LD Capital: MakerDAO where all things grow, the spark has been ignited

Original source:LD Capital

Summary

Original source:SummaryMakerDAO, as one of the most successful veteran encryption projects in decentralized governance, development, and operation, is currently entering the "endgame plan" stage.By establishing several SubDAOs, new functions and products based on the Maker system will be separated, self-government, self-responsible for profits and losses, or new tokens will be issued,

In order to achieve the goal of reducing Maker's operating costs while isolating risks, and enhancing the sustainability of increasingly large and complex systems, this move is expected toMake Maker an ecology like Layer 1, allowing "everything to grow".

The new SubDAO, composed of former MakerDAO members such as Maker core developers and chief growth officers, will release Spark, a lending protocol based on Aave V3 code, in April this year, which is expected to release more value from more than $8 billion in collateral in Maker’s treasury. WillCombined with the cheap D 3 M lending module and the PSM casting pool in the Maker system, it will form a powerful synergy, providing $DAI with the most competitive and relatively stable interest rate.

DeFi "matrixization" has become a trend, and some established DeFi applications are developing more native nested applications based on the advantages of user assets or liquidity.

For example, Curve launched l crvUSD, Aave launched GHO, and Frax launched Lend. However, compared to the difficulty of Aave/Curve to expand the GHO/crvUSD stablecoin, it is much less difficult for Maker to expand the lending business

The launch of Spark represents the beginning of a major change in Maker's ecology. The marginal improvement of the $MKR token is the most obvious. The valuation system needs to change from a single project token to an ecological token similar to a public chain. Because the $MKR token, which originally only had governance rights, has a staking mining scenario for the first time, it may provide 12 to 37% APY for $MKR staking. At the same time, ecological applications will effectively expand Maker's balance sheet. Under pessimistic and neutral scenarios Bring Maker an additional annual income of 2.75 to 12 million US dollars, which in turn increases the amount of $MKR burnt by 1 to 3 times.Spark ProtocolWhen the founder of MakerDAO proposed the "Endgame Plan" (Endgame Plan) plan in June last year, he stated that MakerDAO needs to continue to expand while maintaining maximum flexibility. So on February 9, 2023, some core unit team members of MakerDAO❶

Created Phoenix Labs, the team is committed to developing new decentralized financial products to expand the Maker protocol ecosystem.Spark Protocol is the first protocol developed by Phoenix Labs,

A universal lending protocol for over-borrowing with stable currency DAI and other mainstream encrypted assets as collateral.As the first protocol to illuminate Maker's new DeFi matrix, the name Spark happens to fit the Chinese meaning of "a single spark can start a prairie fire".Users use high-liquidity assets such as ETH, WBTC, stETH, etc. as collateral, and lend the corresponding assets according to the interest rate model.

Combined with the cheap D 3 M lending module in the Maker system and the nearly 100% capital-efficient PSM casting pool for stablecoins, it forms a strong synergy, which is the most competitive and relatively stable interest rate for $DAI in the entire market.Spark,Trend Research

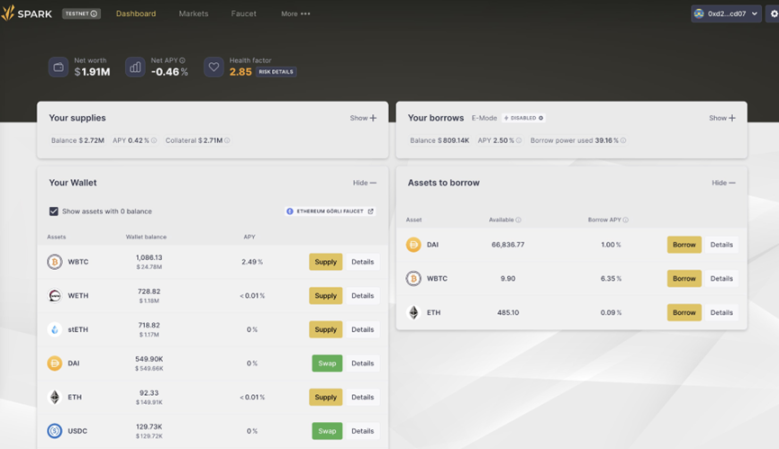

image descriptionFigure 1: Spark application beta page, source:。

Of course, the Spark team has stated that after the DAI loan scale reaches 100 million US dollars in the next two years, it will allocate 10% of the profits earned by the DAI market to Aave.

Start a proposal on the Aave forum

Spark Protocol product advantages

1. Tried and tested code

Based on Aave's mature code modification, the code has passed the historical test and has high security. Also, like aTokens, depositors can also get tokenized (spTokens) versions of their positions. spTokens can be moved and traded like any other cryptoasset on Ethereum, further improving capital efficiency.

2. Loans with low and stable interest rates

Spark Lend can directly use Maker's credit line, called the Dai direct deposit module (D 3 M ❷), and users will theoretically be able to borrow any amount Dai (but there is a limit of 200 million at the beginning)

3. The utilization efficiency of ETH assets is high

Spark Lend also introduced the e-Mode module of Aave V3. ETH assets can be borrowed at an LTV of up to 98%. For example, pledging wstETH can lend up to 98% of ETH, increasing the efficiency of capital use.4. Double Oracle price feed manipulation is more difficultSpark may adopt ChronicleLabs (formerly Maker Oracles) and Chainlink

5.Fair Launch

dual data sourceto provide on-chain prices. These two data sources will be processed through three checkpoints of TWAPs (weighted average price), signature price source and circuit breaker to ensure that the price will not be manipulated.The issuance of protocol tokens is completely distributed through liquidity mining, without any pre-allocation❹, a fair distribution mechanism, which can attract more people to join the community and improve the consensus and value of the community.

The project party also believes that

Spark Protocol needs to compete on a level playing field to win SubDAO's support for it to be accepted as a product.6. MakerDAO 100% endorsementSpark is not an "independent tripartite" protocol in the usual sense. Although the protocol was developed by Phoenix Labs, it

Wholly owned by Maker Governance

(Including all smart contracts, trademarks, IP, etc.), which means that if the agreement encounters any difficulties that cannot be solved independently, Maker will most likely come forward to help.

