Issue 46 of JZL Capital Digital Weekly Report: Macro improvement is hard to beat the crypto black swan, the market encounters Lehman moment

secondary title

1. Last week's industry trends:

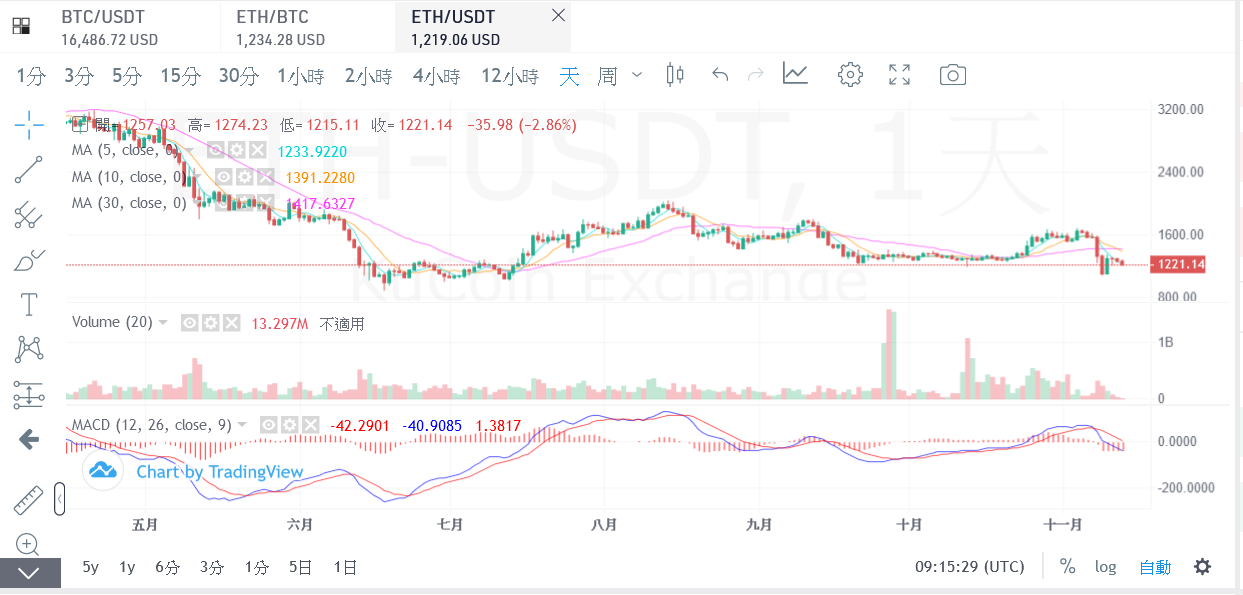

The crypto market this week can be described as a bloody storm. This week should have been a good week for the macro policy, but the thunderstorm incident on the top 3 exchanges in the world has dealt a serious blow to the market. The total market value of the crypto market has also reached 845 billion U.S. dollars. The highs have fallen 70%, back to levels seen at the end of 2020. As of writing, Bitcoin closed at 16575.7, the lowest in two years, with a drop of 21.98% and an amplitude of 27.16% during the week. Ethereum closed at 1225.09, a drop of 24.13% and a swing of 34.12% within the week. This incident not only implicated FTX’s native token FTT, but projects related to SBF and its ventures such as SOL, NEAR, APT, etc. all experienced a sharp drop ranging from 40% to 60% this week. Paying more attention to and intending to increase regulation in the encryption market is beneficial to the long-term development of the entire market. Moreover, this plunge has accelerated the liquidation of institutional and personal leverage, and accelerated the bottoming of the market, which is still positive in the long run. Of course, what should be paid more attention to in the near future is the series of liquidation issues that may be brought about by the follow-up of the incident. This year’s LUNA incident later caused several centralized asset management platforms to be implicated, and the impact this time may be more serious. A more detailed review of the FTX incident It will be introduced in Encryption Ecological Tracking.

