Original title: "The Encrypted FBI with a Valuation of $8.6 Billion, Chainalysis Escorts Governments and Institutions"

Original Source: Overseas Unicorns

Original Source: Overseas Unicorns

Palantir helped the CIA track bin Laden's location more than a decade ago, and Chainalysis allows government agencies such as the FBI and IRS to expand their investigation and law enforcement capabilities to the blockchain.

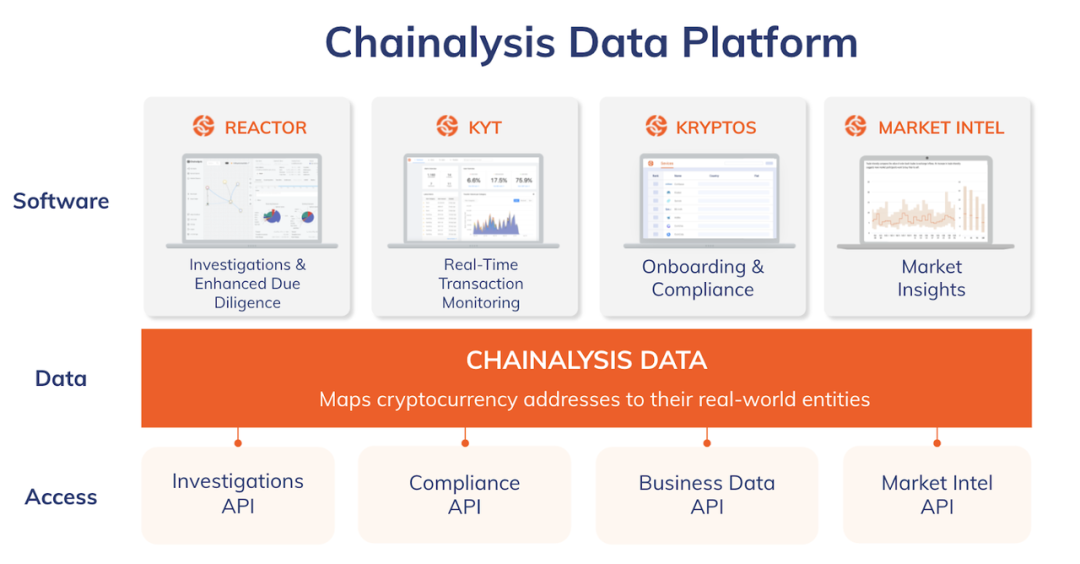

Chainalysis was founded in 2015 by former Kraken COO Michael Gronager and others. At that time, the Mt. Gox exchange had lost coins, and Bitcoin was almost synonymous with hackers, online drug trafficking and terrorism.Based on the public data, label data and machine learning models on the chain, Chainalysis's product matrix allows customers (from prosecutors, FBI agents to compliance personnel of the exchange) to conduct in-depth investigations of any transaction on the chain and its related transactions, and Real-time monitoring of transactions to meet compliance requirements such as anti-money laundering, trying to build everyone's trust in the blockchain.

In May 2022, Chainalysis announced the completion of a $170 million Series F round of financing led by GIC, with a valuation of $8.6 billion. Its other shareholders include institutions such as Benchmark, Accel, Paradigm and Coatue. It has more than 750 customers in 70 countries and regions, 150 of which can contribute more than $100,000 in ARR.

Many people have the impression that Chainalysis is "doing government business", but its private business revenue has accounted for more than 40% since 2019, and it has become an exchange, a stablecoin issuer, an NFT trading platform, and even a Crypto-Friendly bank And other customers' compliance must-haves.

Chainalysis' ARR has doubled its YoY in the past few years, its NDR once reached 140%, and its gross profit margin exceeded 80%, which is in line with the characteristics of a typical high-growth SaaS company.It is no longer satisfied with staying in the compliance and risk control scenarios, and will launch a variety of BI-type data products in 2021, trying to enter the daily business links of customers.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

The following is the table of contents of this article, and it is recommended to read it in combination with the main points.

01. Thesis

02. Market: Cryptocurrencies are favored by illegal activities

03. Origin: Make prosecutors more willing to choose encrypted cases

04. Product: Create a product matrix based on data advantages

05. Customers: From government to private sector

06. Competition: Chainalysis has a data moat

07. Conclusion: Geographic and product expansion determine Upside

01. Thesis

The main reasons that attract us to pay attention to Chainalysis as growth investors are as follows:

market

On-chain transactions are not outside the law, and governments are willing to pay for new regulatory and enforcement challenges.Due to the anonymity and irreversibility of on-chain transactions, it is widely used in illegal activities such as dark web transactions, extortion, terrorist financing, and money laundering. Governments have a long-standing need to regulate and enforce these activities, and Chainalysis has built easy-to-use data products and investigative services that can attract significant projects and large contracts from them.

With sound regulation, financial institutions and Crypto Native companies also have strong compliance requirements.From Europe, America to Asia-Pacific, the KYC and AML (anti-money laundering) regulatory framework surrounding encrypted assets is becoming more and more perfect. Whether it’s exchanges like Binance, FinTech apps like Robinhood, or traditional financial institutions like Barclays, wherever they deal with crypto assets, Chainalysis is a compliance imperative. The number and volume of these private sector clients has grown rapidly in the past 2 years.

Competitiveness

Chainalysis started early, accumulated deep, and has the longest and most reliable data set in the industry.Chianalysis builds models in the way of machine learning, and the quality of the data set is the core competitiveness. It has systematically built data sets related to illegal activities since 2014, grabbing information from thousands of websites, dark web forums and fraud databases, and currently has hundreds of millions of address labels from more than 6,500 service providers. And the daily transaction data and KYC information of the exchange customers accessed by its KYT have brought it a positive flywheel of data accumulation.

Chainalysis has been involved in the "biggest, fastest, most important" cryptocurrency enforcement incident.Chainalysis is similar to CrowdStrike or Palantir in the Crypto field. It is known for participating in the most important investigations: it helped Mt.Gox creditors track down the whereabouts of hundreds of thousands of bitcoins, and helped the Department of Justice seize the largest child pornography site in history, Welcome to Video , Participating in the USD 1 billion seizing operation on the Silk Road Darknet... These best practices have supplemented Chainalysis with unique data sources and helped it build natural trust in the hearts of overseas government and private enterprise customers.