Three measures to help $DAI become a better "world currency"

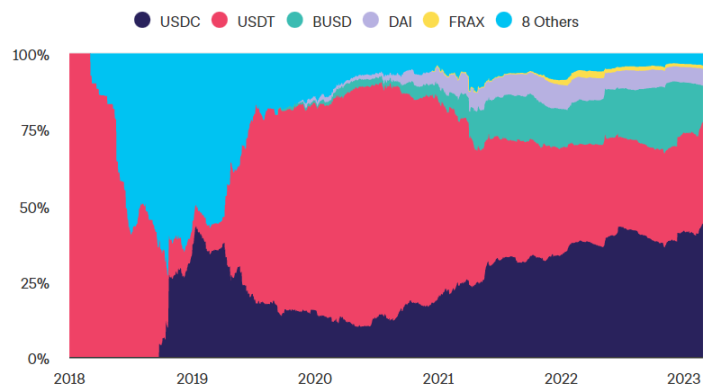

Maker's mission is to create a "fair world currency," but so far $DAI's $5B+ market cap pales in comparison to $USDT's $70B+ market cap. So how does it scale and eventually surpass centralized stablecoins?

The launch of Spark Protocol indicates three major directions for the future development of Maker products, all of which aim to increase the amount of DAI minted and reduce the cost of use:

1. Internal D 3 M, PSM function integration

Spark Lend integrates the existing D 3 M❺ within Maker, and the PSM ❻ module provides liquidity for the stable currency DAI.Among them, the most significant advantage of D 3 M is that it allows the secondary market to directly mint $DAI, eliminating the need for a first-level minter to mint in Maker, and then depositing DAI in the secondary market for application. Mortgages are merged into one layer, improving the actual capital efficiency of DAI.

The initial plan is to provide $300 million in D 3 M liquidity to Spark Lend,

Among them, 200 million is the hard cap of the first phase, and 100 million is the buffer fund. In theory, this size limit will be adjusted according to the actual market lending rate performance.In addition, the Spark Lend front-end page will support MakerDAO's PSM and DSR. USDC holders can directly convert USDC in PSM to DAI through the Spark Protocol official website, and obtain deposit interest through DSR, promoting the use of DAI from the demand side.For example, under the normal path, 1 $DAI flows out of Aave in the lending market,There are actually two layers of collateral behind it:~$1.50 in Aave collateral + $1.50 in Maker vault ❼, without revolving borrowing,

This common scenario actually takes up USD 3 in encrypted asset collateral, but after integrating D 3 M and PSM, lending 1 DAI on Spark only requires USD 1.5 in collateral

(or a $1 whitelisted stablecoin like $USDC), capital efficiency is greatly improved.

2. Enter the LSD market through EtherDAI

The Spark Protocol will bootstrap the use of EtherDAI. EtherDAI is a liquid mortgage derivative created around ETH, such as Lido's stETH, users can package stETH into ETHD and use it as collateral to lend DAI.

Maker governance will have backdoor access to ETHD collateral, possibly incentivizing liquidity by setting up ETHD/DAI short-term liquidity mining on Uniswap. On the other hand, it is possible to set the stability fee of EtherDAI Vault to zero to induce demand for EtherDAI Vault.

Secondly, after the upgrade of Ethereum Shanghai, it is equivalent to the fact that the official Ethereum will provide more than 4% of the basic income, which will inevitably usher in a large-scale migration of ETH assets. Spark supports liquid pledge (LSD) encapsulation tokens to prevent TVL from shrinking, and through income superposition It may even attract more funds into the agreement, thereby reducing dependence on USDC.

More importantly, TVL represents the lock-up value of the funds in the agreement. When the TVL in the agreement rises, the liquidity and availability will increase, and the agreement itself can obtain more considerable benefits. For Spark, a notable source of revenue is depositing lending spreads between borrowers.

3. Maker + Spark = the lowest interest rate in the market with predictable fluctuations

The advent of the Spark protocol will also allow Maker to better actively control the supply of DAI based on market demand, thereby directly interacting with its secondary market, with the goal of providing better interest rates to its users and increasing the supply of DAI.Specifically, when the DeFi industry is booming, lending rates tend to soar, causing users to pay higher than expected loan costs, thus negatively impacting the $DAI supply and demand market. D 3 M will affect the main $DAI lending market (Spark) by stabilizing the $DAI rate. When market demand for $DAI is high, Maker can extend Spark's hardcap of minting and supplying $DAI to lower its rate. Conversely, if demand is low, $DAI liquidity will be removed from Spark to increase its rate.put it all together,Keeping $DAI the cheapest in the stablecoin war, with predictably volatile lending rates, is a key competitive advantage in increasing its usage.

Through the D 3 M fund pool can

Analysis of the current balance of payments of the MakerDAO protocol

income

The current cost of MakerDAO is more than 40 million US dollars per year. If it is not aggressively invested in RWA financial management, the project will have a net loss of 30-40 million yuan. Therefore, there is an "end plan" proposed by the founder to increase revenue and reduce expenditure.

income

MakerDAO's current income sources mainly come from four aspects:

Overcollateralized Vault's stability fee income, that is, minting/borrowing DAI interest;

Liquidation penalty income from liquidation of undercollateralized assets;

Stablecoin transaction fees earned through PSM;

RWA (Real Assets) Vault earnings.

The stability fee charged by the encrypted asset Vault used to be the most important source of income for the agreement, but the current wealth management income of RWA has become the largest source of income.

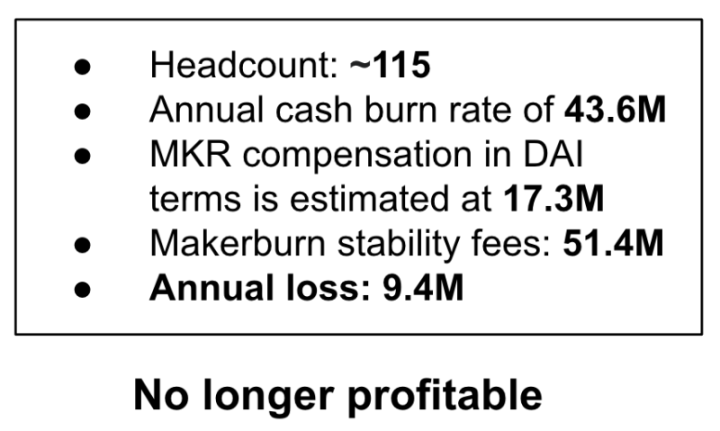

expenditureAgreement expenses are mainly staff salaries, market growth/marketing expenses, among which the largest proportion is the salaries of engineers who maintain the core of the agreement.In June 2022, data released by MakerDAO co-founder Rune Christensen showed:Including $43.6 million in cash flow and $1,730 in $DAI-denominated $MKR, costs have outstripped protocol revenue, causing the protocol to