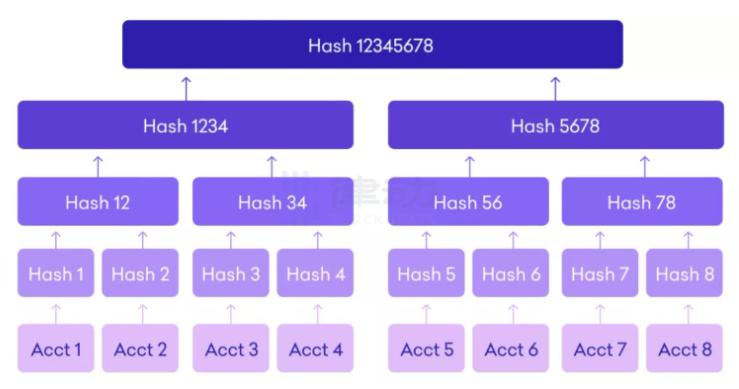

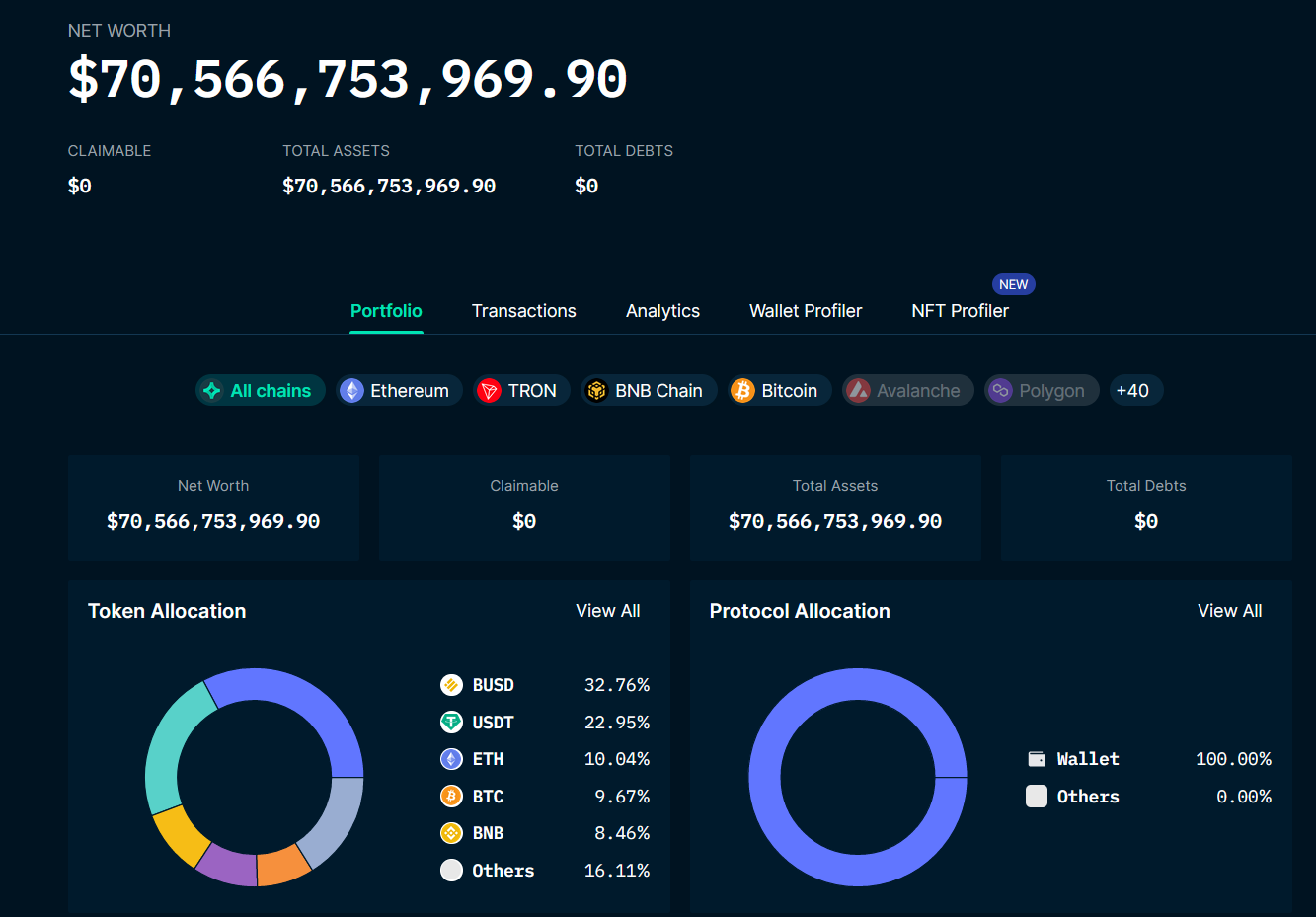

But this incident also helped the industry take an important step forward. This impact is not only in terms of price. Since the incident, many exchanges have successively carried out proof of reserves (Proof of Reserves) to varying degrees, and started the process of making their reserves transparent. . Binance first shared the details of the wallet address in their blog through the Proof of Reserves. They have a strong reserve of nearly 69 billion US dollars in their wallets. After that, many exchanges followed suit and disclosed their reserves to varying degrees. As of now, Kucoin, Huobi, OKX, BitMex and many other exchanges have announced the details of their reserves.

On the other hand, the U.S. stock market’s trend this week has been very different due to systemic problems in the encryption market. The U.S. stock market still follows market laws and is accompanied by macro policy fluctuations. This week, there are three major news that are good for US stocks. They are that US inflation has improved, and domestic relaxation of overseas epidemic control and geopolitical wars seem to have improved. The three major benefits were announced within ten hours before and after, which directly took the US stock market away from the bottom position. Among them, the Nasdaq has stepped out of the bottom space on Friday, breaking through the 60-day moving average, forming a neckline at 11280 points; the S&P also showed signs of forming an upward channel, rising 5% on Thursday to break through the half-year line. Line pressure, it is possible to take advantage of the trend to break through. These three positive benefits are ranked in order of importance, and the improvement in inflation is the top priority. The CPI in October increased by 7.7% year-on-year, which was significantly lower than the expected value of 8%. The probability immediately rises to more than 80%. The official statement of the Federal Reserve’s interest rate meeting in November also clearly put forward a dovish point of view, but it will take time to return to normal levels. The core inflation rate excluding food and energy increased month-on-month last month. 0.3%, which is 3.6% a year. There is still a gap between inflation expectations of 2%. Tightening is still difficult to relax. Rebound and relaxation are marginal improvements rather than policy reversals. It will take time to return to normal levels. What can be expected is After December, the Fed's policy will have a marginal improvement, that is, the interest rate will be reduced from 75 points to 50 points, and then it will start to cut interest rates in mid-2023 (UBS forecast) and the technology stocks that should issue financial reports have also been released. In the third quarter All the thunder points have been exhausted, so before the last interest rate hike at the end of the year, there may not be another sharp drop in US stocks.

secondary title

2. Macro and technical analysis:

The market has broken its position under the ferment of FTX. At present, with the bankruptcy and liquidation of FTX, there will be negative feedback one after another. It is recommended to participate in the market cautiously.

BTC has broken its position at present, and the possibility of a subsequent rebound back to the original platform becomes smaller, and the possibility of a downward trend is greater. The two-year U.S. bond is back to about 4.3%, and the interest rate will be raised by 50bp in the next December.

BTC has broken its position at present, and the possibility of a subsequent rebound back to the original platform becomes smaller, and the possibility of a downward trend is greater. The two-year U.S. bond is back to about 4.3%, and the interest rate will be raised by 50bp in the next December.

Nasdaq stood on the 60-day line, and the short-term rebound was strong.

