Inside Tether: The unbreakable 'tie' in cryptocurrencies

Original source: Forbes

Tether, its largest liquidity provider, has withstood multiple multibillion-dollar redemptions amid the cryptocurrency's existential crisis. Will competition and regulatory pressure from rival stablecoins like USDC force Tether to be completely honest?

On Monday, November 7, 2022, Tether executives received an unusual call from a longtime business partner, FTX CEO Sam Bankman Fried.

Bankman Fried, the young, disheveled cryptocurrency executive who has ridden the crypto boom to a personal fortune of $26.5 billion, sounded desperate on the phone. A news release in the industry press five days ago revealed that underpinning the highly leveraged balance sheet of his trading firm, Alameda Research, was a token called FTT issued by Bankman Fried, worth about $5 billion. FTX and Alameda are big customers of Tether. To date, Bankman Fried has issued a whopping $36 billion worth of the U.S. dollar-based stablecoin USDT, accounting for almost half of the total issuance.

"He contacted us asking for financial help,"Terther's CTO Paolo Ardoino said."He didn't go into details or exactly how much it would take, but we flatly declined."

Paolo Ardoino said the request was an odd one, and he quickly decided to decline it."He's suddenly asking for something he's never asked for before, and the way he talks shows that he's facing a big problem. And he wasn't talking about $10 million, he was asking for billions."

In the weeks following that desperate call, FTT fell from $26 to less than $2, wiping about $3 billion off its market value. FTX and Alameda will soon file for bankruptcy protection, and on December 12, Bankman Fried was arrested and indicted on eight counts, including money laundering and fraud.

The demise of Bankman Fried is bittersweet for Tether, the controversial company behind the $66 billion stablecoin USDT used for more than 50% of all bitcoin transactions worldwide.

FTX is Tether’s largest client, but unlike Bankman Fried, who cultivates the media and engages with politicians, Tether resists regulatory scrutiny, which has been a source of media contempt.

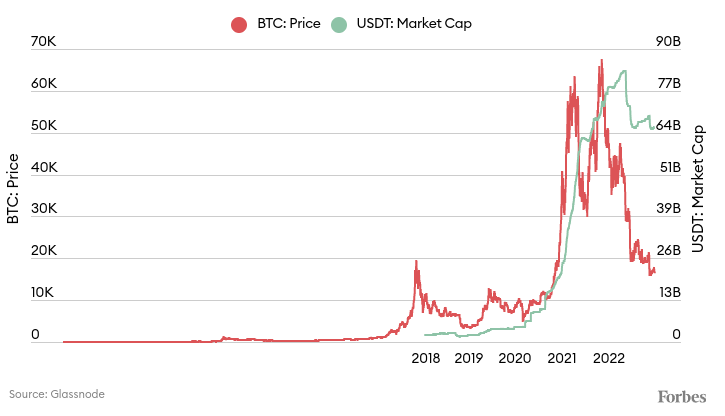

image description

USDT Market Cap Surges Amid Recent Bitcoin Bull Run

According to Paolo Ardoino, Tether’s CTO,"Everyone sees Tether as a mob incapable of doing things,"He is Tether's CTO and the only member of the C-suite willing to speak to the media.

While Tether has so far proven its staying power in the market, the stablecoin provider has yet to gain enough trust outside of cryptocurrencies. Over the years, it has been accused of manipulating markets, placing client funds in the personal accounts of its executives, and propping up the price of bitcoin. In 2021, the CFTC and the New York Attorney General forced Tether to pay $41 million and $18.5 million in fines, respectively, for misleading customers that USDT was backed one-to-one by U.S. dollars.

The company has never produced an audit report and has declined to disclose its exact mix of collateral, which includes crypto tokens, loans and other illiquid investments. By contrast, its closest competitor, USD Coin, operated by Boston-based Circle Financial, has published specific Treasury bills, CUSIPs and maturities backing its $45 billion digital dollar.

But if the cryptocurrency is to survive the current brutal winter, its dominant liquidity provider, Tether, must grow up. That's why Tether has recently been on a campaign to clean up its image. It has long been accused of stuffing its balance sheet with questionable commercial paper, and in June 2022 it pledged to eliminate $30 billion worth of commercial paper assets from its reserves and replace most of it with U.S. Treasury bills and other cash equivalents. Then in August, it hired BDO, a Big Five accounting firm, with the aim of conducting a full audit. Last Tuesday, the company announced that it would stop lending USDT — whose loans make up 9 percent of its assets — by the end of 2023.

