The New Journey of Cosmos: Everything Starts from Interchain

Summary

Summary

The Cosmoverse conference was held on September 26-28, and the main content revolved around technology upgrades and new solutions for Cosmos 2.0, including inter-chain functions of Cosmos and ATOM 2.0 version. In addition, the main ecological chains of Cosmos, such as Osmosis, updated their progress and thoughts and suggestions for Cosmos 2.0.

This article mainly focuses on three parts to analyze the major impact of this conference on Cosmos:

(1) Comprehensively expounded and analyzed the development status of Cosmos from the perspectives of data, nodes and ecology;

(2) Conducted a detailed analysis of the new three-layer framework model of the Hub in the Cosmos Hub 2.0 white paper;

(3) The research compares the issuance and distribution mechanism of ATOM 2.0. In general, the Cosmos Hub 2.0 version has greatly improved on the original basis, but it is limited to the flexibility of the Cosmos-SDK. The Cosmos Hub has low control over the application chain, and the recognition of the new version will take time to test.

The views are summarized as follows:

The entire ecological volume of Cosmos is second only to Ethereum. IBC cross-chain transactions are relatively active, and inter-chain operations have great potential. However, the interior of the Cosmos ecosystem is too loose, the functionality of the Cosmos Hub is lacking, and the ability to capture the value of $ATOM tokens is poor;

In Cosmos Hub 2.0, four major functional sections, inter-chain security, liquidity pledge, inter-chain scheduler, and inter-chain allocator, were introduced, redefining the new role of Cosmos Hub as an ecological center. The inter-chain scheduler and inter-chain allocator, as the tax department and financial department, promote the development of the entire Cosmos ecosystem.

The ATOM 2.0 issuance plan can greatly reduce the high inflation problem caused by the 1.0 version. At the same time, the control of issuance and circulation is in the hands of the Cosmos treasury, reducing inflation while achieving ecological sustainability. Judging from the price performance of $ATOM in recent days, the market’s recognition of the new white paper is low.

The newly produced ATOM will not be directly used for validator incentives, but for proportional distribution of projects/inter-chain security/cross-chain, etc. In the first few months of the implementation of the ATOM 2.0 scheme, the verifier’s income may increase to a certain extent due to inter-chain security and IBC transfer transaction fees, but in the long run, it depends on the support of each application chain for new functions.

The way Cosmos Hub can best reflect its status is to use governance to participate in cross-chain and ecological construction. To this end, the Cosmos Hub has designed the governance stack as the infrastructure for any governance DAO. The Cosmos power hierarchical model is also proposed, giving $ATOM holders the highest authority.

first level title

1. Development Status of Cosmos

Cosmos launched its mainnet in 2019 and has been running for more than 3 years. It brings great significance to the entire blockchain industry. Cosmos has built a multi-chain system, each application has its own chain, and each chain can communicate with each other smoothly. From a technical perspective, there are three major highlights of Cosmos:

(1) Tendermint consensus engine;

(2) Cosmos-SDK development framework;

(3) Inter-chain communication protocol IBC.

These three technologies solve the three major problems of modular chain building, native token cross-chain and cross-chain security.

In addition, the blockchain built using Tendermint and Cosmos-SDK is also developing new ecology and new technologies that lead the industry, such as the privacy chain Nym, Celestia that provides data availability, EVM compatible chain Evmos, etc. It is precisely because of the flexibility and ease of use provided by Cosmos that developers can focus on project innovation without having to consider repetitive work.

As for the technology upgrade, it has been planned as early as the end of 2021, including the upgrade of IBC, inter-chain accounts, inter-chain security, liquid pledge, etc. So these technical concepts are not unfamiliar to those who continue to pay attention to the dynamics of Cosmos.

