A detailed explanation of the status quo and future of decentralized stablecoins (Part 2)

Original author:SCapital

Related Reading:

A detailed explanation of the status quo and future of decentralized stablecoins (Part 1)

introduction:The algorithm part of FRAX is not significantly different from that of LUNA, but its high proportion of USDC mortgage and dynamic mortgage rate linked to market confidence reduces the risk of death spiral and shows considerable resilience in the bear market. In addition, as floating stablecoins that are not linked to fiat currencies, RAI and FLOAT are two interesting attempts. They are not anchored to any fiat currency, but pursue low price volatility and expect to become native stablecoins in the encrypted world.

Part algorithm, Part crypto-collateralized Stablecoin

Frax Finance

first level title

Basic Mechanism

secondary title

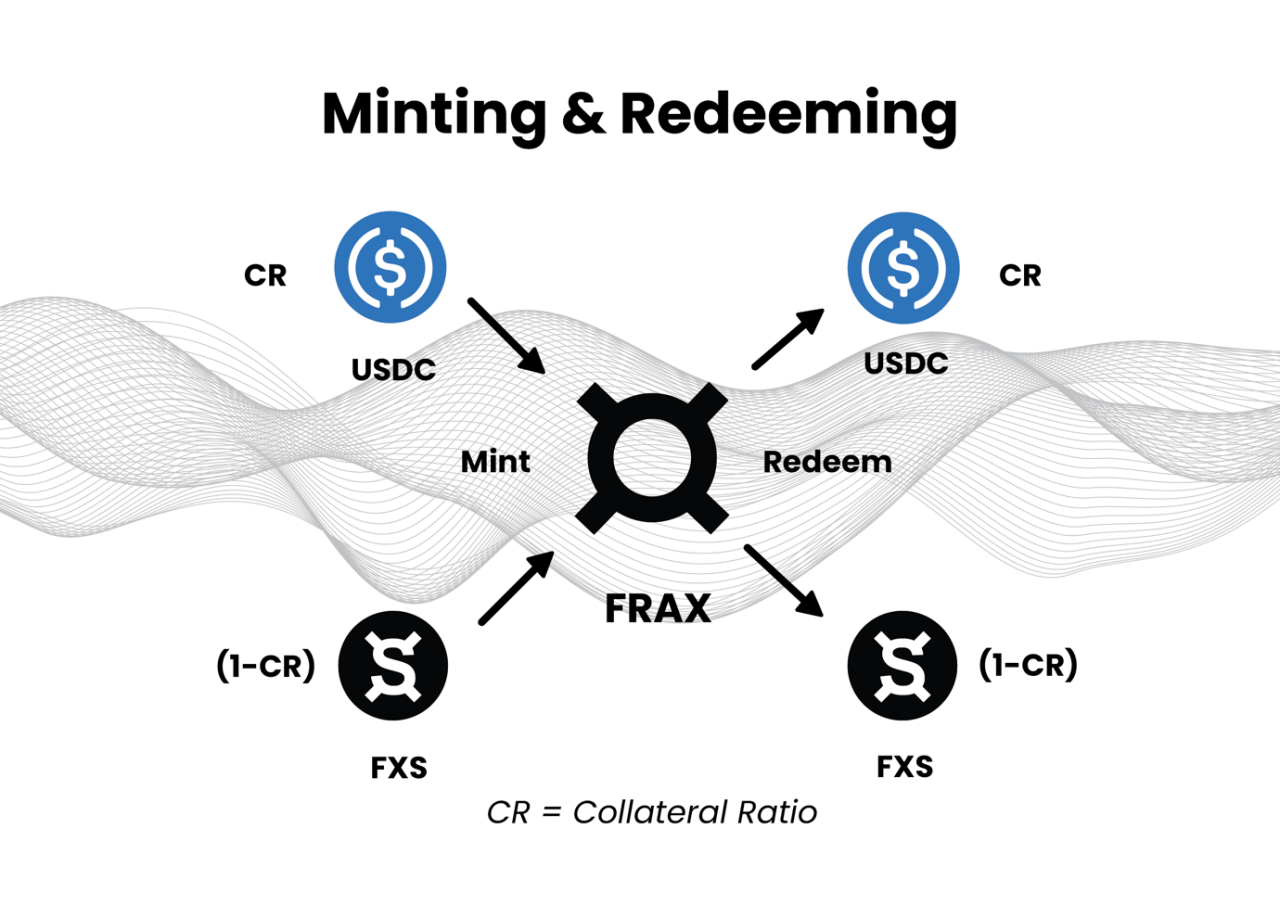

The FRAX Protocol introduces the crypto world to the concept of a decentralized stablecoin, partially backed by collateral and partially algorithmically stabilized.