Chainalysis' SaaS metric outperforms, more like a software product company than a project services company.team

team

The CEO is a Crypto Native serial entrepreneur who has experienced bulls and bears.Its founder and CEO, Michael Gronager, once served as the CEO of Nordic DataGrid Facility, the largest distributed storage installation company in the world at that time, and then served as the COO of Kraken, the most secure Crypto exchange. Bear.

The Chainalysis team has built sustainable relationships with regulators.Chainalysis has established a strong government relationship in the early days. The earliest Demo display object was Katie Haun, who also introduced Benchmark's A round of investment in Chainalysis; Sigal Mandelker, the former deputy secretary of the US Department of the Treasury, also participated in the investment in Chainalysis after joining Ribbit Capital. Investment and served as a consultant, and her previous work in the government was a comprehensive co-ordination of counter-terrorism, anti-money laundering and financial intelligence.

02. Market: Cryptocurrencies are favored by illegal activities

Chainalysis is a market for vertical industries. According to Philippe Botteri of Accel, it acts as a link between exchanges, financial institutions, regulators, and law enforcement agencies, using deep analysis and machine learning to help law enforcement agencies investigate illegal transactions. , and make financial institutions comply with AML.

The size of this market is difficult to model, because it is highly dependent on our belief in the overall development of the encryption market, and it is also extremely reflexive - whether regulatory infrastructure such as Chainalysis can get financial support will in turn determine the development of the encryption ecosystem trend. In general, the potential market size of Chainalysis has nothing to do with the rise and fall of currency prices, but mainly depends on the number of governments and private companies entering this field and the number of transactions.

However, the pain point in this market is very clear: when Bitcoin appeared, all kinds of illegal activities in the world seemed to find the most suitable means of payment and transaction for them. In 2021, $14 billion worth of cryptocurrencies will be used in illicit activities, an increase of more than 80%. The IRS criminal investigation agency seized more than $3.5 billion worth of cryptocurrencies in 2021.

This includes the migration of traditional payment methods for illegal activities - P2P, anonymous and irreversible payment methods perfectly fit the needs of criminals.

Fraud:This is the largest form of crime by volume, with victims losing $7.7 billion worth of tokens to fraud in 2021. In addition to the traditional forms of online fraud, the encryption world has also evolved new scams such as Rug Pull (DeFi or NFT project parties abandon the project and run away with money) and Ponzi collapse.

Dark web transactions:Online black markets such as Silk Road are the most typical examples. Criminals trade drugs, stolen credit cards and even pay for murder on these platforms, and Bitcoin is a common means of payment. Such transactions generated more than $2 billion in stolen cryptocurrency in 2021.

blackmail:Criminals will send emails or ransomware to victims, using their fear to force them to pay a ransom to protect privacy or redeem control of their computers. In 2021, ransomware generated $600 million in stolen money in the crypto world.

Terrorist Financing:This includes funding terrorist organizations in the form of cryptocurrencies. For example, the most funded team in 2021 is the Palestinian armed group Hamas, and in previous years there were ISIS, Al Qaeda, and Malhama Tactical.

Child Pornography:Cryptocurrencies such as Bitcoin are one of the mainstream payment methods for obtaining indecent videos of children.

Funding by sanctioned countries:image description

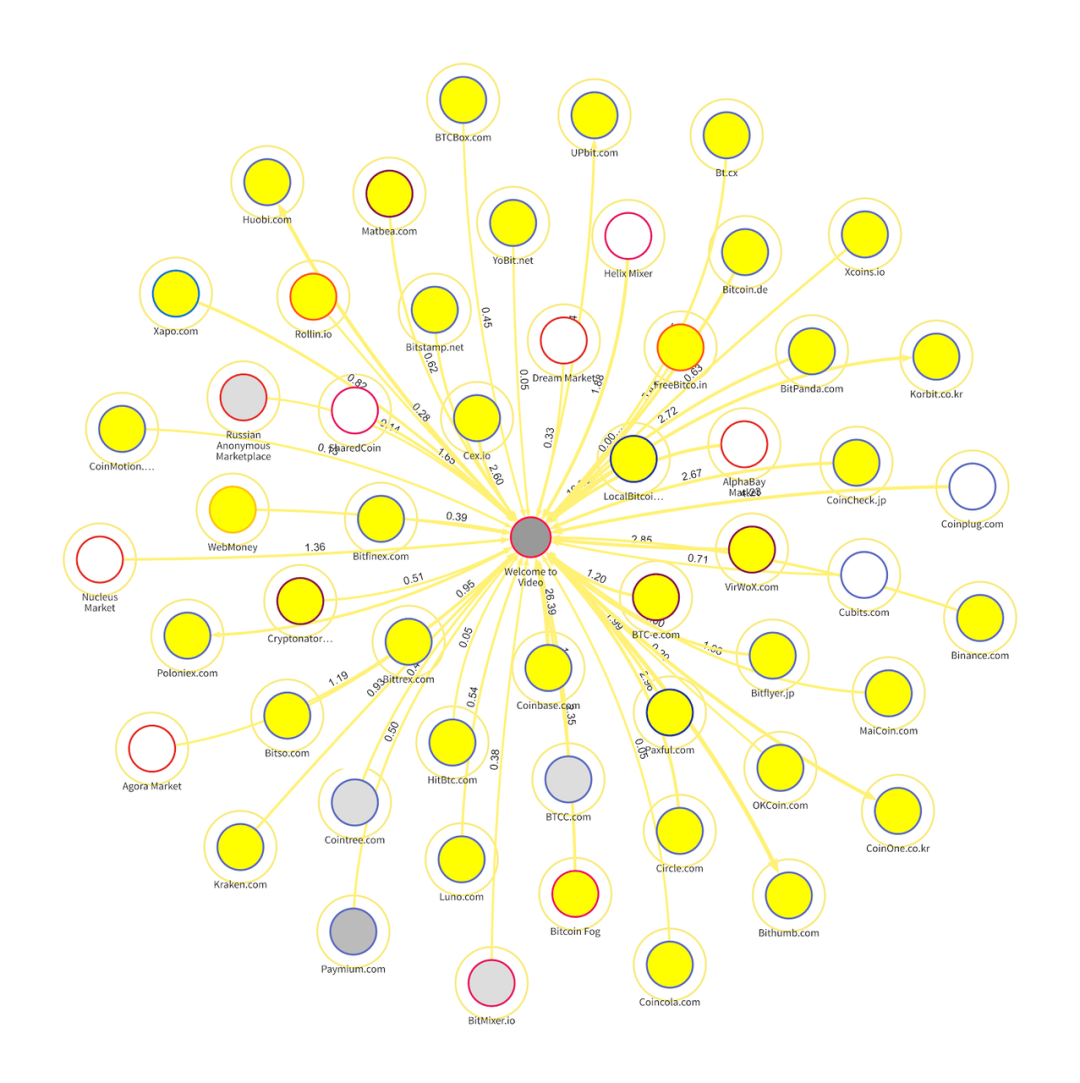

Chainalysis Reactor Helps Law Enforcement Analyze Money Flows in and Out of On-Chain Addresses for Child Porn Site Welcome to Video

Also covers Crypto-native questions:

Pirates:This includes information theft, clipboard attacks, and Trojan horse software to steal the other party's private key, and also includes invading the other party's computer in the form of Cryptojacking to mine for profit. This not only threatens individual currency holders, but also institutional currency holders such as centralized exchanges, DeFi protocols, cross-chain bridges, or funds locked in contracts. Over $3 billion in tokens will be stolen in 2021 alone.

