Issue 42 of JZL Capital Digital Weekly Report

1. Last week's industry trends:

1. Last week's industry trends:

This week, the crypto market has calmed down after Thursday’s roller coaster. Unlike the U.S. stock market’s continuous record lows, the currency market still held its lows in this round of market, and the overall volatility remained low. It is still waiting for the market to choose a direction. But looking at the current trend of US stocks, the probability of a downward trend is too high. As of writing, Bitcoin closed at 19134.9, down 2.05% during the week, the same as last week's gain; Ethereum closed at 1283.16, down 3.25% during the week. The inactivity of the market is evident in the trading volume. In the past 10 trading days, Bitcoin’s daily trading volume has lagged behind its 20-day moving average for 9 days, with the exception of Thursday’s CPI. After the four bitcoins rose following the heavy volume of the U.S. stock market, a few people believed that the large volume increase at the bottom would produce a positive trend, but the market returned to flat on Friday, and the price also fell back to the original point. The inactive trading is also a major reason why the overall volatility of the encryption market in the past four weeks is smaller than that of the US stock market. More people choose to wait and see or enter "hibernation".

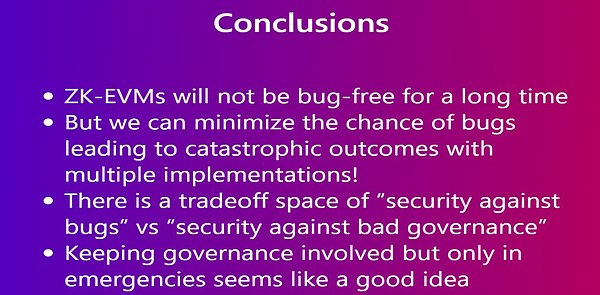

10/11 - 10/14 The Ethereum Developers Conference was held as scheduled in Bogota, the capital of Colombia. This conference was hosted by the Ethereum Foundation, aiming to deepen the community's understanding of decentralized systems by providing education for the Web3 community. This Ethereum Developers Conference mainly focuses on project parties introducing project technologies, promoting protocols, programming, usage, etc. Among them, V God participated in topics related to ZK-Rollup. The new ZK new force Scroll A speech titled "Hardening Rollups with Multi-proofs" was held at the Rollup Day event. He believes that the current Rollup code is difficult to achieve no loopholes. Too complex code will increase the attack surface of the system, and a ZK-EVM circuit will have more than 30,000 lines of code. The solution given by V God is to improve the governance plan, as well as the order of magnitude and difficulty of proof. Through the participation of more decision makers, increasing the ratio of successful voting (such as 6/8), and using multiple certifiers or more complex methods to reduce the chance of loopholes, the Rollup system is strengthened.

The discussion on Rollup at this conference was extremely heated. In addition to Scroll, the founders of MakerDao and l2beat.com also shared Rollup as the safest cross-chain bridge and the latest progress of zkEVM. Outside of the meeting, polygon released the zkEVM testnet; Uniswap V3 will also be deployed on zkSync. Currently, the competition for the leading position of zkRollup is heating up, and the era of zkRollup may come soon.