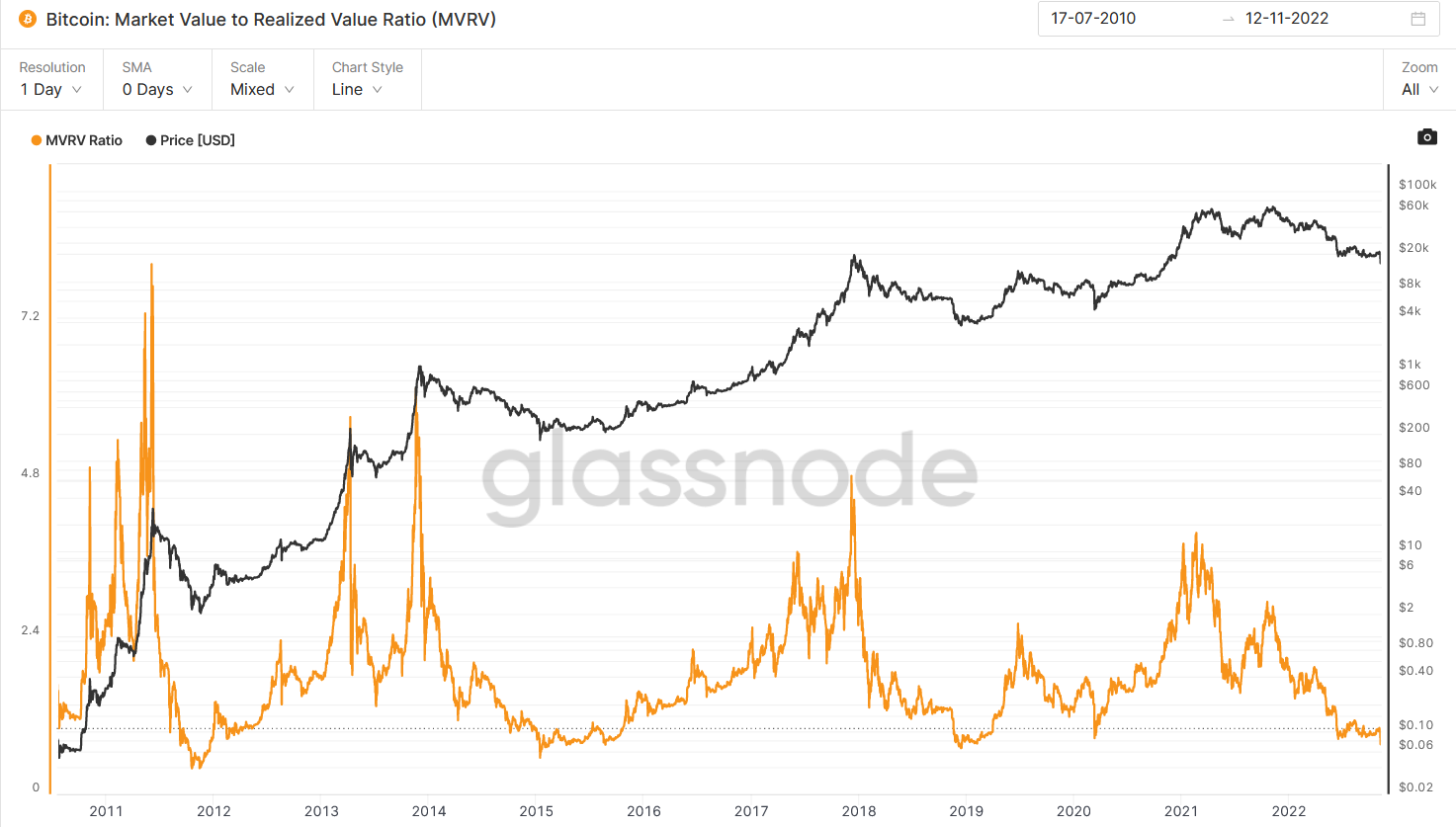

1. Arh999: 0.3, but it is recommended to make a fixed investment after it stabilizes.

2. MVRV: 0.758, the cost performance is the same as Arh999.

Number of ETH holding addresses: The number of all holding addresses has increased significantly.

secondary title

3. Summary of investment and financing:

1) Investment and financing review

Affected by the FTX & Alameda incident, only 8 investments and financings were disclosed during the reporting period, with a cumulative amount of US$194 million. Ramp Network, an encrypted payment solution, and TRM Labs, an on-chain asset compliance monitoring platform, each raised US$70 million in financing, accounting for 72% of the financing scale during the reporting period:

The main participants of the two projects are from traditional investment institutions, and the current round of financing of Ramp Network is led by Abu Dhabi sovereign wealth fund Mudabala Capital;