The loss was about $9.4 million.MakerDAO Forum,Trend Research

image description

Figure 2: MakerDAO protocol revenue disclosure, source:The main reasons for the loss of the agreement are: 1) In the bear market environment, the income of the agreement has dropped sharply; 2) The team has generous expenditure; 3) Governance redundancy. The existing governance process is complex, requiring the participation of a large number of people and the governance cycle is too long, which also restricts the development speed of new product functions.Rune Christensen on The Endgame Plan

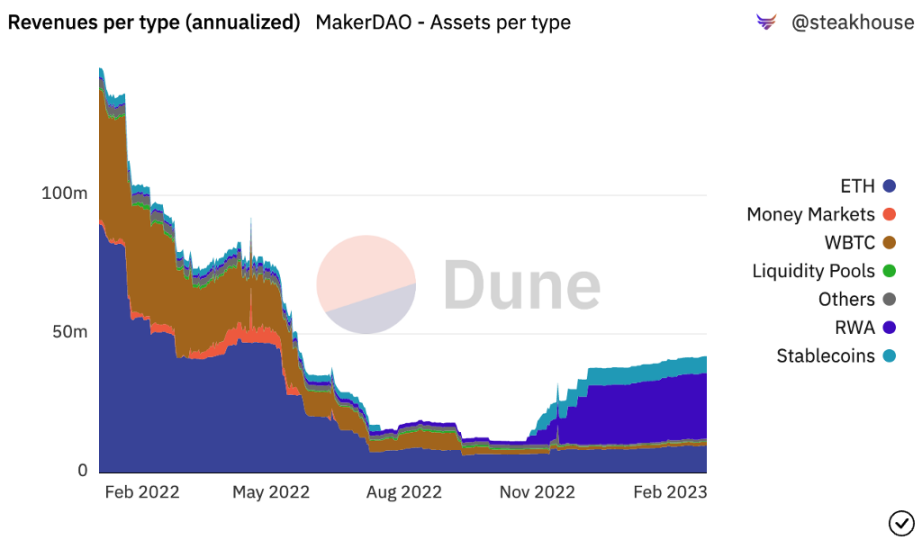

We will develop the plan in detail below. Its plan includes a solution to the current protocol's inability to make ends meet, that is, to increase the growth of RWA (real assets).Dune Analytics,Trend Research

image description

Figure 3: MakerDAO revenue structure, source:As can be seen from the above figure: 1) ETH Vault has been an important source of profit for MakerDAO until November 2022; 2) After November 2022, RWA (real asset) Vault has become the largest source of revenue for MakerDAO protocol.RWA Vault is an investment in off-chain financial markets, mainly bonds and mortgages. Because RWA collateral can bring higher stability fee income to MakerDAO, it has indeed brought higher income to the MakerDAO protocol as expected. Based on current investment of $696 million

Expected to generate over $26 million in interest income

, accounting for more than 40% of Maker's revenue.

But on the other hand, the potential seizure risk of RWA being regulated is relatively high, so the "End Plan" proposes a series of strategies including resisting RWA regulatory risks: under a moderate regulatory situation, Maker will give priority to maintaining a 1: 1 ratio with the U.S. dollar Anchor strategies without limiting RWA exposure to maximize revenue. The founder assumes that regulatory policies will become tighter and tighter in the future, so Maker's exposure to RWA will not exceed 25%, and it may be de-anchored from the US dollar when necessary. The ultimate stance is to maintain the maximum flexibility and viability of DAI, and no longer allow easily seized RWA as collateral, and there may be no major currency as a price reference.

Therefore, relying on the income of RWA is not a long-term solution. Expand Maker's income sources as much as possible, optimize the system organizational structure, and aim at "opening up sources of income and reducing expenditure" to ensure the sustainability of the Maker protocol to the greatest extent.

Endgame plan, all things grow

In order to better understand the upcoming major changes in the Maker ecosystem and the improvement of the supply and demand relationship of $MKR tokens, it is necessary to understand the "Endgame Plan" (Endgame Plan). Although there are many discussions in this plan to deal with regulations and politics, but In essence, Maker will become the same ecology as Layer 1, allowing "everything to grow".

The endgame plan was first proposed by Rune in June 2022, and there have been at least three versions of full-member discussions on the governance forum. This is a structural restructuring plan for MakerDAO, which aims to make MakerDAO a decentralized, self-operating DAO (Decentralized Autonomous Organization) in order to better meet the needs of its stablecoin Dai users. Specifically, it includes four main contents:

Building Complete Decentralization of MakerDAO

Improving Dai's liquidity and stabilizing its interest rate

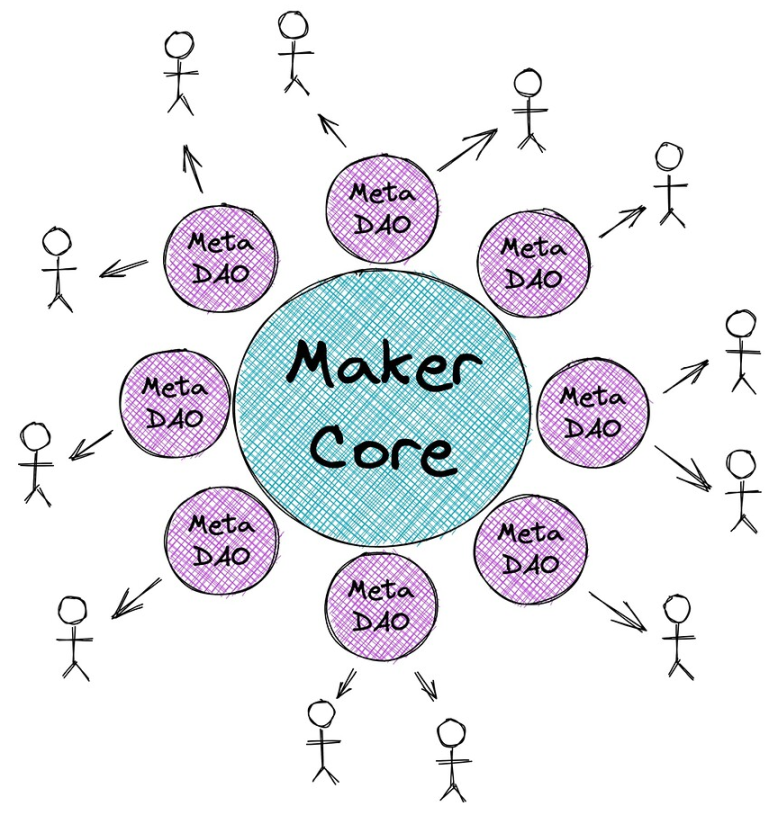

Improve protocol sustainability and reduce system riskImproving decentralized governance and DAO operationsAmong them, in order to simplify the complexity of governance, Maker will create a series of self-sustaining DAOs called MetaDAO❽. Rune willMaker Core compared to L1 Ethereum, which is secure but slow and expensive.

