JZL Capital Blockchain Industry Weekly Report No. 33: Inflation Turning Point, Market Stock Game

Overview of the week

first level title

- Crypto-Mixing protocol Tornado Cash has been blacklisted by the US Treasury Department and Tornado Cash Dao has been banned. What is the future of privacy projects?

1. Industry dynamics last week

secondary title

1. Industry dynamics last week

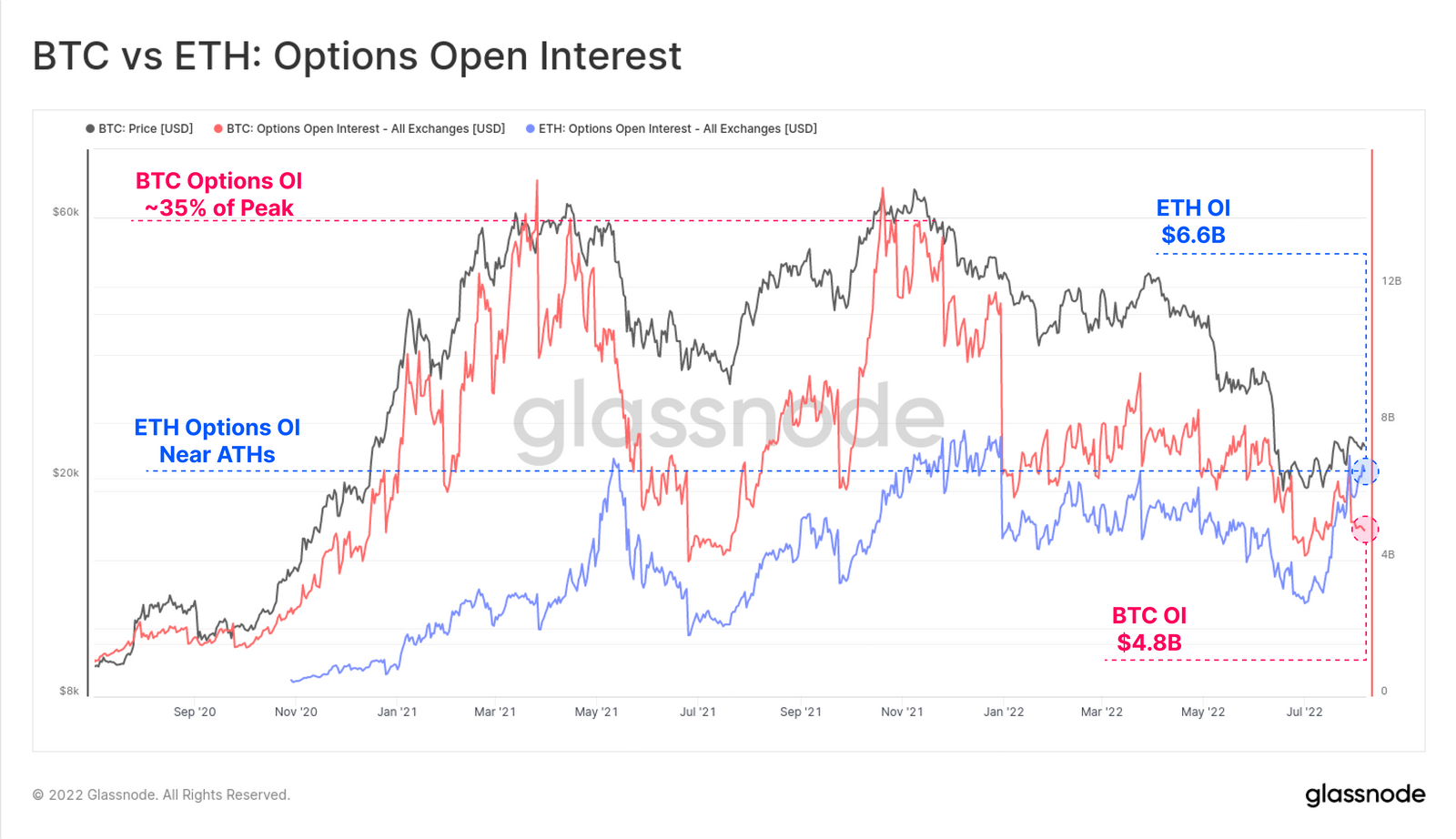

Last week, the encryption market continued to follow the strong rebound of the U.S. stocks. After the CPI was announced on Wednesday, Bitcoin rose 4% and broke through the previous high close to 25,000. The market value of stablecoins in the current market has not changed much. Stock funds are playing games as the main price driving force, but It can push the price to a new platform every time. As of writing, Bitcoin closed at 24525.4, up 6.54% within a week; Ethereum continued to perform amazingly, breaking through the $2,000 mark at its highest, closing at 1980, up 16.79% within a week , up nearly 80% in the past month. The current ETH/BTC currency pair has quietly approached a new high in the past five years. Ethereum has been in the limelight during the approaching upgrade period. The last testnet Goerli was successfully upgraded. As the merger approaches, the entire community is full of expectations. The total number of ETH currently pledged has exceeded 13.3 million, which shows that about 11% of the total supply of Ethereum has been out of circulation, and this number is still expanding, which has also led Ethereum bulls to continue to bet on the upcoming merger in September. In the event, Ethereum futures have already risen to a state of premium, and the current open interest of Ethereum is about 6.6 billion US dollars, which is close to creating a new history and higher than the value of Bitcoin. This is the first time this has happened in history. A large number of call options with a target price of $2,200, and even a large number of open contracts at $5,000, make everyone look forward to this Ethereum merger event.

This week, Tornado Cash, a well-known mixed currency pool project, was involved in the vortex of centralization and decentralization. The result was a fiasco of decentralization. TORN fell by more than 60% within the week, and the decentralized governance organization was closed. TORN, the governance token, also lost its usefulness. Some wallets related to Tornado Cash were banned and assets were confiscated.

