USDC is chasing USDT fiercely, and the stablecoin market pattern is quietly changing

This article comes from |Decrypt, original author: Stacy Elliott

Odaily Translator |

This article comes from |

Odaily Translator |

In the past two months, all the signs in the encryption market have undermined investors’ beliefs: the collapse of the Terra stablecoin UST, the run on the cryptocurrency lending platform Celsius, and the liquidation crisis of the encryption hedge fund Three Arrows Capital, etc.

As the prices of various tokens plummet, cryptocurrencies are entering a new round of winter. Under the general bearish sentiment, in order to avoid losses, investors are more willing to exchange part of their gains in the bull market into stable coins to survive this difficult crypto bear market. At this time, the performance of the two major stablecoins Tether (USDT) and US Dollar Coin (USDC) in the encryption market is quite different.

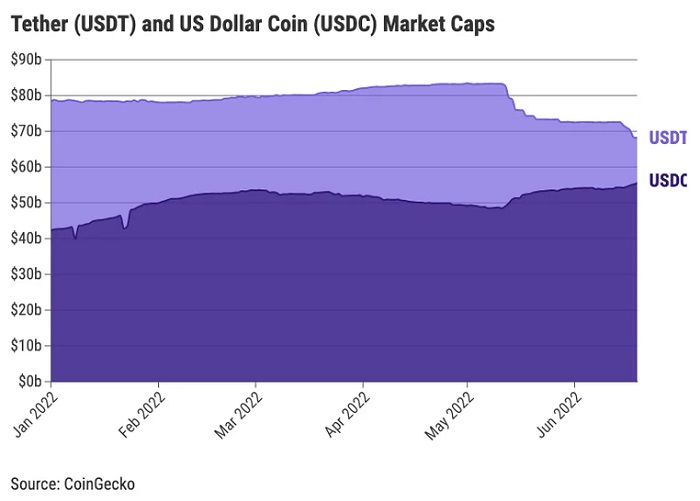

secondary title

According to CoinGecko, since the beginning of May, Tether's market value has fallen by 19% from its historical high of US$83 billion; in contrast, USDC has risen by 5% over the same period, and its market value once exceeded US$56 billion, setting a record high. It is not difficult to see from this set of data that the supply of Tether is continuing to shrink, and large investors have been cashing out their USDT positions since the market crash, while the supply of USDC continues to expand as demand increases.

I have to admit that USDC has performed strongly during the bear market. In the past 50 days, USDC has broken new highs in circulation 28 times. On June 15, the market value gap between USDC and Tether had narrowed to about $12 billion, the closest since the fall of 2020.

In the case of Tether's market value continues to decline, USDC's market value only needs to increase by another 21% to surpass Tether, and this growth rate does not seem to be too difficult for USDC. If Tether continues its downward trend, then USDC will catch up faster. All of this seems to be a very serious warning: in the current crypto bear market, no asset can maintain its dominance, even if it is good.

secondary title

What went wrong with Tether?

Typically, investors use stablecoins such as Tether and USDC as a medium of exchange for other cryptocurrencies, especially when the U.S. dollar is not available or traded on a DEX such as Uniswap. Frankly speaking, stable currency transactions often occupy a large part of the encrypted market transaction volume. If calculated by market value, the current stable currency transaction volume even exceeds the total transaction volume of BTC, ETH, and other top ten Tokens.

In fact, the run on investors seems to show a loss of confidence in the recovery of the cryptocurrency market, and even investing in assets such as stablecoins looks like a risky move. However, Paolo Ardoino, Tether's chief technology officer, explained the market situation from another angle. He publicly stated that the run showed another aspect of the company's ability to handle such redemptions. And since then, Tether has paid out about $8 billion to investors.

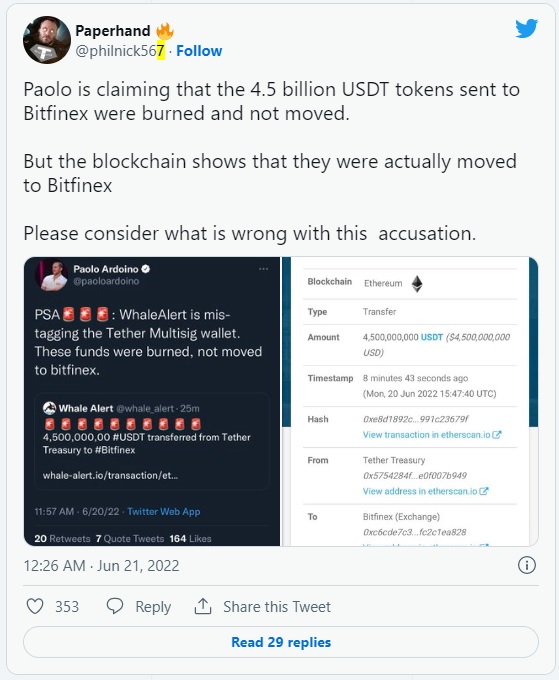

Of course, Tether still has some controversies. For example, Tether recently transferred $4.5 billion to its affiliated trading platform Bitfinex, but it is still doubtful whether the corresponding Tether stablecoins were destroyed. People do not know whether these stablecoins were converted into cash and removed from circulation. Eliminate, or transfer directly to Bitfinex.

