Bankless: The market war between OpenSea and Blur has just begun

Compilation of the original text: The Way of DeFi

Original source:Bankless

Compilation of the original text: The Way of DeFi

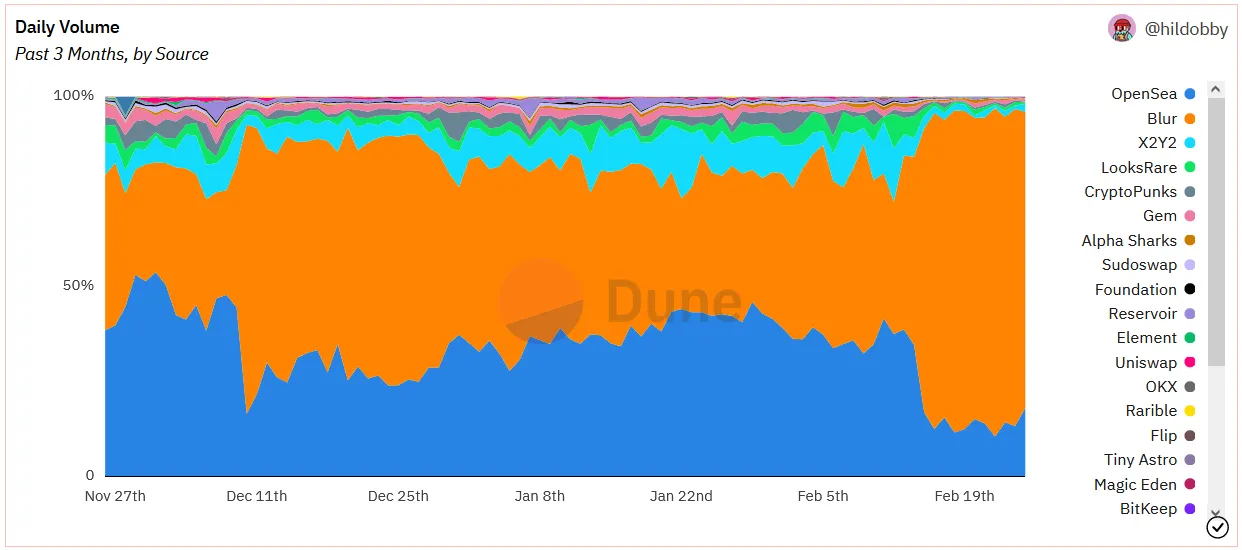

OpenSea's near-absolute market dominance over the years makes Blur's astonishing rise all the more impressive. The fledgling NFT market still faces many challenges, but so far, its pursuit of OpenSea's transaction volume and users has been going well.

This article will delve into the battle between the two platforms and describe areas where OpenSea still has the upper hand.

image description

This is Blurrie.

After numerous flimsy upstart challengers, OpenSea finally has a well-rounded competitor that could threaten its market dominance.

After its successful airdrop, Blur didn’t stop there like other popular NFT marketplace platforms. In fact, Blur has consistently outpaced OpenSea in transaction volume for the past week.

Much of this volume still appears to be focused on milking Blur rewards, but if regulatory constraints prevent VC-backed OpenSea from launching a token, Blur may have a better chance of revealing itself to its competitors Strength.

Blur entered the NFT market in October 2022 as an aggregator. Relatively late to the scene, how did it rise so quickly? This is thanks to its pricing strategy for a niche audience and its well-designed liquidity mining program.

Blur traction prompted OpenSea to tweak its underlying monetization mechanism and sparked a war over one of the most-cited benefits of the NFT market — creator royalties.