Is this enough to silence naysayers who were even more timid about the dodgy stablecoin provider after FTX’s demise?

"There is a difference between usually stable and always stable,"Acting Comptroller of the Currency Michael Hsu said."What is always stable is the Fed's money and the central bank's money. And if you're in the ever-stable category, you don't have to defend yourself publicly."

The fact that a stablecoin like Tether needs to exist on all fronts points to a clear weakness in Bitcoin and other cryptocurrencies. More than a decade later, the original cryptocurrency is still very volatile. In the past 18 months alone, the price of Bitcoin has twice approached $70,000 before retreating more than 65% to a recent $17,000. Daily price fluctuations of 5% or more are not unheard of.

Stablecoins were invented to solve this problem, and cryptocurrency investors have long faced another problem: most cryptocurrency exchanges, especially those based overseas, have been shut out by banks, So conducting business in dollars and other fiat currencies is difficult, if not impossible. Stablecoins live and move on top of various blockchains, like Bitcoin, avoiding the control of central banks. In the case of USDT, which only exists in digital form, it is pegged to the U.S. dollar.

If stablecoins that exist outside of the global banking industry make you uneasy, consider Tether, the world's leading stablecoin provider, run by a group of less transparent characters.

Its CTO Paolo Ardoino is the face of Tether. All media information about Tether goes through him. Tether’s chief financial officer, Giancarlo Devasini, is the company’s controlling shareholder, owning an estimated 40 percent of Tether’s parent company, while DigFinex also owns cryptocurrency exchange Bitfinex, according to sources familiar with its finances.

Turin, Italy-born Devasini, 58, was a successful pioneer in the semiconductor market, growing his business to €113 million in annual revenue before he sold it shortly before the 2008 financial crisis, according to his official bio on the Bitfinex website. But a July 2021 Financial Times investigation found that Devasini's business empire had sales of just €12m in 2007 and went into liquidation the following June. Additionally, a Devasini company called Acme was sued for patent infringement by Toshiba over the DVD format specification. (Tether said the lawsuit was baseless and did not reach adverse conclusions.)

Numerous sources claim that Devasini, who studied to be a doctor, was the mastermind behind Tether and played a direct role in issuing Tether tokens for large clients such as Alameda. The exact location of Devasini is unclear, with various sources saying he is in the African island nation of Sao Tome and Principe, the Bahamas, Italy and the French Riviera, among other places.

Tether's CEO is a Dutchman named Jan Ludovicus van der Velde. He owns 20 percent of the combined entity and lives in Hong Kong, according to a source familiar with Tether’s finances. He also avoided interviews and stayed in the background.

If Devasini is running Tether and Bitfinex (incorporated in the Virgin Islands) behind the scenes, Jan Ludovicus van der Velde is more of a figure responsible for maintaining high-level strategic relationships with banks and regulators. According to Paolo Ardoino, since the pandemic, Jan Ludovicus van der Velde has made several trips to Europol to explain how Tether works. Jan Ludovicus van der Velde also helped the company obtain a digital securities issuance license in Kazakhstan and is leading the acquisition of new banking relationships in Europe and Turkey.

In addition to shared ownership, Tether and Bitfinex share the same CEO, CFO, CTO and general counsel. The chief operating officer of Bitfinex and Tether is actually Paolo Ardoino's wife, although she is not listed as a shareholder in documents seen by Forbes. In total, Tether has about 50 employees, while exchange Bitfinex has 200.

There are two ways to earn Tether tokens, known in cryptocurrency lingo as USDT. It can be purchased on any of the hundreds of cryptocurrency exchanges around the world that list the digital asset, or directly from Tether using a smart contract that Tether controls itself and runs on several different blockchains. The latter method is reserved for loan sharks, which must exceed $100,000 in USDT per transaction. It is said that Devasini was involved in these large transactions, such as Sam Bankman Fried, who personally called to issue a large amount of USDT for Alameda. Issues can sometimes be as high as $500 million.

Such a business can be said to be very profitable. In terms of revenue, the issuance and redemption of USDT is an important source of profit for the company. It charges a fee of 0.1% on each transaction. Forbes estimates that Tether has earned no less than $109 million in fee income since its founding in 2014, most of it in the past two years, during which time its market cap has soared from $5 million to May 2022. over $84 billion.