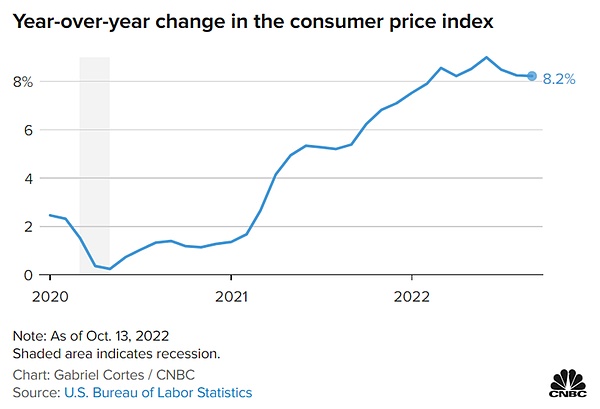

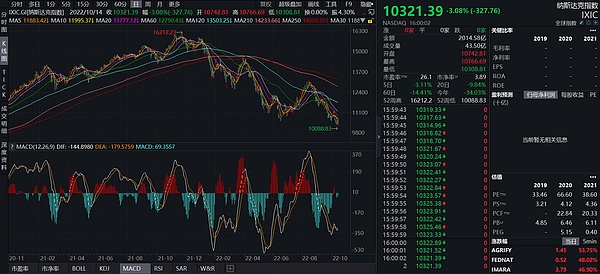

On the other hand, the U.S. stock market rebounded after opening low and moving high after the release of the CPI on Thursday, and all fell back to its prototype on Friday. The three major indexes fell below new lows one after another. It also fell to the key support level between the 200-week moving average and the 250-week moving average. In the history of the past ten years, the S&P only fell below the 200-week and 250-week moving averages for a short period of time during the panic at the beginning of the 2020 epidemic. The S&P currently closes at 3583.07, which has fallen below the 200-week moving average of 3600 points, which may push the stock index down further. The one-day parade on Thursday did not change the pessimistic views of large financial institutions. Barclays Bank and Bank of America strategist Michael Harnett believe that Thursday is just a bear market rebound, which is still early from the bottom of US stocks. Bank of America believes that the bottom of US stocks will be at It will appear in 2023, waiting for the Fed's policy shift. Both the year-on-year and core CPI in September were higher than expected again. In September, the CPI rose by 8.2% year-on-year, which was higher than the expected value of 8.1%. Like the core PCE, the core CPI hit a 40-year high year-on-year. The probability of raising interest rates by 75 basis points on November 3 is as high as 97.2%, and the probability of raising interest rates by 75 points in December is also as high as 69.8%. The market is very pessimistic.

This Wednesday, the Federal Reserve meeting minutes will be released. This is a written document formed on the meeting on September 21. Although the meeting minutes will not have an impact on the market, studying the meeting minutes will help predict the Fed’s movements. The Federal Reserve’s open service desk survey The figures suggest monetary policy will remain on hold after interest rates peak in 2023. This sentence has two meanings. One is that the interest rate will reach its peak in 2023, and the other means that it is basically impossible to cut interest rates in 2023. The minutes of the meeting reaffirmed the pursuit and determination of 2% inflation, and continued to implement the plan to shrink the balance sheet. At the same time, there were some internal discussions on the impact of interest rate hikes on the real economy. The end of 2022 is drawing to a close, and the economic data in 2023 will be refreshed. It is hoped that the new data will bring some vitality to the market.

2. Macro and technical analysis:

After the market CPI data was released, there was a small rebound, but it basically fell back to the original level on Friday. We judge that the current overall market is still a short market, and the strength to do more is limited.

BTC has been oscillating sideways for 4 months, and it is in a state of convergence as a whole. There is a high probability that the direction will be determined in the future. If the market chooses to fall, you can take advantage of the trend to go short, and if the market chooses to go up, you can go long. At present, it is more likely to go down.

If ETH falls, the range will be greater than BTC.

The two-year U.S. bond broke through to 4.5, suggesting that interest rates still need to be raised by 150bp this year.

After the Nasdaq rebounded, it immediately fell back to the original point the next day.

1. Arh999: 0.35, the cost performance is already in a relatively good position, and regular investment can be made.

Number of BTC addresses: The number of addresses holding 1,000 coins decreased, and the rest remained stable.

Number of ETH holding addresses: The number of addresses holding more than 100 coins continues to decline.

3. Summary of investment and financing:

1. Review of investment and financing

1. Review of investment and financing

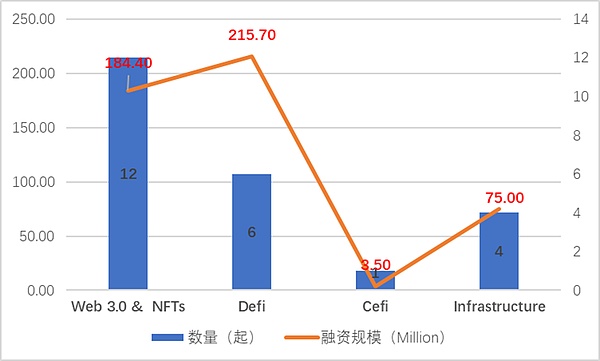

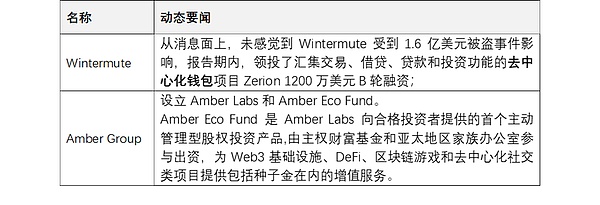

During the reporting period, 23 investment and financing events were disclosed (a month-on-month increase of 53.3%), and the financing was about US$478 million (a month-on-month increase of 171.59%); • In terms of specific tracks, although Web 3.0 & NFTs are still in the leading position in terms of the number of projects participating in financing Leading, but Uniswap's $165 million B round of financing has made a huge contribution to the total financing scale of the Defi track;