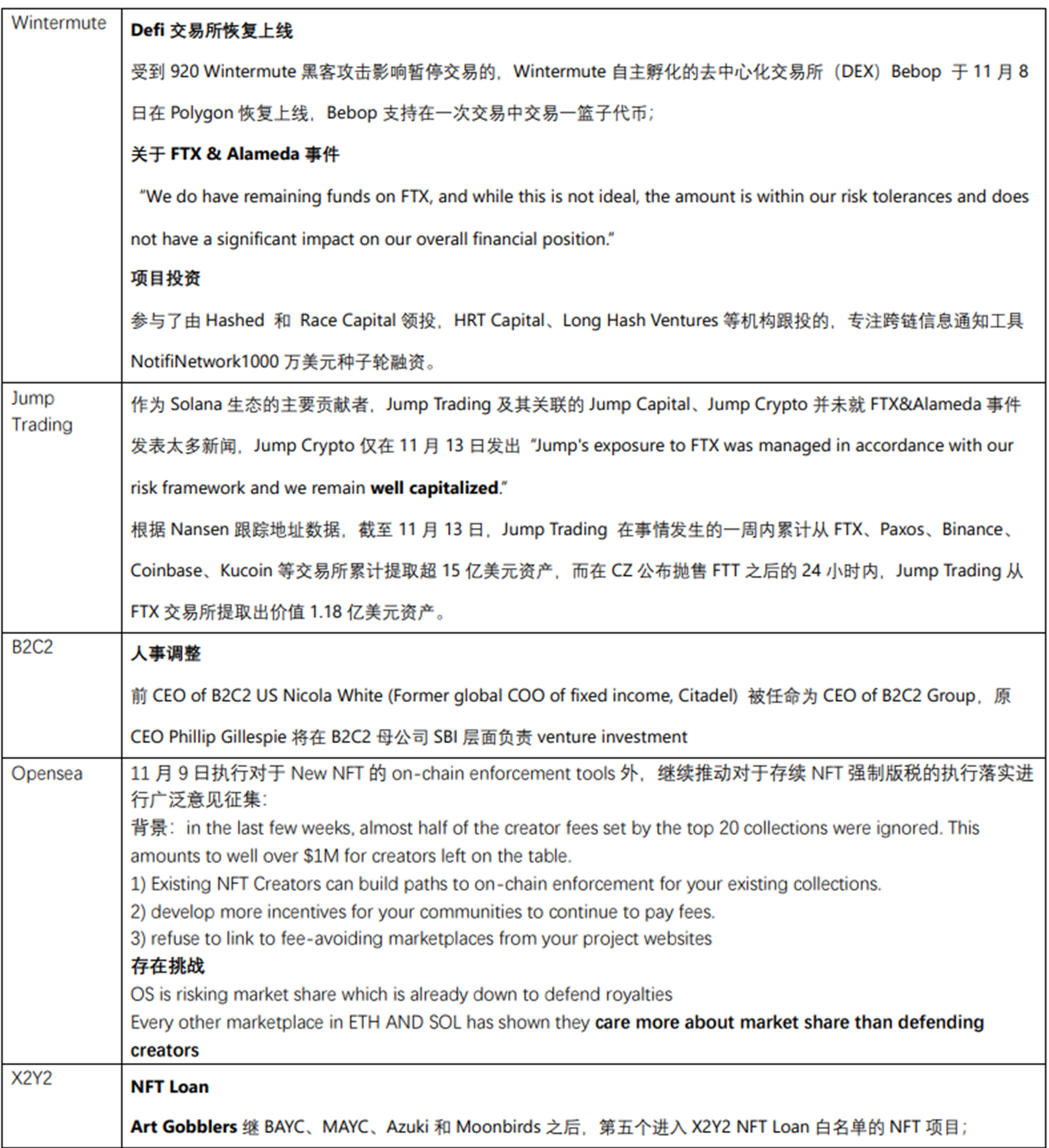

2) Current situation of the organization

secondary title

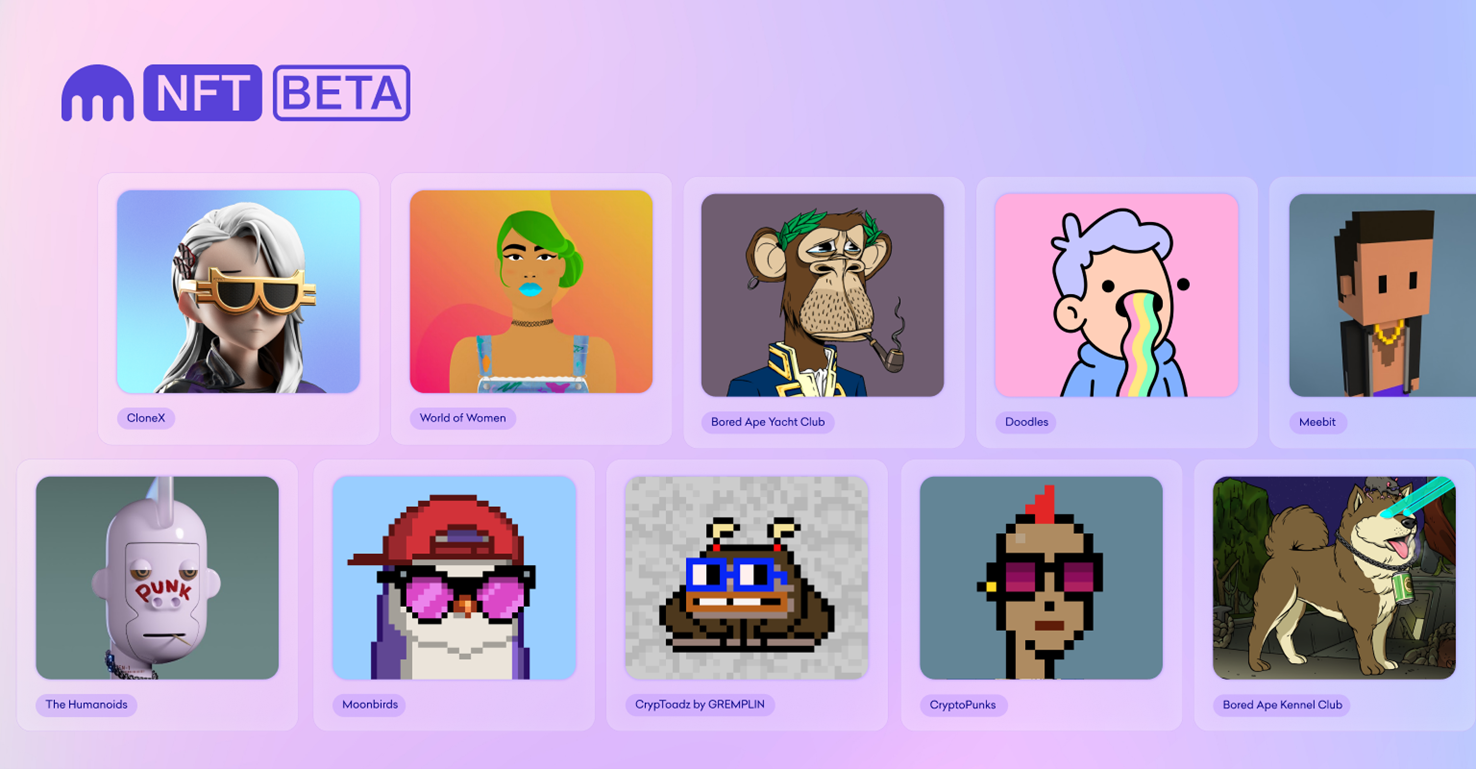

1.NFTs

4. Encrypted ecological tracking:

1) Market overview

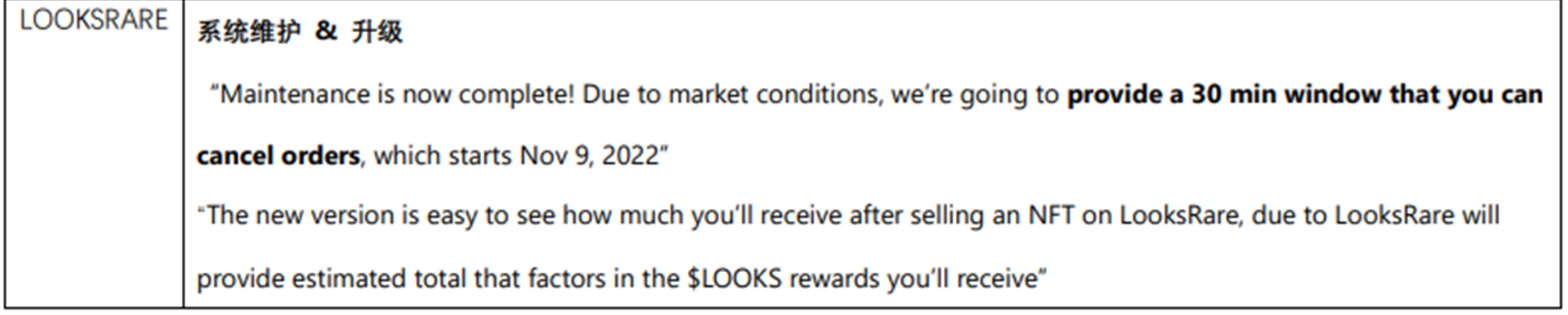

This week, the NFT blue-chip index dropped slightly compared to last month. As of November 13, the blue-chip index dropped slightly compared with last week, and there was no major change, and the market sentiment was at a historical low.

This week, the total market value of the NFT market decreased by 4.31% year-on-year, and the total transaction volume decreased by 32.31% year-on-year. This week, the NFT trading volume has dropped to a freezing point. Because of the FTX thunderstorm, the NFT market has also been affected by liquidity, so the trading volume has also decreased relatively.

The activity of holders/traders in the NFT market decreased this week. Buyers decreased by 16.97% compared with last week, sellers decreased by 11.09% year-on-year, and holders increased by 1.28%. The bad situation in the macro market has also affected the activity of most traders, and some blue-chip pledges have also encountered a liquidation crisis.

The top three NFTs with the highest trading volume in the market this week are BAYC, KPR, and Otherdeed. Some BAYCs have been liquidated by pledges, and the floor price of BAYCs has also been reduced by 10ETH.

2) Dynamic focus

OpenSea will continue to use the royalty function

After most NFT trading platforms announced that they would replace the royalty function in various forms, the battle for the protection of the rights and interests of creators' labor followed. This week, OpenSea announced that its platform will retain creator royalties, and each transaction will still pay creators the amount of transaction royalties set by them. OpenSea's decision this time was also prompted by the continued protests of a large number of creators, and the future of royalties and creator rights protection is still unclear.

BAYC Board of Directors Passes Resolution to Create New Creator Royalty Agreement

Recently, there has been a lot of controversy about royalties in the NFT market, so BAYC passed a draft to create a new creator royalties agreement. The draft is a new royalty agreement adopted by the BAYC community to protect the rights and interests of creators, and its content may include a new protocol function: users can transfer through wallets, but cannot trade through NFT trading platforms that are "not allowed by smart contracts" . The draft has now been adopted and further development is required.

Kraken released a new gas-free NFT trading platform

The Kraken exchange recently announced its NFT trading platform. The feature of the trading platform released this time is that users will not incur additional Gas fees when trading, buying and selling. Kraken will also continue to support creator royalties, and both users and creators have been well protected.

