Brilliance and collapse: a review of the ebb and flow of encryption projects in 2022

Looking back on the upcoming 2022, how would you sum up this ups and downs, turbulent year?

If you want to extract a key word for the encryption industry in 2022, the word "turmoil" may be the most appropriate. This year, we witnessed the collapse of Luna’s tens of billions of public chains, the disintegration of the FTX empire, and the unprecedented interest rate hike by the Federal Reserve, feeling that the encryption market is heading for a cold winter step by step. At the beginning of the year, I was still talking about the transformation of Crypto, and at the end of the year, I was struggling to support it in the cold wind of capital. Countless encryption projects are iterating, evolving, and dying in the wave.

first level title

>>Crypto Moments | Glory and Crash

1. Luna

As the first big thunder in the encryption industry in 2022, Luna triggered a series of chain reactions, and even laid the groundwork for the subsequent collapse of Sanjian Capital and FTX.

In January 2018, Do Kwon and Daniel Shin from South Korea launched a blockchain network called Terra, planning to develop an e-commerce payment application Chai and a stable currency to facilitate transactions, followed by the launch of the main network of Terra and the stable currency UST Development, this initial idea has gradually expanded into a huge public chain ecology. However, on May 8, 2022, Luna was detonated by a UST sell-off. No one expected that this 84 million UST sell-off on Crv would become an event that crushed this billion-dollar giant. the last straw. The next day, May 9th, affected by the panic, a large amount of Terra’s on-chain funds fled from the interest-earning agreement Anchor, causing a stampede. The UST generation model that originally created the Luna Building became an accelerated Luna The catalyst of death, accompanied by the death spiral of UST and Luna, in one day, the market value of Luna evaporated by nearly 40 billion US dollars, and the TVL of the whole ecological project almost returned to zero.

Once again, the Brilliant Building was full of chicken feathers in an instant, and this once again reminded us that nothing in the encryption industry is too big to fail.

2. Solana

As in the FTX thunderstorm incident, the most influential public chain is Solana.

In early 2018, Solana was founded by Anatoly Yakovenko, and an internal testnet and an official white paper were released at the same time. SBF has always been the biggest booster of Solana. Not only is Alameda Research, a subsidiary of SBF, one of Solana’s early investors, but he has also been actively promoting the development of the Solana ecosystem, such as: Serum, Raydium, Oxygen, Maps.me and many other Sol ecological projects have the shadow of SBF behind them. In addition, Many projects in the ecology will also be the first to be launched on the FTX exchange. For these reasons, Solana has always been regarded as a public chain under the aura of SBF.

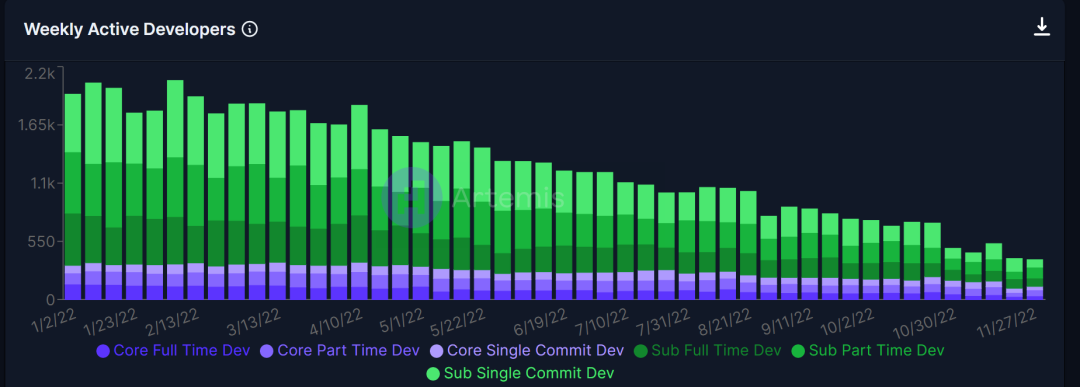

Under the influence of SBF, Solana not only became the contract public chain second only to Ethereum and BSC, but also became the largest non-EVM public chain. The TVL on the chain once reached tens of billions of dollars, whether it is the activity on the chain or the number of developers. All showed great vitality. However, after the FTX thunderstorm, the ecology on the Solana chain began to avalanche, DeFi projects experienced liquidity crises one after another, bad debts continued to accumulate, NFT triggered a wave of sell-offs, etc., and the TVL of many projects almost returned to zero overnight. In addition, in the past year, active developers on the Solana chain have also continued to lose. At present, both the number of core developers and sub-ecosystem developers have decreased by more than 80% compared to the beginning of the year.