During the reporting period, there were two projects with a financing scale of more than US$100 million, namely Uniswap Labs’ US$165 million Series B financing and mobile game publisher Homa Games’ US$100 million Series B financing:

Uniswap’s parent company, Uniswap Labs, completed a $165 million financing led by Polychain Capital at a valuation of $1.66 billion, followed by existing investors such as a16z and Paradigm. According to Defi Llama data, Uniswap contributed nearly 65% of the transaction scale in the decentralized field, and was affected by the overall market downturn. The market value of its tokens has dropped significantly from the peak of 22.5 billion US dollars in 2021, and is currently maintained at 5 billion US dollars. Nearby; this financing will be used to deploy NFTs transaction aggregation function and wallet function development in Uniswap (One of the new offerings will allow customers to trade NFTs on Uniswap from a number of marketplaces and another is a wallet, according to people familiar with the matter);

The main business of Homa Games is to provide third-party game developers with development tools (Homa's software development kit). Homa Games' goal is to build a Homa metaverse jointly built and owned by creators and players. Homa Games will use this financing to expand the team to explore the world of web3 and NFTs, and has already started to cooperate with Sorare to formulate grand plans for future game series.

4. Encrypted ecological tracking:

1.NFTs

1) Market overview

1) Market overview

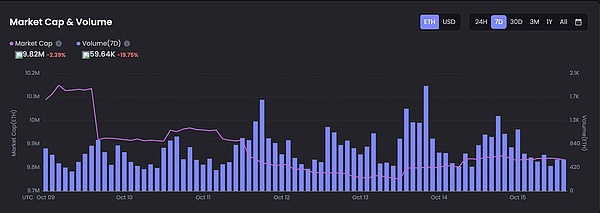

This week the NFT blue chip index is relatively dull. As of October 16, the blue chip index has declined from the previous week's rebound, and the market sentiment is still low.

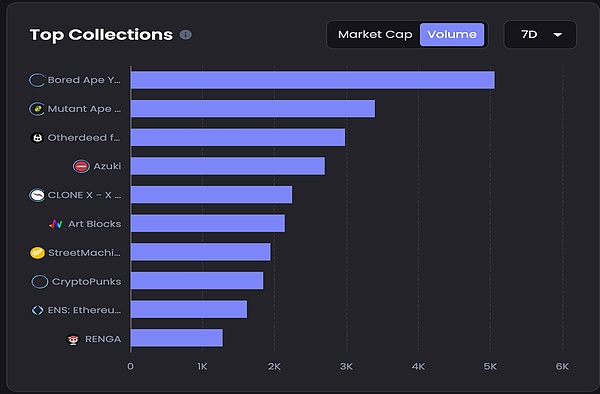

This week, the total market value of the NFT market decreased by 2.39% year-on-year, and the total transaction volume decreased by 19.75% year-on-year. Among them, there were large transaction volumes on October 13 and October 10. The reason may be that the macro impact and new NFT offering projects (Street Machine, etc.) were gathered on these two days, resulting in a sharp increase in transaction volume. Therefore, even if the NFT transaction volume continues to remain sluggish, the market still shows an upward trend compared with last month.

The top three NFTs in terms of market trading volume this week are BAYC, MAYC, and Otherdeed for Otherside.

2) Dynamic focus

2) Dynamic focus

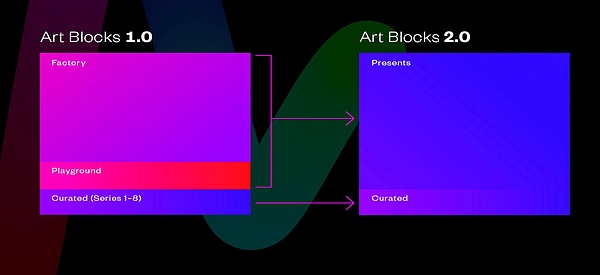

NFT platform Art Blocks will release a new version Art Blocks 2.0

The NFT art platform Art Blocks said that it will release a new version of Art Blocks 2.0. In the new version, the Art Blocks project will release NFTs for new themes through "Art Block Presents". At the same time, Art Blocks will create new smart contracts and reduce the cost of gas fees by 65%.

