In the post-"Ethereum Shanghai Upgrade" era, what should we pay attention to?

Summary

Summary

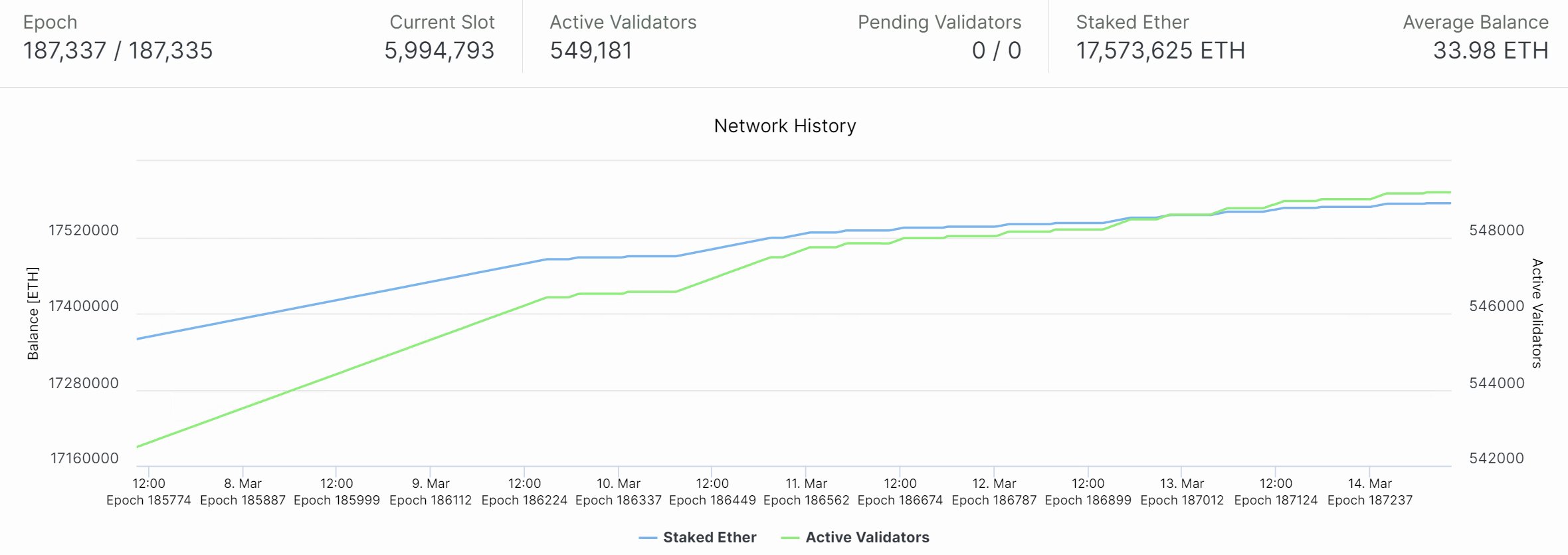

Ethereum will complete the Shanghai upgrade in April, when the beacon chain pledged ETH withdrawal function will be opened. The Shanghai upgrade is a hard fork of the Ethereum execution layer, and a total of 9 EIPs are expected to be realized. As of March 14, 2023, approximately 17.5 M ETH is staked, representing 15.25% of the total ETH supply. Ethereum validators have accumulated more than 2 ETH in staking rewards on average, and more than 1 million ETH will flow to the market after the Shanghai upgrade. The impact of the Shanghai upgrade on the Ethereum ecosystem is undoubtedly significant. This time, we mainly discuss the withdrawal design and related risks of the Ethereum and LSD protocols after the Shanghai upgrade, as well as the impact on the price of ETH and the price of derivative tokens related to the LSD protocol.