Second, the Cosmos Hub has a low influence on the ecology because it has no governance rights over the ecological chain. Anyone can submit a proposal to Cosmos, and if the proposal enters the voting stage, there is a minimum deposit requirement. Therefore, the entire governance framework of Cosmos is very simple.

secondary title

1.1 From the data point of view

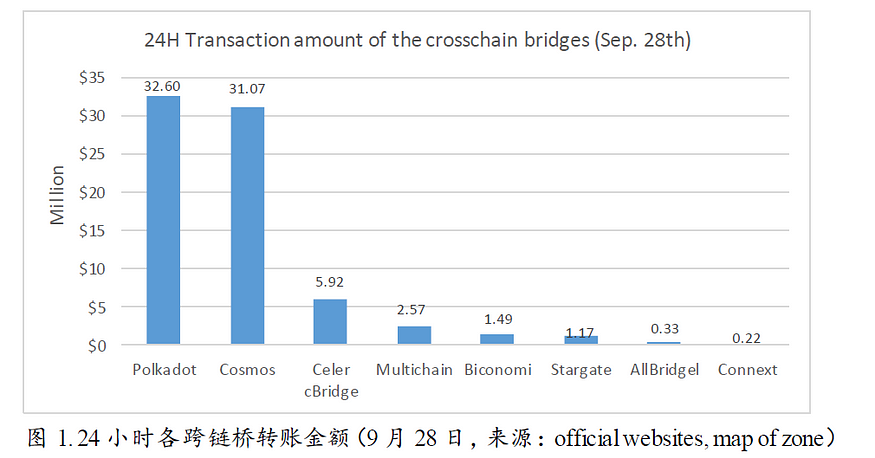

Since the release of IBC last year and the popularity of the concept of modular blockchain at the beginning of the year, the Cosmos ecosystem has continued to grow and develop. The ecology currently has more than 263 projects, with a total market value of 11.7 billion US dollars, ranking fifth among all public chains, second only to RippleNet, and there is still a big gap compared with Ethereum. There are two reasons: (1) The value capture ability of $ATOM token is poor; (2) Many ecological tokens are not listed on centralized exchanges, such as $OSMO. Among them, 5 projects rank in the top 100 by market value, namely Cosmos, Cronos, Terra Classic, THORChain, and Kava. According to Map of Zones, there are currently 49 links to IBC, and the 24-hour IBC trading volume is $31 million. The top ten projects in the 24-hour IBC trading volume are Osmosis, Axelar, Cosmos Hub, Juno, Kujira, Crescent Network, Injective , Evmos, Bostrom, and Sercret. According to the data on September 28, the Cosmos 24H IBC transaction amount is second only to Polkadot among mainstream cross-chain projects, surpassing Multichain, Celer cBridge, etc.

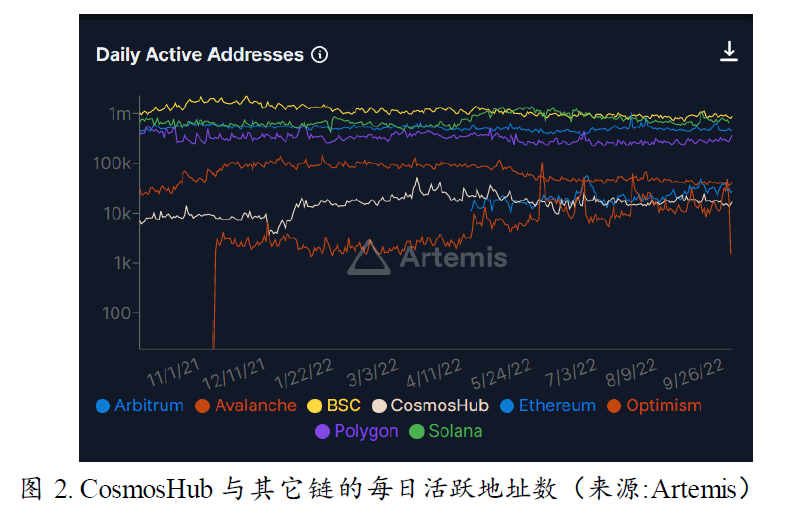

Judging from the number of addresses on the chain, the number of daily active addresses of Cosmos Hub has basically remained above 10,000 since January this year. The public chains such as BSC, Ethereum, Solana, and Polygon all have more than 300,000. Compared with the main Layer2 projects, the number of active addresses is lower than that of Arbitrum and higher than that of Optimism. Although there are many ecological projects, the Cosmos Hub currently has no application, the adoption rate is low, and the number of active addresses is lower than other ecology. The number of active addresses of its ecological head DEX Osmosis is currently slightly higher than that of Cosmos Hub.