Yuga Labs Announces $1 Million Donation Program

Yuga Lab this week launched a $1 million donation on its website to support arts education in Miami. The main purpose of this donation is to support the provision of scholarships to help more people learn STEM courses and career planning in universities. Yuga Labs has donated $300,000 to the Venture Miami Scholarship Fund, and will continue to provide donations in the future and continue to plan to continue.

Fashion brand RTFKT has released a video teaser for Project Animus, which will launch in 2023. RTFKT is an encrypted fashion brand under Nike. Additionally, EggDrop for Clones is scheduled for release in November 2022.

3) Key projects

3) Key projects

Yu-¥i-¥i Game Court

GuGiYi is an NFT project jointly led by TNZ NFT DAO and YU-¥I Lab. The theme of this project is the metaworld created in Future Tokyo as a world view, and NFT is the user's ID in Future Tokyo.

The sale of the game court was very successful. The project party sold 8888 NFTs and sold them at a price of 0.07777. Within one day, all 8,888 NFTs have been sold to the public.

2. GameFi blockchain games

2. GameFi blockchain games

overall review

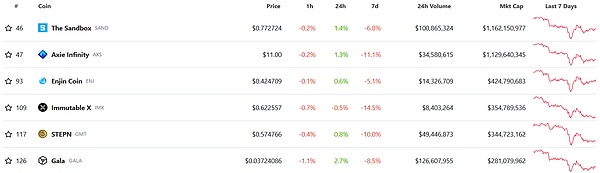

This week, the mainstream tokens in the Gaming sector fell with the market, but the decline was significantly higher than that of BTC and ETH, and it was the largest decliner among all sectors.

Item of the Week –Hometopia

Item of the Week –

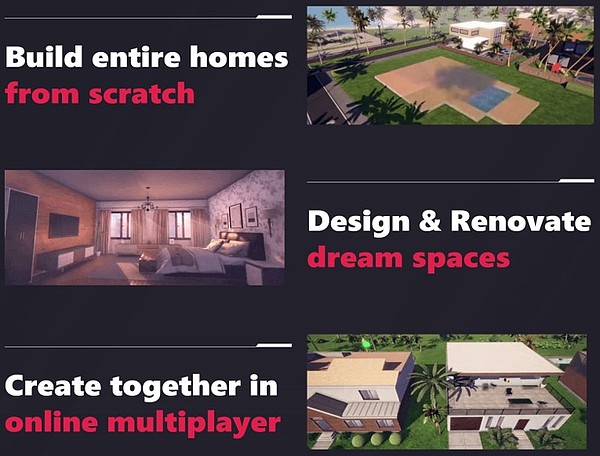

Metaverse real estate developer Everyrealm announced that it will launch the virtual real estate construction game Hometopia, which adopts the Free-to-play and Play-to-own modes, and players can fully own their creations in the game.

3. Infrastructure construction

3. Infrastructure construction

1) Market overview

1) Market overview

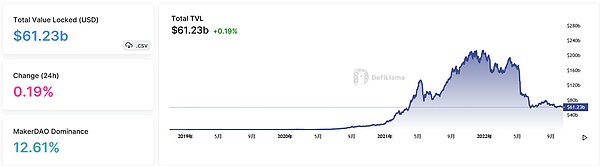

As of October 16, the overall lock-up volume of all public chains (including Staking) denominated in US dollars has declined slightly, mainly due to the overall decline in the market, but the range is small and the ranking of the top five public chains has not changed.

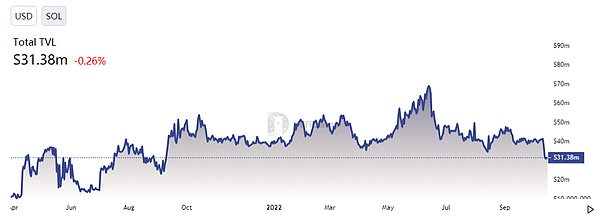

2) Solana ecology

Solana's TVL has experienced a large-scale decline recently, and it has also dropped to No. 8 in dollar terms, ranking behind Arbitrum and Optimism. The trend after September is more obvious. OpenSea also tweeted on the 16th that it has temporarily canceled the display of popular NFTs on Solana on the homepage to avoid the phenomenon of "scraping rankings". Solana was blocked before and after.