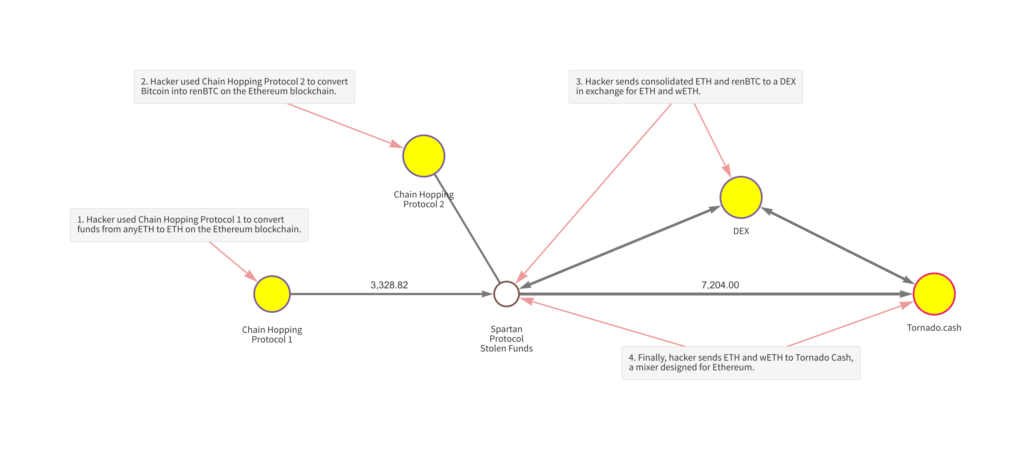

image description

In 2021, $30 million was stolen from Spartan Protocol, and the perpetrators laundered money through DEX and Tornado.cash mixers

In the early days, these illegal activities made up the vast majority of use cases for cryptocurrencies. But as more financial services use cases and even Web3 narratives emerge, the crypto ecosystem is coming into the light, and these dark side use cases are inhibiting its mainstream development - exchanges have long been unable to open accounts with banks due to compliance relations , financial institutions worried that embracing cryptocurrencies would damage their reputations, and regulators and law enforcement agencies have been helpless against the new technology for a long time.

Ribbit Capital partner Sigal Mandelker is a regulator and enforcer who has seen the process firsthand. After joining the U.S. Treasury Department in 2016 as undersecretary, some of her responsibilities include curbing North Korea's weapons of mass destruction and Russia's terrorism.

She observed that cryptocurrencies are playing an increasingly important role in these behaviors, but for a long time, only a few countries such as the United States, South Korea, and Japan have perfect regulations, and the financial review capabilities of many regions have hindered her work. , and RegTech represented by Chanalysis can complement everyone's capabilities, allowing the encryption ecosystem to promote the inclusiveness of financial services and humanitarian assistance.

03. Origin: Make prosecutors more willing to choose encrypted cases

The Mt.Gox thunderstorm is a turning point event that shaped today's encryption ecology. Its influence is no less than the earthquake triggered by Terra/UST in 2022. It has given birth to the awareness of self-hosting and RegTech companies such as Chainalysis.

Teacher Min Dao, the founder of dForce, described the incident on Twitter as follows:

Mt. Gox was the largest Bitcoin exchange in the world between 2010 and 2013. At its peak, its transaction volume accounted for 70% of the world. Today, the top 10 in the world combined (concentration) is not as large as it. It filed for bankruptcy in February 2014. During the three-year period, it lost 850,000 bitcoins and only recovered 200,000. Nearly 650,000 bitcoins were lost (the current market value is 20 billion U.S. dollars), and the exchange entered bankruptcy liquidation. Mt.Gox users basically cover more than 50% of the bitcoin players in the world, and many of them have lost their fortunes.

The CEO of Chainalysis, Michael Gronager, joined Kraken, the most security-oriented exchange in the United States, as COO in April 2013. Bitcoin rose from $10 to $1,000 that year.

Then the bankruptcy of Mt. Gox happened.

Michael Gronager still believes that the cryptocurrency represented by Bitcoin is the most transparent financial system ever, but it was almost synonymous with hacking, online drug trafficking and terrorism at the time. He spoke to banks and regulators in the U.S., Europe, and Asia to discover their pain points in monitoring transactions, understanding the movement of funds, and investigating cases. He decided to leave Kraken to work on solving these pain points.

On the flight back to Europe from Kraken's San Francisco office, he wrote 50 lines of code and completed the initial Proof of Concept of Chainalysis.

The key to the establishment of Chainalysis's PoC lies in the pseudo-anonymity and transparency of Bitcoin.

In the cash scenario, you can submit a SAR (Suspicious activity report) to those who walk into the bank with a sack of money.

In the digital payment scenario, there are established manufacturers such as ComplyAdvantage and emerging companies such as Unit 21 serving anti-money laundering scenarios. They can access various AML rules for customers' transactions and allow them to customize their own rules. At the same time, they often provide a Case Management system to handle risk warnings and submit SAR.

In cryptocurrencies, the difficulty of anti-money laundering is somewhat lower-most criminals don’t really trade drugs for a sack of money at the bank door, once they hide behind the wall and trade, it’s very difficult for you Monitor money laundering operations. The distributed ledger technology used by BTC and mainstream cryptocurrencies allows us to have a "perspective eye", because each address on the chain and their transaction records are open and permanent, and suspicious transactions, darknet Information such as the transaction address, its associated addresses, and the KYC record of an address on the exchange can help us link the address on the chain with the corresponding entity.

