A brief history of the evolution of the encryption mining industry: mining machine upgrades and computing power changes

Original title: "Blockchain Evolution History (5): A Brief History of Crypto Mining Evolution》

Original author: Wesely, The Way of DeFi

Original author: Wesely, The Way of DeFi

In the encryption industry, miners are a special group. They are the underlying security guarantee of the blockchain. They are the richest and most powerful group of people in the encryption industry, representing the barometer of the encryption market; In his eyes, the industry he is in is a behemoth devouring energy and a backward production capacity dressed in data technology.

Helkissin, Finland is the place where the encryption mining industry started. In early 2009, Satoshi Nakamoto dug up the first block of Bitcoin here. Afterwards, with the skyrocketing price of Bitcoin, the arms race of computing power began to intensify. , In September 2010, the GPU mining bitcoin code appeared, breaking the CPU mining routine, and various mining machines were rapidly iterated shortly thereafter.

In December 2010, Czech programmer Marek created the world's first mining pool "slushpool". This large-scale collective mining farm has gradually become the main mode of industry development. Developments such as the listing of mining companies, and the financialization of computing power have brought continuous impetus to the mining industry, and have also allowed this new track to gradually develop a large-scale commercial landscape. As of April 2022, the total market value of 21 listed Bitcoin mining companies exceeded US$15 billion. Before the merger of Ethereum, the market value of Ethereum mining machines alone was as high as US$5 billion.

However, the resistance to the development of the mining industry is not small. Under the global consensus of green and environmental protection, the high energy-consuming POW mining has become a natural political incorrectness, and has become the object of criticism from many people. Policies and rising electricity costs have forced miners to move around, which also restricts the further development of the industry. The decline of the POW era has caused the discourse power of the miners to continue to shrink, but the ZK mining brought about by liquidity mining and zero-knowledge proof has also expanded the boundaries of the mining industry again.

Counting the history of the encryption mining industry, its development may not be called magnificent, but it is equally exciting in the ups and downs of the encryption industry for more than ten years. It shuttles back and forth between Utopia and Shura field, but it is also in the cracks and crises Grow upwards again and again.

Elimination and Evolution

The most direct example of the evolution of the encryption industry is the iteration of different hardware mining machines.

From CPU to ASIC

In July 2010, the over-the-counter price of Bitcoin rose from $0.008 to $0.08 in a few days, which also made the earliest batch of "miners" smell business opportunities.

During this period, the computing power of the entire Bitcoin network was only 140 MH/s, and most of them were mined by personal computers. The threshold for mining was not high. It began to grow rapidly, and some people began to turn their attention from CUP to GPU with more powerful computing power. It is estimated that the computing power of GPU was 3 orders of magnitude higher than that of CPU at that time, reaching 9 MH/S, while the computing power of CPU was only about 1 KH /S, in the era of PC CPU mining, the emergence of GPU mining can be said to be a blow to dimensionality reduction, so just 7 months later, the computing power of the entire network rose to 500 GH/s, an increase of 3500 times , and reached 15 TH/s a year later (an increase of about 100,000 times), so far, the way of personal computer mining has become a thing of the past, and GPU computing power dominates the Bitcoin mining market.

Data source of Bitcoin computing power growth from July 2010 to February 2011: btc.com

The advantage of GPU computing power allows everyone to see the additional benefits that higher computing power can bring, so under the boost of the Bitcoin bull market in 2011 (during which Bitcoin rose from $0.08 to $30), the armament of computing power The competition was officially launched, and then FPGAs with more powerful computing power began to appear.

In June 2011, the professional mining equipment called Field Programmable Gate Array (FPGA—Programmable Gate Array) was widely mentioned. For those who use amateur hardware to mine, it is undoubtedly a huge improvement, and it also opens the door for more professional ASIC professional mining chips in the future. On the basis of the original GPU, the computing power of FPGA has increased by about 3 orders of magnitude again, reaching the level of GH/S. However, due to the difficulty of development and the slow improvement of computing power, it has faded out of people's vision after a short-lived.