The FRAX protocol has a dual-token system, including the stablecoin FRAX and the governance token FXS. FRAX is pegged to the US dollar and partially collateralized by the stablecoin (USDC). In this mode, FRAX is allowed to be backed by collateral and algorithms (burning and minting of FXS) at the same time. Except for the USDC collateral, FRAX is actually very similar to LUNA.

Although the current FRAX protocol supports a variety of collaterals, in order to maintain the stability of FRAX, the protocol encourages the centralized stable currency USDC as the main collateral. We can regard the mortgage rate as the market's confidence index for FRAX, and it will be dynamically adjusted. This is also the difference The biggest difference from LUNA's unlimited money printing model. In other words, only when the mortgage rate is 0, the minting of FRAX is fully supported by the burning of FXS is the model equivalent to LUNA.

Stability Mechanism

FRAX V1 :

FRAX is minted when collateral (USDC) and FXS are deposited into the FRAX protocol contract. The amount of collateral required to mint 1 FRAX is determined by the collateralization ratio. In other words, the FRAX collateralization ratio determines the ratio between the collateral and the algorithm that make up the value of $1 in FRAX.

If the transaction price of FRAX is higher than $1, it means that the market demand is greater than the supply. The agreement will reduce the mortgage ratio, thereby reducing the collateral, and increasing the FXS that must be deposited to mint FRAX, which will reduce the amount of collateral supporting all circulating FRAX . If the transaction price of FRAX is lower than $1, it means that the market supply is greater than the demand, and the agreement will increase the collateral ratio. The increased collateral also means that the deposited FXS is reduced to mint FRAX. The collateral in the system accounts for 10% of the FRAX supply. The ratio will grow, thereby increasing market confidence in FRAX.

FRAX can be minted and exchanged for $1 of value from the system, which allows arbitrageurs to balance supply and demand for FRAX on open markets such as Uniswap.

If the market price of FRAX is higher than the target price of $1, then there is an arbitrage opportunity to mint FRAX by injecting $1 of value into the system and sell FRAX tokens on the open market for more than $1. At any time, to create a new FRAX, the user must put 1 dollar value in the system, the difference lies in the ratio of collateral and FXS combined into 1 dollar value. When FRAX is in the 100% collateral stage, 100% of the value put into the system to create FRAX is collateral. As the protocol enters the mixing phase, a portion of the value that enters the system during minting becomes FXS (and then burned during circulation). For example, at a collateral ratio of 98%, each minted FRAX requires $0.98 in collateral and burns $0.02 worth of FXS. At a collateral ratio of 97%, each minted FRAX requires $0.97 in collateral and burns $0.03 worth of FXS, and so on.

FRAX V2 AMO

If the market price of FRAX is below the $1 price range, then there is an arbitrage opportunity to redeem the value of $1 in the system by purchasing FRAX tokens at a discount on the open market. At any time, users can redeem $1 worth of FRAX from the system, the difference is only in the ratio of collateral and FXS returned to the redeemer. When FRAX is in the 100% collateral stage, 100% of the value returned by redeeming FRAX is collateral. As the protocol enters the hybrid phase, a portion of the value redeemed from the system is denominated in FXS (minted for redeeming users). For example, at a collateral ratio of 98%, each FRAX can be exchanged for $0.98 in collateral and $0.02 worth of FXS. With a collateral ratio of 97%, each FRAX can be exchanged for $0.97 in collateral and $0.03 worth of FXS.

The redemption process at FRAX is easy to understand and economically sound. At the 100% collateralization stage, it is very simple, meaning that one dollar worth of collateral can mint one dollar worth of FRAX. In the mortgage + algorithm phase, FXS is burned and FRAX is minted. On the other hand, minting of FXS happens when FRAX is redeemed. Therefore, the value of FXS tokens is partly determined by the demand of FRAX, and they are also significantly positively correlated with each other. Different from the redemption mechanism between LUNA and UST, FRAX itself has more than 85% USDC as collateral, and the CR ratio will be flexibly and dynamically adjusted according to the market supply and demand balance, so the selling pressure of FXS is relatively much smaller, and FRAX is not too Prone to a death spiral.