1. The official withdrawal process of Ethereum

Withdrawal is jointly upgraded by the executive layer and the consensus layer. There are two rules: "partial withdrawal" and "full withdrawal". Partial withdrawal is to withdraw only the proceeds; full withdrawal is to withdraw from the validator node, and all proceeds + pledges are withdrawn. There is no difference in priority between these two withdrawal methods, as long as the necessary conditions are met, they will be executed automatically:

Necessary condition: Validator has 0x 01 Credential (active validator's deposit certificate, the current proportion of validators with this certificate is 42%)

Partial withdrawal conditions: Validator is Active, and the balance of Validator is greater than 32 ETH

All withdrawal conditions: Validator is Withdrawable (this usually means that Validator has exited the network)

The number of withdrawal requests executed by the Ethereum beacon chain within a fixed period of time is strictly limited, and each block can process up to 16 withdrawal requests. After the validator meets the withdrawal conditions and submits an application, a withdrawal list will be created to include all validators who have submitted withdrawal requests. The list lists the order of withdrawal, the receiving address of the execution layer, and the withdrawal amount. Withdrawal requests are all initiated at the consensus layer, and will not be carried out independently or entered into the transaction memory pool, so the withdrawal behavior does not require gas and will not increase the gas of Ethereum.

According to data from Beaconcha.in, as of March 14, 17,573,625 ETH has been pledged on the Beacon chain. The number of active validators is 549,181, and the average ETH pledged by each validator is currently 33.98. The total number of ETH on the Beacon chain is 18,661,170.4 ETH.

image description

Figure 1. The network history of Ethereum (Source: Beaconcha.in)

ETH staking began in November 2020, when ETH prices were between $500-600, and these long-term stakers are likely to be eager to withdraw their ETH and rewards. However, the pledge starting from February 2021 will be a loss relative to the current price. Most withdrawal requests will be "Partial Withdrawals". It is expected that after the withdrawal is opened, the selling pressure of ETH will not be too serious, mainly due to the selling behavior of early players.

image description

Figure 2. ETH price curve (source: coinmarketcap)