As a multi-chain platform, the development of Polkadot is inferior to that of Cosmos. At present, there are more than 179 Polkadot ecological projects, of which 66 are launched on the Polkadot or Kusama parallel chain, 35 projects are launched on the test network, 77 projects are being developed based on substrate, and there is currently 1 project with a daily activity of more than 6,000. Polkadot has a total market capitalization of $7.5 billion, ranking 11th among cryptocurrencies. Compared with Cosmos, Polkadoot has a certain gap in ecology and project market value. There may be several reasons:

(1) Cosmos launched the main network in March 2019, and the ecological development was earlier. In May 2021, IBC was successfully launched, and at the same time, it caught up with the blossoming of the public chain ecology, and successfully realized the explosion of the Cosmos ecology. Polkadot launched its mainnet in May 2020, and launched XCMP in May 2022. The imperfection of early development tools and infrastructure also caused Polkadot to miss the free ride of the ecological explosion in 2021 to a certain extent.

(3) During the market upswing in the past two years, staking Cosmos can receive airdrops of a large number of ecological projects and also allowed many users to enter the Cosmos ecology, thus forming a certain wealth effect.

secondary title

1.2 From the perspective of ecological development

At present, Cosmos application chains have their own characteristics, and many of them have won the favor of investment institutions. Although the Cosmos chains are independent of each other, they will cooperate with each other and compete in a healthy manner. For example, Osmosis is the liquidity center of Cosmos, and the tokens of the new chain will provide initial liquidity on it. Both Osmosis and the new chain will provide higher mining income to increase the adoption rate of the new chain. In addition, Cosmos projects have a tradition of airdrops. When new projects issue coins, they will be airdropped to ATOM stakers, Osmosis LP, and other IBC chain stakers. For the project side, these users are long-term supporters of the Cosmos ecosystem.

The following is a brief introduction to the latest developments of several core projects.

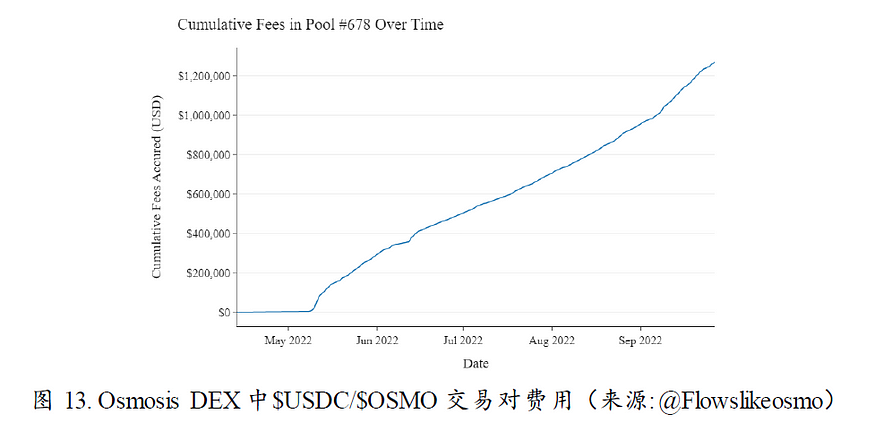

(1) The liquidity center of Cosmos is Osmosis, which is the earliest chain to support IBC. The Osmosis mainnet achieved a transaction volume of 17.6 billion US dollars in the first year, and it is also the most cross-chain with Cosmos IBC, with a 24h transaction volume reaching $10 Million. In terms of technology, Osmosis improved the proof of rights and developed superfluid pledge. During the crash of Terra, superfluid allowed Osmosis to reduce losses. Osmosis will have many new developments in the future. It is expected to introduce Phase Finance in November this year to build an automated investment strategy (DCA) for Osmosis users.

(3) Celestia, which implements the data availability layer, solves the problem of Layer 2 expansion and provides data availability for Layer. Celestia has launched the Arabica developer testnet and the Mamaki public testnet, and the mainnet is expected to be launched in 2023.

secondary title

At present, ATOM has issued a total of 310 million tokens, of which 200 million (66.36%) are pledged, and the current annual inflation rate is about 12.81%. Cosmos Hub currently has 175 active verification nodes. The rewards for validators and delegators come from inflation rewards and part of Cosmos Hub transaction fees, which are then shared. According to Stakingrewards and Mintscan, the current block reward is 9.13 ATOM, and about 43,624,800 ATOM are newly issued every year; the daily transaction fee is 30.91 ATOM (30d average), assuming that the transaction fee remains stable, the estimated transaction fee for one year is 11,282 ATOM. The current overall annualized return on staking is about 18.94%, and the annualized return on users who pledge to the top 10 verification nodes ranges from 15.51% to 19.19%.

