2022 Investment and Financing Annual Report: 1,660 public financing events with a total of 34.8 billion US dollars, and the infrastructure track is the most popular

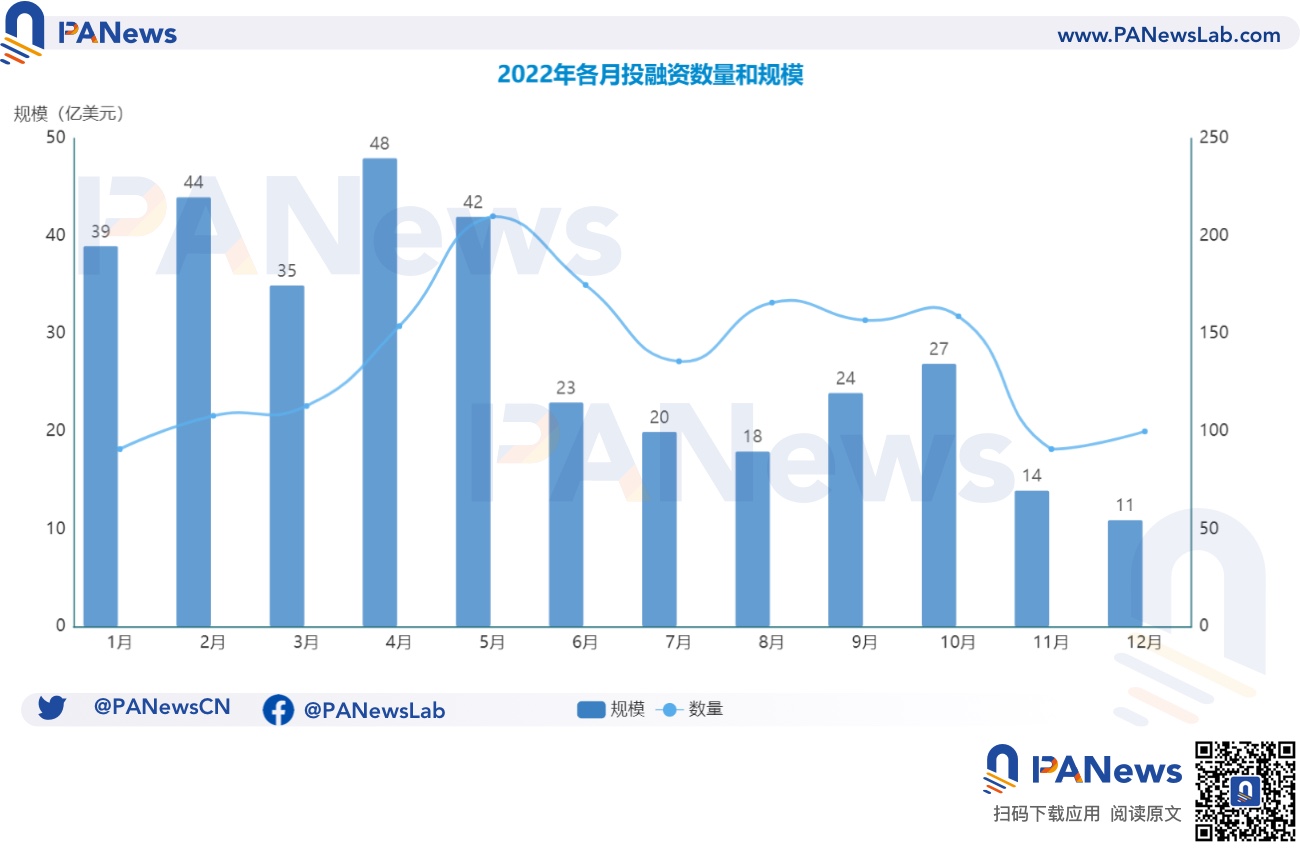

Against the background of the bear market, compared with last year, the overall investment and financing market will still maintain growth in 2022, mainly due to the hot performance of the market in the first half of the year: the total financing scale in the first half of 2022 will reach 23.3 billion US dollars, accounting for 67% of the total for the whole year. %, by quarter or month the highest market figures are also concentrated in this period. Including the first quarter with the highest amount of financing in the whole year, the total amount of funds reached US$11.8 billion, and the second quarter with the largest number of financing events announced 539 investment and financing events; by month, the largest financing scale was US$4.8 billion in April, and the investment and financing incidents announced in May were as high as US$4.8 billion. Financing up to 210 events.

With the sudden collapse of Luna in the middle of last year, it sounded the alarm that the encryption industry entered a cold winter, and became a watershed in the primary market from prosperity to decline, and the domino effect began to show. In the second half of the year, negative news in the industry emerged one after another, and many institutions such as Three Arrows Capital, Voyager Digital, Celsius, and FTX were exposed one after another. Affected by this, the investment and financing market dropped sharply in the second half of the year and began to continue to decline. Compared with the second quarter, the scale of financing in the third quarter dropped rapidly from US$11.4 billion to US$6.2 billion, a decrease of 45% from the previous quarter; while the data in the fourth quarter was the most bleak, the total amount of investment and financing announced was only US$5.2 billion, which accounted for the largest share of the whole year. 15% of the total, among which the investment and financing transaction amount of the encryption industry in December hit a new low in nearly two years, only 1.1 billion US dollars.