Then he found his own CTO Moller, built the underlying database and API in January 2015, and then outsourced a version of the UI. When the above series of work is completed, the first display object of the Chanalysis demo is Katie Haun. She was the deputy attorney general for the Northern District of California and was working with two FBI agents on a cryptocurrency-related case.

Chainalysis was deeply involved in the investigation of this case, which allowed it to understand at an early stage what kind of product regulators and enforcers needed. In addition, Chainalysis was also a member company of Techstars, an accelerator program of Barclays Bank, which allowed the team to understand the thinking of financial institutions on Day One.

Then Chainalysis participated in the theft of Mt. Gox. Michael Gronager met the other founder of the company, Johnason, in the process, and became famous again for finding the whereabouts of these lost bitcoins in 2017.

Having a tool like Chainalysis changes the way prosecutors and agents approach cryptocurrencies, as Sigal Mandelker told Wharton FinTech:

Suppose there are 3 money laundering cases for prosecutors to choose: cash, shell companies plus offshore bank accounts, and cryptocurrencies. Generally speaking, they would prefer to choose money laundering cases in cryptocurrencies.

04. Product: Create a product matrix based on data advantages

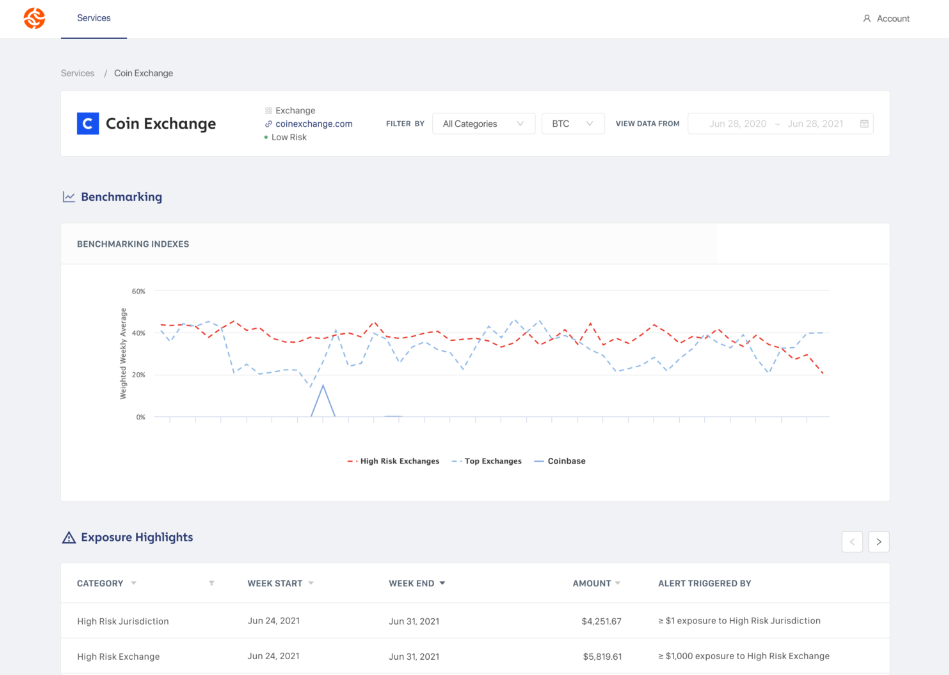

Chainalysis started with retrospective analysis of Reactor for law enforcement investigations. With customer expansion and in-depth customer management stacks, it currently has 5 products, which not only cover compliance and risk control scenarios, but also can be used in business scenarios.

Overall, we believe that Chainalysis's product development process and strategic choices have the following characteristics:

With the underlying data assets as the core:The primary use of funds emphasized by Chainalysis after recent rounds of financing is to strengthen data advantages. This is mainly because the new data in the encrypted world is large in magnitude and time-sensitive, and some data may no longer be valid after a few months. Therefore, Chainalysis requires continuous investment in data assets (especially those that are relatively long-lasting);

Keep up with the evolution of the multi-chain era:Chainalysis focused on Bitcoin in the early days, and new public chains such as Ethereum introduced smart contracts, which increased the difficulty of analyzing transaction execution addresses, and their account system was also very different from Bitcoin's UTXO design. Chainalysis has not fallen behind in the evolution of the multi-chain landscape, and is still actively providing customers with multi-chain panorama capabilities;

Actively adapted to various on-chain innovations:The methods of criminals are not static, and often follow the evolution of innovations on chains such as DeFi, NFT, and cross-chain bridges. Chainlysis has actively adapted to this innovation, and can help its exchange customers list coins faster by identifying the risks of assets on the chain;

Continuously drill down into the customer's business stack:Compliance is a cost to many private companies just to meet regulatory requirements. Chainalysis is trying to make itself a cost item and an investment item at the same time, deeply participating in the daily operations of enterprises through new industry analysis and business data analysis tools.

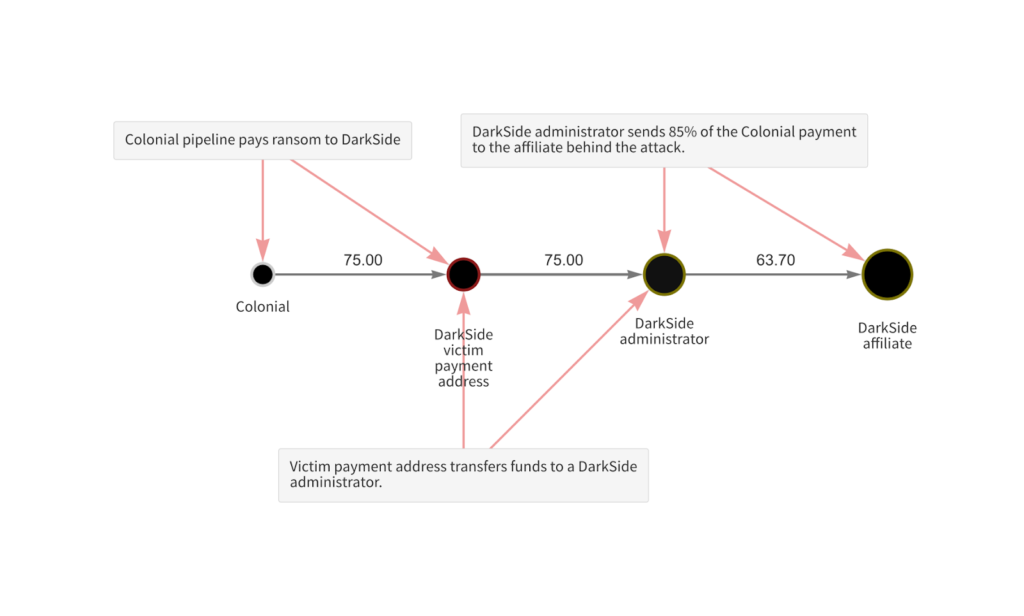

Case: Chainalysis helps FBI recover Colonial ransom

We can first use a case to understand how the law enforcement investigation capability provided by Chainalysis works.

