Popular science article: Many big Vs "playing memes" caused WETH crash panic farce

In the past two days, KOLs in the encryption community have jointly made a big joke "WETH went bankrupt and unanchored", but this also caused panic among users who did not know the truth. Let me talk about the conclusion first, this is a "community meme": the WETH Foundation is not bankrupt, there is no de-anchoring between WETH and ETH, and the prices of each platform are normal.

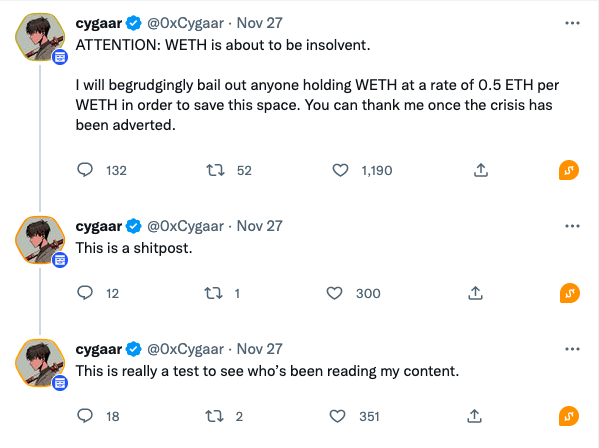

The joke of "WETH bankruptcy" first started with cygaar, a contributor to the ERC-721 A token standard. On November 27th, cygaar issued an article saying: "Attention: WETH is about to go bankrupt. In order to save this project, I can recover the assets of anyone who holds WETH at a price of 0.5 ETH. Once the crisis is widely publicized, you will then Thank you for mine."

Just the day before, cygaar also sent multiple tweets, emphasizing that WETH will never go bankrupt and explaining how WETH works. "Your WETH will always be swapped 1:1 with ETH. The project code and logic is very simple. In fact, it only takes 60 lines of code to implement."

Cygaar’s tweet about WETH’s bankruptcy was liked and reposted by thousands of people. Some users commented on their tweets, such as “0.7 ETH unlimited repurchase of WETH, large discounts”. However, some users who did not know the truth asked about the authenticity of the news, and finally cygaar clarified: "This is a spam post. The main purpose is to test how many people are reading my tweets."

Cygaar is not the only one who "jokes". After that, more encrypted KOLs joined this FUD.

Anthony Sassano, the host of The Daily Gwei with 231,000 fans, posted: "I have an old friend who I have known for more than ten years. He told me that WETH is about to decouple and collapse. I don't know the specifics." A few hours later, Anthony said that this is a spoof post, WETH is safe.

Gnosis co-founder Martin Köppelmann, who has 38,000 fans, posted: "With ETH being burned, wrapped ETH (WETH) is no longer fully supported. We may soon see WETH redemption runs."

A few hours later, Martin explained that it was a joke and "hopefully it doesn't cause too much confusion."

If the spoofs of the big Vs are just small troubles, then the addition of poorart (co-founder of WETH) will undoubtedly cause people to panic without careful consideration. On November 27th, poorart tweeted: "Unfortunately the rumors are true. The entire project will be returned to the community (except for the treasury). I will be retiring to a non-extradition country for mental health recuperation. Sorry guys and good luck .”

Sun Ge (Sun Yuchen), who has never been absent from hot spots, also appeared in due course. This afternoon, Justin Sun issued an article saying that after discussing with his friend Vitalik, the founder of Ethereum, he will jointly invest 2 billion US dollars in the WETH Fund (WEF) to help fill its funding gap and survive the current crisis.

In this farce, there are also many community users who spread fake news to add fuel to this FUD: For example, WETH official website was seized and taken over by FBI; WETH price plummeted to zero; real news.

That concludes the review of the WETH farce. The background of the birth of this FUD stems from the fear of WBTC unanchoring in the encryption community last week. According to the data website, Alameda Research, which has filed for bankruptcy, is the largest minter of WBTC, and the market is worried that WBTC will be affected by it and lead to de-anchor.

In fact, Alameda Research is only the minter of WBTC. When it mints WBTC, it needs to send the real BTC to the custodian address; Alameda can only mint WBTC, not custodian BTC. Therefore, even if it files for bankruptcy, it will not bring any systemic risk to affect the operation of WBTC. Last week's WBTC unanchored to 0.985 for a short period of time, which was more caused by market panic rather than WBTC's insolvency. Currently, its exchange rate is temporarily reported at 0.9962.

The controversial issue of WBTC lies in its centralized custody method, where assets are managed by several specific custody institutions. Unlike WBTC, WETH's asset custody relies on smart contracts. Users can exchange the ETH they hold into Wrapped Ethereum through the application to be used in Ethereum or other ecosystems. The ETH sent by the user is stored in the smart contract and is open-sourced for anyone to see. Unless there is a bug in the smart contract, nothing will go wrong with the asset. In the past few years, WETH has not had any loopholes, which is enough to prove the reliability of its mechanism and the security of smart contracts.

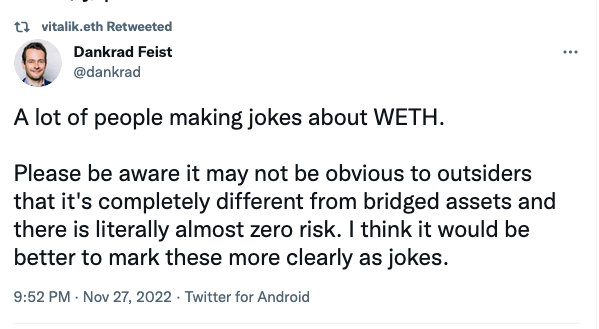

Although many professional encryption professionals have expressed that there is no risk of collapse in WETH, but as this tweet liked by V God said: For outsiders, so many professional KOL voices should express that they are joking, otherwise it will always be a joke. It is easy to cause unnecessary trouble, especially in today's fragile and sensitive market stage.