On 8/8, the Office of Foreign Assets Control (OFAC) under the U.S. Department of the Treasury announced sanctions against the mixed currency pool project Tornado Cash, saying that the service had laundered more than $7 billion in the past three years and helped the North Korean state-run hacker organization, as well as 6 The Horizon Bridge hack laundered more than $555 million in profits in March, and the North Korean hacker group has been accused of involvement in multiple cryptocurrency thefts, including the $600 million theft from Axie Infinity. Currently affected are:

Part of the Ethereum and USDC addresses and USDC assets that have interacted with Tornado Cash and are included in the Special Sanctions List SDN;

Tornado Cash's Github code base and front-end official website are no longer accessible. But users can still interact with Tornado Cash on the backend via Ethereum;

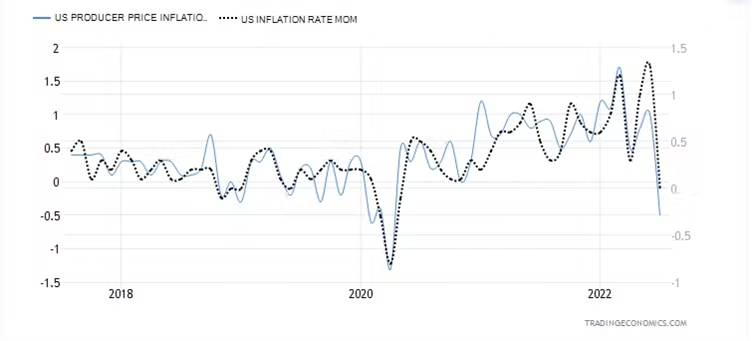

In terms of U.S. stocks, the broader market is rebounding. The Nasdaq index stood at 13,000 and rose 2.09% on Friday. Both the S&P and the Nasdaq are on all moving averages below the half-year line. This week, the United States announced the latest CPI, which fell sharply to 8.5. Inflation may have an inflection point. The PPI released after the same also indicates this. Unlike the CPI, which mainly counts people’s daily expenditures and core goods and services, the PPI is the statistics of producers’ purchases. Changes in the prices of raw materials and services are mainly composed of raw materials, semi-finished products, and upstream products, so PPI is a leading indicator of CPI. The big plunge in PPI announced on Thursday night dropped by 0.5%. Judging from the line chart released by the Bureau of Statistics, the last big plunge in PPI was in the first quarter of 2020 when the epidemic just broke out. The drop in PPI was mainly due to the fall in energy prices. PPI and The lower-than-expected CPI has brought a strong boost to US stocks this week. The Nasdaq currently has a head-and-shoulders pattern on the technical image, and is attacking the annual line. Cooperating with Powell's speech at the Jackson Hole annual meeting at the end of August, it will set the tone for raising interest rates in September. The current expectation of 50 basis points is considered For the doves, the Nasdaq may have the opportunity to continue the current rebound trend. However, the current impact of inflation, interest rate hikes and balance sheet reduction is still there, but the market reaction is numb. Therefore, it will take time to verify whether there will be another wave of decline.

2. Macro and technical analysis

secondary title

2. Macro and technical analysis

Under the premise that the CPI did not exceed expectations, the market led by ETH and went out of a wave of upward trend. We judge that there is still upward momentum in the short term, but closely follow Nasdaq. If the Nasdaq touches the annual line, then you can win by shorting Certain income.

BTC slowly rose sideways to 24,000USDT, and it started to move sideways, and it is more likely to go up in the future.

ETH rebounded strongly from the bottom, and the follow-up trend is likely to follow BTC.

Nasdaq basically rebounded 30% from the bottom, and there is still about 5% room for the annual line.

U.S. bond interest rate: The 2-year U.S. bond is sideways because the CPI is lower than expected, but the speeches of the voting committee are basically hawkish, so it is withdrawn after falling, which still reflects the expectation of three interest rate hikes of 125bp in the next three years in 2022.

