This article takes stock of the development status of 25 stablecoin projects

Original Author: Ignas

Original compilation: Skypiea

Original Author: Ignas

The stablecoin market currently accounts for 14.2% of the total $1.07 trillion crypto market.

https://defillama.com/stablecoins

However, 90% of the entire stablecoin market ($140.9 billion) is dominated by 3 fiat-backed centralized projects: USDT, USDC, and BUSD.

image description

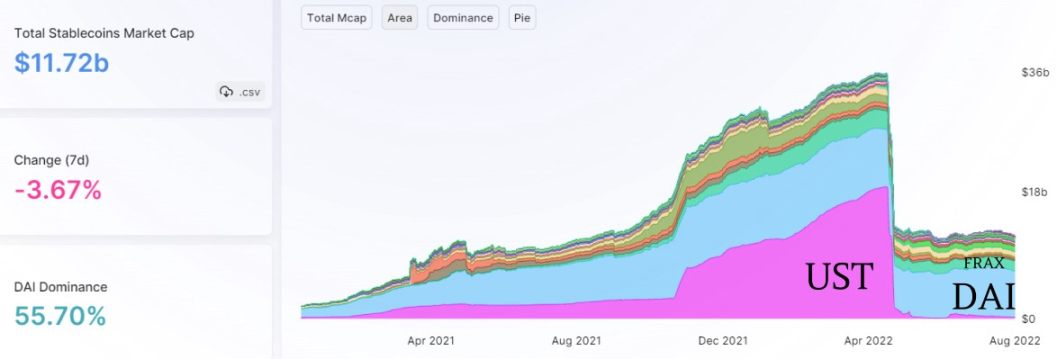

In contrast, the other 63 smart contract-based DeFi stablecoins combined accounted for only 8.3% of the total stablecoin market cap ($11.72 billion).

In April 2022, the market cap of the UST algorithmic stablecoin was higher than that of DAI, but due to design flaws, UST collapsed. Terra's UST debacle wiped out half of the decentralized stablecoin's market cap.

So what's next for DeFi stablecoins?

With Aave and Curve about to launch their own stablecoins, I ventured out and analyzed 25+ decentralized stablecoin protocols to find out:

How do they work?

How do they stay hooked?

What are their main use cases and key risk factors?

Most importantly, what makes them different from each other?

A complete database and analysis of stablecoins is available on ignasdefi.notion.site.

image description

I analyzed these protocols by type, market cap, mechanism of operation, main use cases, utility of governance tokens, and main risks.

Stable, decentralized and capital efficient?

Stablecoins avoid cryptocurrency volatility by keeping their value stable.

However, decentralized stablecoins must have transparent operating mechanisms and contingencies to avoid censorship. Decentralization is a key selling point of DeFi stablecoins.

The third key characteristic is capital efficiency: how can growing demand and scale be met efficiently? In other words, how to create money cheaply?

The holy grail is achieving all 3 traits, but every project has to compromise on one of them.

Maker's DAI is decentralized and the stability of the peg is guaranteed by over-collateralization, so it cannot mint DAI cheaply.

Terra's UST compromised on peg stability, and all who trusted its algorithmic mechanisms paid for it.

There are at least 3 more algorithmic stablecoins you should know about: Tron’s USDD, Waves’ Neutrino USD, and Celo’s cUSD

Algorithmic Stablecoins: Maximize Capital Efficiency at Your Own Risk.

In short, algorithmic stablecoins are created by depositing $1 worth of volatile assets to issue $1 of stablecoins. If it is UST, LUNA worth 1 USD can be exchanged for 1 UST.

If the UST price drops below $1, anyone can buy and burn UST for $1 to mint LUNA, then sell LUNA at a profit. Only in this way can prices be stabilized.

The realization of capital efficiency is simple: as the demand for UST increases, it increases the demand and price for LUNA. When the price of LUNA increases, it costs less to mint 1 UST.

On the way down, the process reversed, culminating in the UST's death spiral.

There are currently 3 major projects still using this algorithm model: Tron's USDD, Waves' Neutrino USD, and Celo's cUSD.