, can run quickly and flexibly, but at the same time gain security from L1. Through MetaDAO, MakerDAO can focus more on its primary goal, which is the issuance and stabilization of the stablecoin Dai. At the same time, MetaDAO can provide governance support for other projects in the MakerDAO ecosystem.

The so-called MetaDAO refers to the modularization of the Maker protocol. Each MetaDAO is a small community that can have its own tokens and treasury. The core value proposition of MataDAO is to isolate, mitigate risk, and parallelize Maker's highly complex governance process.MakerDAO Forum,Trend Research

Figure 4: Visual structure of the MakerDAO protocol, source:

There will be three types of MetaDAO:MakerDAO Forum,Trend Research

image description

Figure 5: MetaDAO types, source:Maker Core preserves all components that are integral and non-removable to the Maker protocol to function fully and achieve its goals of generating and maintaining Dai. Each type of MetaDAO surrounding the Core has its own function, which determines its interaction with Maker Core:

Creator Governor (also called Facilitator)

ProtectorResponsible for organizing Maker Core's decentralized employee management, on-chain governance, engineering, protocol management, and brand management;

Focus on the growth of the Maker ecological chain and the development of new functions, such as the Spark team belongs to this category;

Will manage the RWA Vaults, focusing on real-world assets, protecting Maker from physical and legal threats to its real-world asset collateral.MetaDAO also has a governance process similar to Maker Core. By deploying new ERC-20 tokens for governance, this can also overcome the single-threaded problem of the current Maker governance process, allowing MetaDAO to execute in parallel and speed up the governance process.

The protocol control of MetaDAO is actually held by MKR voters.

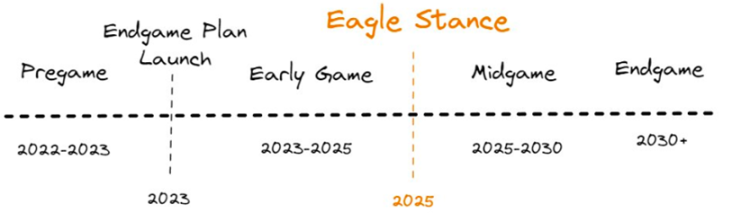

The final plan is divided into four stages. The Pregame stage team is expected to go online in 2023, including building ETHD, launching MetaDAO, and starting liquidity mining, etc.MakerDAO Forum,Trend Research

image description

Figure 6: Endgame Plan Roadmap, Source:

Spark Protocol will be the first MetaDAO and is expected to be launched in April 2023. It is currently undergoing mainnet deployment and a series of branding plans. In the second half of this year, Spark plans to integrate with Element Finance and Sense Finance to provide fixed-rate loans and more diversified income strategies.In the early days of the Endgame plan, Maker will launch 6 MetaDAOs, and each MetaDAO will issue Sub Tokens. Although Spark Protocol does not clearly introduce the token-related parts in the document, according to the plan and the Spark founder’s description, Spark should have its own tokens.Each Sub Token will form a core liquidity pool with $MKR,

The Maker team plans to issue 45,000 MKR per year as an LP incentive for the pool, which means that during the Endgame period, each MetaDAO will accumulate 7,500 MKR. Of course, liquidity pools related to ETHD, DAI, and MKR will also receive a small amount of token rewards.MakerDAO Forum,Trend Research

image description

Figure 7: Spark roadmap, source:

Spark, as the first application of the endgame plan, is expected to bring an annual revenue growth of $10 million+ to Maker, and at the same time allow the $MKR token to have a liquidity mining scenario for the first time, which we will analyze below.

Industry Trend: Matrixization of DeFi Applications

The lending platform that the Spark protocol will create will directly compete with established lending protocols such as Aave and Compound. Although Aave and Compound have integrated D 3 M ❾ , in the future Maker's limited D 3 M quota resources ❿ will inevitably give priority to Spark. Because the mainstream DeFi protocols on Ethereum seem to have started a "matrix" competition.

Each DeFi application is developing more native nested applications based on the advantages of user assets or liquidity, and "matrixization" has become a trend. For example:

Curve, which was originally a DEX, has been actively promoting its own "stable currency" $ 3 CRV, trying to tilt as much incentives as possible to the $ 3 CRV currency pair instead of a separate stable currency pair, and announced a new one last year. over-collateralized stablecoin crvUSD;

TVL’s #1 universal lending protocol, Aave, also announced plans to launch its DeFi over-collateralized stablecoin $GHO last summer;

FRAX, which has always been flexible in thinking, also launched Frax Lend in September last year, allowing users to borrow/mint FRAX from official contracts by paying market interest rates instead of conventional casting mechanisms. The mechanism is similar to MakerDAO's D 3 M.

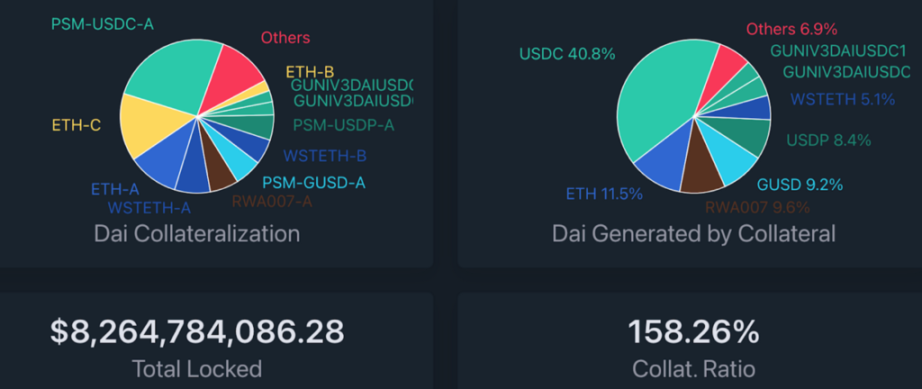

Among these applications, MakerDAO’s TVL has long occupied the top spot. As of February 25, 2023, its mortgage vault has collateral worth 8.2 billion U.S. dollars. In theory, all of it can be released into new borrowable funds. If realized, it is expected to It surpassed Aave in one fell swoop and turned into the largest lending agreement, so its strategy of moving towards the DeFi matrix will open up new imagination space for its ecological expansion.1. For a nascent stablecoin, the selling pressure is certain (first-level minters can only choose to sell in addition to pledge), while the buying is uncertain,