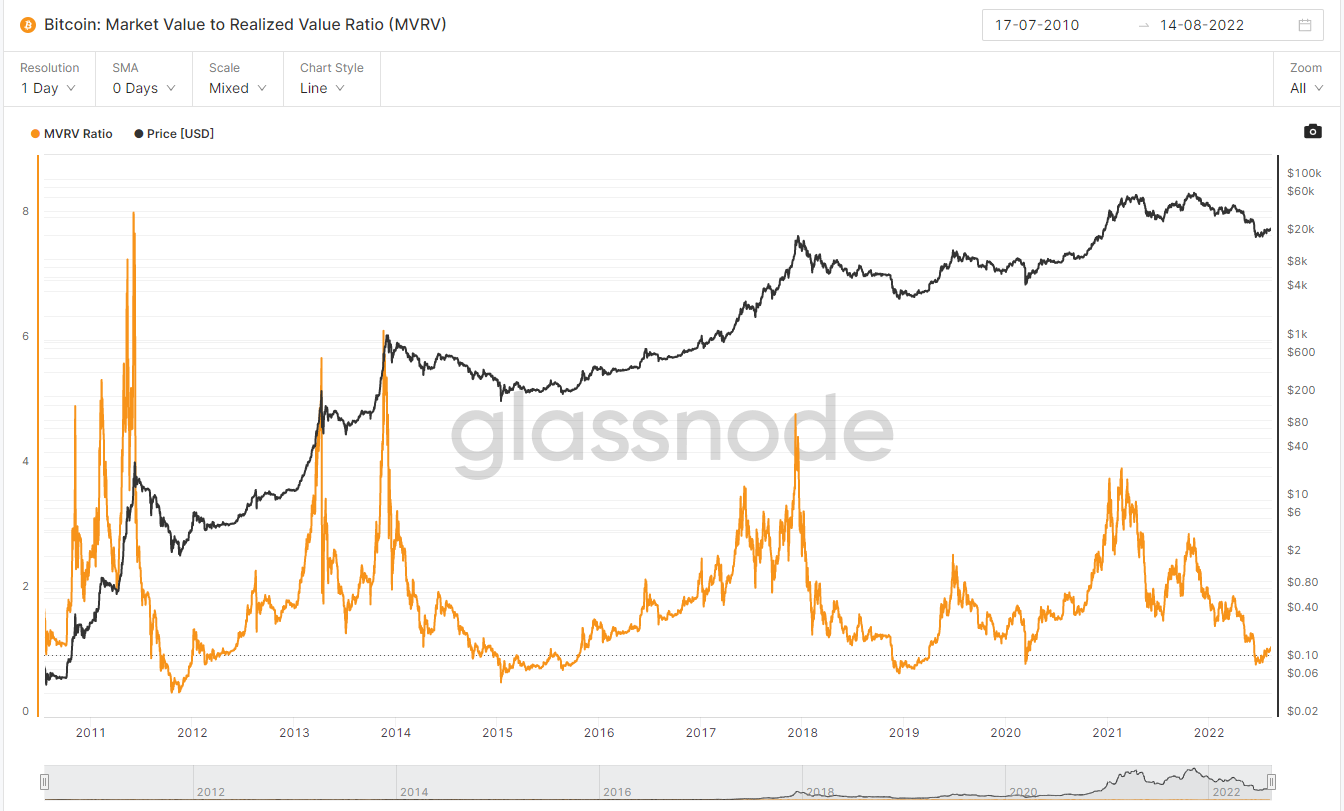

Ahr999: 0.49, the price-performance ratio of regular investment in this position is average.

secondary title

3. Summary of investment and financing

1) Investment and financing review

3. Summary of investment and financing

1) Investment and financing review

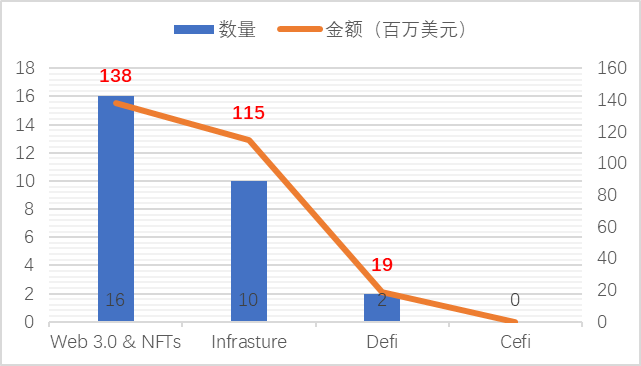

During the reporting period, 28 investment and financing events were disclosed, and the financing was about 308 million US dollars. In terms of specific tracks, 16 projects on the Web 3.0 & NFTs track ($138 million) accounted for 63%, 10 projects on the Infrastructure track ($115 million), 2 projects on the Defi track ($19 million), Cefi Tao has no items;

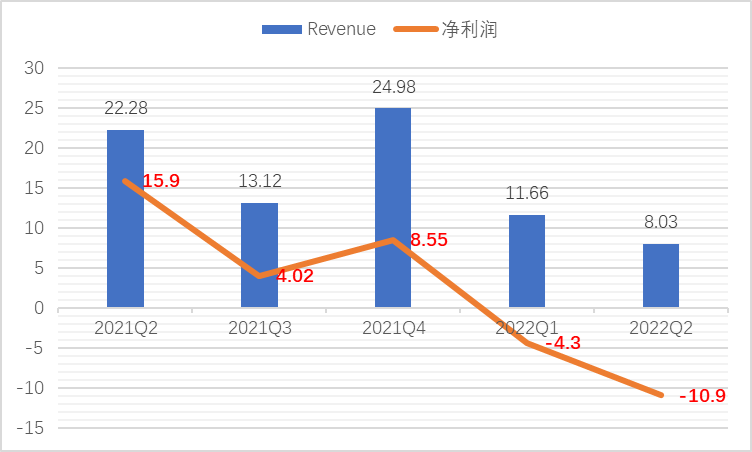

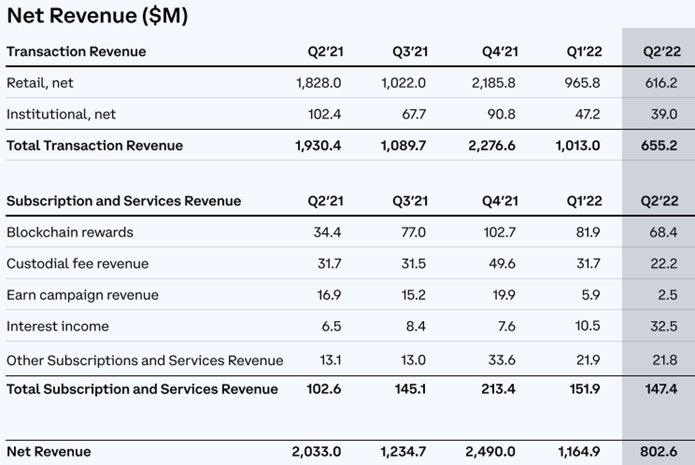

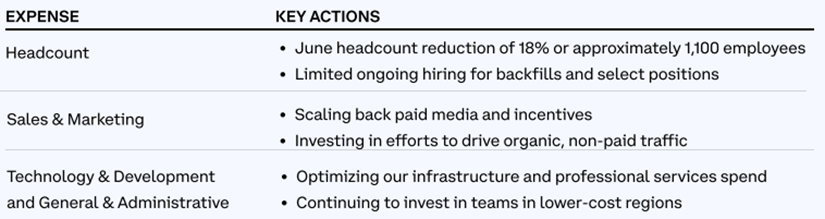

2) Institution of the Week – Coinbase

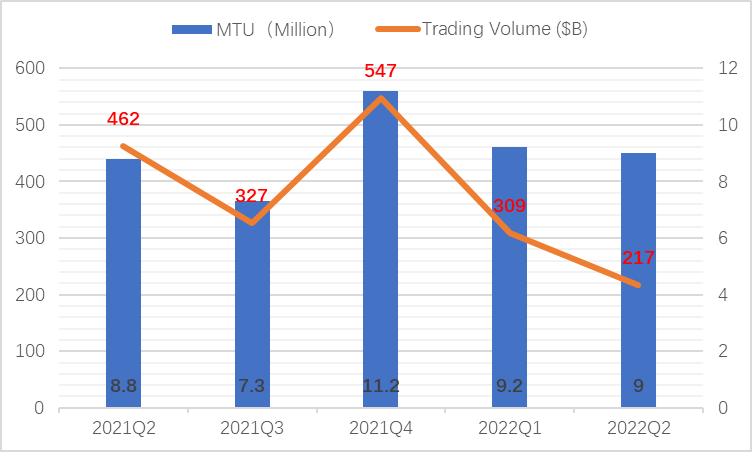

Form 10-Q shows that Coinbase’s net revenue in the second quarter was US$0.3 billion, with a net loss of US$1.094 billion. It is worth noting that this is the second consecutive quarterly loss for Coinbase, and its data also created the lowest level in five quarters. level;