They have some characteristics:

All three are minted with $1 worth of governance tokens to mint 1 stablecoin, but Tron limits minting to nine Tron DAO members, including Alameda Research, Wintermute, and more. Tron also has no clear redemption policy.

Tron and Celo claim their stablecoins are overcollateralized by DAO reserves such as BTC, USDT and USDC and ETH. But reserve assets cannot be minted. The "collateral" here is similar to the BTC buffer reserve that Terra obtains for use in case of decoupling. However, these reserves did not succeed in saving UST.

CUSD can only be minted with CELO, but its reserves include other crypto assets.

Wave's USDN is currently only 10.89% backed by WAVES. Just a week ago, it was 16%. USDN lost its peg several times, and once extended to the vires.finance lending agreement, investors lost $500 million.

To remedy the situation, WAVES issued SURF tokens for purchasing WAVES at a discount, but it was locked until USDN support returned to 115%.

Near's USN was originally designed as an algorithmic design, but due to the collapse of UST, USN is moving away from algorithmic design. The team announced USN V2 which is now backed by USDT and will eventually support a wider range of collaterals.

Shiba Inu (SHI) and Thorchain (TOR) plan to release algorithmic models, but both projects are looking for ways to “avoid problems found in other moonshots.”

Overall, purely algorithmic models are in crisis. USDD is the largest by market capitalization, but it suffers from a lack of transparency and is centralized because its minting process is limited to a few entities.

Popularized by Maker's DAI, 12 of the 28 protected stablecoin projects use overcollateralization to secure the peg.

https://hackernoon.com/whats-makerdao-and-what-s-going-on-with-it-explained-with-pictures-f7ebf774e9c2

Maker requires collateral worth more than $1 to open a Collateral Debt Position (CDP) to mint 1 DAI. Launched in 2017, Maker initially only supported ETH collateral for minting DAI.

image description

As demand for DAI grows, limiting it to ETH hinders growth. Added more types of mortgage assets. It now accepts wBTC, Lido's stETH, Curve and Uniswap LP tokens, real world assets, and most controversially, USDC.

Maker DAO added USDC to keep the price of DAI stable, and DAI has been trading above $1 ever since.

USDC is becoming Maker's liability after Tornado Cash sanctions freeze USDC addresses. At the time of writing, 55% of the collateral is USDC. To avoid potential peg crashes and censorship, Maker founder Rune recommends staying away from USDC.

“I think we should seriously consider preparing to depeg from the dollar...it’s almost inevitable and only realistic if there’s a lot of preparation.” — Rune Christensen

Nonetheless, Maker’s model has proven successful in maintaining the dollar peg over the years.

However, some projects dare to challenge Maker in two areas: capital efficiency and/or governance model

Abracadabra's MIM

Abracadabra's MIM uses a wide range of complex collateral, including interest-bearing tokens such as Stargate's USDC.

Collateral for Abracadabra

Accepting different collateral assets is more capital efficient, but riskier. MIM previously backed UST, but while it managed to keep the peg, its market capitalization dropped from $4.6 billion to its current $220 million.

Still, MIM is the fifth-largest DeFi stablecoin thanks to diverse collateral, liquidity mining, and an attractive SPELL staking mechanism that accrues protocol fees for token holders.

Liquidity's LUSD

Liquity's LUSD is like Maker Lite.

ETH is the only accepted collateral. It avoids the cumbersome Maker governance model, provides 0% interest rate lending, and the mortgage rate is only 110%.

Smart contracts are immutable (cannot be upgraded or changed), and minting fees are adjusted algorithmically.

LUSD has a stable pool that acts as a source of liquidity to pay off liabilities on liquidated positions. Liquity even offers LQTY rewards for running front-end websites to avoid censorship.

LUST is probably the most decentralized stablecoin on the market. It won’t be the number one stablecoin by market capitalization as it only accepts ETH collateral, but it has a clear product-market fit for a specific DeFi user base.

What's so special about Tron's JUST, Kava's USDX, and Mai Finance MAI?

The Tron DeFi ecosystem has two stablecoins: USDD and JUST.