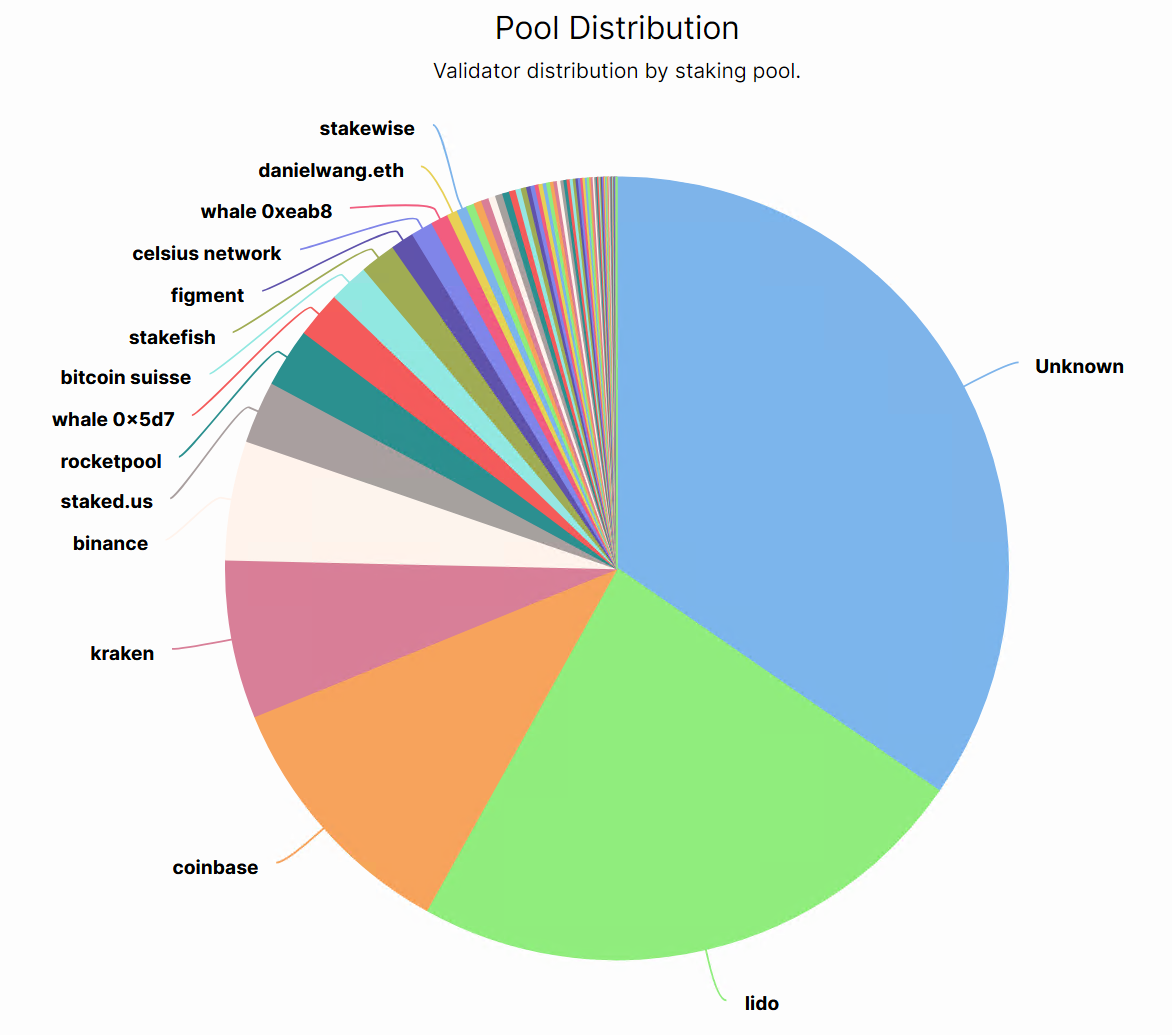

In addition, according to data from glassnode, there are about 920 nodes who are willing to withdraw from validators. At the same time, due to regulatory reasons, most of the ETH tokens pledged by centralized institutions will be unlocked, and in extreme cases, they need to be completely withdrawn. This may include Kraken (6.52%) and Binance (4.92%), which have more than 2 million ETH, and due to the validator churn limit function, it will take a month for all withdrawals to complete. However, these pledged ETH will not be fully circulated in the market, and it is very likely that they will continue to be deposited in other pledge agreements.

image description

Figure 3. Statistics on the number of voluntary exit validator nodes (source: glassnode)