Creator Royalty Battles

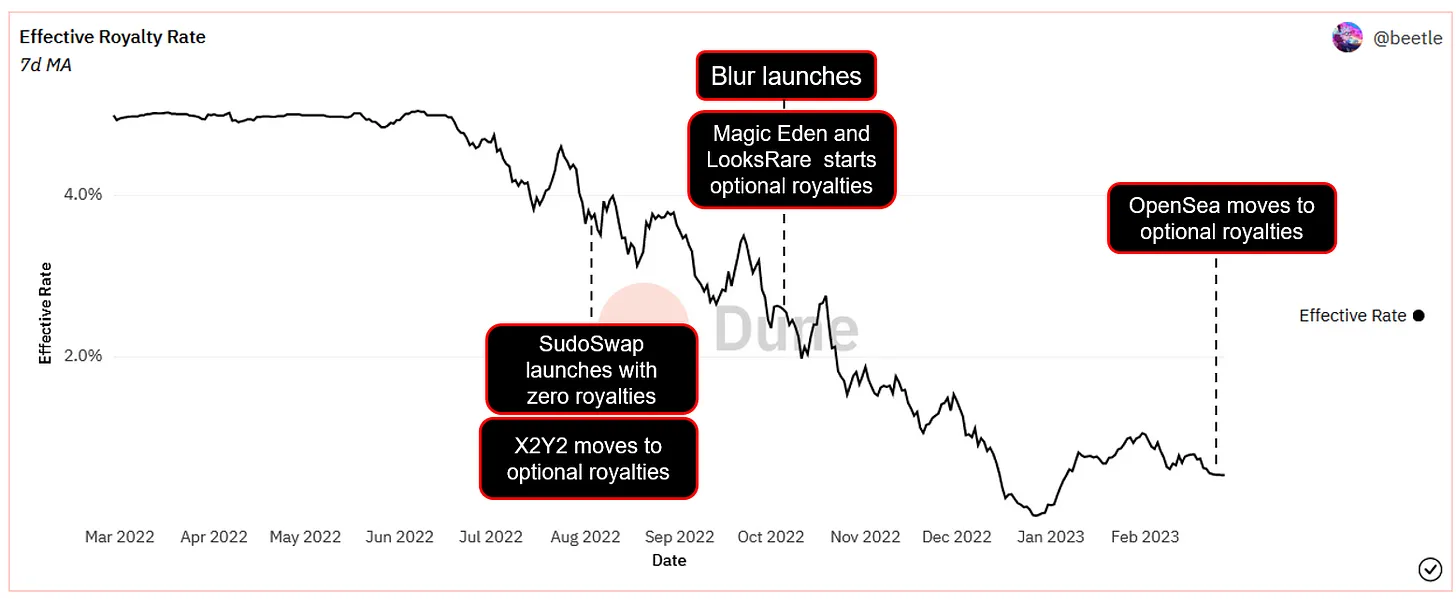

Blur seems to realize that one of the ways to gain market share in a space dominated by OpenSea is to be the first to capture the most price-sensitive user base in the NFT market. It starts by targeting a small group of speculative NFT traders by offering a frictionless optional royalty, zero transaction fee marketplace.

It's by no means the first company to employ this pricing strategy. Prior to this, both Sudoswap and Magic Eden had achieved varying degrees of success. But Blur has greatly accelerated the zero-royalty race.

Royalty has become an increasingly thorny topic. Should NFT creators get a cut every time their collectibles are traded?

Most NFT royalties are nothing more than a social agreement; NFT creators pay no marginal cost of maintaining their digital art, but many creators in the market see perpetual royalties as a way to offset the initial cost, in a way that is similar to Collectors' incentives are aligned.

The market standard for NFT royalties stems from the 1/1 NFT art boom, when Degen transactions were relatively rare and collectors were less concerned about paying a royalty percentage to creators enforced by third-party marketplaces like OpenSea.

And in the speculative frenzy of the NFT bull market in 2021, many things have changed. When metadata for 10,000 NFT collectibles comes out, the maintenance cost of altruistic royalties becomes high. However, the concept of royalties still exists and continues to be enforced at the centralized marketplace level. Royalties are a huge source of revenue for the largest NFT projects, but NFT speculators are increasingly bemoaning them.

image description

The "Effective Royalty Rate" is calculated by dividing the total royalties earned across all markets (ETH and WETH) by the total trading volume across all markets.