It is very dependent on whether Aave/Curve can create enough usage scenarios in its own ecology and cooperative ecology. Judging from the performance of the second-ranked decentralized stablecoin Frax in the two years since its launch, its market value has barely exceeded a quarter of DAI, even though Frax controls a considerable voting power in Curve War. It can be seen that even if the usage scenarios are hard created through subsidies, the ceiling of its scale expansion is still obvious.The Block,Trend Research

image descriptionFigure 8: The proportion of various stablecoins on Ethereum, source:

2. The governance of stablecoins is difficult and requires governance representatives with high professional knowledge to participate in maintenance.MakerDAO is one of the DAOs with the earliest establishment (founded in 2015) and the most mature governance. It has gathered a group of professional DeFi and money and banking researchers, leading DAI through several spirals of leverage and de-leverage, effectively accumulating Stablecoin governance experience. It must be admitted that the governance forum of Aave/Curve is also very active, but unlike lending, the governance failure of stablecoins can easily lead to a "death spiral" and the protocol will collapse. From this point of view, Aave/Curve still has a long way to go .

3. The threshold for establishing liquidity is high and the window period is limited.

In order for users to be willing to use a new stablecoin, in addition to high staking returns in some places, more importantly, it needs to have good depth and low slippage when exercising its role as a "transaction medium". This means that new stablecoin issuers may need to subsidize very heavily in the early stage to encourage users to recharge their stablecoins for other token liquidity, and before the subsidy drops to unattractiveness, users need to cultivate enough user stickiness, otherwise When the subsidy income falls below a certain threshold, the former LPs will begin to withdraw—the trading experience will decline—and depeg will occur frequently. This is the moment when this stablecoin enters a death spiral.

$MKR Use Case Revolution: Liquidity Mining + Double Burn

The launch of Spark will not only be a product update, but also the beginning of a major change in the Maker ecosystem. The marginal improvement of the $MKR token is the most obvious. The valuation system also needs to change from a single project token to an ecological token similar to a public chain. Because the $MKR token, which originally only had governance rights, has a liquidity mining scenario for the first time, or provides 12% to 37% APY for $MKR pledges, and at the same time, ecological applications will effectively expand Maker’s balance sheet. The base case is Maker brings an additional annual income of 10-20 million US dollars, which in turn increases the burning amount of $MKR by 1-3 times.

MakerDAO is the leading project of the DeFi protocol, and the siphon effect of the DeFi protocol is obvious. The TVL that Spark can achieve is expected to benchmark Aave. The most important types of Aave assets are ETH assets and stable coins. Taking the Aave V2 market as an example, the total market size reached 5.44 billion US dollars, and the annual income was 16.3 million US dollars, of which $USDC, $DAI, $ETH, The market size of the five assets of $WBTC and $stETH is about 1 billion US dollars, accounting for 1/5 of the total market size.

The value of collateral locked in the MakerDAO protocol is now $8.2 billion, and the value of single currency assets (non-LP tokens, non-RWA assets) is $6.6 billion. The total supply of $DAI is 5.2 billion, of which the $DAI generated by pledged $USDC reaches 4 billion. Judging from this value, even if only 1/4 of the $USDC released by PSM can reach Aave's current TVL.daistats.com,Trend Research

image description

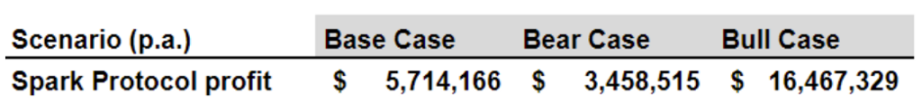

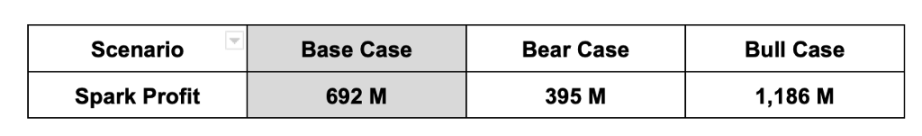

The Spark official team also assumes the revenue performance of the Spark protocol under neutral, pessimistic, and optimistic scenarios. Readers can compare and refer to it. Under the Bull Case, the expectation is higher than ours, which means that their optimistic estimate may have 5 billion + TVL, while the middle Sexual and pessimistic expectations we think are relatively reasonable:

Data Sources:forum.makerdao.com,Trend Research

image description

MakerDAO will convert from the current dual-token (MKR/DAI) system to a multi-token system, and MKR will open liquidity mining scenarios.

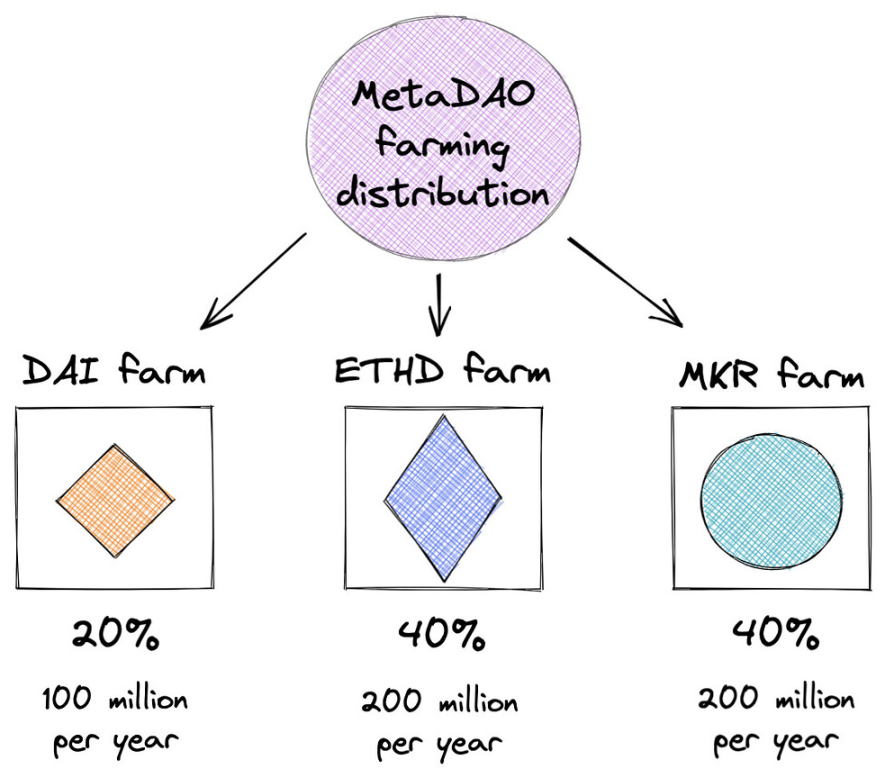

It is estimated that 2.6 billion MetaDAO (MDAO) tokens will be deployed when the new MetaDAO is launched, of which 2 billion will be released through liquidity mining, 1 billion will be released in the first two years, and then halved every two years. 400 million is allocated to MetaDAO contributors and 200 million is allocated to MetaDAO Treasury.MakerDAO Forum,Trend Research

image descriptionFigure 10: Distribution of liquidity mining rewards, source:

Liquidity mining distribution plan: 20% is used to stimulate the demand for DAI, 40% is allocated to ETHD Vault holders,40% is allocated to $MKR stakers.Staking mining is a significant change in its economic model for $MKR, because the supply and demand relationship of $MKR will be readjusted.

Lack of driving force in market demand. Moreover, when a debt deficit occurs, additional tokens need to be issued to cover the bottom line, and there is a possibility of inflation⓫.

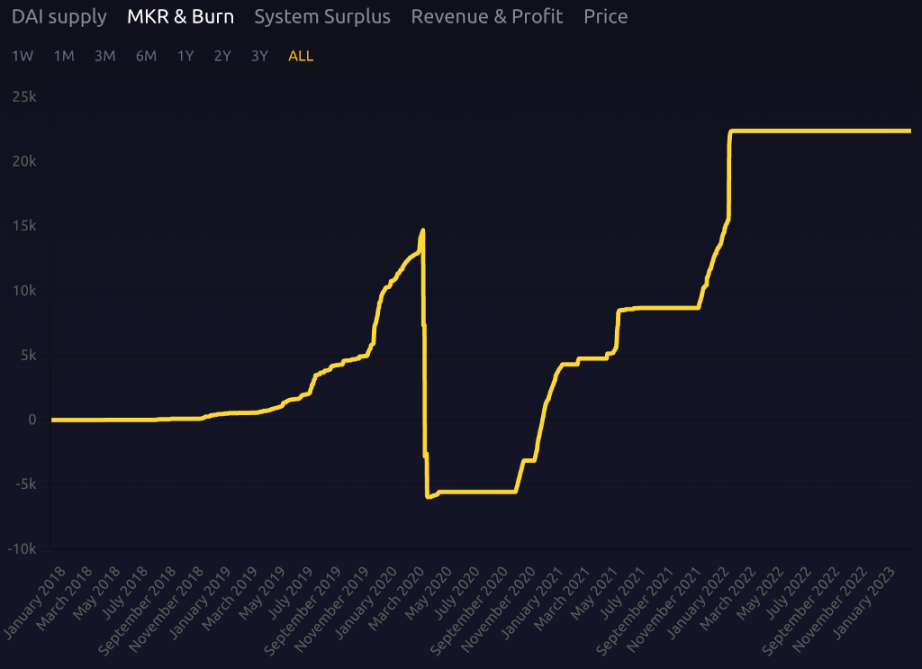

Although the surplus of the agreement can be used to repurchase and destroy MKR to make it deflationary, it does not seem to be considerable. MKR has been online for 5 years, and only 22,000 of the total 1 million tokens have been destroyed, with an average annual deflation rate of 0.4%.Makerburn,Trend Research

image description

Figure 11: $MKR issuance & destruction, source:

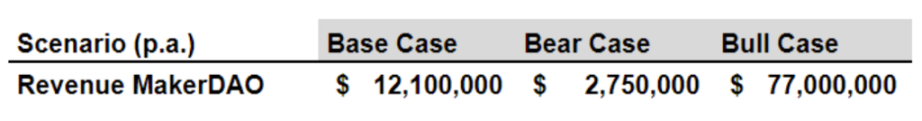

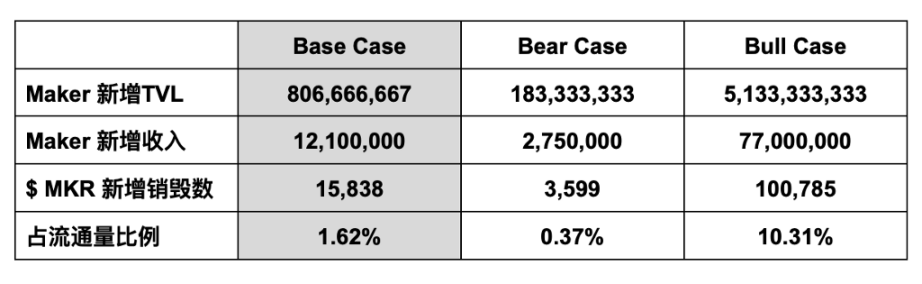

Because the expansion of Spark’s lending business will bring additional TVL to MakerDAO and generate additional fee income, Spark also gave MakerDAO’s simulated income for reference:

If the three situations are calculated based on the average 1.5% stability fee (annualized casting interest) and $MKR current price of $764 ⓬, the corresponding Maker's new TVL $MKR annual deflation rate will have the following expectations, which may bring Maker $800 million in new TVL, 12 million in annual revenue, and 1.6% annual deflation rate, four times the current rate, and the pessimistic scenario may only bring less than 200 million TVL growth and 2.75 million in annual revenue, but Even so, it can correspond to an annual $MKR burn of 0.37%:

The above is only a linear destruction assumption. In fact, MakerDAO will trigger the repurchase mechanism when the protocol surplus reaches 250 million US dollars. The current surplus is only 74 million US dollars, which has not yet reached the repurchase and destruction standard⓭.

With the improvement of Maker's income structure, the deflation rate of MKR should be accelerated. At the same time, the open pledge mining scene will stimulate the surge in market demand for MKR, which will largely make $MKR in circulation more valuable.

1. Build a DeFi ecological matrix around stable coins, and MakerDAO has changed from a single currency protocol to a DeFi application chain.

The goal of stablecoins is to expand the acceptance and usage scenarios of stablecoins as much as possible, so MakerDAO has been committed to seeking cooperation with external top DeFi protocols, such as Aave and Compound. After the MetaDAO model is established, Maker will build its own DeFi ecological matrix around stablecoins, which can recycle the value of stablecoins into the Maker ecosystem, thereby increasing the overall valuation of $MKR.