On May 7, 2021, Colonial Pipeline, an oil pipeline systems company in the United States, was hit by a ransomware attack and was forced to temporarily suspend operations. Within hours of the attack, Colonial paid a ransom of 75 bitcoins (worth about $4.4 million at the time) to Russian cybercriminal group DarkSide. But Colonial didn't resume operations until six days later.

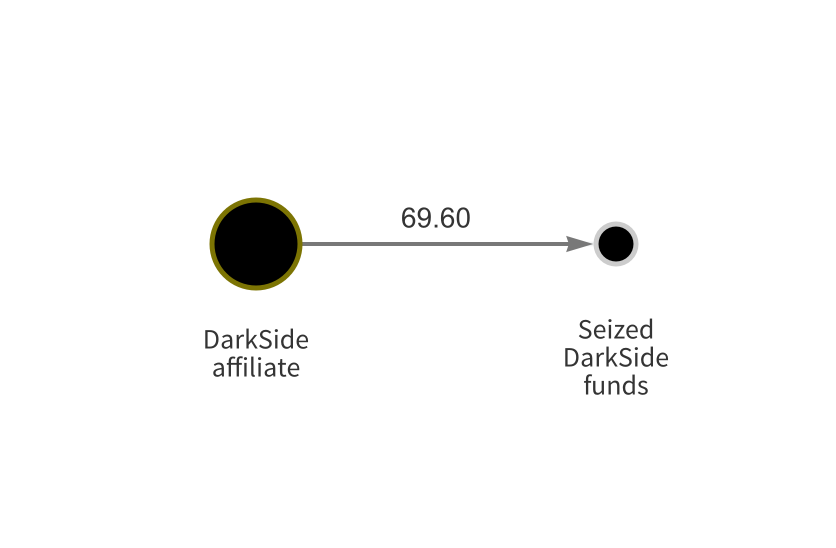

Chainalysis helped the FBI recover $2.3 million worth of Bitcoin from Colonial's ransom.

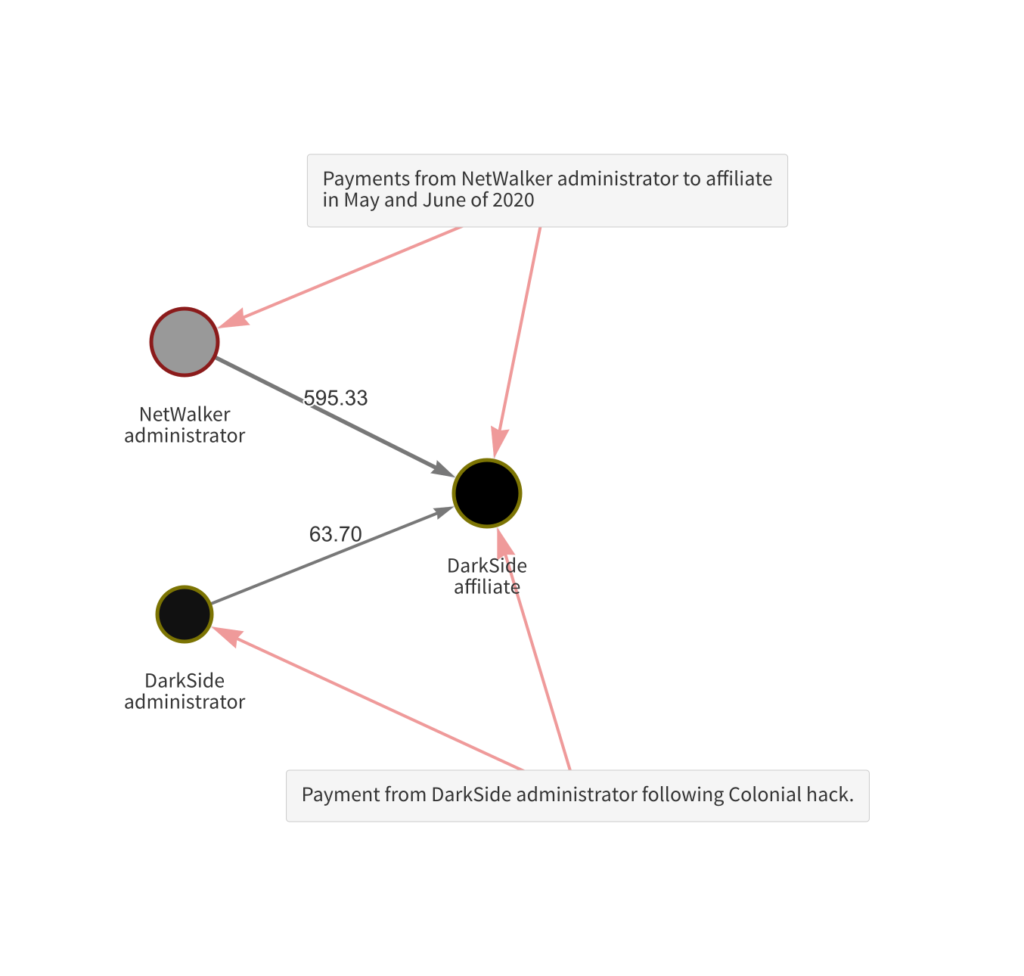

The specific fund tracking process is as follows, FBI agents can see a similar fund flow chart in Chainalysis Reactor:

Colonial first transferred 75 bitcoins to the address provided by the attacker. The stolen money was then transferred to the DarkSide admin's address, and the admin only transferred 85% of the stolen money (ie 63.7 bitcoins) to DarkSide affiliates. This split of the spoils means that DarkSide offers RaaS (Ransomware-as-a-Service), and the affiliate uses its technology to carry out the attack.

And the address of this DarkSide affiliate has received payments from NetWalker related addresses. NetWalker, another RaaS software, was taken down by law enforcement in January 2021. This provided a lead to FBI agents who seized the stolen money on May 28, 2021.