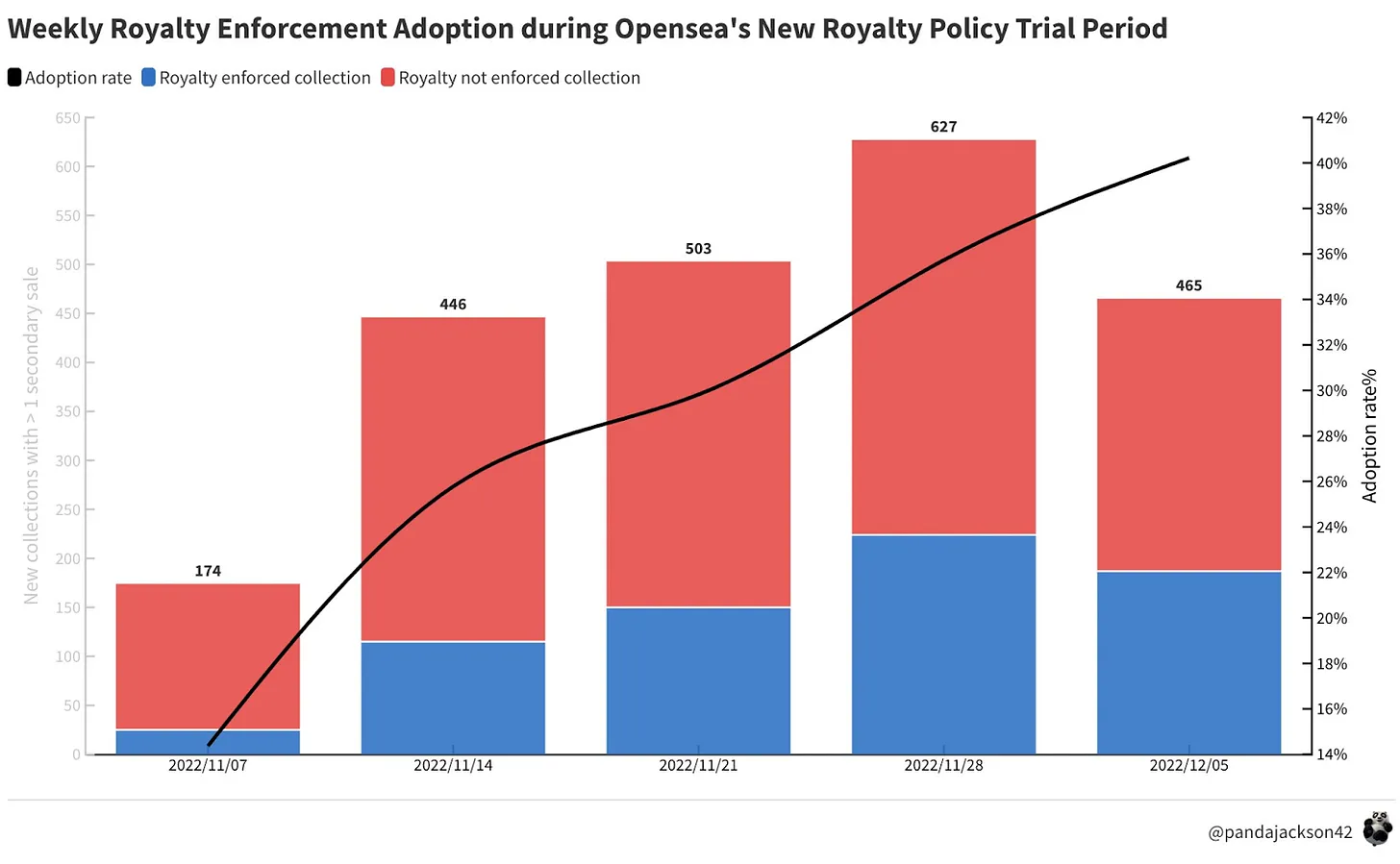

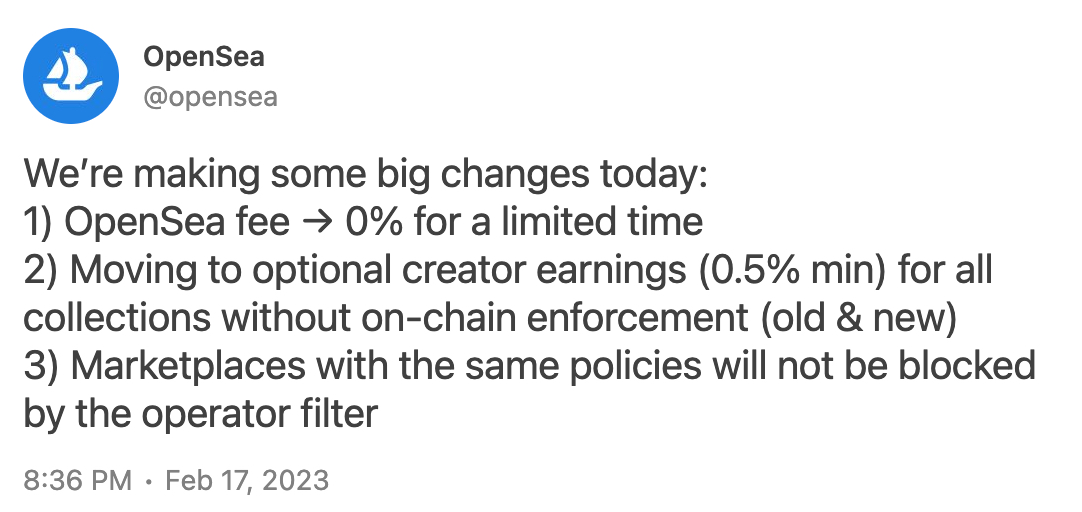

This breach of OpenSea was a test of its values. OpenSea's initial positioning was an attempt to side with creators and leverage its market dominance to drive traders to list only with OpenSea buyers.