Solana chain developer weekly activity data source: gokustats

It can be said that Solana is also SBF in success and SBF in failure. Generally speaking, when someone has too much influence on a public chain or a project, it is not a good thing. They may be able to gather together, but they will also leave. Tea" is cold, so is Fantom, and so is Solana.

3. Fantom

The development of the public chain Fantom has the most direct relationship with the legendary Andre Cronje (AC).

At the end of February at the beginning of the year,"Father of DeFi"AC announced the launch of its new project Solidly in Fantom, which combines the veTokne voting custody mechanism of the Curve protocol and the rebase mechanism of the DeFi 2.0 protocol. Once launched, it quickly detonated the market and triggered a competition of dozens of protocols for the Solidly token airdrop In just a few days, the Fantom ecology soared, and the TVL once reached 8 billion US dollars, becoming the fourth public chain in TVL.

The dramatic part is that only a few days later, AC announced its official withdrawal from the currency circle. For a while, the AC concept currency crashed, and the TVL on Fantom's chain also fell by nearly 50% in three days, and lost the protection of AC. Fantom also began to go downhill in the subsequent development. At present, Fantom TVL has only 460 million US dollars left, which is less than a fraction of the peak period, and the ranking has also dropped from fourth to eighth. But what’s interesting is that AC suddenly posted a post not long ago suggesting a comeback, but when he decided to withdraw, he also issued a statement that he would not come back, and even bluntly said that “cryptocurrency is dead, hope it will last forever”, is this a self-slap in the face?

In addition to the above-mentioned relatively large projects in this round of bear market, there are more application-oriented projects that have also been affected. Of course, CeFi projects are more mired in the quagmire, so let’s take stock of which CeFi projects have already Fall in this cold winter.

4. StepN

Like many encryption projects, the Move-to-Earn application StepN can also be divided into two distinct development periods. The first half is a glorious narrative, and the second half is the prologue of decline.

At the end of December 2021, StepN officially launched the beta version on the Soana chain. Shortly after the launch, it quickly detonated the chain game circle. In 5 months, the DAU exceeded one million, and the market value reached 1 billion US dollars. It also won Sequoia Capital, Binance In the most frenzied April-May months, there are rumors that StepN will change lives, change the Crypto industry, and reshape the chain game industry. However, on May 27th, with the release of a piece of "Announcement on Checking Accounts in Mainland China", it quickly repelled the market's confidence in StepN players, and the governance token GMT plummeted by 40%. The continuous loss caused StepN to start a round of death spiral decline.

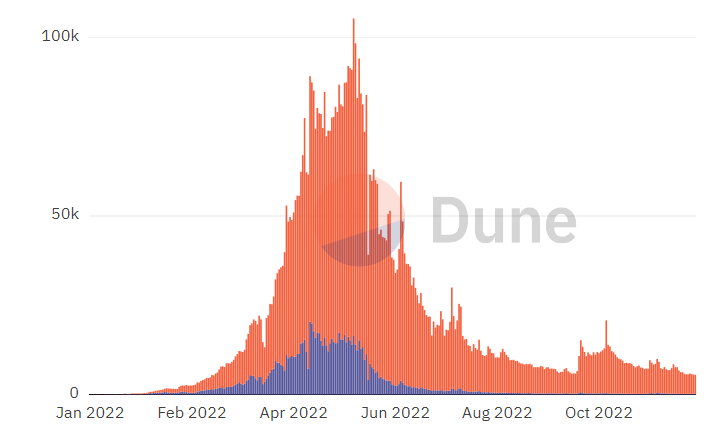

According to the statistics on dune, the current daily active users of StepN are less than 5,000, which is only about 5% of the peak period. Among them, there are only 100 active users on the Solana chain. Earn chain game, if it is not for the basic users still maintained on the BNB chain, it may have been completely cold.