In the second quarter, the global financial market experienced a sharp correction in the second quarter, and the encryption market was not immune. Although the number of Coinbase’s monthly trading users remained basically stable, the transaction scale of the platform in the second quarter was severely affected, with a quarter-on-quarter decline 30%, down 60% from the 2021Q4 high point;

secondary title

4. Encrypted ecological tracking

1.NFTs

1) Market overview

4. Encrypted ecological tracking

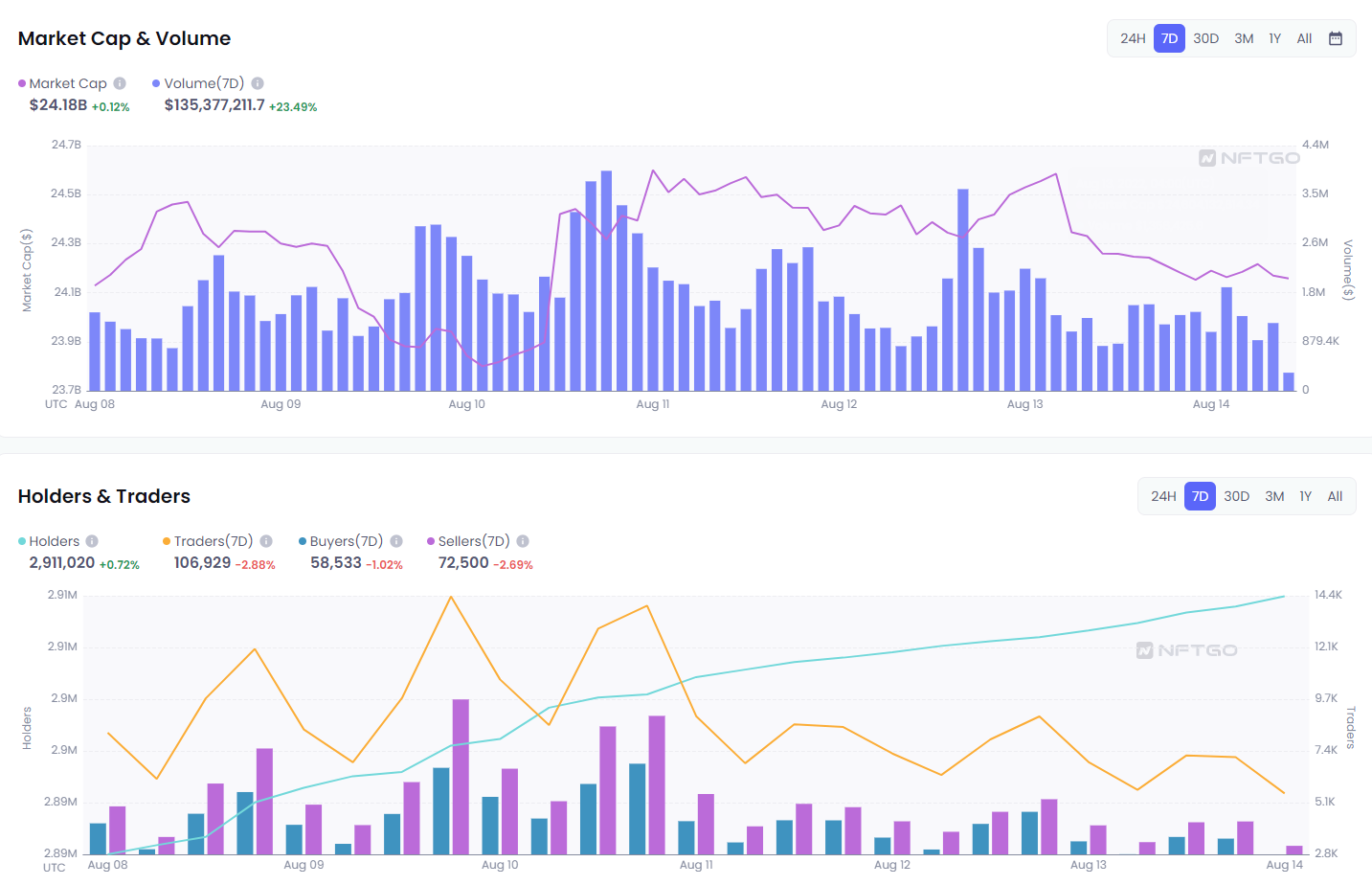

Last week, the overall market value of the NFT market did not rise with the encryption market, and was basically at a flat position. However, judging from the 24% increase in trading volume, the market activity has relatively increased;

2) Dynamic focus

According to the analysis of the number of holders and traders, the number of holders is still on the rise recently, and the number of sellers is always greater than that of buyers. It can be seen that although the increase in transaction volume may be more driven by sales.

2) Dynamic focus

The NFT trading market Magic Eden announced that it now supports the use of ETH to purchase NFTs of 10 SolanaNFT series such as ASTRALS. Previously, Magic Eden stated that it is turning to multi-chain development, will expand to Ethereum, and has supported the connection of Ethereum wallet MetaMask, Wallet Connect and Coinbase Wallet plug-ins.

The Sandbox announced that it has reached a cooperation with 11:11 Media, a company owned by Paris Hilton, the heir of the Hilton Hotel Group, to create a virtual mansion Malibu Mansion (Malibu Mansion) in its metaverse. Her community will be invited to events such as a rooftop party at the virtual Malibu mansion. Players will also be invited to a Halloween event.