The platform rolled out its "Support Creators" policy on Nov. 8, forcing creators to choose between earning royalties on OpenSea or Blur. OpenSea announced that it will limit creator royalties on its marketplace unless creators voluntarily block zero-royalty marketplaces (including Looksrare, X2Y2, and Sudoswap) from trading their collectibles within their smart contract code.

The strategy has worked to a certain extent. Hundreds of NFT projects have embraced OpenSea’s royalty policy, longing to go back to the days when they could collect blank checks via perpetual royalties. Smaller NFT marketplaces such as Manifold, Sound, and Zora that previously adopted optional royalties have updated their policies to allow creators to choose. Unlike Blur, smaller competitors can't compete with OpenSea.

During this period, Blur even changed its attractive pricing strategy, trying to attract NFT creators by promising to enforce royalties.

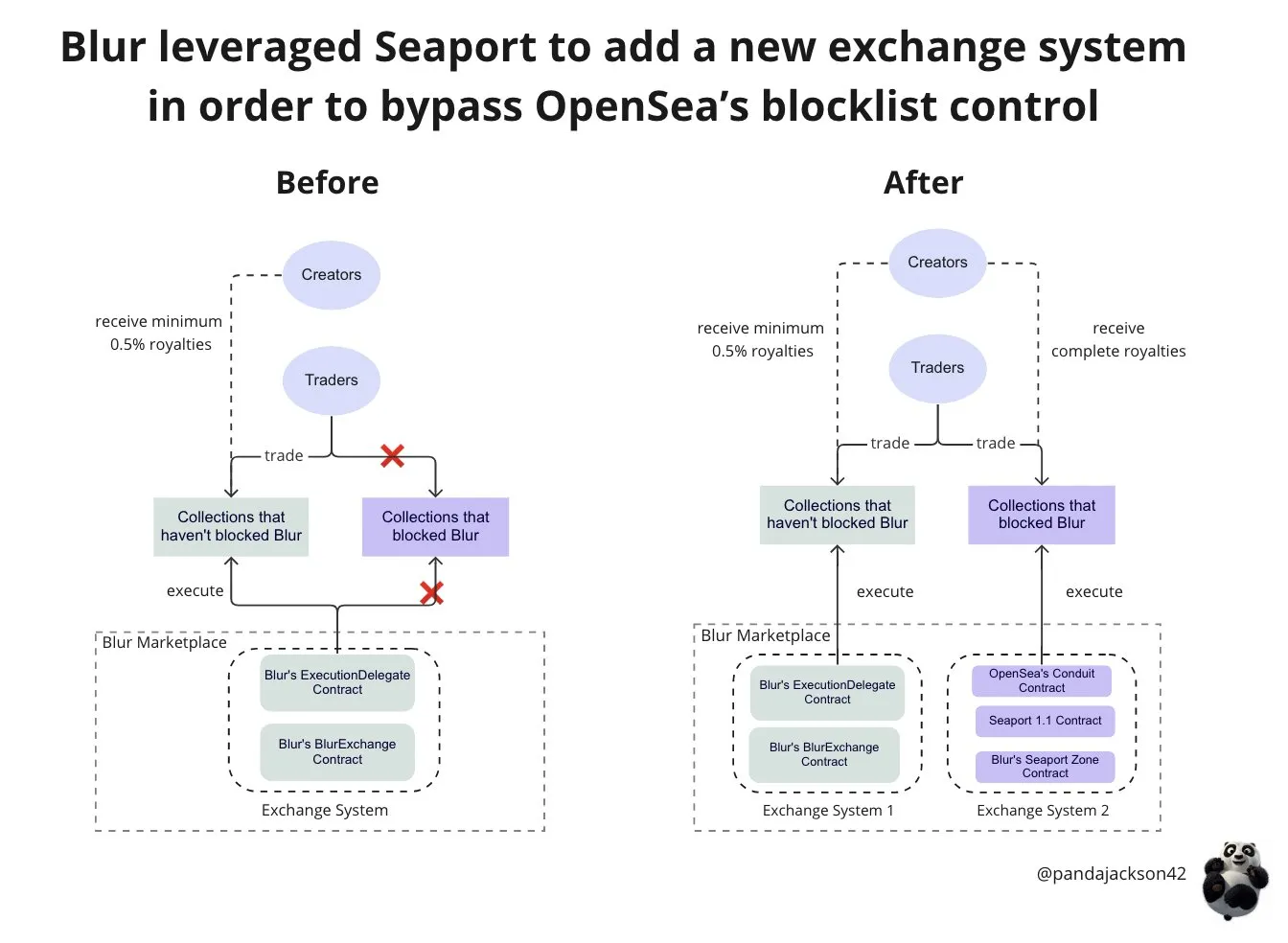

However, to everyone's surprise, Blur found a way around the blockade. It cleverly leverages OpenSea's Seaport protocol and builds its marketplace on top of it. Seaport is OpenSea's permissionless decentralized protocol on which anyone can build a marketplace.

In fact, Blur is putting the ball back in OpenSea's court and saying: "If you want to stop us, you have to stop your own Seaport deal."

So the NFT market returned to normal. From a user perspective, "restricted" collectibles are once again tradable on Blur. From a creator's perspective, they no longer have to choose - they get full royalties from OpenSea and Blur.

OpenSea then fought back by announcing the unprecedented revocation of its "pro-creator" royalty enforcement policy and temporarily reducing marketplace transaction fees to zero.

The correct approach to liquidity mining

The second step in Blur’s market strategy is a familiar page in the DeFi playbook: mining liquidity from free helicopter money.

But what’s different about Blur’s liquidity mining strategy is that it combines a mercenary airdrop game with the incentives of actual value creation (i.e. providing liquidity for bidding).

