After the feast of throwing money, Blur carefully provoked a new round of royalties

At 2:30 a.m. on February 15th, Blur, the "highly anticipated" NFT market, launched its native token BLUR on major exchanges, and opened airdrops. So far, this "blind box" airdrop event has finally landed.

As the leader of the "small rising market" in the NFT market this year, Blur has been considered to be able to break the wrist with the industry leader OpenSea. In addition, in the NFT market royalty war last year, Blur identified the entry point to earn traffic and became a member of the optional royalty, allowing users to freely set the royalty rate, and at the same time, it will also use airdrop token incentives and other methods to Encourage users to pay royalties (for example, buyers who set the royalty above 0.5% will get more airdrop rewards). With this series of measures, the traffic of Blur market once surpassed that of OpenSea.

In this round of highly anticipated airdrops, Blur did not disappoint users, and the effect of creating wealth is considerable. According to the statistics of Twitter users, the largest BLUR airdrop beneficiary received 3.2 million BLUR, and about 25 "rich men" with a single wallet of one million BLUR were produced.

While everyone was immersed in the joyful atmosphere of the Blur airdrop season, Blur struck while the iron was hot and opened a new chapter in the royalty competition. Just the day after the token went live,It issued a new royalty policy,One of them is to recommend that NFT creators block Opensea, and any NFT project that does not use Opensea will be forced to enforce full royalties on Blur.Clearly, Blur is using the moment to hit back at its strongest competitor and take the first leg of the new year's "royalty battle."

Judging from the explanation article released by Blur, Blur’s new royalty policy involves 4 options. According to the content of the article, Odaily makes a simple interpretation:

1. Blur will help you enforce a minimum 0.5% royalty if the collection doesn't use a blacklist to ban the zero-royalty or optional-royalty market, while OpenSea is optional- Blur provides creators with a minimum guarantee.

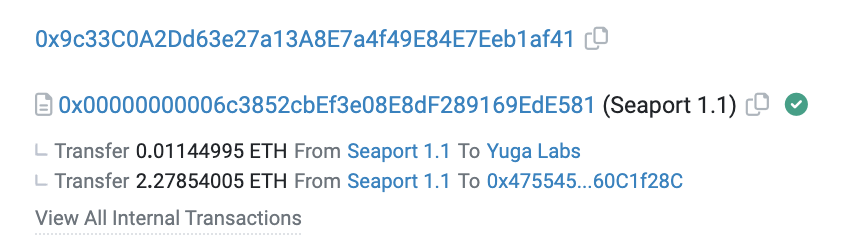

2. If the collection uses a blacklist, although it cannot be bid on Blur, it can still be traded on Blur (using the Seaport protocol). This type of collection can obtain royalties on both Opensea and blur, but Blur only imposes a minimum royalty of 0.5%. This has also been proven, with projects such as A KID Called BEAST and Sewer Passs now down to a minimum 0.5% royalty.

But when Blur backdoored the new project through Seaport, the once-everything collectible would get "full royalties" from OpenSea and Blur. However, the latest royalty policy can only obtain a minimum royalty of 0.5%, and the creators of some collections have not been informed of the policy changes in advance. Blur has silently completed the update of the royalty policy this time, which can be described asSilent warnings are given for using blacklisted creators.

3. The third point is the solution recommended by Blur, which is to hope that creators will blacklist Opensea, so that they can get full royalties on Blur, but they cannot be traded on Opensea. Does it look familiar?This is what Opensea did to Blur, and now it's doing it back the same way。

4. The fourth solution is that both parties cancel the blacklist mechanism, "I, Blur, will put aside the previous grievances and reconcile with you", and both parties can truly protect creators from the perspective of allowing them to collect royalties on all platforms.

Looking back on Blur's past royalty policy, it has always been moderate,Try to avoid conflicts with Opensea. Although Opensea blacklisted Blur, Blur also intends to reconcile with Opensea, hoping to lift its blacklist restrictions, but was strongly rejected by Opensea. At that time, although Blur's transaction volume and popularity were approaching Opensea, the large number of wash transactions and the large gap in the number of users still could not allow Blur to compete with giants like Opensea.

However, as Blur gradually occupies the head traffic of the NFT market, and Opensea has not issued platform tokens for a long time, everyone's expectations for the value of Blur tokens have gradually increased. After three rounds of "blind box" airdrops, the number of users of Blur surged. Among them, giant whales almost monopolized the leaderboard, and briefly drove the trading volume of NFT. This may have given Blur some confidence,So Blur is also trying to take the initiative.

After careful observation, Blur's royalty policy this time can be described as a "careful" layout.

First of all, Blur developed a new trading market by using Seaport, OpenSea's own underlying trading protocol, which solved the problem that new items could not be traded on Blur.