3. Current status and withdrawal design of each LSD agreement

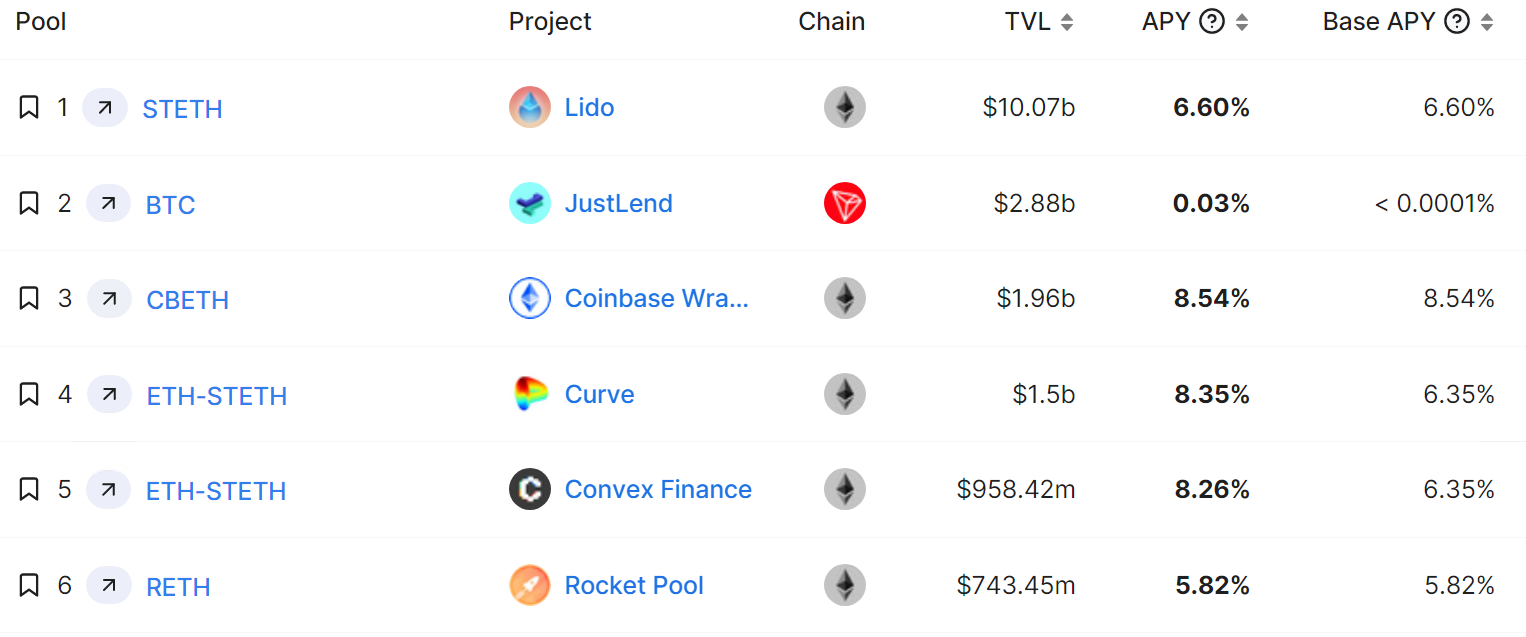

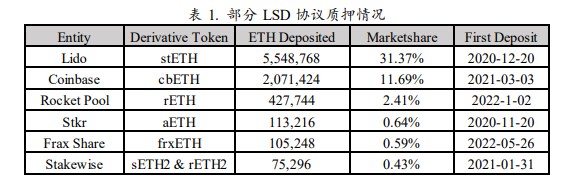

At present, the total ETH pledge amount of various LSD protocols accounts for 42.97% of all pledge amounts, and the Lido protocol alone accounts for more than 30%. The mortgage derivative token LST of these agreements has already been circulated in the secondary market earlier than the Shanghai upgrade, and their current yields in DeFi agreements have performed very well.

image description

LST tokens already account for around 65% of total collateral. And these mortgage derivative tokens have experienced a substantial discount in the past two years. At present, due to the approach of the Shanghai upgrade, the overall liquidity of LST is relatively good. The openness of withdrawal is good for the return of LST price, but it also tests the risk management ability and withdrawal process design of each LSD project party.