Football media platform One Football has partnered with Lega Serie A to launch NFTs on Flow's NFT marketplace Aera. The first NFT was announced on August 1st, and it is planned to provide early access opportunities on August 29th and the official release on September 5th. It is reported that Aera is built on the Flow network and is an NFT marketplace for football fans, jointly launched by One Football, Animoca Brands and Dapper Labs.

South Korean internet giant Naver’s metaverse platform Zepeto has partnered with Solana and Web 3.0 developer Jump Crypto to build a cryptocurrency-based metaverse project ZepetoX. ZepetoX aims to build a 3D open world platform where creators and users can build, play games and earn money on the basis of blockchain technology. Zepeto will be building the platform on the Solana blockchain and plans to launch its first NFT land sale in the coming months.

The company's web2 platform, launched in 2018, already includes elements of its own metaverse. It has more than 320 million registered users, one of the largest in Asia. In the current version, users interact through an avatar, which they can personalize with virtual accessories. A marketplace called Zepeto Studio allows third parties — from small digital artists to global fashion brands like Gucci and Nike — to sell custom virtual accessories. In the four years since Zepeto launched, participants have purchased 2.5 billion.

3) Key investment and introduction

Overtime, the world's largest sports community for Generation Z and millennials, announced the completion of a US$100 million Series D financing. Liberty Media Corporation and Counterpoint Global jointly led the investment, and Winslow Capital, which manages more than US$30 billion in growth equity strategic funds, participated in the investment. The total amount of financing of the company has exceeded 250 million US dollars. It is reported that Overtime will use the funds to expand the development of its two innovative sports leagues, OTE and OT7, and explore e-commerce and Web3 verticals.

Overtime was founded in May 2016. Zach Weiner, who was in his early 20s, and Dan Porter, who was 50 years old, had the idea of founding overtime because they saw the scene of Curry killing the Thunder at a party. · Weiner just founded the sports website SportsQuotient. Overtime overturned the inherent logic of content creators. The two realized the market potential of the Z-generation group in the sports market, took the lead in identifying Overtime's younger audience, and then studied what content they wanted to watch. The two founders turned more attention to high school sports, which seem to have no interest at all, but are closer to young people.

Zach Weiner, one of the founders, led many photographers, who became Overtime's exclusive scouts, and walked into various high school stadiums across the United States with only one purpose, that is to find the most eye-catching young talents and post them on the Overtime account. In addition to their basketball talents beyond ordinary people, Overtime also showed the audience their lives as high school students. It is hard to imagine that the Ball brothers, Trey Young, Zion Williamson and other stars who have shined in the NBA were once the "Basketball Boys Next Door" on Overtime.

Zach Weiner, one of the founders, led many photographers, who became Overtime's exclusive scouts, and walked into various high school stadiums across the United States with only one purpose, that is to find the most eye-catching young talents and post them on the Overtime account. In addition to their basketball talents beyond ordinary people, Overtime also showed the audience their lives as high school students. It is hard to imagine that the Ball brothers, Trey Young, Zion Williamson and other stars who have shined in the NBA were once the "Basketball Boys Next Door" on Overtime.

Entering the age of social media, traditional media is on the decline, and the proportion of Generation Z among sports audiences is increasing. The way people pay attention to sports is changing. Overtime is one of the early catches. Compared with making stars, Overtime is using its own three-dimensional content to shape these young talents into friends who are worthy of role models for fans. In addition, Overtime's positioning of itself is not just as simple as a sports social media account, but to build Overtime into a community that fans love. From their inception, they have made it their mission to create chemistry with their audience. According to statistics, the number of times they interact with fans (private messages, comments) exceeds the average level of sports media by 4.2 times.

2. GameFi blockchain games

1) Overall review

https://www.coingecko.com/en/categories/gaming

2. GameFi blockchain games

1) Overall review

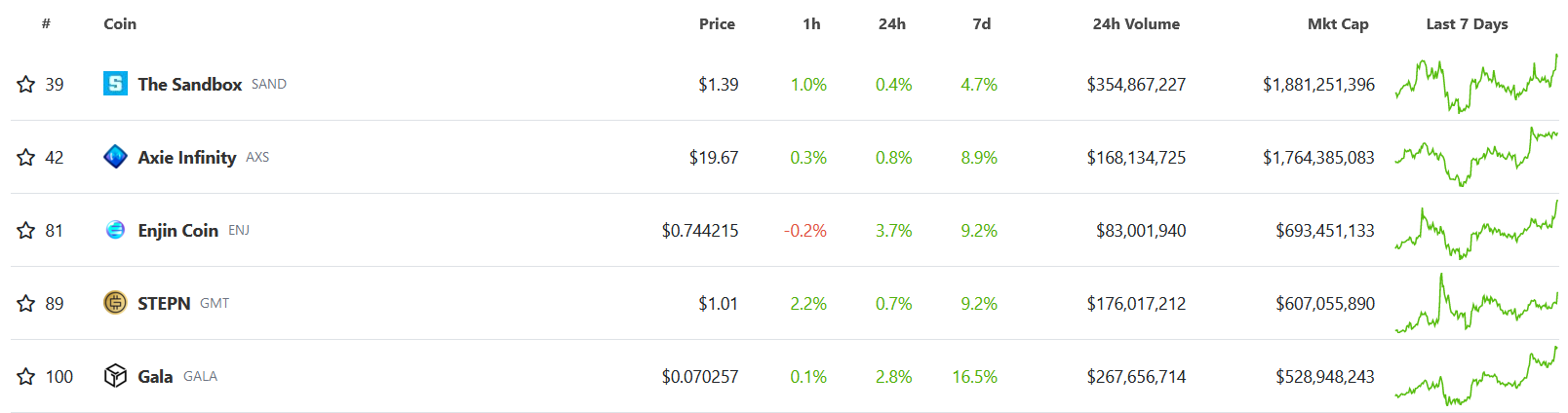

The performance of mainstream tokens in the Gaming sector was acceptable, in line with our expectations last week. After a slight correction, the market continued to rebound, but the overall strength was average, and the increase lagged ETH and mainstream public chain tokens.

https://twitter.com/GunzillaGames/status/1557685083657617408

2) Project of the week - Gunzilla Games

Game studio Gunzilla Games announced the completion of $46 million in financing, led by Republic Capital, with participation from institutions such as Griffin Gaming Partners, Animoca Brands, Jump Crypto, GSR, KuCoin Labs, Spartan Investment Group, Blizzard, NGG, and Huobi Group, and angel investors Including Twitch co-founder Justin Kan.