first level title

2. New functional modules of Cosmos Hub

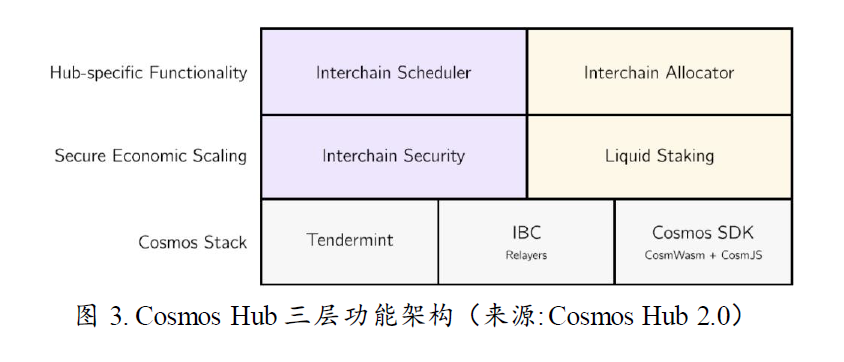

Now it is necessary to redefine and upgrade the role and function of Cosmos Hub: serving interchain. The Cosmos Hub 2.0 white paper tries to solve the problems of Cosmos Hub in terms of inter-chain security, central fiscal and taxation, and ecological construction, and divides the Hub into a three-tier structure, as shown in the figure below. The bottom layer is the Cosmos Stack, which is funded by the Hub and managed by the core team, including the three innovative technologies of Cosmos. The middle layer is the security economy expansion layer, including the functions of inter-chain security and liquid pledge that will be upgraded to the Hub soon. The top layer is the newly defined functional modules: inter-chain scheduler and allocator. The basic purpose of the design of Cosmos Hub 2.0 is to promote inter-chain development and the connection between ATOM tokens and the entire ecosystem.

secondary title

2.1 Interchain Security

The problem with Cosmos right now is not just the inability of the $ATOM token to capture value. One of the differences between Cosmos and Polkadot is that the Cosmos application chain needs to be responsible for the security of its own chains. For the new chain, fewer verifiers are easy to be attacked.

To solve this kind of problem, Cosmos has launched its own interchain security technology, which allows application chains to rent security from the Cosmos Hub. Interchain security is similar to Polkadot's shared security model, allowing validators on one blockchain to produce blocks and maintain the security of another chain. Unlike Polkadot, Cosmos' shared security does not require all IBC chains, but is more flexible. Regarding the cost of inter-chain security, the currently discussed version is that the application chain needs to pay a certain percentage of transaction fees, about 75% goes to the verifier, and 25% goes to the Cosmos treasury.

There are 3 versions of interchain security:

Phase V1: All verifiers are collected and become a hub-and-spoke type again. All shared security chains are connected to the Cosmos Hub and share verifiers. The secure consumption chain has the same security, but this will cause the power of the Cosmos Hub to be too centralized, and the secure consumption chain lacks sovereignty.

V2 stage: Part of the set of verifiers, part of the verifiers in the Cosmos Hub can choose to participate in the consensus in a certain chain, this scheme is similar to the subnet of Avalanche, and has the same problem as the V1 version, that is, the consumption chain lacks sovereignty. But the mechanism is more flexible, providing an open market to participate in the consensus of different chains.

V3 stage: layered security, V1 and V2 stages are mainly for new chains that have not yet recruited their own validators. However, if a certain chain has been launched and has its own validators, Cosmos Hub will still have some validators participating in the consensus of the chain, which ensures the security and partial autonomy of the chain at the same time.