image description

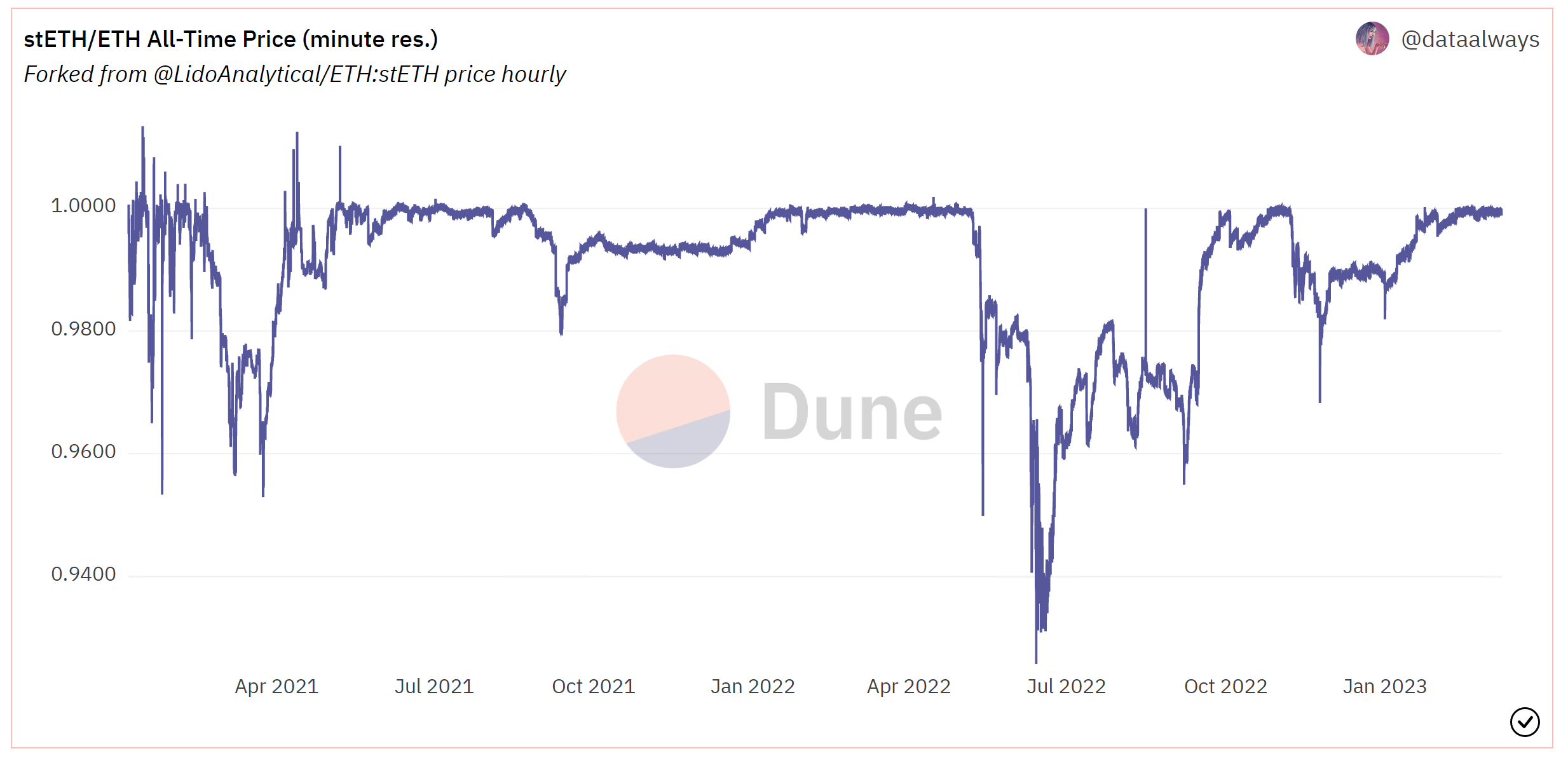

stETH is currently the most liquid LSD token. As can be seen from the stETH/ETH price curve in the figure below, the price of stETH/ETH has experienced a large-scale discount during March 2021 and June 2022, corresponding to 3AC and FTX events. This is mainly due to insufficient liquidity. This part of the sale in 2021 happens to be at the high point of the market. Most of the selling users in this part are mortgage users at the end of 2020, and they will make more profits by exiting here.