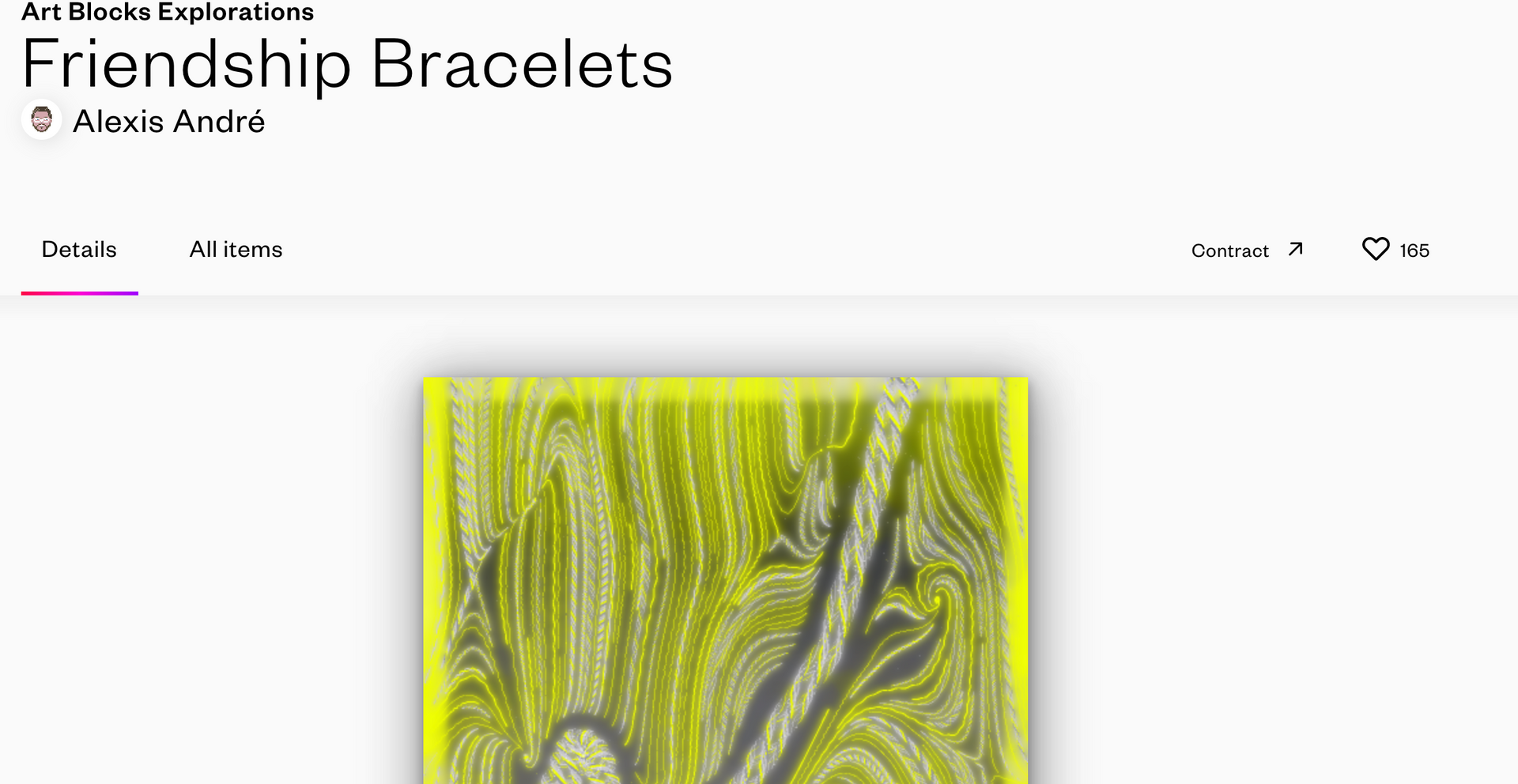

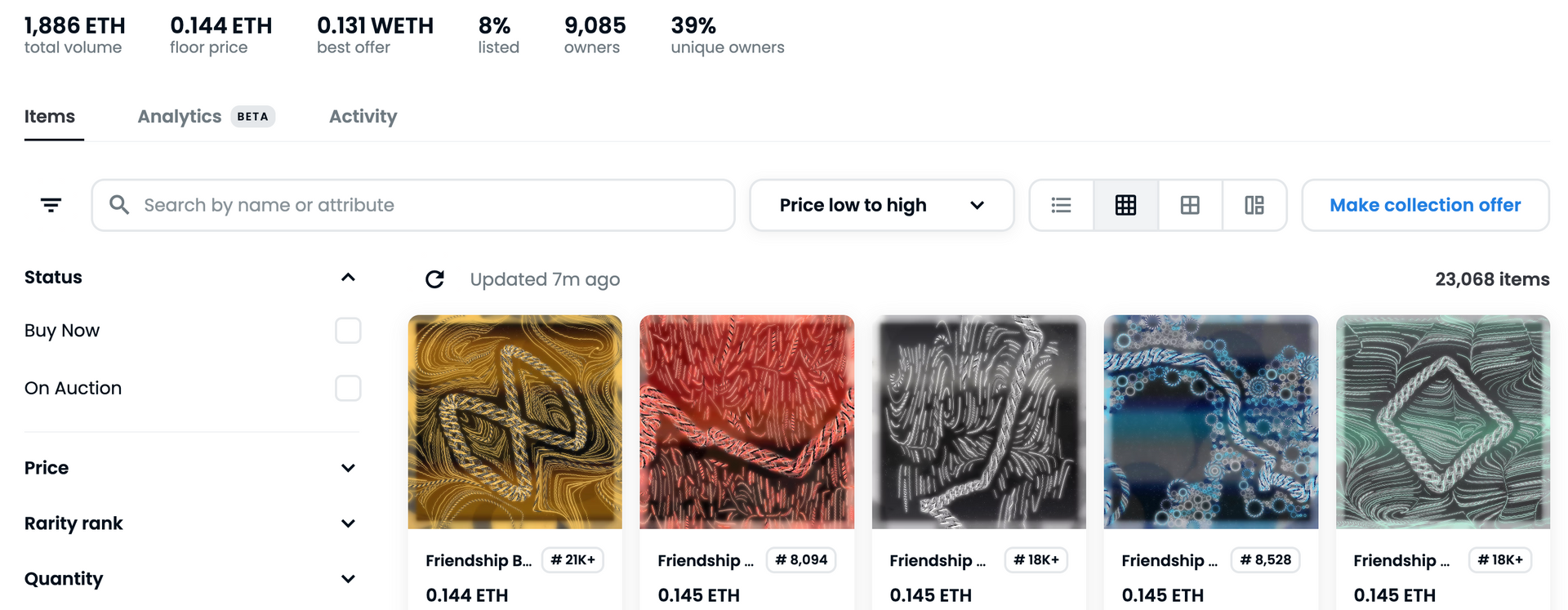

FriendshipBracelets by Alexis André

3) Key projects

The FriendshipBracelets project is a new project promoted by ArtBlocks. ArtBlocks CEO Eric Calderon advocates working with artist Alexis André to express what he sees and hears in his daily life in the form of NFT through generative art.