In 2013, Bitcoin ushered in the second round of bull market after halving, and a new round of influx of computing power began. The difficulty of Bitcoin mining has risen, and everyone has to look for equipment with more powerful computing power. ASIC chips designed for mining emerged as the times require. Because of their concentrated computing power and other features, they can achieve higher computing speeds with lower unit energy consumption. ASICs have pushed the computing power of mining machines to a new level. The first generation of Ant mining machines began to be shipped out. Afterwards, ASIC chips also rushed from 110 nm to 3 nm, and were continuously optimized from multiple dimensions such as low power consumption and high performance. Generations of ASIC mining machines iterated rapidly.

In January 2013, the first commercial Bitcoin ASIC mining machine, Avalon mining machine, was delivered, bringing Bitcoin into the era of ASIC computing power. Completed the listing and became a well-known mining machine leader in the upstream of the encryption industry. Interestingly, the first FPGA mining machine was developed and launched by Canaan founder Nangua Zhang (Zhang Nangeng). Only half a year after the FPGA mining machine After dropping out of school, he used the ASIC mining machine to squeeze the FPGA mining machine off the stage. Also in 2013, Jihan Wu founded Bitmain, when the Antminer S 1 was launched and was snapped up by the market.

During this period, many mining machine brands have emerged in the mining market, such as Roasted Cat, Western, Ant, ASICME, TMR, Bitmain, etc., but many mining machine manufacturers have been eliminated in the competition, and the one that has not changed is the ASIC The dominance continues to this day.

For the group of people who were first exposed to Bitcoin mining, with the development of the encryption mining industry, some of them became developers of upstream mining machines, such as Canaan Zhizhi, who started with pumpkins, while some chose to become professional miners. , such as the god fish.

ASIC mining machines continue to evolve on the road of low power consumption and high performance. Since 2013, Bitcoin has officially entered the era of high computing power.

From individual to mine

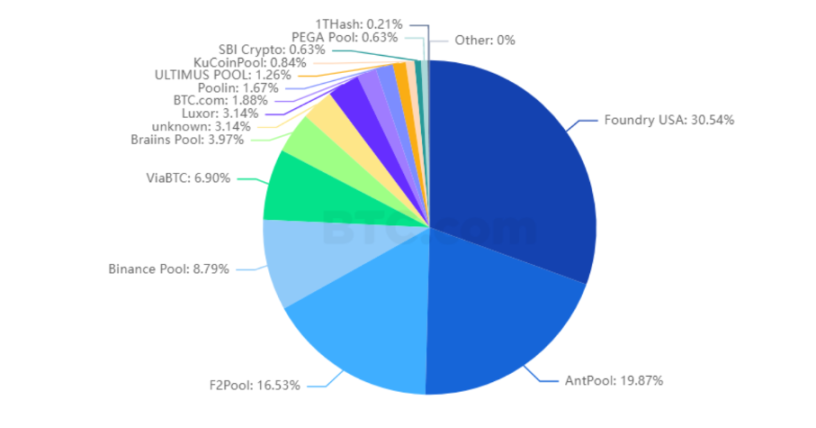

In May 2013, the Bitcoin mining pool F 2 Pool (F 2 Pool) was officially opened and quickly became the premier Bitcoin mining pool. China also occupies a very high proportion. As of January 11, 2023, F 2 Pool ranks third with a computing power ratio of 16.53%, second only to Antpool and Foundry.

After experiencing the era of contention among a hundred schools of thought on mining machines in 2013, some mining machine manufacturers have also begun to directly get involved in mining, such as Antpool and BTC.com under Bitmain (later acquired by 500 lottery.com and now known as Bit Mining). In February, Bitmain launched its mining platform Antpool. It currently ranks second with 19.87% of Bitcoin computing power. In February 2018, Bitmain's mining pools once accounted for 40% of the entire network.

image description

Data source of current mining pool computing power distribution: explorer.btc.com

In July 2013, the GHash.IO mining pool was established. With its operating strategy of not charging mining pool fees, it grew rapidly. In June 2014, the computing power of the mining pool once approached 51% of the entire network. However, under the blow of large-scale DoS attacks and the bear market, operators shut down GHash.IO, and its shares were successively eaten by Chinese mining pools such as Yuchi, Antpool, and BTC.com.

The mining method has changed from the unilateral operation in the past to the mining pool mode of "teaming and fighting monsters", which reflects that platformization and intensification are an inevitable evolution process. In the era of ASIC mining machines, this trend has been further strengthened , and the competition among mining farms is equally fierce, once-famous mining pools such as GHash.IO, BTCC Pool, Eligius, etc. have also disappeared in the long river of history.