StepN daily active user change (orange: new user blue: existing user)

Looking at the existing GameFi, the Ponzi gene that comes with them at birth seems to be doomed to their end. The smash hit projects such as Axie and StepN have also verified that Game+Fi may be a false concept. The future of chain games needs a new one. train of thought.

5. Tornado Cash

On August 8, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) officially added the mixed currency protocol Tornado Cash and its associated encrypted wallet address to its “Specially Designated Nationals List” (SDN), prohibiting U.S. citizens from communicating with the protocol or It is the first DeFi protocol to face such a high-profile ban.

Tornado Cash was established in 2019 and runs on Ethereum as a tool for users to conduct private transfers. This decentralized anonymous private transfer function has also become a "sacred place" for hackers to launder money. Most of the $600 million stolen from Ronin Network and the $200 million stolen from Nomad Bridge this year have flowed to Tornado Cash. According to statistics, since 2019, more than $7 billion worth of virtual currency has been laundered through Tornado Cash. This also doomed the ending of Tornado Cash.

first level title

>>CeFi Moments | Failures and Bankruptcies

1. The closed exchange

FTX:

It was established in May 2019 and ended on November 12, 2022, and lasted for about 3 years and 6 months. Since there are already many contents about its thunderstorm bankruptcy, I won’t repeat them here.

AEX:

Established in 2013, expired on July 17, 2022, and lasted for about 9 years. AEX is also known as Anyin (formerly known as Bit Times), and its founder is Huang Tianwei. AEX is one of the exchanges with the longest history. Due to the collapse of Luna, the liquidity of its assets plummeted. On June 16, the withdrawal of mainstream currencies was suspended, the withdrawal function was closed on July 14, and all platform services were suspended on July 17. So far, this has existed for nearly 9 years. The exchanges that survived two rounds of bull and bear also fell into this round of cold wave.

Tiger Talisman:

Established in June 2018, expired on August 1, 2022, and lasted for about 4 years. Hoo was founded by Wang Ruixi, and fell into a liquidity crisis after the Luna thunderstorm. On July 15, 2022, Hoo employees broke the news that the founder had transferred most of the assets, and the company had wage arrears; all transactions will be suspended from August 1 Services; on December 7, Hufu’s official website cleared all content, leaving only one announcement announcing the information of the actual controller of Hufu, and there is no follow-up, and the assets left by users on the platform are also unknown.

Bitfront:

It was established in 2020, ended in November 2022, and lasted for about two years. Bitfront is an exchange supported by the Japanese social media giant LINE. LINE first established the exchange BITBOX in Singapore in July 2018, then closed BITBOX and established Bitfront in the United States. On January 28, it officially announced that it would close the service and stop New User Registration.

ZB:

It was established in December 2013 and ended in August 2022, with a duration of about 9 years. Although the ZB official has not issued any bankruptcy announcement yet, the withdrawal of the platform has been suspended for several months, and the U price on the platform is only 3.2 yuan. Group users are identified as running away.

Nuri:

Founded in 2015, it will end in August 2022 and last for about 7 years. This is a trading platform based in Germany, formerly known as Bitwala. Due to its in-depth cooperation with the former well-known lending institution Celsius, along with the bankruptcy of Celsius, Nuri’s assets were also implicated. In August, it officially filed for bankruptcy in the Berlin court.

Digital Surge:

It was established in 2017 and ended in November 2022 and lasted for more than 5 years. Digital Surge is an Australian encryption exchange. Affected by the FTX thunderstorm, all deposits and withdrawals were suspended on November 16, and it entered the "voluntary custody" stage on December 9, which means that Digital Surge basically confirmed that it will face insolvency. Liquidation.

AAX:

Established in early 2018, it will end in November 2022 and last for about 5 years. This is a Hong Kong-based trading platform. Affected by the collapse of FTX, AAX suddenly announced the suspension of withdrawal services in November 2022. It has not been open since then, and soon there was news of a partner absconding with money. It is worth mentioning that during the Hong Kong Financial Technology Week held in October this year, AAX Vice President Ben Caselin also attended and delivered a speech.