image description

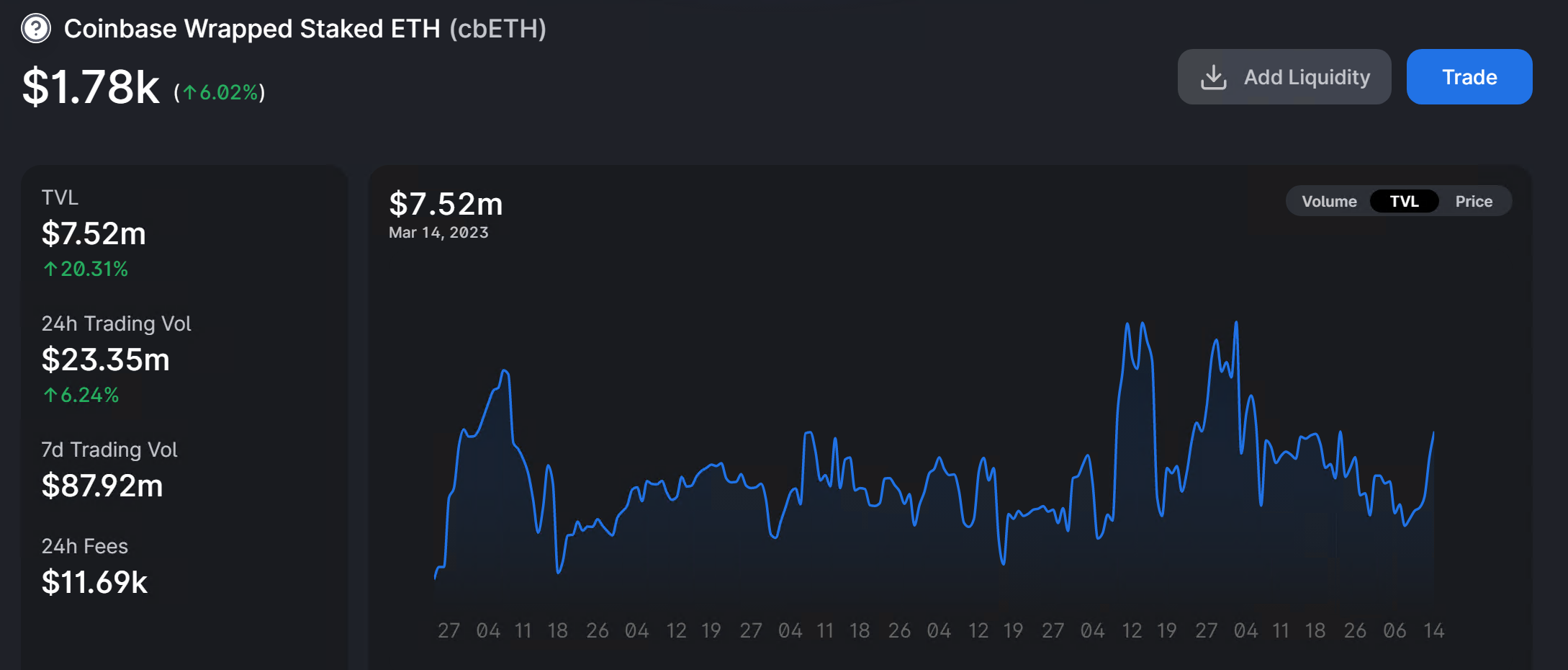

Coinbase’s LST token cbETH has been in a discounted state before. cbETH is mainly in Uniswap, and the current TVL is about $7.5 M. The daily transaction volume is low, and there may be insufficient liquidity. But lately it has been strong. Perhaps as the Shanghai upgrade approaches, arbitrageurs can profit by buying cbETH at a discount.

image description

Rocket pool has the third largest market share in the LSD protocol, and its derivative token rETH has a market value of $391 M and a circulation of 210,000. After the Shanghai upgrade, users can return rETH to the agreement to redeem the pledged ETH and corresponding rewards, so the price of rETH in the secondary market has always been higher than that of ETH.

image description

Figure 8. rETH/WETH price curve

3.2 Comparison of the withdrawal process of each LSD agreement

There are uncertain risks in the design of the withdrawal scheme of each LSD protocol. The upgrade of Ethereum Shanghai is a perfection of the PoS mechanism and a challenge to the LSD protocol. Protocols need to strike a balance between user experience, speed of operation, and security. Overall, the Ethereum PoS withdrawal process is very complicated, especially the time allocation on various withdrawal protocols is different. After the Shanghai upgrade, each LSD protocol may be attacked due to design flaws. Most withdrawal designs will address the following two issues:

(1) Avoid attacks and arbitrage behaviors: mainly the exchange of LST tokens and ETH and the secondary market may have price fluctuations for arbitrage, reducing the APR of the agreement. How to meet the agreement to have enough ETH for users to redeem, etc.

3.2.1 Lido

(2) When setting the withdrawal threshold, it can improve the user experience, especially the user waiting time.

Lido v2 has been voted by the community. Lido withdrawals are designed with two modes: Turbo and Bunker. Lido has established a withdrawal buffer for withdrawals, which is mainly composed of three parts: execution layer rewards, withdrawal ETH and user mortgage ETH. After the Shanghai upgrade, Lido will have 20w ETH that can be withdrawn immediately (no need to go out of the verification node process), and this part can be used for the establishment of the buffer zone.