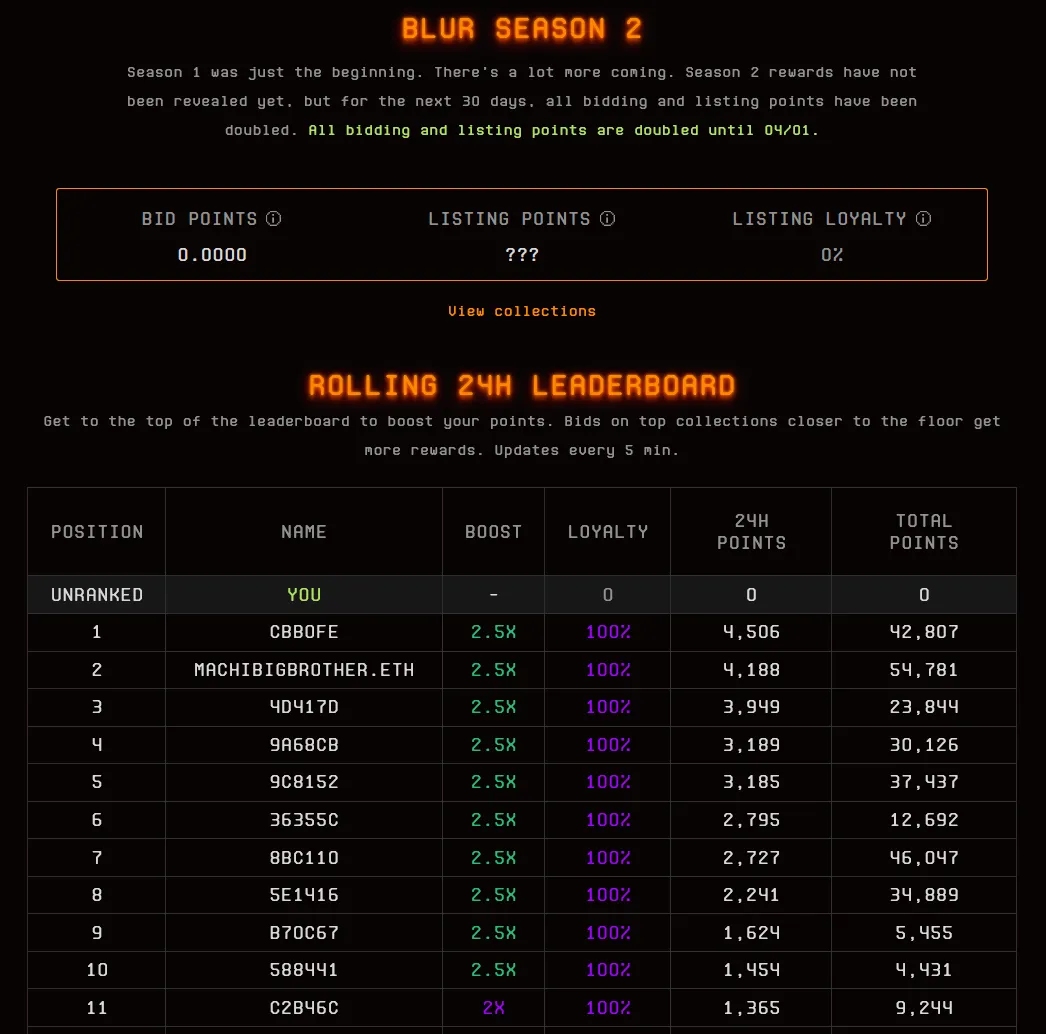

Blur’s airdrop is designed around a “loyalty points” system that rewards users with points based on how much they bid on its marketplace. The higher a user bids, the closer those bids are to the series' floor price, the more loyalty points the user earns, and the larger their final airdrop.