A Tether spokesperson said that in the first 24 hours on June 22, Tether’s stablecoin transaction volume reached 48 billion U.S. dollars, while USDC’s transaction volume was only about 5 billion U.S. dollars. From this perspective, Tether is more practical, although The market value has declined, but in fact it just proves that Tether reserves can fully meet the liquidity redemption needs. The spokesperson also said that Tether does not want to cater to the traditional banking industry, but wants to focus on being a liberalized tool for P2P transactions, remittances, and hedging inflation, which is why Tether's market value has been affected by cash redemptions in the past few weeks. The reason for the decline. Overall, even though the market value of USDT has fallen, the 24-hour trading volume is still more than 9 times higher than that of USDC.

secondary title

Will USDT and USDC de-peg from the US dollar?

Although USDT and USDC have a long-term competitive relationship, it does not prevent them from firmly occupying a dominant position in the stable currency team. According to CoinGecko's historical data, on June 15, the total market capitalization of these two stablecoins accounted for 79% of the total market capitalization of stablecoins ($155 billion), and the market capitalization of the third largest stablecoin, Binance USD (BUSD), was 17 billion Dollar.

At the beginning of 2022, Tether's market value was about 78 billion US dollars, which was almost twice the market value of USDC at that time, but then the market value gap between USDT and USDC began to narrow. From the perspective of market value, these two stablecoins are currently second only to BTC and ETH The third and fourth largest cryptocurrencies.

When Terra’s stablecoin UST was depegged from the U.S. dollar in early May, there was a rush to draw the line between algorithmic stablecoins like UST and centralized stablecoins backed by reserves of cash or cash equivalents like USDT and USDC. At the time, Tether co-founder Reeve Collins said that Tether holders should feel very safe because Tether will remain pegged to the U.S. dollar and will not be affected by market turmoil. In addition, Reeve Collins also said that he would not be surprised to see holders of algorithmic stablecoins turning to asset-backed tokens such as Tether.

But even so, USDT still seems to be affected by the collapse of UST. Just two days after the UST crash, market panic intensified, Tether once fell to $0.95, and then it was re-pegged 1:1 with the US dollar. On the same day, Dante Disparte, Circle’s chief strategy officer, published a blog post that seemed to satirize the fact that Tether “masquerades as a stablecoin” but is not actually stable. He wrote:

“If you want to retain buyers with a 1:1 peg to the U.S. dollar, then you have to hold high-quality liquid assets denominated in U.S. dollars and regulated (called HQLA in banking lingo).”

It turns out that USDC did not fall below $0.99, and was very lucky to survive this stablecoin crisis caused by Terra. However, according to CoinGecko, just last Monday (June 13), the day after Celsius announced the freezing of user accounts, USDC actually experienced a short-lived decoupling of the US dollar, when the price once fell to 0.97 US dollars.

But since then, Tether has decided to adjust its reserve strategy and said it will further reduce its commercial paper holdings. Commercial paper and bonds account for only about a quarter of Tether's $82 billion in reserves as of March 31, 2022, the company's accounting firm said in a report.

Not only that, Tether's statement last week also attempted to draw a line between Celsius and Three Arrows Capital. The statement stated that Tether “has no interest in Celsius other than a small investment of the company’s net worth, and has not provided loans to Three Arrows Capital. Tether has also been working hard to reach a consensus with its creditors to avoid the risk of liquidation. "

(Side note: Three Arrows Capital co-founders Kyle Davies and Su Zhu have said they lost $200 million when Terra crashed in May. At its peak, Three Arrows Capital managed about $10 billion, but as of In April, its funds under management had shrunk to about $3 billion.)

secondary title

The rapidly changing market has been warning USDT and USDC

According to CoinGecko data, as of May 17, 2021, the gap between the market capitalization of Tether and USDC reached the largest since 2020, when USDT’s market capitalization was $59 billion, almost four times that of USDC ($17 billion) .

However, starting from May 2021, the encryption market began to enter a long period of turmoil. Especially on May 23, 2021, the global encryption market fell by 9% within 24 hours.