The game Gunzilla Games is developing is called Off The Grid (OTG), which is a 3A multiplayer online cyberpunk-style third-person battle royale shooting game that supports 150 players fighting on the same map, including PVE and PVP Two ways to play; at the same time, the game map will change in real time with the player's choice. The game is built using the Unreal 5 engine and is expected to be launched in 2023, supporting PS5, XBOX and PC at the same time.

We believe that this project is worth looking forward to. The synergy between investment institutions is obvious, and the team has rich development experience. The project is expected to become a successful case of the combination of Crypto and the game world.

3. Infrastructure infrastructure:

1) Market overview

3. Infrastructure infrastructure:

1) Market overview

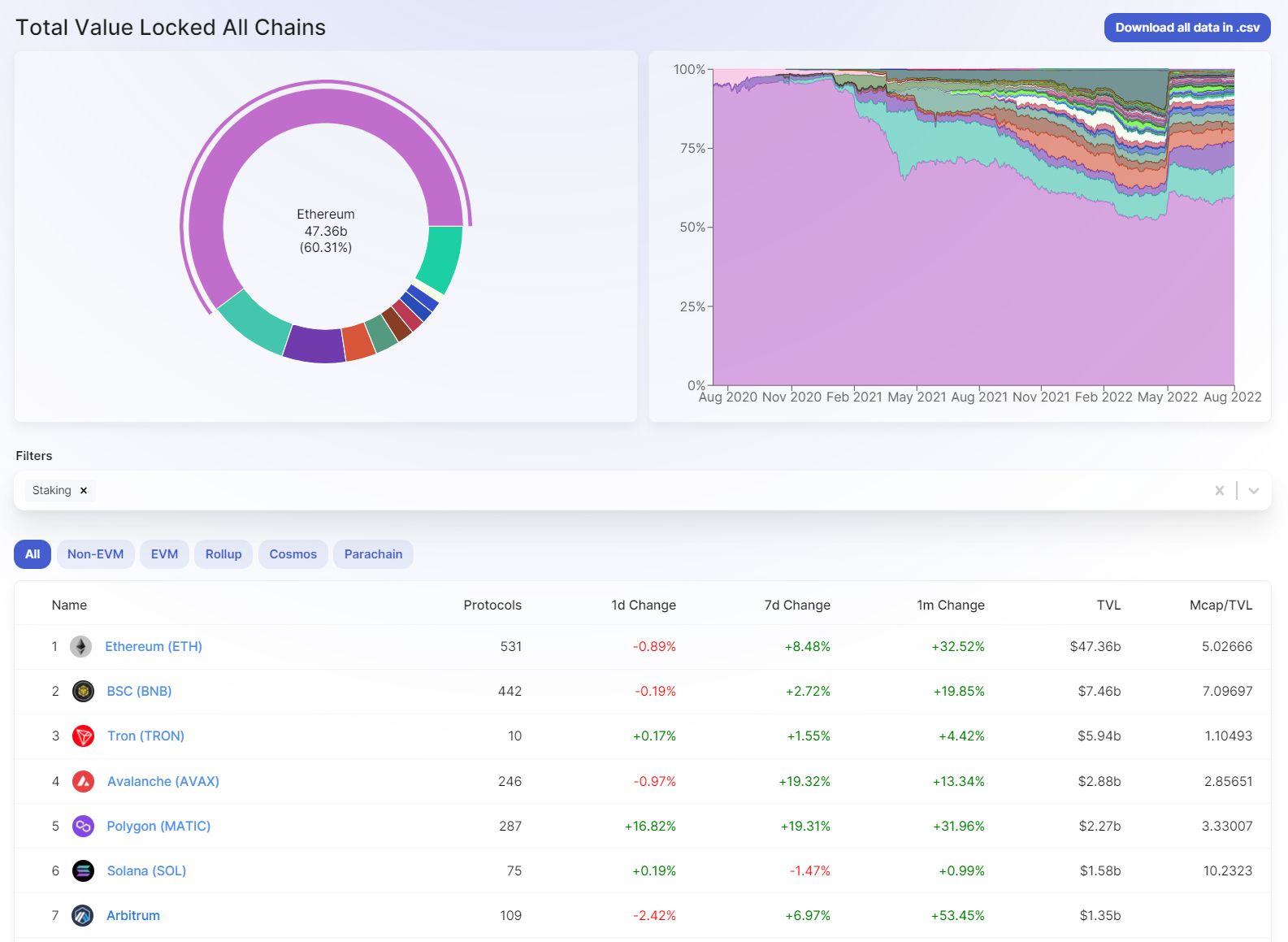

Last week, the TVL of each public chain continued to grow upwards, and the overall lock-up volume (including staking) was 78.3 billion US dollars, a slight increase of 1% from last week.

Recently, due to the positive impact of the merger of ETH, the TVL of Ethereum accounted for more than 60% again. At the same time, Polygon and Arbitrum, as Ethereum-related ecology, also ushered in a period of rapid TVL growth.

Solana founder Anatoly Yakovenko recently tweeted that the Solana communication protocol has been rebuilt based on QUIC, and the original protocol UDP has been disabled. Some RPC vendors have switched from UDP to QUIC. Currently, some wallets/users/bots have been able to add additional priority fees (Additional fees) to transaction settings, and fee markets (Fee markets) will be implemented after QUIC is fully adopted. Previously in May, Solana officially released the mainnet Beta interruption report and mitigation measures, saying that three mitigation measures are currently being formulated to solve the stability and elasticity of the network, including rebuilding the Solana communication protocol based on QUIC, developing pledged equity-weighted QoS, and Adopt fee-based transaction prioritization.