In March 2021, FRAX V2 introduced AMO (Algorithmic Market Operations Controller). The iteration of the mechanism retains the basic functions of the V1 version, and expands the concept of peg stability, so that each AMO module is an autonomous contract. As long as the FRAX price does not change from its peg, any monetary policy can be issued. This means that AMOs can algorithmically conduct open market operations, but they cannot arbitrarily mint FRAX out of thin air and break the peg.

Each AMO has 4 attributes.

De-mortgage--the part of the strategy that reduces CR

Market operation - the part of the strategy that operates in equilibrium and does not change the CR

Remortgage - the part of the strategy that increases CR

FXS 1559 - Formal accounting of AMO's balance sheet, defining exactly how much FXS can be burned with profits above target CR.

FXS Proposition 1559

Before FXS 1559 regulations, 50% of CR excess assets were used to purchase and destroy FXS (creating income for FXS holders by reducing supply), and 50% were directly given to veFXS holders.

In October 2021, the Frax protocol passed a new proposal, FXS 1559. FXS 1559 calculates all the value in the system that exceeds the collateral ratio, and uses this value to buy FXS for burning. It is equivalent to distributing all rewards to FXS token holders. Specifically, every time interval t, FXS 1559 will calculate the excess period above CR, and mint FRAX according to the collateral ratio to price ratio. Then, it buys FXS on the FRAX/FXS trading pair and burns them.

With the clear definition of the above framework, it is now easy to see that Frax v1 is the simplest form of AMO, and its function is to simply adjust the CR ratio to stabilize the currency price. FRAX V2 AMO adds market operation functions and creates more for FRAX scenes to be used.

1. Collateral Investor

The purpose of AMO market operation is to use the remaining funds in the agreement to earn income, such as investing in reliable DeFi agreements, AAVE, Compound, Yearn, Uniswap, etc. It should be noted that the DeFi agreements invested by AMO are all agreements without a lock-in period, so as to ensure that funds can be withdrawn at any time when needed, and prevent the currency price from falling out of anchor.

The general direction of AMO market operation:

Collateral investment is AMO's transfer of idle USDC collateral to DeFi protocols that provide reliable returns. Current protocols include: Aave, Compound, and Yearn. The main requirement of this AMO is to be able to exit the invested collateral instantly in the event of a large FRAX redemption.

3. FRAX Lending

2. Curve and Uniswap Liquidity

Advantages and Weaknesses

Curve and Uniswap v3 Liquidity AMOs, put FRAX and collateral to work by providing FRAX-specific liquidity to other stablecoins, providing liquidity to the protocol and maintaining a price peg.

Supplying FRAX to a money market, like Compound or AAVE, allows anyone to borrow FRAX by paying interest instead of the basic minting mechanism. In essence, Lending AMO creates a new path for FRAX circulation, and realizes the operation of raising and lowering interest rates by paying the interest rate set by the money market. For example, AMO can mint more FRAX (lower interest rate) and recycle FRAX (increase interest rate).

As a hybrid stablecoin, Frax mainly solves the inefficient use of over-collateralized funds such as DAI and the corresponding liquidation risks, and the speculation of algorithmic stablecoins such as AMPL without collateral is far greater than practicality. By introducing the concept of mortgage rate, the direct balance between the two is well regulated.

From another perspective, why does the market need a new stable currency that is mostly supported by USDC? Frax's AMO mechanism tries to answer this question by depositing the income generated by funds in Defi. Due to its compliance features, USDC's asset allocation can only be extremely conservative, consisting of US dollar cash and inter-bank notes, and these benefits are not attributable to USDC holders. Frax participates in Defi through deposited USDC, and the income similar to commercial banks generated will be much higher than USDC's US dollar income, and through the burning mechanism of FXS 1559, the income will be fed back to FXS.

Floating Stablecoins

Float Protocol

first level title

secondary title

Basic Mechanism

The starting point of Float Protocol is the belief that cryptocurrencies should have their own stablecoins, a decentralized unit of account for the DeFi economy. Investors are accustomed to anchoring the price of stablecoins at $1, but maintaining a precise peg faces various challenges. The expansionary monetary policy of the U.S. dollar will continue to weaken the purchasing power of U.S. dollar stablecoins. Additionally, the global nature of cryptocurrencies makes it risky to peg a primary stablecoin to a country's fiat currency. Therefore, if cryptocurrency is to establish a new financial system, it should be denominated in its own currency, and the US dollar is the symbol of traditional centralized finance.