The development boundary of the mining industry is also constantly expanding. The emergence of IPFS makes storage a new type of "computing power". The emergence of physical computing power to cloud computing power lowers the threshold for mining but also introduces a larger The innovation of the financialization of computing power (computing power Token) has promoted the application of computing power from bottom-level mining to the secondary market, deriving a new financial asset, but it also puts forward higher expectations for investors. investment requirements.

Changes in computing power

Looking at the development of the mining industry for more than ten years, computing power, as its core element, can be said to have undergone earth-shaking changes in the development of more than ten years. This change mainly reflects the two dimensions of time and space:

time dimension

Let’s take a three-year cycle to see the growth of Bitcoin’s entire network computing power:

From 2009 to 2011, the computing power of Bitcoin's entire network increased from 10 GH/s to 10 TH/s, an increase of about 1000 times;

From 2012 to 2014, the computing power increased from 20 TH/s to 300 PH/s, an increase of 15,000 times;

From 2015 to 2017, the computing power increased from 1 EH/s to 14 EH/s, an increase of 14 times;

From 2018 to 2020, the computing power will increase from 40 EH/s to 160 EH/s, an increase of about 4 times;

From 2021 to January 2023, the computing power will increase from 200 EH/s to 255 EH/s, an increase of about 1.3 times;

First of all, the comparison shows that since the birth of Bitcoin, the computing power of the network has been increasing. Although there will be a short-term decline in computing power due to market changes, policy regulation and other reasons, the long-term trend of growth has always been there.

Second, the momentum of this growth is gradually weakening. This is mainly due to the fact that after the computing power of the mining machine starts to approach the physical limit, it will be more difficult to further upgrade the mining machine. In addition, after the computing power of the entire network has climbed to a certain height, the industry threshold is getting higher and higher, which hinders the entry of new computing power , thus slowing down the growth of Bitcoin computing power.

Third, from 2012 to 2014, the 15,000-fold increase in Bitcoin computing power was mainly due to the emergence of ASIC mining machines. During this period, Bitcoin rose more than 600 times in more than a year, attracting a large amount of new computing power. In order to expand their respective competitive advantages, ASIC mining machines specially designed for mining came out and became the dominant cryptocurrency mining industry in the future. products and continues to this day.

Fourth, after 2019, the growth of computing power began to slow down, and it was also during this period that the importance of electricity prices began to gradually exceed hardware efficiency, because both chip design and the pursuit of power consumption ratio began to touch the current technological limit , without a new breakthrough technology, it will be difficult for Bitcoin miners to rely on hardware and equipment updates to compete in dimensionality reduction computing power as in the past, and cost control is even more important, so the Bitcoin computing power in this period Migration in lateral space becomes more pronounced.

spatial dimension

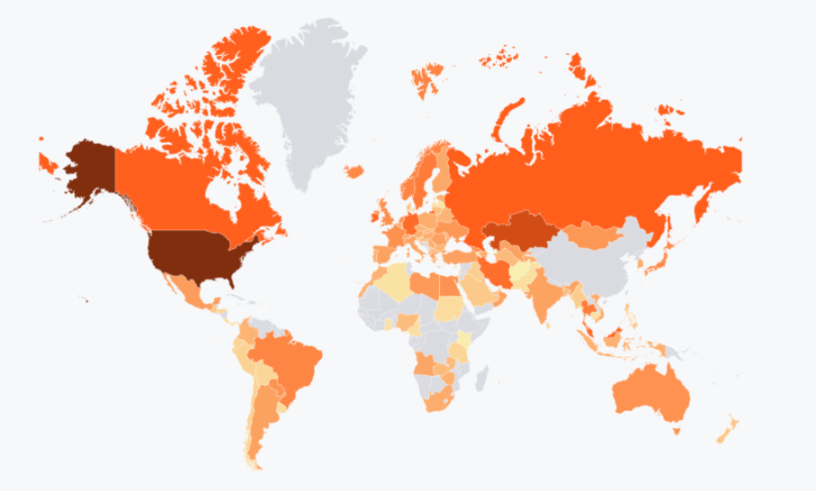

In 2013, after the domestic mining industry experienced the contention of a hundred schools of thought on mining machines, more than 70% of the computing power of the entire Bitcoin network has been firmly rooted in China's territory. Until October 2020, China's share of computing power began to decline all the way. According to statistics from the Cambridge Alternative Finance Research Center, from October 2020 to May 2021, the proportion of computing power in China dropped from over 70% to 44%. In contrast, the bitcoin computing power in the United States has risen sharply, from 17% in April 2021 to 35% in August. After that, the United States has successfully surpassed China to become the world's largest source of bitcoin computing power.