3) Key investment

NEAR recently launched the JavaScript Software Development Kit (JSSDK) at ETH Toronto, the official hackathon of the Blockchain Futurist Conference. JavaScript is currently the most popular coding language in the world, and traditional developers can join web3 to quickly build fast, scalable and user-friendly decentralized applications. Rust and Solidity are understood to be the most prominent programming languages for layer 1 blockchains, with less than 2.5 million developers using these languages globally. JS can run in every browser, is easy to learn, does not require compiler settings, and comes preloaded with tool libraries such as RegExp, Math, and Array.

3) Key investment

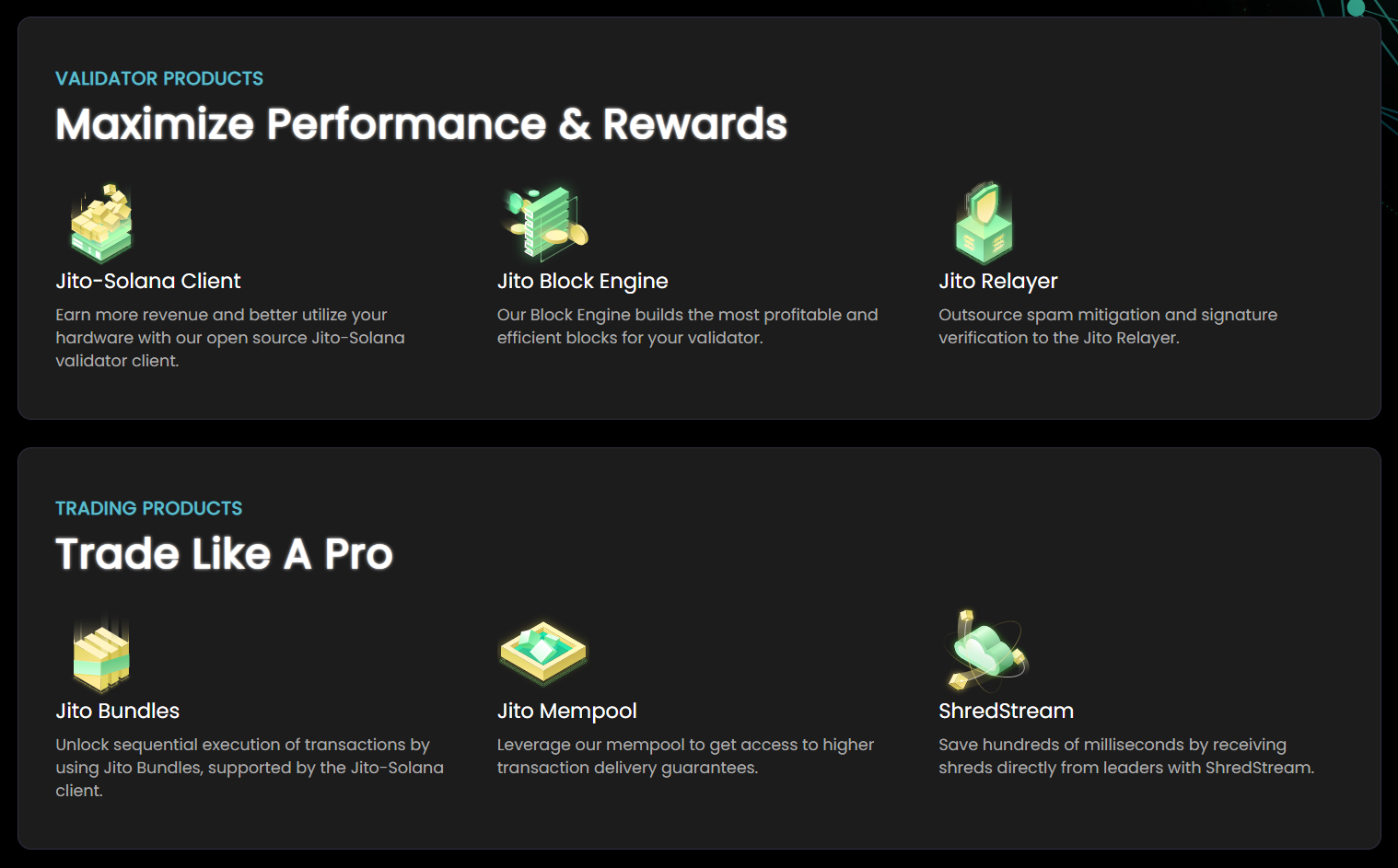

Solana MEV infrastructure developer Jito Labs completes $10 million Series A financing led by Multicoin Capital and Framework Ventures, Alameda Research, Solana Ventures, Delphi Digital, Robot Ventures, Solana Labs co-founder Anatoly Yakovenko, Coral founder and former Alameda Research engineer Armani Ferrante and Solana Foundation communications director Austin Federa participated.

Jito Labs aims to improve the speed and finality of Solana transactions and provide rewards for validators and stakers. The infrastructure developed by Jito Labs is currently being audited by Neodyme and is expected to be live within the next two months.

MEV refers to the maximum value that can be extracted from block production over standard block rewards and gas fees by including, excluding, and changing the order of transactions in the blockchain.

Injective is a public chain focused on financial transactions. It is built using the Cosmos SDK and can use the Tendermint state proof consensus framework to achieve instant final results of transactions. Additionally, Injective can facilitate fast cross-chain transactions across the largest layer-1 networks such as Ethereum and Cosmos Hub.