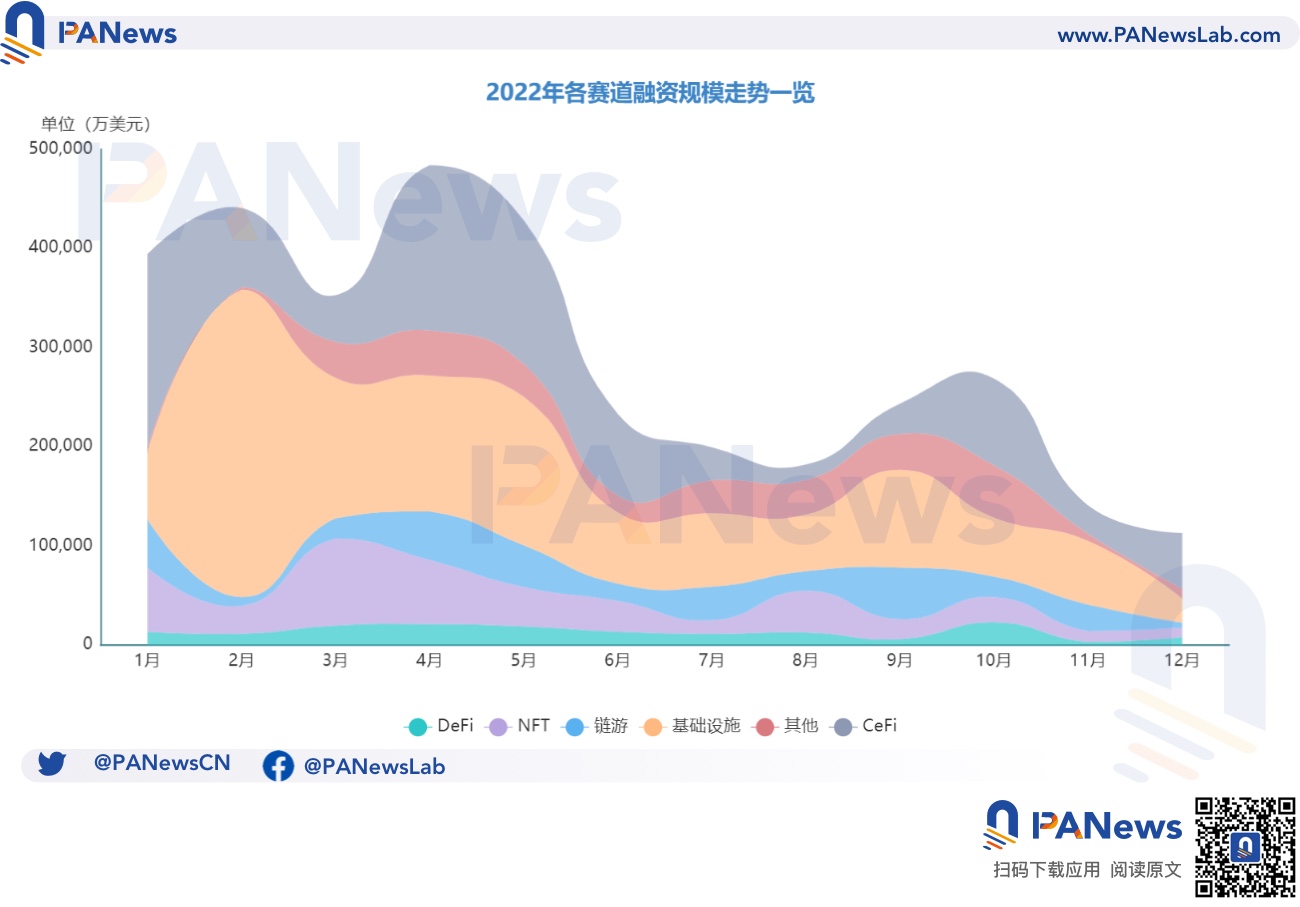

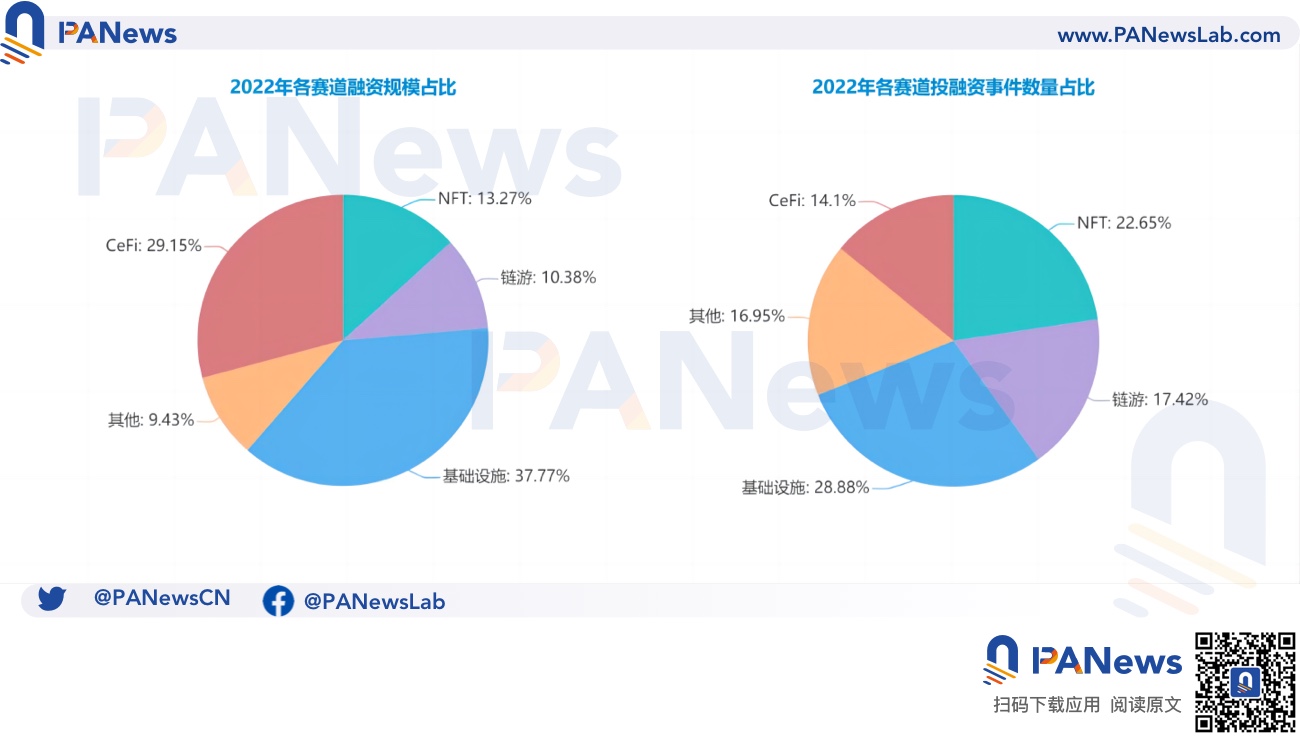

PANews divides investment and financing events into six tracks based on project classification: DeFi, infrastructure and tools, NFT & Metaverse, chain games, centralized finance, and others, and makes statistics on the investment and financing of each track. Overall, infrastructure and tools are the most capital-focused and favored tracks in 2022. The number and amount of investment and financing transactions are the largest among all tracks, and the two data are 426 and 12.5 billion US dollars respectively. From the perspective of the number of investment received, NFT and Metaverse track ranked second in popularity, with 334 events announced, and its total capital scale ranked third at US$4.4 billion; Dow ranked second with US$9.6 billion, and the average single financing amount was also the highest. Chain games are on par with other categories, and the number and amount of DeFi investment and financing transactions are the lowest.