image description

In July 2020, the proportion of China's Bitcoin computing power dropped to 0

From October 2020 to May 2021, the decline in the proportion of China's computing power is mainly due to the crowding out effect caused by the large-scale expansion of overseas mining companies. The mainland has ordered 30,000 and 17,000 S 19 series mining machines respectively, and a large number of mining farms have been built in batches in many places in the United States. In addition, in September 2020, China clearly proposed a dual-carbon target, and the encryption mining industry has long been regarded as backward production capacity and has experienced varying degrees of regulatory pressure, which also made some miners with a keen sense of smell start to take action.

In February 2021, under the guidance of the dual-carbon targets, Inner Mongolia, a large coal province, took the lead in taking action. Inner Mongolia announced "Several Guarantee Measures for Ensuring the Completion of Dual Control Targets and Tasks for Energy Consumption in the 14th Five-Year Plan" to solicit opinions. The virtual currency mining projects were cleaned up and shut down before the end of April, and a draft of eight measures to punish mining was released later, with unprecedented rectification efforts.

On May 21, 2021, the State Council held the 51st meeting of the Financial Stability and Development Committee of the State Council on May 21, which mentioned the need to crack down on Bitcoin mining and trading. For a while, Xinjiang, Sichuan, Yunnan, Guizhou Power-rich provinces have issued withdrawal orders one after another, so the proportion of domestic Bitcoin computing power quickly dropped to 0. It is worth mentioning that on June 16, the Xinjiang Zhundong Economic Development Zone shut down the cryptocurrency mines, causing the average computing power of the Bitcoin network to drop by 20%. Great influence, but this influence is now a thing of the past."On September 24, 2021, with the release of the document "Notice on Rectifying Virtual Currency "Mining" Activities", the "death penalty" for the domestic encryption mining industry was announced.

, this document jointly issued by ten ministries and commissions including the National Development and Reform Commission, the Energy Bureau, and the Ministry of Public Security stipulates:

Comprehensively sort out and investigate virtual currency "mining" projects

List virtual currency "mining" activities as an eliminated industry, and strictly prohibit new project investment and construction

It is strictly forbidden to carry out virtual currency "mining" activities in the name of data centers, and strengthen the credit supervision of data center enterprises

Stop all financial and tax support for virtual currency "mining" projects

As a result, mining has become illegal from a gray area. This year, Chinese miners have migrated out on a large scale.

On May 23, 2021, Mars Cloud Mining announced that some mining machines would be transferred to the mine in Kazakhstan, and Jiang Zhuoer, the founder of Leibit Mining Pool, said that he would deploy the mine in North America.

On May 24, 2021, Bit Mining announced that it will cooperate with a Kazakhstan company to invest 60 million yuan in the construction and operation of a new mine.

On July 27, 2021, Bitmain announced that it would spin off its mining pool brand AntPool, saying that it would carry out this part of the business overseas, and also cooperated with Enegix to equip more than 50,000 Antminer S 19 Pro mining machines in Kazakhstan mines. In addition, many large and medium-sized mining companies such as Huobi, Binance Mining Pool, and Canaan Technology have transferred their business overseas.