Float Protocol is trying to redefine stablecoins instead of pegging to $1. To this end, the Float protocol is establishing a new order for the future decentralized currency system. At the core of the protocol is the FLOAT token, a floating currency that is not pegged to any specific value. So, just like a country's currency might become more valuable as demand increases (such as through trade, travel, or as a financial safe haven), a true crypto stablecoin should also be able to grow as demand for it and cryptocurrencies increases. demand fluctuates and fluctuates. To achieve floating value, FLOAT is backed by a basket of cryptocurrencies. In version 1 of the protocol, the basket started with only Ethereum, but over time, more cryptocurrencies will be added to the basket to spread the risk against one cryptocurrency. In short, in the short term, we can regard FLOAT as ETH with low volatility, but with the addition of a variety of mainstream cryptocurrencies in the basket, FLOAT will be more like an index of the cryptocurrency market, reflecting the crypto The overall economy and purchasing power of the market.

Float has an initial target price of $1.618, which is subject to change based on market conditions. If the value of the Basket is growing relative to the value of the Floats in circulation, the Target Price will increase over time (and vice versa). Float's target price is directly proportional to the demand for Float.

Stability Mechanism / Price Adjustment

FLOAT stabilizes supply through frequent auctions to expand or contract supply. It is also partially backed by a basket of cryptocurrencies that are used as part of the auction process. The ratio between the value of the basket and the total FLOAT value of the target price is called the Vault Factor. Therefore, at the beginning, the basket coefficient should be equal to 100%, and over time, the basket coefficient will change. Since the value of ETH is unstable, the collateralization factor may be higher or lower than 100% at any time. In each contraction or expansion auction, the protocol aims to move the basket coefficient towards its target price.

The other part is supported by the native token BANK, which is responsible for the stability of the value of FLOAT (for example, if the price of FLOAT is too high, this excess demand will be captured and transferred to BANK. Similarly, if the price of FLOAT is too low , BANK is used to support the price of FLOAT), in addition, BANK also assumes the role of governing the Float protocol.

For stability adjustments, Float Protocol needs to know the prices of FLOAT, BANK, and ETH.

The protocol uses the following methods to do this. Get the ETH price from the ETH-USD feed on Chainlink and the FLOAT price in ETH from the FLOAT-ETH TWAP (time-weighted average price) on Sushiswap. Finally, get BANK-ETH TWAP from Sushiswap to know the price of BANK in ETH.Every period (initially set to 24 hours), calculate FLOAT TWAP (time-weighted average price, a measure of price for a specific period). If it diverges from the target price, the protocol alters the supply by minting (expansion) or buying and burning FLOAT (contraction). Dutch auctions are used during periods of expansion and reverse Dutch auctions during periods of contraction. In the long run, the protocol aims to gradually reduce the length of an epoch and eventually hand over power to protocol participants to expand and contract as deemed necessary or profitable.

If TWAP is higher than the target price, inflation will be carried out; if TWAP is lower than the target price, deflation will be carried out. The method of inflation and deflation is affected by the Vault Factor, which measures whether the reserve assets are sufficient. Vault Factor=ETH value locked in the vault/market value of the FLOAT target price in circulation. If Vault Factor>1, it means that the vault is in surplus; if Vault Factor

<1 , it is in a loss state.

Historical performance

In the deflation phase, arbitrageurs sell FOLAT to the agreement in a reverse Dutch auction at a price lower than the target price and higher than the market price. If it is in a state of surplus, the agreement will pay all users in ETH, and BANK will not be affected; if it is in a state of loss, the agreement will use part of ETH + minted BANK to pay, reducing the expenditure of the agreement.

risk

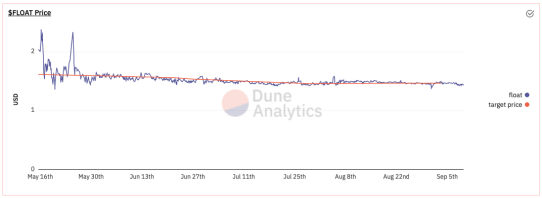

Judging from the historical price trends of FLOAT Price and Target Price, the mechanism of the agreement has indeed achieved a certain degree of stability between the two prices.

risk

If the price fluctuates sharply downward for a long time, liquidity and speculative demand for BANK may disappear. This means that the agreement will have a hard time getting the price back to the target (eventually the agreement has insufficient collateral or cannot back the price of FLOAT with newly minted BANK).