Matrix expansion: Gradually penetrate into the customer's business links

The launch of Chainalysis's current several products has obvious chronological and strategic considerations:

The oldest and core Chainalysis Reactor

The products Chainalysis sold from 2015 to 2018 were basically Reactors. Until 2018, 90% of the team's revenue came from law enforcement agencies. This is mainly because Reactor provides retrospective analysis of transactions, so the purpose of early customers using it is mainly to investigate existing cases.

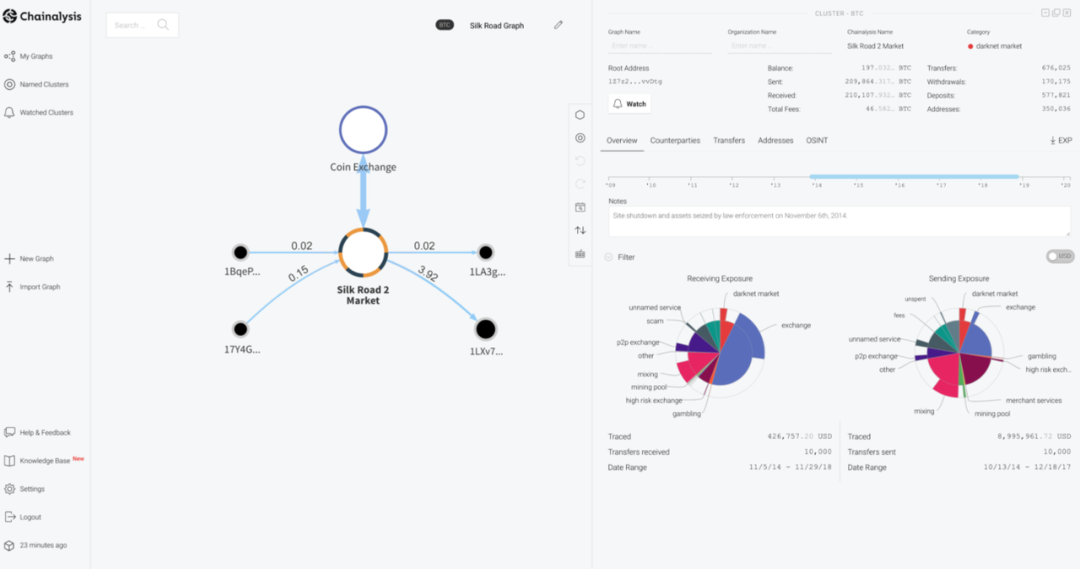

Reactor can be seen as a "visual blockchain map" or an "enhanced version of on-chain due diligence product". The child pornography site Welcome to Video and the Colonial extortion case we showed above are typical use cases for it.

The bottom layer of this product is the Chainalysis data set, which includes the public data on the chain, the real-world label data obtained by Chainalysis (combining the addresses on the chain with the dark web, scammers, ransomware, DeFi platforms, mining pools and other legitimate or non-legal entities) and the output of its machine learning model.

Reactor is a simple and easy-to-use product. Chainalysis has maintained the simplicity of the product in the past few years, and added capabilities related to on-chain innovation such as cross-chain survey charts and DeFi activity monitoring.

Get Chainalysis KYT for enterprise customers

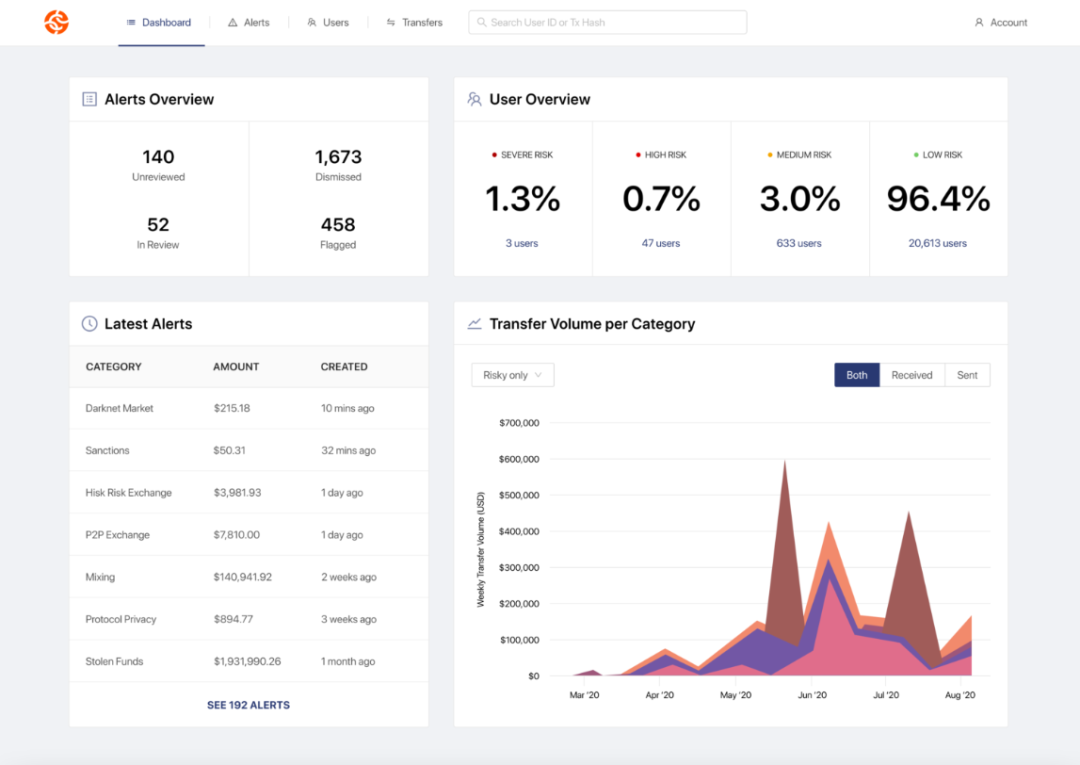

Chanalysis KYT is largely similar to anti-money laundering transaction monitoring software in the traditional world. It provides a web-side panel and an API for real-time monitoring of transactions, which can help customers automatically comply with local and global anti-money laundering regulations and sanctions lists, track fund movements and expose risks.

This product was launched in 2018, and soon became a large-scale Go-To-Market. At that time, it was mainly for exchanges and stablecoin issuers, and signed head customers such as Binance and Paxos at a very early stage. This helped to improve Chainalysis' client mix, reducing revenue from government clients to 40%.

Like the new generation of anti-money laundering software such as Unit 21, Chainalysis KYT is more flexible and supports customers to customize their own rules for high-risk activities. For example, gaming companies may be considered illegal and high-risk in some regions, but not in other regions. is legal.