The following are the specific statistics of each track.

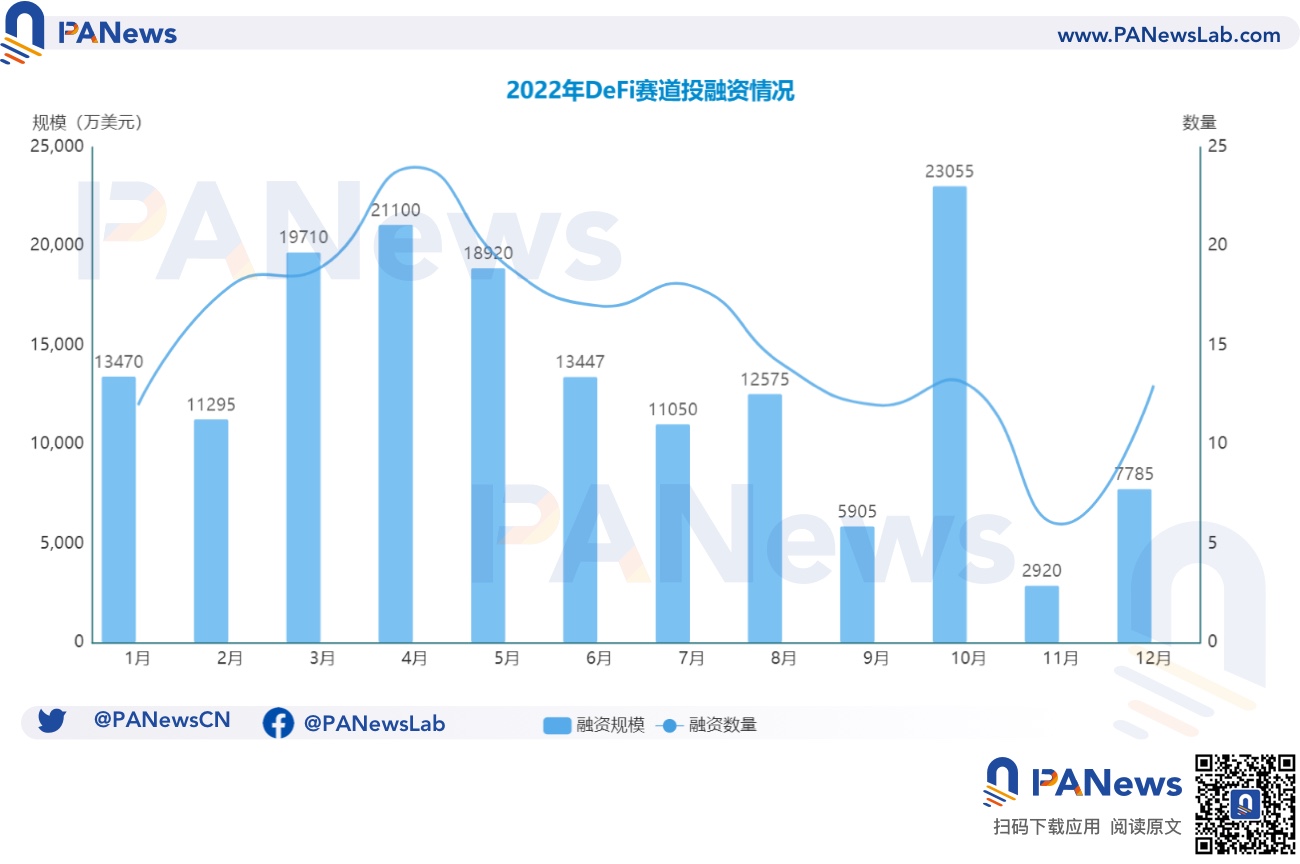

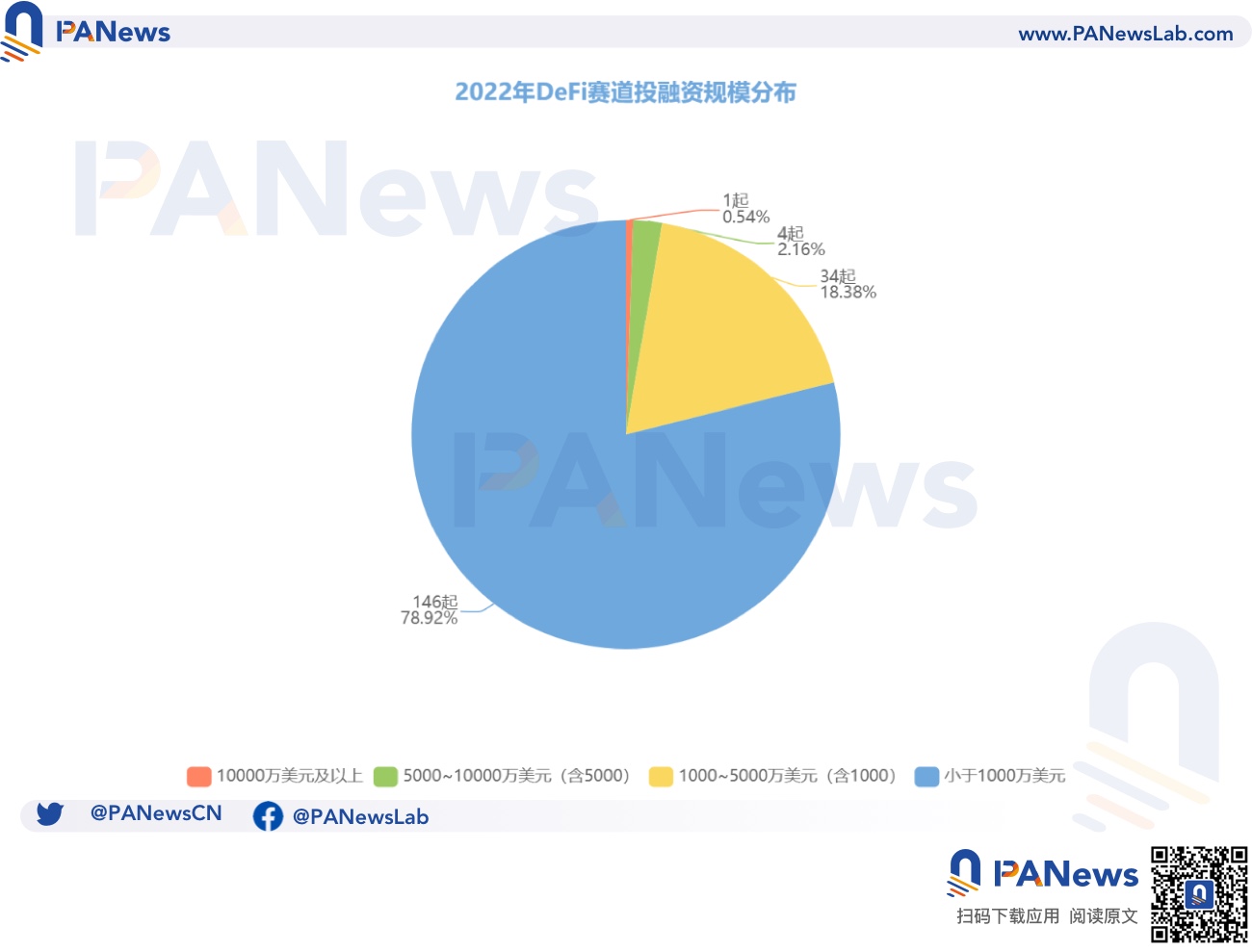

DeFi: 185 financings were raised throughout the year, and only Uniswap raised more than 100 million

In 2022, the DeFi track announced a total of 185 investment and financing events, with a total financing scale of 1.6 billion US dollars, and the average financing amount of each public financing event was 10.55 million US dollars. Among them, there is only one case with a scale of more than US$100 million, which is the US$165 million B round of financing completed by Uniswap Labs. This round was led by Polychain Capital, and a16z and others participated in the investment; the investment and financing of 50 million and above to 100 million US dollars There were 4 incidents; 34 investment and financing incidents ranging from 10 million and above to 50 million US dollars; 146 investment and financing incidents of less than 10 million US dollars accounted for 79%.

