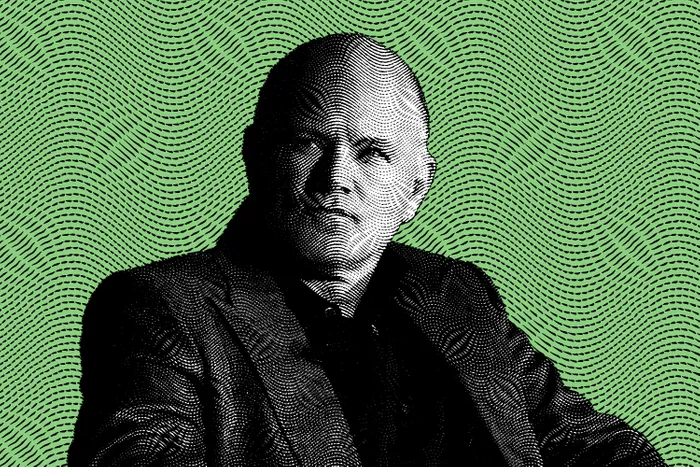

Interview with Mike Novogratz: What mistakes did Galaxy Digital make in this bear market?

This article comes from|nymagOdaily Translator |

Odaily Translator |

Mike Novogratz used to be a senior traditional hedge fund manager, but his real success came after he entered the encryption industry. As the CEO of Galaxy Digital, a blockchain investment company, Mike Novogratz established his reputation and reputation in this field .

When the billionaire was asked what he was most interested in, Mike Novogratz said bluntly that LUNA was his favorite Token. In January 2022, when the price of LUNA soared to $100, Mike Novogratz couldn't hide his excitement. He tattooed a wolf howling at the moon tattoo on his arm to express his excitement.

However, who would have thought that in less than half a year, LUNA staged an "epic-level return to zero", and the market value of 50 billion US dollars evaporated instantly. As a former super fan of LUNA, Mike Novogratz couldn't hide his frustration when talking about the crash, and he didn't want to mention the past of being a LUNA platform. However, it is also fair to say that when the cryptocurrency skyrocketed last year, Mike Novogratz did remind the crypto upstarts to be cautious, and suggested that they can appropriately set aside part of their funds to buy real estate instead of dumping money in the crypto market. out of the bag.

It's not just LUNA, in fact, Galaxy Digital has suffered a lot from the downturn that has engulfed the entire cryptocurrency market, and of course, Mike Novogratz himself has not been spared (BTC's price fell from a high of nearly $70,000 to $20,000 in recent days. U.S. dollars, while ETH, the second largest cryptocurrency, fell directly below $1,000 after reaching a high of nearly $5,000, and Mike Novogratz's net worth has also shrunk significantly).

In addition, in this wave of crashes, DeFi is also one of the most affected vertical fields. For example, Celsius, an encrypted lending platform, is one of them. Services for withdrawals, transactions and transfers between accounts.

It is no exaggeration to say that the crash in 2022 caused heavy casualties to a large number of cryptocurrency funds and gradually spread to the entire industry. This reminds people of the impact of the 2008 financial crisis on Wall Street, and history seems to be repeating itself before our eyes.

secondary title

Q: A lot of people will say in hindsight, "We told you that cryptocurrency is a scam." But is that true?

A: I have to say that you have to look at things objectively. If you bought Zoom stock or BTC when the new crown epidemic first started, then the money you made through BTC has doubled by today, but Zoom will make you nothing. I think maybe that's what people don't understand.

In fact, for many asset classes, we hope to gain benefits through speculation, but we must first learn to distinguish the good from the bad, and don't waste food because of choking. When we want to throw away something we don't want, remember not to lose its valuable that part.

Therefore, I think that as a macro asset, BTC will not disappear, and Web3 will not disappear either. On the contrary, in the future, we will spend more time in the metaverse, and the platform will continue to sell digital assets, and for digital assets to have value, they must be unique, and this must be built on the blockchain basically.

That being the case, is there still controversy over the crypto ecosystem? The answer is of course yes, because this is a very amazing mechanism. Once you own a token in a certain ecosystem, you can get benefits from people who also buy the token, and these people in the same ecosystem It's like forming a tribe.

secondary title

Q: How do you see this cryptocurrency crash, is it different from the past - like 2018 or 2014? How do you understand this?