The works released this time are generative art, which is also one of the main features of the projects promoted by the Art Blocks platform. Users who get any NFT of Art Blocks will take a snapshot within a certain period of time, thus obtaining the whitelist casting right of the Friendship Bracelet project.

2. GameFi blockchain games

2. GameFi blockchain games

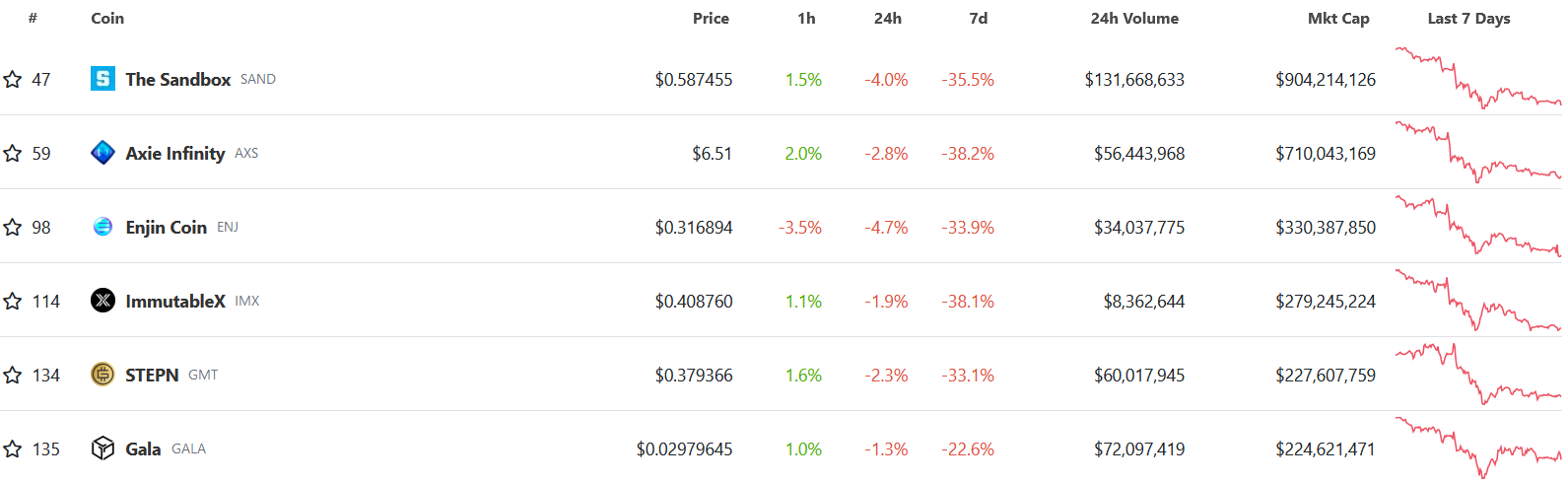

overall review

This week, mainstream tokens in the Gaming sector followed the market and fell sharply, generally falling by more than 30%, significantly underperforming the 20% decline of ETH and mainstream tokens.

Items of the week—Symbiogenesis

Items of the week—

Japanese 3A game developer Square Enix announced that it will launch a new NFT-based game series Symbiogenesis, which is expected to be released in the spring of 2023 and will use Ethereum as its blockchain platform.

This game will be based on the collection of character NFT (expected to be Square Enix's previous game characters), and enjoy stories, mission plots and decryption in an independent fantasy world. The collected NFT can be used as the player's social avatar.

As a game company among traditional game manufacturers actively exploring blockchain and Web3, if Square Enix's water-testing work is successful, it may become a benchmark for traditional game manufacturers to enter Web3.

3. Infrastructure & Web3 infrastructure

3. Infrastructure & Web3 infrastructure

1) Market Overview - Public Chain & TVL

As of November 13, the overall lock-up volume (including staking) of all public chains denominated in US dollars was affected by the market plunge, and fell to 50B from nearly 65B last week, a drop of more than 20%.

Among the major public chains, ETH, BSC, Tron, Avalanche and Polygon are still in the top 5. However, due to the deep participation of SBF and the impact of the FTX incident, the Solana ecosystem has plummeted by 66% this week and has fallen out of the top 10. If there is a lack of new With the support of the capital, the future development is worrying.

In addition, the encapsulated assets soBTC and soETH used for Solana’s ecological DeFi have both been seriously de-anchored. Since the encapsulated assets are issued by Alameda and FTX, such encapsulated assets are obviously unable to be redeemed in the case of bankruptcy.

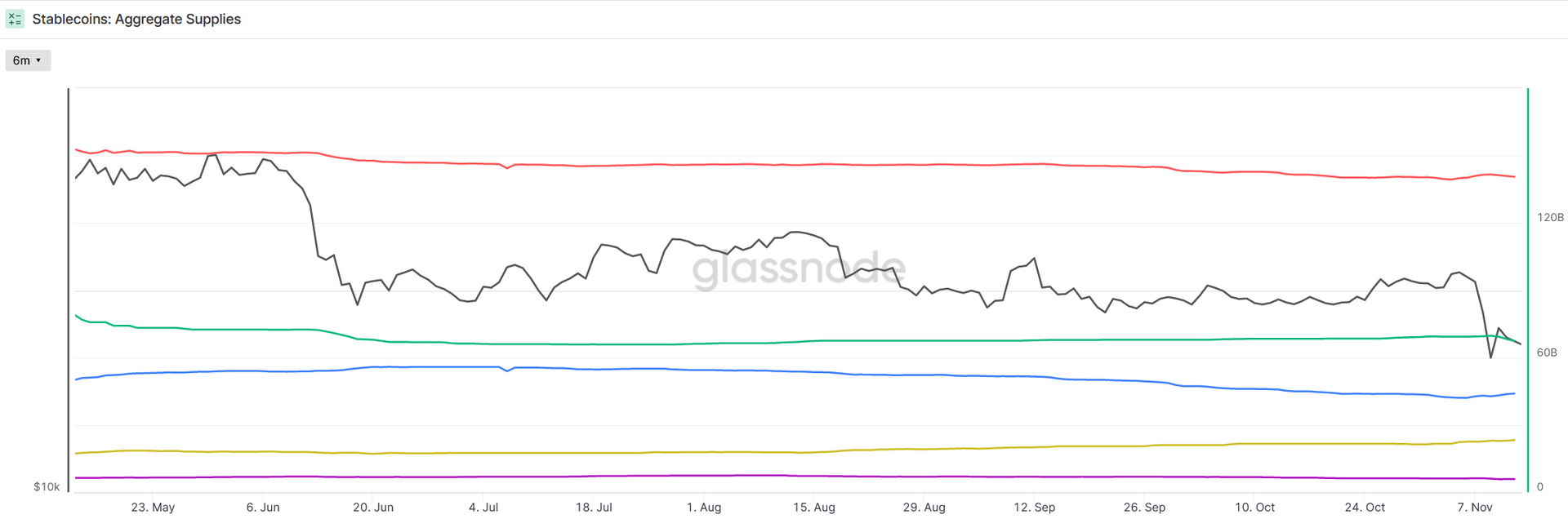

2) Market Overview - Stablecoin Supply

As of November 12, the total supply of the top four stablecoins (USDT, USDC, BUSD, DAI) was about 140.605 billion, a slight increase of about 629 million (0.45%) from 139.976 billion a week ago. Among them, the supply of USDC and BUSD increased, and the supply of USDT decreased, mainly due to the run on USDT caused by the distrust of Tether during the turmoil last week. In addition, the supply of DAI fell by nearly 5% due to the deleveraging of the market crash.