Also take the current $764 $MKR pledged to mine Spark tokens as an example to simulate and predict, and also assume that Spark token can reach the valuation of Aave token 35% / 20% / 60% under neutral, pessimistic, and optimistic conditions, and calculate 20% of $MKR participates in staking mining APR ranges from 12% to 37%:

1. MKR Spending Slows

image descriptionMakerburn,Trend Research

Summarize

Figure 12: Treasury Fund Income, Source:

Summarize

As the first application of the "End Plan", the essence of Spark Lend is to change the D 3 M module with higher capital efficiency from the original authorized tripartite use to self-use, eliminating the security, governance and other risks that may be caused by external agreements, superimposed The PSM module allows $DAI to maintain the best competitive advantage in terms of cost in the stablecoin war. Compared with variable rate competitors such as Aave or Compound, $DAI is also more certain in the interest rate charged, and users do not have to come back often Check to see if your borrowing costs have risen too high.

After Spark, there will be a series of subDAO project tokens available for MKR pledge mining. While isolating the risk, it will greatly increase the income scenario of $MKR, allowing it to have a real pledge mining scenario for the first time, superimposing Maker The ecology may further encourage $MKR/$DAI to trade liquidity LP for subDAO tokens, and may change the market's valuation framework for the token—from a single project token to a token similar to Layer 1 ecology.

As the most successful decentralized stablecoin, $DAI has been widely used in various DeFi applications, whether it is lending, trading, liquidity mining or other applications, you can see $DAI. But the disadvantage is that the increase in the usage of $DAI does not seem to have made enough corresponding contributions to the sustainability of the Maker ecosystem. The bigger the project, the more losses it has. In addition to maintaining the technical operation and maintenance of this complex and huge system, the market operation In order to make Maker sustainable enough, it is necessary to motivate high-quality governance talents and proposals. In view of the fact that the main incentive method is only $MKR tokens other than fee income. From this perspective, this Endgame series The essence of product upgrades can be understood as:

Capturing the value of $DAI usage scenarios that were originally outside the Maker ecosystem into the ecosystem, similar to the diversified development of banks, to serve the entire process of customer target needs.

appendix

As a result, it is expected that the amount of assets locked within the Maker ecosystem, the amount of DAI minted, and the price of $MKR will rise together.

appendix

risk warningD 3 M’s low-interest casting hard cap setting is relatively conservative, which will greatly limit Spark’s ability to help Maker “expand its balance sheet”, and has certain constraints on the increase of the total asset scale in the agreement.Maker has invested 700 million RWA assets and plans to invest further, and there are regulatory risks: 1) The RWA collateral itself has the potential to be frozen; 2) Thunderstorms from cooperative institutions, such as the cooperative Centrifuge, have resulted in 6 million defaults; and Planning to do asset management for Maker

Coinshares has admittedBellwood Studios, if the regulator has any doubts, it will have to cooperate with the regulator to review the source of funds, which means that there will be a temporary freeze/seizure.

The marketing capabilities of the Spark project party are still unknown: First, the founder Sam MacPherson holds several positions and is currently a game companyThe CTO and co-founder of the company, whether they have enough energy to devote themselves to Spark is very important for the future development of the project. The second is that the person in charge of Spark operations is @nad 8802, the current chief growth officer of MakerDAO. According to past operating performance, he is relatively Buddhist in terms of market operations.

DAI may abandon and USD peg

, leading to the loss of a large number of users in the short term, although this may be good for DAI to become the ultimate decentralized currency with stable purchasing power (rather than the dollar exchange rate) (the community did not reach a consensus, it was the unilateral idea of the founder Rune, and it will be released in the future as planned. Around 2025, it will become the focus of discussion), but V God has expressed concern about this.Risk of changing $MKR reward mechanism. Because the current discussion topic about how to repurchase MKR or even reduce the repurchase of protocol income exists in the governance forum, including the subDAO token rewards for MKR in Endgame may also change with the deepening of governance discussions. Generally speaking, Maker Most of the core members of the community are relatively conservative and not eager for quick success.Decentralization under supervision can be at odds with the true spirit of decentralization because

MakerDAO front-end provider Oasis recently assisted Jump Crypto, a third-party authorized by the court, to recover 120,000 ETH stolen by attackers in the cross-chain bridge Wormhole in February last year at the request of the court order.

As the attacker deposited funds into Oasis, Jump Crypto changed the contract logic by utilizing the upgradable proxy pattern in the Oasis protocol automation contract to transfer collateral and debt from the attacker's vault. Although Oasis made this decision with the intervention of legal regulation, and the MakerDAO protocol itself does not control any front-end vendors or products that enable end users to access the Maker Vault, it is ultimately contrary to Maker's mission of making DAI a fair world currency . Of course, this also demonstrates the necessity and importance of Rune's planning in advance to resist regulatory strategies.

Potential security risks of smart contracts. Even after a strict audit, no code can be said to be completely 100% safe. Its maturity and reliability need to be tested by the market, and users must remain vigilant against such risks.

Basic mechanics of MakerDAO

List of main data of Maker system

MakerDAO Vault Collateral Value & Type

source:makerburn.com,Trend Research

ETH/stETH distribution changes in mainstream lending agreements: MakerDAO has the largest share

source:Dune Analytics,Trend Research

MakerDAO Protocol Annual Revenue at a Glance

source:Dune Analytics,Trend Research

RWA Debt Distribution: Largest debt incurred by Monetalis Clydesdale

source:Dune Analytics,Trend Research

DAI distribution: the largest proportion is EOA account, followed by DEX

source:Dune Analytics,Trend Research

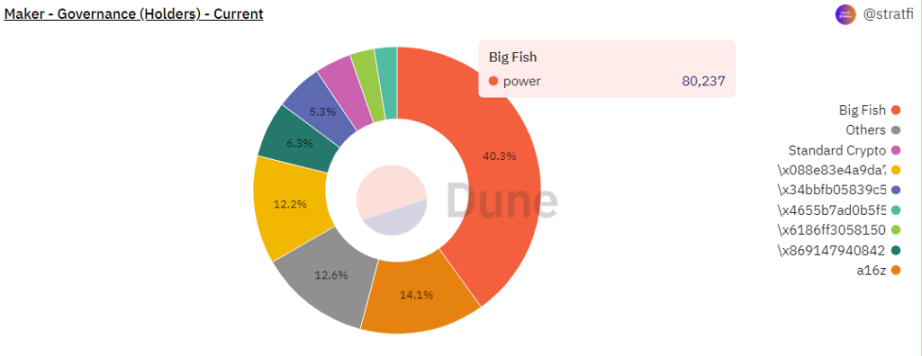

$MKR Governance Weight Distribution

source:Dune Analytics,Trend Research

image description

source:

Important events and milestones in MakerDAO history:

In 2013, Daniel Laimer (founder of EOS) proposed the concept of Decentralized Autonomous Corporation (DAC), which is also one of the predecessor concepts of DAO.