Different from the above three versions, Mesh Security combines the advantages of V3, that is, the chain has its own set of verifiers, and some verifiers of Cosmos Hub will also participate in the consensus of the consumption chain. The difference is that the verifier of the consumption chain itself can also be the verifier of other consumption chains or Cosmos Hub. This creates a mesh security model rather than a hub-and-spoke. The benefit brought by Mesh Security is that all chains have equal status, and their coordination and connection will be closer. The validator's governance of the entire Cosmos network will become more and more important, and economic flows will become more frequent. It is not yet known what version Cosmos Hub's inter-chain security will eventually evolve into, but it is likely that the v2 phase will coexist with Mesh Security, that is, there are good security solutions for new chains and mature chains.

secondary title

The functional module of liquid pledge is similar to Lido. Users pledge $ATOM tokens in the DeFi protocol and get pledge certificates, which allow free transactions on the platform, and users can also obtain pledge income. The Lido liquidity staking protocol hosts tokens on nodes, while Cosmos Hub’s liquidity staking benefits are multifaceted, including cross-chain interoperability fees, inter-chain security fees, and more.

secondary title

2.3 Value catcher: inter-chain scheduler and inter-chain allocator

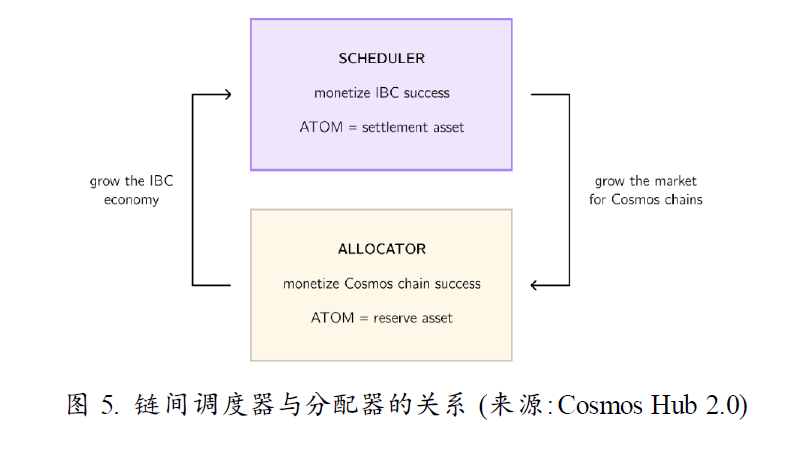

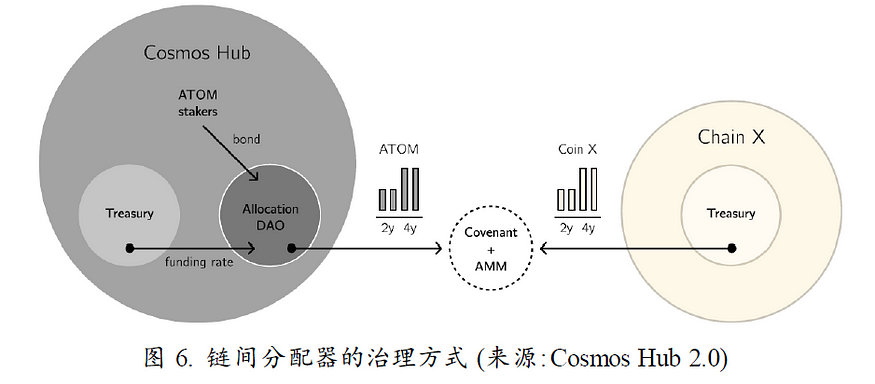

Interchain Scheduler and Interchain Allocator are new functions of Cosmos Hub. The Interchain Scheduler provides an open and transparent MEV market for interchain transactions. Cosmos Hub uses the Interchain Scheduler to collect fees for cross-chain activities. The function of the inter-chain allocator is to use the central income to promote the long-term construction of the entire Cosmos ecology. It is a $ATOM-based platform controlled by multiple delegators through staked tokens, facilitating multi-chain trust and coordination.

These two functions complement each other, and the most direct impact is to enhance the value capture ability of $ATOM. $ATOM has become the preferred collateral in Cosmos, and the Cosmos Hub has become a long-term holder of ecosystem assets, introducing valuable projects into Cosmos.

(1) Inter-chain scheduler

The inter-chain scheduler ensures the fairness and efficiency of cross-chain transactions by bringing the MEV market on-chain. In addition, the on-chain market can provide a fairer and transparent system to return revenue to its original protocol and token holders. This module is implemented by using the function enabled by Tendermint's latest ABCI++ upgrade to separate transaction packaging and sorting, and the power of sorting is tokenized in the form of NFT and can be auctioned. Specifically:

After the consumer chain opens the Scheduler module, it provides part of the block space for cross-chain contract transactions;

Afterwards, Scheduler issues NFTs that reserve block space on the consumer chain. Then regularly auction NFT in batches, and all validators can participate in the auction, and the auction form is not limited to the Dutch auction;

Before the block space is used, NFT can be traded in the secondary market.