A: Like Beauty and the Beast theme song "Tale as old as time", obviously, these assets that we have are in a bubble, but when it crashes, you always find people Added a variety of strange and a lot of leverage. And even if you know that many people have increased leverage, you still don't want to believe the fact that those people are actually gambling when it crashes.

secondary title

Q: Do you think cryptocurrencies are not bad? Why is there such a conclusion?

secondary title

Q: Are you still worried about cryptocurrencies now? We know that some recent black swan events in the crypto industry have caused ripple effects, such as Triple Arrows Capital, and it seems that they have collapsed and have wider effects.

A: I think people at least understand what's going on, time will sort it out, they're either going bankrupt or they're being sold. Just like after 2008, in the financial industry, we Lehman claims, hedge funds and their assets were acquired, and a similar situation will happen in the encryption industry.

But probably everyone's biggest worry is whether or not the stablecoin Tether is going to crash, and all I can say right now is that you don't need to worry too much, Tether is pretty stable for a lot of different reasons (although they're not as much as we'd like) transparency – after all, everyone wants more transparency).

secondary title

Q: Coinbase seems to be in trouble recently. People have been worried that the company may go bankrupt. Do you think this is also a threat to the encryption industry?

A: Coinbase has a lot of cash on their balance sheet, but they also have a lot of expenses. So, my guess is that Coinbase CEO Brian Armstrong is going to lower payouts a lot over the next quarter or two, they have a great brand. However, I think Coinbase is now facing one of the worst problems: some traditional big conglomerates want to buy them.

secondary title

Q: The scary thing about this crypto market crash is that some companies or protocols that have failed are held in high regard in the industry. Of course there's Luna, and Celsius, a multibillion-dollar company with relatively generous interest payments for consumers, do you think you see that?

A: Relatively speaking, I am more worried about the macro environment. I hope Bitcoin stays in the $30K-50K range, Galaxy Digital has not invested in any credit protocols like Celsius, although previously invested in their competitor BlockFi, we exited over a year ago, Because I am not optimistic about this business model. Of course, Galaxy Digital sometimes plays the role of a large investor, such as on Terra, but actually scales down the holdings ahead of time - which is what we do in most cases.

secondary title

Q: Is DeFi over too? Will this market crash raise more questions?

Answer: To some extent, regulators will enter the market. Celsius and BlockFi are like black boxes for investors to invest in funds, but they are not actually blockchain decentralized financial systems. Investors don’t know what leverage is. Unless you're behind the scenes. You also don't know about their balance sheet mismatch, short-term borrowing versus long-term borrowing, which is why you die suddenly in the market. A similar situation also happened to financial service companies such as European banks, Lehman Brothers, and Merrill Lynch in 2008. They adopted excessively high leverage ratios in the bull market and thought they were geniuses. In the end, everyone knows what happened.

secondary title

Q: So, will the Luna incident that Galaxy Digital has experienced this time, and the market crash, change your investment approach in the future?

A: The market will judge me, Galaxy Digital is actually doing well, if you look back to 2022, we sold some private equity and venture capital, took a lot of chips off the table, but also left a lot of chips. If I was smart, I'd sell more and take more chips, but it's hard not to be hard on yourself as a trader. If you've been in this business for 30 years, you don't want to lose.

secondary title

Q: Seems like a good time to make money if you're short. Are you already short, or are you considering shorting?

A: Galaxy Digital has never been purely short, otherwise I would have a bigger smile on my face now. Investors trust us and invest in us to be long crypto and make us good risk managers, and as I said before, I hope the bear market doesn't last too long, although we did sell a lot.

secondary title

Q: Is there anything you would avoid completely? Such as pledged ETH or algorithmic stable currency, such as the Terra token whose value is basically zero now?

A: To be honest, Galaxy Digital has never really participated in algorithmic stablecoins, we watched but did not participate. We're not betting on ETH, but I do think that staking ETH is going to be big business. So my feeling is that Galaxy Digital will be in this business in the future.

secondary title

Q: So, you think it's kind of like a crypto recession right now?

secondary title

Q: So how serious do you think it will be and how long will it last?

secondary title

Q: Who do you think is responsible for the current encryption crisis?

A: You can blame the Fed, you can blame the new crown virus, of course, these are all jokes, these factors just make the bubble dissipate faster. In fact, the root of the problem is that many people are using too much leverage, and they are suffering tremendously. Last year, BlockFi raised money at a $5 billion valuation and Celsius was valued at more than $3 billion, but now, those who leveraged too much have paid the price.