But the real wealth comes from how Tether invests the billions it receives to issue USDT. In theory, Tether should just keep its customers’ funds in cash and treasuries, fulfilling its promise of a 1:1 backing of its reserves with the U.S. dollar. However, Forbes found that Tether began creating a diversification model of reserve assets as early as 2015.

Why does Tether need to invest in risky assets other than US Treasury bonds and money market funds? Paolo Ardoino said Tether is obligated to make a profit in order to obtain certain commercial licenses."One of the most important things for our company, and speaking of the difference between us and Circle (the USDC issuer), is to make sure the business model remains profitable,"Ardoino said he expects the stablecoin company to generate more than $600 million in revenue this year. In the third quarter of 2022, with"transparent and stable"Circle, the tagline company, reported a $43 million profit on $274 million in revenue — its first profit since it was founded in 2018.

As with other stablecoins, the largest portion of Tether's reserves has always been"Cash and cash equivalents and other short-term deposits and commercial paper". Based on its current reserve classification, 82.45% of its assets are in cash and cash equivalents, of which, 70% are in treasuries. The remaining 17.5% is invested in various riskier assets, including secured loans, details of which Tether has long been reluctant to disclose.

Tether has never had a definitive audit of its $66 billion in reserves, and its website only lists so-called certificates that are snapshots, without an accounting firm actually tracking the flow of funds or doing any serious due diligence.

Some of its counterparties include cryptocurrency trading firm Jump Crypto and Cumberland/DRW, according to companies familiar with Tether's business. Additionally, the company provided an $841 million loan in 2021 to now-bankrupt cryptocurrency lender Celsius, backed by Bitcoin. Paolo Ardoino said Celsius' loan has been fully repaid. The company did not say whether the other parties to the transaction were affiliated companies.

In a recent Wall Street Journal article, a spokesperson for the company said the company itself holds collateral on all outstanding loans.

The rest of Tether's assets (approximately 4%) are invested in tokens and equity in private cryptocurrency companies, including Blockstream, Dusk Network and Renrenbit. It also invested in ShapeShift, OWNR Wallet and STOKR, LN Wallets and Exordium Limited. Given that the total market capitalization of cryptocurrencies has fallen by 63% this year, these assets are likely to take a huge hit.

While Tether is taking steps to become more transparent, Paolo Ardoino believes that no matter what the company does, it will not be able to satisfy its critics.

“Genesis recently stopped withdrawals. Voyager is a public company, you know, Celsius and BlockFi, which is a behemoth that is praised by all parties. Three Arrows, regarded as the perfect trader,” Paolo Ardoino said. "Everyone is always better than Tether."

Surprisingly, Paolo Ardoino pointed to Tether’s $18.5 million settlement with the New York Attorney General’s Office in 2019 as proof of his company’s staying power. In that case, Tether secretly provided an emergency loan of $850 million to sister company Bitifinex using its customers’ collateral after the crypto exchange’s Panamanian bank, Crypto Capital, had its own funds seized by government regulators. In response, Tether stated at the time:"The loan is to ensure continuity for Bitfinex customers. It has since been prepaid in full, including interest. At no point did this loan affect Tether's ability to process redemptions."

“It’s fine for people to ask questions,” Ardoino said, “but we keep proving our innocence and the other side talks about him, which to me means there are ulterior motives.”

At the same time, Paolo Ardoino isn't having sleepless nights worrying about meeting other people's expectations of how Tether should operate or be disclosed. Tether has no plans to become a public company, and no changes to its management structure are expected.

A more serious concern for Ardoino, Devasini and van der Velde is the state of the overall cryptocurrency market, of which Tether is a key liquidity provider. Stablecoins are vital for active traders, but Tether has lost more than 25% of its value amid the crypto winter. The situation is exacerbated by the massive increase in interest rates that now offer traders a plethora of alternatives to cryptocurrencies and DeFi to park their idle cash reserves. On major cryptocurrency exchanges, USDT’s yield currently averages 2%.

If the cryptocurrency recovers, Tether could see other competitors vying for its position. That includes USDC, which already has a 29.8% market share and is favored by Wall Street firms like BlackRock and BNY Mellon bank, as well as major exchange Binance itself, which has created its own stablecoin, BUSD. Then there’s also the possibility that at some point, a major bank or central bank that’s insured by the FDIC will offer a digital dollar.

"We do not intend to be the largest stablecoin in the market forever. If tomorrow JPMorgan decides to create their JPUSD or something, they will pass us in two seconds,"Ardoino said."Original link"