2. Closed CeFi application companies and capital institutions

Three Arrows Capital:

Founded in 2012, it will end in June 2022 and last for about 10 years. Before the bankruptcy, Three Arrows Capital, as the industry's leading native encryption capital, had a great influence in the venture capital circle, and the net asset value under its management was once as high as 18 billion U.S. dollars. However, due to the radical operating model and the thunderstorm of Luna, many of its assets were zeroed and a major default was caused. The highly leveraged Three Arrows Capital quickly collapsed and was officially ordered to liquidate on June 27, 2022. In the end, they owed Up to 3.5 billion U.S. dollars in foreign debts, while the founders, Kyle Davies and Su Zhu, are still missing.

Voyager Digital:

Established in 2018, it will end in July 2022 and last for about 4 years. Voyager is a cryptocurrency broker. Affected by the thunderstorm of Three Arrows Capital, a huge loan of nearly 666 million US dollars cannot be recovered. On July 5, 2022, it officially filed for bankruptcy protection. It was taken by FTX in the bankruptcy asset bidding in September, and then FTX collapsed, Voyage had to restart the bidding process, and Voyager after bankruptcy was still ill-fated.

Celsius:

Founded in 2017, it will end in July 2022 and last for about 5 years. Celsius is a centralized crypto-asset lending company valued at $3 billion in a funding round in October 2021, and at one point had 1.7 million customers and $12 billion in assets. However, due to the impact of the Luna thunderstorm in June 2022, the platform suspended all transfer and withdrawal services indefinitely. One month later, on July 13, Celsius officially filed for bankruptcy protection, and finally disclosed a balance sheet of up to US$1.2 billion. deficit.

Alameda Research :

Established in September 2017, expired in November 2022, and lasted for about 5 years. As a leading encryption investment fund, Alameda was once one of the representatives in the field of Crypto venture capital, and was founded with SBF, who is also the founder of the FTX exchange. Due to the impact of the FTX thunderstorm, the Alameda website was shut down on November 9, and soon after, Alameda Research, together with FTX and more than 130 affiliated entities, formally filed for bankruptcy protection and came to an end.

BlockFi:

Established in 2017, expired on November 28, 2022, and lasted for about 5 years. Like the Celsius company above, it is also an encrypted lending institution, once valued at $4 billion, but after FTX declared bankruptcy in November, BlockFi stopped all withdrawals on the platform because of its huge risk exposure to FTX, Liabilities as high as $ 1 billion in November 28th formally filed for bankruptcy.

Affected by the bankruptcy of FTX, more aftermath will spread further. Not long ago, the encrypted lending platform Salt has stopped deposits and withdrawals, and it is likely to be one of the fallen members. It has witnessed the fall of so many exchanges and CeFi institutions. , countless users cannot recover their funds, we need to bear in mind an old saying: NO your keys, No your money!

3. Bankrupt mining enterprises

With the price of Bitcoin falling from more than 47,000 US dollars at the beginning of the year to around 17,000 US dollars, as well as the increase in electricity costs and the computing power of Bitcoin’s entire network, all major mining companies have been hit hard, and many well-known mining companies have also fallen. In this round of cold wave.

Compute North:

Founded in 2017, it will end in July 2022 and last for about 5 years. As the second largest bitcoin mining hosting service provider in the United States, Compute North not only has 4 large mining farms in Texas, South Dakota and other places, but also received a financing of 380 million US dollars in February this year. With the soaring costs and the sharp downturn of the encryption market, the company's capital chain broke, and it formally filed for bankruptcy protection in the Texas court on September 23, and it also owed at least 200 creditors $500 million in foreign debt.

Core Scientifi:

Founded in 2017, it will end in December 2022 and last for about 6 years. Core Scientifi is the largest bitcoin mining and blockchain hosting service provider in North America, and it is also a listed mining company. Its valuation reached 4.3 billion US dollars in July last year. During the bull market period, Core expanded wildly. At the end of the year, more than 320,000 mining machines were deployed, but with the sudden drop in the liquidity of the entire market, the increase in operating costs of the mine, and the inability to recover relevant funds due to the bankruptcy of the partner Celsius, the capital chain was broken. In October, it submitted a statement to the US SEC that there is a possibility of bankruptcy in the future, and it will no longer pay due debts. It is basically on the verge of death. Its stock price has fallen by nearly 96% since the beginning of the year, leaving only 0.43 US dollars.