After a block is successfully executed, the Scheduler's revenue share is sent back to the partner chain.

(2) Inter-chain allocator

The inter-chain allocator is similar to an ecological governance system. Its main function is to coordinate the economic development of the Cosmos ecosystem, increase the utility of $ATOM and the value of the entire ecosystem, which is actually part of governance, including increasing the speed of creating new Cosmos projects, adjusting project incentives, etc.

The allocator provides two basic tools:

Covenant: The covenant system works by creating a tool that can implement inter-protocol transactions. The right to use the system and the right to modify parameters are obtained by pledging tokens in each protocol.

Rebalancer: A tool that performs third-party fund allocation.

VotingPower =AtomAmount × RemainingBondDuration

Some proposals that require human judgment need to be executed by DAO. Similar to the governance process, voters obtain voting rights by pledging $ATOM, and voting rights are proportional to the number of tokens and the pledge time. details as follows:

The funding rate or performance obtained by the DAO will also be distributed to the participants. Then this new DAO can use Covenant and Rebalancer to realize the task of allocator.

The allocator is somewhat similar to Curve's governance mechanism, and the governance rights of the corresponding pools are obtained by holding veCurve. Here, the Cosmos Hub pledges $ATOM in Covenant, and other application chains pledge their own native tokens, thereby obtaining the right to modify parameters on the Allocator until an agreement is reached, so as to better manage cross-chain and incentive ecology. In the future, the allocator will take on multiple roles, including providing liquidity and loan services to the application chain.

first level title

The Cosmos Hub white paper also includes the $ATOM 2.0 release. This redesign of $ATOM focuses on the distribution scheme. The current issuance or inflation rate design of $ATOM is coordinated according to the network pledge rate. The initial issuance of ATOM is 200 million. When the network pledge rate exceeds 66%, the token issuance rate will decrease; otherwise, the token issuance rate will increase. The annual inflation rate is controlled between 7% and 20%. This scheme is to balance network security and token liquidity. But it also limits the growth of capital, and does not take into account the impact of cross-chain. In order to cooperate with the new functions of Cosmos Hub, including liquid pledge, inter-chain security, etc., these functions expand the usage scenarios of $ATOM, so the issuance scheme can be redesigned.