Since the issuance and redemption of Float are carried out through the auction mechanism, it cannot be expanded quickly and can only be carried out slowly through the market adjustment mechanism, which also limits the application of Float.

Reflexer Finance

“I am focusing on RAI rather than DAI because RAI better exemplifies the pure ideal type of a collateralized automated stablecoin,backed by ETH only。DAI is a hybrid system backed by both centralized and decentralized collateral,which is a reasonable choice for their products but it does make analysis trickier”-Vitalik Buterin

Float itself has no effective market demand and use value, resulting in very little circulation of Float. Bank also has no effective value capture mechanism.

Basic Mechanism

secondary title

Reflexer is a platform that can use cryptocurrency collateral to issue non-pegged stable assets. RAI is the first of its kind, and like the original DAI, it is generated only by ETH over-collateralization and has a local funding rate calculated by the on-chain PI controller to correspond to complex market conditions. The market price of RAI converges towards the redemption price. In short, RAI can be described as a low-volatility ETH denominated in USD with a moving peg.

The exchange rate of RAI/USD is determined by its supply and demand relationship, and the agreement will try to stabilize the price of RAI by continuously depreciating or revaluing its value. The supply and demand mechanism is played between two parties. SAFE users (users who generate RAI with ETH) and RAI holders."Different from Float's mechanism, RAI will actively update its peg (that is, the redemption price) to adjust the deviation between the market price and the redemption price. RAI uses an on-chain PI controller to set the rate of change of its redemption price, called the redemption rate, expressed as an annualized rate. The sensitivity of the redemption rate to market price deviations is determined by the PI parameters of the controller. The purpose is to adjust these parameters so that RAI can autonomously maintain price stability in the face of various situations and potential shocks."A PI controller consists of two terms, proportional (P) and integral (I). The P term is only based on the current error, so when the error disappears, it immediately resets the redemption rate to 0%. Error is defined as the RAI redemption price (also known as

target price

Monetary Policy

) and the RAI market price. The I term accumulates error over time, increasing the redemption rate over the duration of the error, not just the magnitude of the error (unlike the P term, it has no time component). Therefore, the final redemption rate set by the controller is calculated by adding the ratio determined by the P term and the I term.

Note that the reason the controller has two terms is that the P and I terms operate on different time scales, enabling the controller to detect and respond to sudden shocks and long-term disturbances. The P term is more important for dealing with sudden shocks, as it can be raised quickly when the RAI detects a price shock and resets quickly when the price shock wears off. The I term is more important for correcting long-term price deviations - called steady-state errors - because it will rise slowly, get stronger as long as the errors persist, and then slowly reset over time. Term I holds the redemption rate at whatever value makes the error zero. In effect, term I is looking for the average long-term redemption rate that keeps the error at zero.

The long-term price trajectory of RAI is determined by the leverage demand of ETH. If SAFE (like Vault) users deleverage and/or RAI users go long, RAI tends to appreciate in value, and if SAFE users increase leverage and/or RAI users go short, it will depreciate.To better understand the behavior of RAI, we need to analyze its monetary policy, which mainly consists of four elements.

Redemption price:This is the price the protocol wants RAI to be on the secondary market (e.g. on Uniswap). The redemption price is used by SAFE users to mint RAI, and it is also used in global settlements to allow SAFE and RAI users to redeem collateral from the system. But the redemption price is almost always floating, so it's not tied to any particular peg.

market price:This is the price at which RAI is traded on the secondary market (on exchanges).

Redemption rate:This is the depreciation or revaluation rate of the RAI. The process of devaluing/revaluing RAI includes the redemption rate to change the redemption price.

Global Settlement:

Settlement consists of closing the protocol, allowing SAFE and RAI users to redeem collateral from the system. Settlement uses the redemption price (rather than the market price) to calculate how much collateral each user can redeem.

When the market price of RAI > the redemption price for a period of time, the redemption rate will become negative.

Arbitrage Mechanism

When the market price of RAI < the redemption price for a period of time, the redemption rate will become positive.

When the market price of RAI = the redemption price for a period of time, the redemption rate will be stable in a state (may not be zero, the redemption rate is determined by the sum of P and I).