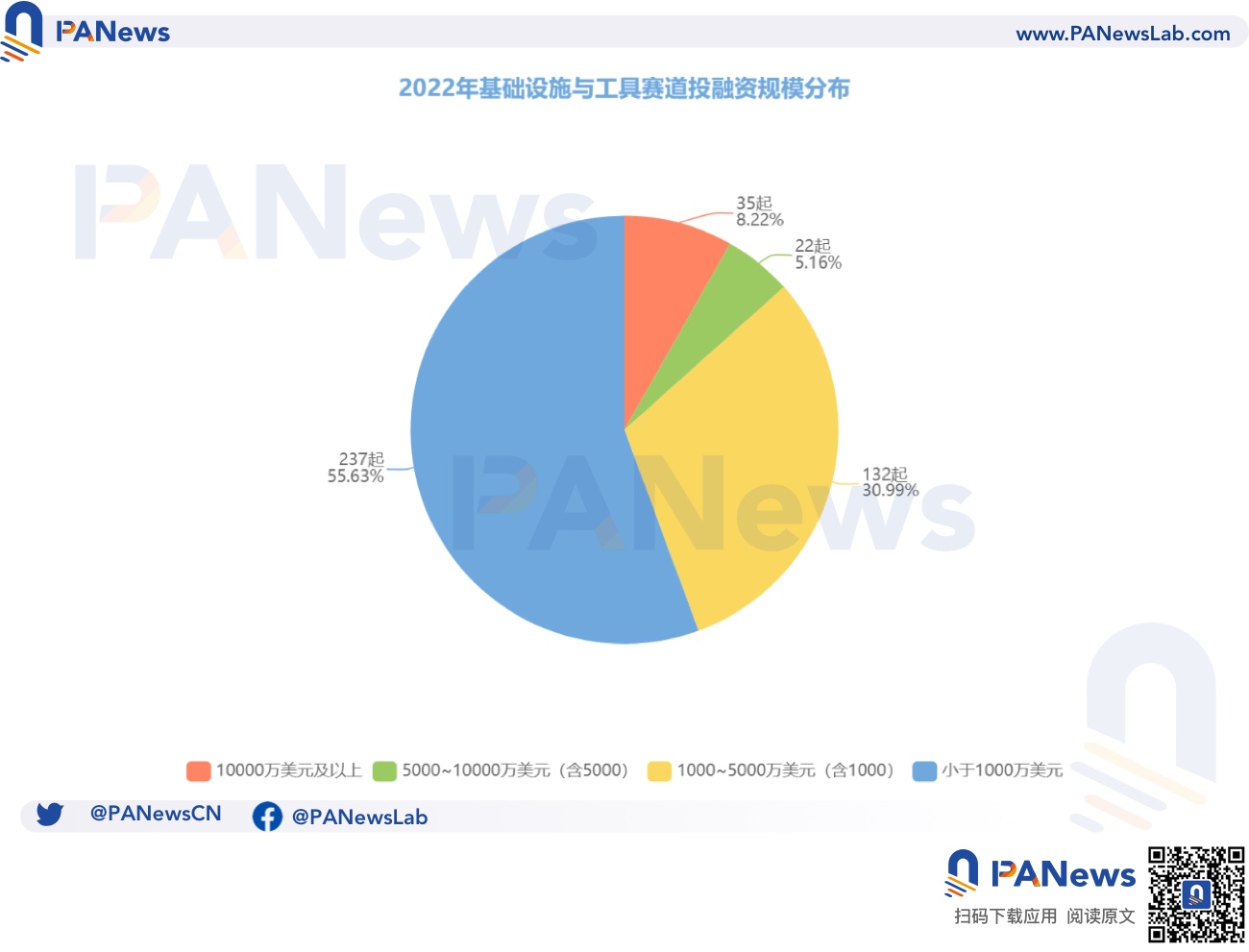

Infrastructure and tools: financing scale leads all tracks throughout the year

In 2022, the infrastructure and tools track announced a total of 426 investment and financing events, with a total financing scale of 12.5 billion U.S. dollars, and the average financing amount of each public financing event was 16.75 million U.S. dollars. Among them, there are 35 cases with a scale of US$100 million or more, and the largest is the US$1 billion financing completed by Luna Foundation Guard (LFG) through off-market sales of LUNA, led by Jump Crypto and Three Arrows Capital; 50 million and above There were 22 investment and financing events ranging from USD 100 million to USD 100 million; 132 investment and financing events ranging from USD 10 million to USD 50 million; 237 investment and financing events below USD 10 million accounted for 56%.