For Tron, backing USDD makes sense because it doesn't need to be over-collateralized. Tron can mint more USDD than the same amount of TRX.

https://app.kava.io/earn/busd

Kava's USDX supports BUSD, BNB, BTCB, XRP collateral and previously accepted UST. After Terra crashed, USDX dropped to $0.65. The high yield of BUSD is the main selling point of USDX at present.

image description

MAI pushes the limits with the widest range of collateralized tokens: Supports 60 assets on 10 chains to mint MAI with 0% lending rate.

Overcollateralized Innovation Beyond Maker

A number of stablecoins have brought innovations focused on capital efficiency or returns:

Synthetix's sUSD is minted when SNX holders stake their SNX as collateral at a collateralization rate of 400%. SNX stakers receive weekly staking rewards in exchange for managing their staking ratio and debt.

Inverse Finance's DOLA is borrowed against various collaterals on its lending money market. Mortgage lending improves capital efficiency by renting out assets for income.

https://alchemix.fi/

Venus is a lending marketplace that allows minting VAI on lent collateral.

image description

It seems like Aave's GHO would fall into this category, with a focus on capital efficiency. GHO will be minted on the collateral provided, but Aave eventually plans to support Real World Assets and Delta-Neutra positions (see UXD below).

Frax

Algorithmic stablecoins are more capital efficient but have proven to be volatile. On the other hand, over-collateralized stablecoins have a hard-pegged mechanism but are expensive to issue (a $1 stablecoin requires more than $1 in collateral).

Frax is a partially algorithmic stablecoin: partially backed by collateral, partially algorithmically stable.

https://messari.io/report/frax-a-fractional-algorithmic-stablecoin

It started out 100% collateralized by USDC, but as the protocol went into a partial state, some of the value that entered the system during minting became FXS (and then burned). As of this writing, 9.5% of the FRAX supply is algorithmic.

image description

For example, at a collateral ratio of 90%, every FRAX minted requires $0.9 of collateral and burns $0.1 of FXS. At a 95% collateral ratio, every minted FRAX requires $0.95 of collateral and burns $0.05 of FXS, and so on.

When FRAX is $1.01, CR decreases. If the price of FRAX falls to $0.99, CR will increase.

Frax is the second largest DeFi stablecoin after DAI. Like DAI, FRAX faces the censorship risk of USDC, although the team plans to support more diverse collateral and issue other asset-pegged assets such as frxETH.

UXD

Frax's economy currently consists of two stablecoins (FRAX and FPI, indexed to inflation), a native AMM (Fraxswap), and a lending facility (Fraxlend).

This model is more capital efficient and allows flexibility to increase the FRAX supply. However, the most interesting innovation to improve Frax supply and capital efficiency is the automation of market operations, which I will describe later.

Few people have heard of the UXD stablecoin (UXD), as its market cap is only $21 million. Still, it uses a simple and interesting model for decentralization, capital efficiency, and stability.

As the only DeFi stablecoin native to Solana, UXD is pegged to the USD using delta position neutral derivatives.

Users can issue 1 UXD with $1 worth of SOL without over-collateralization.

Deposits of SOL collateral are hedged by opening corresponding short positions on the Mango market. Thus, long exposures to spot SOL are hedged by short positions, so price movements in SOL balance each other out. This is called a delta neutral position.

Funding rates for delta-neutral short positions are generated and automatically distributed to stakers on the UXD protocol.

Interestingly, the "Delta Neutral" position appears in Aave's GHO proposal. Will it use something like UXD? We'll have to wait and see.

Hedge Fund Stablecoins

Thanks to yield farming, stablecoin holders can earn higher yields than any traditional bank can offer. At least during a bull market.

Yield farming is an active investment strategy. To maximize returns, farming farmers need to find the highest yield while reducing risk, taking into account gas and time opportunity costs.

Origin Dollar (OUSD) and mStable (MUSD) were launched to address these pain points. Both stablecoins are backed by other stablecoins such as USDT, USDC and DAI. mUSDT also includes sUSD and allows the exchange of one stablecoin for another.

These protocols function as hedge funds, using pooled funds and employing different strategies to earn returns for their investors.

