SBF's latest reflection post: I will do my best to serve FTX users first

Yesterday, SBF reflected on the FTX crash, saying that because the leverage was much higher than expected, the run and market crash exhausted liquidity, and its overconfidence and carelessness led to the historic crash. However, he emphasized that he is doing his best to this end, will personally meet with regulators and work with the team to serve users first, and then investors.

The following are SBF tweets, translated by Odaily.

Not legal advice, nor financial advice. That's all I remember, but my memory may be partially wrong. But I'll figure out what's going on. Now, let's talk about where we are today.

As far as I know, as of after November 7th (errors may occur):

1) Alameda has more assets than liabilities (but not liquid assets);

2) Alameda holds a margin position in FTX;

3) FTX US assets are sufficient to cover all users.

But not everyone necessarily agrees with that. My only goal right now is to keep the users happy, and I'm doing my best for that. I will personally meet with regulators and work with the team to do my best for users, followed by investors, but users first.

My goal now is to keep cleaning up and focus on asset transparency so users are minimally impacted.

A few weeks ago, FTX was processing about $10 billion in transaction volume and billions of transfers per day. But leverage was much higher than expected, and liquidity was drained by runs and market crashes. So what can I try to do? Improve liquidity, make up customers as much as possible, and start over. Maybe I'll fail, maybe I can't do anything. I did fail before, as you all saw. But all I can do is try. I've failed enough this month, but deep down I think there's still something I can do.

A rough estimate of the current situation:

Has liquid assets of -$8 billion;

Semi-liquid assets of $5.5 billion;

Illiquid assets were $3.5 billion.

Also, maybe $9B semi/illiquid assets ($1B net at mark-to-market) are not worth $9B now, but those assets were worth $18B ($10B net) a month ago.

I know you've all seen this, but roughly speaking, that's how it is today.

FTX was a valuable business a month ago. FTX has a daily trading volume of approximately $10 billion to $15 billion, an annual revenue of approximately $1 billion, and an equity value of as much as $40 billion. FTX has been hailed as a model of efficient running companies and is the darling of Silicon Valley. But (again, as far as I know, these numbers are approximate) most of the underlying assets plummeted more than 50%. At the same time, there was a run on the exchange, with roughly 25% of customer assets being withdrawn every day. The leverage was as high as $13 billion, not the $5 billion previously thought. High leverage, a run on funds, and a total collapse in asset values all happened suddenly and simultaneously.

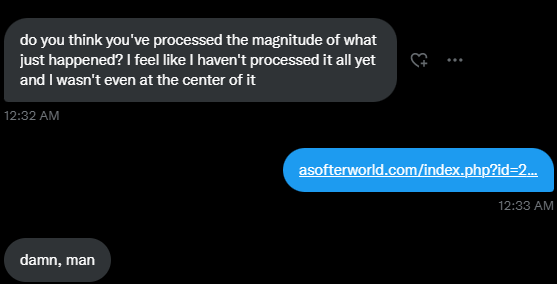

I was chatting with a friend of mine last night.

They posted my information. These were not meant to be made public, but they are now made public anyway.

Well, I guess that makes things worse. I'm really sorry this happened. As I said - I'll do my best to make it more correct.

Some of my thoughts:

Regulators are really hard. They have an impossible job: regulating entire industries that are growing faster than their mandates allow. As a result, they often end up being less than ideally regulated.

Even so, there are some regulators who have impressed me with their knowledge and work, such as the CFTC, SCB, and VARA to name a few. But most regulators are at a loss.

That means interacting with regulation can be really frustrating: a "lot" of work, much of it casual, with relatively little customer protection. You all deserve the framework that allows regulators to protect customers while allowing freedom.

Some of what I said (last night) was flippant or overly strong, but I was venting and not going public. But I guess at this point what I've written will be leaked anyway.

In the future, I will not care about stupid, no (substantial) information.

What matters is the things you do, actually doing good things or doing bad things, not just talking about them.

Anyway, none of that matters now.

The important thing is to do my best.

And do my best to serve FTX's customers.