secondary title

3.1 Change 1: Issuance of ATOM

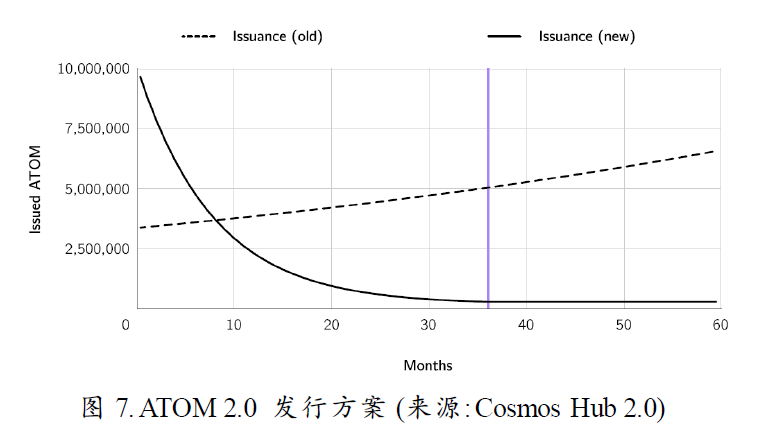

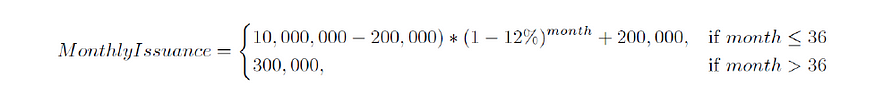

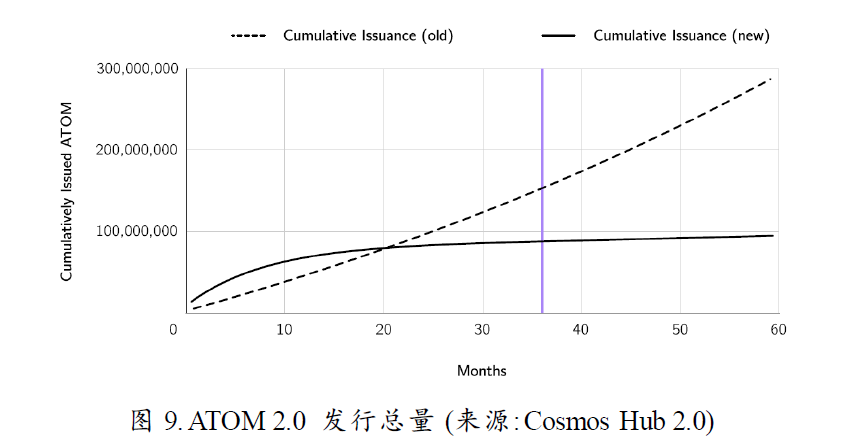

The new distribution plan is divided into two phases: the transition phase and the stabilization phase.

Transition phase: Duration is 36 months. At the beginning of the transition period, 10,000,000 ATOMs will be issued monthly. This issuance decreases at a decreasing rate until 36 months after a stable issuance is reached.

Steady-state phase: After the end of the transition phase, it lasts indefinitely. The steady state issuance is 300,000 ATOM per month.

The purpose of the transition phase is twofold. (1) Let the consumer chain have time to join Interchain Security to help subsidize security expenditures; (2) Fill the treasury of Cosmos and accumulate an economic foundation for future community development.

Inflation of 10 million in the first month, and then a monthly decrease of 12%, until 36 months later fixed at 300,000 per month. In the 36th month, the inflation of the old scheme increased by 5 million, while the new scheme only increased by 300,000. This means that in the first 9 months, the total output of the new scheme is 61 million ATOMs, which is higher than the old scheme of 32 million. But in about 20 months, the total amount of ATOM will reach the same level in the old and new schemes. The new program can make the inflation rate drop rapidly, and finally achieve low inflation of 0.1%. In the long run, the ATOM 2.0 program can greatly reduce the inflation of ATOM. However, the new plan has set up security measures. If the network pledge rate is lower than 66%, the new policy will be suspended, and the original issuance measures will be restarted. So, this security measure makes ATOM circulation unpredictable again.

secondary title

3.2 Change 2: Token distribution

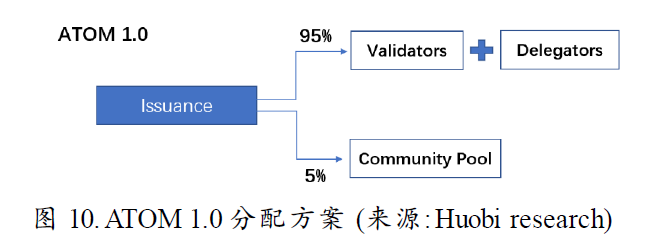

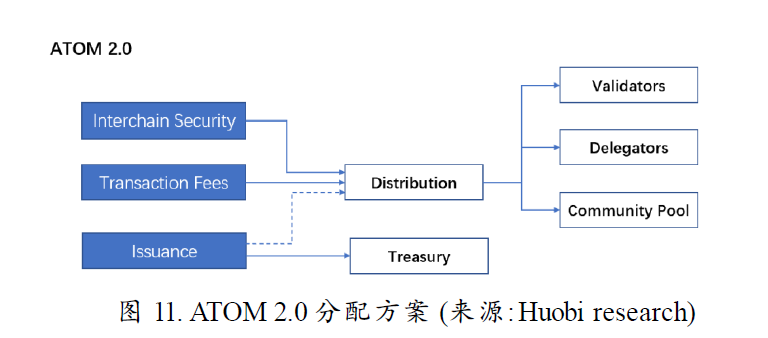

The distribution plan for issuing tokens determines the market circulation. Currently newly issued ATOMs will be fully used for node rewards and community pools.