The bull market in the second half of 2017 was an important driving force for the development of this product. Chainalysis co-founder Levin said at the time:

In 2014, the user base of the exchange was very small. They can manually formulate rules and review them. But they are now attracting more new users per week than all of them were then, so they need to use automated moderation tools for millions of users. And it's real-time, no need to wait 30-45 minutes.

Many customers will purchase Chanalysis Reactor and KYT at the same time. For example, Dapper Labs uses KYT to mark illegal and high-risk transactions in real time, and uses Reactor to query and investigate certain special transactions. And once these customers use KYT, Chainalysis can further strengthen its own data advantages through their transaction data.

Kryptos built for financial institutions

In addition to the above two core compliance products, Chainalysis launched Kryptos in 2020, expanding its products that can be cross-sold - its existing banking and asset management customers are often not so familiar with the cryptocurrency ecosystem, so Chainalysis Kryptos provides them with intelligence on the entire market, including various situations of the market, counterparties and specific assets, and helps these customers establish a compliance and risk control framework around cryptocurrency services.

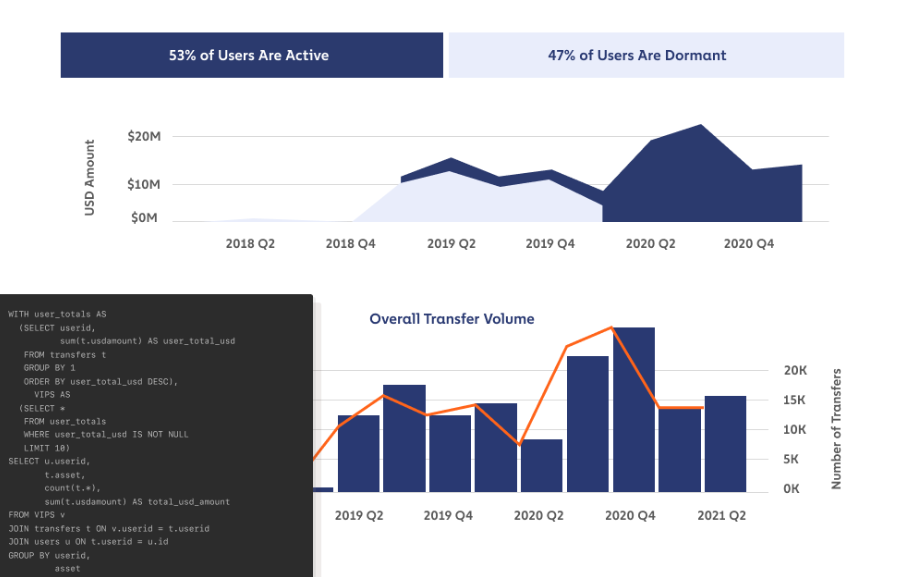

Entering Market Intel and Business Data in business scenarios

These two products are newly launched by Chanalysis in 2021, and have entered daily business scenarios from compliance scenarios.

Market Intel helps customers make investment decisions by providing more transparent and visualized market data, while Business Data is similar to enterprise BI, trying to answer questions such as new customer target groups, asset price strategies, channel analysis and judgment, and customer destinations for customers.

Chainalysis Business Data can be integrated into the customer's data warehouse as a data source to help customers gain a deeper understanding of user behavior. On this basis, Chainalysis also provides expert services from data scientists to assist clients in their analysis.

Phoivos Mytilinaios, head of business intelligence and data engineering at European digital asset platform Bitpanda, said:

Chainalysis' data-driven offerings also extend beyond compliance, and they will help us develop marketing and product development strategies to grow and retain our customer base.

This is a more imaginative piece of business that will determine whether Chainalysis is just a RegTech company or whether it will become a cryptocurrency enterprise OS-level product-cutting into more customer budget categories. We look forward to observing more business progress to judge the breakthrough of Chainalysis in this field.

Fee Model: Government Contract and Recurring Revenue

We did not get the detailed data room of Chainalysis, but this type of chain data service company mainly charges customers through usage billing such as guaranteed annual fee and API calls. Chainalysis mainly serves government services and large enterprise customers. The corresponding solutions are often more complicated, and the overall charging model will not be single.

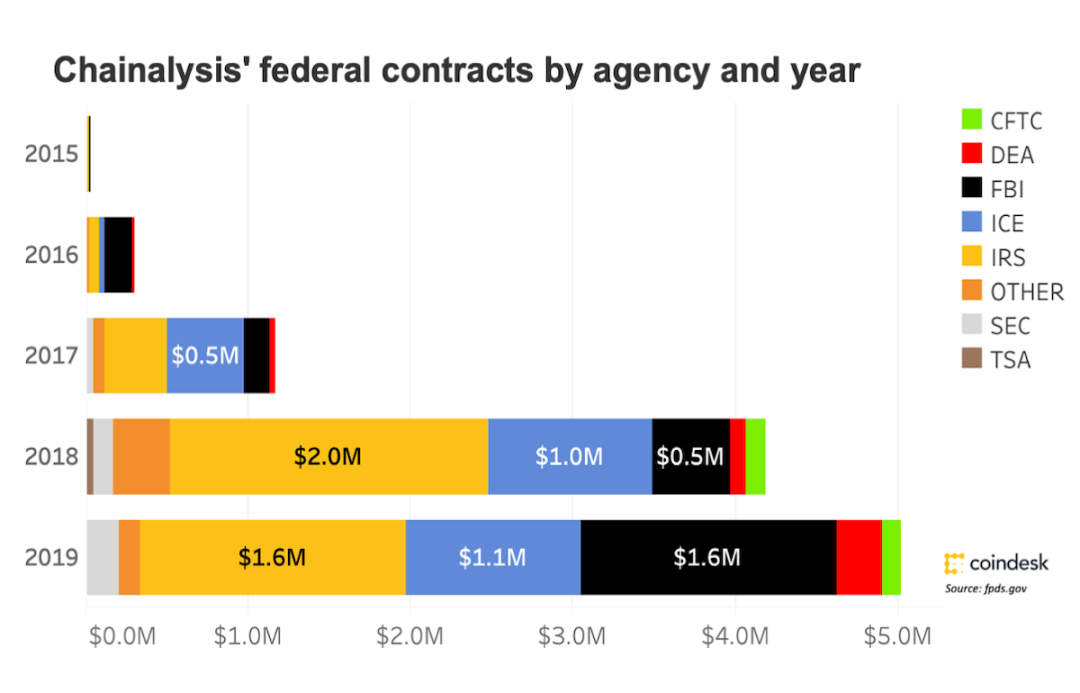

In terms of the nature of income, Chainalysis has To-G attributes, so it has contract income and recurring software income. Revenue contributed by non-government customers has improved significantly from 2019 onwards.

