The U.S. inflation rate reached 9.1% in June, and may usher in faster interest rate hikes

Original Author: Ying Yiru

Compilation of the original text: Wang Li

Original source: Wall Street News

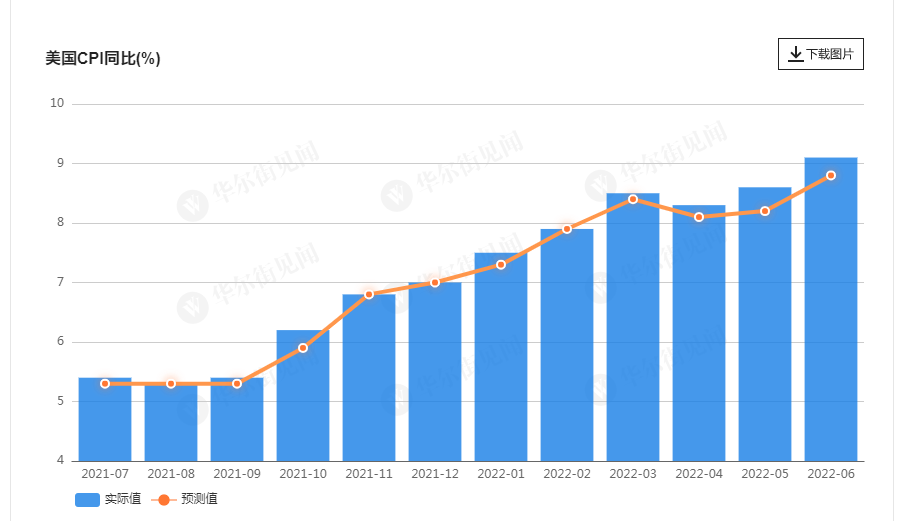

Data released on Wednesday night showed that the U.S. CPI rose 9.1% year-on-year in June, beating market expectations of 8.8%, the highest growth rate since 1981.

first level title

01

text

On July 13, the U.S. Department of Labor released data showing that the U.S. CPI in June was 9.1% year-on-year, compared with an expected 8.8% and the previous value was 8.6%. The core CPI in the United States in June was 5.9% year-on-year, expected to be 5.7%, and the previous value was 6%.

The CPI increased by 1.3% month-on-month, the highest since 2005, and increased by 9.1% year-on-year, the largest increase since the end of 1981.

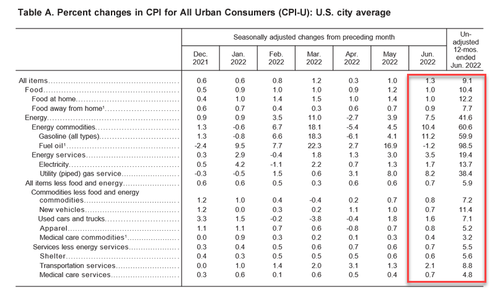

Prices for goods rose broadly across the U.S., with gasoline prices up 11.2% from the previous month, far outstripping other categories, even though gasoline prices have been falling in recent weeks. Prices for energy services, which include electricity and natural gas, rose 3.5%, the biggest increase since 2006.

The Labor Department also said rising housing and food prices were also major contributors to inflation. Food costs rose 10.4% year-over-year, the biggest increase since 1981. Primary dwelling rents rose 0.8% from May, the largest monthly increase since 1986.

first level title

02

Or usher in a faster rate hike

Inflation in the United States accelerated faster than expected in June, and price pressure was huge. The Fed may raise interest rates again later this month. A 75 basis point rate hike in July is already a "basic setting." The market now believes that the probability of raising interest rates by 100 basis points has reached 30%.

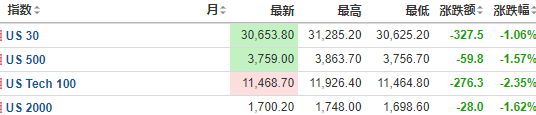

European and American stocks and bonds all plunged, the US dollar rose in the short term, and gold weakened sharply.

Affected by expectations of interest rate hikes, U.S. stock index futures plummeted. As of press time, the Nasdaq futures fell more than 2%, the S&P 500 futures fell 1.6%, and the Dow futures fell more than 1%.

The U.S. dollar index rose by about 50 points in the short term and is now at 108.49.

Spot gold has a short-term dive and is now at $1,712.35 an ounce.

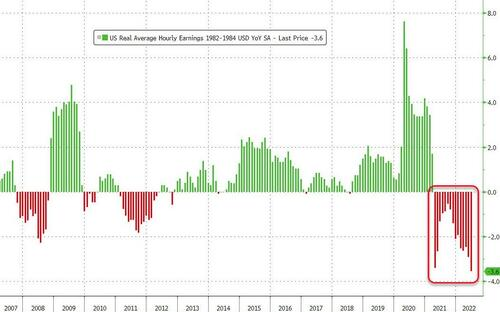

Inflation data reaffirmed that price pressures are pervasive across the economy and continue to undermine purchasing power and confidence.That would keep Fed officials on course to take a policy approach to rein in demand and add to pressure on U.S. President Joe Biden and congressional Democrats, whose approval ratings have fallen sharply ahead of the midterm elections.

While many economists believe this figure will be the peak of the current inflation cycle, several factors, including housing and gasoline, will keep price pressures elevated for longer.

Fed policymakers have signaled a second rate hike of 75 basis points later this month amid persistent inflation and still strong job and wage growth.Even after the release of the US CPI, the swap price showed that the market expected the Fed to raise interest rates in July by 79 basis points.

Previously, Jianwenjun pointed out that this year's U.S. inflation data is crucial, because it determines the Fed's future interest rate hike path. Although the overall situation of the Federal Reserve raising interest rates by 75 basis points in July has been determined, there are still variables in the rate hike situation after the meeting. Fed officials have said the pace of rate hikes could be slowed to half a percentage point after July, but they want to see convincing evidence that inflation is slowing before moving to a more traditional 25-percentage-point hike.

Ed Yardeni, president of Yardeni Research, expects inflation to be in line with the average forecast of economists. Regarding the June CPI data, he said that "bad news" will come again, and inflation will hit a new high. Lower-wage workers, the class most squeezed by inflation, have no choice but to allocate the bulk of the budget to necessities such as "food, fuel and rent". Higher-paid workers are also squeezed by inflation, but they likely have more savings and can cut back on discretionary spending at any time, which has contributed to the recent weakness.

Omair Sharif, founder of Inflation Insights, said,"If June is the start of lower core CPI numbers, then that's what the Fed would like to see, and I think Fed officials' commentary will quickly shift to a 50-basis-point hike in September, with more calls Slowing down to a 25 basis point rate hike later."

Wall Street Journal reporter Nick Timiraos, dubbed the "New Fed News Agency," said,The housing sector can provide more impetus to inflation, so prices in other sectors need to fall significantly, to see a decline in overall U.S. inflation. Rising housing costs will keep inflation high this year, presenting a challenge for Fed officials as they want to see signs that price pressures are easing before slowing the pace of rate hikes.

Original link