Reserve’s RSV stablecoin also supports other stablecoins: 1/3 USDC, 1/3 TUSD, and 1/3 PAX. However, no aggressive farming strategies were employed.

https://morioh.com/p/10612295506e

Finally, I would put FEI in the "hedge fund stablecoin" category. Fei is overcollateralized by various crypto assets, but in contrast to Maker, these assets are "owned" by the protocol. Users "sell" any supported asset for FEI, and the asset "sold" is included in the Protocol Control Value (PCV).

image description

PCV is deployed into a strategy to secure the peg, yield farm and create utility for FEI and its governance token, TRIBE.

The "hedge fund" model is struggling. With DeFi yields falling and risks increasing, FEI announced its closure. MUSD, OUSD, and RSV are also low-cap stablecoins.

To be fair, most stablecoins in this study focus on yield generation through different strategies, but the most popular is through automated market operations (AMO).

AMOs do more than just generate revenue, though.

Automated Market Operations: When Stablecoins Are Constantly Minted

Central banks influence the money supply and manipulate interest rates by minting their own currency to buy securities, lending to banks, etc. to conduct "open market operations."

Buying securities adds money to the system, and loans are more readily available due to lower interest rates. But it devalues the currency, causing inflation.

There is a lot of backlash from cryptocurrency enthusiasts against this kind of money printing, but there are several stablecoins that have learned from the Fed.

Frax's v2 monetary policy can issue new FRAX as long as it does not change the pegged price of FRAX. The protocol can mint FRAX and deposit it in Curve, Aave, or anywhere else the DAO deems beneficial.

These automated market operations (AMOs) have the following effects:

Minting FRAX and depositing it into the lending protocol lowers the lending rate, making FRAX more attractive for lending than other stablecoins.

The Curve AMO provides excess collateral from the Frax protocol and FRAX to the FRAX3CRV pool to ensure deep liquidity and strengthen the USD peg.

Generate income from lending, swap fees, yield farming, etc., which is redistributed to veFRX holders.

Improve FRAX supply and capital efficiency by going beyond Frax v1 partial algorithm model.

Unlike central banks, the smart contract allows for algorithmically reinstating the AMO if FRAX falls below the peg. The withdrawn FRAX reduced its supply and restored confidence.

This approach increases capital efficiency and partially solves the stablecoin trilemma.

To understand the relationship between capital efficiency and AMO, I recommend reading the following tweet from the founder of FRAX.

Frax isn't the only one brrrrrrrrrrr (minting) their own stablecoin. The following protocols do the same:

Maker is launching D3M (Direct Deposit Module) in 2021 for minting and direct depositing DAI on Aave. The operation appears to have been suspended, which may encourage Aave to issue its own stablecoin, GHO.

Synthetix proposes to create a sUSD direct deposit module to deposit 50-100 million additional sUSD into Aave.

Angle's algorithmic market operation deposits agEUR into Euler Finance to channel agEUR liquidity, lower lending rates and generate revenue for the protocol.

MAI: Provide MAI directly to money markets, such as Market.xyz. More AMOs are in the works.

DOLA from Inverse Finance: Whales can extract value to lend themselves DOLA and exchange it for other assets to farm elsewhere. It can also mint DOLA without collateral and deposit it into other protocols.

FEI performed multiple operations. Integrate with Ondo to match FEI with another project's token (liquidity is a service for other DAOs). It also provides FEI to Rari Capital's Fuse and the entire DeFi lending market, guiding the market and increasing the liquidity of FEI.

https://alchemixfi.medium.com/elixir-the-alchemix-algorithmic-market-operator-2e4c8ad04569

These operations are complex, take a look at Alchemix's Elixir AMO below:

image description

In short, AMOs increase capital efficiency by creating money cheaply or for free, while generating revenue for the protocol.

This also explains why Aave and Curve launched their own stablecoins.

Aave and Curve need liquidity to generate revenue. Currently, they attract liquidity through liquidity mining, but by issuing their own stablecoin, they increase the capital efficiency of Liquidity Providers (LPs).

This could start a new bull market as leverage will become cheap and liquidity will be plentiful.