4. DAO Decentralized Autonomous Organization

CreatorDAO

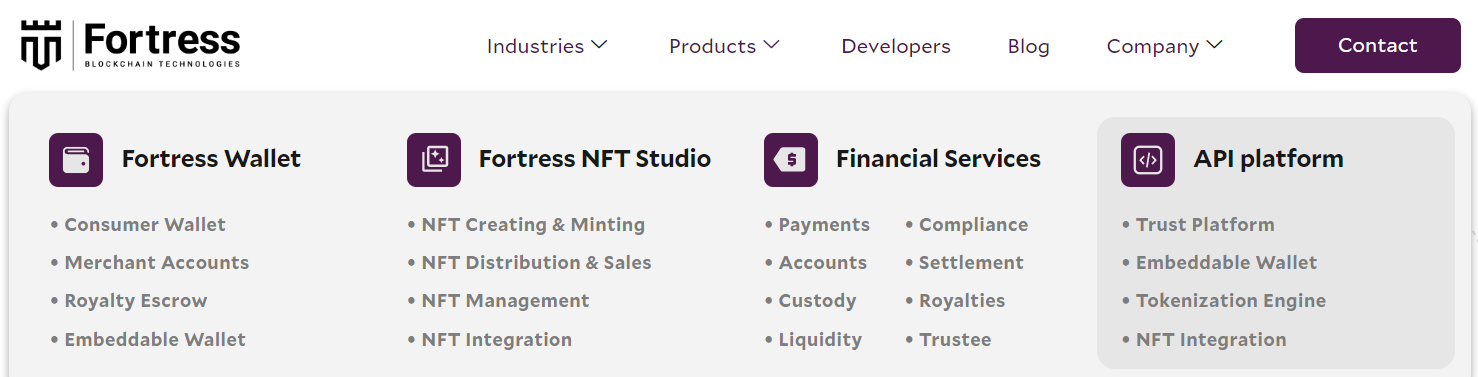

Web3 infrastructure company Fortress Blockchain Technologies announced the completion of a US$22.5 million seed round of financing, led by Ayon Capital, with participation from Soaring Investment Management and Fortress founder Scott Purcell. This round of financing will be used to build and expand its financial, regulatory and technical infrastructure for Web3 innovators, and expand Fortress' sales network.

4. DAO Decentralized Autonomous Organization

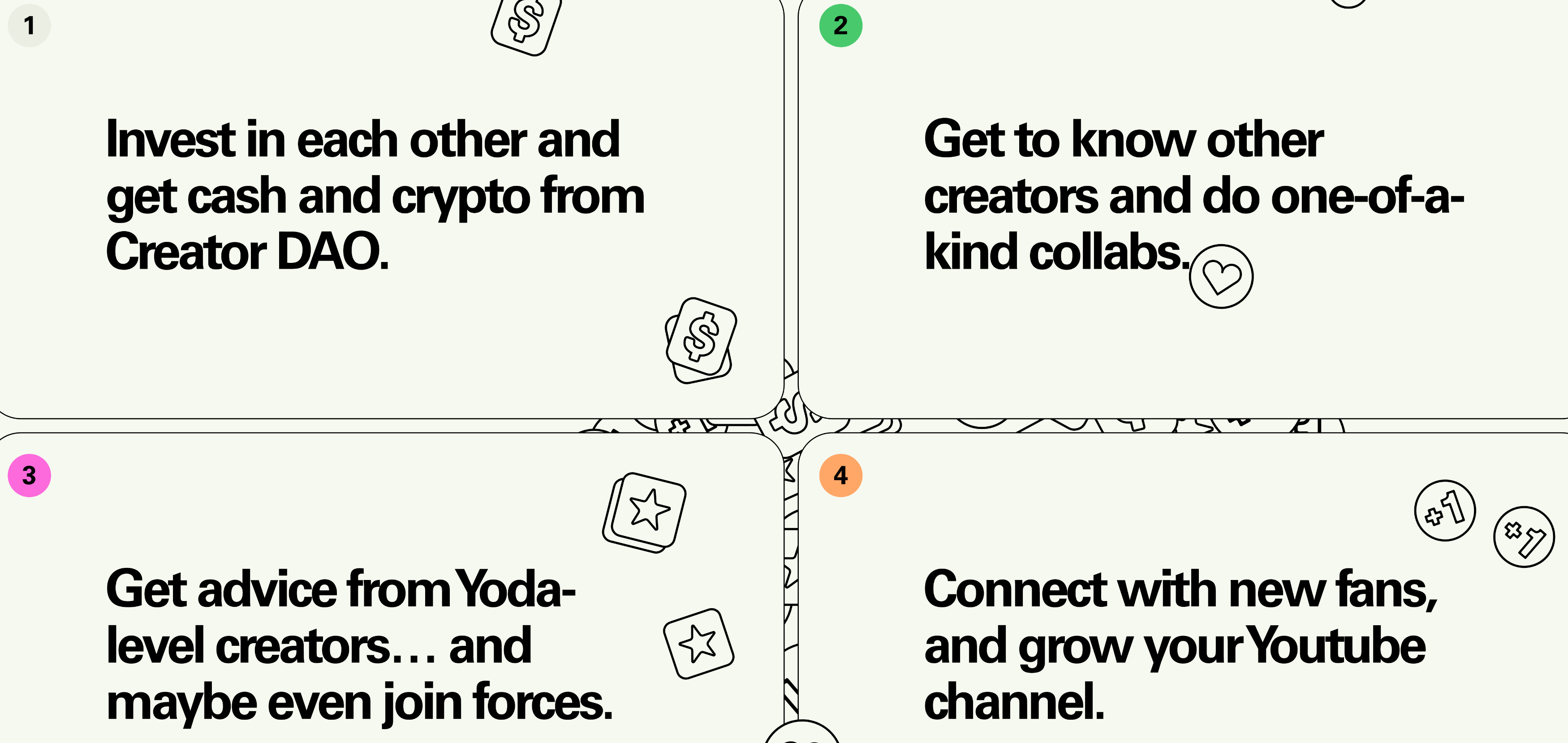

CreatorDAO, a decentralized creator community, completed a $20 million seed round of financing led by a16z and Initialized Capital. Other investors include Liquid 2 Ventures, M13, Audacious Ventures, etc.

contact us

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

The team members are from top universities such as University of Chicago, Columbia University, University of Washington, Carnegie Mellon University, University of Illinois at Urbana-Champaign and Nanyang Technological University, and have served Morgan Stanley, Barclays Bank, Ernst & Young, KPMG, HNA Group , Bank of America and other well-known international companies.

Website www.jzlcapital.xyz

Twitter @jzlcapital

contact us

We are always looking for creative ideas, business and cooperation opportunities, and we also look forward to your reading feedback, welcome to contact hello@jzlcapital.xyz.

If there are obvious facts, understandings or data errors in the above content, welcome to give us feedback, and we will correct the report.