The question of whether validator revenue will decrease after 36 months will determine the success or failure of the ATOM 2.0 proposal. At present, cross-chain transactions through IBC also require a certain fee. This source will become the main source of validator income with the development of the Cosmos ecosystem.

first level title

4. Standardization and flexibility of governance

On the other hand, Cosmos defines a hierarchical power model, the highest level is ATOM holders, followed by Cosmos Assembly and council, and finally arbitrary organizations and individuals. This layering system allows for better clarity of work processes and responsibilities. Although this method makes governance more complicated, due to the significant impact of the new Cosmos Hub on the ecology, including how to use treasury funds and how to balance the interests of various ecological chains, governance is the real role of Cosmos Hub 2.0. key.

first level title

5. Controversies and opportunities

The Cosmos Hub has been elevated to the level of a network core. Whether it is the new functional modules of the Hub or the release and distribution of ATOM 2.0, all of these are based on the underlying logic of Interchain. In general, the new white paper can solve:

(1) The Cosmos ecology is too fragmented;

(2) The ability to capture the value of ATOM tokens is poor, these two major problems.

However, according to the analysis of existing public information, many issues are still highly controversial:

The value capture ability of ATOM is far from enough. In the early stage of the implementation of the scheme, it is difficult to obtain income only by relying on Interchain Security and Scheduler. First, it takes time to build a new chain, and more mature application chains already have their own verifiers. Once there is no application chain support, the income obtained by relying on Interchain cannot make up for the 10% reduction in the income of Cosmos Hub validators.

Intuitively, the way ATOM was issued in the first 9 months was to print money for the purpose of building treasury. How the Cosmos treasury uses the new tokens to stimulate the ecology is also unknown. Although the plan stipulates the upper limit of treasury expenditure, the market circulation situation cannot be predicted. It is unknown whether each application chain submits its own taxes to the Cosmos Hub, or how much.

As a value catcher inter-chain scheduler, whether AppChain can voluntarily contribute block space to participate in the MEV market auction is also a problem, because even if there is no market on the MEV chain, there is no big problem for the development of AppChain. But for some DeFi-based application chains, the fair and transparent MEV market is still very attractive, because it does not need to provide complex privacy calculations like Secret Network to achieve anti-MEV.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute shall not be liable for any losses arising from the use of the contents of this report, unless expressly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

References

1. Cosmos Hub 2.0:https://gateway.pinata.cloud/ipfs/QmWXkzM74FCiERdZ1WrU33cqdStUK9dz1A8oEvYcnBAHeo

2. Map of Zone:https://mapofzones.com/zones?columnKey=ibcVolume&period=24h

3. Mintscan:https://hub.mintscan.io/ibc-network

4. Atomscan:https://atomscan.com/accounts

5. Staking & rewards:https://www.stakingrewards.com/earn/cosmos/?page=1&sort=balance_DESC

6. Artemis:https://www.gokustats.xyz/dashboard

7. Coinmarketcap: https://coinmarketcap.com/view/cosmos-ecosystem/

About Huobi Research

Huobi Blockchain Application Research Institute (referred to as "Huobi Research Institute") was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain, with a view to pan-blockchain As the research object, the research objectives are to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of blockchain industry. The main research contents include industry trends, technical paths, application innovation, Pattern Exploration, etc. In line with the principles of public welfare, rigor, and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms, and build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical foundation and trend judgment to promote the healthy and sustainable development of the entire blockchain industry.

contact us:

Consulting email: research@huobi.com

Official website:https://research.huobi.com/

Twitter: Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Telegram: Huobi Research

https://t.me/HuobiResearchOfficial

disclaimer

1. Huobi Blockchain Research Institute does not have any relationship with the projects or other third parties involved in this report that may affect the objectivity, independence, and impartiality of the report.

2. The materials and data cited in this report are all from compliant channels. The sources of the materials and data are considered reliable by Huobi Blockchain Research Institute, and necessary verifications have been carried out for their authenticity, accuracy and completeness , but Huobi Blockchain Research Institute does not make any guarantees about its authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the conclusions and opinions in the report do not constitute any investment advice on relevant digital assets. Huobi Blockchain Research Institute shall not be liable for any losses arising from the use of the contents of this report, unless expressly stipulated by laws and regulations. Readers should not make investment decisions solely based on this report, nor should they lose the ability to make independent judgments based on this report.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.

4. The information, opinions and speculations contained in this report only reflect the judgment of the researchers on the date of finalizing this report. In the future, based on industry changes and updates of data information, there is a possibility of updating opinions and judgments.