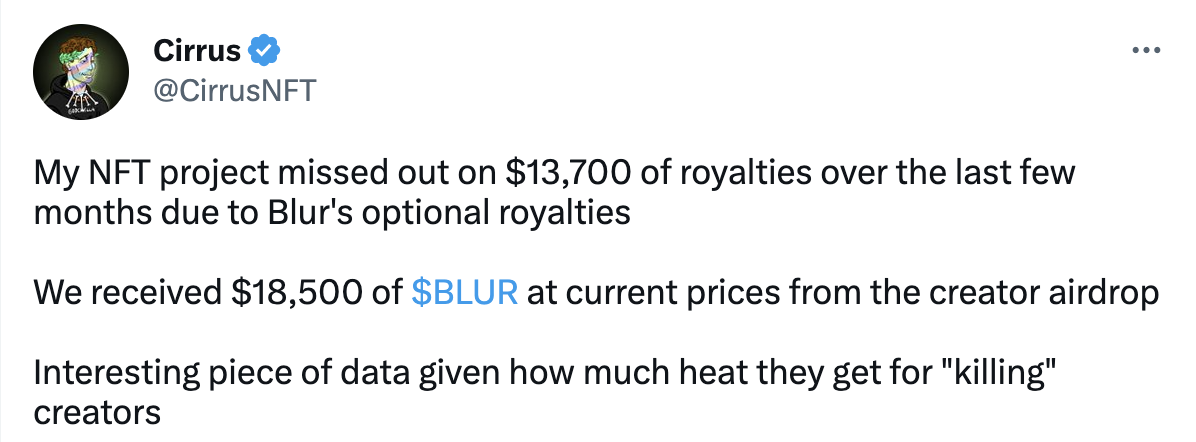

Second, although optional royalties make many NFT creators lose part of their remuneration, Blur will give airdrops to creators who still choose to list the market, such as the Twitter account @CirrusNFT said that its NFT project has missed $13,700 in the past few months , but they made up for it by receiving $18,500 in BLUR tokens from Blur’s creator airdrop.

And then with the final punch, a new royalty policy: you get 0.5 % with me anyway, block Opnesea and get the full amount.

These three moves can be said to have grasped the psychology of creators and traders. At the same time, they have also improved the liquidity and trading volume of the entire NFT market through airdrops, and have captured a large amount of market share from OpenSea and other competitors.

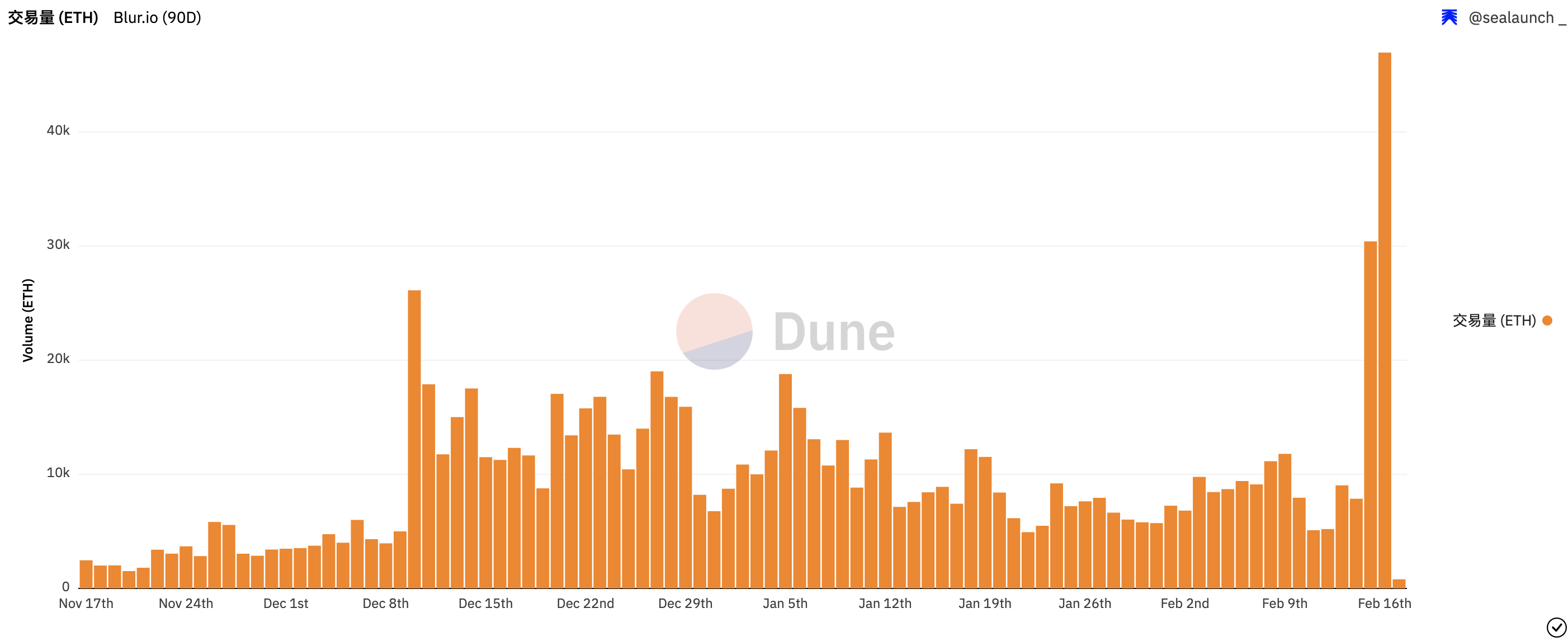

From the perspective of short-term data, since February, Blur's transaction volume has gradually surpassed that of Opensea. And yesterday's NFT trading volume surged to 30,409.79 ETH, a new high in the past three months. In addition, Blur's NFT sales volume was 32,773 yesterday, and its unique users were 9,689, both hitting new highs in the past three months. The lock-up amount in its bidding pool has reached 84 million US dollars, a record high.

Immediately after Blur Season 2 is about to start, although most people think that the second season may not have the rich rewards of the first season, and it is not clear how long Blur can maintain its popularity without the "blind box" airdrop. But after Blur's layout and marketing this time, its competitive advantage is already very obvious.

It seems that Blur is bound to win this time, directly sending out the signal of war. Assuming Opensea doesn't rest on its laurels and do nothing. It is expected that there will be more fierce battles in the next NFT market track.