NFT & Metaverse: Concentrated explosion in the first half of the year, bleak data in the second half of the year

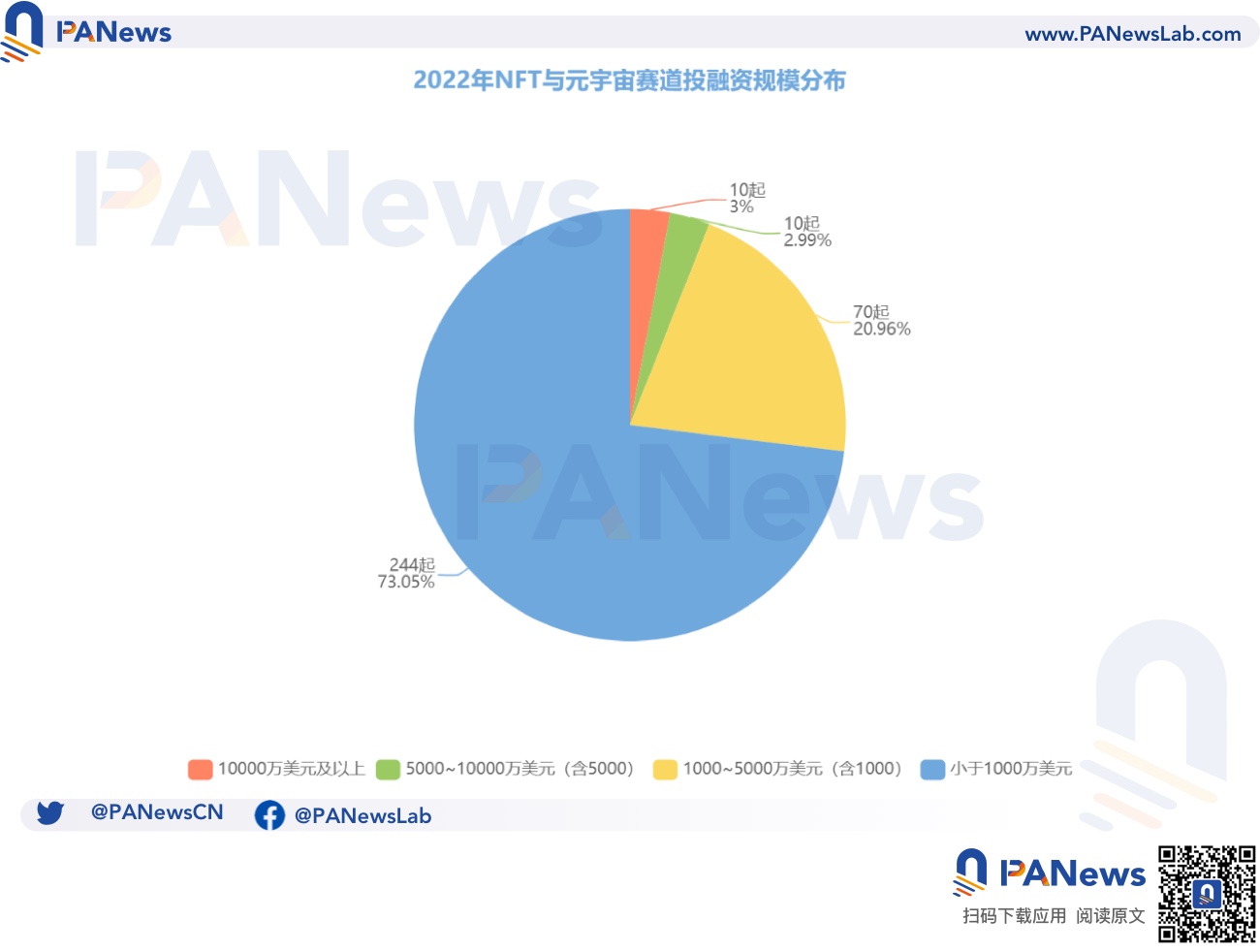

In 2022, NFT and Metaverse Circuit announced a total of 334 investment and financing events, with a total financing scale of 4.4 billion U.S. dollars, and the average amount of financing per public financing event was 6.68 million U.S. dollars. Among them, there are 10 cases with a scale of 100 million US dollars or more, and the largest is Yuga Labs, a boring ape production company, which announced that it has completed a seed round of financing of 450 million US dollars at a valuation of 4 billion US dollars, led by a16z; 50 million and above to 1 There were 10 investment and financing events with a value of 100 million US dollars; 70 investment and financing events with a value of 10 million and above to 50 million US dollars; and 244 investment and financing events with a value of less than 10 million US dollars accounted for 73%.