According to Forbes estimates, Chainalysis had approximately US$8 million in revenue in 2018, and the founder's expectation at the time was to double every year. But due to the violent bull market in 2021, it already has more than $40 million in ARR in 2020, and its ARR in 2021 is likely to exceed $100 million.

Chanalysis has raised a lot of money in this bull market, maintaining a rhythm of raising a round of US$100 million almost every quarter since the fourth quarter of 2020, and its valuation soared from US$1 billion at the end of 2020 to US$8.6 billion in 2022 .

Chanalysis was not profitable until the end of 2020. But the CEO said at the time that the company's burn rate was extremely low and it would be profitable soon. It's unclear whether subsequent funding has changed his mind, as Chainalysis has grown from 200 employees at the time to the currently planned 700.

05. Customers: From the government to various private enterprises

Chainanlysis has built solutions in the directions of investigation, compliance, DeFi, NFT, etc., making its customer composition very diverse. It currently has 750 clients in 70 countries, with 150 clients contributing over $100,000 in ARR.

image description

Coindesk counts public government orders, which largely underestimates the actual contract value of Chainalysis

Chainalysis's early home has always been Europe and the United States, and signed Europol in 2016. It began to make efforts to enter the Asia-Pacific market in 2019, accepting a strategic investment from MUFG Innovation Partners, a subsidiary of Japan's largest Mitsubishi UFJ Bank. After the last round of funding, Chainalysis disclosed that both revenue and the number of customers in the Asia-Pacific region will more than double in 2021.

Its second largest customer base is FinTech and Crypto-Native companies, including Gemini, Paxos, Bitstamp, Bitpay, Dapper Labs, Robinhood, and Square, among others. From its product expansion path, Chainalysis is trying to use the Land and Expand strategy to extract more value from these customers.

Finally, Chainalysis's fastest-growing customer base is financial institutions, which has grown by 200% in the past year to more than 100, including Cross River Bank, NYC Mellon, Barclays and other large banks or crypto-friendly banks that have entered the crypto ecosystem. Chainalysis facilitates the interaction between Crypto-Native companies and the entire traditional financial system, and promotes these companies to comply with anti-money laundering requirements while promoting them to open accounts.

Chainalysis' customers are mainly enterprise-level, and some of them can be counted as Mid-Market. Its expansion in the SMB field mainly relies on other software partners, which is also the mainstream practice in the SaaS field. Companies such as Fireblocks and Sardine that we have studied have chosen to cooperate with Chainalysis KYT when providing anti-money laundering solutions to their customers. The Partnership Program officially launched by Chainalysis in April 2020 confirmed this idea, and it already had more than 50 partners in March 2021 to help distribute its products.

06. Competition: Chainalysis enjoys the Matthew Effect

Because of the professionalism of data assets and services on the chain, Chainalysis’s business is unlikely to be established by the government itself. Its current direct competitors are mainly other third-party professional service providers:

TRM Labs: TRM focuses on serving financial institutional clients. It only started in 2018. It has historically been supported by large financial investors such as BVP and Tiger Global, and has attracted JP Morgan, Amex Ventures, Visa, Citi Ventures, Jump, PayPal Ventures, Salesforce Strategic investors such as Ventures (but the founder of Salesforce invested in Chainalysis), currently signed clients such as Uniswap, Circle, FTX;

Elliptic: Elliptic and Chainalysis started almost at the same time, but they chose to do the compliance scenario of private companies first, and then seek to cut into the government's law enforcement scenario, which is just the opposite of Chainalysis's path. It subsequently also participated in the investigation of Mt.Gox, but its performance was not as impressive as that of Chainalysis. At present, Elliptic has signed clients such as Revolut, Stellar and Spanish banking giant Santander;

Coinbase Tracer: Coinbase Tracer packs a series of capabilities of Coinbase Intelligence and compliance, which can provide capabilities similar to Chainalysis Reactor and KYT, but the scale and volume of Go-To-Market is not large, and it has not shown a particularly strong social determination;

……

On the whole, this track is currently a little crowded, but it presents a pattern of one superpower and many strong ones — whether it is capital reserves, customer resources or data accumulation, Chainalysis has obvious advantages.

Similar to our observations in Metamask, Fireblocks, MoonPay and other cases, the market leader in the encryption ecosystem can enjoy a strong Matthew effect. Chainalysis is now almost synonymous with encryption compliance, and has become an industry standard to some extent. It has the most authoritative clients, can publish the most influential reports, and has become a reference for major mainstream media when citing encrypted data.

According to the CEO, Chainalysis has a lot of cash in its account and may choose to acquire some players in the industry with synergistic effects.

07. Conclusion: Excessive valuation and cycles in the crypto world are the biggest investment obstacles

The period of technological change or the period when technology begins to have an impact on the real economy is a good time to invest in security companies. Several companies with good development in the secondary market made cloud security products when everyone was betting on cloud computing, such as Zscaler, Cloudflare, and Okta around 2008.

Cryptocurrency and cloud computing may not be a perfect analogy, but the nature of Chainalysis is indeed similar to the security company of the year.

Similar to Fireblocks, which we are optimistic about at the business level, Chainalysis is our favorite type of company-essentially SaaS, and its customers are the fast-growing encryption ecosystem. However, due to the excessive valuation and the cycle of the encryption world, the $8.6 billion Chainalysis can hardly be regarded as an attractive opportunity.

Its latest valuation of US$8.6 billion reflects the very strong confidence of other investors (or GIC) in the market-even if it is based on a 22-year ARR of US$200 million, it still enjoys a Forward of more than 40x EV/ARR Multiple. According to FACTSET data, the current 22-year Forward EV/Revenue Multiple of the best high-growth SaaS companies such as Snowflake, Datadog, and Crowdstrike does not exceed 20x.

The most optimistic expectation for Chainalysis is this: the governments of the Asia-Pacific, the Middle East, Latin America, and Africa are willing to spend similar budgets as the US government to combat illegal activities on the chain within five years. If it is successful and the old product can still maintain a strong NDR, then investors can still expect a return of 3-5 times at a valuation of US$8.6 billion.

Original link