In March 2015, Rune Christensen founded MakerDAO and began planning a stable currency pegged to the US dollar.

In December 2017, MakerDAO released the first version of the DAI stablecoin and launched the first version of the smart contract on Ethereum.

In 2018, MakerDAO adjusted the DAI stability fee for the first time, adjusting the lending rate of the DAI stable currency from 1.5% to 0.5%.

In September 2018, venture capital firm Andreessen Horowitz invested $15 million in MakerDAO by purchasing 6% of the total $MKR tokens.

In February 2019, MakerDAO launched the Multi-Collateral Dai (MCD) system, which allows users to generate DAI using multiple types of collateral.

In November 2019, Maker released Multi-Collateral Dai (MCD), which supports multiple types of asset pledges to borrow DAI.

In January 2020, the total supply of DAI exceeded 100 million.

In March 2020, the market crash caused the price of Ethereum to drop sharply, and the system generated a debt deficit of 5.3 million US dollars, which was made up by auctioning MKR.

In April 2020, the Maker Foundation announced that it would transfer control of the MakerDAO protocol to a decentralized community governance system.

In May 2020, MakerDAO launched a decentralized governance system based on on-chain voting.

In November 2020, the total supply of DAI exceeded 1 billion.

In 2021, MakerDAO launched the D 3 M mechanism, providing cooperative lending platform users with a more flexible and low-cost DAI minting method.

In April 2021, the Maker liquidation mechanism 2.0 will be launched, and the Wyoming State Legislature in the United States will officially approve the DAO Act. DAO can be registered as a limited liability company in the state.

In May 2021, the Maker Foundation will return the 84,000 MKR assets held by the Dev Fund to the DAO.

In February 2022, the supply of DAI exceeded 10 billion for the first time, and Maker announced the implementation of a multi-chain deployment plan.

In August 2022, MakerDAO linked its native stablecoin DAI to a US-regulated financial institution for the first time through a partnership with Philadelphia community bank Huntingdon Valley Bank (HVB).

In December 2022, MakerDAO and BlockTower Credit announced the launch of a $220 million real-world asset fund, in which MakerDAO will deploy four vaults to provide a total of $150 million in capital.

References

《endgame-docs-staging》https://makerdao-1.gitbook.io/endgame-docs-staging/tokenomics/subdao-tokenomics

《MIP 116 :D 3 M to Spark Lend》

https://forum.makerdao.com/t/mip 116-d 3 m-to-spark-lend/19732

《Announcing Phoenix Labs and Spark Protocol》

https://forum.makerdao.com/t/announcing-phoenix-labs-and-spark-protocol/19731

《MakerDAO Valuation》

https://messari.io/report/makerdao-valuation

《Endgame Communications Strategy & Plan》

https://forum.makerdao.com/t/endgame-communications-strategy-plan-community-feedback/19818/2

《Endgame Plan v3 complete overview》

https://forum.makerdao.com/t/endgame-plan-v3-complete-overview/17427

《MakerDAO Governance Risk Framework》

https://blog.makerdao.com/makerdao-governance-risk-framework/

In February 2023, MakerDAO announced the creation of the Spark Protocol, a universal lending protocol.

Referencesfootnote❶The team was originally named Crimson Creator Cluster, with 4 core members, the founder Sam MacPherson (Twitter @Hexonaut)Bellwood StudiosJoined MakerDao since 2017

Is the core engineer of the project, and he is also a game company

CTO and co-founder.

❷ D 3 M=Dai Direct Deposit Module will be launched in November 2021 at the earliest.❸According to the description of PhoenixLabs in February, "slightly higher" is 10%, that is, if the DSR is 1%, the user's borrowing rate is 1.1%❹ According to PhoenixLabsFounder's description on Twitteris not pre-allocated, but according to

Endgame Ongoing Discussion Paper

The subDAO project needs to reserve 400 million (a total of 2.6 billion) tokens to motivate subDAO employees, so there may be uncertainty here.

❺ When the D 3 M module is launched, it allows Maker to implement the maximum variable lending rate on cooperative lending agreements such as Aave's DAI market. It works by calculating how much DAI supply is needed to bring the rate down to the desired level, and then minting against the aDAI returned by Aave.

D3M has a specific target lending rate - say 4% was set at the time. Whenever the variable lending rate for DAI in the lending market exceeds 4%, anyone can call the vault's exec() function to readjust the amount of DAI in the pool. In this case, it will calculate the amount of DAI needed to be minted to reach the target rate and put it into Aave's lending pool. This will continue to increase DAI until the debt ceiling is reached or the 4% target is reached.

Conversely, when the variable borrowing is below 4% and the user previously added liquidity, the exec() function will calculate how much liquidity needs to be removed to bring the target rate back to 4%. It will continue to remove liquidity until the vault's debt is fully repaid or the pool's liquidity is exhausted.

❻ PSM allows users to exchange whitelisted stablecoins (USDC, USDP, GUSD) for DAI at a fixed exchange rate (including 0.1% fee) at a 1:1 ratio. Its main purpose is to help keep DAI pegged to the dollar.❼Assume that both Maker and Aave have a 150% mortgage rate.❽ The community later renamed it subDAO, directly reflecting the meaning of "sub-DAO" ❾Aave's D 3 M cooperation module was launched in April 2021, with an initial upper limit of 10 million DAI, and then gradually increased the adjustment limit to 300 million DAI, in June 2022 slammed by turmoil in crypto markets

Temporarily closed

, the Compound V2 D 3 M module will start to operate in December 2022, but the upper limit of the published amount is only 20 million US dollars.

❿Because D 3 M essentially bypasses Maker's Stability Fee system and adopts a relatively cheap DSR interest rate as a cost, increasing Dai's circulation too quickly may lead to oversupply, which in turn will lead to a depeg in Dai's price, so in theory the early The upper limit of the scale of D 3 M should not be increased too quickly, and its impact on the price stability of DAI needs to be further observed.

⓫ The 312 liquidation event in 2020 resulted in a deficit of US$5.3 million in the Maker agreement, and the system made up for it by issuing an additional 20,980 MKR.