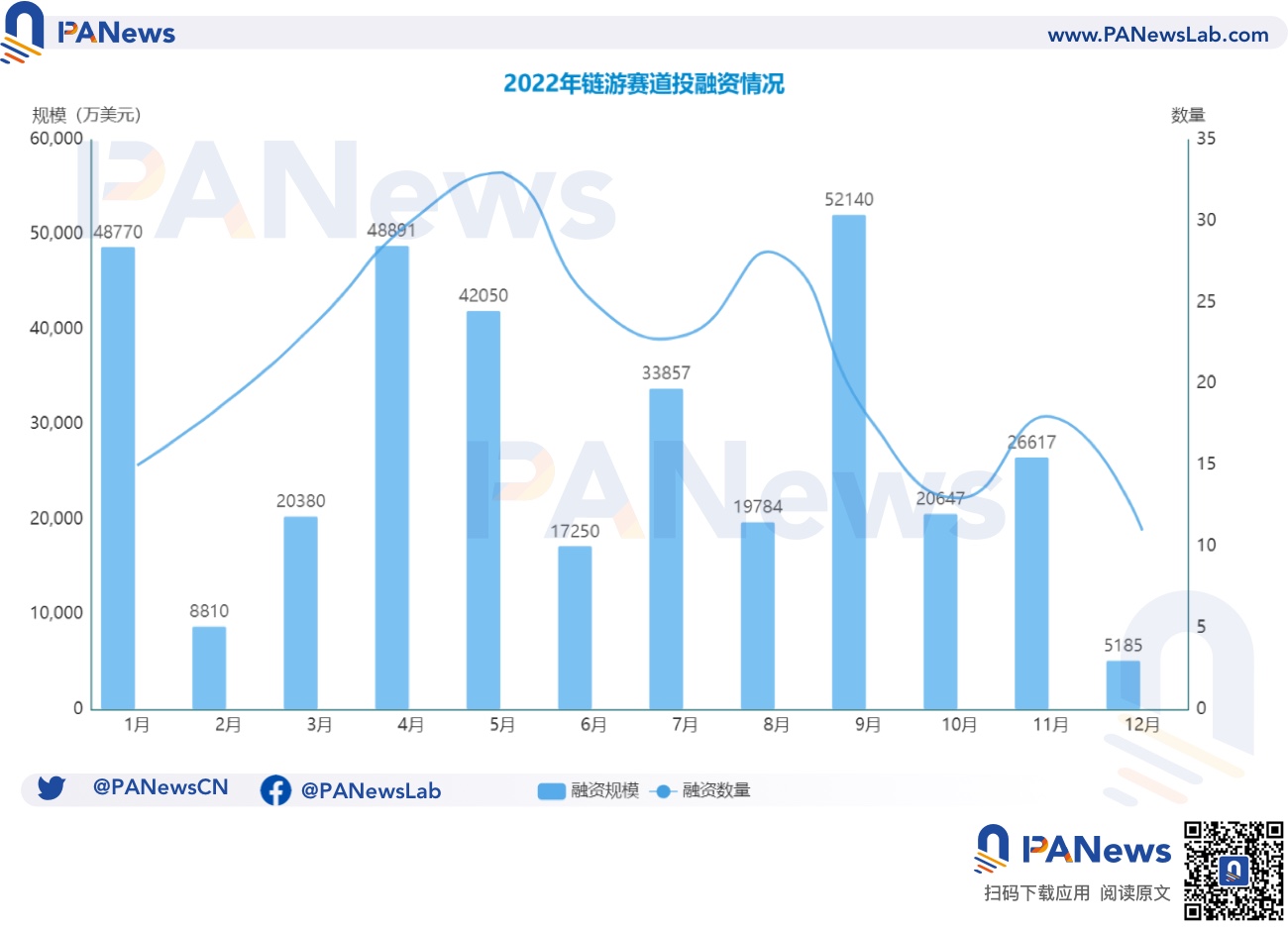

Chain Games: Explosion in the second and third quarters, Animoca became the biggest winner

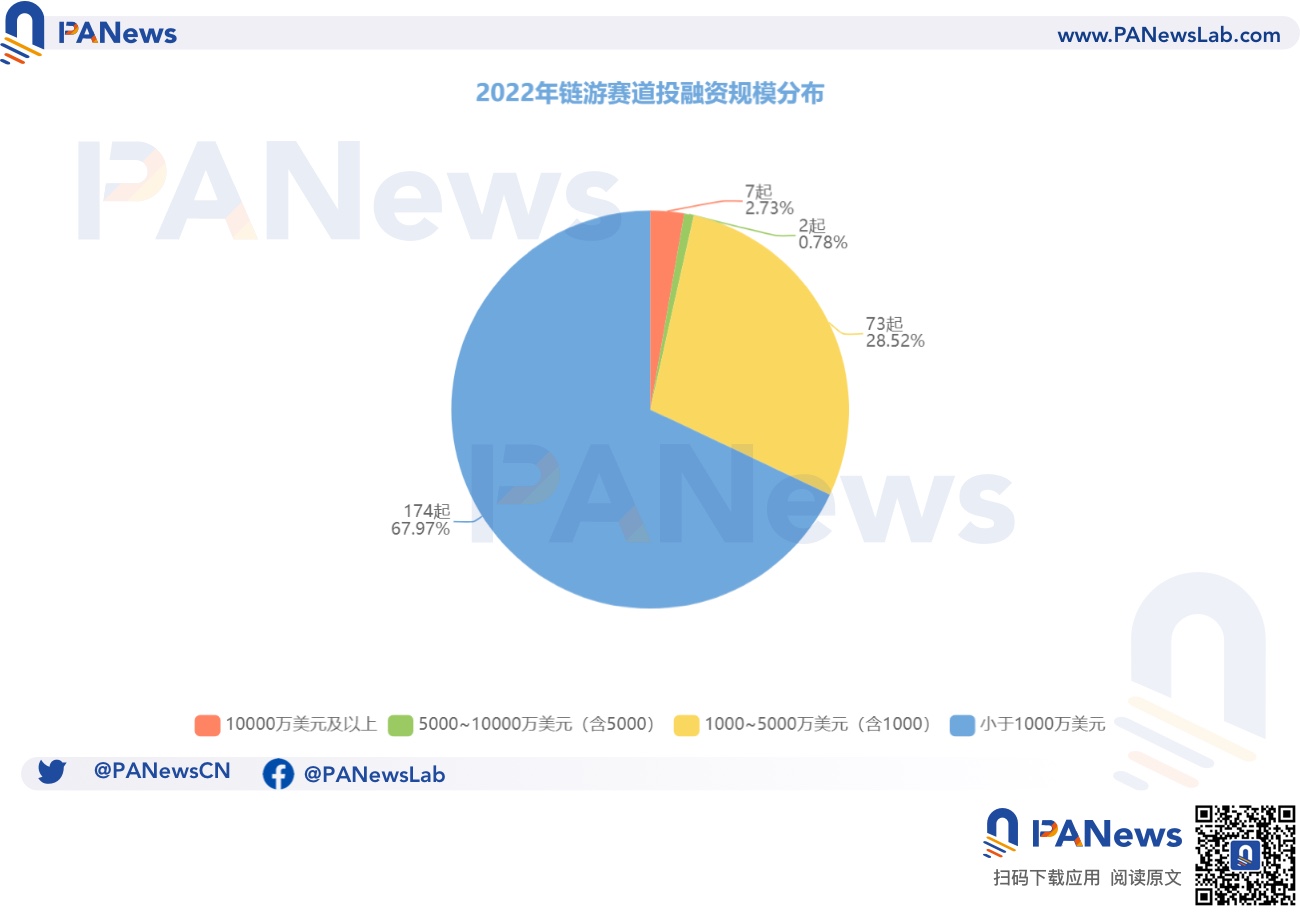

In 2022, the chain game circuit announced a total of 334 investment and financing events, with a total financing scale of 4.4 billion US dollars, and the average financing amount of each public financing event was 12.48 million US dollars. Among them, there were 7 cases with a scale of US$100 million and above; 2 incidents of investment and financing incidents ranging from 50 million and above to US$100 million; 73 incidents of investment and financing incidents ranging from 10 million and above to US$50 million; 174 investment and financing incidents accounted for 68% of the total. Game developer and venture capital firm Animoca Brands has become the strongest winner in this track, announcing the completion of different rounds of financing three times, two of which exceeded US$100 million.