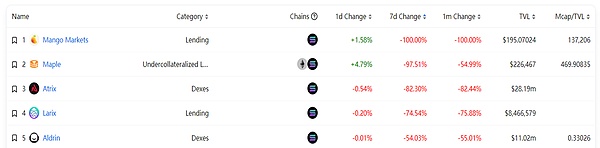

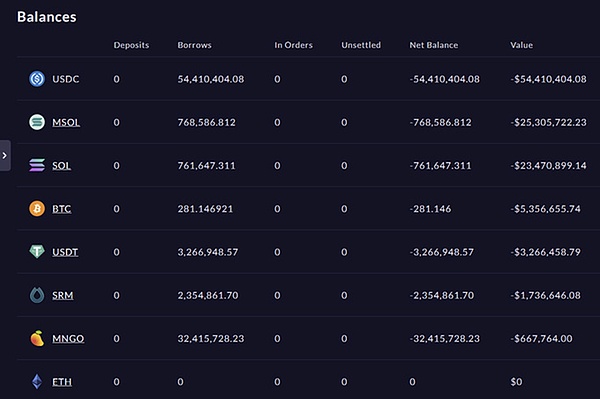

The main reason for the recent decline is of course inseparable from the Mango Market hacking incident. It can be seen that the TVL of Mango has returned to zero in the past week. At the same time, the TVL of the other 4 dapps in the Solana ecosystem has also dropped by more than 50%, and the ecological funds have shrunk. serious.

Mango is a relatively leading lending project in the Solana ecosystem, with leveraged trading and lending functions. Due to the composability of DeFi, multiple DeFi projects using Mango were also affected by this attack.

After many days of tracking, Avraham Eisenberg, the man behind the Mango vulnerability incident, surfaced and issued a statement confirming that he planned the attack on Mango. Completed "legal" open market operations.

Avraham Eisenberg invested a total of 10 million US dollars, which was evenly divided into 2 accounts for price manipulation (the reason for both long and short openings is that the depth of the Mango platform is poor, and it is difficult to open such a high position if you do not compete with yourself):

First provided 5 million USDC (including testing) to the first account (CQvKSNn...);

Immediately, 483 million units of MNGO perps (short selling) were offered in the order book;

Inject 5 million USDC (including testing) into the second account (4ND8FVPjU...);

Then went long 483 million units of MNGO perps at $0.0382 per unit;

After completing the initial position building, the hacker turned around and attacked the spot price of MNGO on multiple platforms, causing the price to increase by 5-10 times. The price was transmitted to the Mango exchange through the Pyth oracle, further promoting the price increase;

The behavior eventually manipulated the price oracle to increase the price of Mango Token by nearly 24 times, from $0.0382 to $0.91. The short account was insolvent, but the long account had a book profit of about $400 million, which increased the value of the collateral. It enabled Eisenberg and his team to borrow more funds from the agreement, such as BTC, USDT, SOL, USDC and other assets, and finally made a profit of 114 million US dollars from Mango Markets.

The frightening thing is that as early as March this year, a Discord user named @Ozcal reminded in the community that Mango has no restrictions on MNGO positions, which may lead to hackers using price attacks to extract platform assets.

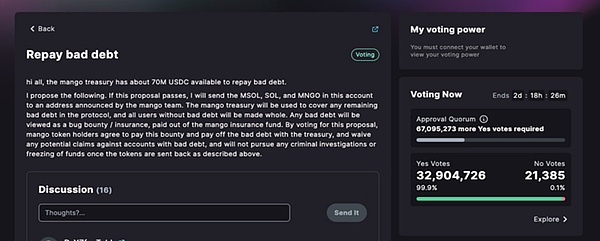

After the attack was successful, the plot started to change. This time, the hacker was "very addicted to drama" and released a new proposal, expressing the hope that the government would use treasury funds ($70 million) to repay users' bad debts, and repay nearly half of the assets themselves. , and the other half is left as a bounty. Although the proposal was not passed because the required number of votes was not reached, the proposal received 32.9 million votes (99%) in favor, of which 32.41 million votes were cast by the hackers themselves.

The Mango community has voted on the 16th to allow Eisenberg to retain $47 million while returning the remaining $67 million to the project. Shortly after voting began, Eisenberg returned tokens worth about $8 million, according to on-chain data. The remaining funds have now been returned to Mango Markets (Solana and on-chain Ethereum), consisting of $48M in SOL, $10M in USDC and $90K in GMT.

3) Cosmos ecology

After the hacking incident of BNB Chain caused by the cross-chain bridge security vulnerability occurred, the Cosmos core team began to audit IBC, and found a serious vulnerability that affected the supported IBC chain. A patch for this vulnerability has been released and has not had a major impact.