Celsius Mining:

Founded in 2017, it will end in July 2022 and last for about 5 years. As a subsidiary of Celsius mentioned above, Celsius Mining has the same fate as the parent company. As early as last year, Celsius Mining invested 500 million U.S. dollars in the bitcoin mining business in North America, and once opened the IPO in March this year. However, with the bankruptcy of the parent company, these mining machine assets have been turned into pending debt assets.

Argo Blockchain:

Founded in 2017, it is currently in deep bankruptcy. Argo Blockchain is a mining company headquartered in the UK. Its stocks have been listed on the London Stock Exchange and Nasdaq successively. It is also the first mining company listed on the London Stock Exchange. The documents submitted to the London Stock Exchange not long ago showed that the company's funds are not enough to maintain continuous operation for one month. It is currently raising funds and selling some assets. If it cannot raise enough funds, bankruptcy will become a high probability event. The current stock price is 3.65 pence sterling, down nearly 96% so far this year.

first level title

>>NFT Moments | Surprise and Reversal

1. Azuki

On January 12, 2022, the Chiru Labs team launched 10,000 PFP items named Azuki through a Dutch auction. , the trading volume of the NFT in the secondary market reached 300 million US dollars, quickly becoming a phenomenal product; the floor price rose from 1 ETH to 30 ETH in a few months, and the trading volume has long been in the top ten of the NFT rankings , and even once surpassed BAYC.

The reversal appeared in a self-destructive way. On May 10, the founder ZAGABOND.ETH published an inspirational article titled "A Builder's Journey", reviewing his career experience, which mentioned his successively leading operations. CryptoPhunks (not well-known NFT CryptoPunks), Tendies and CryptoZunks projects, and these projects all ended in failure, and then ZAGABOND.ETH was questioned by the community, bluntly saying that these are Rug Pulls projects, ZAGABOND.ETH is a liar who betrayed the community, for a time Azuki The project fell into a crisis of confidence, the floor price was cut in half, and the number of holders was greatly reduced.

But judging from its final results, this self-destructive crisis does not seem to have had much substantial impact on the development of Azuki. Azuki still maintains a blue-chip halo. As of writing, the floor price of Azuki is 12.7 ETH, and the cumulative trading volume 271,000 ETH, ranking fifth in transaction volume.

2. SudoSwap

If you sum up SudoSwap in one sentence, it is amazing for a while, but it is full of curses.

As an innovative star in the NFT trading market, SudoSwap's AMM trading model has brought a long-lost nectar to the NFT market. Simply understand, before SudoSwap, the circulation of NFT was mainly through point-to-point transactions. In this case, the circulation of NFT would be greatly limited, and Sudoswap is more like an NFT DEX based on the AMM transaction protocol, and the well-known Like other DEXs, liquidity providers can obtain income by injecting assets, which can solve the liquidity problem of long-tail NFT assets.

In August, when the founder of sudoswap, 0 xmons, introduced the development vision of sudoswap in detail, the news of OpenSea's plan to IPO was widely disseminated in the community, and the community generally expressed dissatisfaction with it. SudoSwap made it clear that it would issue Tokens and airdrops. Time quickly attracted a large number of users and wool parties. The single-day trading volume rose from less than US$50,000 at the beginning to more than US$2.3 million in half a month, showing a faint trend of a dark horse.

But with the announcement of specific airdrop rules, the situation took a turn for the worse. On September 2, Sudoswap announced the Sudo token distribution model, which not only excludes a large number of trading users, but also distributes 41.9% of the Token to the holders of the founder’s previous project. Under this operation, Sudoswap users and The Wool Party retreated collectively, and ended up being scolded.