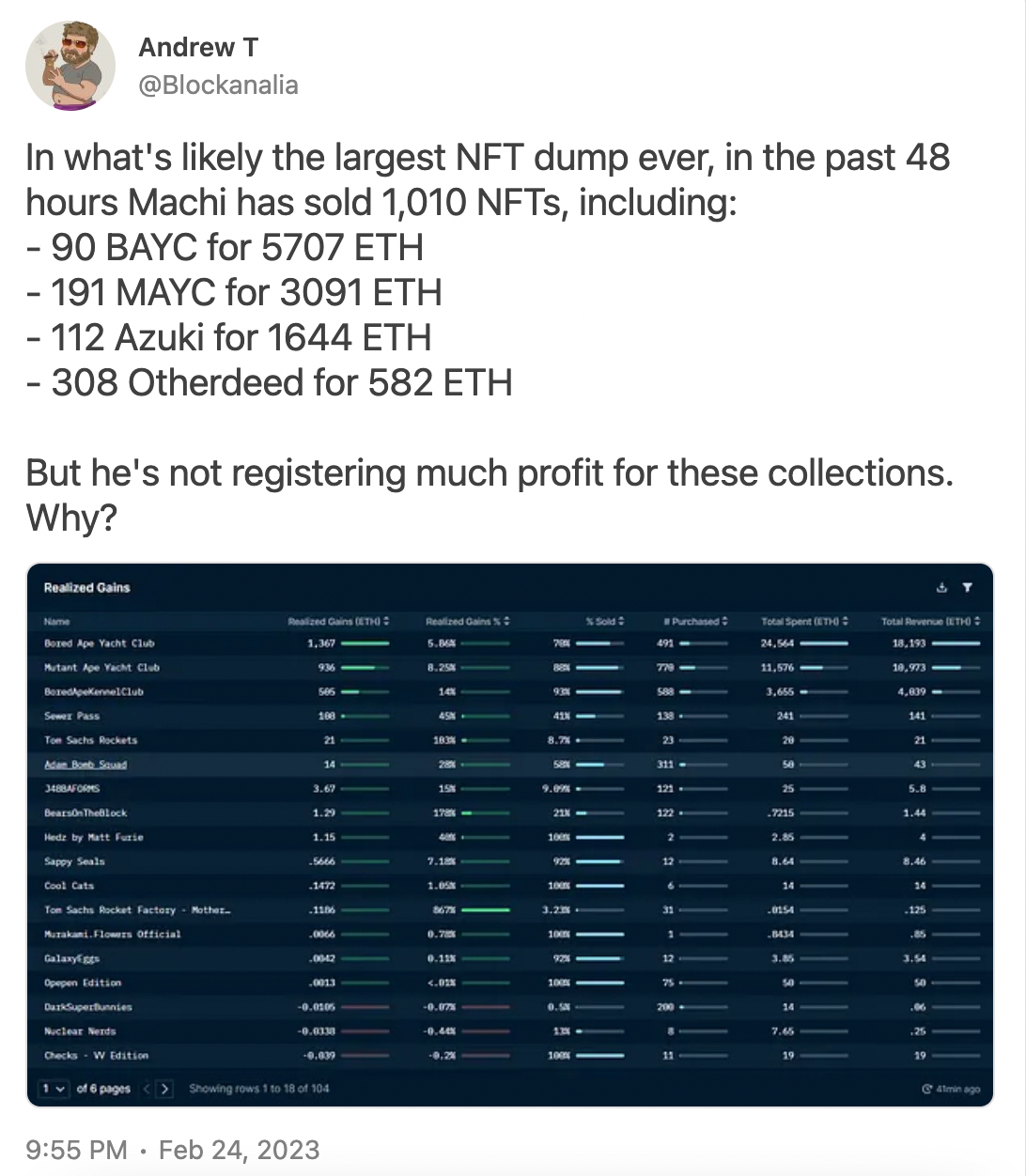

This incentivizes whale mercenaries to take real risk and place multi-million dollar bids, creating liquidity for the Blur market. Positive externalities have impacted Blur's market, making Blur the go-to destination for NFT transactions.

In contrast, previous OpenSea competitors such as X2Y2 and Looksrare tied air investment eligibility to product usage. This incentivizes airdrop hunters to engage in shallow, risk-free wash trading. So while volumes on these platforms surged, it didn’t make these markets an overall better place to trade.

Is Blur's position sustainable?

In short, the rise of Blur is a planned two-pronged attack on OpenSea, based on a pricing strategy of reduced royalties/transaction fees and an elaborate liquidity mining scheme.

OpenSea finally waived transaction fees last week, but the NFT market wars have only just begun.

Blur's liquidity incentive design, while successful so far, is not without risk. The best option for Blur airdrop hunters is the ability to make bids and earn Blur loyalty points... without actually being accepted by the seller.

If the NFT market falters, this could lead to a flurry of bids being accepted as airdrop hunters realize that the risk of offering funding > the gain in Blur loyalty points, causing the market to fall even further.

Second, Blur's surge activity depends on constantly dangling very expensive "carrots." While Blur intentionally split its airdrop into a creative "seasonal" marketing campaign to convey endless meaning, it just masks the massive multimillion-dollar cost Blur is paying to incentivize liquidity.

At this point, the BLUR token is also nothing more than a meme token, or if you're being nice, a "governance token". Anyone wanting BLUR is probably just speculating on the project's future or the wishes of the next bagholder.