In the case of severe market declines, stablecoins have not fallen sharply, indicating that the funds on the market are not willing to leave the market and are still waiting to see the bottom appear, while funds outside the market are also entering the market on a small scale.

3) Market overview - resumption of FTX thunderstorm incident

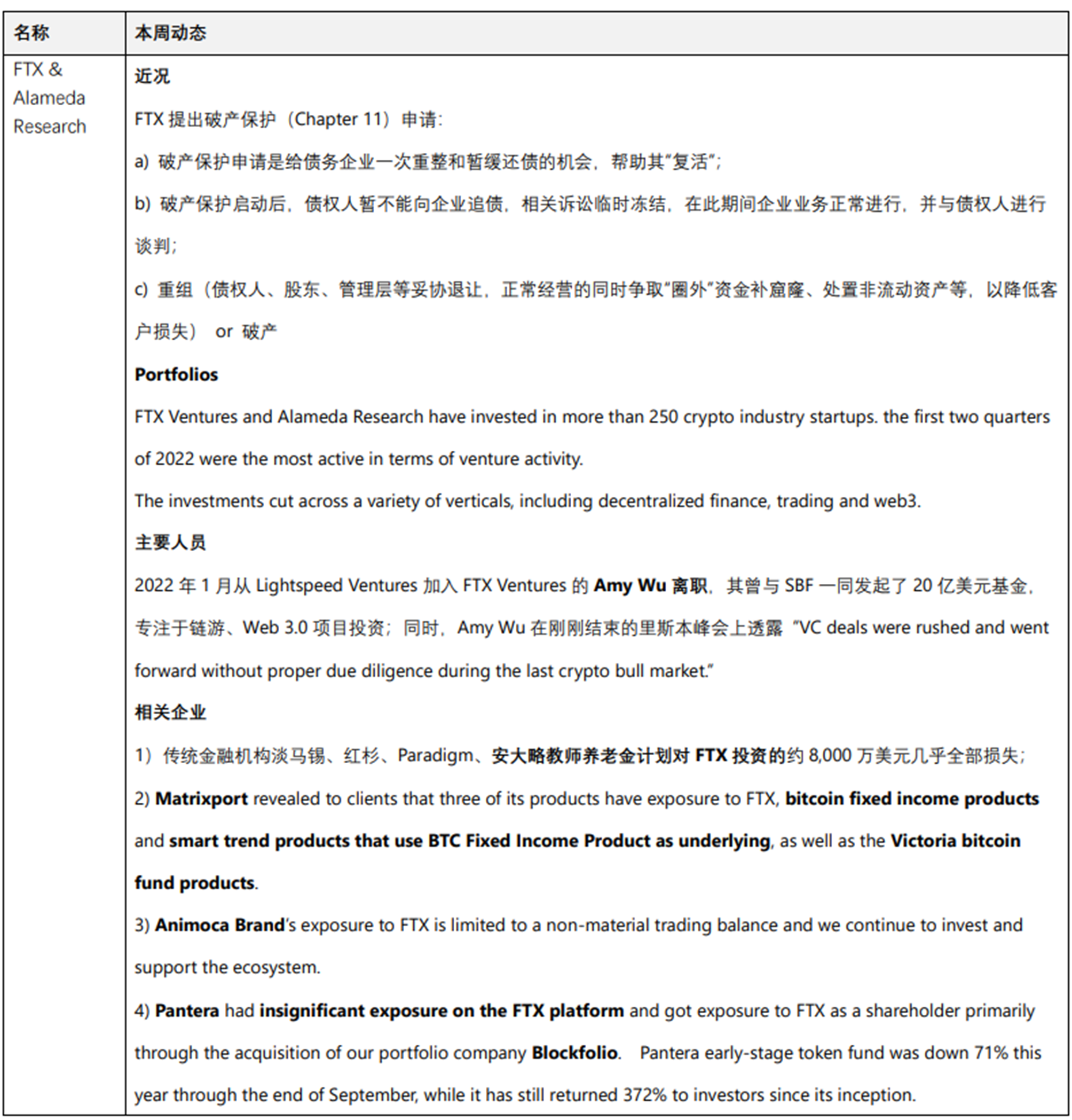

In the past week, the encryption market once again encountered a "Lehman moment". This is also the third crisis after the LUNA incident in May this year and the thunderstorm incident of Three Arrows Capital and CeFi in June this year. We review this event:

The incident first started on November 3, when CoinDesk reported that it had obtained a private financial document that there was a problem with the balance sheet of Alameda Research, a quantitative trading company owned by Sam Bankman-Fried (SBF), which held 14.6 billion Among the US dollar assets, about US$5.8 billion is the platform currency FTT of the FTX exchange, and about US$900 million is the DeFi token of the SOL and Solana ecology, but its liabilities are as high as US$8 billion. As a result, the market began to question the financial status of Alameda Research, that is, the company used a large number of tokens printed out of thin air as collateral to obtain loans. Once the price of FTT fluctuates, it will face liquidation.

At this stage, the market has not yet had major doubts about FTX's financial situation. Alameda CEO Caroline Ellison also tweeted that the balance sheet is only a subset, and there are still $10 billion in assets not included, and the leaked balance sheet The table is June 30 and most of the loan has been repaid. However, a Twitter post from Binance CEO Changpeng Zhao (CZ) made the situation worse.

On November 6th, CZ tweeted that Binance will withdraw the funds it received in FTX investment (approximately 2.1 billion USD in BUSD and FTT), and all FTT will be sold (expected to be completed within a few months ) At this point, the market began to panic, FTT plunged 10% in an instant, and stabilized for a short time around $22. At this stage, the game between SBF and CZ officially begins.

On November 7, FTX users began to withdraw a large number of coins, and the data on the chain showed that the assets of the FTX hot wallet decreased rapidly, and the cycle of recharge-depletion-recharge was repeated. This situation and the delay of some withdrawals further triggered the run. At this point, the situation has gotten out of control, even if SBF tweets to appease users, it will not help. SBF later stated that within 72 hours, $6 billion in withdrawals flowed out of the FTX exchange.

On November 8th, FTX was suspected to have stopped processing customer withdrawals, and the FTT flash crashed below the $22 mark, indicating a liquidity crisis in Alameda and FTX (Caroline Ellison once expressed on Twitter that she was willing to buy all of CZ’s FTT at a price of $22, This underpinning comment only lasted for 1 day). Affected by panic, the overall market fell, and SOL and other SBF-intensive assets fell by more than 20%.