Advantages of RAI’s Monetary policy

If the market price is higher than the redemption price, indicating that there is too much demand for RAI, the system will further reduce the redemption price. This means that users can mint new RAI at the redemption price and then sell it for ETH to arbitrage.

The market price is lower than the redemption price, and there is insufficient demand for RAI on the surface, the system will further increase the redemption price, resulting in higher borrowing costs, which will motivate people to repay the loan, thereby reducing the supply of RAI in the market, under all conditions All the same, this increases the price of RAI."RAI’s monetary policy offers some advantages over other dollar-pegged stablecoins that they don’t"Flexibility: The protocol can devalue or revaluate RAI according to changes in the market price of RAI. This process transfers value between SAFE users and RAI holders and incentivizes both parties to bring the market price back to the target price chosen by the protocol. The mechanism is similar to countries devaluing or revaluing their currencies in response to trade imbalances. In RAI's case,

trade imbalance

Historical performance

Happens between RAI and SAFE users.

Use Cases

Discretion: The protocol itself is free to change the target exchange rate in its favor. It can attract or repel capital at any time.

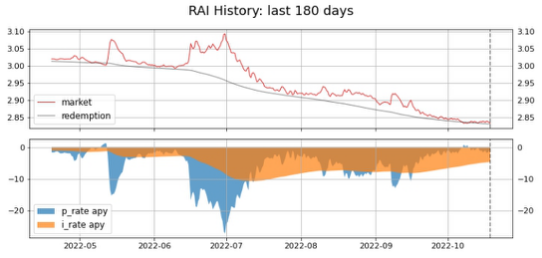

According to the historical performance of RAI, since the above picture has not been smoothed, it may seem at first glance that the price of RAI has fallen sharply within half a year, but in fact, despite the bear market, RAI only fell by about 5%, while During the same period, ETH fell by about 50%, so the stability of RAI is still remarkable.

DeFi collateral: RAI can be used as a supplement to ETH or as an alternative collateral in DeFi protocols, as it can dampen the price volatility of Ethereum, giving users more time to react to market changes.

Comparative analysis between Float Protocol and Reflexer Finance

DAO Reserve Assets: DAOs can keep RAI on their balance sheet and gain a portion of their ETH exposure without being affected by their full market volatility.secondary title"Basic mechanics:"The stability mechanism of FLOAT adopts a more traditional Dutch auction and relies on the quotation of the oracle machine. RAI uses the local fund rate calculated by the PI controller on the chain to correspond to complex market conditions to promote the convergence of the market price of RAI to the redemption price. I believe that the auction mechanism is familiar to everyone, but the disadvantage is that frequent auctions achieve price stability, which is not excellent in efficiency. Moreover, once the collateral plummets, the oracle machine cannot feed the real price in real time, and the price discovery is poor. The PI controller is a very elegant control algorithm, which is widely used in industrial control. Sometimes, without knowing the system model, as long as there is experience to adjust the parameter PI, the desired control effect can be achieved. One of the most interesting things about RAI is that the parameters of the controller largely determine the behavior of RAI assets. We know the protocol wants RAI to be"Suppressing fluctuations"inhibition

stability:degree. Thus, part of the RAI design process involves obtaining feedback from traders and potential RAI holders about their preferences for the degree of volatility suppression, and then using RAI simulations to determine the controller parameters that lead to the expected asset behavior. Therefore, the design of the protocol can clearly capture the upper and lower limits of RAI behavior. It will neither make RAI more volatile than ETH, but it will not make RAI completely uncorrelated with ETH. So the ideal state for RAI is somewhere in between, correlated to ETH but less volatile."stability:"basket

Use Cases:Changes in the demand for cryptocurrencies in China reflect the economics of the overall cryptocurrency market. Subsequent agreements will add more encrypted assets into the basket, but when the market falls sharply, the correlation coefficient between cryptocurrencies itself is very high, so the price of FLOAT will still fluctuate violently. The long-term price trajectory of RAI is only determined by the leverage demand of ETH, and there will be a PI controller on the chain that cooperates with the monetary policy to actively adjust the market price to converge to the redemption price. From the historical price performance, we can also see that RAI is relative to FLOAT more stable.

Use Cases:

SCapitalCompared with other stablecoin projects, these two floating stablecoins currently do not have a wide range of use cases, are only in an experimental stage, and have not been generally recognized by crypto investors.