The security of the cross-chain bridge has always been questioned, and it has been dubbed a "cash machine for hackers". There have been no serious hacking incidents in the Cosmos ecology and IBC mechanism before, perhaps because there are no high-value assets in the ecology except ATOM, and after leaving the eco-DEX, there is a lack of trading channels that can be realized. However, as the current ecological development improves, the market value gradually expands, and after the introduction of Ethereum assets, hacking will be more profitable.

The discovery of this vulnerability and the upgrade patch will help prevent problems before they happen, but the effect remains to be seen.

4) Key investment

Copper has raised $196 million in Series C financing, including $181 million from new and existing shareholders, and a $15 million convertible loan note.

Founded in 2018, Copper uses multi-party computation (MPC), an emerging encryption method for securing private keys, to help protect crypto assets from cybercrime. The company also provides payment settlement and prime brokerage services.

Copper's signature product, ClearLoop, is a system that connects cryptocurrency exchanges together for instant, offline trade settlement. The product was launched in cooperation between Copper and the cryptocurrency derivatives exchange Deribit. With this tool, users can trade directly without transferring the cryptocurrency assets in their escrow accounts to the exchange's hot wallet. ClearLoop reduces exchange deposit and settlement times from 30-60 minutes to 100 milliseconds. Subsequently, Copper expanded its ClearLoop trading framework to add support for institutional-grade cryptocurrency derivatives trading. Copper said the new feature was introduced to reduce the risk of institutions participating in over-the-counter derivatives transactions.

DeepDAO

4. DAO Decentralized Autonomous Organization

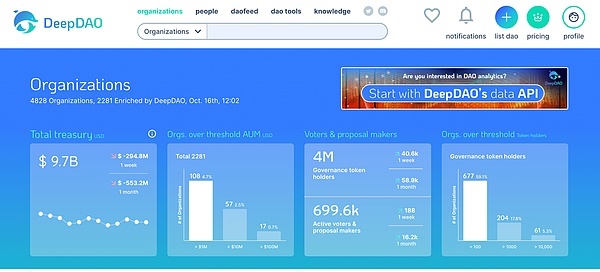

DeepDAO is a DAO comprehensive data analysis platform that provides 24-hour updated DAO-related data insights. Currently, it has collected relevant information on 4,828 DAO organizations. Analysis and ranking of governance, similar to the DAO version of defilama.

Features:

Features:

Features:

1. Summary of fundamental information of DAOFunding situation:

Directly retrieve the latest treasury fund situation of the corresponding dao project, and can be subdivided into two dimensions of liquid and vesting.Community Governance:

Deepdao can rank and rank dao projects based on the number of dao community members reflected by the number of contract addresses and the community activity reflected by the update speed of voting proposals.

2. Member Rating

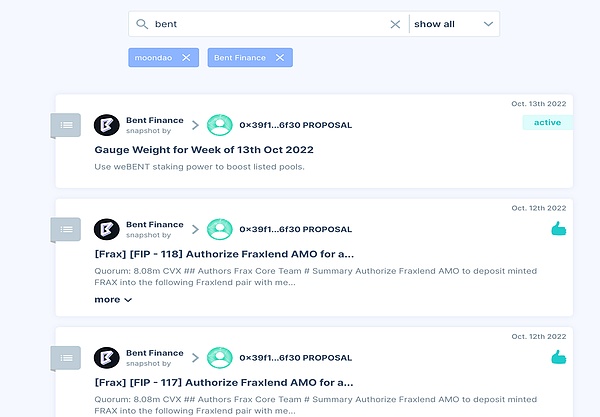

3. Daofeed

According to the number of votes and proposals in the dao community and the corresponding adoption rate, the important contributors in the construction process of each DAO project are summarized and ranked.

The on-chain behavior of the subscribed dao can be pushed in the form of information flow.

4. Tool provision

For developers, a series of dao basic tools are summarized.

5. DAO communication software

Currently under development.

business model:

Deepdao itself is a centralized organization and currently has no plans to issue tokens.

summary:

summary:

DeepDAO started earlier, and with the prosperity of the DAO ecosystem, its own data collection, analysis and other functions have gradually improved, and it belongs to the most mature batch of products in the DAO aggregation analysis track; after the mass adoption in the future, DeepDAO is bound to have greater demand. Become a bigger traffic entrance.

At present, the product still needs greater tolerance in terms of asset accounting, and currently only supports accounting for ETH, SOL, Polkadot, and KSM.

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

If there are obvious facts, understandings or data errors in the above content, welcome to give us feedback, and we will correct the report.