In the early hours of November 9th, CZ tweeted that he had received FTX’s request for help, and signed a non-binding letter of intent to acquire FTX. As soon as the news came out, FTT soared to around $21 in an instant (BNB once soared to $398), but then the market continued to plummet due to the news that the antitrust might terminate the transaction. Since CZ disclosed SBF’s request for help (equivalent to SBF’s own admission of FTX’s crisis and misappropriation of user funds), FTT plummeted all the way down to around $3.

On November 10, after a preliminary review that lasted less than one day, Binance announced that it would abandon the acquisition. The market speculated that FTX’s funding gap was too large, and panic once again dominated the market. BTC fell below $16,000, and ETH fell below $1,100. At this point, the bankruptcy of FTX is a foregone conclusion. SBF issued a long tweet, acknowledging its fault and seeking to raise $9.4 billion in external financing. On November 11, SBF resigned as CEO, and FTX Group initiated bankruptcy proceedings.

The root of this incident may still be traced back to the thunderstorm of LUNA. According to Reuters, Alameda Research suffered a series of losses in transactions in May and June this year (including Voyager Digital’s $500 million loan), while SBF was Rescued Alameda, secretly embezzled FTX user funds, resulting in a funding gap, and fell in the run.

The FTX bankruptcy incident further aroused users' doubts about the opacity of centralized institutions, and even caused the price of USDT to drop to around 0.98. Affected by this, the major exchanges had to prove their innocence and release their own asset certificates. According to Nansen data, under Binance’s public addresses, there are a total of about 70.5 billion US dollars in total assets (55% of which are USDT and BUSD).

For the encryption industry, this incident may lead to two paths for future development: 1) All centralized exchanges will move towards compliance and operate under strict supervision. 2) Users turn to DeFi, and decentralization leads the development of the industry (facing risks such as hackers, KYC, anti-money laundering, etc.).

4) Infrastructure News - Summary of Ethereum Shanghai Upgrade

The ultimate upgrade goal of Ethereum is to create a public chain with very high performance, security, numerous nodes, and a certain degree of resistance to censorship. At the same time, it also hopes that users and developers have a very easy-to-use front-end and back-end.

(EIP) Ethereum Improvement Proposals - is the standard for proposals made when new features are introduced for Ethereum.

EIPs contain technical specifications for proposed improvements. During the process of EIP, the network upgrade and application standards of Ethereum will be discussed and formulated. Anyone in the Ethereum community can create an EIP.

1. EIP-3651:Warm Coinbase

The following is a summary of the 4 major changes in the Ethereum Shanghai upgrade

Warm and cold actually refer to whether there is preloading when executing this transaction, which will affect the gas fee for miners to package coinbase transactions. The COINBASE here is not the company of the exchange, but the concept from Bitcoin = the first transaction in the block is a special transaction called a coinbase transaction.

If no preload, is cold = higher gas costs. If preloaded, is warm = lower gas costs.

(Now the transactions packaged by miners may have more uses, such as batch transactions. Secondly, the same principle can also be used to realize the meta-transaction payment of multiple tokens combined with logic.)what's the effect?

Before EIP-3651, the payment method of ETH was more incentivized. After EIP-3651, the payment method of ERC20 is more encouraged. All in all, a proposal that affects incentives.

The purpose is that after modification, COINBASE will reduce gas consumption when paying ERC20 tokens.

2. EIP - 3855: Add PUSH0 instructionExisting instructions need to execute PUSH1 0 to push the 0 value onto the stack, which consumes 3 gas during the execution process, and additionally consumes 200 gas (2 bytes of storage cost). At present, about 11% of PUSH operations are just pushing 0, so this EIP can save a certain amount of gas after execution, and can also slightly improve the existing TPS of Ethereum ()。

transactions per second

This change proposal is to reduce the meaningless gas consumption

The advantage is that with the PUSH0 command, there is no need to consume an additional 200 gas fee for each transaction.

3. EIP-3860: Improve the quality of initial code

When the contract is deployed, there is an initialization code size. Based on the previous limit, the size of the initcode is 24576, but now the maximum size limit of the initcode is doubled.

Larger code capacity allows the smart contract system to do more things. The contract size can be doubled after modification, and contract developers can deploy richer functions. Support for higher contract size caps. This means that each byte of initcode will add a gas fee of 0.0625, and the gas cost of contract deployment will increase slightly.

In short, this is also a proposal to increase the upper limit of the smart contract system and reduce gas consumption. Although the contract deployment gas fee has been slightly increased, the contract size can be doubled, and contract developers can write richer functional codes.

4. EIP-4895: Use the beacon chain withdrawal as an operation command

It can be said that this is the core of this Shanghai upgrade.

The main content is to determine the main process of withdrawing funds from the beacon chain to the Ethereum Virtual Machine (EVM). After the deployment is completed, the pledged withdrawal function of the Ethereum beacon chain will be activated.

In terms of results, the goal is to withdraw funds for the pledged ETH, and the way to achieve this is to introduce the system-level command Withdraw based on the information of the beacon chain (consensus layer), which can directly control the ETH balance of the specified address unconditionally .Anyway, this

The purpose is to activate the Ethereum Beacon Chain staking withdrawal function.

4. Web3 Social & DAO & DID

Former Meta and Pinterest exec Salil Shah joins social-focused Layer 1 blockchain DeSo as COO. This week, I will briefly review that in September 21, I received more than US$200 million in financing from Sequoia, A16z, and Coinbase, and the Deso project.

The social public chain wants to provide infrastructure for social Dapp products with 1 billion users in the future. The focus is not on TPS, but on the generation of underlying architecture and protocol mechanisms that can store and read information in social networks faster and at lower cost, and Differentiated competition for infrastructure public chains suitable for DeFi

status quo:

status quo:

More than 1.6 million wallet addresses, more than 200 social apps, but the actual number of monthly active users is low (less than 10,000, data to be verified), and there is a lack of popular products; the TVL and income of the chain have not been disclosed;

The latest news is that it has integrated with the Metamask wallet some time ago, which can support Ethereum users to log in to Deso with one click. And launched a decentralized end-to-end encrypted group chat on the chain in October. Also due to the recent integration with MetaMask, users of DeSo applications such as Diamond can register without entering any personal information, truly enabling decentralized freedom of speech.

team:

The soul of Nader, he is a former Google software engineer, and later founded the founder of the earliest stable project Basis and the founder of the decentralized Twitter project Bitclout. The previous projects have all received financing from a16z.

price:

The predecessor of the token is BitClout, which issues the token CLOUT. After the launch of DeSo, no new tokens were launched, but the tokens were directly renamed DeSo. The chips are basically unlocked, and the currency price has dropped by 90% from the high point.

evaluate:

It is doubtful whether a large number of scattered apps can complete the precipitation of social relationships and realize the social network effect;

Putting the cart before the horse, repairing the infrastructure to support 100 million people, but less than 10,000 active users;

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.