nomad bridge, these tokens are not native tokens. In the context of frequent security incidents, the security reputation of cross-chain bridges is still not as good as native ones. The coin is robust. Moreover, the liquidity of stablecoins issued by different cross-chain products is dispersed due to inconsistent mapping formats.

It was not until June this year that Tether officially announced that it would issue native USDT through the Kava network. This also makes up for the lack of stablecoins in Cosmos, a prosperous and long-established ecosystem.

At this point, the two major stablecoins USDT and USDC have both entered the Cosmos network. The collaboration between the Circle, Noble and dYdX teams looks like a pretty win-win situation for all three. As for the Cosmos ecosystem, can the completion of the last piece of the puzzle of stablecoins lead ATOM, which has recently become popular again, to a more ambitious future?