Turbo mode: Once there is enough ETH, the protocol will fulfill the withdrawal request. The request time ranges from 1 hour to 3/4 days, depending on whether there is enough ETH in the buffer, the waiting time is variable (requires the validator node to exit).

Bunker mode: If the Lido validator node suffers a large-scale slash, this mode will be triggered. It needs to wait until the slashed node exits to be able to predict the loss and distribute the loss to the users. And it is necessary to ensure that the redemption calculation of stETH:ETH can be performed accurately. With this mode, withdrawals may take longer than 36 days.

After the user's withdrawal request enters the queue, the user can obtain an NFT, which represents its position in the request withdrawal queue. The NFT can be traded in the secondary market, and users who are willing to bid can purchase the NFT with the highest position. If the price of ETH is volatile in April, this secondary market can play a lot. If slashing occurs during the request, the users in the queue will also share the proportion of the penalty. However, there is no reward for stETH withdrawal requests in the queue, which is also to avoid malicious arbitrage attacks.

3.2.2 Rocket Pool

In addition to the above design, in order to avoid attacks and arbitrage, there are other requirements for Lido withdrawals, such as withdrawal requests cannot be canceled, and the redemption rate of the request cannot be higher than the redemption rate when the request was created.

Rocket Pool introduces minipools, which reduces the capital requirements of verifiers. Only 17.6 ETH can be used to operate a minipool. When the pool is revoked, the verifier's funds will be lost first, so that rETH holders get 110% insurance.

For withdrawal requirements, RocketPool has designed a deposit pool. The redemption of rETH can provide ETH from the deposit pool and partial withdrawals. rETH can also be converted into ETH at a low price from the secondary market. This is an arbitrage for minipools operators Opportunities, because it can buy rETH at a discounted price from the secondary market, and use RocketPool's burning mechanism to withdraw from minipools, thus ensuring the exchange rate of rETH:ETH= 1: 1. Therefore, the operators of Minipools can freely choose whether to withdraw or withdraw rewards, which is completely determined by market behavior.