Others: Gold, September, Silver and October, "reverse growth" in the crypto winter

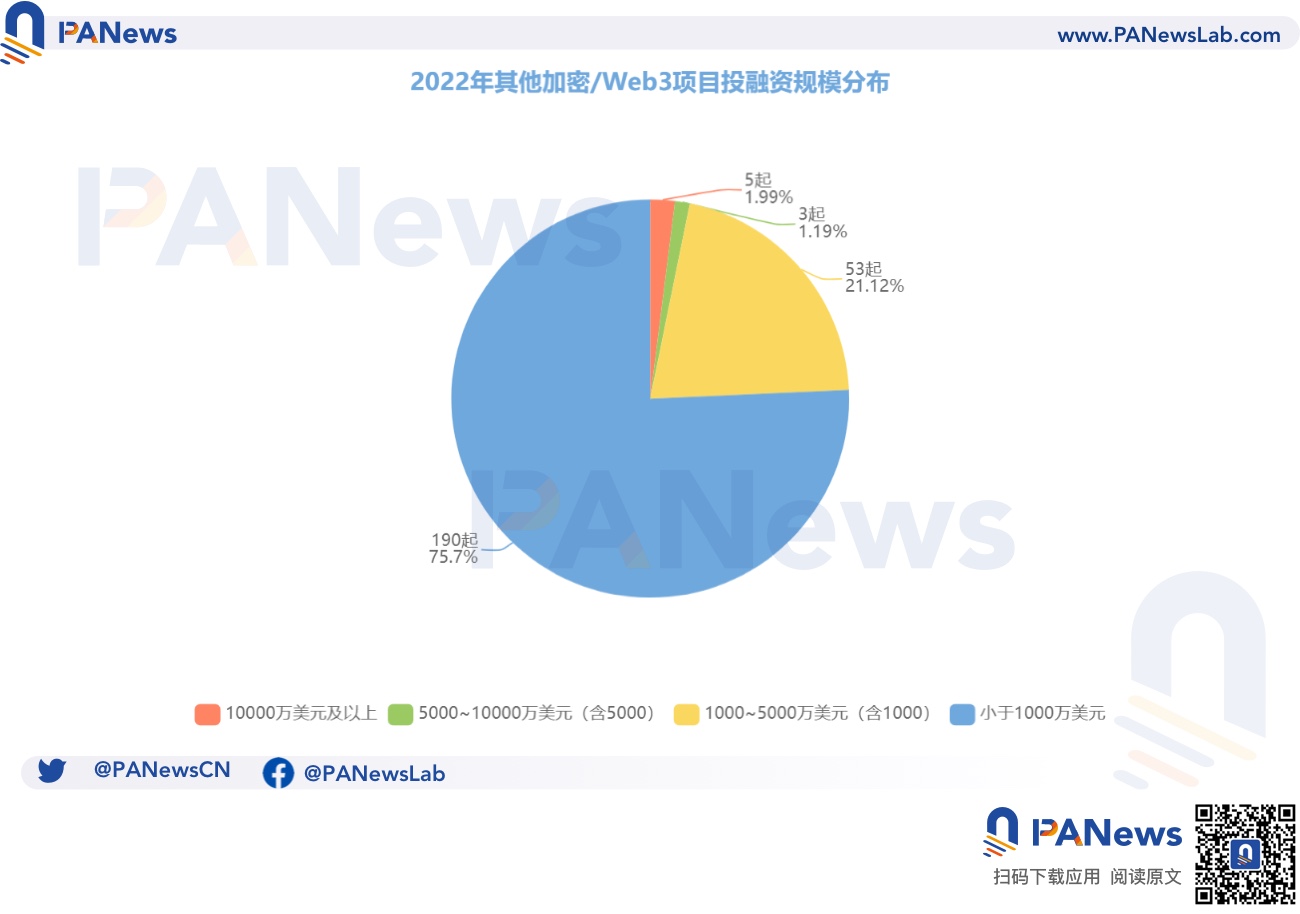

Other categories mainly include projects that combine DAO, media, market, social, education, mining, real estate, carbon neutral and other industries with blockchain and encryption technology. In 2022, there will be a total of 250 investment and financing events for other types of projects, with a total financing scale of 3.1 billion US dollars, and the average financing amount of each public financing event is 10.57 million US dollars. Among them, there were 5 cases with a scale of US$100 million and above; 3 incidents with a scale of 50 million and above to 100 million US dollars; 53 incidents with a scale of 10 million and above to 50 million US dollars; 190 investment and financing incidents accounted for 75% of the total.

