Analysis of the two or three things behind Grayscale’s GBTC tender offer

This evening, the Wall Street Journal (WSJ) reported that Grayscale CEO Michael Sonnenshein said in a letter to investors that if the Grayscale Bitcoin Trust (GBTC) cannot be converted into a Bitcoin ETF in the end, it will consider investing in the Bitcoin ETF. Issued and outstanding shares subject to tender offer. At that time, investors can sell their GBTC shares at a specific price at a specific time.

Sonnenshein said that there is no specific timetable for when the repurchase will be carried out, but he has prepared for all situations; regarding the specific repurchase scale, the initial estimate is 20% of outstanding shares. Of course, the final terms of the repurchase are subject to SEC and shareholder approval. Grayscale added that it may consider additional tender offers if the first attempt is successful.

Why buy back GBTC? Mainly to reduce the discount rate of GBTC.

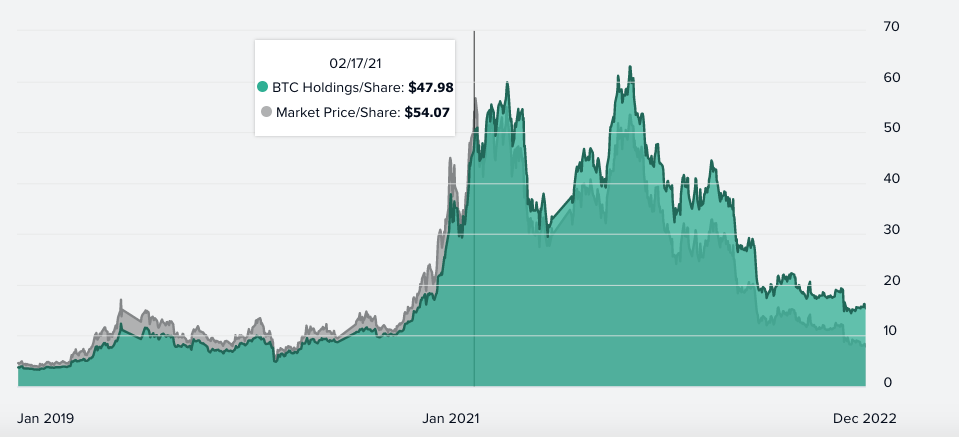

image description

(GBTC market price and real value)

Before March 2021, the positive premium of GBTC is prominent, and the secondary market transaction price of GBTC per share is much higher than the actual value. At this time, investors can get a higher premium by selling GBTC. However, as the encryption market turned bearish, the positive premium of GBTC disappeared, and a discount gradually appeared-the latest data shows that the actual value of GBTC per share is 15.42 US dollars, and the transaction price in the secondary market is only 7.91 US dollars, with a discount rate of 48.7%.

Since GBTC cannot be redeemed at present, for holders, they must either sell it at a discount, or wait for GBTC to be converted into a bitcoin spot ETF and sell it at its real value. Submit a spot bitcoin ETF application. “Converting GBTC to an ETF will help align its share price with its underlying value. Market participants will be able to create and redeem shares of GBTC to ensure they reflect the underlying value of their Bitcoin holdings.”

But contrary to expectations, the SEC finally rejected Grayscale's application, and Grayscale also filed a lawsuit against the SEC, and the case is still ongoing. In such a time window, Grayscale is so "enthusiastic" to propose a new plan to repurchase GBTC, the core purpose of which is to save the parent company DCG (Digital Currency Group) and solve its liquidity crisis.

According to previous media reports, DCG owes Genesis $1.7 billion in loans, and as Genesis creditors liquidate DCG, it faces repayment pressure; in addition, the encryption exchange Bitvavo has 280 million euros in DCG memory, which is temporarily unable to withdraw due to liquidity problems. Last week, a number of DCG-related cryptocurrencies (FIL, ZEN, ETC, NEAR, etc.) were sold on a large scale, and it is suspected that DCG liquidated related assets.

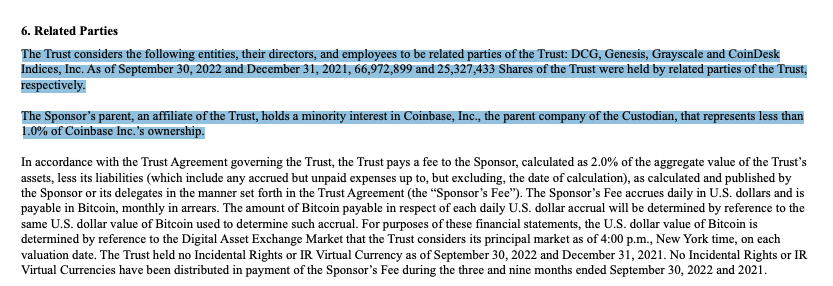

image description

(Greyscale’s third quarter announcement)

According to Grayscale CEO Michael Sonnenshein, subject to Section 144 of the Securities Exchange Act of 1933, the above-mentioned institutions are only allowed to sell 1% of the total outstanding shares to the open market every three months. In other words, companies such as DCG need to wait for more than two years if they want to realize the GBTC in their hands through the secondary market. In order to solve the urgent need and let DCG withdraw funds as soon as possible, this is the repurchase plan for tonight.

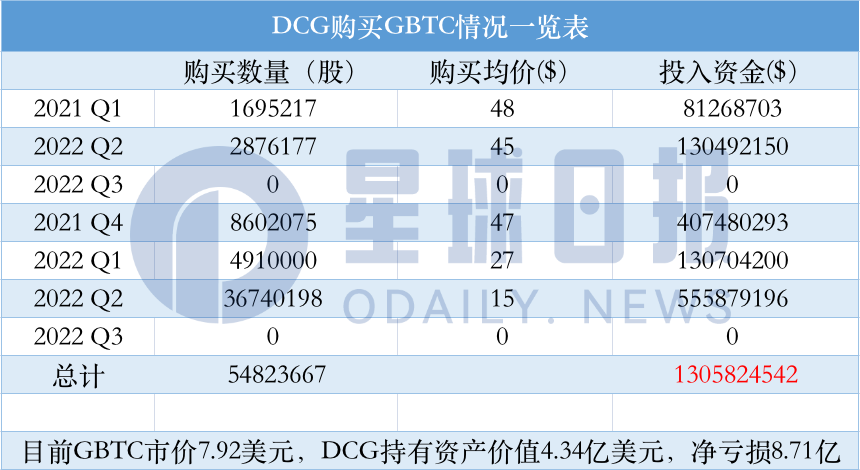

It should be noted that so far, DCG's investment in GBTC has been in a state of loss.

According to Odaily statistics, starting from the first quarter of 2021, DCG has spent a total of US$1.305 billion to purchase 54,823,667 GBTC shares at an average unit price of US$23.8 per share. According to the latest market price ($7.92), DCG has a loss of $871 million; however, if it can repurchase at the real value ($15.42) in the future, DCG will still lose $460 million.

Such a huge loss is due to the fact that DCG misjudged the situation and continued to increase its positions in a bear market. Especially in the second quarter of this year, DCG invested US$550 million to buy 36.74 million GBTC shares, and its assets have been cut in half as the market fell. Second, due to the rising discount rate of GBTC, it has continued to expand from about 20% at the beginning of the year to the current 48%.

Currently, Grayscale is still working hard to convert GBTC to ETF. The company stated that even if the repurchase fails in the end, it will continue to operate GBTC until it is successfully converted into a spot bitcoin ETF.