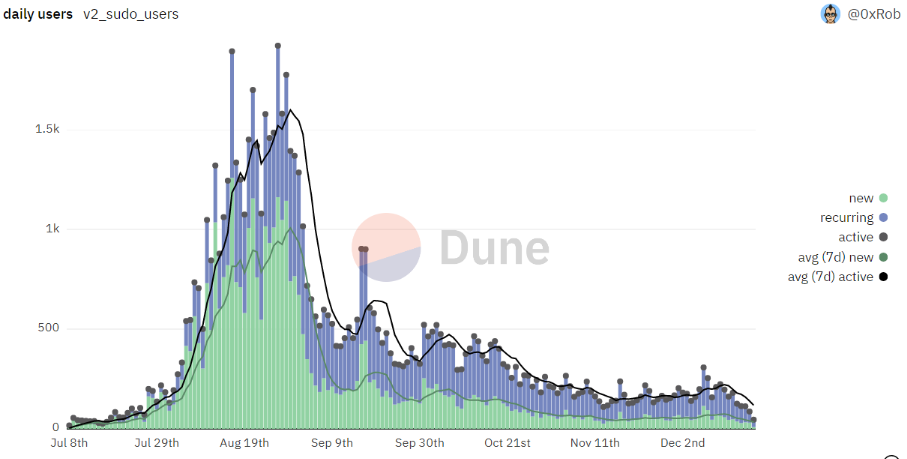

As of December 19, SudoSwap’s 7-day average trading volume is about 200,000 US dollars, and the number of active users in a single day is less than 100. In fact, if the short-seller expectation, the biggest attraction point, is done better, the development curve of SudoSwap may be better .

SudoSwap daily activity curve data source: dune/sudoamm

Three, Ali

Under the name of the light of domestic NFT, it turned into a farce abruptly.

As a popular original animation image in China, the appeal of the IP of Ali is not small at all in the NFT industry, especially in the Chinese circle. Before the project was launched, the users showed their talents in order to obtain the whitelist, and gathered the largest and most active Chinese Discord group. The project has aroused appetite during the publicity stage, and many people have a kind of blue chip for it. What to expect from NFTs.

But at the door, there were many ridiculous operations, which caused ridicule. On February 15, Ahri's "Ali&His Friends" series of NFTs was officially launched, and then a technical loophole broke out, and the logic of the NFT background code was directly exposed. Users can access the corresponding metadata and pictures without opening the blind box; and link the wallet The word Connect was also spelled as Collect, and then there were incidents such as the removal of Opensea and the call for shipment of Mod, which completely lost the reputation of the project.

As of writing, the floor price of Ali NFT is only 0.005 ETH, and the official Twitter has now become a lottery account for other NFT projects. After a year of development, the domestic NFT still failed to enter the mainstream field. Neither the once-famous little ghost nor the Phanta Bear (Phantom Bear) backed by Jay Chou failed to become a blue chip recognized by global users. NFT.

4. DeGods and y 00 ts

DeGods is a deflationary NFT project launched by the FrankDeGods team in 2021. y 00 ts is another project launched by founder Frank in September this year after DeGods. Both are issued on Solana.

On October 9 this year, Frank announced the cancellation of the transaction royalties of his NFT. DeGods and y 00 ts quickly became popular, and the transaction volume of the core project DeGods soared. The market value once surpassed Doodles, Azuki and other well-known blue-chip projects on Ethereum. Once reaching nearly 600 Sol (nearly 20,000 US dollars at the time), it was the largest NFT project in the Solana NFT ecosystem, and y 00 ts has been ranked among the top three in terms of trading volume since its release.

But with the collapse of the FTX building, the Solana ecology was also affected. The floor price of DeGods and y 00 ts once fell by more than 60%, and a large number of holders sold off. Not long ago, the founder Frank expressed his consideration of transferring the NFT collection to Ethereum, but was opposed by the Solana community. No end.

In my opinion, the NFT field is also a Shura field. You can see all kinds of exquisite, gorgeous, and incomprehensible pictures, and feel all kinds of red, grand, and inspiring visions, which may end in the release period After returning to the original form, there are many examples of running away, such as: Evolved Apes that took away 2.7 million USD in ETH, Baller Ape Club that took away 2 million USD in Sol, and Frosties that took away 1.3 million USD, etc., extremely low evil Costs facilitate NFT fraud, and 99% of these thousands of small pictures in the past will inevitably go to zero.

Looking at the entire 2022, the word "turbulence" runs through the whole year. Whether it is a big market or a small project, everyone feels the menace of the bear market in the ups and downs.

Looking back at those people, projects, and institutions that once occupied the mainstream vision this year, you will find that there has never been anything too big to fail, nothing that can turn a stone into gold, and no son of genius. Some are just rising with the tide of capital, and some people and some projects just stand on the top of the wave, but it may only be a moment from the glory of the rising tide to the collapse of the ebb and flow.