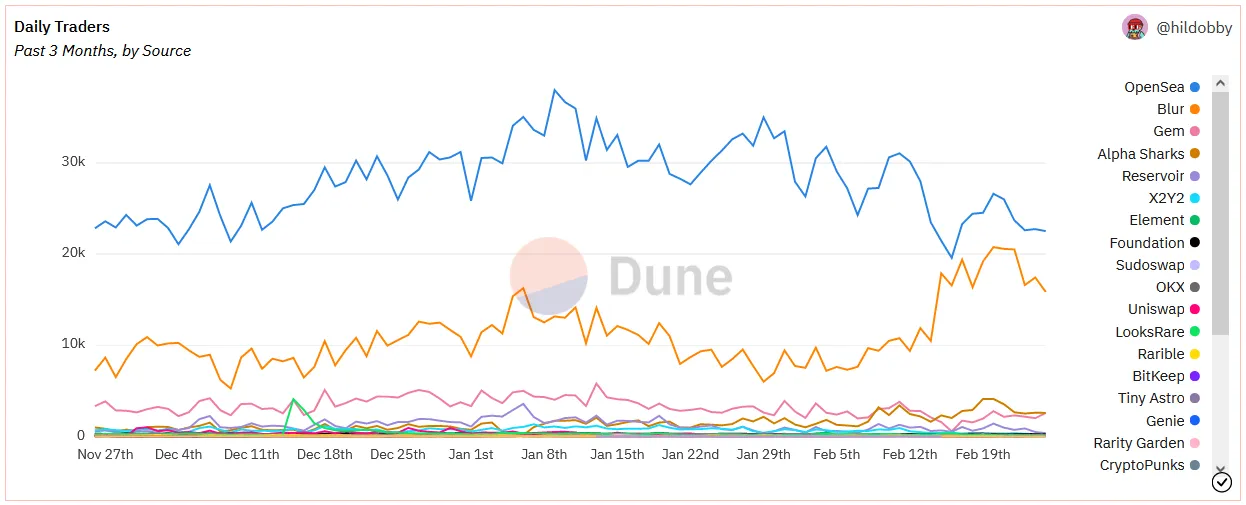

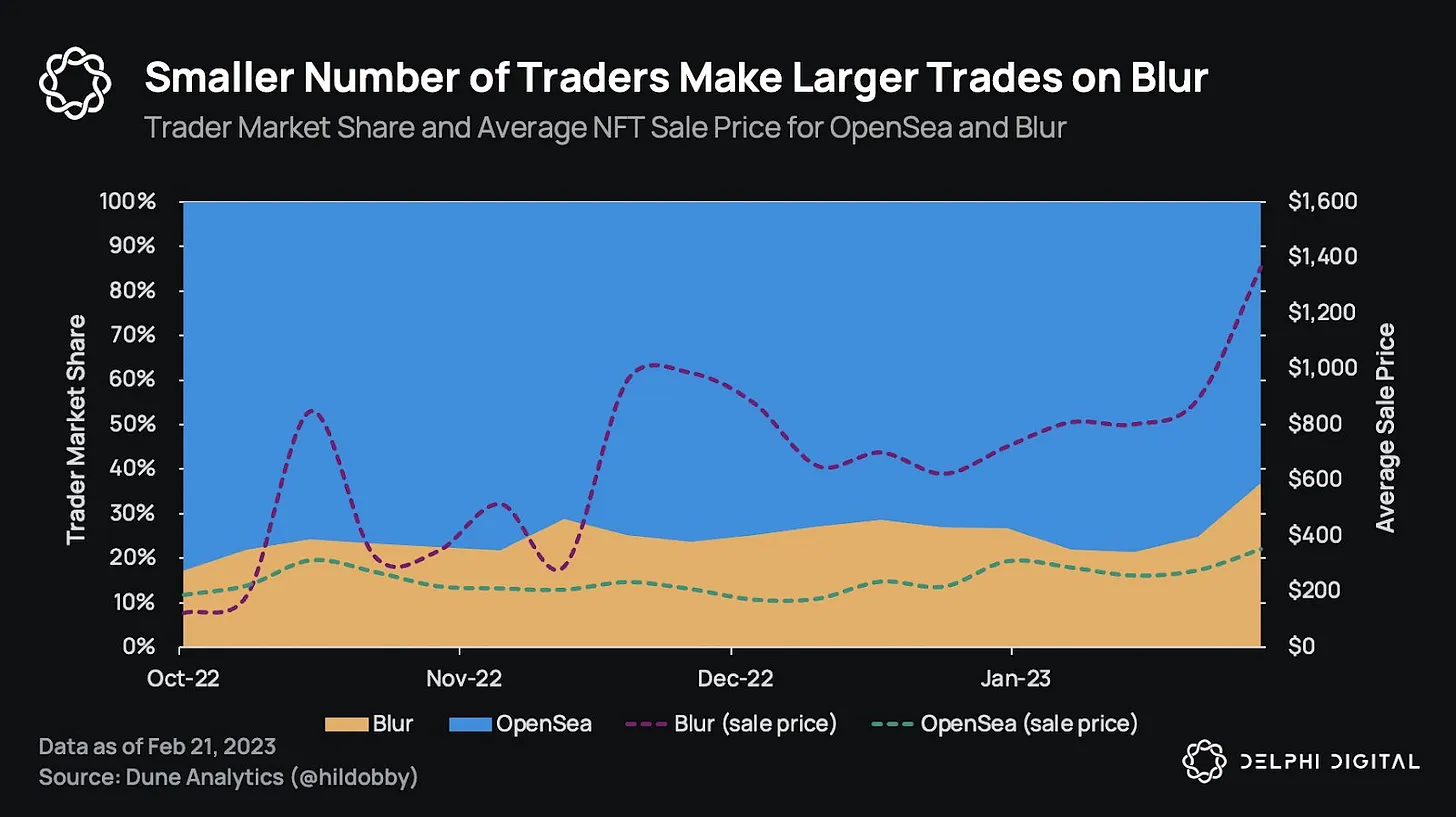

Finally, while Blur outpaces OpenSea in terms of transaction volume, the latter still dominates in terms of organic usage, as shown in the Dune chart below on the unique user metric.

Blur's activity is largely dominated by a handful of wealthy airdrop hunters, while the wider "normal" market remains on OpenSea.

Of course, the rising platform may still lag in some ways, but its rivalry with established platforms certainly worries OpenSea's venture capitalists, who last year valued OpenSea at more than $13 billion.

So, can Blur maintain its market position and momentum? This is the problem.