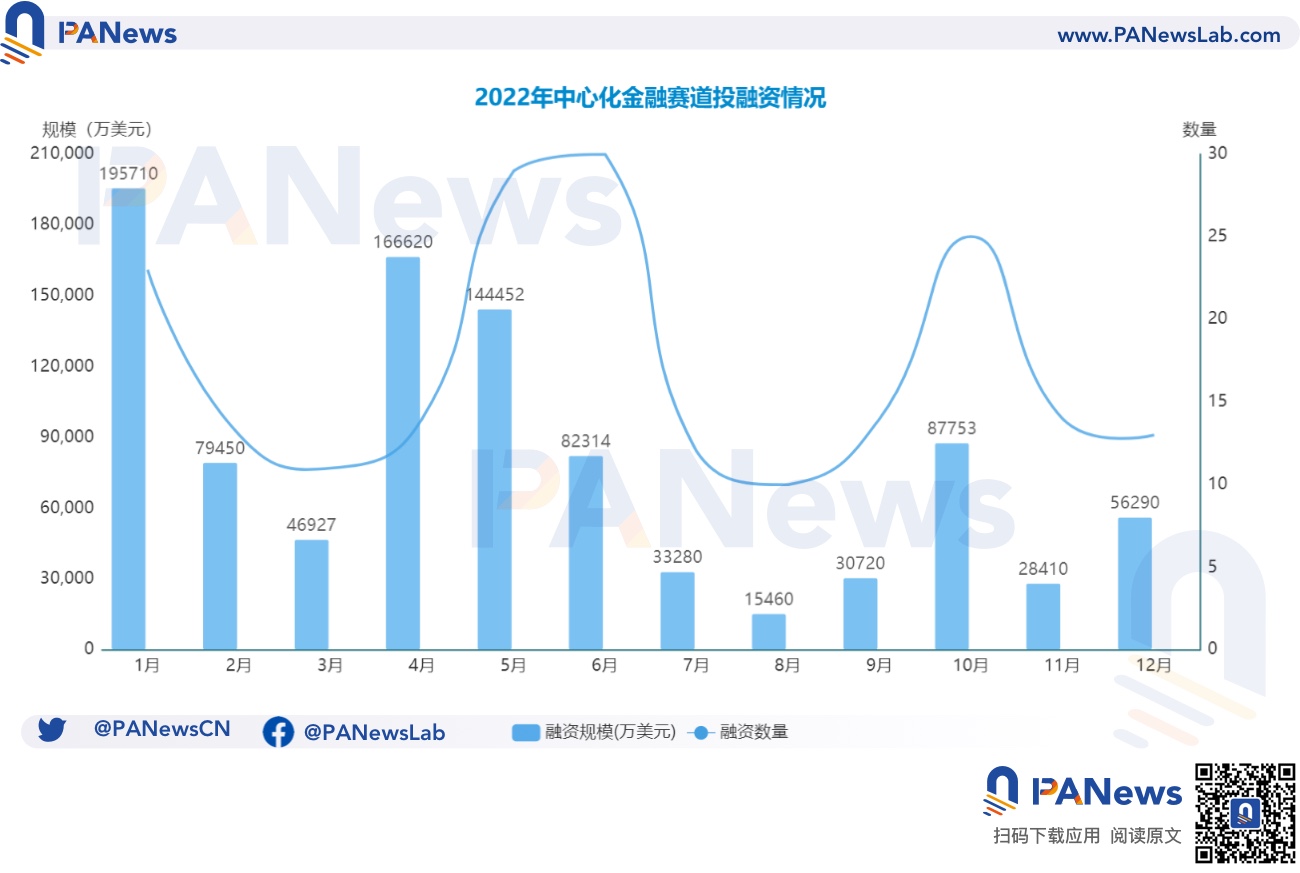

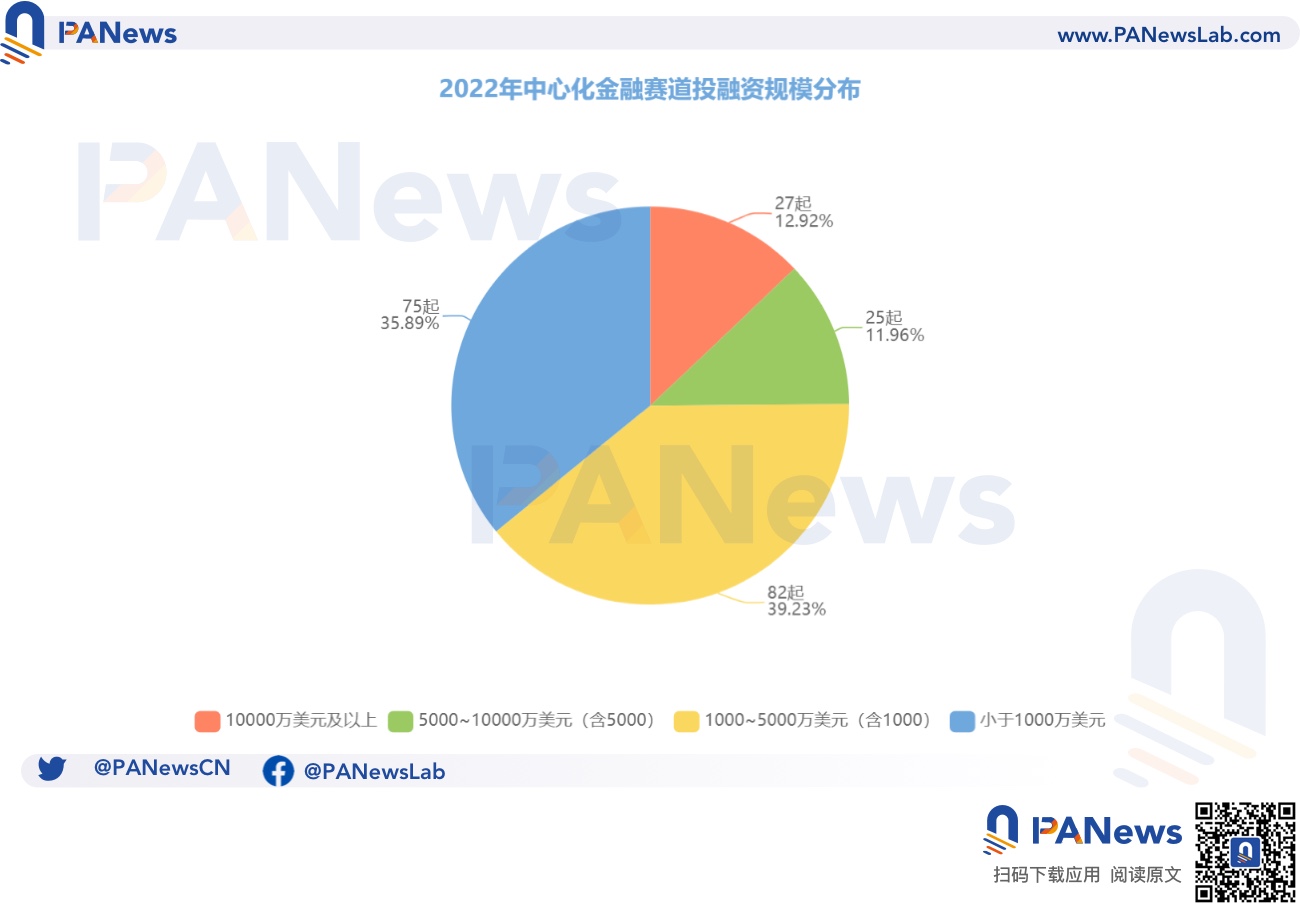

Centralized Finance: The average single financing scale is the highest

In 2022, there will be 208 investment and financing events on the centralized financial track, with a total financing scale of 9.6 billion U.S. dollars, and the average financing amount of each public financing event is 33.16 million U.S. dollars. Among them, there were 27 cases with a scale of US$100 million and above, accounting for 13%, and large-scale financing accounted for the highest proportion among all tracks; there were 25 investment and financing events with a scale of 50 million and above to 100 million US dollars; There were 82 investment and financing events with a value of up to USD 50 million; 75 cases of investment and financing events with a value of less than USD 10 million accounted for 36%.