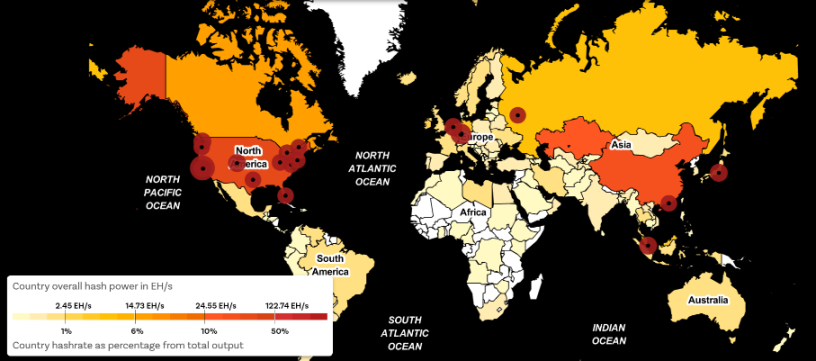

Interestingly, after the wind of regulation slowed down, the domestic bitcoin computing power began to recover partly. According to the statistics of chainbulletin, the current bitcoin computing power in China accounts for about 21.1%, second only to the United States. The reason, according to industry insiders, is that some miners will use foreign proxy servers to evade domestic monitoring, small-scale scattered in remote areas to secretly mine, and even use off-grid power generation to avoid power monitoring.

image description

Bitcoin to the global current computing power map data source: chainbulletin

Post-POW era

In the current encryption industry, the attractiveness of the POW narrative has long lost its luster in the past. On the contrary, its high energy consumption and environmental protection have become the handles of the audience. Coupled with the negative impact of malicious mining in the past, this Many industries that outsiders can't tell clearly are covered with a gray shadow.

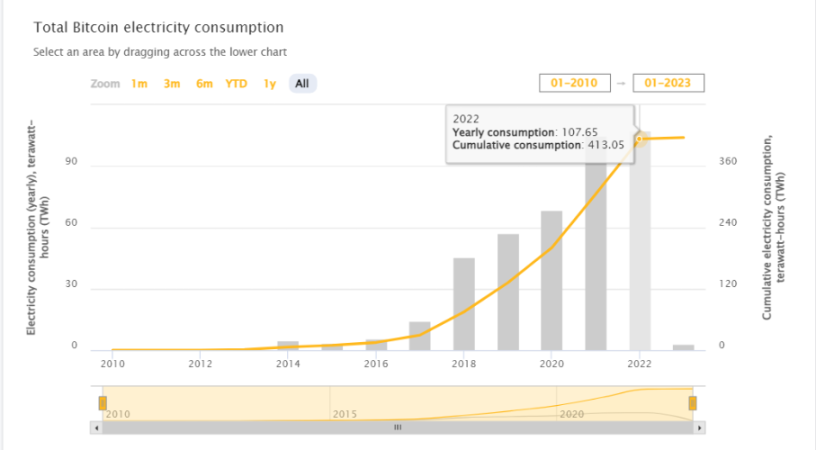

The environmental protection issue is another weakness of Bitcoin or POW public chain mining. According to the statistics of the Cambridge Alternative Finance Research Center, the total electricity consumption of the Bitcoin network in 2022 is about 107 TWH, which is the same as that of the Netherlands, which has a population of 17 million. The power consumption is equivalent, and if you want to talk about the global ranking, it can be ranked 33rd. The carbon footprint generated throughout the year is about 43.28 metric tons, which is equivalent to the carbon footprint generated in Hong Kong throughout the year. In addition, the electronic waste generated by Bitcoin throughout the year is as high as 43,000 tons.

image description

Bitcoin network power consumption statistics source: ccaf

Under the general trend of green and environmental protection, it has become an inevitable choice for Bitcoin mining to turn to clean energy, so more and more mines have begun to choose clean energy such as solar energy and wind power for mining. According to the Bitcoin Mining Committee BMC According to a report released last year, as of June 2022, Bitcoin mining energy consumption has reached 66.8%. As for whether the proportion is really so high, we do not know, but Bitcoin mining using clean energy is also becoming a Broad narrative, which can reduce the policy and public opinion pressure faced by the mining industry.

Whether it is malicious mining or accusations of high energy consumption of Bitcoin mining, it is itself related to the POW mechanism. After the outbreak of the new public chain, the POS consensus public chain began to occupy the mainstream and bypass the above-mentioned problems faced by Bitcoin. These two problems have also brought other development advantages such as scalability to the public chain. The successful transformation of Ethereum from POW to POS also caters to this trend to a certain extent. In addition, the transformation from POW to POS has also introduced the mining industry into a new field, whether it is liquid mining or the ZK mining machine under the trend of Zero-Knowledge Proofs, it has also expanded new boundaries for the mining industry.