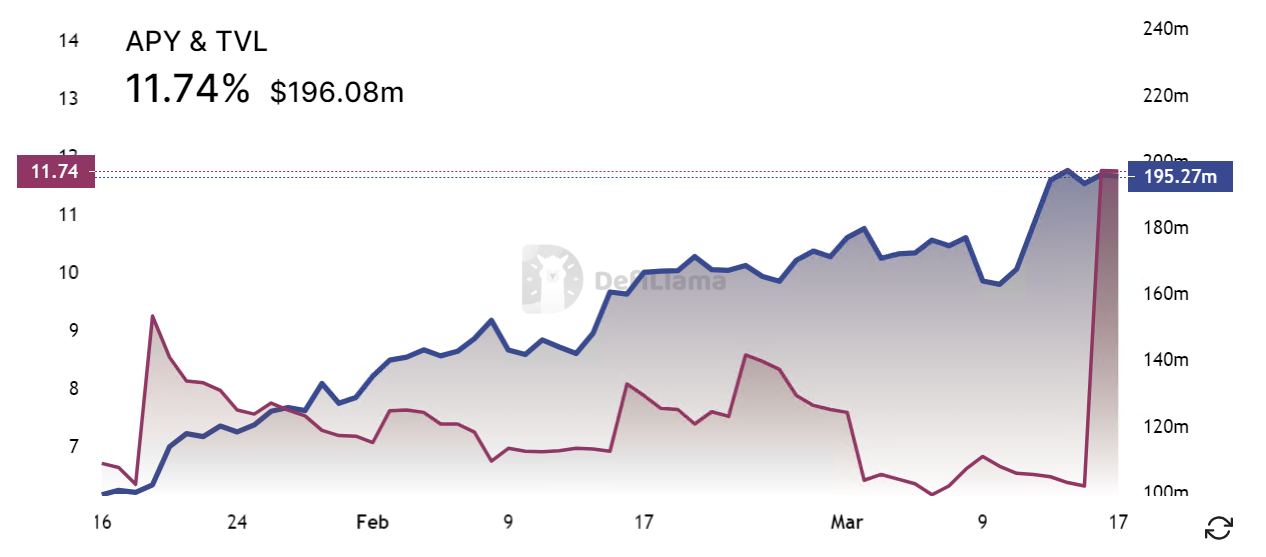

3.2.3 Frax Finance

Users pledge ETH to Frax. frxETH does not accumulate pledge rewards, but redeems ETH 1: 1 within the agreement. In order to get staking rewards, users need to deposit frxETH into the protocol again and get sfrxETH. Therefore, the redemption of Frax will not be affected by the Shanghai upgrade, and it is more important to consider whether the protocol can provide enough ETH for redemption. Especially when Frax can no longer attract users based on higher yields, there may be a large number of redemptions.

image description

3.2.4 StakeWise

Figure 9. frxETH APY & TVL (Source: Defillama)

The liquid staking service provided by StakeWise is similar to Lido. The difference is that StakeWise has upgraded the V3 version to deal with the risk of centralized validators, but this version has not yet been launched. StakeWise has two mechanisms for staking: Pool and Solo. The Pool mechanism is a pledge pool for any ETH holder to participate in, and the Solo mechanism is a non-custodial pledge service provided to each user with 32 ETH.

In terms of the exit mechanism, users of the Pool mechanism need to upgrade in Shanghai before they can destroy sETH 2 and rETH 2 within the agreement, and get ETH in return at a ratio of 1:1. Before the Shanghai upgrade, there was a secondary market that was able to trade sETH 2 and rETH 2, two pledged derivative tokens. Solo users can choose to withdraw voluntarily before the upgrade in Shanghai. The balance cannot be accessed and cannot be re-entered into the pledge. After the upgrade in Shanghai, if they choose to withdraw voluntarily, the fees will continue to accumulate until they are completely withdrawn, which will take about a few days.

4. Conclusion and thinking

The impact of the Shanghai upgrade on the LSD protocol mainly has three aspects:

(1) Currency prices, including prices of ETH, various LSD protocol tokens, and protocol derivative tokens;

(2) Withdrawal design tests the technology of each LSD protocol, and users begin to re-layout;

(3) More DeFi protocols derived from Ethereum pledge or LSD protocol.

Once users are able to re-select the staking protocol, a new round of Ethereum staking begins to reshuffle. Moreover, new LSD protocols or pledge-based mechanisms will be launched, such as applications based on DVT technology and EigenLayer's re-pledging concept, which are likely to have better returns. For most ETH pledgers, after the Shanghai upgrade, they can change the pledge method and object initially decided, and the market share of the entire Ethereum pledge is redistributed.

About Huobi Research Institute

references

2. https://tim.mirror.xyz/zLdl 8 bEiDmobHZ 5 RlvG 2 LrlZLWV 9 c 2 XvkuKQ-vpljSU

3. https://coinvoice.cn/articles/29918

4. Gitcoin Launches gtcETH Index Token To Bolster Funding - The Defiant

5. https://hackmd.io/@lido/SyaJQsZoj

6. Partial withdrawals after the Shanghai fork

https://dataalways.substack.com/p/partial-withdrawals-after-the-shanghai

7. StakeWise document: https://docs.stakewise.io/stakewise-pool

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding research and exploration in various fields of blockchain, with a view to pan-blockchain As a research object, the research objectives are to accelerate the research and development of blockchain technology, promote the implementation of blockchain industry applications, and promote the ecological optimization of the blockchain industry. The main research contents include industry trends, technical paths, application innovations, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

https://research.huobi.com/

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report come from compliant channels, and the sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute is not responsible for any losses caused by the use of the content of this report, unless it is clearly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you want to quote the content of this report, please indicate the source. Please let me know in advance if you need to quote a lot, and use it within the scope of permission. Under no circumstances shall any quotation, abridgement and modification contrary to the original intention be made to this report.